TIDMSYNC

RNS Number : 8343R

Syncona Limited

09 November 2021

Syncona Limited

Achilles reports Third Quarter 2021 Financial Results

9 November 2021

Syncona Ltd, a leading healthcare company focused on founding,

building and funding a portfolio of global leaders in life science,

notes that its portfolio company, Achilles Therapeutics Plc

(NASDAQ: ACHL) (Achilles), announced its financial results for the

third quarter ended September 30, 2021 and recent business

highlights.

The announcement can be accessed on Achilles' website at:

https://ir.achillestx.com/ and the full text of the announcement

from Achilles is contained below. In addition, the Company will

host a live webcast and conference call on Friday, November 12,

2021 at 1:30pm GMT to review the SITC presentations and provide a

corporate update. The live webcast can be accessed in the Events

& Presentations section of the Company's website.

[S]

Enquiries

Syncona Ltd

Annabel Clay / Fergus Witt

Tel: +44 (0) 20 3981 7940

FTI Consulting

Ben Atwell / Natalie Garland-Collins / Tim Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by founding and building a portfolio of global leaders

in life science to deliver transformational treatments to patients

in areas of high unmet need.

Our strategy is to found, build and fund companies around

exceptional science to create a diversified portfolio of 15-20

globally leading healthcare businesses for the benefit of all our

stakeholders. We focus on developing treatments for patients by

working in close partnership with world-class academic founders and

management teams. Our balance sheet underpins our strategy enabling

us to take a long-term view as we look to improve the lives of

patients with no or poor treatment options, build sustainable life

science companies and deliver strong risk-adjusted returns to

shareholders.

Achilles Therapeutics Reports Third Quarter 2021 Financial

Results and Recent Business Highlights

- Oral Presentation at European Society for Gene and Cell

Therapy (ESGCT) demonstrated ability to generate potent anti-cancer

cell therapy candidates in multiple solid tumor types -

- Society for Immunotherapy of Cancer ( SITC) abstracts

highlight the ability to detect, quantify and track

patient-specific cNeT and generate increased cNeT doses from

VELOS(TM) Process 2 manufacturing -

- Conference call and webcast scheduled for Friday, November 12,

2021 at 8:30am ET to review SITC presentations and provide a

corporate update -

London, UK 09 November 2021 - Achilles Therapeutics plc (NASDAQ:

ACHL), a clinical-stage biopharmaceutical company developing

precision T cell therapies to treat solid tumors, today announced

its financial results for the third quarter ended September 30,

2021, and recent business highlights.

"We have continued to make good progress during the third

quarter and will share an update from the first eight patients

across our CHIRON (non-small cell lung cancer, or NSCLC) and THETIS

(melanoma) studies at the upcoming SITC meeting. Our unique ability

to accurately quantify the tumor reactive component of each product

and to track clonal neoantigen reactive T cells (cNeT) in the

patients post-dosing is possible through the detailed genomic

analysis of the tumor and prospective clonal neoantigen targeting

afforded by our proprietary bioinformatics platform. We believe

this best-in-class analytical capability will be critical for the

successful development of TIL-based therapies," said Dr Iraj Ali,

Chief Executive Officer of Achilles. "At SITC, we will also share

details of our VELOS(TM) Process 2 manufacturing, which is able to

routinely generate significantly higher doses of cNeT than our

current Process 1. We will present further GMP scale data from

VELOS Process 2 at the upcoming ESMO Immuno-Oncology Congress

taking place December 8-11, 2021."

Business Highlights

-- Two abstracts for the SITC 36th Annual Meeting were published

today - Poster 543, underscoring the ability to sensitively detect,

quantify and track patient-specific cNeT during manufacture and

post dosing, and Poster 193, highlighting our ability to generate

increased doses of reactive cNeT from VELOS Process 2

-- Delivered an oral presentation at the 2021 European Society

for Gene and Cell Therapy (ESGCT) Congress entitled, "Multicentre,

prospective research protocol for development of a clonal

neoantigen-reactive T cell therapy pipeline across multiple tumour

types" highlighting the Company's Material Acquisition Platform

(MAP) and supporting the potential use of cNeT in a broad range of

solid tumor indications

-- Granted US patent US 11,098,121 and European patent

EP3347039B covering a method of identifying cancer patients that

are likely to respond to a checkpoint inhibitor (CPI) by

determining the total number of clonal neoantigens or the ratio of

clonal to sub-clonal neoantigens in patients' cancer cells

-- Enrolled the first patient in the United States at the

Moffitt Cancer Center in the Phase I/IIa CHIRON clinical trial

-- In-licensed from Secarna Pharmaceuticals GmbH & Co

antisense oligonucleotide technology and intellectual property for

the ex vivo manufacture of a T cell pharmaceutical product

Financial Highlights

-- Cash and cash equivalents: Cash and cash equivalents were

$281.9 million as of September 30, 2021, as compared to $177.8

million as of December 31, 2020. The Company anticipates that its

cash and cash equivalents are sufficient to fund its planned

operations into the second half of 2023, including full funding of

the ongoing Phase I/IIa CHIRON and THETIS clinical trials

-- Research and development (R&D) expenses: R&D expenses

were $10.7 million for the third quarter ended September 30, 2021,

an increase of $5.4 million compared to $5.3 million for the third

quarter ended September 30, 2020. R&D expenses were $30.4

million for the nine months ended September 30, 2021, an increase

of $16.7 million compared to $13.7 million for the nine months

ended September 30, 2020. The increase was primarily driven by

increased activity related to our ongoing clinical trials and

overall R&D

-- General and administrative (G&A) expenses: G&A

expenses were $5.0 million for the third quarter ended September

30, 2021, an increase of $2.0 million compared to $3.0 million for

the third quarter ended September 30, 2020. G&A expenses were

$15.3 million for the nine months ended September 30, 2021, an

increase of $8.2 million compared to the $7.1 million for the nine

months ended September 30, 2020. The increase was primarily driven

by fees associated with the Company's public company obligations,

and an increase in headcount and related personnel costs

-- Net loss: Net loss for the third quarter ended September 30,

2021 was $12.9 million or $0.34 per share compared to $8.2 million

or $7.50 per share for the third quarter ended September 30, 2020.

Net loss for the nine months ended September 30, 2021 was $42.9

million or $1.69 per share compared to $20.3 million or $21.16 per

share for the nine months ended September 30, 2020. The decrease in

loss per share is due in part to the increased number of shares

following the conversion and issuance of shares from the IPO

Upcoming Events

Achilles will present at the following medical and investor

conferences in November and December 2021. Additional details will

be available in the Events & Presentations section of the

Company's website:

-- Society for Immunotherapy of Cancer (SITC) 36th Annual Meeting: November 10 - 14, 2021

-- Piper Sandler Annual Healthcare Conference: November 29 - December 2, 2021

-- ESMO Immuno-Oncology Congress 2021: December 8 - 11, 2021

In addition, the Company will host a live webcast and conference

call on Friday, November 12, 2021 at 8:30am ET / 1:30pm UK to

review the SITC presentations and provide a corporate update. The

live webcast can be accessed in the Events & Presentations

section of the Company's website. The conference call dial-in

numbers for investors and analysts are (833) 732-1204 (toll free

within the USA), 0800 0288438 (toll free within the United Kingdom)

or (720) 405-2169 (outside the USA) with the access code

4795875.

About Achilles Therapeutics

Achilles is a clinical-stage biopharmaceutical company

developing precision T cell therapies targeting clonal neoantigens:

protein markers unique to the individual that are expressed on the

surface of every cancer cell. The Company has two ongoing Phase

I/IIa trials, the CHIRON trial in patients with advanced non-small

cell lung cancer (NSCLC) and the THETIS trial in patients with

recurrent or metastatic melanoma . Achilles uses DNA sequencing

data from each patient, together with its proprietary PELEUS(TM)

bioinformatics platform, to identify clonal neoantigens specific to

that patient, and then develop precision T cell-based product

candidates specifically targeting those clonal neoantigens.

Forward-Looking Statements

This press release contains express or implied forward-looking

statements that are based on our management's belief and

assumptions and on information currently available to our

management. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements

relate to future events or our future operational or financial

performance, and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by these

forward-looking statements. The forward-looking statements in this

press release represent our views as of the date of this press

release. We anticipate that subsequent events and developments will

cause our views to change. However, while we may elect to update

these forward-looking statements at some point in the future, we

have no current intention of doing so except to the extent required

by applicable law.

You should therefore not rely on these forward-looking

statements as representing our views as of any date subsequent to

the date of this press release.

Further information:

Lee M. Stern - VP, IR & External Communications

+1 (332) 373-2634

l.stern@achillestx.com

Consilium Strategic Communications

Mary-Jane Elliott, Sukaina Virji, Melissa Gardiner

+44 (0) 203 709 5000

achillestx@consilium-comms.com

ACHILLES THERAPEUTICS PLC

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

September 30, December 31,

2021 2020

--------------- --------------

ASSETS

Current assets:

Cash and cash equivalents $ 281,875 $ 177,849

Prepaid expenses and other current assets 16,401 9,948

----------- ----------

Total current assets 298,276 187,797

----------- ----------

Non-current assets:

Property and equipment, net 16,378 13,369

Operating lease right of use assets 11,938 14,740

Deferred tax assets 4 4

Restricted cash 33 -

Other assets 3,370 3,008

----------- ----------

Total non-current assets 31,723 31,121

----------- ----------

TOTAL ASSETS $ 329,999 $ 218,918

=========== ==========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 2,460 $ 6,314

Income taxes payable 36 7

Accrued expenses and other liabilities 8,472 6,590

Operating lease liabilities-current 4,398 3,712

----------- ----------

Total current liabilities 15,366 16,623

Non-current liabilities:

Operating lease liabilities-non-current 8,881 12,271

Other long-term liability 643 652

----------- ----------

Total non-current liabilities 9,524 12,923

----------- ----------

Total liabilities 24,890 29,546

----------- ----------

Commitments and contingencies (Note 12)

Shareholders' equity:

Ordinary shares, GBP0.001 par value; 40,603,489 and 4,389,920 shares

authorized, issued and outstanding at September 30, 2021 and December

31, 2020, respectively 54 6

Deferred shares, GBP92,451.851 par value, one share authorized, issued and

outstanding at September 30, 2021; Deferred shares, GBP0.001 par value;

30,521 shares issued and outstanding December 31, 2020 128 -

Convertible preferred shares, GBP0.001 par value; no shares authorized,

issued and outstanding as of September 30, 2021;104,854,673 shares

authorized, issued and outstanding at December 31, 2020 - 134

Additional paid in capital 400,058 234,922

Accumulated other comprehensive income 5,750 12,322

Accumulated deficit (100,881) (58,012)

----------- ----------

Total shareholders' equity 305,109 189,372

----------- ----------

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 329,999 $ 218,918

=========== ==========

(expressed in U.S. Dollars, unless otherwise stated)

ACHILLES THERAPEUTICS PLC

Condensed Consolidated Statements of Operations and

Comprehensive Loss (Unaudited)

(in thousands, except share and per share amounts)

Three Months Ended September 30, Nine Months Ended September 30,

------------------------------------ -------------------------------------

2021 2020 2021 2020

------------------- -------------- -------------------- -----------

OPERATING EXPENSES:

Research and

development $ 10,697 $ 5,291 $ 30,417 $ 13,668

General and

administrative 5,041 3,009 15,318 7,140

--------------- ------------- ---------------- ----------

Total operating

expenses 15,738 8,300 45,735 20,808

--------------- ------------- ---------------- ----------

Loss from operations (15,738) (8,300) (45,735) (20,808)

OTHER INCOME, NET:

Other income 2,806 90 2,907 529

--------------- ------------- ---------------- ----------

Total other

income, net 2,806 90 2,907 529

--------------- ------------- ---------------- ----------

Loss before provision

for income taxes (12,932) (8,210) (42,828) (20,279)

Provision for

income taxes (16) - (41) -

--------------- ------------- ---------------- ----------

Net loss (12,948) (8,210) (42,869) (20,279)

--------------- ------------- ---------------- ----------

Other comprehensive

income:

Foreign exchange

translation

adjustment (7,710) 3,501 (6,572) (3,088)

--------------- ------------- ---------------- ----------

Comprehensive loss $ (20,658) $ (4,709) $ (49,441) $ (23,367)

--------------- ------------- ---------------- ----------

Net loss per share

attributable to

ordinary

shareholders-basic

and diluted $ (0.34) $ (7.50) $ (1.69) $ (21.16)

=============== ============= ================ ==========

Weighted average

ordinary shares

outstanding-basic

and diluted 38,261,480 1,094,543 25,329,672 958,373

=============== ============= ================ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFFVLDLAIIL

(END) Dow Jones Newswires

November 09, 2021 08:31 ET (13:31 GMT)

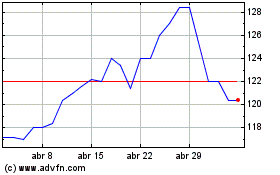

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024