TIDMSYNC

RNS Number : 7758T

Syncona Limited

29 November 2021

Syncona Limited

Syncona co-leads Series B financing in Quell Therapeutics of up

to $156 million

29 November 2021

-- Syncona co-leads Quell's Series B financing of up to $156

million (GBP117 million [1] ), committing $25 million (GBP19

million), with the remainder raised from global specialist

investors

-- Syncona's holding in Quell written up by GBP19 million (3p

per share); 41 per cent uplift to the previous holding value of

GBP45 million [2]

-- Syncona holding value now of GBP74 million following first

tranche investment of $14 million (GBP10 million); on drawdown of

the full Series B financing, Syncona's ownership stake in the

business will be 37 per cent [3]

Syncona Ltd, a leading healthcare company focused on founding,

building and funding global leaders in life science, today

announces that it has committed $25 million (GBP19 million) to

Quell Therapeutics ("Quell"), a world leader in developing

engineered T-regulatory (Treg) cell therapies for serious medical

conditions driven by the immune system, in an up to $156 million

(GBP 117 million) Series B financing. Syncona co-led the financing

round alongside specialist global institutional investors Jeito

Capital, Ridgeback Capital Investments, SV Health Investors and

Fidelity Management & Research Company LLC, which also brought

in investment from Future Fund: Breakthrough managed by British

Patient Capital, amongst others. Following the Series B financing

Syncona has revalued its existing investment, which has resulted in

an GBP 19 million uplift (3p per Syncona share) to Syncona's

holding value of Quell.

Including the drawdown of the first tranche of Syncona's Series

B investment of $ 14 million (GBP10 million) , Syncona's holding

value of Quell is now GBP74 million. On drawdown of the full Series

B financing, Syncona's ownership stake in Quell will be 37 per

cent.

Quell is developing engineered Treg cell therapies, seeking to

harness the suppressive capacity of Tregs by leveraging their

potential to downregulate the immune system, to treat a range of

applications, the first of which will be in solid organ

transplantation. Quell is currently preparing for one of the first

ever clinical trials of an engineered Treg cell therapy with its

lead candidate QEL-001, designed to prevent organ rejection in

liver transplant patients. This Phase I/II clinical trial, known as

LIBERATE, is on track to initiate in Q1 CY2022.

The Series B financing brings Quell to up to $219 million

(GBP163 million) of total funding to date. Proceeds are expected to

continue to fund Quell's early clinical development of its QEL-001

programme in liver transplantation as well as advance its pipeline

elsewhere in its core therapeutic areas of transplantation,

neuroinflammatory diseases (including amyotrophic lateral

sclerosis) and autoimmune diseases (including Type 1 diabetes).

Additionally, the funding will enhance Quell's autologous

engineered Treg platform and enable it to develop an allogeneic

CAR-Treg platform, as well as allowing it to continue the

development of its manufacturing footprint.

Martin Murphy, Chief Executive Officer of Syncona Investment

Management Limited, said: "In 2019, Syncona co-founded Quell,

bringing together pioneering science from leading UK and European

universities, with the ambition to develop first-in-class therapies

in the ground-breaking Treg field offering the potential to make a

real difference to the lives of patients. Since then, the progress

made by the Quell team, led by Iain McGill, is remarkable. The

business has moved from concept-to-clinic in under three years.

"This financing underlines the progress the company has made to

date and the scale of its ambition. Supported by a strong syndicate

of global investors, the business will be able to progress its lead

program and pipeline, whilst building scalable manufacturing

capabilities, as it seeks to entrench its leadership position in an

emerging field of innovative medicine."

Ian McGill, Chief Executive Officer of Quell Therapeutics, said:

"Quell is at the forefront of a new wave of cell therapy. We are

leading the way with our highly differentiated, multi-modular

approach to Treg therapy engineering and production.

"We are proud to have the support of this premiere syndicate of

investors as we drive forward to our next stage of growth. With

this financing, we have the full suite of capabilities - capital,

cutting-edge science, and a world-class team - to advance our

pipeline and platform to key milestones on our path ultimately to

deliver potentially transformative therapies to patients suffering

from the disease of immune dysregulation."

[ENDS]

Copies of this press release and other corporate information can

be found on the company website at: www.synconaltd.com

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

Enquiries

Syncona Ltd

Annabel Clay / Fergus Witt

Tel: +44 (0) 20 3981 7940

FTI Consulting

Ben Atwell / Natalie Garland-Collins / Tim Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by founding and building companies to deliver

transformational treatments to patients in areas of high unmet

need.

Our strategy is to found, build and fund companies around

exceptional science to create a diversified portfolio of 15-20

globally leading healthcare businesses for the benefit of all our

stakeholders. We focus on developing treatments for patients by

working in close partnership with world-class academic founders and

management teams. Our balance sheet underpins our strategy enabling

us to take a long-term view as we look to improve the lives of

patients with no or poor treatment options, build sustainable life

science companies and deliver strong risk-adjusted returns to

shareholders.

About Quell Therapeutics

Quell Therapeutics is the world leader in developing engineered

T-regulatory (Treg) cell therapies that aim to harness, direct and

optimize their immune suppressive properties to address serious

medical conditions driven by the immune system.

The Company is leveraging its pioneering phenotype lock

technology, unique multi-modular platform and integrated

manufacturing capabilities to design and develop a pipeline of

highly engineered Treg cell therapies with greater potential for

persistence, potency and stability than earlier generations of Treg

cell therapy approaches.

Quell's lead candidate QEL-001 is being developed to induce

operational tolerance following liver transplantation, with the

potential to protect the post-transplant liver without the need for

chronic immunosuppressive medications. Quell is also advancing

additional programs in neuroinflammatory and autoimmune diseases.

www.quell-tx.com.

[1] FX rates at 22 November 2021

[2] As of 30 September 2021

[3] Percentage holding reflects Syncona's ownership stake at the

point full current commitments are invested on a fully-diluted

basis

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUBFBATMTMTBMB

(END) Dow Jones Newswires

November 29, 2021 02:00 ET (07:00 GMT)

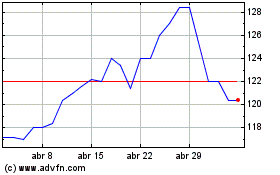

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024