Swiss Franc Drops Amid Risk Appetite

09 Noviembre 2021 - 2:00AM

RTTF2

The Swiss franc declined against its major counterparts in

European deals on Tuesday, as European shares rose amid corporate

earnings, while investors awaited U.S. inflation data to assess Fed

rate hike prospects.

U.S. treasury yields fell following news that Governor Lael

Brainard was interviewed for the top post at the Federal

Reserve.

The CPI data, due Wednesday, is forecast to show a rise in

prices driven by supply chain issues and surging energy costs.

Fed Vice Chairman Richard Clarida said on Monday that although

the central bank is distant from considering raising interest

rates, these conditions for a liftoff is likely to be met by the

end of 2022.

Attention now shifts to U.S. producer inflation data, as well as

speeches from central bank chiefs, including ECB President Lagarde,

BoE President Bailey and Fed Chairman Powell for more

direction.

The franc edged down to 1.0598 against the euro and 0.9154

against the greenback, off its prior highs of 1.0568 and 0.9117,

respectively. The franc is seen finding support around 1.08 against

the euro and 0.93 against the greenback.

The franc reversed from its early highs of 1.2367 against the

pound and 124.02 against the yen, sliding to a 5-day low of 1.2426

and a fresh 3-week low of 123.41, respectively. The next likely

support for the franc is seen around 1.26 against the pound and

119.5 against the yen.

Looking ahead, European Central Bank President Christine Lagarde

is due to deliver opening remarks at the ECB Forum on Banking

Supervision at 8 am ET.

U.S. PPI for October is scheduled for release in the New York

session.

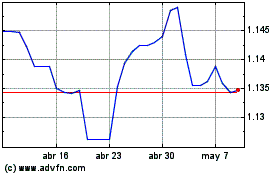

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024