TIDMSYM

RNS Number : 9315L

Symphony Environmental Tech. PLC

16 September 2021

16 September 2021

SYMPHONY ENVIRONMENTAL TECHNOLOGIES PLC

("Symphony", the "Company" or the "Group")

Interim Results

Symphony Environmental Technologies Plc (AIM: SYM), a global

science-based group that makes plastic and rubber products

"smarter, safer and sustainable", is pleased to announce its

interim financial results for the six-month period ended 30 June

2021.

Financial highlights

-- Group revenue of GBP4.9 million (H1-2020: GBP4.8 million)

which on a constant-currency basis, would have shown a 13% increase

to GBP5.4 million

-- Gross profit of GBP1.9 million (H1-2020: GBP2.2 million) due

to higher proportion of finished goods in the product mix

-- Loss before tax of GBP0.6 million (H1-2020: profit GBP0.02 million)

-- Basic loss per share of 0.29 pence (H1-2020: earnings per share of 0.01 pence)

-- Cash generated in operations GBP0.3 million (H1-2020 cash used GBP0.6 million)

Business highlights

-- d2p - substantial progress in many product areas including an

increase in customer trials and product-tests currently underway.

Significant potential sales identified in many of the current

pipeline projects with a number expecting to commercialise in the

near term

-- Continued investment in Symphony's sales team, and new Head

of Innovation appointed to accelerate the commercialisation of the

Group's growing portfolio of new and highly innovative products.

Budgeted increase in one-off professional fees including legal,

communication, advocacy and external specialist technical costs to

assist with many key areas of the Group's activities, alongside

GBP0.05 million of non-budgeted increases in distribution and

shipping costs owing to short-term supply disruption

-- Several patent applications filed to protect our IP as many

new products reach commercialisation

Post period-end highlights

-- d2p - US FDA further approval for antibacterial plastic

technology with greater loading and wider use in bread films

-- d2p - Canadian Health approval for antibacterial bread films

-- 4 significant collaboration agreements with Meditech

o China distribution agreement for d2w and d2p

o Manufacturing and royalty agreement for Nitrile gloves

o Marketing agreement for Symphony to sell d2p Nitrile gloves in

specified markets

o Corporate agreement to acquire not less than 2.5% and not more

than 20% of Symphony's total share capital

Commenting on the results Nicolas Clavel, Interim Chairman of

Symphony, said:

During the period, the Group has substantially developed its

highly relevant product range together with continuing major

improvements in its key operations. This has resulted, amongst

other achievements, in US FDA and Canadian approvals for Symphony's

d2p bread packaging where the size of the market is vast, and where

Symphony already has a presence with its d2w biodegradable

technology. Other product areas are moving ahead strongly including

d2p antimicrobial in pipes and tanks, together with insect and

animal repellent technologies, amongst others. Symphony expects its

d2p bread packaging and some of its other d2p projects to

commercialise in the very near term.

The continuing investment in advisory and advocacy work is

strengthening the outlook for both d2w and d2p in Latin America and

the Middle East. In particular, the Saudi national standards

organisation, SASO, is increasing its enforcement of laws requiring

the use of oxo-biodegradable plastic, and we anticipate this will

lead to a substantial increase in demand during the second half of

the year.

The Far East sales position has also been strengthening, and

since the period end, the Group has augmented this by signing four

agreements with Meditech's Global Co Limited covering

manufacturing, distribution, and marketing in the region, together

with corporate investment in Symphony. The agreements also secure

glove supply using our antimicrobial and/or biodegradable

technologies for sales globally.

As reported in the trading update on 13 July 2021, revenues for

the 6 months ended 30 June 2021 were up marginally at GBP4.9

million (H1-2020: GBP4.8 million), but on a constant-currency

basis, would have been approximately 13% higher than in

H1-2020.

The Group continues to invest in its operations, in third party

consultancy and advocacy, and in R&D, and with this, the Board

is confident it is building a strong position to deliver meaningful

revenue growth in the short to medium term.

Michael Laurier, CEO of Symphony commented:

"The Group's strategy in the short to medium term is to focus on

delivering its innovative technologies for key identified product

lines where test results, trials and regulatory approvals have been

secured, and substantial sales opportunities have been

identified."

Enquiries:

Symphony Environmental Technologies Plc

Michael Laurier, CEO Tel: +44 (0) 20 8207

5900

Ian Bristow, CFO

www.symphonyenvironmental.com

Zeus Capital Limited (Nominated Adviser and

Joint Broker)

David Foreman / Nick Cowles / Kieran Russell Tel: +44 (0) 161

(Corporate Finance) 831 1512

Dominic King / Victoria Ayton (Sales) Tel: +44 (0) 203

829 5000

Hybridan LLP (Joint Broker)

Claire Louise Noyce Tel: +44 (0) 203

764 2341

The person responsible for arranging the release of this

information is Michael Laurier, CEO of the Company.

Chief Executive's review

Financial

Revenue for the 6 months ended 30 June 2021 was GBP4.9 million

(H1-2020: GBP4.8 million), but on a constant- currency basis, would

have been approximately 13% higher than the first half of 2020.

Gross margins were slightly lower due to an increased proportion

of finished products compared to higher margin masterbatches. Also,

distribution costs were higher during the period due to global

vessel and container shortages. This is expected to continue for

the remainder of the year.

As previously advised, cost continued in relation to supporting

d2w advocacy communications in the UK, Middle East and Latin

American markets. In addition, regulatory and other IP related

costs continued for new d2p products for the EU and US markets

together with legal costs pertaining to Symphony's ongoing claim

for very substantial damages against the EU.

The Company continues to invest in its sales and other key

operating functions to better manage its strong and growing

pipeline. A new and highly experienced Head of Innovation was

appointed during the period to work with the recently appointed

Head of Sales to strengthen the skill set of the sales and

procurement teams and to accelerate the commercialisation of

Symphony's growing portfolio of new and highly innovative

products.

This additional strategic investment in key resources, together

with the above-described factors resulted in a net loss before tax

of GBP0.6 million (H1-2020: profit GBP0.02 million).

An R&D tax credit of GBP127,000 was received during the

period (H1-2020: GBPnil). The Group reports a loss after tax of

GBP0.5 million (H1-2020 profit GBP0.02 million).

The loss per share for the period was 0.29 pence (H1-2020:

earnings per share of 0.01 pence).

d2p "Designed to Protect"

The Group has been successfully progressing its d2p sales

pipeline of over 100 projects, the majority of which are

customer-led and are moving towards commercialisation through

technical evaluation, agreeing commercial objectives, conducting

customer-trials, product testing and contract negotiation.

Customer-trials conducted during the period have incorporated

Symphony's d2p anti-microbial (also anti-viral), insecticidal,

odour and ethylene adsorbers, insect and animal repellent, and

flame retardant technologies. The trials have been for, inter alia,

the following products:

-- Food/bread

-- Pipes/tanks

-- PPE including gloves

-- Films for surface protection

-- Electric cables

-- Car components

-- Agricultural products

Many of the trials started during the period are expected to

complete over the coming months, and the Group has identified

substantial revenue potential within these current projects. The

Group is also continually receiving new enquires and therefore

anticipates its product pipeline will continue to grow strongly.

Our sales, technical and procurement teams have also designed and

implemented process improvements, particularly with regard to our

product-evaluation process, which is expected to shorten the period

significantly from enquiry to product commercialisation.

Enhanced FDA approval - subsequent approval by Health Canada

In July the Company received approval from the US Food &

Drug Administration ("FDA") for its d2p antimicrobial food contact

technology, for a much greater loading of the d2p technology, and

also wider use, further to Symphony's original bread-packaging

approval under FCN no. 2031, as announced on 26 February 2020 (RNS

number: 1106E).

The FDA's new approval for Symphony's d2p antimicrobial food

contact technology, now applies to all types of polyolefin and

polyester film for wrapping bread, instead of just linear low

density polythene ("LLDPE"). It now includes low density polythene

("LDPE") and polypropylene ("PP"), which are common packaging

materials. Symphony's d2p technology is intended to inhibit the

growth of bacteria on the surface of the packaging film and is

vital to a very hygiene-conscious industry.

This important wider approval, given under FCN no. 2139 without

limit of time, also allows up to three times increased loading of

d2p technology in an innovative treatment of the multi-layer

plastic films most commonly used in bread-packaging, giving greater

flexibility, efficacy and ultimately, greater value for Symphony's

customers and Symphony itself. The Board therefore anticipates an

acceleration of the commercial process in the near term.

Further to the FDA enhanced approval above, the same technology

was approved by Health Canada in September 2021. The Group has a

number of opportunities ongoing in Canada and other parts of the

world.

d 2w Oxo-biodegradable

The Group has seen stable end-user demand in its main markets,

although distributor and factory stock levels have been kept very

low due to global uncertainty caused by COVID-19 lockdowns. We

anticipate these ultra-low stock levels increasing to pre-pandemic

levels as the world moves out of lockdown.

The outlook for Latin America, the Middle East and some parts of

Asia is becoming much more positive as the vaccine programmes

continue to advance, and lock-down restrictions start to ease. In

addition, the advisory and advocacy work being carried out for d2w

technology in these countries is progressing well. As an example,

in the Middle East, the Saudi national standards organisation,

SASO, is increasing its enforcement of the laws which require the

use of oxo-biodegradable plastic, and we anticipate that this will

lead to a substantial increase in demand during H2-2021.

EU Action

Symphony's legal team has filed Replies to the Defences received

from the three defendants (the Commission, the Parliament, and the

Council of the European Union ("EU")) to the action it has brought

against them in the General Court of the EU. The Defendants now

have until 8 October 2021 to file their Rejoinders, and the

pleadings will then be closed. The next step is for the court to

fix a date for an oral hearing in Luxembourg. This is expected in

2022.

The Defences did not reveal anything unexpected, and Symphony's

legal team remain confident that the EU acted unlawfully in

imposing a ban on a material which they call "oxo-degradable

plastic" in Article 5 of the Directive. In any event, Symphony does

not accept that the ban applies to oxo-BIOdegradable plastics,

which are made by incorporating Symphony's d2w masterbatch into

ordinary plastic.

Patent Applications

In recognition of the growing pipeline of commercial projects

across the Group's product range, the Board believe now is the

appropriate time to invest both time and money in better protecting

its IP through the filing of patents. The Group has submitted

several patent applications during the period and will make further

announcements as appropriate in due course, as and when these

applications are approved.

Eranova

Eranova, with is sustainable algae sourced "plastic" technology,

continues with its pilot plant construction, which is on schedule

to complete during 2021.

Balance sheet and cashflow

The Group had net cash of GBP0.70 million at the end of the

period (30 June 2020: net cash of GBP0.29 million). Net cash of

GBP0.32 million was generated in operations (H1-2020: used in

operations GBP0.62 million) because of a decrease in receivables

since the year end.

The Group has an invoice discounting facility of GBP1.5 million

to assist in funding outstanding receivables when required. The

Board believes that the Group has sufficient working capital to

support the business and its current opportunities going

forward.

Brexit

At the current time, Brexit is not having a material impact on

the operations or financial performance of the Group. The Board

continues to monitor the Group's operations in the UK and Europe in

light of challenges arising from Brexit.

COVID-19

Although COVID-19 affected the markets in which Symphony

operates. So far, the negative effects to Group operations and

finances have been minimal, while the focus on hygiene has enhanced

interest in our d2p range. T here is still the possibility of

disruption to operations (customer or supplier disruption) or

finances (customer bad debt or ability of customers or suppliers to

carry on trading). The Group uses multiple supply sources and

continues in the main to credit-insure receivables or do business

on a letter of credit or proforma basis.

Outlook

After many years of product development, commercialisation of

key product lines is now expected in the very near term with

substantial sales growth anticipated. Further, we are encouraged by

the level of activity in many areas of the business worldwide,

covering many different product applications. Due to this expected

substantial growth, we are continuing to strengthen the Group's

operational teams as well as to further develop business

collaboration in a number of key markets. This, together with our

successes with regulatory clearances, is paving the way for a

strong outlook over the short to medium term.

Michael Laurier, Chief Executive

Condensed consolidated interim statement of comprehensive

income

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------ ------------ ---------- ------------

Revenue 4,878 4,753 9,766

Cost of sales (2,940) (2,594) (5,658)

------------------------------ ------------ ---------- ------------

Gross profit 1,938 2,159 4,108

Distribution costs (234) (164) (364)

Administrative expenses (2,303) (1,955) (4,136)

------------------------------ ------------ ---------- ------------

Operating (loss)/profit (599) 40 (392)

Finance costs (33) (22) (45)

------------------------------ ------------ ---------- ------------

(Loss)/profit for the period

before tax (632) 18 (437)

Tax credit 127 - 109

------------------------------ ------------ ---------- ------------

(Loss)/profit for the period (505) 18 (328)

------------------------------ ------------ ---------- ------------

Total comprehensive income

for the period (505) 18 (328)

------------------------------ ------------ ---------- ------------

Earnings per share:

Basic (0.29)p 0.01p (0.19)p

Diluted (0.29)p 0.01p (0.19)p

------------------------------ ------------ ---------- ------------

All results are attributable to the owners of the parent.

There were no discontinuing operations for any of the above

periods.

Condensed consolidated interim statement of financial

position

At At At

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- ---------- ------------

ASSETS

Non-current

Property, plant and equipment 153 191 166

Right-of-use assets 621 573 510

Intangible assets 72 40 45

Investments 123 - 123

969 804 844

Current

Inventories 1,230 993 1,060

Trade and other receivables 2,573 3,316 3,614

Cash and cash equivalents 1,323 525 1,388

-------------------------------------- ---------- ---------- ------------

5,126 4,834 6,062

-------------------------------------- ---------- ---------- ------------

Total assets 6,095 5,638 6,906

-------------------------------------- ---------- ---------- ------------

EQUITY AND LIABILITIES

Equity

Equity attributable to owners

of

Symphony Environmental Technologies

plc

Share capital 1,768 1,700 1,768

Share premium account 3,185 2,077 3,185

Retained earnings (1,350) (519) (865)

-------------------------------------- ---------- ---------- ------------

Total equity 3,603 3,258 4,088

-------------------------------------- ---------- ---------- ------------

Liabilities

Non-current

Lease liabilities 411 446 381

-------------------------------------- ---------- ---------- ------------

Current

Borrowings 620 231 918

Lease liabilities 158 124 128

Trade and other payables 1,303 1,579 1,391

-------------------------------------- ---------- ---------- ------------

2,081 1,934 2,437

-------------------------------------- ---------- ---------- ------------

Total liabilities 2,492 2,380 2,818

-------------------------------------- ---------- ---------- ------------

Total equity and liabilities 6,095 5,638 6,906

-------------------------------------- ---------- ---------- ------------

Condensed consolidated interim statement of changes in

equity

Equity attributable to the owners of Symphony Environmental

Technologies plc:

Share Share Retained Total

capital premium earnings equity

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- --------- ---------- ---------

For the six months to 30

June 2021

Balance at 1 January 2021 1,768 3,185 (865) 4,088

Share-based payments - - 20 20

Transactions with

owners - - 20 20

------------------------ ------------------ --------- ---------- ---------

Total comprehensive income

for the period - - (505) (505)

--------------------------------- --------- --------- ---------- ---------

Balance at 30 June 2021 1,768 3,185 (1,350) 3,603

--------------------------------- --------- --------- ---------- ---------

Share Share Retained Total

capital premium earnings equity

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- ---------- ---------

For the six months to 30

June 2020

Balance at 1 January 2020 1,700 2,077 (537) 3,240

Total comprehensive income

for the period - - 18 18

------------------------------ --------- --------- ---------- ---------

Balance at 30 June 2020 1,700 2,077 (519) 3,258

------------------------------ --------- --------- ---------- ---------

Share Share premium Retained Total

capital earnings equity

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- -------------- ---------- --------

For the year to 31

December 2020

Balance at 1 January

2020 1,700 2,077 (537) 3,240

Issue of share capital 68 1,108 - 1,176

Transactions with

owners 68 1,108 - 1,176

-------------------------- --------------- -------------- ---------- --------

Total comprehensive

income for the year - - (328) (328)

-------------------------- --------------- -------------- ---------- --------

Balance at 31 December

2020 1,768 3,185 (865) 4,088

-------------------------- --------------- -------------- ---------- --------

Condensed consolidated interim cash flow statement

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- -------------

Operating activities:

(Loss)/profit for the period

after tax (505) 18 (328)

Depreciation 112 91 185

Amortisation 4 9 18

Profit on disposal of tangible

assets - (77) (67)

Share-based payments 20 - -

Foreign exchange (profit)/loss (11) (23) 37

Tax credit (127) - (109)

Interest paid 33 22 45

Change in inventories (170) (111) (178)

Change in trade and other

receivables 1,052 (981) (1,346)

Change in trade and other

payables (88) 437 301

--------------------------------- ----------- ----------- -------------

Net cash generated/(used)

in operations 320 (615) (1,442)

Tax received 127 - 109

--------------------------------- ----------- ----------- -------------

Net cash generated/(used)

in operating activities 447 (615) (1,333)

--------------------------------- ----------- ----------- -------------

Investing activities:

Additions to property, plant

and equipment (210) (12) (36)

Additions to intangible assets (31) (7) (21)

Additions to investments - - (123)

Proceeds from sale of property,

plant and equipment - 92 97

Net cash (used)/generated

in investing activities (241) 73 (83)

--------------------------------- ----------- ----------- -------------

Financing activities:

Movement in working capital

facility - 41 -

Movement in finance lease

liability 60 (61) (123)

Proceeds from share issue - - 1,176

Lease interest paid (14) (14) (27)

Bank and invoice finance

interest paid (19) (8) (18)

--------------------------------- ----------- ----------- -------------

Net cash generated/(used)

in financing activities 27 (42) 1,008

--------------------------------- ----------- ----------- -------------

Net change in cash and cash

equivalents 233 (584) (408)

Cash and cash equivalents,

beginning of period 470 878 878

Cash and cash equivalents,

end of period 703 294 470

--------------------------------- ----------- ----------- -------------

Represented by:

Cash and cash equivalents 1,323 525 1,388

Bank overdraft (620) (231) (918)

--------------------------------- ----------- ----------- -------------

703 294 470

--------------------------------- ----------- ----------- -------------

Notes to the interim financial statements

1 Nature of operations and general information

Symphony Environmental Technologies plc (the "Company") and

subsidiaries' (together the "Group") principal activities include

the development and supply of environmental plastic additives and

products.

Symphony Environmental Technologies plc, a public limited

company, is the Group's ultimate parent company. It is incorporated

and domiciled in England (company number 03676824). The address of

its registered office is 6 Elstree Gate, Elstree Way, Borehamwood,

Hertfordshire, WD6 1JD, England. The Company's shares are listed on

the AIM market of the London Stock Exchange.

These condensed interim consolidated financial statements

("interim financial statements" or "interim report") are for the

six months ended 30 June 2021. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2020.

The financial information set out in this interim report does

not constitute statutory accounts. The Group's statutory financial

statements for the year ended 31 December 2020 have been filed with

the Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

Section 498(2) or 498(3) of the Companies Act 2006. These interim

condensed consolidated financial statements have not been

audited.

These interim financial statements have been prepared in

accordance with the requirements of International Accounting

Standard ("IAS") 34 "Interim Financial Reporting", and are

presented in Pounds Sterling (GBP), which is the functional

currency of the parent company. They have been prepared under the

historical cost convention. They have also been prepared on the

basis of the recognition and measurement requirements of

International Financial Reporting Standards, and the policies and

measurements are consistent with those stated in the financial

statements for the year ended 31 December 2020.

These interim financial statements were approved by the board on

15 September 2021.

2 Significant accounting policies

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year ended 31 December 2020.

3 Seasonal fluctuations

The Group operates in many countries and in many different

markets. There are therefore no formal or considered seasonal

fluctuations affecting the operations of the Group.

4 Segmental analysis

The Board considers that the Group does not have separate

operating segments as defined under IFRS 8.

5 Shares issued

Shares issued are summarised as follows:

6 months 6 months Year to

to to 31 December

Shares issued and 30 June 30 June 2020

fully paid 2021 2020

------------------------ -------------- -------------- --------------

- beginning of period 176,751,277 170,026,277 170,026,277

- issued during the

period - - 6,725,000

------------------------- -------------- -------------- --------------

Total equity shares

issued and fully paid

at end of period 176,751,277 170,026,277 176,751,277

------------------------- -------------- -------------- --------------

6 Earnings per share and dividends

The calculation of earnings per share is based on the result

attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of shares

on the assumed conversion of dilutive options and warrants which

were exercisable during the period.

Reconciliations of the results and weighted average numbers of

shares used in the calculations are set out below:

Basic and diluted 6 months to 6 months Year to

30 June to 31 December

2021 30 June 2020

2020

-------------------------------- --------------- -------------- --------------

(Loss)/profit attributable GBP(505,000) GBP18,000 GBP(328,000)

to owners of the Company

Weighted average number

of ordinary shares in

issue 176,751,277 170,026,277 172,207,989

-------------------------------- --------------- -------------- --------------

Basic earnings per share (0.29) pence 0.01 pence (0.19)

pence

-------------------------------- --------------- -------------- --------------

Dilutive effect of weighted

average options and warrants 4,784,605 5,752,769 4,962,878

Total of weighted average

shares together with dilutive

effect of weighted options

and warrants 181,535,882 189,300,008 172,207,989

-------------------------------- --------------- -------------- --------------

Diluted earnings per share (0.29) pence 0.01 pence (0.19)

pence

-------------------------------- --------------- -------------- --------------

No dividends were paid for the year ended 31 December 2020.

The effect of options and warrants for the six months to 30 June

2021 and year to 31 December 2020 are anti-dilutive.

7 Availability of Interim Financial Statements

Paper copies of the Interim Financial Statements will be sent to

shareholders upon request. Shareholders will be able to download a

copy of the Interim Financial Statements from the Group's website

www.symphonyenvironmental.com . Further copies of the Interim

Financial Statements will be available from the Company's

Registered Office at 6 Elstree Gate, Elstree Way, Borehamwood,

Hertfordshire WD6 1JD.

NOTES TO EDITORS:

Symphony Environmental Technologies plc

https://www.symphonyenvironmental.com

Symphony has developed a range of additives, concentrates and

master-batches marketed under its d2p(R) ("designed to protect")

trademark, which can be incorporated in a wide variety of plastic

and non-plastic products so as to give them protection against many

different types of bacteria, viruses, fungi, algae, moulds, and

insects, and against fire. d2p products also include odour,

moisture, and ethylene adsorbers as well as other types of

food-preserving technologies. Symphony has also launched d2p

antimicrobial household gloves and toothbrushes and is developing a

range of other d2p finished products for retail sale.

Symphony has developed and continues to develop, a biodegradable

plastic technology which helps tackle the problem of microplastics

by turning ordinary plastic at the end of its service-life into

biodegradable materials. It is then no longer a plastic and can be

bioassimilated in the open environment in a similar way to a leaf.

The technology is branded d2w(R) and appears as a droplet logo on

many thousands of tonnes of plastic packaging and other plastic

products around the world. In some countries, most recently Saudi

Arabia, oxo-biodegradable plastic is mandatory for a wide range of

everyday products.

The Group has complemented its d2w biodegradable product range

with d2c "compostable resins and products" that have been tested to

US and EU composting standards.

Symphony has also developed the d2Detector(R), a portable device

which analyses plastics and detects counterfeit products. This is

useful to government officials tasked with enforcing legislation,

and Symphony's d2t tagging and tracer technology is available for

further security.

Symphony has a diverse and growing customer-base and has

established itself as an international business with 74

distributors around the world. Products made with Symphony's

plastic technologies are now available in nearly 100 countries and

in many different product applications. Symphony itself is

accredited to ISO9001 and ISO14001.

Symphony is a member of The OPA (www.biodeg.org) and actively

participates in the Committee work of the British Standards

Institute (BSI), the American Standards Organisation (ASTM), the

European Standards Organisation (CEN), and the International

Standards Organisation (ISO).

Further information on the Group can be found at

www.symphonyenvironmental.com and twitter @SymphonyEnv See also

Symphony on Instagram. A Symphony App is available for downloading

to smartphones.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LELLFFKLLBBZ

(END) Dow Jones Newswires

September 16, 2021 02:00 ET (06:00 GMT)

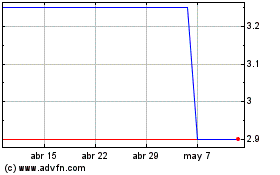

Symphony Environmental T... (LSE:SYM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Symphony Environmental T... (LSE:SYM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024