S & U PLC Trading Update and Notice of Results (0641I)

10 Agosto 2021 - 1:00AM

UK Regulatory

TIDMSUS

RNS Number : 0641I

S & U PLC

10 August 2021

10 August 2021

S&U plc

("S&U" or "the Group")

Trading Update and Notice of Results

S&U plc, the motor and property finance specialist, today

issues its trading update for the period from its AGM Statement of

the 20th May to the 31st July. It will announce half year results

on the 28th September 2021.

Trading

S&U continues to trade well, ahead of expectations in terms

of profitability, collections and book debt quality. Despite recent

inconsistency and incoherence in the Government's path out of Covid

lockdown, particularly in the travel sector, consumer appetite and

business confidence is gradually returning, amid expectations of a

7% UK growth rate in GDP for the year.

At S&U, this has been reflected in strong Advantage motor

finance applications and for Aspen in the strength of the

residential property market- although both slightly constrained by

a present lack of supply of both used vehicles and homes for sale.

This lack of supply will gradually be corrected as the economic

recovery gathers pace. Coupled with very strong cash collections,

rigorous and realistic underwriting and the Group's habitual

financial strength, S&U's return to sustainable and robust

growth promises a successful performance this year.

Advantage Finance

The period has seen Advantage enjoy a profitable, controlled and

cash generative recovery as it continues to gradually increase,

month by month, to nearer normal levels of new business. Whilst

continued sensibly cautious underwriting, and a lack of supply,

have seen transaction numbers slightly under an ambitious budget,

this has been more than offset by a superb collections performance

with related bad debt attrition and impairment more benign than

anticipated. As a result, net receivables are stable versus the

previous year-end, risk adjusted yield is ahead of budget, and

operational cost is well within budget.

The result will be a significant increase in Advantage's half

year profit, comfortably beating budget, and a gradual return

towards its habitual levels of ROCE.

This return will be buttressed by the continuous stream of

improvements that our excellent team in Grimsby and its Chief

Executive, Graham Wheeler, are making to the business. More detail

will be provided at half year and these include refinements to the

scope and range of its customer offering; new simple access for

customers to make online payments; new arrangements with industry

partners to boost our dealership capability, and improvements to

make our social media marketing more effective.

In addition, Advantage continues to prepare for what will be a

significant opportunity in the financing of hybrid and electric

used cars. Whilst Covid, initial pricing and the currently

inadequate charging network have so far restrained growth,

ultimately this new market will provide benefits for our customers,

protection for the environment and profitable growth for

S&U.

Aspen

Over the past two months, Aspen, our property bridging business,

has continued the encouraging trends reported in May. Net

receivables are now at just under GBP58 million against GBP18.5

million a year ago, and book quality and repayments continue to be

very good.

Much of this net receivables growth has been due to Aspen's

successful offer of Government backed CBILS loans to larger and

more established developer customers. Whilst the original CBILS

scheme is being wound down, the additional contacts Aspen have made

has boosted its market credibility and introducer reach. To

consolidate this, Aspen has sharpened its product offering, and its

competitive loan to value offer, and, at the same time,

strengthened its underwriting team to ensure a speedy and bespoke

service to all areas of the property bridging market.

The result is a good half year's performance and a sound basis

for further progress.

Treasury

Following the increase in overall Group funding facilities in

the first quarter to GBP180m, current borrowings levels of GBP116m

(up from GBP110m in the period) give substantial headroom for

growth.

Commenting on S&U's trading outlook, Anthony Coombs, S&U

chairman, said:

"As Britain gradually emerges from the effects of Covid, S&U

is demonstrating by its debt quality, collections performance,

customer service and product improvements, the inherent strength

and potential future profitability of the Group. The challenge now

is to grasp these opportunities for new growth. I am confident that

we will do so."

Enquiries S&U plc c/o SEC Newgate

Anthony Coombs

Financial Public Relations

Bob Huxford, Tom Carnegie, Megan

Kovach SEC Newgate 020 7653 9848

--------------- ----------------

Broker

Adrian Trimmings, Andrew Buchanan,

Rishi Shah Peel Hunt LLP 020 7418 8900

--------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQKLFBFVLBBBB

(END) Dow Jones Newswires

August 10, 2021 02:00 ET (06:00 GMT)

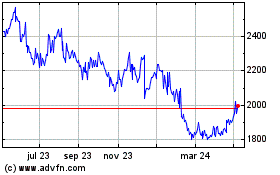

S & U (LSE:SUS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

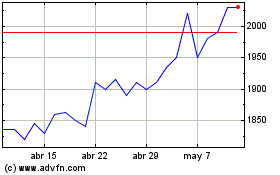

S & U (LSE:SUS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024