TIDMSDX

RNS Number : 2418J

SDX Energy PLC

20 August 2021

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

SDX TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF UK LAW BY

VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR"). ON THE

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

20 August 2021

SDX ENERGY PLC ("SDX", the "Company" or the "Group")

ANNOUNCES ITS FINANCIAL AND OPERATING RESULTS FOR THE THREE AND

SIX MONTHSED 30 JUNE 2021

SDX Energy Plc (AIM: SDX), the MENA-focused oil and gas company,

is pleased to announce its unaudited financial and operating

results for the three and six months ended 30 June 2021. All

monetary values are expressed in United States dollars net to the

Company unless otherwise stated.

Mark Reid, CEO of SDX, commented:

"I am very pleased to report first half 2021 results that show

strong growth in revenue, netback, EBITDAX and operating cash flows

versus the same period in 2020, as well as ending the period with a

strong liquidity position. The producing assets in Egypt and

Morocco are performing well and we remain above our mid-point

guidance for the year. Our drilling activities have yielded three

successful wells in Morocco, all of which are now onstream and

contributing to cash flow, and one at South Disouq, which is due to

start up shortly. As previously announced, whilst the result of the

Hanut-1X well is disappointing, I remain positive about the

remaining prospectivity in the area which has not been materially

impacted."

Three and six months to 30 June 2021 Operations Highlights

-- H1 2021 entitlement production of 5,931 boe/d was 3% higher

than 2021 mid point market guidance of 5,770 boe/d and 4% lower

than H1 2020 mainly due to natural decline, well workovers and

expected sand and water production in two of the five wells at

South Disouq.

-- Capex guidance for Morocco for the 12 months ended 31

December 2021 has been increased by US$1.5 million as wells planned

for the second phase of 2021 drilling are deeper than those

included in the original guidance. Capex of US$15.8 million was

within guidance for South Disouq and West Gharib. This results in

group 2021 capex guidance being revised to US$26.5 - 28.0 million

(previous guidance US$25.0 - 26.5 million).

-- The Company's operated assets recorded a carbon intensity of

2.7kg CO(2) e/boe in H1 2021 which is one of the lowest rates in

the industry. Scope 1 greenhouse gas emissions at operated assets

were 4,405 tons of CO(2) e. Scope 3 greenhouse gas emissions in

Morocco were 75,500 tons of CO(2) e, which is approximately 38,500

tons of CO(2) e less than using alternative heavy fuel oil.

-- In South Disouq, the IY-2X step-out development well, the

first of a two-well campaign, was spud in late June 2021. The well

was drilled to a measured depth of 8,025 feet, encountering 40.5

feet net-pay of high-quality gas-bearing sands, with an average

porosity of 23.4%, near the base of the Kafr El Sheikh ("KES")

formation. The top of the KES sand was encountered at a measured

depth of 6,768 feet. Following well te sting, the well is expected

to be brought on production during the last week in August with a

view to maximising recovery from the Ibn Yunus Field and helping to

maintain current gross production levels of c.45MMscfe/d at the

South Disouq Central Processing Facility (the "CPF").

-- Post-period end, the second well, the Hanut-1X ("HA-1X")

exploration well, spudded on 4 August and reached the target depth

of 6,000ft on 17 August. The primary target for HA-1X was the Basal

Kafr El Sheikh sand at approximately 5,200ft. The well however

found that the Basal Kafr El Sheikh sand had been eroded at this

location. Whilst drilling to target depth, good quality sands were

found at the Qawasim level, however they were not charged with gas.

SDX considers the result of the HA-1X well to have limited impact

on the remaining c.90-100bcf of prospectivity in the SDX acreage at

South Disouq.

-- Following the IY-2X and HA-1X well results, during H2 2021

the Company will evaluate the current and future prospectivity of

the South Disouq concession to assess whether there is evidence

that the carrying value of the asset should be impaired.

-- In West Gharib, following the ten-year concession extension

granted earlier in 2021, preparations continued for a campaign of

three to four development wells, the first of which is expected to

spud in early Q4.

-- The first phase of the Morocco drilling campaign, which

consisted of three appraisal/development wells in SDX's operated

Gharb Basin acreage in Morocco (SDX: 75% working interest), was

successfully completed in June 2021.

-- The OYF-3, KSR-17 and KSR-18 wells were all commercial

successes, with OYF-3 and KSR-17 already connected as at 30 June

2021 and producing into the Company's infrastructure. KSR-18 has

been tested and was connected at the end of July 2021. Management

estimates that 1.5-1.6bcf of gross resources have been added by

these wells, which is in line with pre-drill P50 estimates.

Preparations are underway for the drilling of up to two additional

wells in Morocco later in the year.

-- As previously announced, during the first half of the year,

the Company received the COVID-19 delayed laboratory analysis of

the cuttings and sidewall cores from the LMS-2 well. This

information confirmed that LMS-2 had successfully encountered the

targeted thermogenic gas source that exists in the Top Nappe

horizon but that the reservoir in the Lalla Mimouna Nord concession

has low permeability and the well is unlikely to flow

conventionally. As such, the Company will not risk US$0.5 million

testing this well, nor will it commit to further investment in the

Lalla Mimouna Nord concession post the end of the concession date

in July 2021 as a result of the limited likelihood of it being

commercially developed. Accordingly, the Company has recognised a

US$10.3 million non-cash impairment charge in Q2 ahead of

relinquishment of the concession, of which US$2.8 million relates

to LMS-2.

Six months to 30 June 2021 Financial Highlights

The table below reflects the unaudited results of the Company

for the three and six months ended 30 June 2021 and 2020. The North

West Gemsa and South Ramadan concessions, which were sold in Q3 and

Q4 2020 respectively, are classified as discontinued operations (as

required by IFRS). All revenues, costs and taxation from these

assets have been consolidated into a single line item

"(loss)/profit from discontinued operations" in both periods

reported. Per unit metrics do not include North West Gemsa or South

Ramadan.

Three months Six months ended

ended 30 June

30 June

US$ million, except per unit 2021 2020 2021 2020

amounts

------- ------ --------- --------

Net revenues 13.7 9.2 27.1 21.9

------- ------ --------- --------

Netback(1) 11.4 7.3 22.1 17.6

------- ------ --------- --------

Net realised average oil service

fees - US$/barrel 54.61 20.94 51.10 30.18

------- ------ --------- --------

Net realised average Morocco

gas price - US$/Mcf 11.49 10.40 11.40 10.35

------- ------ --------- --------

Net realised South Disouq gas

price - US$/Mcf (2) 2.83 2.85 2.85 2.85

------- ------ --------- --------

Netback - US$/boe 20.81 13.79 20.61 15.65

------- ------ --------- --------

EBITDAX(1)(3) 10.1 6.3 19.9 15.7

------- ------ --------- --------

Exploration & evaluation expense

("E&E") (4) (10.6) (0.3) (10.9) (5.1)

------- ------ --------- --------

Depletion, depreciation, and

amortisation ("DD&A") (7.5) (5.2) (14.9) (12.0)

------- ------ --------- --------

Total comprehensive loss (10.7) (0.8) (10.1) (4.0)

------- ------ --------- --------

(Loss)/Profit from discontinued

operations - (0.4) - 0.7

------- ------ --------- --------

Capital expenditure 11.9 3.8 15.8 19.4

------- ------ --------- --------

Net cash generated from operating

activities(5) 8.8 5.5 14.9 10.4

------- ------ --------- --------

Cash and cash equivalents 9.1 9.3 9.1 9.3

------- ------ --------- --------

(1) Refer to the "Non-IFRS Measures" section of this release

below for details of Netback and EBITDAX.

(2) South Disouq gas is sold to the Egyptian State at a fixed

price of US$2.65 MMbtu, which equates to approximately US$2.85/Mcf.

During the three months ended 30 June 2021, a small quantity of

off-specification gas was produced, which reduced the realised

price for this period to US$2.83/Mcf.

(3) EBITDAX for six months ended 30 June 2021 and 2020 includes

US$2.6 million and US$2.7 million respectively of non-cash revenue

relating to the grossing up of Egyptian corporate tax on the South

Disouq PSC which is paid by the Egyptian State on behalf of the

Company (respectively US$1.4 million and US$1.3 million for the

three months ended 30 June 2021 and 2020).

(4) For the six months ended 30 June 2021, US$10.3 million of

non-cash Exploration & Evaluation ("E&E") impairment is

included within this line item (US$4.5 million for the six months

ended 30 June 2020).

(5) Excludes discontinued operations.

-- Netback of US$22.1 million, 26% higher than the same period

in 2020 of US$17.6 million, was primarily driven by strong demand

in Morocco, which during H1 2020 was impacted by temporary COVID-19

shutdowns at three customers. West Gharib netback increased due to

higher service fee realisations, which outweighed the impact of

lower production due to natural decline. These factors were partly

offset by a lower netback at South Disouq as a result of lower

production due to natural decline and well management activity,

including workovers.

-- EBITDAX of US$19.9 million was 27% higher than the same

period in 2020 of US$15.7 million due to the netback factors

described above.

-- Depletion, depreciation and amortisation ("DD&A") charge

of US$14.9 million was higher than the US$12.0 million for the same

period in 2020 due to higher production and lower 2P reserves in

Morocco, partly offset by lower production at West Gharib.

-- The Company recognised a US$10.3 million non-cash E&E

impairment in H1 2021 following the decision to not commit to

further investment in the Lalla Mimouna Nord concession in Morocco

post the end of the concession date in July 2021. In H1 2020 US$4.5

million was written off following the drilling of two

sub-commercial wells, SD-6X in South Disouq and SAH-5 in

Morocco.

-- Operating cash flow (before capex, excluding discontinued

operations) of US$14.9 million, was 43% higher than the same period

in 2020, US$10.4 million, primarily due to the netback drivers

discussed above.

-- Capex of US$15.8 million, reflects:

o US$8.9 million (incl. US$0.5 million decommissioning

provisions) on three wells in Morocco;

o US$2.0 million for well workovers in Morocco;

o US$3.7 million for the completion of the SD-12X tie in at

South Disouq, well drilling preparations for IY-2X and HA-1X, the

SD-4X well workover, and other capex projects at South Disouq;

o US$1.2 million for workovers and development drilling

preparations in West Gharib;

-- Liquidity: Closing cash as at 30 June 2021 was US$9.1

million. The Company has satisfied the conditions precedent on the

five-year EBRD credit facility, which remains undrawn and has

US$10.0 million availability.

-- Together with cash generated from operations, the Company is

fully funded for all planned activities in 2021 - 2022.

COVID-19 update

-- The Company has had no COVID-19 business interruptions since

Q2 2020 when three customers in Morocco resumed taking gas

following a short period of mandatory shutdown. Egyptian production

has remained unaffected by COVID-19. The Company continues to

follow applicable government guidance in each of its

territories.

H1 2021 Performance vs 2021 Guidance

Production

-- H1 2021 entitlement production of 5,931 boe/d is 3% higher

than midpoint guidance of 5,770 boe/d and 4% lower than H1 2020. An

analysis of H1 2021 production by asset vs guidance is as

follows:

Gross production SDX entitlement production

(boe/d)

Asset Guidance - Actual - Guidance Actual - Actual -

12 months ended 6 months ended - 12 months 6 months 6 months

31 December 30 June 2021 ended 31 ended 30 ended 30

2021 December June 2021 June 2020

2021

------------------- ----------------- -------------- ----------- -----------

Core assets

------------------- ----------------- -------------- ----------- -----------

South Disouq

- WI 55% & 100% 44 - 46 MMscfe/d 45.2 MMscfe/d 4,300 - 4,500 4,422 4,825

------------------- ----------------- -------------- ----------- -----------

West Gharib - 2,350 - 2,650

WI 50% bbl/d 2,707 bbl/d 446 - 505 516 647

------------------- ----------------- -------------- ----------- -----------

Morocco - WI

75% 7.0 - 7.3 MMscf/d 7.9 MMscf/d 874 - 915 993 707

------------------- ----------------- -------------- ----------- -----------

Total 5,620 - 5,920 5,931 6,179

-------------- ----------- -----------

Discontinued

operations

------------------- ----------------- -------------- ----------- -----------

NW Gemsa - WI

50% N/A N/A N/A N/A 769

------------------- ----------------- -------------- ----------- -----------

South Ramadan

- WI 12.75% N/A N/A N/A N/A 32

------------------- ----------------- -------------- ----------- -----------

Total (incl.

disc. ops.) 5,620 - 5,920 5,931 6,980

-------------- ----------- -----------

o South Disouq : During the first half of 2021, the existing

wells continued to exhibit natural decline and expected sand and

water production from two of the five wells, albeit this was partly

offset by contribution from the SD-12X well which was brought

online in December 2020. The SD-1X and SD-4X wells were

successfully worked over during the period and were put back on

production at improved gas production rates and with reduced sand

and water production. Production for the six months was above

midpoint guidance, with production for the remainder of the year

expected to remain close to this as the impact of the planned 2-3%

Central Processing Facility ("CPF") downtime in H2 should broadly

be offset by contribution from the IY-2X well which is expected to

be tied in during the last week in August.

o West Gharib: The existing wellstock at the asset continued to

produce steadily, albeit exhibiting natural decline as expected.

Preparations are advanced for a development drilling campaign of

four wells plus one water injector well which will commence in Q4

and allow the Company to benefit from low-risk production growth

into a higher commodity price environment. Production will trend

towards midpoint guidance until such time as the new wells are

drilled and brought online.

o Morocco: H1 2021 saw stronger demand from all customers and

this is the reason that the Company is currently exceeding

guidance. In addition, H1 2021 reflects additional consumption from

an existing customer's second factory which came online in December

2020. Production guidance is 8-12% higher than 2020 production and

reflects a sustained return to normal levels of consumption across

the customer base, following COVID shutdowns which impacted 2020

production.

o COVID-19: The 2021 production guidance presented assumes no

significant production curtailments due to COVID-19. Should there

be COVID-19 related disruptions, then production guidance may be

revised.

Capex

-- Capex for the six months to 30 June 2021 is shown below and

is compared to the revised guidance figure of US$26.5-28.0 million

(previous guidance US$25.0-26.5 million) which predominantly

relates to one exploration and one development well in South Disouq

together with workovers and the installation of an inlet

compressor. Five new wells and workovers are planned in Morocco and

four new wells and facilities upgrades will be undertaken at West

Gharib.

Asset Guidance - 12 Actual - 6 months

months ended 31 ended 30 June

December 2021 2021

South Disouq - WI US$7.0 - 7.5 million US$3.7 million

55% & 100% (1)

--------------------- ------------------

West Gharib - WI US$2.5 - 3.0 million US$1.2 million

50%

--------------------- ------------------

Morocco - WI 75% US$17.0 - 17.5 US$10.9 million

million (2)

--------------------- ------------------

Total US$26.5 - 28.0 US$15.8 million

million

--------------------- ------------------

(1) Includes US$0.6 million of expenditure that was pre-paid as

a project milestone in 2020 but has now been reclassified to

capex

(2) Includes US$0.5 million of non-cash decommissioning

provisions

o South Disouq : The development well, Ibn Yunus-2X, spud in

late June 2021 and reached TD in July 2021 encountering 40.5 ft of

net gas sand pay. During the last week in August, the Company

expects that the IY-2X well will be tied in via a short flowline to

the Ibn Yunus-1X location where an existing flowline connects to

the South Disouq CPF. The gross cost of the tie-in was c.US$0.55

million. The Hanut-1X exploration well, which was completed during

Q3 2021, did not encounter gas-bearing sands and will be plugged

and abandoned. An inlet compressor will be installed at the CPF

site to maximise recovery from the fields, and several well

workovers are also planned. In H1 2021, US$3.7 million of capex was

invested for the compressor project (US$1.5 million), the IY-2X

development well (US$0.6 million), the completion of the SD-12X tie

in (US$0.4 million), planning for the HA-1X exploration well

(US$0.2 million), the workovers of SD-4X and SD-1X (US$0.2 million)

and other CPF projects.

o West Gharib: Four infill development wells and one water

injection well will be drilled, and additional facilities to

support this project will be installed. In H1 2021, US$1.2 million

of capex was spent on a number of well workovers and development

drilling preparations.

o Morocco: Capex guidance for Morocco for the 12 months ended 31

December 2021 has been increased by US$1.5 million as the wells

planned for the second phase of the 2021 campaign in H2 are deeper

than those included in the original guidance. In H1 2021, US$10.9

million of capex was spent on three development wells (US$8.9

million which includes US$0.5 million of decommissioning

provisions) and a well workover campaign (US$2.0 million). A

further two development wells will be drilled in the next campaign

in Q3/Q4 2021.

-- The actual and anticipated timings of planned key capex activities are outlined below:

Asset Activity 2021 Timing

South Disouq SD-4X workover Q1(1)

----------------------------- ------------

SD-1X workover Q2(1)

----------------------------- ------------

Compressor fabrication & Q2-Q3(2)

installation

----------------------------- ------------

Ibn Yunus-2X development Q2-Q3

well (incl. tie in)

----------------------------- ------------

Hanut-1X exploration well Q3(2)

----------------------------- ------------

SD-3X workover Q4

----------------------------- ------------

Morocco Well workovers Q1 (1)

& Q4

----------------------------- ------------

Drilling campaign- first Q2 (1)

three wells

----------------------------- ------------

Drilling campaign- remaining Q3-Q4

two wells

----------------------------- ------------

West Gharib Four development wells Q3-Q4

----------------------------- ------------

Water injection well and Q3-Q4

facilities upgrades

----------------------------- ------------

(1) Activity completed

(2) Completed post period end

2021 Drilling and Operations Update

Morocco drilling campaign update (SDX 75% working interest)

-- The first phase of the Morocco drilling campaign consisted of

three appraisal/development wells in SDX's operated Gharb Basin

acreage in Morocco (SDX: 75% working interest).

-- The first well, OYF-3, which spud on 30 April 2021, reached

its TD at 1,183 metres MD on 11 May 2021. The main Guebbas

reservoir target was thicker than expected and encountered a 5.2

metre net gas sand. The well also encountered a 1.7 metre net gas

sand in a secondary zone that OYF-3 will also produce from.

-- The second well, KSR-17, was spud on 13 May 2021 and reached

its TD at 1,848 metres MD on 27 May 2021. In the main Hoot

reservoir, the well encountered a 5.3 metre net gas sand which was

slightly thinner than expected, but with very good reservoir

properties.

-- Both OYF-3 and KSR-17 have been tested, connected, and

producing into our infrastructure before the end of the reporting

period. Post-drill P50 reserves are estimated at a combined gross

0.81bcf recoverable which is in line with predrill estimates.

-- Finally, the third well of the campaign, KSR-18, was spud on

30 May 2021 and reached its TD of 1,905 metres MD on 14 June 2021.

Both prognosed targets were successfully encountered, with the

shallower Mid Guebbas target comprising a 3.8 metre net gas sand

and the main Hoot target encountering a 13.9 metre net gas sand. As

expected, the main Hoot had been slightly depleted by production

from a nearby well, however the well is still expected to

contribute incremental volumes and deliverability from this

extensive compartment. Further to these zones, a third 5.5 metre

net gas sand was encountered at the Base Guebbas and will

contribute to production in the future when the Hoot has been

depleted. Subsequent to the reporting period, KSR-18 has been

tested and put on production.

-- The second phase of the Moroccan drilling campaign is

expected to commence in September/October 2021.

-- The above developments will allow the Company to continue to

supply gas to our customers in line with our contractual

commitments and continue to support lower CO(2) emissions at our

customers.

South Disouq Egypt exploration drilling campaign update (SDX

55%/100% working interest)

-- Following the success of SD-12X and further review of the 3D

seismic, management has now identified c.233bcf of mean unrisked

recoverable volumes, which are close to our existing

infrastructure, located in horizons that are either productive in

South Disouq or in adjacent blocks and which have now been

high-graded to drill-ready prospects.

-- The Company received final Ministerial and Parliamentary

approval of the two-year extension to the South Disouq exploration

area. The campaign kicked off with the drilling of the IY-2X

development well in the Ibn Yunus field to accelerate production

and cash flows. The well will be tied in during the last week in

August and the Company's expectations are that the IY-2X well can

maximise recovery from the Ibn Yunus Field and help maintain

current gross production levels of c.45MMscfe/d at the South Disouq

Central Processing Facility. The IY-2X well was tied in via a short

flowline to the Ibn Yunus-1X location where an existing flowline

connects to the South Disouq Central Processing Facility. The gross

cost of this tie-in was US$0.55 million.

-- Post-period end, the second well, the HA-1X exploration well,

spudded on 4 August and reached the target depth of 6,000ft on 17

August. The primary target for HA-1X was the Basal Kafr El Sheikh

sand at approximately 5,200ft. The well however found that the

Basal Kafr El Sheikh sand had been eroded at this location. Whilst

drilling to target depth, good quality sands were found at the

Qawasim level, however they were not charged with gas. SDX

considers the result of the HA-1X well to have limited impact on

the remaining c.90-100bcf of prospectivity in the SDX acreage at

South Disouq.

-- Management's estimate of the mean prospective resources and

chance of success of the prospects identified in the South Disouq

area are shown below.

Prospect Working Interval Concession Comment Unrisked Chance

Name Interest Detail Mean of Success

% (bcf) (%)

Proposed 2 Yr(2)

exploration

Mohsen 55-100(1) KES extension Single Target 27 46

---------- --------- -------------------- --------------- --------- ------------

Proposed 2 Yr(2)

exploration

El Deeb 55-100(1) Qawasim extension Single Target 22 29

---------- --------- -------------------- --------------- --------- ------------

Proposed 2 Yr(2)

KES/Abu exploration

Ibn Newton/Newton 55-100(1) Madi extension Dual Target 16 40-45

---------- --------- -------------------- --------------- --------- ------------

Up to 25 Yr

Shikabala Development

prospects KES/ Lease to 31 Single Target

(two wells) 100 Qawasim August 2045 & Dual Target 16 25-40

---------- --------- -------------------- --------------- --------- ------------

Up to 25 Yr

Development

Lease to 2 January

Warda 55 KES 2044 Single Target 14 40

---------- --------- -------------------- --------------- --------- ------------

Total 95

---------- --------- -------------------- --------------- --------- ------------

(1) Working interest % dependent on Partner's decision to

participate in the extension. The Company's partner has confirmed

its participation in the Hanut-1X well.

(2) Two-year extension period commences on date of Parliamentary

approval

-- Following the IY-2X and HA-1X well results, during H2 2021

the Company will evaluate the current and future prospectivity of

the South Disouq concession to assess whether there is evidence

that the carrying value of the asset should be impaired.

West Gharib Egypt development drilling campaign update (SDX 50%

working interest)

-- In March 2021, SDX obtained approval for a ten-year extension

to the West Gharib Production Services Agreement increasing audited

working interest 2P reserves in this core oil asset as at 31

December 2020, by 60% year on year, or 119% taking account of 2020

production, to 3.52 million barrels.

-- Following this agreement, SDX and its partner commenced

planning for a four well development drilling campaign plus one

water injector well that is expected to start in Q4 2021, and is

part of a wider three-year plan to arrest production decline in the

asset and return production levels to c.3,000 bbl/d, taking

advantage of low-risk production growth and the improved oil

pricing environment.

Six months to 30 June 2021 Financial Update

-- Netback was US$22.1 million, 26% higher than the Netback of

US$17.6 million for the six months to 30 June 2020, driven by:

o Net revenue increase of US$5.2 million due to:

o US$1.2 million higher revenue at West Gharib as lower

production (2021: 516 bbl/d, 2020: 647 bbl/d) was more than offset

by higher realised service fees (2021: US$51.10/bbl, 2020:

US$30.18/bbl);

o US$4.4 million higher revenue in Morocco due to increased

production following strong demand rebound following COVID-19

shutdowns in early 2020 and an additional factory being supplied

(2021: 993 boe/d, 2020: 707 boe/d). Revenue was further boosted by

higher prices due to the strengthening of the Moroccan dirham and

the additional factory taking gas at a higher price than the

contractual average; offset by

o US$0.4 million lower South Disouq revenue due to lower

production (2021: 4,422 boe/d, 2020: 4,825 boe/d) as a result of

natural decline at several wells and downtime for workover

activity, partly offset by new production from the SD-12X well and

a higher realised price for condensate.

o Operating costs increased by US$0.7 million from the prior

period due to increased well management costs at South Disouq and a

greater number of wells producing in Morocco, partly offset by

lower costs at West Gharib due to cost savings and lower workover

activities.

-- EBITDAX was US$19.9 million, US$4.2 million (27%) higher than

EBITDAX of US$15.7 million for the six months to 30 June 2020, for

the reasons described in the netback section above.

-- The main components of SDX's comprehensive loss of US$10.1

million for the six months ended 30 June 2021 are:

o US$22.1 million Netback explained above;

o US$10.9 million of E&E expense which relates to the

US$10.3 million non-cash impairment of the Lalla Mimouna Nord

concession in Morocco and ongoing new venture activity

(predominantly internal management time);

o US$14.9 million of DD&A expense which reflects lower West

Gharib production offset by increased production in Morocco;

o US$2.3 million of ongoing G&A expense; and

o US$3.7 million of corporation tax predominantly for South

Disouq.

Operating cash flow (before capex, excluding discontinued

operations)

-- Operating cash flow (before capex, excluding discontinued

operations) of US$14.9 million, 43% higher than the same period in

2020 of US$10.4 million primarily due to the netback drivers

discussed above, as well as less cash spent on inventory.

H1 2021 ESG metrics

-- The Company's operated assets recorded a carbon intensity of

2.7kg CO(2) e/boe in H1 2021, which is one of the lowest rates in

the industry. This was higher than the 1.7 kg CO(2e) /boe reported

for the twelve months ended 31 December 2020 as the booster

compressor at South Disouq was online throughout H1 2021, but only

from Q2 2020, and in January 2021 a second production compressor

was commissioned in Morocco. Combined production from the two

assets was also marginally lower in H1 2021 compared to H1

2020.

-- Scope 1 greenhouse gas emissions at operated assets were

4,405 tons of CO(2) e. Scope 3 greenhouse gas emissions in Morocco

were 75,500 tons of CO(2) e, which is approximately 38,500 tons of

CO(2) e less than using alternative heavy fuel oil.

-- There was one Lost Time Injury recorded in Morocco in July

2021. A contractor sustained a minor injury in a road traffic

accident but after a short period of observation was able to return

to work.

-- No produced water was discharged into the environment in

Morocco (100% contained and evaporated) or at South Disouq (100%

recycled) during H1 2021.

-- There were no hydrocarbon spills at operated assets during H1 2021.

-- During the first half of 2021, the Company was delighted to

support two hospitals close to the South Disouq operation by

donating 13 monitors and BPAP ventilators to assist both in

alleviating the current COVID-19 crisis and equipping the teams

there for the longer-term health of our local communities. In

Morocco, the Company is working on several initiatives to be

launched later in 2021 as soon as this can be done safely.

-- The Company continues to adopt high standards of Governance

through its adherence to the QCA Code on Corporate Governance.

Outlook

-- Management believes that the Company is well-placed to

weather the current macroeconomic uncertainties and continues to

screen a number of business development opportunities.

-- Cash generation is expected to continue strongly through 2021

and beyond as approximately 85% of the Company's cash flows are

expected to be generated from fixed-price gas businesses.

-- Whilst acknowledging the volatility of the commodities

market, the current strong oil price and outlook means that the

Group also plans to capitalise on its recent production service

agreement extension at West Gharib by investing in a 12-well

development drilling programme over the next three years, including

four wells in 2021.

-- Anticipated 2021 and 2022 work programmes are fully funded.

-- The Company continues to assess the optimum use of capital in

the interests of all stakeholders, whether that be investment into

new projects or returning cash to shareholders. At present the

Company is focussed on continued investment of its portfolio and

considers this the most appropriate use of the Company's capital.

This will be assessed on an ongoing basis.

KEY FINANCIAL & OPERATING HIGHLIGHTS

Three months ended Six months ended

Prior Quarter 30 June(3) 30 June

-------------------------- -------------- ------------------------------------ ------------------------------------

$000s except per unit

amounts 2021 (unaudited) 2020 (unaudited) 2021 (unaudited) 2020 (unaudited)

-------------------------- -------------- ----------------- ----------------- -----------------

FINANCIAL

-------------------------- -------------- ----------------- ----------------- -----------------

Net revenues 13,383 13,725 9,163 27,108 21,856

Operating costs (2,616) (2,363) (1,844) (4,979) (4,258)

Netback (1) 10,767 11,362 7,319 22,129 17,598

EBITDAX (1) 9,811 10,103 6,307 19,914 15,686

Total comprehensive

profit/(loss) 613 (10,699) (801) (10,086) (3,945)

Net profit/(loss) per

share

- basic $0.003 $(0.052) $(0.004) $(0.049) $(0.019)

Cash, end of period 9,734 9,108 9,275 9,108 9,275

Capital expenditures 3,964 11,875 3,842 15,839 19,375

Total assets 123,788 114,645 129,246 114,645 129,246

Shareholders' equity 97,079 86,430 94,390 86,430 94,390

Common shares outstanding

(000's) 205,378 205,378 204,723 205,378 204,723

OPERATIONAL

-------------------------- -------------- ----------------- ----------------- ----------------- -----------------

West Gharib production

service

fee (bbl/d) 543 490 628 516 647

South Disouq gas sales

(boe/d) 4,094 4,313 4,401 4,204 4,557

Morocco gas sales (boe/d) 1,023 964 551 993 707

Other products sales

(boe/d) 202 235 253 218 268

-------------------------- -------------- ----------------- ----------------- ----------------- -----------------

Total sales volumes

(boe/d)

(2) 5,682 6,002 5,833 5,931 6,179

-------------------------- -------------- ----------------- ----------------- -----------------

Realised West Gharib

service

fee (US$/bbl) $47.90 $54.61 $20.94 $51.10 $30.18

Realised South Disouq gas

price (US$/Mcf) $2.85 $2.83 $2.85 $2.85 $2.85

Realised Morocco gas

price

(US$/Mcf) $11.32 $11.49 $10.40 $11.40 $10.35

Royalties ($/boe) (2) $4.82 $5.02 $4.91 $4.93 $5.01

Operating costs ($/boe)

(2) $4.96 $4.33 $3.47 $4.64 $3.79

Netback ($/boe) (1) (2) $20.41 $20.81 $13.79 $20.61 $15.65

(1) Refer to the "Non-IFRS Measures" section of this release

below for details of Netback and EBITDAX.

(2) Excludes discontinued operations

(3) The Q2 2021 and Q2 2020 information in respect of the three

months ended 30 June 2021 and 30 June 2020 respectively included in

the Condensed Financial Statements has not been reviewed by

PricewaterhouseCoopers LLP (the Company's auditors).

Consolidated Balance Sheet (unaudited)

(US$'000s) As at 30 June 2021 As at 31 December

2020

---------------------- ----------------------------------------- ---------------------------------------

Assets

Cash and cash

equivalents 9,108 10,056

Trade and other

receivables 18,967 18,608

Inventory 7,643 8,414

-------------------------- ----------------------------------------- ---------------------------------------

Current assets 35,718 37,078

Investments 4,013 3,790

Property, plant and

equipment 56,375 57,880

Exploration and

evaluation

assets 16,873 24,455

Right-of-use assets 1,666 1,400

----------------------- ---------------------------------------

Non-current assets 78,927 87,525

Total assets 114,645 124,603

-------------------------- ---------------------------------------

Liabilities

Trade and other payables 18,230 20,120

Decommissioning

liability - 327

Current income taxes 1,187 241

Lease liability 501 461

----------------------- ----------------------------------------- ---------------------------------------

Current liabilities 19,918 21,149

Decommissioning

liability 6,822 5,862

Deferred income taxes 290 290

Lease liability 1,185 960

----------------------- ---------------------------------------

Non-current liabilities 8,297 7,112

Total liabilities 28,215 28,261

----------------------- ---------------------------------------

Equity

Share capital 2,601 2,601

Share premium 130 130

Share-based payment

reserve 7,443 7,269

Accumulated other

comprehensive

loss (917) (917)

Merger reserve 37,034 37,034

Retained earnings 40,139 50,225

Total equity 86,430 96,342

-------------------------- ---------------------------------------

Equity and liabilities 114,645 124,603

----------------------- ---------------------------------------

Consolidated Statement of Comprehensive Income (unaudited)

Unreviewed (1)

Three months ended Six months ended

30 June 30 June

(US$'000s) 2021 2020 2021 2020

-------------------- ------------------- ----------------- ------------------- ----------------

Revenue, net of

royalties 13,725 9,163 27,108 21,856

Direct operating

expense (2,363) (1,844) (4,979) (4,258)

Gross profit 11,362 7,319 22,129 17,598

Exploration and

evaluation expense (10,612) (303) (10,880) (5,099)

Depletion, depreciation

and amortisation (7,521) (5,225) (14,945) (11,973)

Share-based

compensation (50) (68) (174) (313)

Share of profit from

joint venture 108 137 223 384

General and

administrative expenses

- Ongoing general and

administrative

expenses (1,317) (1,013) (2,264) (1,915)

- Transaction costs - (68) - (68)

---------------------- ------------------- ----------------- ------------------- ----------------

Operating

(loss)/income (8,030) 779 (5,911) (1,386)

Finance costs (153) (134) (334) (276)

Foreign exchange

(loss)/gain (70) 30 (162) (301)

(Loss)/income before

income taxes (8,253) 675 (6,407) (1,963)

Current income tax

expense (2,446) (1,085) (3,679) (2,728)

(Loss)/profit from

discontinued

operations - (391) - 737

Loss and total

comprehensive loss

for the period (10,699) (801) (10,086) (3,954)

------------------------ ----------------- ------------------- ----------------

Net loss per

share

Basic $(0.052) $(0.004) $(0.049) $(0.019)

Diluted $(0.052) $(0.004) $(0.049) $(0.019)

-------------------- ----------------- ------------------- ----------------

(1) The Q2 2021 and Q2 2020 information in respect of the three

months ended 30 June 2021 and 30 June 2020 respectively included in

the Condensed Financial Statements has not been reviewed by

PricewaterhouseCoopers LLP (The Company's auditors).

Consolidated Statement of Changes in Equity (unaudited)

Six months ended 30 June

(US$'000s) 2021 2020

-------------------------------- --------------------------------- ---------------------------------

Share capital

Balance, beginning of

period 2,601 2,593

Balance, end

of period 2,601 2,593

Share premium

Balance, beginning of 130 -

period

Balance, end 130 -

of period

Share-based payment

reserve

Balance, beginning of

period 7,269 7,038

Share-based compensation for

the period 174 313

----------------------------------- --------------------------------- ---------------------------------

Balance, end

of period 7,443 7,351

Accumulated other comprehensive

loss

Balance, beginning of

period (917) (917)

Balance, end

of period (917) (917)

Merger reserve

Balance, beginning of

period 37,034 37,034

Balance, end

of period 37,034 37,034

Retained earnings

Balance, beginning of

period 50,225 52,283

Total comprehensive

loss (10,086) (3,954)

---------------------------------- --------------------------------- ---------------------------------

Balance, end

of period 40,139 48,329

Total equity 86,430 94,390

--------------------------------- ---------------------------------

Consolidated Statement of Cash

Flows (unaudited)

Unreviewed (1) Six months ended

Three months ended 30 June

30 June

(US$'000s) 2021 2020 2021 2020

------------------------------------------- -------- --------------- ------------------ ---------

Cash flows generated from/(used

in) operating activities

(Loss)/income before income taxes (8,253) 675 (6,407) (1,963)

Adjustments for:

Depletion, depreciation and amortisation 7,521 5,225 14,945 11,973

Exploration and evaluation expense 10,313 - 10,313 4,527

Finance expense 153 134 334 276

Share-based compensation charge 50 68 174 313

Foreign exchange loss/(gain) (137) 173 (74) 457

Tax paid by state (1,338) (1,240) (2,566) (2,678)

Share of profit from joint venture (108) (137) (223) (384)

------------------------------------------- -------- --------------- ------------------ ---------

Operating cash flow before working

capital movements 8,201 4,898 16,496 12,521

Decrease/(increase) in trade and

other receivables 1,603 2,739 (273) 892

(Decrease)/increase in trade and

other payables (1,057) (763) (763) (498)

Decrease/(increase) of inventory 73 (361) (512) (1,422)

Cash generated from operating activities 8,820 6,513 14,948 11,493

Income taxes paid - (1,062) - (1,135)

------------------------------------------- ------------------ ---------

Net cash generated from operating

activities 8,820 5,451 14,948 10,358

Cash generated from discontinued

operations - 2,970 - 4,140

Cash flows generated from/(used

in) investing activities:

Property, plant and equipment expenditures (7,409) (139) (10,094) (5,625)

Exploration and evaluation expenditures (1,907) (8,466) (5,282) (11,593)

Advance proceeds from NW Gemsa

sale - 1,000 - 1,000

Dividends received - - - 774

Net cash used in investing activities (9,316) (7,605) (15,376) (15,444)

Cash flows generated from/(used

in) financing activities:

Payments of lease liabilities (229) (150) (503) (308)

Finance costs paid (40) (26) (95) (70)

------------------------------------------- -------- --------------- ------------------ ---------

Net cash used in financing activities (269) (176) (598) (378)

(Decrease)/increase in cash and

cash equivalents (765) 640 (1,026) (1,324)

Effect of foreign exchange on cash

and cash equivalents 139 (172) 78 (455)

Cash and cash equivalents, beginning

of period 9,734 8,807 10,056 11,054

------------------------------------------- -------- --------------- ------------------ ---------

Cash and cash equivalents, end

of period 9,108 9,275 9,108 9,275

------------------------------------------- --------------- ------------------ ---------

(1) The Q2 2021 and Q2 2020 information in respect of the three

months ended 30 June 2021 and 30 June 2020 respectively included in

the Condensed Financial Statements has not been reviewed by

PricewaterhouseCoopers LLP (The Company's auditors).

About SDX

SDX is an international oil and gas exploration, production and

development company, headquartered in London, United Kingdom, with

a principal focus on MENA. In Egypt, SDX has a working interest in

two producing assets: a 55% operated interest in the South Disouq

and Ibn Yunus gas fields and a 100% operated interest in the Ibn

Yunus North gas field, all in the Nile Delta and a 50% non-operated

interest in the West Gharib concession, which is located onshore in

the Eastern Desert, adjacent to the Gulf of Suez. In Morocco, SDX

has a 75% working interest in five development/production

concessions, all situated in the Gharb Basin. The producing assets

in Morocco are characterised by attractive gas prices and

exceptionally low operating costs. SDX has a strong weighting of

fixed price gas assets in its portfolio with low operating costs

and attractive margins throughout, providing resilience in a low

commodity price environment. SDX's portfolio also includes high

impact exploration opportunities in both Egypt and Morocco.

For further information, please see the Company's website at

www.sdxenergygroup.com or the Company's filed documents at

www.sedar.com .

Competent Persons Statement

In accordance with the guidelines of the AIM Market of the

London Stock Exchange, the technical information contained in the

announcement has been reviewed and approved by Rob Cook, VP

Subsurface of SDX. Dr. Cook has over 25 years of oil and gas

industry experience and is the qualified person as defined in the

London Stock Exchange's Guidance Note for Mining and Oil and Gas

companies. Dr. Cook holds a BSc in Geochemistry and a PhD in

Sedimentology from the University of Reading, UK. He is a Chartered

Geologist with the Geological Society of London (Geol Soc) and a

Certified Professional Geologist (CPG-11983) with the American

Institute of Professional Geologists (AIPG).

For further information:

SDX Energy Plc

Mark Reid

Chief Executive Officer

Tel: +44 203 219 5640

Stifel Nicolaus Europe Limited (Nominated Adviser and Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Tel: +44 (0) 20 7710 7600

Peel Hunt LLP (Joint Broker)

Richard Crichton

David McKeown

Tel: +44 (0) 207 418 8900

Camarco (PR)

Billy Clegg/Owen Roberts/Violet Wilson

Tel: +44 (0) 203 757 4980

Glossary

"bbl" stock tank barrel

"bbl/d" barrels of oil per day

---------------------------------------

"bcf" billion cubic feet

---------------------------------------

"boe/d" barrels of oil equivalent per

day

---------------------------------------

"CO(2) e/boe" carbon dioxide equivalent per

barrels of oil equivalent

---------------------------------------

"Mcf" thousands of cubic feet

---------------------------------------

"MD" measured depth

---------------------------------------

"MMscf/d" million standard cubic feet

per day

---------------------------------------

"MMscfe/d" million standard cubic feet

equivalent per day

---------------------------------------

"P50" means that there is at least

a 50% probability that the quantities

actually recovered will equal

or exceed the best estimate.

---------------------------------------

"TD" total depth

---------------------------------------

"2P Reserves" proved plus probable reserves

---------------------------------------

Forward-looking information

Certain statements contained in this press release may

constitute "forward-looking information" as such term is used in

applicable Canadian securities laws. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions or future

events or are not statements of historical fact should be viewed as

forward-looking information. In particular, statements regarding

the Company's 2021 production and capex guidance, liquidity and

sources of cash flows in 2021, the impact of COVID-19 on customer

consumption, and future drilling developments and results should

all be regarded as forward-looking information.

The forward-looking information contained in this document is

based on certain assumptions, and although management considers

these assumptions to be reasonable based on information currently

available to them, undue reliance should not be placed on the

forward-looking information because SDX can give no assurances that

they may prove to be correct. This includes, but is not limited to,

assumptions related to, among other things, commodity prices and

interest and foreign exchange rates; planned synergies, capital

efficiencies and cost - savings; applicable tax laws; future

production rates; receipt of necessary permits; the sufficiency of

budgeted capital expenditures in carrying out planned activities,

and the availability and cost of labour and services.

All timing given in this announcement, unless stated otherwise,

is indicative, and while the Company endeavours to provide accurate

timing to the market, it cautions that, due to the nature of its

operations and reliance on third parties, this is subject to

change, often at little or no notice. If there is a delay or change

to any of the timings indicated in this announcement, the Company

shall update the market without delay.

Forward-looking information is subject to certain risks and

uncertainties (both general and specific) that could cause actual

events or outcomes to differ materially from those anticipated or

implied by such forward - looking statements. Such risks and other

factors include, but are not limited to, political, social, and

other risks inherent in daily operations for the Company, risks

associated with the industries in which the Company operates, such

as: operational risks; delays or changes in plans with respect to

growth projects or capital expenditures; costs and expenses;

health, safety and environmental risks; commodity price, interest

rate and exchange rate fluctuations; environmental risks;

competition; permitting risks; the ability to access sufficient

capital from internal and external sources; and changes in

legislation, including but not limited to tax laws and

environmental regulations. Readers are cautioned that the foregoing

list of risk factors is not exhaustive and are advised to refer to

the Principal Risks & Uncertainties section of SDX's Annual

Report for the year ended 31 December 2020, which can be found on

the Company's website at https://www.sdxenergygroup.com/ and on

SDX's SEDAR profile at www.sedar.com , for a description of

additional risks and uncertainties associated with SDX's

business.

The forward-looking information contained in this press release

is as of the date hereof and SDX does not undertake any obligation

to update publicly or to revise any of the included forward --

looking information, except as required by applicable law. The

forward -- looking information contained herein is expressly

qualified by this cautionary statement.

Non-IFRS Measures

This news release contains the terms "Netback," and "EBITDAX"

which are not recognized measures under IFRS and may not be

comparable to similar measures presented by other issuers. The

Company uses these measures to help evaluate its performance.

Netback is a non-IFRS measure that represents sales net of all

operating expenses and government royalties. Management believes

that Netback is a useful supplemental measure to analyze operating

performance and provide an indication of the results generated by

the Company's principal business activities prior to the

consideration of other income and expenses. Management considers

Netback an important measure as it demonstrates the Company's

profitability relative to current commodity prices. Netback may not

be comparable to similar measures used by other companies.

EBITDAX is a non-IFRS measure that represents earnings before

interest, tax, depreciation, amortization, exploration expense and

impairment. EBITDAX is calculated by taking operating income/(loss)

and adjusted for the add-back of depreciation and amortization,

exploration expense and impairment of property, plant, and

equipment (if applicable). EBITDAX is presented in order for the

users to understand the cash profitability of the Company, which

excludes the impact of costs attributable to exploration activity,

which tend to be one-off in nature, and the non-cash costs relating

to depreciation, amortization and impairments. EBITDAX may not be

comparable to similar measures used by other companies.

Oil and Gas Advisory

Certain disclosures in this news release constitute "anticipated

results" for the purposes of National Instrument 51-101 - Standards

of Disclosure for Oil and Gas Activities ("NI 51-101") of the

Canadian Securities Administrators because the disclosure in

question may, in the opinion of a reasonable person, indicate the

potential value or quantities of resources in respect of the

Company's resources or a portion of its resources. Without

limitation, the anticipated results disclosed in this news release

include estimates of volume, flow rate, production rates, porosity,

and pay thickness attributable to the resources of the Company.

Such estimates have been prepared by Company management and have

not been prepared or reviewed by an independent qualified reserves

evaluator or auditor. Anticipated results are subject to certain

risks and uncertainties, including those described above and

various geological, technical, operational, engineering,

commercial, and technical risks. In addition, the geotechnical

analysis and engineering to be conducted in respect of such

resources is not complete. Such risks and uncertainties may cause

the anticipated results disclosed herein to be inaccurate. Actual

results may vary, perhaps materially.

Use of the term "boe" or the term "MMscf" may be misleading,

particularly if used in isolation. A "boe" conversion ratio of 6

Mcf: 1 bbl and a "Mcf" conversion ratio of 1 bbl: 6 Mcf are based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead.

Reserve and Resource Data

The reserve and resource estimates disclosed or referenced

herein have been prepared by Dr. Rob Cook, a qualified reserves

evaluator, in accordance with the SPE's Canadian Oil and Gas

Evaluation Handbook and in accordance with NI 51-101. The reserves

and resources disclosed herein have an effective date of 31

December 2020.

Prospective resources are those quantities of gas, estimated as

of the given date, to be potentially recoverable from undiscovered

accumulations through future development projects. As prospective

resources, there is no certainty that any portion of the resources

will be discovered. The chance that an exploration project will

result in a discovery is referred to as the "chance of discovery"

as defined by the management of the Company.

There is no certainty that it will be commercially viable to

produce any portion of the resources discussed herein; though any

discovery that is commercially viable would be tied back to the

Company's pipeline in Morocco and then connected to customers'

facilities within 9 to 12 months of discovery. Based upon the

economic analysis undertaken on any discovery, management has

attributed an associated chance of development of 100%.

There are uncertainties associated with the volume estimates of

the prospective resources disclosed herein, due to the level of

information available on prospective resources, but ranges are

defined based on data from the Company's nearby existing analogous

wells. Some of the risks and uncertainties are outlined below:

-- Petrophysical parameters of the sand/reservoir;

-- Fluid composition, especially heavy end hydrocarbons;

-- Accurate estimation of reservoir conditions (pressure and temperature);

-- Reservoir drive mechanism;

-- Potential well deliverability; and

-- The thickness and lateral extent of the reservoir section,

currently based on 3D seismic data.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFSFWUEFSEIA

(END) Dow Jones Newswires

August 20, 2021 02:00 ET (06:00 GMT)

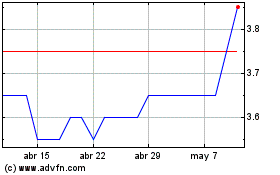

Sdx Energy (LSE:SDX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Sdx Energy (LSE:SDX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024