Sequoia Economic Infra Inc Fd Ld Portfolio Update (6417P)

20 Octubre 2021 - 1:00AM

UK Regulatory

TIDMSEQI

RNS Number : 6417P

Sequoia Economic Infra Inc Fd Ld

20 October 2021

20 October 2021

Sequoia Economic Infrastructure Income Fund Limited

("SEQI" or the "Company")

Portfolio update

As recently noted in the Investment Update for 30 September

2021, Salt Lake Potash or SO4 (representing 1.9% of NAV as at 30

September 2021) was seeking further funding by means of an equity

issue to address additional cost and ramp up requirements at their

Lake Way potash project. The proposed equity raise has been

unsuccessful and Salt Lake Potash have announced a Voluntary

Administration of the company as at 20 October 2021.

The Investment Adviser had been developing a contingency plan

should the funding gap not be addressed. This contingency plan has

now been activated in full alignment with the lender group. The

lender group has appointed KordaMentha, a leading Australian

restructuring and advisory firm, as receivers for the lender

group.

Please refer to KordaMentha's press release on their appointment

as receivers here:

https://www2.asx.com.au/markets/trade-our-cash-market/announcements.so4

Under Australian restructuring processes, receivers act for the

benefit of lenders and can take a variety of measures including

trade sales of the company, debt sales or other restructuring

activities to preserve lender value and maximise recovery. The

Investment Adviser notes that the cost base of the project and

equity invested to date materially exceeds the total debt quantum

and that a similar potash project utilising evaporative production

processes for sulphate of potash production has recently achieved

first production, albeit with reportedly similar ramp-up issues as

SO4. Whilst it is too early and speculative to comment on the

eventual recovery percentage of our investment, our senior secured

position should position us strongly in the restructuring

process.

A further update will be provided as and when appropriate.

For further information please contact:

Sequoia Investment Management Company +44 (0)20 7079 0480

Steve Cook

Dolf Kohnhorst

Randall Sandstrom

Greg Taylor

Anurag Gupta

Jefferies International Limited +44 (0)20 7029 8000

Gaudi le Roux

Neil Winward

Tulchan Communications (Financial PR) +44 (0)20 7353 4200

Martin Pengelley

Elizabeth Snow

Deborah Roney

Praxis Fund Services Limited (Company Secretary) +44 (0) 1481 755530

Matt Falla

Katrina Rowe

About Sequoia Economic Infrastructure Income Fund Limited

The Company seeks to provide investors with regular, sustained,

long-term distributions and capital appreciation from a diversified

portfolio of senior and subordinated economic infrastructure debt

investments. The Company is advised by Sequoia Investment

Management Company Limited.

LEI: 2138006OW12FQHJ6PX91

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFIFVEIFLIFIL

(END) Dow Jones Newswires

October 20, 2021 02:00 ET (06:00 GMT)

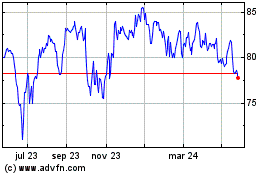

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

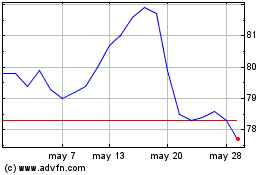

De Mar 2024 a Abr 2024

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024