TIDMSFE

RNS Number : 4132T

Safestyle UK PLC

25 March 2021

25 March 2021

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Safestyle UK plc

("Safestyle" or the "Group")

Final Results for Financial Year 2020

Strong recovery and return to profitability in H2

2021 financial performance expected to be significantly ahead of

market expectations

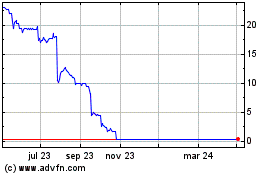

Safestyle UK plc (AIM: SFE), the leading UK-focused retailer and

manufacturer of PVCu replacement windows and doors for the

homeowner market, today announces its final results for financial

year 2020(1) .

Financial and operational highlights

FY 2020 FY 2019

GBPm GBPm % change

--------- -------- ---------

Revenue 113.2 126.2 (10.3)%

--------- -------- ---------

Gross profit 28.5 31.9 (10.8)%

--------- -------- ---------

Gross margin %(2) 25.1% 25.3% (13)bps

--------- -------- ---------

Underlying (loss) before taxation(3) (4.8) (1.5) (213.4)%

--------- -------- ---------

Non-underlying items(4) (1.4) (2.3) 39.5%

--------- -------- ---------

(Loss) before taxation (6.2) (3.8) (60.6)%

--------- -------- ---------

EPS - Basic (4.3p) (4.0p) (7.5)%

--------- -------- ---------

Net cash(5) 7.6 0.4

--------- -------- ---------

(1) The financial statements are presented for the year ended on

the closest Sunday to the end of December. This date was 3 January

2021 for the current reporting year and 29 December 2019 for the

prior year. All references made throughout these accounts for the

financial year 2020 are for the period 30 December 2019 to 3

January 2021 and references to the financial year 2019 are for the

period 31 December 2018 to 29 December 2019.

(2) Gross margin % is defined as gross profit divided by

revenue.

(3) Underlying (loss) before taxation is defined as reported

(loss) before taxation before non-underlying items and is included

as an alternative performance measure in order to aid users in

understanding the ongoing performance of the Group.

(4) Non-underlying items consist of non-recurring costs, share

based payments and the Commercial Agreement amortisation. See

Financial Review for more detail.

(5) Net cash is cash and cash equivalents less borrowings.

A reconciliation between the terms used in the above table and

those in the financial statements can be found in the Financial

Review.

Operational

-- Staff, consumer and business protection was paramount through

2020 with COVID-safe practices in place across our sites and in

home.

-- Growth in order intake exceeded the 15% growth in revenue in

H2 and generated a strong order book at year end, 83% larger than

2019.

-- This large order book has supported sustained operations

during the January 2021 cessation of in home sales & door

canvass.

-- Post H1 lockdown, operations were resilient with no site

closures and continued manufacturing and installation activity

thoughout H2, into Q1 2021.

-- Capacity increases in H2 were enabled by increases in

headcount across survey, manufacturing, customer services and

installations.

-- Market share (as measured by FENSA) rose to 9.2% from 8.4% in 2019.

-- Good progress made on operational KPIs, with average price

per frame up 3.8% to GBP704 and average order value up by 4.1% to

GBP3,474, with the trend continuing in Q1 2021.

-- Continued progress on the Group's sustainability programme

with CO(2) emissions per frame installed reducing by 6.1%.

-- Tangible delivery on the Group's strategic priorities despite

the challenging backdrop, including modernising the Safestyle

brand, improving the national sales and depot network and

sustaining progress in compliance.

Financial

-- Progressive increase in revenue comparisons in H2 with Q3

being 9% ahead of prior year and Q4 being 20% ahead of prior

year.

-- The impact of cessation of operations in H1 resulted in a

GBP(6.0)m loss across the March to May period with underlying

profit before taxation achieved of GBP0.3m in H2 after material

investment in order book.

-- The Group received GBP1.8m from the Government's Coronavirus

Job Retention Scheme ('CJRS') which partly reduced the first half

loss.

-- The business undertook a Placing of New Shares in April which

raised GBP8.2m net of directly attributable costs of GBP0.3m to

strengthen the Group's balance sheet which allowed a strong restart

of operations in late May and a strong year end position, with

year-end net cash of GBP7.6m (2019: GBP0.4m).

Outlook

-- 2021 started with immediate disruption to sales as in-home

selling and canvass operations were halted.

-- Restrictions have now eased and the Group is seeing a good

recovery of sales momentum from 2020.

-- Despite the impact the lockdown has had on order intake thus

far in 2021, management actions and investment in the order book in

2020 have underpinned a good level of manufacturing and

installations activity in the first quarter of 2021. This has

minimised further disruption to our customers and many areas of the

business.

-- Revenue has grown by double digits in Q1 2021 and levels of

profitability have increased versus 2020 exit rate.

-- The order book continues to remain ahead of the prior year

although it has been run down in the first quarter and converted

into profit and cash.

-- In summary, the Group has had a good start to 2021 and will

achieve the highest level of profitability in Q1 for any quarter

since 2017 while also maintaining a healthy installation

pipeline.

-- The UK Government has set out its roadmap for cessation of

all restrictions by the end of June 2021 and based on this plan,

the Board expects there to be no further significant interruption

to our operations.

-- Despite the uncertain operating environment, the Board

expects to see good levels of demand for its products and is

recapturing the order intake momentum achieved in the second half

of 2020 now restrictions on sales activities have been lifted.

-- As a result of this encouraging start to the year, the Board

expects 2021 financial performance to be significantly ahead of

market expectations.

-- The Board also expects to revisit its dividend policy later

in 2021 assuming that the Group has returned to a consistent

delivery of profitability.

Commenting on the results, Mike Gallacher, CEO said:

"I am extremely proud of the way that our colleagues responded

to what was a year with unparalleled challenges, at all times

keeping a constant focus on health and safety while remaining

committed to delivering for our customers.

Having taken decisive action to support the business during the

period, we saw a strong recovery in the second half of the year

with good order intake growth and a step up in operational

capacity, as customer demand remained robust. By the end of 2020,

our order book was 83% larger than 2019's closing position, which

has given us a strong platform to maintain momentum at the

beginning of the current financial year in spite of the external

disruption.

Notwithstanding the uncertain operating environment, as a result

of the strategic and operational progress we have made along with

our strong order book, cash position and market leading brand, the

Board now expects the Group's 2021 financial performance to be

significantly ahead of market expectations.

Our intention remains as before the crisis; to build long term

value for shareholders by consolidating our position as the UK's

number 1 choice for replacement windows and doors."

A conference call for analysts and investors for the 2020 Final

Results will be held today at 9.30 am. If you would like to join,

please contact FTI Consulting at safestyle@fticonsulting.com or

using the details below in order to access the registration

details.

Enquiries:

Safestyle UK plc via FTI Consulting

Mike Gallacher, Chief Executive Officer

Rob Neale, Chief Financial Officer

Zeus Capital Limited (Nominated Adviser Tel: 0203 829

& Joint Broker) 5000

Dan Bate / D aniel Harris / Dominic King

Liberum Capital Limited (Joint Broker) Tel: 0203 100

Neil Patel / Jamie Richards 2100

FTI Consulting (Financial PR) Tel: 0203 727

Alex Beagley / James Styles / Sam Macpherson 1000

About Safestyle UK plc

The Group is the leading retailer and manufacturer of PVCu

replacement windows and doors to the UK homeowner market. For more

information please visit www.safestyleukplc.co.uk or

www.safestyle-windows.co.uk.

CEO's Statement

2020 has been an extraordinary trading year, with huge levels of

disruption and sustained uncertainty. Despite this, the business

has emerged strongly, building momentum in H2 and making progress

on our core strategic priorities. I am immensely proud of the

response of our staff who showed enormous flexibility and

resilience in responding to the sustained challenges the business

faced during 2020.

The business started the year with good growth sustained from Q4

2019 but our priorities shifted rapidly in Q1 to a focus on

protecting our staff, customers and the business through the

pandemic. Our results in H1 were impacted significantly by the

cessation of business operations between March and the end of May.

However, as a result of the support of shareholders and our lenders

in April, the business was able to recapture its strong momentum in

H2, delivering double-digit revenue growth of 15% while also

growing the order book by 83%. The strong order book has allowed us

to entirely mitigate the disruption caused by the interruption in

sales and canvass operations during Q1 2021.

COVID-19 response

The business began contingency planning in February and this

ensured a rapid cessation of operations on 23 March, in line with

government guidance. The hibernation of the business at that point

encompassed canvassing, in-home sales, survey, processing,

manufacturing and installations. We retained a small remote selling

team together with a skeleton customer service function. This

enabled us to minimise our cash outflow during this period of

uncertainty.

The support of shareholders and our lenders during April was

critical given the business was still recovering financially from

2018. The funds provided allowed the business to emerge strongly

from the first lockdown in May and navigate the further disruption

arising from the second lockdown in November.

Within the business we developed COVID-safe practices that

allowed our offices and factories to operate without interruption

from May, with key staff split into socially distanced bubbles and

extensive use of remote working. Staff operating in customers'

homes were subject to new working practices, with the mandatory use

of face masks and other personal hygiene measures. Again, this

approach enabled us to sustain our business operations through

H2.

The COVID-safe measures taken in 2020 carried cost and

inevitably drove a level of inefficiency but were successful in

allowing us to operate commercially throughout H2, while also

protecting our staff and maintaining the confidence of our

customers.

Generating momentum through the turbulence - H2 performance

Furnished with the support of shareholders, the phased restart

was rapid and we quickly found that consumer demand was strong. The

strength of the market reflected the multiple restrictions on other

forms of consumer spending and was seen across the wider Repair,

Maintenance and Improvement (RMI) sector.

In response to this growth we invested in expanding our capacity

across survey, processing, manufacturing and installations. The

resulting capacity increase lagged the growth in sales but

delivered revenue growth of 15% in H2. This meant our order book

grew by 83% versus 2019 as we exited the year, setting us up for a

strong start to 2021.

During H2 we also made significant progress in driving margin,

with reduced complexity, reduced finance subsidy costs and enhanced

management of discounting, all of which contributed to a 3.8% year

on year improvement in average frame price. This partially offset

the financial impact of building the order book in H2 and it is

contributing to the improved financial performance for Q1 2021.

Progress on strategic priorities

Despite the challenges of 2020, I am pleased that we were able

to make progress against our longer term strategic agenda with some

critical milestones achieved.

Improving our national sales and depot network : Q1 saw the

arrival of our new Commercial Director Gary Pickering and the

recruitment of a new regional sales leadership team during H1.

These appointments have enabled an acceleration in the

transformation of our sales and canvass functions, supported by

sophisticated and transparent management information.

In Q4 we were also able to launch our new training programme for

our self-employed branch managers, an initiative that will continue

in 2021 as all managers will be required to complete the programme.

This is the first structured national training programme of its

sort at Safestyle and it is supported by clarified responsibilities

and a new pay structure aligned to business results.

Concurrently our installations network embarked on a parallel

programme, again establishing a new leadership team and updating

our national depot network through a series of closures and

openings across the UK.

Sustaining momentum in compliance and customer service : While

COVID safety was our prime focus in 2020, we completed a number of

key actions that further developed our business compliance. These

included the development of our new canvass app, which now enables

tracing of all sales leads, and the recruitment of a new Data

Compliance Manager to embed and audit our practices.

The progress made on improving customer service was hampered

during 2020 as we sought to mitigate the impact of significant

supply disruption during Q3. This was caused by a combination of

restart challenges with two key suppliers, industry-wide raw

material constraints and global shipping disruption. These

challenges were not unique to Safestyle, but they demonstrated the

difficulty of recovering from this type of issue and the importance

of maintaining a smooth and robust supply chain.

Modernising our value brand : We progressed two elements during

2020; brand development and establishing a digital competitive

advantage. Our appointment of 'Journey Further' as our new digital

agency has proved successful as we have leveraged our scale to

bring best in class practices to our digital marketing work. Our

brand work, which seeks to build on the investment of the past,

will be used to shape our TV investment and brand experience in the

years ahead.

As we move into 2021 and embed the progress that has been made

through the turnaround programme we have updated and refreshed our

key strategic objectives for 2021 and beyond. These will be:

Delivering our financial roadmap : Reshaping our financial

performance to deliver sustained improvements in profitability

through a combination of revenue growth, margin improvement and

measured investment.

Levelling up / standardising depots & branches : Building on

and embedding the work done to date on improving the consistency of

local performance using Standard Operating Procedures ('SOPs'),

role descriptions, effective management reporting and performance

management for all our branches and depots.

Driving profitable growth : This encompasses our planned brand

investment, building a digital competitive advantage, developing

consumer insight and expanding our national sales footprint.

Transforming our customer experience : Our ratings and feedback

show that the majority of customers have a seamless experience.

However, we know that we can do better, using technology and

improved communications to address customer issues more rapidly. We

will support this by embedding the use of Net Promotor Score (NPS)

customer interviews, which we recently introduced to the

business.

Embedding compliance and sustainability : I am pleased that we

have made great progress in these areas, but we also want to drive

further improvements at Safestyle and throughout the wider

industry. We have embedded sustainability into our operations and

now recycle 95% of all materials removed from a customer's home as

part of their installation.

The Group's CO(2) emissions per frame installed in 2020 have

reduced by 6.1% versus 2019. The Group has achieved ongoing

reductions in energy consumption through its furnace energy usage

reduction programme. This has reduced energy consumption for what

is a significant component of our manufacturing process by over 25%

at like for like operating levels.

The Group is also now halfway through replacing its leased van

fleet, representing 333 vans in total. This will be fully completed

by the middle of 2021. Each new van produces 8% less CO(2)

emissions than the previous model which will make an important

contribution to our programme of reducing the impact on the

environment of our business.

Moreover, our existing impressive environmental initiatives will

be broadened and form part of our consumer offer.

These priorities will be supported by the key enabling

initiatives of developing our people, our culture and our

systems.

Together, these initiatives set an exciting direction for the

business, aimed at sustaining improved financial delivery, growth

and continued modernisation of the business.

Current trading & outlook

Our deliberate strategy of building a large order book has

enabled us to entirely mitigate the impact of the further

restrictions on sales and canvass that came with the third national

lockdown in January 2021. This has meant that despite geographic

and national interruptions we have been able to maintain our

survey, processing, manufacturing and installations operations. As

a result, we have now reduced our order book to a more normalised

level (which is still c.20% higher than the prior year) and further

strengthened our cash position.

During Q1 we have taken the opportunity to improve our customer

service levels, with further investments in call centre staffing

and in resolving the backlog of service issues that were caused by

the first lockdown and the significant supply-chain disruption in

Q3. Our intent is to enter Q2 having put the operational challenges

of 2020 fully behind us as we focus on accelerating the

transformation of the business and delivering improved financial

results.

Clearly the outlook remains uncertain, but I am optimistic that

the progress made by the business will allow us to maximise any

opportunity that comes as the economy reopens. Our intention

remains as before the crisis: to build long term value for

shareholders by consolidating our position as the UK's number 1

choice for replacement windows and doors.

As a result of this encouraging start to the year, the Board

expects 2021 financial performance to be significantly ahead of

market expectations.

Mike Gallacher

Chief Executive Officer

25 March 2021

Financial Review

Financials 2020 2019

----------------

Underlying Non-underlying Total Underlying Non-underlying Total Change

items(1) items(1) in

underlying

%

---------------- ------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ------------ --------------- --------- ------------ --------------- ----------------- ------------

Revenue 113,191 113,191 126,237 126,237 (10.3)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Cost of sales (84,732) (84,732) (94,337) (94,337) 10.2%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Gross profit 28,459 28,459 31,900 31,900 (10.8)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Other operating

expenses(3) (32,057) (1,399) (33,456) (32,018) (2,314) (34,332) (0.0)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Operating

(loss) (3,598) (1,399) (4,997) (118) (2,314) (2,432) (2,949.2)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Finance income 1 1 2 2 (50.0)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

(Finance costs (1,161) (1,161) (1,402) (1,402) 17.2%

------------ --------------- --------- ------------ --------------- ----------------- ------------

(Loss) before

taxation(4) (4,758) (1,399) (6,157) (1,518) (2,314) (3,832) (213.4)%

------------ --------------- --------- ------------ --------------- ----------------- ------------

Taxation 1,103 526

------------ --------------- --------- ------------ --------------- ----------------- ------------

(Loss) for the

year (5,054) (3,306)

------------ --------------- --------- ------------ --------------- ----------------- ------------

Basic EPS

(pence

per share) (4.3)p (4.0)p

------------ --------------- --------- ------------ --------------- ----------------- ------------

Diluted EPS

(pence

per share) (4.3)p (4.0)p

------------ --------------- --------- ------------ --------------- ----------------- ------------

Cash and cash

equivalents 11,705 4,435

------------ --------------- --------- ------------ --------------- ----------------- ------------

Borrowings (4,127) (3,991)

------------ --------------- --------- ------------ --------------- ----------------- ------------

Net cash(2) 7,578 444

------------ --------------- --------- ------------ --------------- ----------------- ------------

KPIs FY 2020 FY 2019 Change H2 2020 YOY Change H1 2020 YOY Change

% % %

Revenue GBP000 113.2 126.2 (10.3)% 71.1 15.0% 42.1 (34.7)%

-------- -------- -------- -------- ----------- -------- -----------

Gross margin %(5) 25.1% 25.3% (13)bps 26.3% 165bps 23.1% (271)bps

-------- -------- -------- -------- ----------- -------- -----------

Average Order

Value (GBP inc

VAT) 3,474 3,337 4.1% 3,494 3.6% 3,440 4.1%

-------- -------- -------- -------- ----------- -------- -----------

Average Frame

Price (GBP ex

VAT) 704 678 3.8% 714 3.6% 688 3.0%

-------- -------- -------- -------- ----------- -------- -----------

Frames installed

- units 163,617 190,252 (14.0)% 100,920 10.6% 62,697 (36.6)%

-------- -------- -------- -------- ----------- -------- -----------

Orders installed 39,789 46,412 (14.3)% 24,735 10.5% 15,054 (37.4)%

-------- -------- -------- -------- ----------- -------- -----------

Frames per order 4.11 4.10 0.0% 4.08 0.0% 4.16 1.1%

-------- -------- -------- -------- ----------- -------- -----------

The Group's financial performance measures and KPIs in 2020 were

adversely impacted by the cessation of installation activity for

nine weeks in H1 as a result of the COVID-19 pandemic and lockdown

period.

In the first half of the year, the Group made an underlying

profit before taxation of GBP0.9m for the first two months of the

year before the business entered a temporary lockdown in late March

to the end of May where it incurred losses totalling in excess of

GBP6m.

The second half of the year saw the Group return to

profitability, despite the ongoing disruption and cost of working

in a challenging context and material investment in the Group's

order book which closed the year 83% higher than 2019.

This Financial Review details the changes in the financial

measures of the business across the year within the above context

and draws particular attention to how the revenues and operating

costs changed between the first and second half of the year.

Financial and KPI headlines

-- Revenue declined by 10.3% to GBP113.2m for the full year, the

decrease entirely attributable to the cessation of operations in H1

with Q3 and Q4 revenues increasing versus the prior year by 9.3%

and 20.8% respectively.

-- Frames installed decreased by 14.0% to 163,617, the decline

again fully attributable to the first half disruption.

-- The Group continues to improve average frame price, achieving

a 3.8% increase in the year due to a focus on discount management

and a small annualisation effect of 2019 price increases. This

average price improvement was achieved despite a reduced mix of

higher average-priced composite guard doors which was 7.6% in 2020

compared to 9.2% in 2019.

-- The Group also made changes to its consumer finance portfolio

in the last part of the year which has maintained a strong

promotional finance offering, but which has resulted in a reduction

in finance subsidies of GBP0.8m. This benefit will increase in FY21

when the impact is annualised.

-- In H1, gross profit declined by 41.5% to GBP9.7m and gross

margin percentage reduced by 271bps to 23.1%, which is again

attributable to the volume decline described above although the

impact was partially offset by GBP0.7m of a total GBP1.8m reclaim

under the Government's Coronavirus Job Retention Scheme ('CJRS')

with the remainder included within operating expenses as described

below.

-- H2 gross profit improved versus the prior year by 22.7% to

GBP18.7m with the growth attributable to the increased installation

volumes. Gross margin percentage in the second half increased by

165bps versus H2 2019 to 26.3% due to the combination of a higher

average price per frame as described above and a year on year

reduction in the cost of lead generation (a reduced rate) in the

second half of the year. The second half gross profit and gross

margin percentage improvement would have increased further were it

not for the investment into the closing order book described

above.

-- Underlying other operating expenses(3) for the year were the

same as the prior year. There was a reduction in H1 operating

expenses as a result of no investment in TV advertising and a

GBP1.1m reclaim under the CJRS. H2 operating expenses increased

year on year due to costs associated with many of the Group's

COVID-safe measures - such as PPE and cleaning - coupled with

higher operational capacity costs to support the revenue growth and

to increase our customer-facing headcount.

-- Reported other operating expenses reduced by GBP0.9m (2.6%)

to GBP33.5m as a result of the items described above along with a

year on year reduction in non-recurring costs following completion

of the actions taken as part of the cost reduction initiatives in

2019.

-- Finance costs have decreased year on year as a result of

reduced borrowing costs due to lower utilisation (and thus lower

fees) in relation to the GBP3m revolving credit facility.

-- Underlying (loss) before taxation(4) was GBP(4.8)m for the

year (2019: loss of GBP(1.5)m). As described above, the loss was

generated in H1, totalling GBP(5.1)m, before the Group returned to

profitability in H2.

-- Non-underlying items were GBP1.4m for the period (2019:

GBP2.3m), full details of which are provided on the following pages

of this Financial Review and therefore reported (loss) before

taxation was GBP(6.2)m versus GBP(3.8)m in 2019.

-- Net cash(2) improved to GBP7.6m versus GBP0.4m at the end of

last year. The improved cash position is despite the losses

incurred in the first half of the year and is predominantly the

result of a successful Placing of New Shares in April 2020 which

raised net proceeds of GBP8.2m and the agreed deferral of GBP2.5m

of VAT payments originally payable during the lockdown period which

will be paid in 2021.

(1) See the non-underlying items section in this Financial

Review

(2) Net cash is cash and cash equivalents less borrowings

(3) Underlying other operating expenses are defined in the

'Underlying performance measures' section below and the

reconciliation between this measure and the GAAP measure is shown

in the 'Financials' table at the front of this Financial Review

(4) Underlying (loss) before taxation is defined in the

'Underlying performance measures' section below and the

reconciliation between this measure and the GAAP measure is shown

in the 'Financials' table at the front of this Financial Review

(5) Gross margin % is gross profit divided by revenue

Underlying performance measures

In the course of the last three years, the Group has encountered

a series of unprecedented and unusual challenges. These gave rise

to a number of significant non-underlying items in 2018 and

consequential items continued into 2019 as the Group addressed the

impact of these challenges, predominantly as part of its Turnaround

Plan. The impact of COVID-19 in 2020 has also given rise to a

material non-underlying item in the form of a holiday pay accrual

which is described in detail below.

Consequently, adjusted measures of underlying other operating

expenses and underlying (loss) before taxation have been presented

as the primary measures of financial performance. Adoption of these

measures results in non-underlying items being excluded to enable a

meaningful evaluation of the performance of the Group compared to

prior periods.

These alternative measures are entirely consistent with how the

Board monitors the financial performance of the Group and the

underlying profit / (loss) before taxation is the basis of

performance targets for incentive plans for the Executive Directors

and senior management team.

Non-underlying items consist of non-recurring costs, share based

payments and Commercial Agreement amortisation. A full breakdown of

these items is shown below. Non-recurring costs are excluded

because they are not expected to repeat in future years. These

costs are therefore not included in the Group's primary performance

measures as they would distort how the performance and progress of

the Group is assessed and evaluated.

Share based payments are subject to volatility and fluctuation

and are excluded from the primary performance measures as such

changes year to year would again potentially distort the evaluation

of the Group's performance year to year.

Finally, Commercial Agreement amortisation is also excluded from

the primary performance measures because the Board believes that

exclusion of this enables a better evaluation of the Group's

underlying performance year to year.

Revenue

Revenue for the year was GBP113.2m compared to GBP126.2m last

year, representing a decrease of 10.3% for the year as a result of

the cessation of installation activity across late March, April and

the majority of May. The year on year revenue performance up to the

end of February represented year on year growth of 3.4% with Q3 and

Q4 growth of 9.3% and 20.8% respectively which depicts the

improving trajectory either side of the lockdown period.

Frames installed volume represented a similar decline of 14.0%

to 163,617 frames installed compared to 190,252 in the prior year.

The revenue decline reduction was less than this volume decline as

a result of improvements in the following areas:

-- The average frame price increased by 3.8% to GBP704 (2019:

GBP678). The impact of an annualisation benefit of modest list

price increases in 2019 alongside a larger benefit coming from

reduced discount levels were the major drivers of the

improvement.

-- The improvement in the average frame price was also despite a

reduced mix of higher average-priced composite guard doors which

reduced to 7.6% of installed volumes (2019: 9.2%).

-- The above favourable average price gains were further

augmented by a reduction in the finance subsidy costs linked to our

consumer finance offering. These reductions follow a successful set

of changes to our promotional finance portfolio late in 2020 which

generated a GBP0.8m benefit in the second half of the year. The

Group continues to sell over 43% of its products alongside a

consumer finance agreement which represents a flattening of a trend

that has been steadily rising over the last five years.

-- The metric of the average number of frames per order remained

consistent with 2019 which halts the declining trend of the last

two years and follows the rebalancing of mix out of higher-value

composite doors.

-- Finally, the average order value also improved by 4.1% to

GBP3,474. Progress in these operational KPIs remains a critical

area of ongoing focus for the Group as it continues to target an

improving quality of revenue into 2021.

Gross profit

Gross profit decreased by 10.8% to GBP28.5m while the gross

margin percentage declined by (13)bps to 25.1% (2019: 25.3%). In

the first half of the year, t he gross margin percentage reduced by

(271)bps versus the prior period to 23.1% before improving year on

year for the second half of the year by 165bps to 26.3% (H2 2019:

24.7%).

The reduction in installation volumes described above was the

main contributor to the year on year reduction in gross margin and

the dilution of gross margin percentage in H1. The additional

factors behind the trends of first half dilution and subsequent

improvement in gross margin percentage in the second half of the

year were as follows:

-- Prior to the lockdown, the Group was continuing to experience

increased costs per leads generated as a result of continued

competition driving up 'Pay Per Click' and other digital marketing

channel costs. Moving into the middle of the first half, despite

the cessation of installation activities, the Group continued,

albeit on a much-reduced scale, to respond via remote-selling

methods to customer enquiries during the lockdown period. These

enquiries were generated with minimal levels of investment as

compared to spend prior to the lockdown.

-- Following the restart of operations, the Group experienced a

strong consumer response as it stepped up its lead generation

activities across all lead sources and although the costs per lead

increased as volumes grew when compared to the very low levels

during lockdown, these were still lower than the first two months

of the year. The Group's cost to order intake ratio across the

second half was 10.2% lower than H2 2019.

-- This beneficial rate effect was more than offset by the Group

driving order intake levels that exceeded the level of installation

activity which resulted in an order book at the year end that was

83% ahead of the prior year. This investment diluted the gross

margin percentage across the year.

-- Aside from the above, gross margin in the first half was

impacted favourably by a GBP0.7m reclaim under the CJRS scheme from

the UK Government to contribute to the costs of the Group's

furloughed factory employees.

-- Despite this assistance, the Group continued to incur some

fixed costs in H1 that could not be fully mitigated during the

lockdown such as leased equipment costs. In addition, as the

business restarted its factory in late May, the initial few weeks

of operation were part of a staged return to work plan which

inevitably resulted in a lower level of productivity than normal

whilst COVID-secure ways of working were fully embedded. Both of

these factors diluted H1 gross margin.

-- In the second half of the year, the growth in installation

revenues, the reduction in finance subsidies and the continued

improvement in average price per frame increased the gross margin

percentage above that of 2019.

-- Gross margin in H2 would have recovered more strongly were it

not for the lead generation effect described previously alongside

the Group investing in recovering its warranty and service backlog

that built up during the lockdown period. This investment is

expected to carry on in the early part of 2021 before reducing to

pre-COVID levels in the latter stages of the year.

Underlying other operating expenses

Underlying other operating expenses were consistent versus 2019

across the full year.

-- There were reductions in the amount invested in TV

advertising of GBP0.7m which partially offset the increased

investment in digital media lead generation channels referred to

above.

-- In addition to the amount received and included within gross

margin, the Group also received GBP1.1m in the first half of the

year for its CJRS reclaim for furloughed staff costs that are

expensed within underlying other operating expenses. Half of the

amount reclaimed was for staff furloughed in April with the

remaining half spread across May and June. This reducing reclaim

profile after April reflects the gradual return to work of

furloughed staff through the second half of May with 60% of staff

returned to work by the end of May and 93% by the end of June.

-- Alongside the furlough support, the benefits of the 2019 cost

reduction activities reduced H1 operating expenses versus H1 2019

by a further GBP1.0m. However, as the Group moved into the second

half of the year, as described in the CEO's statement, the high

levels of demand resulted in the Group taking steps to increase its

operational capacity. This equated to an increased cost in the

second half of the year of GBP0.5m as the Group re-opened a

previously-closed depot in Crawley and a new installation depot in

Nottingham alongside growing headcount across surveying, order

processing, installations and customer services.

-- The Group also incurred bonus costs of GBP1.0m in relation to

the H2 bonus scheme that was introduced to incentivise a rapid

restart of the business, delivering profit alongside the building

of a strong order book.

-- IT licensing and infrastructure costs increased by GBP0.3m

versus the prior year as the rollout of technology across the Group

continued, most notably the implementation of Office 365 and

Microsoft Teams which proved crucial to underpin remote working

during the lockdown and to enable a phased return to office working

after restrictions were lifted.

-- Finally, costs associated with the Group's response to

implementing COVID-19 safeguards including enhanced cleaning

routines for offices, the provision of Personal Protective

Equipment ('PPE') to the workforce and providing safety screens

around workstations totalled GBP0.4m in the year.

Underlying (loss) before taxation

Underlying (loss) before taxation was GBP(4.8)m (2019: loss of

GBP(1.5)m), although profitability was achieved either side of the

lockdown period as described above. This loss is before the

non-underlying items described below.

Non-underlying items

A total of GBP1.4m has been separately treated as non-underlying

items for the year (2019: GBP2.3m). The prior period included

GBP1.8m of costs related to restructuring activities and asset

impairment as part of phase two of the Turnaround Plan.

The current year's costs consist of GBP0.5m of non-recurring

costs (2019: GBP1.9m), a GBP0.4m shared based payment charge (2019:

GBP0.0m) and GBP0.5m (2019: GBP0.5m) of Commercial Agreement

(Intangible Asset) amortisation. The table below shows the full

breakdown of these items:

Non-underlying Items 2020 2019

---------------------------------------------------

GBP000 GBP000

--------------------------------------------------- --------- ------------

Holiday pay accrual 470 -

--------- ------------

Litigation costs 74 -

--------- ------------

Restructuring and operational costs 266 1,058

--------- ------------

Impairment of right-of-use assets - 692

--------- ------------

Modification of right-of-use assets and

liabilities 5 -

--------- ------------

Reversal of prior year impairment of right-of-use

assets (292) -

--------- ------------

Commercial Agreement service fee - (13)

--------- ------------

IT project impairment - 113

--------- ------------

Total non-recurring costs (note 5) 523 1,850

--------- ------------

Equity-settled share based payment charge 424 12

--------- ------------

Commercial Agreement amortisation 452 452

--------- ------------

Total non-underlying items 1,399 2,314

--------- ------------

The holiday pay accrual of GBP0.5m has arisen as a result of the

impact of the shutdown of operations and resultant extension of

2020 leave entitlement to the end of 2021 which is in line with the

Government's recommendation. This has significantly increased the

level of deferred holiday entitlement at the year end which has

been recognised as an accrual and which will reverse in full in

2021. This item has been excluded from the underlying performance

measures to ensure performance of the business is not skewed by

both the expense in 2020 or its subsequent full release in

2021.

Litigation costs of GBP0.1m are expenses incurred as a result of

an ongoing legal dispute between the Group and an ex-agent. These

costs were predominantly legal advisor's fees.

In 2020 and 2019, the Group incurred restructuring and

non-recurring operational costs of GBP0.3m and GBP1.1m respectively

which reduced the Group's overheads in some areas. In addition, in

2019, the Group recognised an impairment of right-of-use assets of

GBP0.7m following closure of an installation branch and a sales

office in the period. The installation branch was re-opened in 2020

as the Group increased its capacity levels and consequently,

GBP0.3m of the prior year's impairment charge has been

reversed.

The receipts in relation to the CJRS described earlier in this

Financial Review have not been classified as a non-recurring item

on the basis that these partially offset the wage costs of

unproductive labour in the lockdown period.

In the prior year, the Commercial Agreement service fee costs

arose as a result of an agreement entered into in 2018 with Mr M.

Misra which encompassed a five year non-compete agreement and the

provision of services by Mr Misra in support of the continued

recovery of Safestyle. The Group agreed consideration with Mr Misra

subject to the satisfaction of both clear performance conditions by

him over five years and Safestyle's trading performance in

2019.

Subject to satisfying the strict terms of the agreement, the

consideration took the form of an allotment by Safestyle to Mr

Misra of four million ordinary shares of 1 pence each in the

capital of the Group and a payment of cash consideration of between

GBPnil and GBP2.0 million.

The Commercial Agreement service fee was originally assessed in

2018 at a GBP1.0m fair value as the consideration payable under the

terms of the Commercial Agreement that was attributed to services

received in 2018. Following conclusion of the 2019 year, the value

of the services received was confirmed based on the actual

performance in 2019, and the provision for consideration to be paid

was reduced by GBP13k to GBP987k. This amount was paid and four

million ordinary shares of 1 pence each were issued in October 2020

in accordance with this agreement.

The non-compete element of the Commercial Agreement was

accounted for as an intangible asset on the basis that it is an

identi able, non-monetary item without physical substance, which is

within the control of the entity and is capable of generating

future economic bene ts for the entity. The intangible asset was

measured based on the fair value of the consideration that the

Group expects to issue under the terms of the agreement and is

being amortised over 5 years which matches the term of the

non-compete arrangement.

Further detail of all non-recurring costs is contained in note

5.

The items classified as non-recurring costs on the Consolidated

Income Statement, the share based payment charge and the

amortisation of the intangible asset created as a result of the

Commercial Agreement reached in 2018 have all been excluded from

the underlying (loss) before taxation performance measure to enable

a meaningful evaluation of the performance of the Group from year

to year.

Earnings per share

Basic earnings per share for the period were a loss of (4.3)p

compared to a loss of (4.0)p for the prior year. The basis for

these calculations is detailed in note 6.

Net cash and cashflow

A key aspect of the Group's response to the COVID-19 pandemic to

mitigate the impact on the Group's liquidity as a result of the

cessation of revenue-driving activity was to raise funds via a

share Placing.

The Placing was completed at the end of April with net proceeds

of GBP8.2m raised. Alongside this injection of additional

liquidity, the Group also secured a two year extension to its

existing borrowing facilities until October 2023. Covenant waivers

for the lockdown period and reductions in covenant targets for the

remainder of the facility were also secured.

At the end of the year, net cash was GBP7.6m (2019: GBP0.4m).

GBP4.5m of the Group's GBP7.5m facility, being that of the term

loan, remains fully drawn with the remaining GBP3.0m revolving

credit facility undrawn.

Net cash inflow from operating activities, including the

cashflow impact of non-underlying items, was GBP3.4m (2019:

GBP4.5m). This inflow was despite the losses in the year as a

result of favourable working capital movements. The most

significant increase is attributable to the agreed deferral of

payments originally due in May 2020 to HRMC totalling GBP2.5m. This

deferral will be paid from March 2021 in line with HMRC's deferral

repayment scheme. Since the restart of operations, the Group has

not continued to defer any further tax payments owed to HMRC and,

with the exception of this deferred amount, continues to pay all

liabilities as they fall due.

The other working capital benefit within operating cashflows is

driven by an increase in payments on account for customer deposits

received in line with the growth in the order book of GBP2.6m. This

effect has been partially offset by outflows driven by increases in

buffer stock levels for PVCu profile which have been built as part

of mitigation against any potential supply chain disruption.

Capital expenditure of GBP0.6m increased from GBP0.4m in 2019.

Some capital expenditure was deferred as part of the Group's

response to the pandemic, but the Group continued with its

investment programme to replace and upgrade IT hardware.

After the GBP8.2m proceeds in relation to the share Placing and

the lease payments of GBP3.7m on leased assets (2019: GBP3.6m), net

cash inflow in the period was GBP7.3m (2019: GBP0.3m).

Dividends

The Board does not propose a final dividend for the year (2019:

GBPnil) which will underpin the maintenance of suitable liquidity

levels in the immediate future. The Board expects to revisit its

dividend policy later in 2021 assuming that the Group has returned

to a consistent delivery of profitability.

Rob Neale

Chief Financial Officer

25 March 2021

Consolidated income statement for the year ended 3 January

2021

2020 2019

Note GBP000 GBP000

Revenue 3 113,191 126,237

Cost of sales (84,732) (94,337)

Gross profit 28,459 31,900

Expected credit losses expensed (890) (477)

Other operating expenses (1) (32,566) (33,855)

Operating (loss) (4,997) (2,432)

Finance income 1 2

Finance costs(2) (1,161) (1,402)

Net finance costs (1,160) (1,400)

(Loss) before taxation (6,157) (3,832)

Underlying (loss) before taxation before non-recurring costs, Commercial Agreement

amortisation

and share based payments (4,758) (1,518)

Non-recurring costs 5 (523) (1,850)

Commercial Agreement amortisation (452) (452)

Share based payments (424) (12)

(Loss) before taxation (6,157) (3,832)

----------------------------------------------------------------------------------- ------ --------- ---------

Taxation 1,103 526

(Loss) for the year (5,054) (3,306)

========= =========

Basic EPS (pence per share) 6 (4.3p) (4.0p)

Diluted EPS (pence per share) 6 (4.3p) (4.0p)

(1) Other operating expenses includes GBP523k of non-recurring items, GBP452k of Commercial

Agreement amortisation and GBP424k of share based payments. Adjusting for these gives underlying

other operating expenses of GBP31,167k (2019: GBP31,541k). See Financial Review for details.

(2) Finance costs includes GBP487k of lease related interest costs (see right-of-use assets

and liabilities note).

There is no other comprehensive income for the period.

All operations were continuing throughout all periods.

2019 represents the year ended 29 December 2019.

Consolidated statement of financial position as at 3 January

2021

2020 2019

Note GBP000 GBP000

Assets

Intangible assets - Trademarks 504 504

Intangible assets - Goodwill 20,758 20,758

Intangible assets - Software 850 1,122

Intangible assets - Other 1,284 1,736

Property, plant and equipment 11,475 12,633

Right-of-use assets 10 8,004 6,012

Deferred taxation asset 1,980 886

Non-current assets 44,855 43,651

--------- ---------

Inventories 4,545 2,725

Trade and other receivables 7 5,663 3,999

Cash and cash equivalents 11,705 4,435

Current assets 21,913 11,159

--------- ---------

Total assets 66,768 54,810

========= =========

Equity

Called up share capital 9 1,368 828

Share premium account 89,495 81,845

Profit and loss account 5,347 10,009

Common control transaction reserve (66,527) (66,527)

Total equity 29,683 26,155

--------- ---------

Liabilities

Trade and other payables 8 21,929 15,384

Lease liabilities 10 2,524 2,482

Deferred taxation liability - 17

Provision for liabilities and charges 1,118 990

Current liabilities 25,571 18,873

--------- ---------

Provision for liabilities and charges 1,801 1,891

Lease liabilities 10 5,586 3,900

Borrowings 4,127 3,991

Non-current liabilities 11,514 9,782

--------- ---------

Total liabilities 37,085 28,655

========= =========

Total equity and liabilities 66,768 54,810

========= =========

2019 represents the financial position at 29 December 2019.

Consolidated statement of changes in equity for the year ended 3

January 2021

Share Share premium Profit and Common control Total equity

capital loss account transaction

reserve

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31 December

2018 828 81,845 13,347 (66,527) 29,493

Total comprehensive (loss)

for the period (3,306) (3,306)

Transactions with owners

recorded directly in

equity:

Deferred taxation asset

taken to reserves - - (44) - (44)

Equity settled Commercial

Agreement - - 12 - 12

Balance at 29 December

2019 828 81,845 10,009 (66,527) 26,155

---------------- ---------------- ---------------- ---------------- ----------------

Total comprehensive (loss)

for the period - - (5,054) - (5,054)

Transactions with owners

recorded directly in

equity:

Issue of new shares 500 8,000 - - 8,500

Transaction costs relating

to the issue of new shares - (350) - - (350)

Deferred taxation asset

taken to reserves - - 8 - 8

Issue of shares -

Commercial

Agreement 40 - (40) - -

Equity settled share based

payment transactions - - 424 - 424

Balance at 3 January 2021 1,368 89,495 5,347 (66,527) 29,683

================ ================ ================ ================ ================

Consolidated statement of cash flows for the year ended 3

January 2021

2020 2019

Note GBP000 GBP000

Cash flows from operating activities

(Loss) for the year (5,054) (3,306)

Adjustments for:

Depreciation of plant, property and

equipment 1,559 1,666

Depreciation of right-of-use assets 10 3,745 4,322

Amortisation of intangible fixed

assets 880 904

Reversal of impairment loss 10 (292) -

Modification of right-of-use assets

and liabilities 10 5 -

Finance income (1) (2)

Finance expense 1,161 1,402

IT project impairment - 113

Equity settled share based payments

charge 424 12

Taxation (credit) (1,103) (526)

----- --------- --------

1,324 4,585

(Increase) in inventories (1,820) (309)

(Increase) / decrease in trade and

other receivables (1,664) 479

Increase in trade and other payables 6,545 98

Increase / (decrease) in provisions 38 (1,430)

IFRS 16 prepaid lease costs - (413)

IFRS 16 onerous leases - 67

----- --------- --------

3,099 (1,508)

Other interest (paid) (986) (1,079)

----- --------- --------

Taxation received - 2,540

Net cash inflow from operating activities 3,437 4,538

----- --------- --------

Cash flows from investing activities

Acquisition of property, plant and

equipment (401) (86)

Interest received 1 2

Acquisition of intangible fixed assets (156) (341)

Net cash (outflow) from investing

activities (556) (425)

Cash flows from financing activities

Proceeds from issue of share capital 8,500 -

Transaction costs relating to the (350) -

issue of share capital

Proceeds from loans and borrowings 2,000 2,500

Repayment of borrowings (2,000) (2,500)

Transaction costs relating to loans

and borrowings (39) (235)

Payment of lease liabilities 10 (3,722) (3,606)

Net cash inflow / (outflow) from

financing activities 4,389 (3,841)

Net inflow in cash and cash equivalents 7,270 272

Cash and cash equivalents at start

of year 4,435 4,163

Cash and cash equivalents at end

of year 11,705 4,435

===== ========= ========

2019 represents the year ended 29 December 2019.

1 Statement of compliance

Whilst the financial information included in this Preliminary

Announcement has been prepared on the basis of the requirements of

International Financial Reporting Standards (IFRSs) in issue, as

adopted by the European Union, this announcement does not itself

contain sufficient information to comply with IFRS.

The financial information set out above does not constitute the

company's statutory accounts for the financial years 2020 or 2019

but is derived from those accounts. Statutory accounts for 2019

have been delivered to the registrar of companies with the Jersey

Financial Statements Commission (JSFC), and those for 2020 will be

delivered in due course. Grant Thornton UK LLP has reported on

those accounts. Their report for 2020 was (i) unqualified, (ii) did

not include a reference of any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 113B (3) or (6) of

the Companies (Jersey) Law 1991. KPMG LLP has reported on the 2019

accounts. Their report was (i) unqualified, (ii) contained a

material uncertainty in respect of going concern to which the

auditor drew attention by way of emphasis without modifying their

report and (iii) did not contain a statement under section 113B (3)

or (6) of the Companies (Jersey) Law 1991.

Safestyle UK plc is a public listed group incorporated in

Jersey. The Group's shares are traded on AIM. The Group is required

under AIM rule 19 to provide shareholders with audited consolidated

financial statements. The registered office address of the

Safestyle UK plc is 47 Esplanade, St Helier, Jersey JE1 0BD.

The Group is not required to present parent company

information.

2 Basis of preparation

The Group's financial statements for the financial year 2020

("financial statements") have been prepared on a going concern

basis under the historical cost convention and are in accordance

with International Financial Reporting Standards (IFRSs) as adopted

by the EU and the International Financial Reporting Standards

Interpretations Committee interpretations issued by the

International Accounting Standards Board ("IASB") that are

effective or issued and early adopted as at the time of preparing

these financial statements.

Safestyle UK plc was incorporated on 8 November 2013. On 3

December 2013 Safestyle UK plc acquired Style Group Holdings

through a share for share exchange. This was accounted for as a

common control transaction. The result of this is that the

financial statements of Style Group Holdings have been included in

the Group consolidated financial statements of Safestyle UK plc at

their book value at the IFRS transition date of 1 January 2010 with

the assumption that the Group was in existence for all the periods

presented. The excess of the cost at the time of acquisition over

its book value has been recorded as a common control transaction

reserve.

The accounting policies set out below have unless otherwise

stated, been applied consistently to all periods presented in these

financial statements.

The preparation of financial statements requires Management to

exercise its judgement in the process of applying accounting

policies. The areas involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are

significant to these financial statements are disclosed in note

4.

(a) New and amended standards adopted by the Group

The Group has adopted the following new standards and amendments

for the first time. Unless otherwise stated, they have not had a

material impact on the financial statements.

-- Definition of a Business (Amendments to IFRS 3)

-- Definition of Material (Amendments to IAS 1 and IAS 8)

-- Interest Rate Benchmark Reform (Amendments to IFRS 9, IAS 39 and IFRS 7)

-- Amendments to References to the Conceptual Framework (Various Standards)

-- COVID-19 Rent Related Concessions (Amendments to IFRS 16)

(b) New standards, amendments and interpretations issued but not

effective and not early adopted.

At the date of approval of these financial statements, the

following standards, amendments and interpretations which have not

been applied in these financial statements were in issue but not

yet effective (and in some cases have not yet been adopted by the

EU):

-- Amendments to IFRS 17 Insurance Contracts (Amendments to IFRS 17 and IFRS 4)

-- References to the Conceptual Framework

-- Proceeds before Intended Use (Amendments to IAS 16)

-- Onerous Contracts - Cost of Fulfilling a Contract (Amendments to IAS 37)

-- Annual Improvements to IFRS Standards 2018-2020 Cycle

(Amendments to IFRS 1, IFRS 9, IFRS 16, IAS 41)

-- Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

Basis of consolidation

Subsidiaries are entities that the Company has power over,

exposure or rights to variable returns and an ability to use its

power to affect those returns. In assessing control, potential

voting rights that are currently exercisable or convertible are

taken into account.

The financial statements of subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date control ceases.

Intragroup transactions and balances are eliminated on

consolidation.

Year end

The financial statements are presented for the year ended on the

closest Sunday to the end of December. This date was 3 January 2021

for the current reporting year and 29 December 2019 for the prior

year. All references made throughout these accounts for the

financial year 2020 are for the period 30 December 2019 to 3

January 2021 and references to the financial year 2019 are for the

period 31 December 2018 to 29 December 2019.

Going concern

The financial statements are prepared on a going concern basis

which the directors believe to be appropriate for the following

reasons.

The Group made a statutory (loss) of GBP(5.1)m in the financial

year 2020 (2019: (loss) of GBP(3.3)m) and had net current

liabilities of GBP(3.7)m at the end of financial year 2020 (2019:

net current liabilities of GBP7.7m). As detailed in the Financial

Review, the Group incurred losses in the first half of the year due

to the temporary cessation of operations as a result of the

COVID-19 pandemic. The Group returned to profit in the second half

of the year whilst at the same time building a record level

installation pipeline.

The Group obtained additional shareholder funding in April 2020

through the raising of GBP8.2m via a share placing which

strengthened the Group's cash position during the lockdown period

and facilitated a return to profitability in H2 2020. The Group

also has banking facilities which consist of a GBP4.5m term loan

and a GBP3.0m revolving credit facility. This facility matures in

October 2023 having been extended by two years during 2020. The

finance agreement contains certain covenants, including a minimum

EBITDA to be tested on a cumulative monthly basis which was revised

during 2020 and included a covenant waiver for the loss-making

period in H1 2020. The subsequent minimum EBITDA for covenant

compliance was also reduced for the remainder of 2020 and for all

subsequent years. The covenant target for FY23 is lower than the

target originally agreed for FY21. By the end of financial year

2020, covenant headroom had increased significantly to GBP1.9m

which has further increased in the first 2 months of FY21. As at

the end of financial year 2020, the GBP4.5m term loan was fully

drawn on the facility, while the revolving credit facility was

unutilised. This remains the case at the date of signing the

accounts. In addition, the Group's net cash position was GBP7.4m at

the end of February 2021 (February 2020: net cash of GBP0.1m).

The Directors have prepared forecasts covering the period to

December 2022. The forecasts include a number of assumptions in

relation to sales volume, pricing, margin improvements and overhead

investment. The Directors believe they have taken a cautious

approach to the forecast for 2021 with the core assumptions for

order intake representing a decline of 7.4% versus the levels

achieved in H2 2020. However, revenues are forecast to grow,

facilitated by the strong order book the Group carried into the

start of FY21 which, along with a number of margin-improving

initiatives, forecasts considerable headroom above EBITDA covenant

targets alongside growth in net cash and liquidity.

Whilst the Group's trading and cash flow forecasts have been

prepared using these assumptions, the operating environment

presents a number of challenges which could negatively impact the

actual performance achieved. Excluding the potential impact of

COVID-19 which is considered separately below, these risks include,

but are not limited to, achieving forecast levels of order intake,

the impact on customer confidence as a result of general economic

conditions, achieving forecast margin improvements and the

director's ability to implement cost saving initiatives in areas of

discretionary spend where required. If future trading performance

significantly underperforms the Group's forecasts, this could

impact the ability of the Group to comply with its covenant tests

over the period of the forecasts.

The Group's cash flow forecasts and projections, taking account

of reasonably possible changes in trading performance excluding the

potential impact of COVID-19 (which is considered below), offset by

mitigating actions within the control of management including

reductions in areas of discretionary spend, show that the Group

will be able to operate within the level of its facilities and

associated covenants for the period to at least the end of 2022.

The Group has started the year well, with revenues and profits

significantly ahead of the pre-lockdown period in FY20 which the

directors believe further supports this basis of preparation.

The uncertainty as to the future impact on the Group of the

COVID-19 outbreak has been separately considered as part of the

directors' consideration of the going concern basis of preparation.

As described in the CEO's Statement and Financial Review, the

COVID-19 pandemic had a material impact on the Group's performance

in H1 2020 which required the directors to take swift actions to

protect the business and increase its cash and liquidity reserves.

These actions were successful and the Group restarted operations

quickly and successfully in May 2020 and since then has been

operating safely and profitably despite the impact of ongoing

restrictions that have affected normal ways of working.

The Directors have incorporated their considerations regarding

the continuing impact of potential COVID-19 restrictions on the

Group in their scenario modelling although also note that these

restrictions are reducing as the successful vaccination programme

gathers pace. In preparing this analysis, a number of scenarios

were modelled which included a 26% drop in written sales versus H2

20 performance levels. In this scenario, mitigating actions within

the control of management, including reductions in areas of

discretionary spend have been modelled with the result being that

despite this reduction in written sales, the Group would grow

covenant headroom in FY21 and increase its net cash balance.

In March 2020, the Directors highlighted it was difficult to

predict the overall outcome and impact of COVID-19 and the duration

of disruption to written and fitted sales activity. The Directors

now highlight the current and improving operating context which,

alongside the outcomes in the scenarios modelled, underpin the

Director's conclusion that the risk of the liquidity requirements

of the business exceeding the total quantum of facilities available

are now deemed remote.

Based on the above indications and work prepared, the Directors

believe that it is appropriate to prepare the financial statements

on a going concern basis.

3 Summary of significant accounting policies

Revenue recognition

The Group earns revenue from the design, manufacture, delivery

of, and installation of domestic double-glazed replacement windows

and doors.

There are five main steps followed for revenue recognition:

- Identifying the contract with a customer

- Identifying the performance obligations

- Determining the transaction price

- Allocating the transaction price to the performance obligations; and

- Recognising revenue when or as an entity satisfied performance obligations.

The various stages of the performance obligations are the

design, manufacture, delivery of and installation of domestic

double-glaze d replacement windows and doors.

In applying the principal of recognising revenue related to

satisfaction of performance obligations under IFRS 15, the Group

considers that the final end product is dependent upon a number of

services in the process that may be capable of distinct

identifiable performance obligations. However, where obligations

are not separately identifiable, in terms of a customer being

unable to enjoy the benefit in isolation, the standard allows for

these to be combined. The Group considers that in the context of

the contracts held these are not distinct. As such the performance

obligations are treated as one combined performance obligation and

revenue is recognised in full, at a point in time, being on

completion of the installation.

Revenue is shown net of discounts, sales returns, charges for

the provision of consumer credit and VAT or other sales related

taxes. Revenue is measured based on the consideration specified in

a contract with a customer.

There is no identifiable amount included in the final price for

a warranty, as the Group provides a guarantee on all

installations.

Payments received in advance are held within other creditors, as

a contract liability. The final payment is due on installation.

A survey fee is paid at the point of agreeing the contract and

the customer has up to 14 days, defined in the contract to change

their minds. If the customer changes their mind after this cooling

off period, the Group has the right to retain this survey fee and

as such revenue for this is recognised at the point in time that

this becomes non-refundable.

Recycling Income

The Group recognises the income from the sale of materials for

recycling. The income is recognised when the materials are

collected by the recycling company which represents the completion

of the performance obligation.

Government grants

Grants under the Coronavirus Job Retention Scheme (CJRS) that

compensate the Group for expenses incurred are recognised in profit

or loss in staff costs on a systematic basis in the periods in

which the expenses are recognised.

4 Accounting estimates and judgements

When preparing the Group's consolidated financial statements,

management makes a number of judgements, estimates and assumptions

about the recognition and measurement of assets, liabilities,

revenue and expenses.

Actual results can differ from these estimates. Estimates and

underlying assumptions are reviewed on an ongoing basis. Revisions

to estimates are recognised prospectively.

Significant management judgements

The following are the judgements made by management in applying

the accounting policies of the Group that have the most significant

effect on these consolidated financial statements.

Recognition of deferred taxation assets

The extent to which deferred taxation assets can be recognised

is based on an assessment of the probability that future taxable

income will be available against which the deductible temporary

differences and taxation loss carry-forwards can be utilised. The

deferred taxation asset of GBP1,980k has been recognised on the

basis that the Group is forecasting to make sufficient levels of

profits in future periods.

Estimation uncertainty

Impairment of goodwill

In assessing impairment, management estimates the recoverable

amount of each asset or cash generating unit based on expected

future cash flows and uses an appropriate rate to discount them.

Estimation uncertainty relates to assumptions about future

operating results and the determination of a suitable discount

rate. A discount rate of 10% has been applied to the impairment

assessment calculation. This was calculated and compared to the

discount rates disclosed by a range of comparable quoted companies.

Management used judgement in the decision to use a discount factor

of 10%.

Dilapidations provision

The Group has a portfolio of leased properties that sales

branches and installation depots operate from. A dilapidations

provision is provided for leased properties where the lease

agreement contains a contractual obligation to undertake remedial

works at the end of the lease term and where wear-and-tear or

damage on the property has occurred. The calculation of the

estimate is based on historical experience of cost to rectify upon

exiting similar properties. The estimated costs are subject to

estimation uncertainty as the final payment agreed may differ to

the estimated cost given the process whereby dilapidations are

negotiated.

Product guarantee provision

The Group guarantees all of its products, which in the majority

of cases covers a period of 10 years. The provision is calculated

to cover the cost of fulfilling any guanratee work to its customers

and is based on the expected future costs of rectifying faults and

the future rate of product failure arising within the guarantee

period. The level of provision required to cover this cost is

subject to estimation uncertainty.

Expected credit loss for trade receivables

The Group assesses, on a forward-looking basis, the expected

credit losses associated with its trade receivables. This is based

on historical experience, external indicators and forward - looking

information to calculate the expected credit losses.

5 Non-recurring costs

2020 2019

GBP000 GBP000 Note

Holiday pay accrual 470 - a

Litigation Costs 74 - b

Restructuring and operational costs 266 1,058 c

Impairment of right-of-use assets - 692 d

Modification of impairment of right-of-use assets 5 - e

Reversal of prior year impairment of right-of-use assets (292) - f

Commercial Agreement service fee - (13) g

IT project impairment - 113 h

Total non-recurring costs 523 1,850

============== ===================

a) The holiday pay accrual has arisen as a result of the impact

of the shutdown of operations and resultant extension of 2020 leave

entitlement to the end of 2021. This has significantly increased

the level of deferred holiday entitlement at the year end which has

recognised as an accrual and which will reverse in full in 2021.

This item has been excluded from the underlying performance

measures to ensure performance of the business is not skewed by

both the expense in 2020 or its subsequent full release in

2021.

b) Litigation costs are expenses incurred as a result of an

ongoing legal dispute between the Group and an ex-agent. These

costs are predominantly legal advisor's fees.

c) Restructuring and operational costs are expenses incurred,

including redundancy payments, as a result of changes being made to

reduce the cost structure of the business.