TIDMSTX

RNS Number : 8107I

Shield Therapeutics PLC

17 August 2021

Shield Therapeutics plc

("Shield" or the "Company" or the "Group")

Half-year Report

Interim Report for the six months ended 30 June 2021

Six month period dominated by preparation for launch of

Accrufer(R) in US

London, UK, 17 August 2021: Shield Therapeutics plc (LSE: STX),

a commercial stage pharmaceutical company with a focus on

addressing iron deficiency with its lead product Feraccru (R)

/Accrufer (R) (ferric maltol) , announces its unaudited interim

results for the six months ended 30 June 2021.

Operational Highlights (including post-period end)

-- Accrufer (R) launched in US on 1 July 2021

-- 51% growth in Feraccru(R) sales volumes in Europe compared with H2 2020

-- Chinese authorities confirm regulatory approval pathway for Feraccru(R) in China

-- First stage of Feraccru(R)/Accrufer(R) paediatric study completed

-- License deal for development and commercialisation of

Accrufer(R) in Republic of Korea secured (August 2021)

Financial Highlights

-- Revenues of GBP0.5 million (H1 2020: GBP8.9 million)

-- Loss for the period of GBP7.3 million (H1 2020 profit: GBP3.1 million)

-- Net cash outflow from operating activities of GBP8.0 million

(H1 2020: GBP2.0 million inflow)

-- GBP27.7 million net proceeds from placing, subscription and open offer in March 2021

-- Cash balance at 30 June 2021 GBP22.6 million (31 December 2020: GBP2.9 million)

Commenting on the interim results, Greg Madison, CEO of Shield,

said "The first six months of 2021 have been a truly pivotal and

exciting period for Shield which opens up the prospect of

substantially greater shareholder value for investors. During the

first quarter the Group's US strategy transitioned from an

out-licence approach to one of launching Accrufer (R) ourselves in

the US, and the successful fundraise in March 2021 provided the

financial resources for the launch. In the second quarter a huge

amount of planning and implementation was completed which allowed

us to launch Accrufer (R) on 1 July 2021 and I am pleased with

progress to date. With Accrufer (R) now available in the US, and

Feraccru(R) available in Europe, I am excited about the long-term

prospects for our product(s) and Shield."

Analyst briefing

A briefing open to analysts will take place remotely via video

conference call today, Tuesday, 17 August 2021 at 2.00pm BST/9.00am

EST. If you would like the details of this call please contact

Walbrook PR on shield@walbrookpr.com.

For further information please contact:

Shield Therapeutics plc www.shieldtherapeutics.com

Greg Madison, CEO +44 (0) 191 511 8500

Hans-Peter Rudolf, CFO

Nominated Adviser and Joint Broker

Peel Hunt LLP

James Steel/Christopher Golden +44 (0)20 7418 8900

Joint Broker

finnCap Ltd

Geoff Nash/Alice Lane/George Dollemore +44 (0)20 7220 0500

Financial PR & IR Advisor

Walbrook PR +44 (0)20 7933 8780 or shield@walbrookpr.com

Paul McManus/ Lianne Cawthorne /

Alice Woodings

About Shield Therapeutics plc

Shield is a commercial stage, pharmaceutical company with a

focus on addressing iron deficiency with its lead product

Feraccru(R)/Accrufer(R) (ferric maltol), a novel, stable, non-salt

based oral therapy for adults with iron deficiency with or without

anaemia.

Shield's lead product, Feraccru(R)/Accrufer(R), has been

approved for use in the United States, European Union, UK,

Switzerland and Australia and has exclusive IP rights until the

mid-2030s. Accrufer(R) has been launched in the US in 2021 through

a highly experienced sales and marketing team. Feraccru(R) is being

commercialised in the UK and European Union by Norgine B.V., who

also have the marketing rights in Australia and New Zealand. Shield

also has exclusive licence agreements with Beijing Aosaikang

Pharmaceutical Co., Ltd., for the development and commercialisation

of Feraccru(R)/Accrufer(R) in China, Hong Kong, Macau and Taiwan;

and with KOREA PHARMA CO.,LTD for development and commercialisation

in the Republic of Korea.

For more information, please visit www.shieldtherapeutics.com.

Follow Shield on Twitter @ShieldTx

Forward-Looking Statements

This press release contains forward-looking statements. All

statements contained in this press release that do not relate to

matters of historical fact should be considered forward-looking

statements. These forward-looking statements are based on

management's current expectations and include statements related to

the commercial strategy for Feraccru(R)/ Accrufer(R) These

statements are neither promises nor guarantees, but involve known

and unknown risks and uncertainties, many of which are beyond our

control, that may cause actual results, performance or achievements

to be materially different from management's expectations expressed

or implied by the forward-looking statements, including, but not

limited to, risks associated with, the Group's business and results

of operations, competition and other market factors. The

forward-looking statements made in this press release represent

management's expectations as of the date of this press release, and

except as required by law, the Group disclaims any obligation to

update any forward-looking statements contained in this release,

even if subsequent events cause our views to change.

Operational Review

Commercialisation of Feraccru(R)/Accrufer(R)

USA

Accrufer(R) was launched in the US on 1 July 2021 in line with

prior guidance. During the second quarter of 2021, a sales force

including 30 sales representatives was recruited and trained and

started to contact key prescribers. Due to the ongoing impact of

the COVID pandemic and the emergence of the delta variant in the

US, face-to-face contact with clinicians has been limited in the

initial phase of launch. Discussions are ongoing with payers

regarding formulary placement of Accrufer(R) and will continue over

the next several months.

Europe/Australia

Norgine BV is our license partner for commercialisation of

Feraccru(R) in most of Europe, Australia and New Zealand. Having

initially been focused on Germany and the UK, Norgine took on

responsibility for selling in the Nordic markets during the second

half of 2020 (previously undertaken by AOP Orphan) and also

launched the product in Belgium and Luxembourg in early 2021. The

number of Feraccru(R) packs sold by Norgine in Europe increased by

51% in H1 2021 compared with H2 2020 and by 57% compared with H1

2020.

Norgine continues to focus on driving commercial adoption in

countries where Feraccru (R) has already gained reimbursement while

looking to obtain reimbursement in further countries, with a

particular focus on the major European markets of France, Italy and

Spain.

In March 2021, the Australian Therapeutics Goods Administration

(the local regulatory authority for medicinal products) registered

Feraccru(R) in the Australian Register of Therapeutic Goods to

treat iron deficiency with or without anaemia in adults.

China

Feraccru(R) is not yet approved in China. The Chinese regulatory

authority (CDE) has approved an Investigational New Drug (IND)

application for Feraccru(R) which was submitted by our Chinese

licence partner, ASK Pharm, to conduct two studies which CDE has

confirmed are sufficient to support a New Drug Application: a

12-week Phase III study in 120 Inflammatory Bowel Disease (IBD)

patients and a pharmacokinetic/pharmacodynamic study to be

conducted in parallel. Clinical supplies have been manufactured and

released for the study, and ASK Pharm has started screening

patients. The study could be completed by the end of 2022 and

marketing approval and product launch could follow by late 2023. On

approval, Shield is due to receive an $11.4 million milestone

payment from ASK Pharm and tiered royalties of 10% or 15% depending

on the level of net sales, and up to US$40 million in milestone

payments upon the achievement of specified cumulative sales

targets. ASK Pharm will be responsible for all clinical and

regulatory costs and activities as well as all manufacturing and

distribution costs of goods sold in the territory.

Other markets

We announced a licence deal on 12 August 2021 with KOREA PHARMA

CO. LTD to develop and commercialise Accrufer(R) in South Korea.

The terms of the deal includes an upfront payment of GBP500,000 and

will be entitled to a further GBP1.5 million on first sale in

Korea, 15% royalties and up to GBP4 million in potential sales

milestones. We are also in early discussions with potential

partners in several other countries.

Product development

Shield has agreed a Feraccru (R) /Accrufer (R) Paediatric

Investigational Plan (PIP)/Pediatric Development Plan (PDP) with

the EMA/FDA, respectively, both culminating in the conduct of a

study to evaluate the safety, tolerability and efficacy of the

product in infants, children and adolescents. The first stages were

to develop an age-appropriate formulation suitable for small

children and infants and to demonstrate therapeutic equivalence

with the adult capsule formulation. Both these stages were

completed satisfactorily in the first half of 2021 and the main

study is expected to start recruiting subjects in September

2021.

We have also started work on the development of a new

formulation of PT20, our development stage phosphate binder.

Outlook

The outlook for the second six months of 2021 is dominated by

the launch of Accrufer(R) in the US. The focus will be on building

awareness among healthcare providers, initiating prescriptions for

appropriate patients to generate clinical experience, and extending

patient access through negotiations with payer groups. In Europe,

Feraccru(R) sales are expected to continue to grow steadily in

Germany, the UK, Scandinavia and Belgium whilst progress is made on

pricing and reimbursement in other countries. In China ASK Pharm

will start the Phase III study required for approval while Shield

will start recruiting patients into the paediatric study.

Financial Review

Revenue

Revenue in the first six months of 2021 (H1 2021) was GBP0.5

million (H1 20120: GBP8.9 million). The GBP0.5 million revenue

arises entirely from royalties from Norgine in respect of sales of

Feraccru(R) in Europe. In H1 2020, GBP8.7 million came from the

upfront payment received from ASK Pharm on entering into the

license agreement for the development and commercialisation of

Feraccru(R) in China. The remaining GBP0.2 million arose from

royalties under the Norgine agreement.

Cost of sales

Cost of sales in H1 2021 amounted to GBP0.4 million (H1 2020:

GBP1.0 million). The H1 2021 cost of sales comprises manufacturing

costs of the packs sold in Europe and the 5% royalty on Norgine's

net sales which is payable to Vitra Pharmaceuticals Ltd (Vitra)

under the 2010 Asset Purchase Agreement. In H1 2020 the cost of

sales of GBP1.0 million was predominantly a payment to Vitra of 10%

of the licence upfront received from ASK Pharm. Vitra was the

original owner of the intellectual property underpinning

Feraccru(R) and, under the terms of the 2010 Asset Purchase

Agreement, is entitled to receive either a 5% royalty on net sales

or 10% of any licence upfront and sales milestones. For the Norgine

licence agreement Vitra chose to receive a royalty of 5% of net

sales; for the ASK Pharm agreement Vitra opted to receive 10% of

the upfront receipt and any subsequent milestones.

Selling, general and administrative expenses

Selling, general and administrative expenses were GBP6.1 million

in H1 2020 (H1 2020: GBP4.8 million) of which GBP1.3 million (H1

2020 GBP1.3 million) is the amortisation of intangible assets.

Excluding amortisation, the underlying costs increased from GBP3.5

million in H1 2020 to GBP4.8 million in H1 2021 but the H1 2020

expenses included significant one-off costs related to the China

licence transaction and to the resolution of the issues which arose

on the AEGIS-H2H study in March 2020. The underlying increase from

H1 2020 to H1 2021 is largely due to the pre-launch costs in the

US.

Research and development

In H1 2021, GBP1.6 million (H1 2020: GBP0.7 million) development

costs were incurred. The increase in H1 2021 is predominantly due

the paediatric study. Stage 1 of the paediatric study, during which

the child-appropriate suspension formulation was tested for

equivalence with the adult capsule was started in H2 2020 and

completed in H1 2021. H1 2021 also saw expenditure on the set up of

Stage 2 during which subjects will be dosed with the new suspension

formulation. The bulk of the H1 2020 costs were incurred on

employee and contractor costs, with relatively little external

spend.

Tax

The tax credit of GBP0.3 million (H1 2020: GBP0.4 million)

comprises the anticipated UK R&D tax credit in respect of the

first half of 2021. The H1 2020 tax credit included GBP0.2 million

UK R&D tax credit in respect of the first half of 2020 and a

reduction in the prior-year tax charge for Shield TX (Switzerland)

AG as a result of the final tax returns being completed (GBP0.2

million).

Loss for the period

The loss for H1 2021 was GBP7.3 million. In H1 2020 a profit of

GBP3.1 million was recorded as a result of the GBP8.7 million

upfront received from ASK Pharm on the signing of the Chinese

licence transaction in January 2020.

Balance sheet

Intangible assets at 30 June 2021 were GBP26.0 million (31

December 2020: GBP27.3 million). The components of this are GBP16.5

million (31 December 2020: GBP17.4 million) relating to the

acquisition costs of PT20, the phosphate binder product in our

development portfolio; GBP8.1 million (31 December 2020: GBP8.4

million) relating to capitalised Feraccru(R) development

expenditure, and GBP1.3 million (31 December 2020: GBP1.4 million)

expenditure on strengthening the Group's intellectual property. The

reductions in the balances all relate to amortization charged in

the period.

Inventory at 30 June 2021 amounted to GBP1.4 million which

mainly comprises GBP1.1 million of raw materials and GBP0.3 million

finished product. The GBP1.4 million inventory balance at 31

December 2020 was entirely raw materials.

Trade and other receivables increased to GBP2.0 million at 30

June 2021 compared with GBP0.6 million at 31 December 2020. A

substantial part of the increase relates to prepaid expenses in the

US operation.

The current tax asset of GBP0.3 million (31 December 2020:

GBP0.3 million) represents anticipated R&D tax credits.

Following the equity fundraise completed in March 2021, which

raised GBP27.7 million net of expenses, cash at 30 June 2021 was

GBP22.6 million (31 December 2020: GBP2.9 million).

Trade and other payables at 30 June 2021 were GBP1.3 million,

slightly lower than the GBP1.5 million at 31 December 2020.

Other liabilities reduced from GBP0.8 million at 31 December

2020 to GBP0.1 million at 30 June 2021. The balance at 31 December

2020 included a tax liability of GBP0.5 million in respect of

Shield TX (Switzerland) AG which was paid during the period.

Cash flow

The net cash outflow from operations in H1 2021 was GBP8.0

million, compared with an inflow of GBP2.0 million in H1 2020 which

was attributable to the upfront received in January 2020 from ASK

Pharm. The H1 2021 loss for the period was GBP7.3 million but,

after adjusting for non-cash items, the actual cash outflow from

this loss was GBP5.4 million. Working capital cash outflows

amounted to GBP2.6 million caused mainly by prepaid expenses in the

US operations and the reduction in trade payables and other

liabilities.

Following the receipt of GBP27.7 million from the March 2021

fundraise and including GBP0.1 million of other minor movements,

the cash inflow for the period was GBP19.6 million.

Going concern

For the reasons set out in Note 3 below, the Directors believe

that it remains appropriate to prepare the financial statements on

a going concern basis.

Financial outlook

As explained above the focus in the US will be on building

awareness among healthcare providers, initiating prescriptions for

appropriate patients to generate clinical experience, and extending

patient access through negotiations with payer groups. Over the

course of the next six to twelve months, we expect to increase

payer coverage of Accrufer(R) by signing reimbursement agreements

with various providers. As we increase payer coverage, we will be

able to accelerate revenue growth beyond the increases in sales

volumes, which will then determine the extent of further

investments in related commercial activities. We expect steady

growth in European royalties from Norgine. Expenditure is expected

to increase significantly as the US launch gathers momentum and

recruitment in the paediatric study gets under way. Having signed

the Korea licence transaction, we expect to recognise the GBP500k

upfront as revenue in the second half of 2021.

Consolidated statement of profit and loss and other

comprehensive income

for the six months ended 30 June 2021

Six months

ended Year

30 June Six months

ended ended

2021 30 June 31 December

(unaudited) 2020 2020

GBP000 (unaudited) (audited)

Note GBP000 GBP000

------------------------------------------ ----- -------------- -------------- -------------

Revenue 4 481 8,919 10,387

Cost of sales (411) (1,011) (1,354)

------------------------------------------ ----- -------------- -------------- -------------

Gross profit 70 7,908 9,033

Operating costs - selling, general

and administrative expenses 5 (6,121) (4,834) (8,608)

Operating (loss)/profit before

research and development expenditure (6,051) 3,074 425

Research and development expenditure (1,592) (681) (2,579)

Operating (loss)/profit (7,643) 2,393 (2,154)

Financial income 63 358 269

Financial expense (3) (3) (1)

------------------------------------------ ----- -------------- -------------- -------------

Profit/(loss) before tax (7,583) 2,748 (1,886)

Taxation 6 300 376 (744)

------------------------------------------ ----- -------------- -------------- -------------

(Loss)/profit for the period (7,283) 3,124 (2,630)

------------------------------------------ ----- -------------- -------------- -------------

Attributable to:

Equity holders of the parent (7,283) 3,124 (2,630)

Other comprehensive income

Items that are or may be reclassified

subsequently to profit or loss:

Foreign currency translation differences

- foreign operations 58 (29) (16)

------------------------------------------ ----- -------------- -------------- -------------

Total comprehensive income/(expenditure)

for the period (7,225) 3,095 (2,646)

------------------------------------------ ----- -------------- -------------- -------------

Attributable to:

Equity holders of the parent (7,225) 3,095 (2,646)

Total comprehensive income/(expenditure)

for the period (7,225) 3,095 (2,646)

------------------------------------------ ----- -------------- -------------- -------------

Earnings per share

Basic and diluted (loss)/profit GBP(0.04) GBP0.03

per share 7 GBP(0.02)

------------------------------------------ ----- -------------- -------------- -------------

Group balance sheet

at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

Note GBP000 GBP000 GBP000

------------------------------- ----- -------------- -------------- -------------

Non-current assets

Intangible assets 8 26,016 28,641 27,266

Property, plant and equipment 59 5 32

------------------------------- ----- -------------- -------------- -------------

26,075 28,646 27,298

------------------------------- ----- -------------- -------------- -------------

Current assets

Inventories 9 1,435 1,385 1,379

Trade and other receivables 1,996 543 619

Current tax asset 300 1,152 292

Cash and cash equivalents 22,602 6,515 2,940

------------------------------- ----- -------------- -------------- -------------

26,333 9,595 5,230

------------------------------- ----- -------------- -------------- -------------

Total assets 52,408 38,241 32,528

------------------------------- ----- -------------- -------------- -------------

Current liabilities

Trade and other payables (1,281) (2,320) (1,471)

Lease liabilities - - (28)

Other liabilities (113) (454) (753)

------------------------------- ----- -------------- -------------- -------------

(1,394) (2,774) (2,252)

------------------------------- ----- -------------- -------------- -------------

Total liabilities (1,394) (2,774) (2,252)

------------------------------- ----- -------------- -------------- -------------

Net assets 51,014 35,467 30,276

------------------------------- ----- -------------- -------------- -------------

Equity

Share capital 10 3,238 1,758 1,764

Share premium 114,583 88,352 88,352

Merger reserve 28,358 28,358 28,358

Currency translation reserve 111 40 53

Retained earnings (95,276) (83,041) (88,251)

------------------------------- ----- -------------- -------------- -------------

Total equity 51,014 35,467 30,276

------------------------------- ----- -------------- -------------- -------------

Group statement of changes in equity

for the six months ended 30 June 2021

Currency

Share Share Merger translation Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------- --------- --------- --------- ------------- ---------- --------

Balance at 1 January 2020 (audited) 1,758 88,352 28,358 69 (86,392) 32,145

------------------------------------- --------- --------- --------- ------------- ---------- --------

Loss for the year - - - - (2,630) (2,630)

Other comprehensive income:

Foreign currency translation

differences - - - (16) - (16)

------------------------------------- --------- --------- --------- ------------- ---------- --------

Total comprehensive expense

for the year - - - (16) (2,630) (2,646)

Transactions with owners, recorded

directly in equity

Equity-settled share-based payment

transactions 6 - - - 771 777

------------------------------------- --------- --------- --------- ------------- ---------- --------

Balance at 31 December 2020

(audited) 1,764 88,352 28,358 53 (88,251) 30,276

------------------------------------- --------- --------- --------- ------------- ---------- --------

Loss for the period - - - - (7,283) (7,283)

Other comprehensive income:

Foreign currency translation

differences - - - 58 - 58

------------------------------------- --------- --------- --------- ------------- ---------- --------

Total comprehensive expense

for the period - - - 58 (7,283) (7,225)

Transactions with owners, recorded

directly in equity

Share options exercised 15 11 - - - 26

Equity placing - new shares

issued 1,459 26,220 27,679

Equity-settled share-based payment

transactions - - - - 258 258

------------------------------------- --------- --------- --------- ------------- ---------- --------

Balance at 30 June 2021 (unaudited) 3,238 114,583 28,358 111 (95,276) 51,014

------------------------------------- --------- --------- --------- ------------- ---------- --------

Group statement of cash flows

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

---------------------------------------------------- -------------- -------------- --------------

Cash flows from operating activities

(Loss)/profit for the period (7,283) 3,124 (2,630)

Adjustments for:

Depreciation and amortization 1,290 1,281 2,705

Equity-settled share-based payment expenses 257 227 771

Financial income (63) (358) (269)

Financial expense 3 3 1

Unrealised foreign exchange losses 58 (29) (11)

Income tax 300 (376) 744

---------------------------------------------------- -------------- -------------- --------------

(5,438) 3,872 1,311

(Increase)/decrease in inventories (56) (437) (431)

(Increase)/decrease in trade and other receivables (1,685) (14) (264)

(Decrease)/increase in trade and other payables (190) (1,227) (2,075)

(Decrease)/increase in other liabilities (640) (153) 140

Change in lease assets and liabilities (28) - 8

Income tax (paid)/received - - (89)

Net cash flows from operating activities (8,037) 2,041 (1,400)

---------------------------------------------------- -------------- -------------- --------------

Cash flows from investing activities

Financial income 2 358 3

Acquisitions of intangible assets (66) (2) (23)

Net cash flows from investing activities (64) 356 (20)

---------------------------------------------------- -------------- -------------- --------------

Cash flows from financing activities

Financial expense (3) (3) (1)

Finance leases - interest payment - - (4)

Proceeds of share options exercise 26 - 6

Net proceeds from equity share placing 27,679 - -

Finance leases - capital payment - (20) (48)

---------------------------------------------------- -------------- -------------- --------------

Net cash flows from financing activities 27,702 (23) (47)

---------------------------------------------------- -------------- -------------- --------------

Net increase/(reduction) in cash 19,601 2,374 (1,467)

Effect of exchange rate fluctuations on cash

held 61 - 266

Cash and cash equivalents at beginning period 2,940 4,141 4,141

Cash and cash equivalents at period end 22,602 6,515 2,940

---------------------------------------------------- -------------- -------------- --------------

Notes

for the six months ended 30 June 2021

1. General information

Shield Therapeutics plc (the "Company") is incorporated in

England and Wales as a public limited company. The Company trades

on the London Stock Exchange's AIM market.

The Company is domiciled in England and the registered office of

the Company is at Northern Design Centre, Baltic Business Quarter,

Gateshead Quays NE8 3DF.

This interim report, which is not audited, has been prepared in

accordance with the measurement and recognition criteria of EU

Adopted International Financial Reporting Standards. It does not

include all the information required for full annual financial

statements and should be read in conjunction with the financial

statements of the Company and its subsidiaries (the "Group") as at

and for the year ended 31 December 2020. This financial information

does not constitute statutory financial statements as defined in

Section 435 of the Companies Act 2006. The comparative figures for

the year ended 31 December 2020 are not the Company's statutory

accounts for that financial year. Those accounts have been reported

on by the Company's auditor and delivered to the Registrar of

Companies. The report of the auditors was unqualified. The auditor

has reported on those accounts; their report was unqualified and

did not contain a statement under Section 498 (2) or (3) of the

Companies Act 2006; though it did include a reference to a matter

to which the auditor drew attention by way of emphasis without

qualifying their report in relation to going concern. It does not

comply with IAS 34 Interim financial reporting, as is permissible

under the rules of AIM.

The interim report was approved by the board of directors on 16

August 2021.

2. Accounting policies

The accounting policies applied in these interim financial

statements are consistent with those of the annual financial

statements for the year ended 31 December 2020, as described in

those annual financial statements.

3. Critical accounting judgments and key sources of estimation

uncertainty

In the application of the Group's accounting policies,

management is required to make judgments, estimates and assumptions

about the carrying amounts of assets and liabilities that are not

readily apparent from other sources.

The significant judgments made in relation to the financial

statements are:

Going concern

At 30 June 2021 the Group held GBP22.6 million in cash. The

Directors have considered the funding requirements of the Group

through the preparation of detailed cash flow forecasts for the

period to 31 December 2022 including the Accrufer(R) US launch

costs and prospective sales revenues and the costs of the

paediatric study. These forecasts show that the Group has

sufficient funds to allow the business to continue in operations

for at least 12 months from the date of approval of these financial

statements. The Directors have considered severe but plausible

scenarios in which sales revenues fall below base case forecasts.

In these circumstances mitigating actions such as reduction of

discretionary selling and marketing expenditure could be taken to

preserve cash. The Directors also believe that other forms of

finance, such as debt finance or royalty finance are likely to be

available to the Group.

Based on the above factors the Directors believe that it remains

appropriate to prepare the financial statements on a going concern

basis.

Development expenditure

Development expenditure is capitalised when the conditions

referred to in Note 2 of the Company's annual report are met.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future

periods if the revision affects both current and future periods.

The significant estimates which may lead to material adjustment in

the next accounting period are:

Valuation of intellectual property acquired with Phosphate

Therapeutics Limited - GBP16.5 million

The valuation of intellectual property acquired with Phosphate

Therapeutics Limited in 2016 is based on cash flow forecasts for

the underlying product, PT20, and an assumed appropriate cost of

capital and other inputs, such as the size of the market in major

markets, in order to arrive at a value in use for the asset. The

realisation of its value is ultimately dependent on the positive

outcome of a PT20 Phase III clinical study followed by regulatory

approval and successful commercialisation of the asset. Whilst

earlier PT20 clinical studies provide grounds for confidence that

the Phase III study would be successful, this cannot be guaranteed.

Work on the development of a suitable commercial formulation of the

drug product is ongoing. In the event that commercial returns are

lower than current expectations this may lead to an impairment.

Valuation of intellectual property associated with Feraccru(R)

/Accrufer(R) - GBP9.5 million

The valuation of intellectual property associated with

Feraccru(R) /Accrufer(R) (including patents, development costs and

the Company's investment in Shield TX (Switzerland) AG)) is based

on cash flow forecasts for the underlying business and an assumed

appropriate cost of capital and other inputs in order to arrive at

a fair value for the asset. The realisation of its value is

ultimately dependent on the successful commercialisation of the

asset. In the event that commercial returns are lower than current

expectations this may lead to an impairment. No impairment has been

recognised to date.

Deferred tax assets

Estimates of future profitability are required for the decision

whether or not to create a deferred tax asset. To date no deferred

tax assets have been recognised.

4. Segmental reporting

The following analysis by segment is presented in accordance

with IFRS 8 on the basis of those segments whose operating results

are regularly reviewed by the Chief Operating Decision Maker

(considered to be the Board of Directors) to assess performance and

make strategic decisions about the allocation of resources.

Segmental results are calculated on an IFRS basis.

A brief description of the segments of the business is as

follows:

-- Feraccru(R)/Accrufer(R) - development and commercialisation

of the Group's lead Feraccru(R)/Accrufer(R) product

-- PT20 - development of the Group's secondary asset

Operating results which cannot be allocated to an individual

segment are recorded as central and unallocated overheads.

Year

Six months ended

ended 31

30 June December

2021 2020

(unaudited) (audited)

------------- ------------- ------------- -------- -------------- ----------- ------------- --------

Central Central

Feraccru PT20 and Total Feraccru(R)/ PT20 and Total

(R)/ GBP000 unallocated GBP000 Accrufer(R) GBP000 unallocated GBP000

Accrufer(R) GBP000 GBP000 GBP000

GBP000

------------- ------------- ------------- -------- -------------- ----------- ------------- --------

Revenue 481 - - 481 10,387 - - 10,387

------------- ------------- ------------- -------- -------------- ----------- ------------- --------

Operating

loss (4,315) (61) (3,267) (7,643) 424 (2,047) (531) (2,154)

Financial

income 63 269

Financial

expense (3) (1)

Tax 300 (744)

------------- ------------- ------------- -------- -------------- ----------- ------------- --------

Loss for

the

period (7,283) (2,630)

------------- ------------- ------------- -------- -------------- ----------- ------------- --------

The revenue analysis in the table below is based on the country

of registration of the fee paying party. GBPNil revenue (year ended

31 December 2020: GBP9.7 million) was derived from licence upfront

and milestone payments from commercial partners. The remainder of

revenue is derived from the sale of goods.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------- -------------- -------------- --------------

UK - 23 -

Europe 463 203 729

Rest of the World 18 8,692 9,658

481 8,919 10,387

------------------- -------------- -------------- --------------

5. Operating costs - selling, general and administrative

expenses

Operating costs are comprised of:

Six months Six Year

ended months ended

30 June ended 31 December

2021 30 June 2020

2020

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- --------------

Selling costs 2,245 137 281

General and administrative expenses 2,586 3,417 5,622

Depreciation and amortisation 1,290 1,281 2,705

6,121 4,834 8,608

------------------------------------- -------------- -------------- --------------

6. Taxation

The Group's tax credit in the 6 months ended 30 June 2021 was

GBP300,000 (H1 2020: GBP376,000), comprising anticipated R&D

tax credits in respect of claims not yet submitted for the 2021

financial year.

7. Loss per share

The basic loss per share of GBP0.04 (H1 2020 (restated): profit

per share GBP0.03) has been calculated by dividing the loss for the

period by the weighted average number of shares of 182,955,436 in

issue during the six months ended 30 June 2021 (six months ended 30

June 2020: 117,088,657).

Although there are potentially-dilutive ordinary shares these

would not serve to increase or reduce the loss per ordinary share,

as the Group is loss-making. There is therefore no difference

between the loss per ordinary share and the diluted loss per

ordinary share.

8. Intangible assets

Phosphate

Patents Development Therapeutics

Group and trademarks costs licences Total

GBP000 GBP000 GBP000 GBP000

--------------------------------------- ----------------- -------------- --------------- ---------

Cost

Balance at 1 January 2020 (audited) 2,055 9,943 27,047 39,045

Additions - externally purchased - - 23 23

Balance at 31 December 2020 (audited) 2,055 9,943 27,070 39,068

Additions - externally purchased - - 9 9

Balance at 30 June 2021 (unaudited) 2,055 9,943 27,079 39,077

--------------------------------------- ----------------- -------------- --------------- ---------

Accumulated amortisation

Balance at 1 January 2020 (audited) 574 982 7,591 9,147

Charge for the period 94 527 2,034 2,655

Balance at 31 December 2020 (audited) 668 1,509 9,625 11,802

Charge for the period 47 302 910 1,259

Disposals - - - -

Balance at 30 June 2021 (unaudited) 715 1,811 10,535 13,061

--------------------------------------- ----------------- -------------- --------------- ---------

Net book values

30 June 2021 (unaudited) 1,340 8,132 16,544 26,016

--------------------------------------- ----------------- -------------- --------------- ---------

31 December 2020 (audited) 1,387 8,434 17,445 27,266

--------------------------------------- ----------------- -------------- --------------- ---------

9. Inventories

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

Group GBP000 GBP000 GBP000

------------------- ---- -------------- -------------- --------------

Raw materials 1,079 524 1,379

Work in progress - 861 -

Finished goods 356 - -

1,435 1,385 1,379

------------------------ -------------- -------------- --------------

10. Share capital

Six months Six months Year Year

ended ended ended ended

30 June 30 June 31 December 31 December

2021 2021 2020 2020

Number Number

000 GBP000 000 GBP000

At beginning of period 117,189 1,758 117,189 1,758

--------------------------- ------------- ------------- -------------- --------------

Equity placing 97,700 1,465 - -

Exercise of share options 985 15 431 6

At end of period 215,874 3,238 117,620 1,764

--------------------------- ------------- ------------- -------------- --------------

985,067 share options were exercised during the 6 months ended

30 June 2021 (6 months ended 30 June 2020: Nil)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QQLFFFVLLBBQ

(END) Dow Jones Newswires

August 17, 2021 02:00 ET (06:00 GMT)

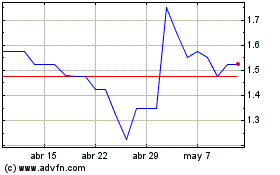

Shield Therapeutics (LSE:STX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Shield Therapeutics (LSE:STX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024