TIDMSML

RNS Number : 6208W

Strategic Minerals PLC

23 December 2021

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

23 December 2021

Strategic Minerals plc

("Strategic Minerals" or the "Company")

Leigh Creek Copper Mine

Funding and PEPR Update

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company , is pleased to provide the following

update on the Company's progress in relation to funding of the

Leigh Creek Copper Mine ("LCCM" or the "Project") and progress on

addressing the conditional elements of the Project's Program for

Environmental Protection and Rehabilitation ("PEPR").

Highlights

-- Focus of funding sought, while still expected at the LCCM

level, has moved to a convertible note/joint venture basis after

debt negotiations with a top global bank ceased

-- Company seeking US$10m at the LCCM level - approximately

US$6m for resumption of production and US$4m for copper oxide and

sulphide exploration

-- LCCM level funding is still expected within the project's

critical development path and is not considered likely to delay

expected 2022 resumption of production

-- Negotiations have been based on the Company's internal

forecasts of the Project's expected EBITDA of US$68m, reflecting a

US$4-25 lb copper price and an AUD/USD exchange rate of 0.7500

-- LCCM has applied for a South Australian government grant to assist planned drilling in 2022

-- Resubmission of PEPR details to the South Australian

Department of Energy and Mines ("DEM") almost complete and is

expected to be submitted to DEM in January 2022

-- Company is confident that, on the basis of work completed for

the PEPR resubmission, the Environmental Bond required is likely to

be reduced by a significant amount, although there can be no

assurances of this as the decision rests solely with DEM

Funding Update

As announced on 8 October 2021, the Company had been in

negotiations for a substantial debt facility from a respected

global bank. Ultimately, as a result of the high costs of a large

approved undrawn facility and the Company's current low market

capitalisation, these negotiations have now ceased. The advanced

nature of these discussions and a belief, at the time, that an

offer was imminent were announced by the Company to ensure all

potential investors had the same information regarding the LCCM

funding situation ahead of the equity raise in October.

As attempts to raise pure debt-based funding for LCCM have not

been successful thus far, the Company has shifted its emphasis to

funding involving an equity component. Accordingly, marketing has

refocused on a proposed US$10m convertible note facility at the

subsidiary level.

Marketing to potential investors is based on current market

conditions utilising a copper price assumption of US$4-25 lb and an

AUD/USD exchange rate of 0.7500. This produces an expected project

EBITDA of US$68m according to the Company's internal forecasts.

Initial marketing feedback has indicated that, in order to

ensure broader appeal, a minimum funding size of US$10m needs to be

sought and, with some investors, a planned liquidity event is

preferred. Accordingly, LCCM is currently seeking US$10m by either

a convertible note or equity investment and plans to apply such

funding to recommence production (approximately US$6m) and for

exploration costs (approximately US$4m).

The US$6m earmarked to recommence production, prior to receipt

of revenues, is made up of approximately:

Capital items including new leach pads US$1.0m

Mining prior to revenue commencement including pre-strip (4 months) US$2.5m

Environmental bond US$2.5m

The provision of additional funds will provide LCCM with the

ability to bring forward planned exploration drilling.

Drilling is expected to focus on two areas, namely:

a) Copper Oxide confirmatory drilling around the Mount Coffin

mineralisation, within LCCM's tenements. While there has been

historical assessment of the mineralisation, such drilling does not

qualify the mineralisation to the JORC (2012) standards. Twinning

of existing known holes will assist with the definition of a JORC

(2012) compliant resource which could extend the life of the oxide

operating project. The Directors believe this additional resource

could increase expected project EBITDA by up to US$40m.

b) Copper Sulphide exploratory drilling around a significant

intersection in a Bridge Minerals Pty Ltd's 1974 historical drill

hole PDH38. The drill hole, close to the Paltridge North ("PN")

deposit, was drilled to 183m and showed a high-grade copper

sulphide intersection from 137.2m to 144.8m with a 15-20% sulphide

component and copper grade of 1.34% (a PDF of the drill hole

results can be viewed at

https://www.strategicminerals.net/investors/presentations.html).

While exploration for additional copper resources within the

Adelaide Geosyncline in the northern Flinders Ranges has always

been a key strategy for LCCM, the current expected funding package

will provide the opportunity to undertake a staged exploration

programme more quickly.

Discussions with potential LCCM convertible note/equity

investors, to date, has made Management confident that funding is

likely to be achieved prior to final clearance of the PEPR for PN.

However, timing of the commencement of production and exploration

will be dependent on both regulatory approvals and sourcing

funding.

In anticipation of proposed drilling programmes at Mount Coffin

and around PN, LCCM has lodged applications with the South

Australian government for grant payments under its Accelerated

Development Initiative ("ADI") programme. If approved, LCCM could

receive grant payments of up to 50% of the drilling costs.

PEPR Update

Since July 2021, when LCCM received conditional approval for the

PEPR associated with LCCM's PN deposit and its treatment of

material at the adjacent Mountain of Light ("MoL") processing

facility, considerable work has been undertaken to satisfy the

conditions that DEM applied and LCCM anticipates that it will

resubmit the requested information in January 2022.

The work undertaken for this resubmission, through updating the

pit design, has seen the Project's expected profitability increase

through higher copper prices making more of the PN deposit

economically viable. Further, from both work undertaken and

consultation with members of DEM, it is the Company's strong belief

that the amount of the Environmental Bond, currently A$3.5m, can be

significantly reduced.

Commenting, John Peters, Managing Director of Strategic

Minerals, said:

"The Company is confident that 2022 will see the recommencement

of production at Leigh Creek.

"Whilst it was felt that funding on a pure debt basis would have

produced the best result for our shareholders, the market was not

prepared to debt fund the Project at this time. Accordingly,

discussions involving equity linked funding, at the LCCM level,

have now commenced and considerable interest has been received to

date. It is for this reason that we feel that these funding

arrangements will be completed before the Project is "shovel

ready".

"Given that the response to the conditions of the July PEPR is

being lodged shortly with the DEM, it is considered that the

earliest LCCM will be in a position to recommence production is

March 2022 and this would be subject to all regulatory clearances

and funding being secured.

"Strategic Minerals is excited by the prospect of undertaking

drilling in 2022. Planned drilling at Mount Coffin is expected to

lead to an increase in LCCM's reported copper oxide JORC resource

and commence its long-term strategy to use cash flows from copper

oxide production to locate a substantial copper sulphide deposit in

this copper rich province. "

Competent Person's Statement

The expected exploration results in this announcement are based

on information compiled by Mr. David Larsen, who is a Member of the

Australian Institute of Geoscientists. Mr Larsen is the Principal

of D&J Larsen Consulting Pty Ltd and is a consultant to the

Company. He has sufficient experience relevant to the style of

mineralisation and type of deposit under consideration and to the

activity he is undertaking to qualify as a Competent Person, as

defined in the 2012 Edition of the Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves and a

qualified person as defined in the AIM Note for Mining and Oil

& Gas Companies dated June 2009. Mr Larsen has over 35 years'

Australia and international experience in exploration, mining

geology and resource estimation for gold, base metals and iron ore

deposits.

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole drilling programme and the resource update that resulted

was announced in February 2019. In March 2019, the Company entered

into arrangements to acquire the balance of the Redmoor

Tin/Tungsten project which was settled on 24 July 2019 by way of a

vendor loan which was fully repaid on 26 June 2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Austra lia and brought the project temporarily into production in

April 2019. The project has been granted a conditional approval by

the South Australian Government for a Program for Environmental

Protection and Rehabilitation (PEPR) in relation to mining of its

Paltridge North deposit and processing at the Mountain of Light

installation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDZZMZZRFKGMZG

(END) Dow Jones Newswires

December 23, 2021 03:27 ET (08:27 GMT)

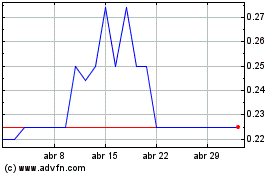

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024