TIDMSBSI

RNS Number : 2141Q

Schroder BSC Social Impact Trust

26 October 2021

REPORT AND ACCOUNTS

Schroder BSC Social Impact Trust plc (the "Company") hereby

submits its Report and Accounts for the period from incorporation

on 24 September 2020 to 30 June 2021, as required by the Financial

Conduct Authority's Disclosure Guidance and Transparency Rule

4.1.

Highlights

-- Strong progress since launch with IPO proceeds fully

committed, ahead of original timetable, into a high-quality and

diversified portfolio.

-- NAV returns of 6.09%, ahead of target, driven primarily by capital gains.

-- Maiden dividend of 0.57p per share, a dividend yield of 0.55%

for the period from IPO to 30 June 2021/1.05% annualised

(ex-dividend date of 28 October 2021).

-- Invested capital already driving positive social outcomes

across the UK, with the Company's investments supporting over a

hundred frontline organisations.

-- Potential for further fundraise in 2021 to invest in an

attractive pipeline of investments, that can deliver high social

impact in the UK alongside sustainable real returns and low

correlation to traditional quoted markets.

The Portfolio Manager will be presenting at a webinar on 9

November 2021 at 11.30 a.m. Shareholders can sign up for the

webinar at: https://registration.duuzra.com/form/SBSIAnnual

The Company's Report and Accounts for the period from

incorporation on 24 September 2020 to 30 June 2021 is also being

published in hard copy format and an electronic copy will shortly

be available to download from the Company's website:

www.schroders.com/sbsi

Please click on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/2141Q_1-2021-10-25.pdf

The Company has also submitted its Report and Accounts to the

National Storage Mechanism. It will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Enquiries:

Gareth Faith

Schroder Investment Management Limited

Tel: 020 7658 5264

Chair's Statement

I am pleased to present the first annual report of Schroder BSC

Social Impact Trust plc ("the Company"), covering the period from

incorporation on 24 September 2020 to 30 June 2021.

Investment opportunity

Despite decades of economic growth, the UK still struggles with

many deep-rooted social issues, including homelessness, uneven

health outcomes, rising income inequality and unequal life

opportunities. The global pandemic has highlighted the extent of

many of these problems as well as creating a number of new societal

challenges. The pandemic has also placed further pressure on

Government finances at a time when funding in many areas of health

and social care had already been drastically reduced over recent

years. An increasing number of private and charitable impact-driven

organisations are developing investable solutions to these

challenges. However, they often lack access to capital to reach

more people and improve and increase their impact.

The Company was created to help address this funding gap and

builds on Big Society Capital's track record of delivering

sustainable financial returns, while having a positive impact on

the lives of vulnerable and disadvantaged people across the UK. Big

Society Capital (the "Portfolio Manager") manages the Company's

portfolio, and Schroders (the "Manager") serves as the AIFM

(Alternative Investment Fund Manager, as defined by the Alternative

Fund Management Directive), bringing extensive experience as the

manager of a large stable of investment trusts, including those

investing in private markets. It is a powerful partnership and the

Board is confident it can deliver the unique combination of

financial and social returns expected by our shareholders.

The Company targets investments in high-need areas aligned to

the United Nations Sustainable Development Goals ("SDGs"), such as

housing, health and social care. It is our strong belief that

understanding and measuring impact can enhance accountability and

facilitate more informed decisions about balancing financial and

social goals, thus reducing risk and creating long-term value for

investors.

Progress since IPO

At the time of the Company's initial public offering ("IPO") and

listing on the premium segment of the London Stock Exchange on 22

December 2020, the Company raised GBP75 million. The Portfolio

Manager has made strong progress since launch and committed all IPO

proceeds ahead of the originally envisaged 12-month period into

high quality assets. As at 30 June 2021 the Company had deployed

66% of its IPO proceeds into 23 investments, supporting over 100

front-line organisations across three broad sectors: High Impact

Housing, Debt for Social Enterprises, and Social Outcomes

Contracts. The remaining commitments are expected to be called over

the coming months with Liquid ESG funds being used to avoid

short-term cash drag to investors.

More details on these initial investments including a

description of how they are defined can be found in the Portfolio

Manager's Report.

Financial performance

The Company has delivered strong shareholder returns since

launch. The Company's NAV produced a positive total return of 6.1%

in the period, ahead of the performance target of CPI +2%, with

returns primarily driven by capital growth. It is also pleasing

that the Company's share price has risen since launch with a

positive total return of 3.5% to 103.50p per share as at 30 June

2021, which we believe reflects the high level of investor interest

in the Company's unique investment strategy.

A more detailed analysis of performance may be found in the

Portfolio Manager's Report.

Social impact performance

One of our commitments at the time of the IPO was to provide an

easily accessible and informative map to bring to life the

"on-the-ground" work done by our investees in towns and cities

across the UK. I would like to draw readers' attention to the

Portfolio section of the Company's webpage where this map can be

found. The interactive map tracks the Company's underlying

investments by region, outcome area, asset class and the SDG to

which it contributes. Place-based impact investment is a growing

trend and we are pleased that your Company's investments are

facilitating beneficial change through engagement with local

communities across the country.

To ensure that impact considerations are purposefully integrated

throughout the investment life cycle, Big Society Capital follows

the Operating Principles for Impact Management (the "Principles").

The intention of the Principles is to provide a framework that

brings greater discipline and transparency around impact management

practices to the impact investing market. Big Society Capital has

been a signatory to the Principles since March 2020. Big Society

Capital's alignment against the Principles is documented and

independently verified in its disclosure and verification

statement.

Many investors use the SDGs as a framework to guide their impact

investing, and as stated above, the Company maps all investments to

the SDGs. The SDGs are a "blueprint to achieve a better and more

sustainable future for all." The UN describes them as a "call for

action" to "promote prosperity while protecting the planet." They

were adopted by all UN Member States in 2015 as part of the 2030

Agenda for Sustainable Development to address global

challenges.

Additionally, Schroders and Big Society Capital also endorse and

adopt the work of the Impact Management Project, an initiative

supported by various standard setting organisations, such as the

International Finance Corporation and United Nations Development

Programme, which proposes frameworks for measuring and managing

impact as well as aligning investments to impact objectives. Big

Society Capital, as one of the UK's leading impact investors, has

been an advisor to the Impact Management Project since inception,

and was involved in the development of its approach. We think it is

a great advantage that our Portfolio Manager is able to bring this

extensive expertise to its sourcing of opportunities, support for

investees and monitoring of impact across the Company's

holdings.

More details on the positive social impact created by the

Company since launch can be found in the Impact Report on pages 15

to 25 in the Report and Accounts.

Promotion and premium/discount management

The Company has shareholder authority to issue shares under the

prospectus. That authority will expire at the Annual General

Meeting ("AGM") to be held on 3 December 2021 and it is the

Company's intention to issue new ordinary shares following the

strong growth in NAV.

At the Company's AGM, resolutions to authorise the Board to

issue up to 10% of the issued share capital on a non-pre-emptive

basis, and a proposal for authority to purchase up to 14.99% of the

Company's issued share capital, will be put forward. Any shares so

purchased may be cancelled or held in treasury for potential

reissue.

Dividend

The Company will seek to use the investment trust interest

streaming regime which enables an investment trust which receives

"qualifying interest income" to treat the whole or part of a

dividend distribution as an interest distribution. The effect of

streaming is to move the point of taxation in respect of the

Company's qualifying interest income, from the Company to its

investors. For UK income taxpayers it will be taxed as interest

received on the date the distributions were made. The potential

benefit of splitting the dividend between a normal equity dividend

and a streamed interest payment is for investors who are not liable

to taxation.

The Board has considered the amount available to distribute to

investors and has declared that the Company will pay out

substantially all income as a dividend, resulting in a dividend of

0.57p per share, payable to shareholders on the Company's share

register as at 29 October 2021. This is consistent with the target

dividend communicated to investors at IPO. All of this dividend

payment should be treated by shareholders as an interest

distribution.

AGM

The AGM will be held on Friday, 3 December 2021 at 12.00 noon at

the Company's registered office. Shareholders are encouraged to

cast their votes by proxy.

The Portfolio Manager will be presenting at a webinar on 9

November 2021 at 11.30 a.m., to give shareholders the opportunity

to hear from them, and to ask questions. Shareholders are

encouraged to sign up using this link:

https://registration.duuzra.com/form/SBSIAnnual

In addition, the Board would like shareholders to get in touch

via the Company Secretary with any questions or comments, so that

the Board can answer them in advance of the AGM. The Board will be

providing answers to commonly asked questions on the Company's

webpage, as well as the answers to questions received from

shareholders before the AGM. To email, please use:

amcompanysecretary@schroders.com or write to us at the Company's

registered office address: Company Secretary, Schroder BSC Social

Impact Trust plc, 1 London Wall Place, London, EC2Y 5AU.

For regular news about the Company, shareholders are also

encouraged to sign up to the Manager's investment trusts update by

visiting the Company's webpage:

https://www.schroders.com/en/uk/private-investor/fund-centre/funds-in-focus/investment-trusts/schroders-investment-trusts/never-miss-an-update/

Outlook

The Board is pleased with the initial progress made by the

Company in deploying IPO proceeds and delivering against its

investment objectives. The investments made have already started to

impact lives positively and this impact should continue to grow

over time as the Company deploys further capital.

Looking forward, the funding gap of capital required to address

a broad range of societal challenges seems certain to grow, and at

the same time, new sustainable and creative solutions and

enterprises are being developed. Therefore, we are confident that

the pipeline of opportunities for the Company to invest in will

remain robust. Our focus will continue to be on our core areas of

social housing, debt for social enterprises and social outcomes

contracts, but the Company will continue to utilise the Portfolio

Manager's expertise and deep networks in identifying potentially

new areas for investment.

It is the intention of the Company to continue to grow in time

in order to increase the magnitude of its impact, increase

liquidity in its shares, and bring down ongoing costs for

shareholders. The Company will continue to consult with its

shareholders on its growth plans and will update the market on

future fundraising plans in due course.

Susannah Nicklin

Chair

25 October 2021

Portfolio Manager's Report

Market developments

The social issues we set out to address with the Company are as

pressing as ever. Although the economic recovery from COVID-19 is

under way, the pandemic has exacerbated the underlying structural

challenges of UK society. Since the start of the pandemic, people

in the lowest pay quintile are more than twice as likely as those

in the highest to have lost their job, been furloughed or had hours

and pay reduced. NHS waiting lists recently reached 4.7 million

people, a 14-year high. At the end of 2020, over 95,000 UK

households, including over 121,000 children, were living in

temporary accommodation; double the number ten years ago.

Social impact investment, and the areas that we focus on

specifically for the Company's portfolio, are one part of the

solution to such growing challenges. While we are aware that social

impact investment is not a universal solution for social

challenges, we are encouraged to see an increasing number of

organisations developing investable models that provide successful

solutions. There is an expanding universe of opportunities for the

Company to make successful investments with a deep impact.

The global impact investing market is made up of diverse

investments across a range of asset classes, in both private and

publicly listed markets. When the Company was launched, the Global

Impact Investing Network had estimated the value of this market at

US$715bn.

The Company is exclusively focused on the social impact

investment segment in the UK. Over the last decade, this segment

has grown significantly, with an annual growth rate of 25 per cent

since 2011, the year before Big Society Capital was established.

Big Society Capital estimates the total market size has grown from

GBP5.1bn in 2019 to GBP6.4bn in 2020, an increase of 26% over the

year. In late 2020, we estimated, based on underlying market demand

and current growth rates, the investable high-impact segment of the

UK market would be approximately GBP10 to GBP15bn by 2025. From

what we have seen so far in 2021, we are confident that this

forecast is on track. New funds have come to market and existing

ones have raised further capital, because of the coming together of

investor demand and an increasing opportunity set of investable

high impact enterprises tackling issues such as housing, health

& social care and education.

The positive market developments have enabled us to commit the

Company's initial capital ahead of schedule to high quality

holdings which meet our financial return and impact targets.

Performance update

We are pleased with the progress our portfolio has made since

launching the Company in December 2020, with overall performance

ahead of plan.

This section outlines the financial performance of the Company,

taking into account the period of operation since IPO. In the next

set of financial statements, with a full year of performance, we

intend to publish a broader set of key performance indicators.

Total return to 30 June 2021 was ahead of expectations, with a

total return since IPO of 6.1%. Gains on investments in the period

were driven primarily by strong performance in Bridges Evergreen

Holdings. This fund comprised part of the seed portfolio purchased

from Big Society Capital and benefited from the strong performance

of earlier investments, in particular AgilityEco, tackling fuel

poverty and New Reflexions, providing children's services. Other

assets in the portfolio performed in line with forecasts. Overall,

the Company's Net Asset Value rose from GBP73.7m at IPO to GBP78.2m

at the period end, or 104.3p per share as set out in the NAV bridge

below. This represents an increase in NAV of 6.1% since IPO and

4.4% since the last reported NAV as of 31 December 2020.

The portfolio proved resilient during the period, with income

from investments stable and increasing in some cases with

additional demand for services, despite significant uncertainty

created by the ongoing pandemic. The investments targeted by the

Company have remained resilient throughout the last 18 months,

demonstrating the value of its diversification and revenue streams,

with low correlation to economic cycles and mainstream markets. We

established the Company with a substantial seed portfolio to help

drive initial performance, and it is the seed portfolio assets

later in their investment cycle that have driven positive

performance in the period.

Importantly, we were able to source and deploy capital into

highly attractive investment opportunities that meet our high bar

of impact and our target returns more quickly than expected. We

committed substantially all the initial capital raised by the end

of June 2021, faster than the original 12-month commitment

timetable. Two thirds of the net proceeds of the initial public

offering had been invested by the end of the reporting period.

At the time of publication of the Annual Report, the net IPO

proceeds are fully committed, following the signing of a GBP2m

secured loan to Abbeyfield York Society, a charity for older people

providing housing that enhances quality of life. The loan is a

co-investment with Charity Bank and is part of the Debt for Social

Enterprises asset class.

Portfolio allocation

In the period from IPO to 30 June 2021, the Company recorded

gross revenue return of GBP0.8m and net revenue after fees, costs

and expenses of GBP0.44m, a net revenue return per share of 0.58

pence. The Company also recorded gains on the fair value of

investments of GBP4.2m, resulting in a total gross return of

GBP5.0m, and total net return of GBP4.5m, or 5.98 pence per

share.

The Company will pay out a dividend of 0.57p per share, or

dividend yield of 0.55% for the period from IPO to 30 June

2021/1.05% annualised. This is in line with the guidance in the IPO

prospectus of an expected dividend yield in the region of 1-2%

p.a.

One of our key aims is for the Company to provide investors with

a diversified mix of high-impact assets, that have a low

correlation to traditional quoted financial markets. We achieve

this in part by backing business models that are underpinned by

government expenditure that does not fluctuate in line with

economic cycles. At the end of the period, 79% of the committed

portfolio is underpinned by government backed revenue streams.

These revenue streams are themselves diversified across policy

areas, such as housing, clean energy and energy poverty, education,

redressing inequalities / "levelling up". This diversification

reduces exposure to individual policy risk, such as the risk that

government or budgetary changes would significantly reduce or

withdraw payments (e.g. housing or other benefits). We target areas

with a track record of delivering impact for more disadvantaged

groups and generating savings for the public purse which provide

additional revenue resilience.

Our target is to provide a Net Asset Value total return of CPI

plus 2% per annum, once the portfolio is fully invested and

averaged over a rolling three- to five-year period, net of fees. We

target a significant degree of inflation linkage (such as leases

indexed to CPI) and correlation (such as government payments that

have historically moved with inflation) in the revenues that

underpin returns.

We have also made good progress with our approach to measuring

and managing social impact. This is an essential part of how we

manage the portfolio, and we are committed to continuous

development of this process and to bringing the impact of our

investments to life for our shareholders. Please see the dedicated

Impact section on pages 15 to 25 of the Report and Accounts for

further detail.

Portfolio developments

The Company invests primarily in three asset classes that were

selected to give a diversified set of opportunities with low

correlation, both with one another and with mainstream financial

markets. We have been pleased to see positive developments across

all three in the period.

Asset Class: Debt for Social Enterprises

Many impact-led social enterprises need capital so they can grow

and increase their impact, as well as to satisfy their existing

working capital requirements. The Company's portfolio is designed

to include a diversified set of debt products, including

asset-backed lending, mezzanine debt (including some equity) and

charity bonds. The underlying charities and social enterprises

deliver interventions which often support the most disadvantaged or

vulnerable members of society, in areas such as health and social

care, which benefit from government backed revenue streams.

As of 30 June 2021, the Company had committed GBP33m to

investments in this asset class (45% of net IPO proceeds); the

current value of investments in this asset class is GBP36m (45% of

NAV).

Initial Seed Portfolio Review

The existing social enterprise debt investments have contributed

well to the Company's overall performance in the period.

Evergreen Holdings , run by Bridges Fund Management is a GBP50m+

long-term capital vehicle that makes subordinated debt, mezzanine

and equity investments into mission-led businesses. The fund

targets a 5% yield alongside capital growth. Total return in the

period was particularly strong driven to a large degree by strong

earnings growth at AgilityEco, a leading provider of fuel poverty,

energy efficiency and low carbon services across the UK. New

Reflexions, a leading provider of residential care to children with

complex needs, also had strong trading performance and contributed

to the overall valuation uplift. The Evergreen team made one new

investment, into learning and skills provider Skills Training UK.

It works with funding partners in central and local Government to

offer a diversified range of apprenticeships, traineeships, adult

skills and employability courses that support 16-24 year-olds and

adult learners, many of whom are from disadvantaged

communities.

The Charity Bond Portfolio managed by Rathbones supports larger

UK charities seeking to raise significant amounts of capital via

the public and private bond markets, providing an alternative

source of funding to bank finance. The portfolio is invested in

nine bonds (both listed and unlisted) issued by charities and

social enterprises. The total portfolio value is GBP15m, which has

been fully committed and drawn, delivering an annualised yield of

4.5%. Bond issuers have repaid capital and interest in line with

schedule and no defaults have been reported.

The Company holds three secured loans within the Charity Bank

Co-investment Portfolio, totalling GBP5.1m. The portfolio is fully

committed and 75% drawn. Working with Charity Bank, the portfolio

supports housing and care related investments in Sue Ryder,

Abbeyfield South Downs and Uxbridge. Overall, the three facilities

are performing well, with no material change in credit quality,

provisioning, security or repayment profile. The facilities are

secured with low loans to value and floating interest rates with a

current annualised yield of 2.4%.

New investments since IPO

Shortly after the IPO, in December 2020, the Company made a

GBP2.5m investment in the inaugural private bond issue by Triodos

Bank UK Ltd, a leading lender to sustainability and social impact

focused organisations. This includes social housing, healthcare,

education, renewable energy, arts and culture, and community

projects. The bond issue enables Triodos Bank to continue to grow

its loan book and contribute to the resilience and growth of

charities and social enterprises. The bond has a ten-year duration,

callable by Triodos Bank at year five. It pays a fixed 4% coupon,

which will reset to base rate +3.9% at year five, if not

called.

Asset Class: High Impact Housing

The portfolio is invested in affordable and social housing,

which is intended to address the housing needs of a wide spectrum

of people, who are often those on the lowest incomes and the most

vulnerable. We invest across a range of asset types, from long-term

inflation-linked lease contracts with high-quality counterparties

to shorter leases to address specific issues, such as homelessness

or the housing needs of survivors of domestic abuse. Counterparties

include Registered Providers of social housing (such as housing

associations) and charities with long-standing track records, deep

expertise in addressing specific issues, and strong local

relationships with authorities and beneficiaries.

In addressing these needs, we seek to deliver returns that are

often supported by the government-backed and inflation-linked

housing benefit system. This has led to a lower historical

correlation to mainstream markets and insulation from the sharper

price movements in the private housing market.

As of 30 June 2021, the Company had committed GBP30m to

investments in this asset class (41% of net IPO proceeds), of which

GBP13m has been invested (17% of NAV).

Initial Seed Portfolio Review

The high-impact housing investments in the portfolio have

continued to deliver in line with our strategy.

The UK Affordable Housing Fund raised GBP244m at launch in 2018.

Its objective is to deliver a positive social impact by

contributing to the supply of sustainable and affordable homes for

people unable to purchase or rent in the open market. The fund

achieves this by providing equity financing for Registered

Providers, where the assets are owned by the fund and managed for

the long term by the Registered Provider through leases of 10 to 25

years. The fund has invested or committed GBP210m (86% of its

initial capital commitments) and raised a further GBP137m in the

first half of 2021, bringing total client commitments to GBP381m.

This reflects the strong performance so far and the robust pipeline

of opportunities that the manager has identified. The fund aims to

produce a total return greater than 6% (with an annual target

income distribution yield of 4% from income producing assets) net

of all costs over the long term.

The Real Lettings Property Fund, managed by Resonance, is a

GBP57m fund operated in partnership with leading homelessness

charity St Mungo's. It provides homes for people in temporary

accommodation or at risk of homelessness by purchasing ordinary

homes and leasing them to St Mungo's. In doing so, the fund helps

people to be more independent. The fund is fully invested and at

the end of the reporting period had housed 971 tenants (including

515 children) to date, in 259 properties. Quarterly profit grew

during the period, largely due to an increase in Local Housing

Authority rates from 1 April. The fund continues to generate a cash

yield of 3% and a life to date net internal rate of return ("IRR")

of 5%, in line with its financial projections.

New investments since IPO

We committed GBP5m to the Man GPM RI Community Housing Fund,

which is addressing the UK's housing crisis through the provision

of new affordable housing. The fund aims to deliver 3,500 new homes

in mixed-tenure communities, predominantly leased to UK councils

and housing associations, and seeks to achieve returns driven by

long-term, inflation-linked income streams. The fund is targeting

8-10% net IRR with a stabilised yield of 6% from income producing

assets.

We also made a follow-on commitment of GBP5m to the Social and

Sustainable Housing LP (SASH), following the first GBP5m commitment

acquired through the initial portfolio in December 2020. SASH

provides investment to high-performing social sector organisations

with local knowledge and networks, and a strong track record of

managing transitional supported housing for vulnerable individuals.

They may include survivors of domestic violence, children leaving

the care system, ex-offenders, asylum seekers, people with complex

mental health issues and people with addiction issues. SASH makes

flexible secured loans which participate in changes in property

prices and rental incomes - generated from government-backed rental

payments with a target net IRR of 6%.

In addition to these investments, a key development in the

period was our publication of two reports from the initiative we

are leading with social advisory firm The Good Economy Partnership.

The initiative aims to establish new consistent and transparent

impact management norms in UK affordable housing investment and

build greater ability to assess and compare impact performance and

understand impact risk.

Asset Class: Social Outcomes Contracts

Social outcomes contracts aim to help the government achieve

better life outcomes for vulnerable people and better value for

public funds. They are public sector contracts designed to overcome

challenges in the way that public services have traditionally been

managed. The providers of these services are being paid for

achieving specified outcomes rather than prescribed inputs, using

investment to cover the upfront costs incurred to deliver the

service, which ultimately produces the desired social outcomes. We

look to invest in a pool of outcomes contracts that is diversified

across central and local government commissioners and different

policy areas.

As of 30 June 2021, the Company had committed GBP8m to

investments in this asset class (11% of net IPO proceeds), of which

GBP3m has been invested (4% of NAV).

Initial Seed Portfolio Review

There is one fund holding in the portfolio and there were no new

fund investments in the period. Significant future growth in the

social outcomes contract market will be determined by central

government spending decisions that we expect to be made in late

2021. We will assess the potential for further investments once

that position is clear.

The GBP35m Social Outcomes Fund II managed by Bridges Fund

Management invests in social outcomes contracts, receiving payments

when outcomes are delivered and thereby ensuring that payment is

completely aligned with measurable improvements in the lives of

participants.

The fund is 50% committed, with three out of nine of the

underlying contracts being written up in value in the period. These

contracts have already supported over 6,000 individuals with

complex needs. The fund has a good pipeline of social outcome

contract investments, is currently ahead of plan on the delivery of

social outcomes and on track to deliver its target IRR of 6%, net

of all costs.

Asset Class: Liquid ESG Investments

The Company includes a Liquid ESG allocation of up to 20% of net

assets, which can be invested in bond funds, real estate investment

trusts, infrastructure trusts and other liquid investments that

align with the Company's liquidity requirements, meet high ESG

requirements and are compliant with the Company's investment

policy. As at 30 June 2021, we had invested a total GBP11.0m in

four funds, detailed in the table below.

Liquid ESG Investments Invested

GBP'000

Edentree Responsible and Sustainable

Sterling Bond Fund 1,993

Rathbone Ethical Bond Fund 2,099

Threadneedle UK Social Bond Fund 3,186

Twenty Four Sustainable Short

Term

Bond Income (Vontobel Fund) 3,625

-------------------------------------- ---------

Total Liquid ESG Investments 10,903

-------------------------------------- ---------

Liquid ESG investments sit within a broader set of tools to

manage Company cash and commitment levels, with the central

objective of contributing to the Company's target returns and

impact goals by minimising the amount of unproductive cash held

prior to deployment.

The initial priority for Liquid ESG investments over 2020-22 is

to mitigate cash drag during the Company's ramp up phase, by

reaching a full 20% allocation to high-quality investments.

Following this we expect the Liquid ESG allocation will be

dependent on the Company's liquidity needs and commitment levels.

The Company does not charge management fees on allocations to

Liquid ESG investments or cash.

Covid-19's impact on portfolio

The Company's portfolio has shown its structural resilience

during the pandemic, with revenue stable and increasing in some

areas with increased demand. The Company's investments are helping

to tackle significant social issues across the UK, with a

substantial proportion of revenues (79%) coming from government

sources. The pandemic has exacerbated many social issues and

providing solutions has become a political priority. An example was

the Everyone In initiative in the early stages of the pandemic,

which was designed to help protect rough sleepers from Covid and

was supported by emergency government funding. More generally, we

have seen revenues increase in response to greater social needs,

such as addressing homelessness and domestic violence.

The portfolio's underlying fund managers have actively supported

their portfolio companies and worked with regulators and industry

bodies to support their resilience in extraordinary times. In

particular in the social outcomes contract segment, BSC worked with

Bridges and commissioners to convert outcomes contracts to payment

on the basis of fee for service, during a period when certain

face-to-face services could not be delivered or were being

transitioned to remote delivery. This ensured that services for

vulnerable beneficiaries could continue at a time when they were

most needed, while the organisations delivering those services

continued to be paid for their delivery and for adapting their

model to a remote setting.

In high-impact housing, revenues for the majority of our

portfolio companies are government backed and demand for

high-impact housing has remained elevated during the pandemic with

stable rents. This contrasts to private rental and commercial real

estate, which have experienced high volumes of voids, arrears and

rent defaults. The Company's high-impact housing investments are

diversified across affordable and social housing for key workers,

social rent and homes for vulnerable people, such as asylum

seekers, homeless people and women experiencing domestic

violence.

Outlook

Looking ahead to 2022, we see continued strong potential. The

social impact of the COVID-19 pandemic will take much longer to

address than the immediate economic impact of the lockdown

measures. The UK government faces a tight fiscal situation, with

the Institute for Fiscal Studies saying in July that "the

Chancellor is likely to have very little room for manoeuvre in his

forthcoming Spending Review". We believe that this fiscal position

will make social impact investments a continued important part of

the solution, allowing the government to leverage outside capital

and deliver services that can create government savings alongside

significant social impact.

In addition, wider markets have been affected this year by the

increased uncertainty over the future path of inflation. We expect

this will make the inflation-linked or inflation-correlated aspect

of our approach an even more valuable part of investor portfolios

in the coming period.

Within this overall picture of a dynamic and growing market, the

Company will remain focused on three specific areas, discussed in

detail in this report. These are debt for social enterprises,

high-impact housing and social outcomes contracts.

These three asset classes were selected to give a diversified

set of opportunities that have low correlation, both with one

another and with mainstream financial markets. BSC has been

investing across these three asset classes since we launched in

2012. There are established models and managers with a track record

of delivering high social impact alongside a financial return,

whilst also being areas with significant opportunity for future

investment. They are also investment areas which are generally

inaccessible or present liquidity challenges for most investors. We

have an ambition to raise further capital in order to put it to

work in these areas, allowing the Company to expand the resources

available to organisations dedicated to improving people's lives in

our society and also to serve as a partner in facilitating further

growth of the impact investment ecosystem.

Strategic Report

Principal risks and uncertainties

The Board is responsible for the Company's system of risk

management and internal control and for reviewing its

effectiveness. The Board has adopted a detailed matrix of principal

risks affecting the Company's business as an investment trust and

has established associated policies and processes designed to

manage and, where possible, mitigate those risks, which are

monitored by the Audit and Risk Committee on an ongoing basis. This

system assists the Board in determining the nature and extent of

the risks it is willing to take in achieving the Company's

strategic objectives. Both the principal and emerging risks and the

monitoring system are also subject to regular, robust review. The

last review was completed in October 2021.

Although the Board believes that it has a robust framework of

internal controls in place this can provide only reasonable, and

not absolute, assurance against material financial misstatement or

loss and is designed to manage, not eliminate, risk.

Actions taken by the Board and, where appropriate, its

committees, to manage and mitigate the Company's principal risks

and uncertainties are set out in the table below.

Risk Mitigation and management

Strategic risks

The Company's investment objectives The appropriateness of the Company's

may become out of line with the investment remit is regularly

requirements of investors, or reviewed and the success of the

the Company's investment strategy Company in meeting its stated

might not lead to the Company objectives is monitored.

achieving its investment objective

resulting in the Company being The share price relative to NAV

subscale and shares trading at per share is monitored and the

a discount. Board has undertaken a capital

reduction to facilitate a buy-back

programme should this be required.

If in the two-year period ending The Portfolio Manager has extensive

on 31 December 2023, and in any experience and a track record

two-year period following such in accurately timing the exits

date, the Ordinary Shares have of private equity investments.

traded, on average, at a discount The Board will regularly monitor

in excess of 10 per cent. to the position to ensure that any

Net Asset Value per Share, the alternative proposals to be made

Directors will propose an ordinary to shareholders are put forward

resolution at the Company's next at an appropriate time.

annual general meeting that the

Company continues its business If the Continuation Resolution

as presently constituted (the is not passed, the Directors

"Continuation Resolution"). will put forward proposals for

the reconstruction or reorganisation

It could take several years until of the Company, bearing in mind

all of the Company's private the liquidity of the Company's

equity investments are disposed Investments, as soon as reasonably

of and any final distribution practicable following the date

of proceeds made to shareholders. on which the Continuation Resolution

is not passed. These proposals

may or may not involve winding

up the Company and, accordingly,

failure to pass the Continuation

Resolution will not necessarily

result in the winding up of the

Company.

Investment management risks

Risks relating to the social The Portfolio Manager has extensive

impact of investee companies experience in selecting private

social impact investments and

has a robust investment process

to ensure that the anticipated

positive impact of investee companies

is realistic and achievable.

Liquidity risk

Liquidity risks include those Concentration limits are imposed

risks resulting from holding on single investments to minimise

private equity investments as the size of positions.

well as not being able to participate

in follow-on fundraises through The Portfolio Manager can sell

lack of available capital which Liquid ESG Investments to meet

could result in dilution of an investment commitments and capital

investment. calls. The Portfolio Manager

will monitor and manage cash

Risks relating to investment flows and expected capital calls.

commitments and capital calls.

The Portfolio Manager will seek

to manage cashflow such that

the Company will be able to participate

in follow on fundraisings where

appropriate.

Valuation risk

Private equity investments are Contracts with investee companies

generally less liquid and more are drafted to include obligations

difficult to value than publicly to provide information to the

traded companies. A lack of open Portfolio Manager in a timely

market data and reliance on investee manner, where possible.

company projections may also

make it more difficult to estimate The Portfolio Manager and AIFM

fair value on a timely basis. have extensive track records

of valuing privately held investments.

A valuation policy has been agreed

by the AIFM and Portfolio Manager

and includes a robust process

for the valuation of assets,

including consideration of the

valuations provided by investee

companies and the methodologies

they have used. Any changes to

this policy must be approved

by the Audit and Risk Committee.

The Audit and Risk committee

reviews all valuations of unlisted

investments and challenges the

methodologies used by the Portfolio

Manager and AIFM. The Audit and

Risk Committee may also appoint

an independent party to complete

a valuation of the Company's

assets.

Cyber security risks

Each of the Company's service Experienced third party service

providers is at risk of cyber providers are employed by the

attack, data theft or disruption Company under appropriate terms

to their infrastructure which and conditions and with agreed

could have an effect on the services service level specifications.

they provide to the Company.

These risks could lead to reputational The Board receives regular reports

damage or the risk or loss control from its service providers and

of sensitive information leading the Management Engagement Committee

to a potential breach of data will review the performance of

protection law. key service providers at least

annually.

The Audit and Risk Committee

reviews reports on the external

audits of the internal controls

operated by certain of the key

service providers.

Emerging risks and uncertainties

In October 2021, the Board also discussed and monitored a number

of risks that could potentially impact the Company's ability to

meet its strategic objectives. These were political risk, climate

change risk and COVID-19-related risks. The Board has determined

they are not currently material for the Company. The Board receives

updates from the Manager, Portfolio Manager, Company Secretary and

other service providers on other potential risks that could affect

the Company.

Risk assessment and internal controls review by the Board

Risk assessment includes consideration of the scope and quality

of the systems of internal control operating within key service

providers, and ensures regular communication of the results of

monitoring by such providers to the Audit and Risk Committee,

including the incidence of significant control failings or

weaknesses that have been identified at any time and the extent to

which they have resulted in unforeseen outcomes or contingencies

that may have a material impact on the Company's performance or

condition.

No significant control failings or weaknesses were identified

from the Audit and Risk Committee's ongoing risk assessment which

has been in place throughout the financial year and up to the date

of this report. The Board is satisfied that it has undertaken a

detailed review of the risks facing the Company.

A full analysis of the financial risks facing the Company is set

out in note 20 to the accounts on

pages 67 to 70 of the Report and Accounts.

Viability statement

The Directors have assessed the viability of the Company over a

five year period, taking into account the Company's position at 30

June 2021 and the potential impact of the principal and emerging

risks and uncertainties it faces for the review period. The

Directors have assessed the Company's operational resilience and

they are satisfied that the Company's outsourced service providers

will continue to operate effectively, following the implementation

of their business continuity plans as required by COVID-19.

The Board believes that a period of five years reflects a

suitable time horizon for strategic planning, taking into account

the investment policy, liquidity of investments, potential impact

of economic cycles, nature of operating costs, dividends and

availability of funding. In its assessment of the viability of the

Company, the Directors have considered each of the Company's

principal and emerging risks and uncertainties detailed on pages 32

and 33 of the Report and Accounts and in particular the impact of a

significant fall in regional equity markets on the value of the

Company's investment portfolio.

The Directors have also considered the Company's liquid

investments, the Company's cash balances and the forecast income

and expenditure flows as well as commitments to provide further

funding to the Company's private equity investee companies; the

Company currently has no borrowings. A substantial proportion of

the Company's expenditure varies with the value of the investment

portfolio. In the event that there is insufficient cash to meet the

Company's liabilities, the liquid investments in the portfolio may

be realised. The Company has additionally performed stress tests

which confirm that a 50% fall in the market prices of the portfolio

would not affect the Board's conclusions in respect of going

concern. The Directors have also considered the continuation vote

which the Company is required to put to shareholders if, in the

two-year period ending on 31 December 2023, and in any two-year

period following such date, the ordinary shares have traded, on

average, at a discount in excess of 10 per cent. to net asset value

per share. The Company has not traded at a discount of this level

since launch in December 2020 and the Directors therefore currently

do not believe this affects the viability of the Company over a

five year horizon. Based on the Company's processes for monitoring

operating costs, the Board's view that both the Manager and

Portfolio Manager have the appropriate depth and quality of

resource to achieve superior returns in the longer term, the

portfolio risk profile, limits imposed on gearing, counterparty

exposure, liquidity risk and financial controls, the Directors have

concluded that there is a reasonable expectation that the Company

will be able to continue in operation and meet its liabilities as

they fall due over the five year period of their assessment.

Going concern

The Directors have assessed the principal risks, the impact of

the emerging risks and uncertainties and the matters referred to in

the viability statement. Based on the work the Directors have

performed, they have not identified any material uncertainties

relating to events or conditions that, individually or

collectively, may cast significant doubt on the Company's ability

to continue as a going concern for the period assessed by the

Directors, being the period to 25 October 2021 which is at least

twelve months from the date the financial statements were

authorised for issue.

By order of the Board

Schroder Investment Management Limited

Company Secretary

25 October

Statement of Directors' Responsibilities

The Directors are responsible for preparing the annual report

and accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial

statements for each financial period. Under that law the Directors

have prepared the financial statements in accordance with United

Kingdom Generally Accepted Accounting Practice (FRS: 102 The

Financial Reporting Standard applicable in the UK and Republic of

Ireland) and applicable law. Under company law the Directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the return or loss of the Company for that period.

In preparing these financial statements, the Directors are required

to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK Accounting Standards, comprising

FRS 102, have been followed, subject to any material departures

disclosed and explained in the financial statements;

- notify the Company's shareholders in writing about the use of

disclosure exemptions in FRS 102 used in the preparation of the

financial statements; and

- prepare the financial statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements and the Directors' Remuneration Report

comply with the Companies Act 2006. They are also responsible for

safeguarding the assets of the Company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The Manager is responsible for the maintenance and integrity of

the webpage dedicated to the Company. Legislation in the United

Kingdom governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

Each of the Directors, whose names and functions are listed on

pages 35 and 36 of the Report and Accounts, confirm that to the

best of their knowledge:

- the financial statements, which have been prepared in

accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards and applicable law),

give a true and fair view of the assets, liabilities, financial

position and net return of the Company;

- the Strategic Report contained in the report and accounts

includes a fair review of the development and performance of the

business and the position of the Company, together with a

description of the principal risks and uncertainties that it faces;

and

- the annual report and accounts, taken as a whole, is fair,

balanced and understandable and provides the information necessary

for shareholders to assess the Company's position and performance,

business model and strategy.

On behalf of the Board

Susannah Nicklin

Chair

25 October 2021

Income Statement

For the period from the date of incorporation on 24 September

2020, to 30 June 2021

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Gains on investments held

at fair value through

profit or loss - 4,200 4,200

Income from investments 775 - 775

Other interest receivable

and similar income 5 - 5

----------------------------- -------- -------- --------

Gross return 780 4,200 4,980

Investment management

fees (121) (121) (242)

Administrative expenses (224) - (224)

Transaction costs - (30) (30)

----------------------------- -------- -------- --------

Net return before taxation 435 4,049 4,484

Taxation - - -

---------------------------- -------- -------- --------

Net return after taxation 435 4,049 4,484

----------------------------- -------- -------- --------

Return per share 0.58p 5.40p 5.98p

The "Total" column of this statement is the profit and loss

account of the Company. The "Revenue" and "Capital" columns

represent supplementary information prepared under guidance issued

by The Association of Investment Companies. The Company has no

other items of other comprehensive income, and therefore the net

return after taxation is also the total comprehensive income for

the period.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the period.

Statement of Changes in Equity

For the period from the date of incorporation on 24 September

2020, to 30 June 2021

Called-up

share Share Special Capital Revenue

capital premium reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Issue of Management

Shares 50 - - - - 50

Redemption of Management

Shares (50) - - - - (50)

Issue of Ordinary

Shares 750 74,250 - - - 75,000

Share issue costs - (1,229) (28) - - (1,257)

Cancellation of

share premium - (73,021) 73,021 - - -

Net return after

taxation - - - 4,049 435 4,484

-------------------------- ---------- ---------- -------- --------- -------- --------

At 30 June 2021 750 - 72,993 4,049 435 78,227

-------------------------- ---------- ---------- -------- --------- -------- --------

Statement of Financial Position

at 30 June 2021

2021

GBP'000

Fixed assets

Investments held at fair value through profit

or loss 41,369

Investments held at amortised cost 21,142

------------------------------------------------ --------

62,511

Current assets

Debtors 221

Cash at bank and in hand 17,086

------------------------------------------------ --------

17,307

----------------------------------------------- --------

Current liabilities

Creditors: amounts falling due within one

year (1,591)

------------------------------------------------ --------

Net current assets 15,716

------------------------------------------------ --------

Total assets less current liabilities 78,227

------------------------------------------------ --------

Net assets 78,227

------------------------------------------------ --------

Capital and reserves

Called-up share capital 750

Special reserve 72,993

Capital reserves 4,049

Revenue reserve 435

------------------------------------------------ --------

Total equity shareholders' funds 78,227

------------------------------------------------ --------

Net asset value per share 104.30p

Cash Flow Statement

For the period from the date of incorporation on 24 September

2020, to 30 June 2021

GBP'000

Net cash inflow from operating activities 397

Investing activities

Purchases of investments (57,245)

Sales of investments 191

--------------------------------------------- ---------

Net cash outflow from investing activities (57,054)

--------------------------------------------- ---------

Net cash outflow before financing (56,657)

--------------------------------------------- ---------

Financing activities

Issue of Management Shares 13

Redemption of Management Shares (13)

Issue of Ordinary Shares 74,843

Share issue costs (1,100)

--------------------------------------------- ---------

Net cash inflow from financing activities 73,743

--------------------------------------------- ---------

Net cash inflow in the period 17,086

--------------------------------------------- ---------

Cash at bank and in hand at the beginning -

of the period

Net cash inflow in the period 17,086

--------------------------------------------- ---------

Cash at bank and in hand at the end of the

period 17,086

--------------------------------------------- ---------

Included in net cash inflow from operating activities are

dividends received amounting to GBP285,000, income from debt

securities amounting to GBP283,000 and other interest receivable

and similar income amounting to GBP5,000.

Notes to the Accounts

1. Accounting Policies

The accounts are prepared in accordance with the Companies Act

2006, United Kingdom Generally Accepted Accounting Practice ("UK

GAAP"), in particular in accordance with Financial Reporting

Standard (FRS) 102 "The Financial Reporting Standard applicable in

the UK and Republic of Ireland", and with the Statement of

Recommended Practice "Financial Statements of Investment Trust

Companies and Venture Capital Trusts" (the "SORP") issued by the

Association of Investment Companies in October 2019. All of the

Company's operations are of a continuing nature.

The accounts have been prepared on a going concern basis under

the historical cost convention, as modified by the revaluation of

investments held at fair value through profit or loss. The

directors believe that the Company has adequate resources to

continue operating until 31 October 2022, which is at least 12

months from the date of approval of these accounts. In forming this

opinion, the directors have taken into consideration: the controls

and monitoring processes in place; the Company's level of debt and

other payables; the low level of operating expenses, comprising

largely variable costs which would reduce pro rata in the event of

a market downturn; the Company's cash flow forecasts and the

liquidity of the Company's investments.

The accounts are presented in sterling and amounts have been

rounded to the nearest thousand.

Certain judgements, estimates and assumptions have been required

in valuing the Company's investments and these are detailed in note

19 on page 66 of the Report and Accounts .

2. Income from investments

Period to

30 June

2021

GBP'000

Income from investments:

UK dividends 285

Interest income from debt securities and other financial

assets 490

---------------------------------------------------------- ----------

775

---------------------------------------------------------- ----------

Other interest receivable and similar income:

Deposit interest 1

Other income 4

---------------------------------------------------------- ----------

5

---------------------------------------------------------- ----------

Total income 780

---------------------------------------------------------- ----------

3. Investment management fee

Period to 30 June 2021

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Investment management fees 121 121 242

---------------------------- -------- -------- --------

The bases for calculating the investment management fees are set

out in the Report of the Directors on pages 35 and 36 of the Report

and Accounts and details of all amounts payable to the managers are

given in note 17 on page 66 of the Report and Accounts.

4. Dividends

A final dividend of 0.57p per share has been declared in respect

of the period ended 30 June 2021, and has been designated as an

interest distribution.

5. Return per share

Period to

30 June

2021

GBP'000

Revenue return 435

Capital return 4,049

------------------------------------------------------- -----------

Total return 4,484

------------------------------------------------------- -----------

Weighted average number of shares in issue during the

period 75,000,000

Revenue return per share 0.58p

Capital return per share 5.40p

------------------------------------------------------- -----------

Total return per share 5.98p

------------------------------------------------------- -----------

6. Called-up share capital

The issued share capital at the accounting date was as

follows:

2021

GBP'000

Ordinary shares allotted, called-up and fully paid:

75,000,000 shares of 1p each: 750

----------------------------------------------------- --------

On incorporation, the issued share capital of the Company

comprised a single 1p Ordinary Share,

GBP1 paid, held by an employee of the Company's legal adviser,

as subscriber to the Company's memorandum of association.

On 2 November 2020, 50,000 Redeemable Shares were allotted to a

member of the Schroder Group, in order to obtain a certificate to

conduct business. These shares were paid up to one quarter of their

nominal value of GBP1 per share.

On 22 December 2020, 74,499,999 Ordinary Shares were issued at

GBP1 per share, following a placing and offer for subscription, and

the 50,000 Redeemable Shares were redeemed out of the proceeds of

the issue.

7. Net asset value per share

2021

Net assets attributable to shareholders (GBP'000) 78,227

Shares in issue at the period end 75,000,000

--------------------------------------------------- -----------

Net asset value per share 104.30p

--------------------------------------------------- -----------

8. Transactions with the Manager

Under the terms of the Alternative Investment Fund Manager

Agreement, the Manager is entitled to receive a management fee.

Details of the basis of the calculation are given in the Directors'

Report on pages 37 and 38 of the Report and Accounts.

The fee payable to the Manager in respect of the period ended 30

June 2021 amounted to GBP209,000, and the whole of this amount was

outstanding at the period end. Any investments in funds managed or

advised by the Manager or any of its associated companies, are

excluded from the assets used for the purpose of the calculation

and therefore incur no fee.

No Director of the Company served as a director of any company

within the Schroder Group at any time during the period.

In accordance with the terms of a discretionary mandate,

Rathbone Investment Management Limited is entitled to receive a

management fee for portfolio management services relating to

certain of the Company's investments. The fee payable to Rathbone

in respect of the period ended 30 June 2021 amounted to GBP33,000,

of which GBP16,000 was outstanding at the period end.

Status of announcement

2021 Financial Information

The figures and financial information for 2021 are extracted

from the Report and Accounts for the period from incorporation on

24 September 2020 to 30 June 2021 and do not constitute the

statutory accounts for the period. The 2021 Report and Accounts

include the Report of the Independent Auditors which is unqualified

and does not contain a statement under either section 498(2) or

section 498(3) of the Companies Act 2006. The Report and Accounts

will be delivered to the Registrar of Companies in due course.

Neither the contents of the Company's webpages nor the contents

of any website accessible from hyperlinks on the Company's webpages

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKPBNNBDBQKB

(END) Dow Jones Newswires

October 26, 2021 02:00 ET (06:00 GMT)

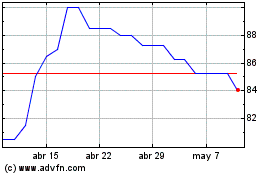

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024