TIDMSDI

RNS Number : 7429F

SDI Group PLC

20 July 2021

SDI Group plc

("SDI", the "Company", or the "Group")

Final Results

SDI Group plc, the AIM quoted Group focused on the design and

manufacture of scientific and technology products for use in

digital imaging and sensing and control applications, is pleased to

announce its final audited results for the year ended 30 April

2021.

Financial Highlights

-- Revenue increased by 43.2% to GBP35.1m (2020: GBP24.5m) including 19% organic growth

-- Adjusted operating profit* increased by 67.3% to GBP7.7m (2020: GBP4.6m)

o Reported operating profit increased 69% to GBP5.9m (2020:

GBP3.5m)

-- Adjusted profit before tax* increased by 70.5% to GBP7.4m (2020: GBP4.3m)

o Reported profit before tax increased 73% to GBP5.6m (2020:

GBP3.3m)

-- Adjusted Diluted EPS* increased by 74.0% to 5.97p (2020: 3.43p)

o Reported diluted EPS increased 79% to 4.58p (2020: 2.56p)

-- Cash generated from operations increased by 125.0% to

GBP11.7m (2020: GBP5.2m), benefitting from one-off customer

downpayments

-- Net cash (cash less bank finance) was GBP0.8m (2020: net debt of GBP4.0m)

-- Earnout of GBP2.35m for Monmouth Scientific agreed and settled post year end

Operational Highlights

-- Two new acquisitions added to the Group - Monmouth Scientific and Uniform Engineering

-- Companies across the Group adapted quickly to challenging

market conditions of Covid and Brexit

Ken Ford, Chairman of SDI said:

"The past year has been extraordinary with possible permanent

changes to the way we work. The resistance, adaptability,

dedication and hard work of our team has led to further growth this

past year. The outlook, thanks to our agile business model, is

positive and we are planning for further organic growth, including

from one-off COVID-19 related orders, and appropriate acquisitions

during 2021-22. Trading in our 2021-22 financial year remains in

line with market expectations and we look to the future with

confidence."

* before reorganisation costs, share based payments, acquisition

costs and amortisation of acquired intangible assets.

FOR FURTHER INFORMATION

SDI Group plc

Ken Ford, Chairman

Mike Creedon, Chief Executive Officer

Jon Abell, Chief Financial Officer

www.thesdigroup.net 01223 727144

finnCap Ltd

Ed Frisby/Kate Bannatyne/Milesh Hindocha

- Corporate Finance

Andrew Burdis/Sunila de Silva - ECM 020 7220 0500

JW Communications

Julia Wilson - Investor & Public Relations 07818 430 877

About SDI

SDI designs and manufactures scientific and technology products

for use in digital imaging and sensing and control applications

including life sciences, healthcare, astronomy, manufacturing,

precision optics and art conservation. SDI operates through its

company divisions: Atik Cameras, Synoptics, Graticules Optics,

Sentek, Astles Control Systems, Applied Thermal Control, MPB

Industries, Chell Instruments, Monmouth Scientific and Uniform

Engineering.

SDI continues to grow by developing its own technology

advancements and by improving its global sales channels, as well as

through pursuing strategic, complementary acquisitions.

Audited Report and Financial Statements

The results have been extracted from the audited financial

statements of the Group for the year ended 30 April 2021. The

results do not constitute statutory accounts within the meaning of

Section 434 of the Companies Act 2006. Whilst the financial

information included in this announcement has been computed in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 that applies to

companies reporting under IFRS, this announcement does not itself

contain sufficient information to comply with IFRS. The Group will

publish full financial statements that comply with IFRS. The

audited financial statements incorporate an unqualified audit

report. The Auditor's report on these accounts did not draw

attention to any matters by way of emphasis and did not contain

statements under S498(2) or (3) Companies Act 2006.

Statutory accounts for the year ended 30 April 2020, which

incorporated an unqualified auditor's report, have been filed with

the Registrar of Companies. The Auditor's report on these accounts

did not draw attention to any matters by way of emphasis and did

not contain statements under S498(2) or (3) Companies Act 2006. The

accounting policies applied for the financial year ending 30 April

2021 are consistent with those described in the Annual Report &

Accounts for the year ended 30 April 2020.

The Group's Annual Report for the year ended 30 April 2021 will

in due course be available to view on the Company's website:

www.thesdigroup.net/investors/reports-presentations/ and be sent to

shareholders, together with a notice of AGM which will also be

available on the Company's website.

Chairman's Statement

Performance

In the financial year ended 30 April 2021, despite the global

economy being affected by the COVID-19 pandemic, SDI achieved

another record year of revenues and profits together with the

completion of two acquisitions.

Whilst protecting the health and safety of all our staff

remained a priority, the Group was able to take proactive,

practical measures to maintain our manufacturing capabilities. This

resulted in protecting our profitability and cashflow which arose

due to an increase in orders from some life science sectors which

the Group serves. SDI finished the year with profits above market

expectations and strong trading cash flows, enabling the Group to

continue to take advantage of new market opportunities and acquire

two companies, one of which offers sought-after clean air

technologies which has been required in greater quantities during

this pandemic.

The strength of SDI's business model has allowed us to complete

the acquisition of Monmouth Scientific (Monmouth) in December 2020

for GBP6.1m and Uniform Engineering (Uniform) for GBP0.5m in

January 2021. Monmouth offers clean air systems and during the

COVID-19 pandemic the company's biological safety cabinets have

been in high demand. SDI acquired Uniform to secure Monmouth's

supply chain for metal cabinet housings and Uniform also offers a

potential supply of cabinets to other SDI Group divisions. Both

companies have become part of our Sensors and Control segment of

the SDI Group.

To part fund these new acquisitions, SDI issued 230,680 new

Ordinary Shares in December 2020. SDI's record profits and cash

generation in the period, alongside the Group's banking facilities,

ensure the Group has a good level of funding available for

acquiring new companies, as well as investing in our existing

companies and technologies.

Full year Revenues of GBP35.1m have increased by 43.2% from 2020

and Adjusted Profit before Tax* at GBP7.4m is up 70.5% from the

previous year. Reported Profit before Tax has increased by 73.3% to

GBP5.6m. This performance has been achieved through an exceptional

19% organic sales growth, demonstrating continued commercial demand

for the niche technologies SDI provides. The newly acquired

Monmouth and Uniform have delivered an earnings enhancing

contribution in line with the Board's expectations for this

financial year.

Strategy

The Group's successful buy and build strategy is unchanged as

this is still creating shareholder value. We will continue to seek

targeted acquisitions, funded by earnings and cashflows from our

existing businesses where possible. The Group's policy is to

acquire small/medium-sized companies with technologies in the

digital imaging and sensing and control sectors. However, we are

open to acquiring companies with broader scientific applications or

associated supply chain businesses like Uniform Engineering if they

provide significant benefits to the Group. To obtain immediate,

continuing earnings enhancements, we seek to acquire businesses

with high-quality, niche technologies that have sustainable profits

and cashflows. The pandemic and current economic climate in the UK

is providing greater opportunities for purchasing companies and we

expect to acquire one or two new businesses for the Group in the

coming financial year. To ensure we maintain the right level of

operating capital and funding for acquisitions, without the need to

take on additional debt, the Board has decided not to pay a

dividend this financial year but will review again in 2022.

The need for SDI products, particularly in the life science and

medical industries remains robust and there has been strong demand

for technologies from several companies in our Group for use in the

fight against the COVID-19 pandemic. The volatility in many global

markets caused by the pandemic has impacted companies in our Group

both positively and negatively this financial year, and we expect

this to continue into 2022. However, underlying market drivers such

as automation and in-line and off-line analysis for use in

continuous processes, as well as the production of affordable

vaccines and biologics globally means many of our technologies will

continue to be in demand especially with original equipment

manufacturers (OEMs) with which SDI companies have long standing

trading relationships.

Delivering returns to our shareholders is a key objective of the

SDI Group. In this financial year, due to the increase in

manufacturing throughput and the price of raw materials, our costs

have been increasing. However, our overall costs are not yet at

pre-pandemic levels and has meant that our gross margins remain in

line with forecast at 65.2%. We intend to continue reviewing

operating costs and will where appropriate pass on unexpectedly

high materials costs to our customers to maintain

profitability.

Corporate Governance

It is the Board's responsibility to ensure that the Group has a

corporate governance framework that is effective whilst dynamic, as

a foundation for a sustainable growth strategy, and identifying,

evaluating and managing risks and opportunities that will be the

foundation for long term value creation.

In 2019 the Group adopted the 2018 QCA Corporate Governance Code

after concluding that it was the one best suited to SDI's business,

aims and ambitions. The Board believes that the Group complies with

the Code, but is committed to continuously improving its governance

over time. Further detail on Corporate Governance is available on

the Group's website

https://thesdigroup.net/investors/governance/

Team

SDI now employs over 300 staff across its companies, who have

worked tirelessly throughout this financial year, delivering to and

ahead of budget and quality targets, often in challenging working

conditions. It is thanks to them that all our manufacturing

facilities have been able to operate safely to keep our day-to-day

production running, with many delivering components for systems

that are vital to treat or detect COVID-19. The outstanding results

achieved during the 2020-2021 financial year are due to their hard

work and flexible approach to new working practices and the Board

is grateful for their contribution. The increase in performance in

a difficult year underlines the strength of SDI's operating model

and is a testament to the dedication of our team.

Outlook

During the last six years, turnover has grown from GBP8.4m to

GBP35.1m and profit before tax from GBP0.5m to GBP5.6m. The policy

of delegated responsibility to subsidiaries has allowed this growth

to work well with strong central financial control. We have

invested in our subsidiaries where required and look for strong

organic growth as well as through acquisitions.

Our strong balance sheet, increased debt capacity but most

importantly cash generation should allow for further acquisitions.

We continue to be shown acquisitions; previous choices and the

quality of the subsidiary management has given credibility to our

model. We are a buyer of integrity with a strong sense of purpose

and attitude.

The past year has been extraordinary with possible permanent

changes to the way we work. The resistance, adaptability,

dedication and hard work of our team has led to further growth this

past year. The outlook, thanks to our agile business model, is

positive and we are planning for further organic growth, including

from one-off COVID-19 related orders, and appropriate acquisitions

during 2021-22. Trading in our 2021-22 financial year remains in

line with market expectations and we look to the future with

confidence.

Ken Ford

Chairman

19 July 2021

Chief Executive's Operating Report

The COVID-19 pandemic has had a significant impact on the global

business community. Our Group is somewhat protected from that

because we operate in a space where we can provide products and

services as solutions to help combat the problem. This has resulted

in SDI Group revenues for the financial year ended 30 April 2021

progressing from GBP24.5m to GBP35.1m, an increase of 43.2%. During

this financial year, we acquired two new businesses, Monmouth

Scientific and Uniform Engineering.

Revenues and profit

SDI's digital imaging segment delivered GBP15.8m revenue and a

32.7% adjusted operating profit margin during the 2020-2021

financial year. Revenues have been enhanced by organic growth from

Atik and Synoptics both of which had an outstanding year.

Atik Cameras is now the largest business in the SDI Group and

grew well above management's expectations for the year. Demand for

products from Atik underwent a dip across all global markets during

the first quarter of the financial year due to the global shutdown

of many academic facilities. However, there was a significant

increase in orders from an OEM manufacturer to supply cameras for

real-time PCR DNA amplifiers used in COVID-19 testing. Atik has

secured a significant follow-on camera order with this OEM which

will run for the duration of the 2021-2022 financial year and is an

endorsement of the company's design and production capability in

life science imaging.

The sensors and control segment grew from GBP13.4m to GBP19.3m

in revenue, an increase of 44.0% in this financial year. Adjusted

operating margin remained steady at 22.6%. While many of the

companies in the division were adversely affected by the pandemic

during the first half of 2020, revenues have been enhanced by

organic growth of MPB Industries and part year revenues from

Monmouth Scientific and Uniform Engineering during the period. The

COVID-19 pandemic generated a surge in demand for Monmouth's

biological safety cabinets in COVID-19 testing facilities but in

this current year we are seeing the product mix returning to a pre

pandemic mix. We expect those companies in the segment that have

been affected negatively by COVID-19 to experience a period of

growth as the impact of COVID-19 decreases.

Basic earnings per share increased by 80.8% from 2.66p to 4.81p;

fully diluted earnings per share before adjusting items also

improved by 78.9% to 4.58p (2020: 2.56p).

Acquisitions

The UK is a centre of excellence for product innovation and

manufacturing with many world-leading businesses operating in life

science and technology niches. As a buy and build group, finding

those businesses with niche capabilities is key to our success. The

SDI Group has a reputation as a supportive owner that invests to

improve staff expertise and facilities, as well as trusts

subsidiary management teams with their day-to-day operations. This

approach has allowed companies in our group to upgrade capacity,

efficiency and safety in their manufacturing facilities and their

businesses to thrive.

On 2 December 2020, the Group acquired 100% of the share capital

of Monmouth Scientific for a total consideration of GBP6.1m,

including an earnout cash payment of GBP2.35m paid after the year

end, funded from existing cash resources and our revolving credit

facility with HSBC UK Bank. For the year ended 31 March 2020,

Monmouth generated revenues of GBP6.2m, and profit before tax of

GBP0.4m. Monmouth manufactures biological safety cabinets, fume

cupboards, laminar flow cabinets and cleanrooms. Its biological

safety cabinets sales have increased six-fold in 2020 and 80% of

production is now dedicated to these product lines as they are in

high demand globally for ensuring operator safety at COVID-19

testing sites.

On 29 January 2021, SDI acquired the business and net assets of

Uniform Engineering, a component supplier to Monmouth Scientific

and other companies with a requirement for metal fabrication, for a

cash consideration of GBP0.5m. For the year ended 31 May 2020

Uniform generated GBP1m in revenue and profit before tax of

GBP0.1m. The company, a manufacturer of bespoke metal enclosures

and housings is being managed by Monmouth but is currently

maintaining its separate premises in Highbridge, Somerset.

Our acquisition of Monmouth Scientific and Uniform Engineering

this year has added two new manufacturing sites with clean air

expertise. It has also ensured Monmouth, as well as other companies

in the Group access to a key supplier of fabricated metal

enclosures and is vital to the security of the Monmouth business.

Our new acquisitions have contributed GBP3.6m of third-party

revenues to SDI in this financial year, and have been immediately

earnings enhancing.

Operations

The pandemic has meant we have had to reassess our working

practices to accommodate social distancing in our manufacturing

areas and provide the IT capabilities to our workforce to where

possible work from home efficiently. This has meant that all our

manufacturing sites have remained fully operational and due to

safety measures put in place we have fortunately had few cases of

COVID-19 amongst our staff, and none have become seriously ill.

SDI is continually investing in improving its facilities and

staff expertise, as well as developing new technologies and

manufacturing capacity where required. To this end, we are

investing in larger purpose-built premises for Monmouth Scientific.

The new site, which will provide 25% more space for the company and

will consolidate operations on one site, is expected to be ready

for use by the first half of calendar 2022. Our R&D effort,

aimed at increasing the breadth and competitiveness of our product

range, has continued during the year, although with some resources

distracted on supply chain issues and with product launches more

muted than usual. We continue to see R&D as a source of growth

for our businesses.

While many of our businesses have seen revenues negatively

impacted by the COVID-19 pandemic, two (Atik and MPB) secured

significant one-time contracts for equipment relating respectively

to testing and treatment of COVID-19. Atik has a follow-on contract

with a global OEM until April 2022 to supply customised CCD cameras

for use in real-time PCR DNA amplifiers that can be used for

COVID-19 testing. Atik has the capacity and expertise to fulfil

this large contract safely because SDI has invested in a larger

production site in Lisbon, Portugal which is now fully operational

and has recruited extra R&D and manufacturing staff. There is

no certainty of further orders once this contract has been

fulfilled.

In this financial year, MPB also completed a major contract from

a medical devices company Penlon, to supply 40,000 human

anaesthetic variable area flowmeters for ventilator systems to help

treat patients suffering with COVID-19. Again, fulfilling this

contract was made possible due to the additional investment SDI

made in state-of the art tube washing plant, laser engraving

equipment and IT infrastructure. MPB is now in a stronger

manufacturing position and has a solid order book, including for

veterinary gas anaesthesia flowmeters, making their business secure

going into the new financial year.

Synoptics had a good year for orders of its Syngene DNA imaging

systems in Asia-Pacific and Europe and has also sold five Synbiosis

AutoCOL fully automated systems for colony counting. The AutoCOL is

the highest priced equipment the company has ever produced, and

Synoptics staff have become highly proficient at on-line demos and

training which is helping with orders. To date, systems have been

delivered to a top ten pharma company and to major contract

research organisations, where they are being used for environmental

monitoring.

OEM production of Fistreem water purification systems by

Synoptics for a major US life science supplier continues to provide

a steady flow of orders. Synoptics forecasts that its product mix

of low-end consumable type products and high-end automation will

continue to be in demand and will ensure Synoptics sales and

profitability are robust in the new financial year.

Graticules Optics has been working hard with key customers and

suppliers to perfect definition and production of grids made from

molybdenum, gold, and other rare metals to satisfy demand from

leading customers in applications such as semiconductors, life

sciences and material analysis, and is investing in production

equipment for both process and capacity improvement.

Cash and Liquidity

SDI has a strong balance sheet with current year-end cash at

more than GBP3.8m, and GBP5.0m of undrawn bank facility, which ends

in April 2023. The Group therefore has sufficient funds that can be

used, with its steady cash flow, to acquire new companies with

niche technologies. SDI expects to announce further expansion of

the Group with the acquisition of one to two new companies by the

end of the 2021-2022 financial year.

Trading Outlook

Many of the academic and pharma/biotech laboratories are now

operating at normal capacity and have budget to spend. The pandemic

is still affecting global travel and scientific conventions, but we

have been able to resume UK-based service contracts and have become

highly efficient with our on-line demos and training and are now

able to sell and install even our high-cost systems outside the UK

this way.

Due to the increase in the price of raw materials, labour and

logistical costs, our costs of goods sold are increasing. However,

our operating expenses are not yet at pre-pandemic levels. We

intend to continue reviewing all costs and will where appropriate

pass on cost increases to our customers to maintain

profitability.

We are in a strong position financially with good operational

cash flows and robust orders from our companies involved in

supplying products and services in the fight against COVID-19. To

date the effects of the pandemic on our trading performance has

been limited because we are a diversified group of companies. Our

Group has shown its resilience and adaptability in the past year

and we expect to trade profitably this year.

Mike Creedon

Chief Executive Officer

19 July 2021

Chief Financial Officer's Report

Revenue and Profits

SDI Group revenues for the year were GBP35.1m, compared with

GBP24.5m in 2020, an increase of 43.2% over 2020. Sales growth from

acquired businesses, including sales of Chell Instruments in the

period to the acquisition anniversary at end November 2020 and

post-acquisition sales of Monmouth Scientific and Uniform

Engineering, contributed GBP6.1m, while organic sales growth was

GBP4.5m or 19%. Sales arising from two specific one-off

COVID-19-related contracts, at Atik for cameras into PCR

instruments and at MPB for flowmeters into ventilators, totalled

GBP6.1m in the year. The contract at Atik is continuing in

2022.

Gross profit increased to GBP22.9m (2020: GBP16.6m), with margin

reduced to 65.2% (2020: 67.8%) due to significant product mix

changes including lower than average gross margins at Monmouth

Scientific and on the Atik PCR camera sales.

Operating profit for the year was GBP5.9m (2020: GBP3.5m), and

Adjusted Operating Profit (AOP) was GBP7.7m (2020: GBP4.6m) before

reorganisation costs, share based payments, acquisition costs and

amortisation of acquired intangible assets, an increase of 67.3%.

Significant drivers of the increase were the organic sales

increase, plus the added contributions of the acquired

businesses.

Under the major disruption to activities of the COVID-19

pandemic, all of our businesses responded by reducing costs, while

also taking advantage of the UK government's Coronavirus Job

Retention Scheme to maintain employment and skills in the early

phase. As economic activity recovered and customers' buying

resumed, our businesses each returned to full active employment.

Two businesses, Atik Cameras and MPB Industries, have repaid the

government furlough subsidy received for the years 2020 and 2021 in

the light of their COVID-19-related sales. The total subsidy

received across the Group in the year was GBP273k. The Group did

not receive business rates relief.

Investment in R&D

Under IFRS we are required to capitalise certain development

expenditure and in the year ended 30 April 2021 GBP367k (2019:

GBP536k) of cost was capitalised. Much of the work of our growing

R&D teams does not qualify for capitalisation, and is charged

directly to expense. Amortisation and write-offs for 2021 were

GBP425k (2020: GBP528k). The carrying value of the capitalised

development at 30 April 2021 was GBP1.0m (2020: GBP1.2m) to be

amortised between 3 - 5 years.

Reorganisation

The Board carried out a thorough review of the operations and

cost structure of the Group and this gave rise to GBP132k (2020:

GBP110k) of reorganisation costs in the year impacting several

businesses, which should bring benefits in the current year.

Acquisition Costs

There were costs of GBP179k (2020: GBP58k) in relation to stamp

duty, legal fees, and other advisor remuneration for the

acquisitions completed in the year.

Financing

Financing costs totalled GBP287k (2020: 254k), reflecting the

drawdown on loans effected early in the year as the outcome of the

pandemic was uncertain.

Taxation

Taxation accrued for the year was GBP936k (2020: GBP666k) with

the increase arising mainly through improved profitability. The net

tax rate was 16.6% (2020: 20.4%). 2020 was impacted adversely by

the reversion to a 19% enacted UK statutory tax rate (previously

17%) on deferred tax liabilities which resulted in additional

expense of GBP158k. The group continues to benefit from R&D tax

credits.

Earnings per Share

Diluted earnings per share for the Group was 4.58p (2020:

2.56p). Adjusted diluted EPS, an alternative performance measure

which excludes certain non-cash and non-recurring expenses was

5.97p (2020: 3.43p), an increase of 74.0%.

Cash Flow and Working Capital

During the year the Group generated cash from operations of

GBP11.7m (2020: GBP5.2m). Most notable was the GBP3.5m increase in

customer advanced payments received, which Is largely attributable

to COVID-19 related contracts in Atik. Taxes paid increased from

GBP786k to GBP1.2m.

Our investment in fixed assets increased to GBP667k (2020:

GBP506k) with significant investments in Atik and Monmouth.

Capitalised Research and Development expense at GBP367k (2020:

GBP536k) was lower than amortisation of GBP425k (2020:

GBP528k).

As in prior years, our biggest investment was in the acquisition

of new businesses, with GBP6.6m deployed on a cash-free basis

(including contingent consideration) for Monmouth Scientific and

Uniform Engineering (2020: GBP5.2m for Chell Instruments). At the

end of the year contingent consideration of GBP2.35m was

outstanding for Monmouth and this has since been paid to the

sellers.

National Insurance and Deferred Tax

During the year to 30 April 2021, the share price of SDI Group

plc increased from 52.5p to 179p. This will, of course, be welcomed

by shareholders. However, this increase, outside of the immediate

control of the Group, has had two contrasting effects on the

profitability and future cash flows of the company, related to

share options issued to directors and management.

Firstly, we have accrued GBP578k for future employer's National

Insurance charges on option exercises outside of HMRC approved

schemes (2020: GBPnil). As the Group is no longer eligible to issue

share options under the EMI approved scheme, shareholders should

expect such accruals and cash expense going forward, although the

actual cost is directly related to share price movements and to the

amount of options outstanding.

Secondly, the exercise of share options by directors and

employees generates a tax deduction for the Group, leading to lower

cash taxes to be paid. To the extent that the expected tax

deduction is higher than the share-based payment expense originally

recorded for the same options, part of the tax expense saved is

credited directly to equity. In 2021, we have credited GBP1,438k

(2020: GBPnil) of deferred tax benefit directly to equity, based on

the closing share price at 30 April 2021. Subject to future share

price movements, option vesting and exercises, and tax rates, this

represents future cash tax savings available to the Group.

Funding

Our investments were financed out of our own cash flow, except

for the issue of 230,680 shares valued at GBP200,000 as part

payment for our Monmouth Scientific acquisition.

Having started the year with our bank loan facility almost

completely drawn down during the initial phase of the COVID-19

pandemic, with gross bank debt of GBP9.3m and cash of GBP5.3m, we

closed 2021 with loans of GBP3.1m and cash of GBP3.8m. Our

committed but undrawn loan facility was GBP5.0m. Our lender has

signalled that it is willing to increase our facility further, and

our increasing cash flow and resilience during the pandemic gives

directors confidence that the Group can support a higher level of

borrowing if needed.

Jon Abell

CFO

19 July 2021

Strategic Overview

SDI Group is an AIM-quoted group specialising in the acquisition

and development of a portfolio of companies that design and

manufacture products for use in digital imaging and sensing and

control applications in science, technology and medical markets.

Corporate expansion is being pursued, both through organic growth

within its subsidiary companies and through the acquisition of

high-quality businesses with established reputations in global

markets.

The Board believes there are many businesses operating within

the market, a number of which have not achieved critical mass, and

that presents an ideal opportunity for consolidation. This strategy

will be primarily focused within the UK but, where opportunities

exist, acquisitions in Europe and the United States and elsewhere

will also be considered, particularly if these also enable

geographic expansion of our existing businesses.

We intend to continue to buy stand-alone businesses as well as

smaller entities and technology acquisitions which bolt onto our

existing ones. Our track record over the last seven years has been

good, with thirteen businesses acquired across our digital imaging

and sensors and controls segments.

An important element of our strategy is that we are known to be

a good acquirer, able to help sellers to achieve a sale quickly and

easily, and without surprises.

We keep a lean headquarters, and our businesses are run by

seasoned local management with broad discretion within defined

limits. Our aim is to grow them, profitably, and we seek to provide

them with the resources necessary to grow. Acquired businesses

often find that they can grow faster within the SDI Group than they

were prepared to do under private ownership, and they are able to

learn from and share experience with other companies in the

Group.

Our current businesses fall broadly into two segments, which we

call Digital Imaging and Sensors & Control, and within these

groupings there are significant commonalities of applications,

industries served and technologies employed. This provides

additional opportunity for knowledge sharing, which we

encourage.

Growth in revenues and profit within our businesses depends on

both technology advancement and seeking new customers, often by

expanding geographical reach, and the Board sees geographical

expansion as a driver of organic growth for the future.

By lowering the cost of capital of businesses we acquire and by

facilitating their profitable growth, our business model has

demonstrated that it can provide good returns to shareholders and

can be scaled into the future.

Key Performance Indicators

A range of financial key performance indicators are monitored on

a monthly basis against budget by the Board and by management,

including order pipeline, revenue, gross profit, costs, adjusted

operating profit, and cash.

In support of our acquisition strategy as outlined above, we

monitor our acquisition pipeline, including any prospects that fail

to progress. Post-acquisition, the Board discusses integration

progress, and monitors financial performance against our initial

plans. Over a longer period, we monitor the return on total

invested capital of all of our businesses.

The Board regularly discusses progress in all major research and

development and other projects with project and business leaders,

including with respect to cost, timelines and adherence to the

projects' initial objectives.

Additionally, the Board reserves a specific agenda item for

discussion of health and safety and other employee welfare-related

issues.

Consolidated income statement and statement of comprehensive

income

2021 2020

Note GBP'000 GBP'000

Revenue 2 35,076 24,498

Cost of sales (12,206) (7,899)

-------- --------

Gross profit 22,870 16,599

Other income 21 19

Operating expenses (16,960) (13,107)

Operating profit 5,931 3,511

Net financing expenses (287) (254)

Profit before tax 3 5,644 3,257

Income tax 4 (936) (666)

Profit for the year 4,708 2,591

Earnings per share

Basic earnings per share 7 4.81p 2.66p

Diluted earnings per share 7 4.58p 2.56p

All activities of the Group are classed as continuing.

2021 2020

GBP'000 GBP'000

Profit for the year 4,708 2,591

Other comprehensive income

Items that will subsequently be reclassified

to profit and loss:

Exchange differences on translating foreign

operations (96) 41

---------- ----------

Total comprehensive income for the year 4,612 2,632

---------- ----------

Consolidated balance sheet

Restated*

Company registration number: 2021 2020

6385396 Note

GBP'000 GBP'000

Assets

Intangible assets 26,237 21,650

Property, plant and equipment 4,131 3,901

Deferred tax asset 1,697 246

-------- ---------

32,065 25,797

Current assets

Inventories 6,059 3,728

Trade and other receivables 6,743 3,617

Cash and cash equivalents 3,836 5,290

-------- ---------

16,638 12,635

Total assets 48,703 38,432

-------- ---------

Liabilities

Non-current liabilities

Borrowings 6 (3,764) (10,376)

Deferred tax liability (2,479) (2,134)

-------- ---------

(6,243) (12,510)

Current liabilities

Trade and other payables 5 (12,826) (3,350)

Provisions for warranties (230) (85)

Borrowings 6 (1,880) (1,910)

Current tax payable (750) (513)

-------- ---------

(15,686) (5,858)

Total liabilities (21,929) (18,368)

-------- ---------

Net assets 26,774 20,064

======== =========

Equity

Share capital 984 975

Merger reserve 2,606 2,606

Merger relief reserve 424 424

Share premium account 9,092 8,746

Share based payment reserve 714 467

Foreign exchange reserve 85 181

Retained earnings 12,869 6,665

-------- ---------

Total equity 26,774 20,064

======== =========

*See note 8

Consolidated statement of cashflows

Note 2021 2020

GBP'000 GBP'000

Operating activities

Net profit for the year 4,708 2,591

Depreciation 973 831

Amortisation 1,589 1,189

Finance costs and income 287 254

Impairment of intangible assets 130 22

(Decrease)/increase in provisions (15) 74

Taxation in the income statement 936 666

Employee share-based payments 305 276

-------- -------

Operating cash flows before movement in

working capital 8,913 5,903

Decrease in inventories (977) (539)

(Increase)/decrease in trade and other

receivables (2,363) 726

Increase/(decrease) in trade and other

payables 6,137 (921)

-------- -------

Cash generated from operations 11,710 5,169

Interest paid (287) (253)

Income taxes paid (1,166) (786)

-------- -------

Cash generated from operating activities 10,257 4,130

Investing activities

Capital expenditure on fixed assets (667) (506)

Sale of property, plant and equipment 67 -

Expenditure on development and other intangibles (367) (582)

Acquisition of subsidiaries, net of cash (4,057) (5,182)

-------- -------

Net cash used in investing activities (5,024) (6,270)

Financing activities

Finance leases net repayments 6 (489) (511)

Proceeds from bank borrowing 6 5,404 6,496

Repayment of borrowings 6 (11,652) (1,143)

Issues of shares and proceeds from option

exercise 155 80

-------- -------

Net cash from financing (6,582) 4,922

Net changes in cash and cash equivalents (1,349) 2,782

Cash and cash equivalents, beginning of

year 5,290 2,494

Foreign currency movements on cash balances (105) 14

======== =======

Cash and cash equivalents, end of year 3,836 5,290

======== =======

Consolidated statement of changes in equity

Merger Own Share

relief shares based

Share Merger reserve Foreign Share held by payment Retained

capital reserve exchange premium EBT reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 April 2019 972 3,030 - 140 8,696 (17) 284 3,981 17,086

Restatement (note 8) - (424) 424 - - - - - -

------------ -------- -------- --------- -------- -------- ------------- ----------- --------

Restated balance 30 April

2019 972 2,606 424 140 8,696 (17) 284 3,981 17,086

Shares issued 3 - - - 50 17 - - 70

Share based payment

transfer - - - - - - (93) 93 -

Share based payments - - - - - - 276 - 276

Transactions with owners 3 - - - 50 17 183 93 346

Profit for the year - - - - - - - 2,591 2,591

Foreign exchange on

consolidation of

subsidiaries - - - 41 - - - - 41

------------ -------- -------- --------- -------- -------- ------------- ----------- --------

Total comprehensive income

for the period - - 41 - - - 2,591 2,632

Balance at 30 April 2020 975 2,606 424 181 8,746 - 467 6,665 20,064

============ ======== ======== ========= ======== ======== ============= =========== ========

Consolidated statement of changes in equity

Share Merger Merger Foreign Share Own Share Retained Total

capital reserve relief exchange premium shares based earnings

reserve held by payment

EBT reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 April 2020

(previously stated) 975 3,030 - 181 8,746 - 467 6,665 20,064

Restatement (note 8) - (424) 424 - - - - - -

-------- -------- -------- --------- -------- -------- ------------- ----------- ---------

Restated balance at 30

April 2020 975 2,606 424 181 8,746 - 467 6,665 20,064

Shares issued 9 - - - 346 - - - 355

Tax in respect of share

options - - - - - - - 1,438 1,438

Share based payment

transfer - - - - - - (58) 58 -

Share based payments - - - - - - 305 - 305

Transactions with owners 9 - - - 346 - 247 1,496 2,098

Profit for the year - - - - - - - 4,708 4,708

Foreign exchange on

consolidation of

subsidiaries - - - (96) - - - - (96)

-------- -------- -------- --------- -------- -------- ------------- ----------- ---------

Total comprehensive income

for the period - - - (96) - - - 4,708 4,612

Balance at 30 April 2021 984 2,606 424 85 9,092 - 714 12,869 26,774

======== ======== ======== ========= ======== ======== ============= =========== =========

Notes to the consolidated financial statements

1 ALTERNATIVE PERFORMANCE MEASURES

The Group uses Adjusted Operating Profit, Adjusted Profit Before

Tax, Adjusted Diluted EPS and Net Operating Assets as supplemental

measures of the Group's profitability and investment in

business-related assets, in addition to measures defined under

IFRS. The Group considers these useful due to the exclusion of

specific items that are considered to hinder comparison of

underlying profitability and investments of the Group's segments

and businesses, and is aware that shareholders use these measures

to evaluate performance over time. The adjusting items for the

alternative measures of profit are either recurring but non-cash

charges (share-based payments and amortisation of acquired

intangible assets) or exceptional items (reorganisation costs and

acquisition costs).

The following table is included to define the term Adjusted

Operating Profit:

2021 2020

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Operating Profit (as reported) 5,931 3,511

---------

Adjusting items (all costs):

---------

Non-underlying items

---------

Share based payments 305 276

---------

Amortisation of acquired intangible assets 1,153 647

---------

Exceptional items

---------

Reorganisation costs 132 110

---------

Acquisition costs 179 58

---------

Total adjusting items 1,769 1,091

---------

Adjusted Operating Profit 7,700 4,602

-------------------------------------------- --------- ---------

Adjusted Profit Before Tax is defined as follows:

2021 2020

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Profit before tax (as reported) 5,644 3,257

---------

Adjusting items (all costs):

---------

Non-underlying items

---------

Share based payments 305 276

---------

Amortisation of acquired intangible assets 1,153 647

---------

Exceptional items

---------

Reorganisation costs 132 110

---------

Acquisition costs 179 58

-------------------------------------------- --------- ---------

Total adjusting items 1,769 1,091

---------

Adjusted Profit Before Tax 7,413 4,348

-------------------------------------------- --------- ---------

Adjusted EPS is defined as follows:

2021 2020

GBP'000 GBP'000

--------------------------------------------- ------------ ------------

Profit for the year 4,708 2,591

------------

Adjusting items (all costs):

------------

Non-underlying items

------------

Share based payments 305 276

------------

Amortisation of acquired intangible assets 1,153 647

------------

Exceptional items

------------

Reorganisation costs 132 110

------------

Acquisition costs 179 58

--------------------------------------------- ------------ ------------

Total adjusting items 1,769 1,091

------------

Less taxation on adjusting items calculated

at the UK statutory rate (336) (207)

------------ ------------

Adjusted profit for the year 6,141 3,475

------------

Divided by diluted weighted average number

of shares in issue

(note 7) 102,799,084 101,206,148

------------

Adjusted Diluted EPS 5.97p 3.43p

--------------------------------------------- ------------ ------------

The following table is included to define the term Net Operating

Assets:

2021 2020

GBP'000 GBP'000

----------------------------------------------- --------- ---------

Net assets 26,774 20,064

---------

Deferred tax asset 1,697 246

---------

Corporation tax asset 17 52

---------

Cash and cash equivalents 3,836 5,290

---------

Borrowings and lease liabilities (current and

non-current) (5,644) (12,286)

---------

Deferred consideration (2,350) -

---------

Deferred tax liability (2,479) (2,134)

---------

Current tax payable (750) (513)

----------------------------------------------- --------- ---------

Total adjusting items within Net assets (5,673) (9,345)

---------

Net Operating Assets 32,447 29,409

----------------------------------------------- --------- ---------

2 SEGMENT ANALYSIS

The Digital Imaging segment incorporates the Synoptics brands

Syngene, Synbiosis, Synoptics Health and Fistreem, the Atik brands

Atik Cameras, Opus and Quantum Scientific Imaging, and Graticules

Optics. These businesses share significant characteristics

including customer application, technology, and production

location. Revenues derive from the sale of instruments, components

for OEM customers' instruments, from accessories and service and

from licence income.

The Sensors & Control segment combines our Sentek, Astles

Control Systems, Applied Thermal Control, Thermal Exchange, MPB

Industries, Chell Instruments, Monmouth Scientific and Uniform

Engineering businesses. All of these businesses provide products

that enable accurate control of scientific and industrial

equipment. Their revenues also derive from the sale of instruments,

major components for OEM customers' instruments, and from

accessories and service.

The Board of Directors reviews operational results of these

segments on a monthly basis, and decides on resource allocations to

the segments and is considered the Group's chief operational

decision maker.

2021 2020

Total Total

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Revenues

---------

Digital Imaging 15,788 11,050

---------

Sensors & Control 19,288 13,448

---------

Group 35,076 24,498

---------

Adjusted Operating Profit

---------

Digital Imaging 5,165 2,382

---------

Sensors & Control 4,360 3,028

---------

Other (1,825) (808)

-------------------------------------------- --------- ---------

Group 7,700 4,602

---------

Amortisation of acquired intangible assets

---------

Digital Imaging (175) (182)

---------

Sensors & Control (978) (465)

---------

Group (1,153) (647)

-------------------------------------------- --------- ---------

Analysis of amortisation of acquired intangible assets has been

included separately as the Group considers it to be an important

component of profit which is directly attributable to the reported

segments.

The Other category includes costs which cannot be allocated to

the other segments, and consists principally of Group head office

costs.

2021 2020

Total Total

GBP'000 GBP'000

------------------------------------------------ --------- ---------

Operating assets excluding acquired intangible

assets

---------

Digital Imaging 7,895 6,281

---------

Sensors & Control 9,683 5,993

---------

Other 131 120

------------------------------------------------ --------- ---------

Group 17,709 12,394

---------

Acquired intangible assets

---------

Digital Imaging 5,195 5,370

---------

Sensors & Control 20,251 15,068

---------

Group 25,446 20,438

---------

Operating Liabilities

---------

Digital Imaging (5,439) (1,190)

---------

Sensors & Control (4,204) (2,087)

---------

Other (1,064) (158)

------------------------------------------------ --------- ---------

Group (10,707) (3,435)

---------

Net operating assets

---------

Digital Imaging 7,650 10,550

---------

Sensors & Control 25,731 19,042

---------

Other (934) (183)

------------------------------------------------ --------- ---------

Group 32,447 29,409

---------

Depreciation

---------

Digital Imaging 461 435

---------

Sensors & Control 505 389

---------

Other 7 7

------------------------------------------------ --------- ---------

Group 973 831

---------

The geographical analysis of revenue by destination, analysis of

revenue by product or service, and non-current assets by location

are set out below:

Revenue by destination of external customer 2021 2020

GBP'000 GBP'000

United Kingdom (country of domicile) 15,343 10,249

Europe 5,137 5,129

America 3,365 3,290

China 6,854 910

Asia (excluding China) 3,088 3,582

Rest of World 1,289 1,338

------- -------

35,076 24,498

======= =======

Revenue by product or service 2021 2020

GBP'000 GBP'000

Instruments and spare parts 34,640 23,894

Services 436 604

------- -------

35,076 24,498

======= =======

16% of Group revenue was from a single customer during the

year.

Non-current assets by location 2021 2020

GBP'000 GBP'000

United Kingdom 29,824 24,872

Portugal 396 412

America 148 227

------- -------

30,368 25,511

======= =======

3 PROFIT BEFORE TAXATION

Profit for the year has been arrived at after charging:

2021 2020

GBP'000 GBP'000

Amortisation and write-down of intangible

assets 1,589 1,189

Depreciation charge for the year - Right-of-use

assets 528 490

Depreciation charge for the year - Other

assets 445 342

Auditor's remuneration Group:

* Audit of Group accounts 20 18

Fees paid to the auditor and its associates

in respect of other services:

* Audit of Company and of subsidiaries 165 151

* Tax compliance services - 34

* Audit related assurance services 12 12

Currency exchange loss 72 9

Reorganisation costs 132 110

Acquisition costs 179 58

4 TaxATION

2021 2020

GBP'000 GBP'000

Corporation tax:

Prior year corporation tax adjustment - 17

Current tax charge 1,220 544

------- -------

1,220 561

Deferred tax expense/(income) (284) 105

------- -------

Income tax charge 936 666

======= =======

Reconciliation of effective tax rate

2021 2020

GBP'000 GBP'000

Profit on ordinary activities before tax 5,644 3,257

------- -------

Profit on ordinary activities multiplied

by standard rate of

Corporation tax in the UK of 19% (2020:

19%) 1,072 619

Effects of:

Expenses not deductible for tax purposes 30 22

Additional deduction for R&D expenditure (162) (135)

Prior year tax adjustments (18) 17

Update deferred tax liabilities and assets

to enacted future tax rate of 19% (2020:

19%) - 158

Other 14 (15)

------- -------

936 666

======= =======

The Group takes advantage of the enhanced tax deductions for

Research and Development expenditure in the UK and expects to

continue to be able to do so.

5 Trade and other payables

2021 2020

GBP'000 GBP'000

Trade payables 3,347 1,427

Social security and other

taxes 751 379

Contingent consideration 2,350 -

Other payables 705 90

Accruals and deferred income 5,673 1,454

-------

12,826 3,350

======= =======

Accruals and deferred income includes an amount of GBP3,875k

(2020: GBP398k) in respect of contract liabilities for revenues

relating to performance obligations expected to be satisfied within

the next 12 months. The contract liabilities balance has increased

significantly during the year as a result of the significant

contract for equipment relating to testing of COVID-19 in Atik. All

of the prior year contract liabilities of GBP398k were recognised

as revenue during the current year.

At the end of the year, contingent consideration of GBP2.35m was

outstanding for Monmouth and this has since been paid to the

sellers.

All amounts are short-term. The carrying values are considered

to be a reasonable approximation of fair value.

6 Borrowings

Borrowings are repayable as follows:

2021 2020

GBP'000 GBP'000

Within one year

Bank finance 1,371 1,371

Leases 509 539

------- -------

1,880 1,910

------- -------

After one and within five years

Bank finance 1,714 7,962

Leases 2,050 2,414

------- -------

3,764 10,376

------- -------

Total borrowings 5,644 12,286

======= =======

Bank finance relates to amounts drawn down under the Group's

bank facility with HSBC Bank plc, which is secured against all

assets of the Group. The facility consists of a revolving facility

of GBP5.0m and an amortising facility which reduces in quarterly

instalments from GBP4.8m when it was taken out in November 2019 to

zero by April 2023, when the current agreement expires. The

revolving facility is undrawn, and is available for general use.

The facility has covenants relating to leverage (net debt to

EBITDA), interest coverage, and cashflow to debt service.

7 Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of SDI Group plc divided

by the weighted average number of shares in issue during the

period. All profit per share calculations relate to continuing

operations of the Group.

Profit

attributable Weighted Earnings

to average per share

shareholders number of amount in

GBP'000 shares pence

----------------------------- -------------- ------------ -----------

Basic earnings per share:

-----------

Year ended 30 April 2021 4,708 97,852,313 4.81

-----------

Year ended 30 April 2020 2,591 97,277,721 2.66

-----------

Dilutive effect of share

options :

-----------

Year ended 30 April 2021 4,946,771

-----------

Year ended 30 April 2020 3,928,426

-----------

Diluted earnings per share:

-----------

Year ended 30 April 2021 4,708 102,799,084 4.58

-----------

Year ended 30 April 2020 2,591 101,206,148 2.56

----------------------------- -------------- ------------ -----------

At the year end, there were no (2020: 425,000) share options

which were anti-dilutive but may be dilutive in the future.

8 Prior year restatement

A prior year restatement was made to split out the merger relief

reserve of GBP424k from the merger reserve. A third balance sheet

is not required for this restatement as per IAS 1.40A given that

the only effect on the information in the statement of financial

position at the beginning of the comparative period was splitting

out the reserve from where it was aggregated in the comparative

period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BCGDRUXBDGBC

(END) Dow Jones Newswires

July 20, 2021 02:00 ET (06:00 GMT)

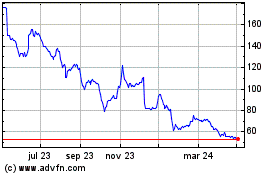

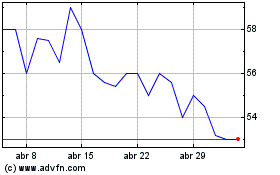

Sdi (LSE:SDI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Sdi (LSE:SDI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024