TIDMSTCM

RNS Number : 1253M

Steppe Cement Limited

17 September 2021

Steppe Cement Ltd

Interim Results for the Half Year ended 30 June 2021

and General Market Update

1. Interim Results

Steppe Cement Ltd ("Steppe Cement" and "the Company") posted a

consolidated profit after tax of USD6.2 million for the six months

ended 30 June 2021, an increase of 52%.

6 months 6 months % of change

ended ended

30 June 30 June

21 20

Sales (Tonnes) 840,661 764,752 10%

------------- ------------- ----------------

Consolidated turnover KZT

million 16,657 13,677 22%

------------- ------------- ----------------

Consolidated turnover (USD

Million) 39.5 33.8 17%

------------- ------------- ----------------

Consolidated profit after

tax (USD Million) 6.2 4.1 52%

------------- ------------- ----------------

Earnings per share (Cents) 2.8 1.9 47%

------------- ------------- ----------------

Average exchange rate (USD/KZT) 424 405 -5%

------------- ------------- ----------------

-- The Company managed to increase cement prices during the first half of 2021.

-- The average ex-factory price increased from 14,727 KZT /tonne

(USD36 per tonne) to 16,571 KZT/tonne (USD39 per tonne) or 11%

during the period.

-- Steppe Cement's gross margin increased from 40% to 46% in USD terms due to price increases.

-- Selling expenses per tonne increased in USD terms by 16% and

in KZT by 21% due to increases in transportation prices from the

national railways.

-- General and administrative expenses increased by 16% in USD.

-- The Kazakh Tenge average rate depreciated by 5% compared to

the first half of 2020 but only translated in a small foreign

exchange loss of USD 0.2 million as the company maintains very

small loan balances in USD.

-- The Company generated operating profit before working capital

changes of USD12.9 million in 1H 2021 against USD 11 million in

2020.

-- Kazakhstan GDP increased by 2.3% in 1H2021 compared to 1H2020

rebounding from a drop of 1.4% in the first quarter of 2021.

-- Reported inflation has been 7% up to the end of August 2021.

2. Production costs

-- Production costs increased by 5% in KZT mostly due to the

higher electricity cost, diesel and spare parts for

maintenance.

3. Update on the Kazakh cement market

-- The Kazakh cement market increased by 28% during the first

half of the year. The increase is due mostly to the program set in

place by the government that allows partial withdrawal from

personal pension funds for real estate investment or health

reasons. It was done to stimulate the economy and it may bring

total cement consumption in 2021 to 10.5 to 11 million tonnes in

2021, an increase of more than 1 million tonnes from 2020.

-- Steppe Cement's local market share decreased from 16.5% in

1H2020 to 15% in 1H2021 due to the strong growth in the overall

market. We expect to maintain this share for the full year. Exports

represented 9% of the volumes in the 1H2021 from 11% last year.

-- Imports into Kazakhstan have increased to 0.4 million tonnes

in 2021 and represent 7% of the market.

-- Exports from Kazakhstan have increased slightly to 0.97 million tonnes.

-- Exports from Kazakhstan represent 17% of local production from 18% last year.

-- Overall production of all factories in Kazakhstan has

increased by 1 million tonnes to 5.7 million tonnes for the 1H2021

as closures in the smaller factories were balanced by increases in

production by Gezhuoba Cement and Alacem.

-- Currently 82% of production in the country is manufactured

from dry lines up from 80% in 2020.

4. Financing

-- Interest expenses on bank debt were reduced to USD 0.37

million from USD 0.41 million in 2020 mostly on subsidised loans

while we reduced interest expenses on lease liabilities to USD 0.13

million from USD 0.35 million after the application of IFRS 16 on

the 3 years wagon leases. The rental on those wagons was considered

selling expenses previously.

-- Steppe Cement recorded a net cash position of USD7.4 million

compared to net cash of USD6.4 million as of 30 June 2020.

-- The borrowings of the Company as of 30 June 2021 were USD6.1

million while we carried a cash balance of USD 13.5 million. For

comparison, on 30 June 2020 we had USD3.2 million in borrowings and

USD9.6 million in cash.

-- As of 15 September 2021 after paying the dividend, the

financial debt was the equivalent of USD 5.6 million (all

denominated in KZT) and the cash was USD10.5 million.

-- We have maintained the working capital lines available for the winter.

A pdf copy of the announcement and the full interim financial

statements is available on the company's website at

www.steppecement.com .

Steppe Cement's AIM nominated adviser and broker is RFC Ambrian

Limited.

Nominated Adviser: Contact Stephen Allen or Andrew Thomson at

+61 8 9480 2500.

Broker: Contact Charlie Cryer at +44 20 3440 6800

SUMMARY OF INTERIM FINANCIAL STATEMENTS

FOR THE PERIODED 30 JUNE 2021 (UNAUDITED)

(In United States Dollars)

The Notes to the Interim Financial Statements form an integral

part of the Condensed Financial Statements. Please visit the

Company's website at www.steppecement.com to view the full interim

financial statements.

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF PROFIT AND LOSS

FOR THE PERIODED 30 JUNE 2021 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2021 30 June 2020 30 June 30 June

2021 2020

USD'000 USD'000 USD'000 USD'000

Revenue 39,534 33,786 691 701

Cost of sales (21,230) (20,285) - -

----------------- ----------------- ------------ ------------

Gross profit 18,304 13,501 691 701

Selling expenses (6,577) (5,162) - -

General and administrative

expenses (2,965) (2,566) (157) (135)

----------------- ----------------- ------------ ------------

Operating profit 8,762 5,773 534 566

Interest income 78 112 - ^

Finance costs (475) (766) - -

Net foreign exchange

(loss)/gain (147) (571) (1) 3

Other income, net (511) 248 - 82

----------------- ----------------- ------------ ------------

Profit before income

tax 7,707 4,796 533 651

Income tax expense (1,515) (736) - -

----------------- ----------------- ------------ ------------

Profit for the period 6,192 4,060 533 651

================= ================= ============ ============

Attributable to:

Shareholders of the

Company 6,192 4,060 533 651

Earnings per share:

Basic and diluted

(cents) 2.8 1.9

================= =================

^ Insignificant amount.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE PERIODED 30 JUNE 2021 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2021 30 June 2020 30 June 2021 30 June

2020

USD'000 USD'000 USD'000 USD'000

Profit for the period 6,192 4,060 533 651

Other comprehensive

loss:

Item that may be reclassified

subsequently to profit

or loss

Exchange differences

arising on translation

of foreign subsidiary

companies (902) (3,499) - -

Total other comprehensive

loss for the period (902) (3,499) - -

----------------- ----------------- ----------------- ------------

Total comprehensive

income for the period 5,290 561 533 651

================= ================= ================= ============

Attributable to:

Shareholders of the

Company 5,290 561 533 651

================= ================= ================= ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021 (UNAUDITED)

The Group The Company

Unaudited Audited Unaudited Audited

30 June 2021 31 Dec 2020 30 June 2021 31 Dec 2020

USD'000 USD'000 USD'000 USD'000

Assets

Non-Current Assets:

Property, plant

and equipment 49,461 48,856 - -

Right-of-use assets 2,571 3,483

Investment in subsidiary

companies - - 36,307 36,294

Loan to subsidiary

company - - 30,100 30,110

Advances 11 - - -

Other assets 1,887 1,901 - -

Total Non-Current

Assets 53,930 54,240 66,407 66,404

----------------- ---------------- ----------------- ----------------

Current Assets

Inventories 11,766 11,098 - -

Trade and other

receivables 3,438 2,332 7,807 6,776

Other assets - 305 - -

Income tax receivable 1,037 1,435 - -

Loans and advances

to subsidiary companies - - 40 40

Advances and prepaid

expenses 4,915 3,644 18 6

Cash and cash equivalents 13,470 8,214 846 1,353

Total Current Assets 34,626 27,028 8,711 8,175

----------------- ---------------- ----------------- ----------------

Total Assets 88,556 81,268 75,118 74,579

================= ================ ================= ================

The Group The Company

Unaudited Audited Unaudited Audited

30 June 2021 31 Dec 2020 30 June 31 Dec 2020

2021

USD'000 USD'000 USD'000 USD'000

Equity and Liabilities

Capital and Reserves

Share capital 73,761 73,761 73,761 73,761

Revaluation reserve 2,222 2,370 - -

Translation reserve (119,416) (118,514) - -

Retained earnings 106,665 100,325 1,164 631

----------------- ---------------- -------------- ----------------

Total Equity 63,232 57,942 74,925 74,392

----------------- ---------------- -------------- ----------------

Non-Current Liabilities

Borrowings 3,587 2,368 - -

Lease liabilities 1,057 2,077 - -

Deferred taxes 4,728 4,560 - -

Deferred income 1,762 1,492 - -

Provision for site

restoration 177 151 - -

Total Non-Current

Liabilities 11,311 10,648 - -

----------------- ---------------- -------------- ----------------

Current liabilities

Trade and other

payables 5,116 4,075 - -

Accrued and other

liabilities 3,139 1,638 193 187

Borrowings 2,470 4,429 - -

Lease liabilities 1,914 1,831 - -

Taxes payable 1,374 705 - -

Total Current Liabilities 14,013 12,678 193 187

----------------- ---------------- -------------- ----------------

Total Liabilities 25,324 23,326 193 187

----------------- ---------------- ----------------

Total Equity and

Liabilities 88,556 81,268 75,118 74,579

================= ================ ============== ================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2021 (UNAUDITED)

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

Balance as at

1 January

2021 73,761 2,370 (118,514) 100,325 57,942

------------- ---------------------- ---------------- ------------------ ------------

Profit for the

period - - - 6,192 6,192

Other

comprehensive

loss - - (902) - (902)

------------- ---------------------- ---------------- ------------------ ------------

Total

comprehensive

income/(loss)

for the

period - - (902) 6,192 5,290

Transfer of

revaluation

reserve

relating to

the

depreciation

of property,

plant and

equipment

through

use - (148) - 148 -

------------- ---------------------- ---------------- ------------------ ------------

Balance as at

30 June

2021 73,761 2,222 (119,416) 106,665 63,232

============= ====================== ================ ================== ============

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

Balance as at

1 January

2020 73,761 2,016 (113,286) 100,386 62,877

------------- ---------------------- ---------------- ------------------ ------------

Profit for the

period - - - 4,060 4,060

Other

comprehensive

(loss)/income - - (3,499) - (3,499)

------------- ---------------------- ---------------- ------------------ ------------

Total

comprehensive

income

for the

period - - (3,499) 4,060 561

Transfer of

revaluation

reserve

relating to

the

depreciation

of property,

plant and

equipment

through

use - (157) - 157 -

------------- ---------------------- ---------------- ------------------ ------------

Balance as at

30 June

2020 73,761 1,859 (116,785) 104,603 63,438

============= ====================== ================ ================== ============

The Company Share capital Retained earnings Total

USD'000 USD'000 USD'000

Balance as at 1 January 2021 73,761 631 74,392

Total comprehensive income for the

period - 533 533

Balance as at 30 June 2021 73,761 1,164 74,925

================== ========================== ==============

Balance as at 1 January 2020 73,761 1,577 75,338

Total comprehensive income for the

period - 651 651

Balance as at 30 June 2020 73,761 2,228 75,989

================== ========================== ==============

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 30 JUNE 2021 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2021 30 June 30 June 2021 30 June

2020 2020

USD'000 USD'000 USD'000 USD'000

OPERATING ACTIVITIES

Profit before income

tax 7,707 4,796 533 651

Adjustments for:

Depreciation of property,

plant and equipment 3,733 3,559 - -

Depreciation of right-of-use

assets 1,031 1,446 - -

Adjustments for non-cash

items 478 1,192 (1,030) (329)

----------------- ------------ ----------------- ------------

Operating Profit/(Loss)

Before Working Capital

Changes 12,949 10,993 (497) 322

(Increase)/ Decrease

in:

Inventories (1,607) 541 - -

Trade and other receivables, (2,175) (1,411) (12) (872)

advances and prepaid

expenses

Loans and advances from

subsidiary companies - - (3) 10

Increase in:

Trade and other payables, 3,317 2,251 5 16

accrued and other liabilities

Cash Generated From/(Used

In) Operations 12,484 12,374 (507) (524)

Income tax paid (730) (185) - -

Interest paid (299) (580) - -

----------------- ------------ ----------------- ------------

Net Cash Generated From/(Used

In) Operating Activities 11,455 11,609 (507) (524)

----------------- ------------ ----------------- ------------

INVESTING ACTIVITIES

Purchase of property,

plant and equipment (4,529) (2,644) - -

Purchase of other assets (18) - - -

Interest received 78 112 - 330

----------------- ------------ ----------------- ------------

Net Cash (Used In)/Generated

From Investing Activities (4,469) (2,532) - 330

----------------- ------------ ----------------- ------------

FINANCING ACTIVITIES

Proceeds from borrowings 3,350 2,098 - -

Repayment from borrowings (4,089) (9,003) - -

Payment of lease liabilities (877) (1,133) - -

----------------- ------------ ----------------- ------------

Net Cash Used In Financing

Activities (1,616) (8,038) - -

----------------- ------------ ----------------- ------------

NET INCREASE/(DECREASE)

IN CASH AND CASH EQUIVALENTS 5,370 1,039 (507) (194)

EFFECTS OF FOREIGN EXCHANGE

RATE CHANGES (114) (486) - -

CASH AND CASH EQUIVALENTS

AT BEGINNING OF THE PERIOD 8,214 9,014 1,353 262

----------------- ------------ ----------------- ------------

CASH AND CASH EQUIVALENTS

AT END OF THE PERIOD 13,470 9,567 846 68

================= ============ ================= ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAANXFSLFEEA

(END) Dow Jones Newswires

September 17, 2021 01:59 ET (05:59 GMT)

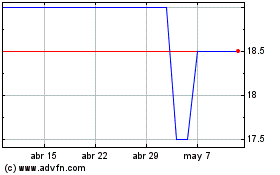

Steppe Cement (LSE:STCM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Steppe Cement (LSE:STCM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024