S & U PLC AGM Statement and Trading Update (1840Z)

20 Mayo 2021 - 1:00AM

UK Regulatory

TIDMSUS

RNS Number : 1840Z

S & U PLC

20 May 2021

20(th) May 2021

S&U plc

("S&U" or "the Group")

AGM Statement and Trading Update

S&U PLC, the leading specialist motor finance and property

bridging lender, issues a trading statement for the period 1st

February 2021 to the 19th May 2021 prior to its AGM today. As last

year, Covid restrictions dictate a closed AGM but S&U will be

holding a question and answer session for registered shareholders

at 11:30 am today, the 20th of May. Details on how to access the

conference are in note 9 of the AGM notice.

As outlined in our Chairman's statement accompanying the

full-year results published in March, the Group has weathered the

Covid pandemic and its consequences quite superbly. All S&U

staff are well and looking forward to the new "normality". For

Advantage Finance ("Advantage") this means that currently 60 staff

are back at our Grimsby offices with 120 expected to return at the

end of June. Aspen Bridging ("Aspen") also expects to return to its

Solihull offices by the end of June.

All staff, however, are being given the option of flexible

continued homeworking, to which they have adapted so successfully

over the past year.

As a result of their sterling efforts, the Group continues its

strong recovery as both motor and housing markets revive and as,

more generally, the UK is poised for 7% GDP growth this year.

Profitability for the period in our Advantage motor finance

business and in Aspen, our property bridging arm, was ahead of

group projections. Loan advances and collections rates in the

period were ahead of the same period last year, whilst Group net

receivables are now around GBP295 million.

Advantage Finance

Advantage Finance has produced an excellent first quarter, ahead

of expectations, and continues to invest in operational

improvements which will strengthen its market position, risk

profile and efficiency.

Although the bounce in loan advances anticipated following the

reopening of motor dealerships in April was less than expected,

year on year advances growth continues to accelerate and new

business quality has continued at a very good level. Advantage

continues to develop its offering across the non-prime motor

spectrum, which is reflected in the quality of new customers it is

attracting. As well as developing closer links with its loyal

introducer partners, Advantage is making good progress in its own

digital marketing and in providing loans for the nascent electric

vehicle market. Indeed, Advantage is supporting the Finance and

Leasing Association in its work to try to create a Green Finance

Guarantee with HM Treasury.

Monthly collection rates are cumulatively above budget and an

excellent GBP12.6 million of monthly collections were reached in

April. Covid-related FCA "payment holidays" have now fallen to just

1,200 customers from the cumulative 21,527 customers originally

taking such deferrals. Customers unaffected by "payment holidays"

maintain their usual excellence, and even those returning from

"payment holidays" have now returned to levels at 85.4% of due, as

the labour market strengthens and consumer confidence revives.

Hence, the trends currently observed at Advantage make us

optimistic that profit recovery and advances growth will meet our

expectations this year. We are laying the foundations for a return

towards Advantage's historic levels of profitability.

Aspen Bridging

Fuelled by a rising and buoyant residential property market in

which price levels currently stand 7% ahead of 2020, Aspen, is set

for a record year. Early transaction numbers have been boosted by

Aspen's authorisation for the Government guaranteed CBILS scheme,

so that current net receivables have reached over GBP50 million.

Whilst the past quarter has also seen an increase in average gross

loan size to GBP1 million per deal, book quality is at its best

ever level. Thus, the first quarter saw repayment collections at

GBP11.5 million - or nearly three times the figure last year.

Profitability in the first quarter reflects this and April saw a

record surplus for the business. Costs remain close to budget

despite systems investment and new recruitment, reflecting the

increase in business. Meanwhile underwriting processes and

standards continue to be refined, valuations remain conservative,

and overall maximum gross LTVs have reduced to just 59%.

Treasury

Both our very encouraging business prospects and our

traditionally conservative Treasury policy have resulted in further

strengthening of S&U's Treasury position during the first

quarter. The latter is reflected in Group gearing of just 60%, and

current medium-term facilities standing at GBP155 million against

borrowings of GBP111 million. In my statement for S&U's

full-year results, I said that "our growth prospects and strategy

will require additional funding"; I am therefore pleased to report

an additional GBP25 million of funding arranged during the period.

This takes Group facilities to GBP180 million, which provides

appropriate scope for the Group's future growth.

Commenting on S&U's trading outlook, Anthony Coombs, S&U

chairman, said:

"The financial year has started very well for S&U - a

recovery which, as the British economy resumes growth, we expect to

continue. With our habitual determination, imagination and

commitment we remain very confident as to the Group's prospects for

this year."

Enquiries S&U plc c/o SEC Newgate

Anthony Coombs

Financial Public Relations

Bob Huxford, Tom Carnegie, Megan

Kovach SEC Newgate 020 7653 9848

--------------- ----------------

Broker

Adrian Trimmings, Andrew Buchanan,

Rishi Shah Peel Hunt LLP 020 7418 8900

--------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUKSORAWUVAAR

(END) Dow Jones Newswires

May 20, 2021 02:00 ET (06:00 GMT)

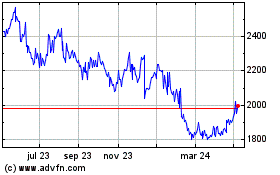

S & U (LSE:SUS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

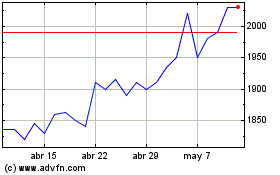

S & U (LSE:SUS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024