TIDMSWG

RNS Number : 2349W

Shearwater Group PLC

22 April 2021

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

22 April 2021

SHEARWATER GROUP PLC

("Shearwater", or the "Group")

Post Close Trading Update

Second half momentum; underlying EBITDA expected to be ahead of

expectations

Shearwater Group plc, the organisational resilience group which

provides cybersecurity, advisory and managed security services, is

pleased to provide the following post close trading update for the

financial year ended 31 March 2021(1) .

Following a robust second half of trading, and subject to audit,

the Group expects to report FY21 underlying EBITDA(2) in excess of

GBP3.6 million (FY20: GBP3.4m), ahead of market expectations.

Revenue of GBP31.8m was delivered in the year (FY20: GBP33.0m),

reflecting a substantial increase in sales activity converted

across the second half and strong margin improvement.

Over the past 12 months the Group's balance sheet has

significantly strengthened. Cash collection also exceeded

expectations, resulting in unaudited net cash(3) balances of GBP7.3

million as at 31 March 2021 (31 March 2020: GBP1.4m net debt), of

which GBP1.3m will be applied towards the settlement of deferred

VAT payments relating to FY21 revenues.

Shearwater delivered very strong trading in H2 FY21 with year on

year revenues for the six months up by 24% on the same period in

the prior year. Revenue was driven by new client wins and several

high value contract renewals. The Group noted numerous positive

signs of returning business confidence, including the early

commencement of the previously announced GBP3.6m project to monitor

and provide support to next generation mobile communications which

had initially been scheduled to commence in Q1 FY22.

A particular demonstration of execution on strategy was the

success of the Group's cross-selling initiatives seen over the

year, which contributed in excess of GBP500,000 of revenue in FY21.

There are good opportunities to expand these projects, and many new

leads, generated through cross-company introductions, remain in the

pipeline.

The Group also continued to invest in innovation, further

developing its SaaS based Secure Identity & Access Management

Platform in the period. Demand for this offering is set to increase

substantially and represents an exciting opportunity for the

business as hybrid working is adopted as routine. Shearwater's

platform is well positioned to take market share in this area.

The Group remains committed to making acquisitions in line with

its buy, focus, grow strategy and strict acquisition criteria. It

has an active pipeline of M&A opportunities.

The Group expects to publish its audited results for the

financial year ended 31 March 2021 in July 2021.

Phil Higgins, Group Chief Executive Officer of Shearwater,

commented:

"I am very proud of what Shearwater has achieved in the year,

navigating Covid-19 related challenges and continuing to both renew

contracts with existing customers and to secure new business to

deliver underlying EBITDA ahead of market expectations. This

performance reflects the strength of our offering and the growing

demand for organisational resilience services, alongside the

recovery of more normalised patterns of decision making as greater

macro-economic confidence begins to return.

"The majority of our businesses are reporting a solid increase

in enquires, quotations and consulting utilisation for Q1 of the

new financial year, in comparison to the same period last year. We

are very encouraged by the uplift in market activity and remain

confident of our ability to capitalise on the numerous

opportunities for growth going forward, both organic and in the

consolidation of the market. Whilst inevitably, uncertainty

remains, we are well-placed to now return to driving growth in the

business over the coming year and beyond, delivering value to all

our stakeholders."

(1) All figures unaudited

(2) Underlying EBITDA is defined as profit before tax, before

one off exceptional items, share based payment charges, finance

charges, impairment of intangible assets, fair value adjustments to

deferred consideration, contingent consideration depreciation and

amortisation.

(3) Net cash includes gross cash on hand less loans and drawings

against RCF (excluding lease liabilities).

Enquiries:

Shearwater Group plc www.shearwatergroup.com

David Williams c/o Alma PR

Phil Higgins

Cenkos Securities plc - NOMAD and

Joint Broker

Max Hartley / Ben Jeynes - NOMAD

Julian Morse / Michael Johnson

- Sales +44 (0) 20 7397 8900

Berenberg - Joint Broker

Matthew Armitt / Mark Whitmore +44 (0) 20 3207 7800

Alma PR shearwater@almapr.co.uk

Susie Hudson / Caroline Forde / +44 (0) 20 3405 0205

Harriet Jackson

About Shearwater Group plc

Shearwater Group plc is an award-winning organisational

resilience group that provides cybersecurity, advisory and managed

security services to help assure and secure businesses in a

connected global economy.

The Group's comprehensive cybersecurity solutions and services

maintain trust between users, assure the protection of information

assets and critical infrastructure, and support organisations'

operational effectiveness. Its capabilities include identity and

access management and data security, cybersecurity solutions and

managed security services, and security governance, risk and

compliance.

The Group is headquartered in the UK, serving customers across

the globe who are active in a broad spectrum of industries.

Shearwater shares are listed on the London Stock Exchange's AIM

under the ticker "SWG". For more information, please visit

www.shearwatergroup.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBFLLLFZLZBBF

(END) Dow Jones Newswires

April 22, 2021 02:00 ET (06:00 GMT)

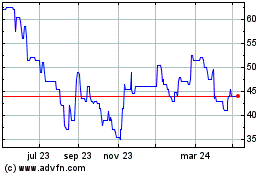

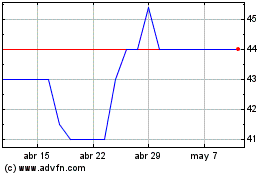

Shearwater (LSE:SWG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Shearwater (LSE:SWG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024