Strategic Minerals Shares Down on $10 Million Loan Negotiations Ending

23 Diciembre 2021 - 3:35AM

Noticias Dow Jones

By Anthony O. Goriainoff

Shares in Strategic Minerals PLC fell Thursday after the company

said the negotiations on the provision of an at least $10 million

loan facility aimed at the Leigh Creek copper mine, or LCCM, in

Australia had ended.

Shares at 0846 GMT were down 0.13 pence, or 36%, at 0.23

pence.

The AIM-listed mining company said it is seeking $10 million by

either a convertible note or equity investment. It said it plans to

apply such funding to restart production at the project and for

exploration costs.

"Whilst it was felt that funding on a pure debt basis would have

produced the best result for our shareholders, the market was not

prepared to debt fund the project at this time. Accordingly,

discussions involving equity linked funding, at the LCCM level,

have now commenced and considerable interest has been received to

date," the company said.

Strategic Minerals said negotiations ended because of the high

costs of a large approved undrawn facility and the company's

current low market capitalization.

In October, the company said that it was in talks with a top

global bank and that there was no guarantee that a loan would be

offered.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

December 23, 2021 04:20 ET (09:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

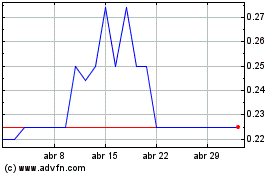

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024