TIDMSML

RNS Number : 5729N

Strategic Minerals PLC

30 September 2021

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Strategic Minerals plc

("Strategic Minerals", "SML", the "Group" or the "Company")

Interim Results

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a producing

mineral company actively developing projects prospective for

battery materials, is pleased to announce its unaudited interim

profit for the half year ended 30 June 2021.

Financial Highlights

-- Interim six-month pre-tax profit of US$388,000 (H1 2020:

US$261,000) reflecting reduced overheads in and a reduction in

impairment charges.

-- After tax profit for the interim six months of US$207,000 (H1 2020 US$77,000).

-- US$48,000 of share-based payment expense for the interim

six-month period reflects the final charge relating to options

which expired 30 June 2021.

-- During the period, Southern Minerals Group received a

US$50,000 Covid-19 government grant which was used to partially

offset direct payroll costs.

-- Unrestricted cash and cash equivalents at 30 June 2021 were

US$734,000 (31 Dec 2020: US$833,000).

Corporate Highlights

-- Maintenance of uninterrupted operations at Cobre despite the impact of Covid -19.

-- Access to the Cobre magnetite stockpile rolled over for the 9th time

Commenting, John Peters, Managing Director of Strategic Miners,

said:

"The first half of 2021 has again been globally trying.

Continued prudent management has seen the Company maintain and

improve underlying operations to produce a strong result for the

period.

"With the post balance date granting of a conditional Program

for Environment Protection and Rehabilitation ("PEPR") for mining

of the Paltridge North deposit at the Leigh Creek Copper Mine

project, the Company is looking forward to getting into operations,

subject to procuring suitable finance, next year. While the

conditions associated with the PEPR were broadly in line with the

Company's expectations, they have required a more "in depth"

description of the planned mine which has, due to the increased

copper price, slightly increased the planned mine area, providing

for economic recovery of an additional 600 tonnes of metal. This

has pushed planned production into the first quarter of 2022.

"Discussions on financing the Leigh Creek Copper Mine project

continue and the Company hopes to bring firm news on this to the

market in the near future.

"The Company has progressed the Redmoor project on a limited

basis and has actively, in conjunction with NRG Capital, progressed

discussions with potential investors/joint venture partners.

"It is the Board's view that the second half of the year will

also prove profitable resulting in an overall profit for the 2021

financial year. This view is based on expected continued demand at

Cobre, and the reduction in the charge for share-based payments

which were reflecting the options which expired at 30 June

2021.

"The Board looks forward to securing finance for the Leigh Creek

Copper Mine project and progressing the Redmoor project."

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Charlie Bouverat

NOTES TO EDITORS

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26 June

2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project temporarily into production in

April 2019. The project has been granted a conditional approval by

the South Australian Government for a Program for Environmental

Protection and Rehabilitation (PEPR) in relation to mining of its

Paltridge North deposit and processing at the Mountain of Light

installation.

CHAIRMAN'S STATEMENT

I am pleased with the Company's achievements, in what has been a

particularly challenging period for Strategic Minerals and the

world.

Financial results

The Company continued its underlying profitable performance in

the first half of 2021, when many businesses were forced to shut

down operations due to the pandemic. This is a credit to both our

local management and the management team as a whole. The

combination of challenges, associated with our dealings with CV

Investments LLC ("CVI" or "CV Investments") at Cobre and the

general impact on development processes associated with the impact

of the Covid-19 pandemic, has slowed our progress on projects and

access to capital to drive these projects forward. However, the

Company expects cash flow and profitability to improve dramatically

as full-scale production commences at the Leigh Creek Copper Mine

in 2022 subject to funding.

Unrestricted cash on hand at 30 June 2021 was US$734,000.

Corporate overheads and amortisation of US$775,000 were down

significantly on the same period last year (H1 2020: US $902,000),

reflecting a general tightening of costs and minimal legal fees

associated with CVI arbitration during this period.

Strategic Focus

Despite a reduction in sales compared to last year, current

sales levels at the Cobre operations continue to cover operating

costs and allowed the Company some scope to continue its strategic

investment focus on investments in metals such as Nickel, Copper

and Tin/Tungsten which it expects are likely to see significant

price improvements over the next three to five years driven by

battery/electronic vehicle demand.

On the back of this strategy, the Company continues to invest in

development programmes, particularly those associated with Leigh

Creek Copper Mine (copper) and Redmoor (tin/tungsten/copper

focused).

Cobre Operations

During the first six months of 2021, the management at our Cobre

operations continued their excellent adaption to the challenges

associated with the disruption to world markets arising from the

Covid-19 pandemic. As an essential service, they were permitted the

opportunity to continue trading and modified arrangements to ensure

that a contactless service, protecting both our clients and our

personnel, was provided.

The first half of the year also saw the receiver for CV

Investments, against which our subsidiary has a substantial claim,

report on assets secured to date. While these assets are

substantive, whether the Company will receive any funds from this

claim will be subject to the final result of the receivership of CV

Investments which is ongoing.

Leigh Creek Copper Mine ("Leigh Creek" or "LCCM")

The significant work conducted at Leigh Creek throughout 2020

and the first 6 months of 2021, which resulted in a draft PEPR

being submitted and a feasibility study being completed, has moved

the project along to the point where it currently awaits the final

sign off of the formal PEPR and the capital to commence operations.

The strong performance of the copper price in recent times has

improved the project's potential profitability and the Board feels

confident that 2022 will see full scale production re-commence at

Leigh Creek.

Redmoor Tin-Tungsten Project ("Redmoor")

2020 saw the finalisation of payment on the acquisition of the

balance of Redmoor. With the project fully in the Company's control

and with the overhang associated with repayment removed, the

Company appointed an external consultant, NRG Capital, to assist in

progressing the Redmoor project.

During the first 6 months of 2021, the Company has continued to

work with NRG Capital and those parties that have expressed

interest in the Redmoor project to achieve a way forward, which

will see the market value the size and potential of the Redmoor

resource and reflect this in the Company's share price.

Safety

The Company focuses on safety issues and continues to maintain a

high level of performance when it comes to safety. SML and its

subsidiaries have had no reportable environmental or personnel

incidents recorded in the period.

The first half of 2021, was a challenging environment in which

to operate and I would like to take this opportunity to thank my

fellow Directors, our management and staff in New Mexico, South

Australia and Cornwall, along with our advisers, for their support

and hard work on our behalf during the period. Additionally, I

would like to thank our clients, contractors, suppliers and

partners for their continued backing. I look forward to further

progressing our key strategic goals in 2021 and pushing onto a

brighter 2022.

Alan Broome AM

Non-Executive Chairman

30 September 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to to Year to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Continuing operations

Revenue 1,511 1,645 3,025

Other revenue - 47 -

Cost of sales (286) (314) (562)

_________ _________ _________

Gross profit 1,225 1,378 2,463

Overhead expenses (698) (902) (1,705)

Other Income - - 155

Amortisation (77) - (152)

Depreciation (6) (6) (15)

Share based payment (48) (149) (176)

Impairment charge - (17) -

Foreign exchange gain/(loss) (2) (43) (46)

_________ _________ _________

Profit from operations 394 261 524

Finance expense (2) - (65)

Lease Interest (4) - (9)

_________ _________ _________

Profit/ (loss) before taxation 388 261 450

Income tax (expense)/credit (181) (184) (236)

_________ _________ _________

Profit for the period 207 77 214

_________ _________ _________

Profit for the period attributable

to:

Owners of the parent 207 77 214

_________ _________ _________

Other comprehensive income

Exchange gains/(losses) arising

on translation

of foreign operations (145) (359) 876

_________ _________ _________

Total comprehensive (loss)/ Income 62 (282) 1,090

_________ _________ _________

Total comprehensive (loss)/income

attributable to:

Owners of the parent 62 (282) 1,090

_________ _________ _________

Profit/ (loss) per share attributable to the ordinary equity holders

of the parent:

Continuing activities - Basic c0.13 c0.05 c0.14

- Diluted c0.13 c0.05 c0.14

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

6 months

to

6 months

to 30 June Year to

30 June 2020 31 December

2021 (Unaudited) 2020

(restated,

(Unaudited) Note 2) (Audited)

$'000 $'000 $'000

Assets

Non-current assets

Intangible Asset 600 549 616

Deferred Exploration and evaluation

costs 5,240 4,390 5,026

Other Receivables 151 137 155

Property, plant and equipment 7,363 6,453 7,351

Right of Use Assets 150 - 78

_________ _________ _________

13,504 11,529 13,226

_________ _________ _________

Current assets

Inventories 4 6 3

Trade and other receivables 335 477 330

Cash and cash equivalents 734 533 833

Prepayments 7 16 16

_________ _________ _________

1,080 1,032 1,182

_________ _________ _________

Total Assets 14,584 12,561 14,408

_________ _________ ____ _____

Equity and liabilities

Share capital 2,770 2,551 2,770

Share premium reserve 49,010 48,552 49,010

Share options reserve 88 692 272

Merger reserve 21,300 21,300 21,300

Warrant Reserve 153 - 153

Foreign exchange reserve 64 (1,026) 209

Other reserves (23,023) (23,023) (23,023)

Accumulated loss (36,700) (37,723) (37,139)

_________ _________ _________

Total Equity 13,662 11,323 13,552

_________ _________ ____ _____

Liabilities

Non-Current Liabilities

Provision for Mining Royalties - - -

Lease Liabilities 19 - 22

Environmental Liability 429 387 439

_________ _________ _________

448 387 461

_________ _________ _________

Current liabilities

Income Tax Payable 17 492 21

Trade and other payables 335 359 316

Lease Liabilities 122 - 58

_________ _________ _________

474 851 395

_________ _________ _________

Total Liabilities 922 1,238 856

_________ _________ ____ _____

Total Equity and Liabilities 14,584 12,561 14,408

_________ _________ ____ _____

CONSOLIDATED STATEMENT OF CASH FLOW

6 months 6 months

to to Year to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Cash flows from operating activities

Profit/ (loss) after tax 207 77 214

Adjustments for:

Depreciation of property, plant,

and equipment 6 6 15

Amortisation of Right of Use asset 77 - 152

Impairment of deferred exploration

and expenditure - 17 -

Finance expense 2 - 65

Income Tax expense 181 184 236

(Increase) / decrease in inventory (1) (3) -

(Increase) / decrease in trade and

other receivables (125) (256) 746

(Increase) / decrease in prepayments 9 18 116

Increase / (decrease) in trade and

other payables 91 (92) (171)

Increase /(decrease) in prepaid

income tax - - (98)

Income tax paid (177) - (522)

Share based payment expense 48 149 176

_________ _________ _________

Net cash flows from operating activities 318 100 929

_________ _________ _________

Investing activities

Increase in PPE Development Asset (202) (96) (251)

Sale of tenements - 80 -

Receipt of research and development

incentive - 595 41

Increase in deferred exploration

and evaluation (131) (96) (348)

_________ _________ _________

Net cash used in investing activities (333) 483 (558)

_________ _________ _________

Financing activities

Net proceeds from issue of equity

share capital - 1,485 2,256

Proceeds from borrowings - 68 -

Finance expenses paid - (96) -

Lease Payments (88) - (176)

Repayment of borrowings - (2,026) (2140)

_________ _________ _________

Net cash from financing activities (88) (569) (60)

_________ _________ _________

Net increase / (decrease) in cash

and cash equivalents (103) 13 311

Cash and cash equivalents at beginning

of period 833 519 519

Release of restricted cash - - -

Exchange gains / (losses) on cash

and cash equivalents 4 1 4

_________ _________ _________

Cash and cash equivalents at end

of period 734 533 833

_________ _________ ____ _____

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Warrant Share Initial Foreign

Share premium Merger Warrant options Re-structure Exch. Retained Total

capital reserve Reserve Reserve reserve Reserve reserve earnings equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at

1 January

2020 2,203 47,415 21,300 - 543 (23,023) (667) (37,800) 9,971

_______ _______ _______ _______ _______ _______ _______ _______ _______

Profit for

the year - - - - - - - 214 214

Foreign

exchange

translation - - - - - - 876 - 876

_______ _______ _______

Total

comprehensive

income/(loss)

for the year - - - - - - 876 214 1090

Share based

payments - - - - 176 - - - 176

Transfer - - - - (447) - - 447 -

Shares issued

in the year 567 1,865 - 153 - - - - 2,585

Share issue

costs - (270) - - - - - - (270)

_______ _______ _______ _______ _______ _______ _______ _______ _______

Balance at

31 December

2020 2,770 49,010 21,300 153 272 (23,023) 209 (37,139) 13,552

Profit for

the year - - - - - - - 207 207

Foreign

exchange

translation - - - - - - (145) - (145)

_______ _______ _______

Total

comprehensive

income for

the year - - - - - - (145) 207 62

Share based

payments - - - - 48 - - - 48

Transfer - - - - (232) - - 232 -

Shares issued

in the year - - - - - - - - -

Share issue

costs - - - - - - - - -

_______ _______ _______ _______ _______ _______ _______ _______ _______

Balance at

30 June 2021 2,770 49,010 21,300 153 88 (23,023) 64 (36,700) 13,662

_______ _______ _______ _______ _______ _______ _______ _______ _______

All comprehensive income is attributable to the owners of the

parent Company.

NOTES FORMING PART OF THE CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. General Information

Strategic Minerals Plc ("the Company") is a public company

incorporated in England and Wales. The consolidated interim

financial statements of the Company for the six months ended 30

June 2021 comprise the Company and its subsidiaries (together

referred to as the "Group").

2. Accounting policies

Basis of preparation

In preparing these financial statements the presentational

currency is US dollars. As the entire group's revenues and majority

of its costs, assets and liabilities are denominated in US dollars

it is considered appropriate to report in this currency.

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

These financial statements have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006.

The preparation of financial statements in compliance with

adopted IFRS requires the use of certain critical accounting

estimates. It also requires Group management to exercise judgment

in applying the Group's accounting policies. The areas where

significant judgments and estimates have been made in preparing the

financial statements and their effect are disclosed in note 2.

The financial statements have been prepared on a historical cost

basis, except for the acquisition of LCCM and the valuation of

certain investments which have been measured at fair value, not

historical cost.

Going concern basis

The Directors have considered the Group and Parent Company's

(together "the Group") ability to continue as a going concern

through review of cash flow forecasts prepared by management for

the period to 30 September 2022, and a review of the key

assumptions and sensitivity analysis on which these are based.

The Group has continued to monitor costs during 2021 to reduce

its overhead expenditure and is maintaining vigilance in preserving

cash in response to depressed market conditions due to Covid-19 and

its associated impact on commodity prices and capital markets. As

at 30 June 2021, the Group had US$0.73m of cash on hand.

The forecasts show that through the Group's operations at Cobre,

there are sufficient funds until the end of our forecast period, 30

September 2022, to meet all operational costs. However, additional

funds will be required to progress the development of the Leigh

Creek Copper Mine and Redmoor projects. Management is actively

pursuing such funding and envisage that this will be sourced at the

asset level.

The Group is reliant on cash being generated from the Cobre

asset in line with forecast. Management has performed reverse

stress testing which shows that a 6% reduction in forecast sales

would result in a cash deficit in November 2021, without management

taking mitigating actions within their control. In addition,

management has assumed that the annual renewal of the Group's

access permit will be rolled over in March 2022, as it has on each

occasion since entering into the underlying access agreement.

In the event the Cobre offtake permit rollover is not received

or there is a significant reduction in forecast sales, there is

potential for a material uncertainty to arise which may cast

significant doubt as to the Group and parent Company's ability to

continue as a going concern and therefore it may be unable to

realise its assets and discharge its liabilities in the normal

course of business.

In the event that the further funds are required, the Directors

have reasonable expectation that the Group will have access to

sufficient resources by way of debt or equity markets.

Consequently, the consolidated financial statements have been

prepared on a going concern basis.

The financial report does not include adjustments relating to

the recoverability and classification of recorded asset amounts or

to the amounts and classification of liabilities that might be

necessary should the Group not continue as a going concern.

New standards, interpretations, and amendments effective 01

January 2021:

IBOR Reform and In August 2020, the IASB issued amendments to IFRS

its Effects on 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16. These amendments

Financial Reporting complement those made in 2019 ('IBOR - phase 1')

- Phase 2 and focus on the effects on entities when an existing

interest rate benchmark is replaced with a new

benchmark rate as a result of the reform.

The group has assessed the impact of these new accounting

standards and amendments and does not believe they will have a

material impact on the financial statements.

Change in accounting policy

Under the terms of the various agreements in relation to the

LCCM, the Company has the following royalties:

-- 3.5% royalty to the South Australian state government

-- 1.0% royalty on tons of copper sold at LME prices over the life of the project and

-- $A100,000 following 3,000 tonnes of copper sales from the project.

At acquisition of LCCM, the Group recognised the estimated fair

value of the above mining royalties in the financial statements as

a liability. In subsequent reporting periods the liability has been

fair valued with any change in fair value being recognised in the

income statement. The calculation of the liability is dependent on

inherently judgemental estimates over future copper prices, and the

timing and volume of copper sold.

During 2020 the Group has opted to retrospectively change the

accounting policy so that the royalties are not presented

separately as liabilities, but the fair value of the asset on

initial recognition is adjusted to factor potential cash outflows

from the royalties. This is on the basis that the new policy

provides users of the financial statements more relevant and

reliable information in which to assess the value of the LCCM

asset.

The impact of this change in accounting policy is to reduce 2019

non-current liabilities and non-current assets by $424,000. There

is no income statement impact. The June 2020 accounts have been

restated to reflect this change.

Investment in joint arrangements

The Group is a party to a joint arrangement when there is a

contractual arrangement that confers joint control over the

relevant activities of the arrangement to the group and at least

one other party. Joint control is assessed under the same

principles as control over subsidiaries.

The group classifies its interests in joint arrangements as

either:

-- Joint ventures: where the group has rights to only the net assets of the joint arrangement.

-- Joint operations: where the group has both the rights to

assets and obligations for the liabilities of the joint

arrangement.

In assessing the classification of interests in joint

arrangements, the Group considers:

-- The structure of the joint arrangement

-- The legal form of joint arrangements structured through a separate vehicle

-- The contractual terms of the joint arrangement agreement

-- Any other facts and circumstances (in any other contractual arrangements).

The Group accounts for its interests in joint ventures initially

at cost in the consolidated statement of financial position.

Subsequently joint ventures are accounted for using the equity

method where the Group's share of post-acquisition profits and

losses and other comprehensive income is recognised in the

consolidated statement of profit and loss and other comprehensive

income (except for losses in excess of the Group's investment in

the associate unless there is an obligation to make good those

losses).

Profits and losses arising on transactions between the Group and

its joint ventures are recognised only to the extent of unrelated

investors' interests in the joint venture. The investor's share in

the joint ventures' profits and losses resulting from these

transactions is eliminated against the carrying value of the joint

venture.

Any premium paid for an investment in a joint venture above the

fair value of the Group's share of the identifiable assets,

liabilities and contingent liabilities acquired is capitalised and

included in the carrying amount of the investment in joint venture.

Where there is objective evidence that the investment in a joint

venture has been impaired the carrying amount of the investment is

tested for impairment in the same way as other non-financial

assets.

The Group accounts for its interests in joint operations by

recognising its share of assets, liabilities, revenues, and

expenses in accordance with its contractually conferred rights and

obligations. In accordance with IFRS 11 Joint Arrangements, the

Group is required to apply all of the principles of IFRS 3 Business

Combinations when it acquires an interest in a joint operation that

constitutes a business as defined by IFRS 3.Where there is an

increase in the stake of the joint venture entity from an associate

to a subsidiary and the acquisition is considered as an asset

acquisition and not a business combination in accordance with

IFRS3, this step up transaction is accounted for as the purchase of

a single asset and the cost of the transaction is allocated in its

entirety to that asset with no gain or loss recognised in the

income statement. The step-up acquisition of CRL in 2019 has been

accounted for as a purchase of a single asset and the cost of the

transaction is allocated in its entirety to that balance sheet.

3. Critical accounting estimates and judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The estimates and assumptions that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below.

Estimates

(a) Carrying value of intangible assets

Management assesses the carrying value of the exploration and

evaluation assets for indicators of impairment based on the

requirements of IFRS 6 which are inherently judgemental. This

includes ensuring the Group maintains legal title, assessment

regarding the commerciality of reserves and the clear intention to

move the asset forward to development.

i) The Redmoor projects are early-stage exploration projects and

therefore Management have applied judgement in the period as to

whether the results from exploration activity provide sufficient

evidence to continue to move the asset forward to development.

There are no indicators of impairment for the Redmoor project in

the period to 30 June 2021.

(b) Share based payments

The fair value of share-based payments recognised in the

statement of comprehensive income is measured by use of the Black

Scholes model after taking into account market-based vesting

conditions and conditions attached to the vesting and exercise of

the equity instruments. The expected life used in the model is

adjusted based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour based on past experience.

(c) Carrying value of amounts owed by subsidiary undertakings.

IFRS9 requires the parent company to make certain assumptions

when implementing the forward- looking expected credit loss model.

This model is required to be used to assess the intercompany loan

receivables from its subsidiaries for impairment. Arriving at an

expected credit loss allowance involved considering different

scenarios for the recovery of the intercompany loan receivables,

the possible credit losses that could arise and probabilities for

these scenarios.

The following were considered: the exploration project risk, the

future sales potential of product, value of potential reserves and

the resulting expected economic outcomes of the project.

(d) Carrying Value of Development Assets

Management assesses the carrying value of development assets for

indicators of impairment based on the requirements of IAS36 which

are inherently judgemental.

The following are the key assumptions used in this assessment of

Carrying value.

i) Mineable reserves over life of project

ii) Forecasted Copper pricing

iii) Capital and operating cost assumptions to deliver the mining schedule

iv) Foreign exchange rates

v) Discount rate

vi) Estimated project commencement date.

If the carrying amount of the Development asset exceeds the

recoverable amount, the asset is impaired. The Group will reduce

the carrying amount of the asset to its recoverable amount and

recognise an impairment loss. The assessment is carried out twice

per year - end of half year reporting period and end of annual

reporting period.

(e) Determination of incremental borrowing rate for leases

Under IFRS 16, where the interest rate implicit in the lease

cannot be readily determined the incremental borrowing rate is

used. The incremental borrowing rate is defined as the rate of

interest that a lessee would have to pay to borrow, over a similar

term and with a similar security, the funds necessary to obtain an

asset of a similar value to the cost of the right-of-use asset in a

similar economic environment.

Judgements

(a) Investments in subsidiaries

Investment in subsidiaries comprises of the cost of acquiring

the shares in subsidiaries.

If an impairment trigger is identified and investments in

subsidiaries are tested for impairment, estimates are used to

determine the expected net return on investment. The estimated

return on investment takes into account the underlying economic

factors in the business of the Company's subsidiaries including

estimated recoverable reserves, resources prices, capital

investment requirements, and discount rates among other things.

(b) Contingent consideration as part of Asset acquisition

Judgement was required in determining the accounting for the

contingent consideration payable as per of the CRL acquisition. The

group has an obligation to pay A$1m on net smelter sales arising

from CRL production reaching A$50m and a further A$1m on net

smelter sales arising from CRL production reaching A$100m.

Whilst a possible obligation exists in relation to the

consideration payable, given the early stage of the project it was

concluded that at reporting date it is not probable that an outflow

of resources embodying economic benefits will be required to settle

the obligation.

4. Segment information

The Group has five main segments during the period:

-- Southern Minerals Group LLC (SMG) - This segment is involved

in the sale of magnetite to both the US domestic market and

historically transported magnetite to port for onward export

sale.

-- Head Office - This segment incurs all the administrative

costs of central operations and finances the Group's operations. A

management fee is charged for completing this service and other

certain services and expenses.

-- Australia - This segment holds the Central Australian Rare

Earths Pty Ltd tenements in Australia and incurs all related

operating costs.

-- Development Asset - This segment holds the Leigh Creek Copper

Mine Development Asset in Australia and incurs all related

operating costs.

-- United Kingdom - The investment in the Redmoor project in

Cornwall, United Kingdom is held by this segment.

Factors that management used to identify the Group's reportable

segments.

The Group's reportable segments are strategic business units

that carry out different functions and operations and operate in

different jurisdictions.

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision maker has been identified as the board

and management team which includes the Board and the Chief

Financial Officer.

Measurement of operating segment profit or loss, assets, and

liabilities

The Group evaluates segmental performance on the basis of profit

or loss from operations calculated in accordance with International

Accounting Standards.

Segment assets exclude tax assets and assets used primarily for

corporate purposes. Segment liabilities exclude tax liabilities.

Loans and borrowings are allocated to the segments in which the

borrowings are held. Details are provided in the reconciliation

from segment assets and liabilities to the Group's statement of

financial position.

Intra

6 Months to 30

June 2021 Head Segment

United Development

(Unaudited) SMG Office Australia Kingdom Asset Elimination Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenues 1,511 - - - - - 1,511

Cost of sales (286) - - - - - (286)

_______ _______ _______ _______ _______ _______ _______

Gross profit 1,225 - - - - 1,225

Overhead expenses (311) (247) (136) (4) - - (698)

Management fee

income/(expense) (200) 201 - - (1) -

Share based payments - (48) - - - - (48)

Amortisation (77) - - - - - (77)

Depreciation (6) - - - - - (6)

Lease Interest (4) - - - - - (4)

Foreign exchange

gain/(loss) - (201) (105) - - 304 (2)

_______ _______ _______ _______ _______ _______ _______

Segment profit

/(loss) from operations 627 (295) (241) (4) - 303 390

_______ _______ _______ _______ _______ _______ _______

Finance Expense - - - - (2) - (2)

_______ _______ _______ _______ _______ _______ _______

Segment profit

/(loss) before

taxation 627 (295) (241) (4) (2) 303 388

_______ _______ _______ _______ _______ _______ _______

Inter

6 Months to 30 June 2020 Head Segment

(Unaudited) SMG Office Australia Development Asset Elimination Total

$'000 $'000 $'000 $'000 $'000 $'000

Revenues 1,645 - - - - 1,645

Other Revenue 47 - - - - 47

Cost of sales (314) - - - - (314)

_______ _______ _______ _______ _______ _______

Gross profit 1,378 - - - 1,378

Overhead expenses (516) (237) (135) (14) - (902)

Management fee income/(expense) (450) 441 - 9 -

Share based payments - (149) - - - (149)

Depreciation (6) - - - - (6)

Impairment of DEE - - (17) - - (17)

Foreign exchange gain/(loss) - 145 (23) - (165) (43)

_______ _______ _______ _______ _______ _______

Segment profit /(loss) from operations 406 200 (175) (14) (156) 261

_______ _______ _______ _______ _______ _______

Segment profit /(loss) before taxation 406 200 (175) (14) (156) 261

_______ _______ _______ _______ _______ _______

Intra

Year to 31 December

2020 Head Segment

United Development

(Audited) SMG Office Australia Kingdom Asset Elimination Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenues 3,025 - - - - - 3,025

Cost of sales (562) - - - - - (562)

_______ _______ _______ _______ _______ _______ _______

Gross profit 2,463 - - - - 2,463

Other Income - - - 155 - - 155

Overhead expenses (821) (614) (233) (37) - - (1,705)

Management fee

income/(expense) (630) 631 - - (1) -

Share based payments - (176) - - - - (176)

Amortisation- right

of use asset (152) - - - - - (152)

Depreciation (15) - - - - - (15)

Lease Interest (7) - - (2) - - (9)

(Loss)/ gain on

intercompany loans - (485) - - - 485 -

Foreign exchange

gain/(loss) - 156 360 - - (562) (46)

_______ _______ _______ _______ _______ _______ _______

Segment profit

/(loss) from operations 838 (488) 127 116 - (78) 515

_______ _______ _______ _______ _______ _______ _______

Finance Expense - (33) (28) - (4) - (65)

_______ _______ _______ _______ _______ _______ _______

Segment profit

/(loss) before

taxation 838 (521) 99 116 (4) (78) 450

_______ _______ _______ _______ _______ _______ _______

As at 30 June 2021 Head

(Unaudited) SMG Office Australia United Kingdom Development Asset Total

$'000 $'000 $'000 $'000 $'000 $'000

Additions to non-current assets - - - 131 202 333

_______ _______ _______ _______ ______ _______

Reportable segment assets 1,166 57 86 5,298 7,977 14,584

_______ _______ _______ _______ ______ _______

Reportable segment liabilities 227 78 68 37 512 922

_______ _______ _______ _______ _______ _______

As at 30 June 2020 Head

(Unaudited) SMG Office Australia United Kingdom Development Asset Total

$'000 $'000 $'000 $'000 $'000 $'000

Additions to non-current assets - - 16 80 96 192

_______ _______ _______ _______ ______ _______

Reportable segment assets 1,066 95 15 4,414 6,971 12,561

_______ _______ _______ _______ ______ _______

Reportable segment liabilities 591 121 93 14 419 1,238

_______ _______ _______ _______ _______ _______

As at 31 December 2020 Head

(Audited) SMG Office Development Asset Australia United Kingdom Total

$'000 $'000 $'000 $'000 $'000 $'000

Additions to non-current assets - - 251 - 348 599

_______ _______ ______ _______ _______ _______

Reportable segment assets 839 433 7,975 70 5,091 14,408

_______ _______ ______ _______ _______ _______

Reportable segment liabilities 174 115 474 37 56 856

_______ _______ _______ _______ _______ _______

External revenue by Non-current assets

location of customers by

location of assets

30 June 30 June 30 June 30 June

2021 2020 2021 2020

$'000 $'000 $'000 $'000

United States 1,511 1,645 275 171

United Kingdom - - 5,305 4,391

Australia - - 7,924 6,967

_______ _______ _______ _______

1,511 1,645 13,504 11,529

_______ _______ _______ _______

Revenues from Customer A totalled $244,683 (2020: $281,805),

which represented 15% (2020: 17%) of total domestic sales in the

United States, Customer B totalled $673,560 (2020: $$795,125) which

represented 43% (2020: 48%). Customer C totalled $523,027 (2020:

$$471,371) which represented 33% (2020: 27%).

5. Operating Loss

6 months 6 months

to to Year to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Operating gain/loss is stated

after charging/(crediting):

Other Income - - (155)

Directors' fees and emoluments 222 146 307

Depreciation 6 6 15

Equipment rental 63 131 134

Amortisation of Right of use

assets 77 - 152

Equipment maintenance 34 21 36

Auditors' remuneration - - 74

Salaries, wages, and other staff

related costs 211 260 495

Legal, professional and consultancy

fees 85 273 396

Impairment charge - 17 -

Lease Interest 4 - 9

Finance Fee 2 - 65

Foreign exchange 2 43 46

Share based payments 48 149 176

Other expenses 83 71 263

6. Intangible assets - exploration and evaluation costs

6 months 6 months

to to Year to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Cost

Opening balance for the period 5,026 4,567 4,567

Additions for the period 131 129 285

Interest and Borrowing Costs - - -

Research and development incentive - - (41)

Sale of mineral rights - (80) -

Sale of mineral rights (reclassified

to income) - 80

Foreign exchange difference 83 (209) 152

Impairment Charge (17) -

Impairment Charge (reclassified

to expense) (i) - - (17)

_______ _______ _______

Closing balance for period 5,240 4,390 5,026

_______ _______ _______

i) The Company has recognised an impairment charge in relation

to the CARE in 2019.Expenses incurred in 2020 and 2021 have been

expensed.

7. Property, plant and equipment

Development Plant and

Asset Machinery Total

$'000 $'000 $'000

Group

Cost

At 1 January 2020 (audited)(i) 5967 735 6,702

Additions 96 - 96

Foreign exchange difference (105) (6) (111)

________ ________ ________

At 30 June 2020 (unaudited) 5,958 729 6,687

Additions for period 155 - 155

Foreign exchange difference 715 33 748

________ ________ ________

At 31 December 2020 (audited) 6,828 762 7,590

________ ________ ________

Additions 202 - 202

Foreign exchange difference (176) (9) (185)

_______ ________ _______-

At 30 June 2021 (Unaudited) 6,854 753 7,607

________ ________ ________

Depreciation

At 1 January 2020 (audited) - (228) (228)

Charge for the period - (6) (6)

Foreign exchange difference - -

________ ________ ________

At 30 June 2020 (unaudited) - (234) (234)

Charge for the period - (9) (9)

Foreign exchange difference - 4 4

________ ________ ________

At 31 December 2020 (audited) - (239) (239)

________ ________ ________

Charge for the period - (6) (6)

Foreign exchange difference - 1 1

________ ________ ________

As at 30 June 2021 (unaudited) - (244) (244)

________ ________ ________

Carrying Value

As at 30 June 2020 (unaudited) 5,958 495 6,453

________ ________ ________

As at 31 December 2020(audited) 6,828 523 7,351

________ ________ ________

As at 30 June 2021 (unaudited) 6,854 509 7,363

________ ________ ________

i) During 2020 the Group has opted to retrospectively change the

accounting policy so that the royalties are not presented

separately as liabilities, but the fair value of the asset on

initial recognition is adjusted to factor potential cash outflows

from the royalties. This is on the basis that the new policy

provides users of the financial statements more relevant and

reliable information in which to assess the value of the LCCM

asset. The impact of this change in accounting policy is to reduce

2019 non-current liabilities and non-current assets by $424,000.

There is no income statement impact.

8. Loans and borrowings

Loan R&D Loan CRL

Tax Incentive Acquisition Total

$'000 $'000 $'000

Cost $'000 $'000 $'000

As at 1 January 2020 (audited) 419 1,692 2,111

Loan Advance 68 - 68

Loan repayments (447) (1579) (2,026)

Interest accrued 27 33 60

Interest paid (43) (53) (96)

Foreign exchange difference (24) (93) (117)

________ ________ ________

As at 30 June 2020 (unaudited) - - -

________ ________ ________

As at 31 December 2021 (audited) - - -

________ ________ ________

As at 30 June 2021 (unaudited) - - -

________ ________ ________

Loan CRL Acquisition

In July 2019 SML entered into a Convertible Note with NAE to

finalise the purchase of CRL.

SML made an initial payment totalling AUD $300,000 and entered

into an 11-month payment schedule for the balance of AUD $2,700,000

(US$1,858,000). A payment of AUD $300,000 (US$206,000) was paid on

or around 31 October 2019. During the six months to 30 June 2020

the remaining principal of AUD $2,400,000 (US$1,579,000) was repaid

along with interest of AUD $80,000 (US$53,000).

Loan R&D tax incentive

In September 2019 SML entered into a loan agreement against the

anticipated receipt of a Research and Development Tax Incentive

(RDTI) from the Australian Tax Office. A drawdown on the loan of

$68,000 occurred in February 2020 while the principal of $447,000

and interest of $43,000 was paid in May 2020 which fully

extinguished the debt.

9. Dividends

No dividend is proposed for the period.

10. Earnings per share

Earnings per ordinary share have been calculated using the

weighted average number of shares in issue during the relevant

financial year as provided below.

6 months 6 months

to to Year to

30 June 30 June 31 December

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Weighted average number of shares

- Basic 1,573,956,203 1,485,627,639 1,573,956,203

Weighted average number of shares

- Diluted 1,573,956,203 1,557,127,639 1,573,956,203

Earnings for the period $207,000 $77,000 $214,000

Earnings per share in the period

- Basic c0.13 c0.05 c0.14

Earnings per share in the period

- Diluted c0.13 c0.05 c0.14

11. Share capital and premium

30 June 30 June 30 June 30 June

2021 2021 2020 2020

No $'000 No $'000

Allotted, called up

and fully paid

Ordinary shares 1,909,297,949 51,780 1,734,297,948 51,103

____________ ____________ ____________ ____________

Share options and warrants

The number of options as at 30 June 2021 and a reconciliation of

the movements during the half year are as follows:

Granted

as at 31 Granted

Date of December as at 30 Exercise Date of Date of

Grant 2020 Expired June 2021 price vesting expiry

15.02.18 38,500,000 (38,500,000) - 3.75p 01.01.21 30.06.21

15.02.18 17,500,000 - 17,500,000 5.00p 01.01.22 30.06.22

09.08.18 - - - 2.75p 01.04.20 30.06.20

09.08.18 10,750,000 (10,750,000) - 3.75p 01.01.21 30.06.21

09.08.18 4,750,000 - 4,750,000 5.00p 01.01.22 30.06.22

____________ ____________ ____________

71,500,000 (49,250,000) 22,250,000

____________ ____________ ____________

Warrants

The number of warrants as at 30 June 2021 and a reconciliation

of the movements during the half year are as follows:

Granted

as at 31 Granted

December as at 30 Exercise Date of Date of

2020 Expired June 2021 price vesting expiry

03.12.20 175,000,000 - 175,000,000 1.00p 03.12.20 30.12.22

12. Post balance date events

In July 2021 LCCM was granted a conditional approval from the

Department of Energy and Mining of South Australia ("DEM") for its

Programme for Environmental Protection and Rehabilitation ("PEPR")

on the Paltridge North deposit.

DEM approved the PEPR application subject to reviewing:

-- LCCM's final plans for identifying and managing Potentially Acid Forming ("PAF") material.

-- The cover design for Paltridge North Waste Rock Dump ("WRD") and heap leach pads.

-- Visual amenity associated with the Paltridge North WRD.

-- Plans for post completion of surface water management structures.

-- Continued liaison with Traditional Owners of the land.

-- The groundwater monitoring programme which is to be submitted

to and approved by the Minister of Water Resources.

As part of the approval, the DEM requires:

-- An environmental security deposit of AUD$3.7m and a Native

Vegetation Fund contribution of AUD$81k.

To a large extent, the conditions associated with the approval

were as expected and reflected the comprehensive nature of LCCM's

PEPR application. Whilst the bond requirement is larger than

catered for in the Company's financial modelling of the project,

the Company is comfortable with this level given the current

overall amount of funding being sought to fund the project.

Copies of this interim report will be made available on the

Company's website, www.strategicminerals.net.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR URVRRAOUKOAR

(END) Dow Jones Newswires

September 30, 2021 06:59 ET (10:59 GMT)

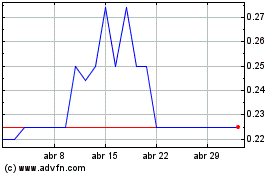

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024