TIDMTRG

RNS Number : 0145P

TR European Growth Trust PLC

14 October 2021

Legal Entity Identifier: 213800N1B1HCQG2W4V90

TR EUROPEAN GROWTH TRUST PLC

Financial results for the year ended 30 June 2021

This announcement contains regulated information

Investment Objective

The Company seeks capital growth by investing in smaller and medium

sized companies which are quoted, domiciled, listed or have operations

in Europe (ex UK).

Highlights

* Net asset value total return(1) per ordinary share of

63.5% compared to a total return from the

benchmark(2) of 36.5%

* Share price total return(3) per ordinary share of

79.5%

* Total dividend(4) of 25.00p for the year, an increase

of 13.6%

Total return performance to 30 June 2021

(including dividends reinvested and excluding transaction costs)

1 year 3 years 5 years 10 years

% % % %

------------------------------ --------- --------- --------- ----------

NAV(1) 63.5 56.1 143.8 279.1

Benchmark(2) 36.5 37.9 100.0 182.0

Average sector(5) NAV 46.7 52.3 125.3 248.1

Share price(3) 79.5 56.8 166.2 320.5

Average sector(5) share

price 55.0 52.9 146.0 290.9

------------------------------ --------- --------- --------- ----------

Financial highlights

At 30 June 2021 At 30 June 2020

-------------------------------------- ---------------- ----------------

Shareholders' funds

Net assets (GBP'000) 840,667 523,374

NAV per ordinary share 1,677.70p 1,044.48p

Share price 1,485.00p 844.00p

Year ended Year ended

30 June 2021 30 June 2020

Profit for year

Net revenue profit (GBP'000) 10,390 6,954

Net capital profit/(loss) (GBP'000) 6,571

318,127

------------ ------------

Profit/(loss) for the year 328,517 13,525

======= =======

Total return per ordinary share

Revenue 20.74p 13.88p

Capital 634.88p 13.11p

------------- -------------

Total return per ordinary share 655.62p 26.99p

======= =======

Ongoing charge (6) 0.71% 0.73%

-------------------------------------- ---------------- ----------------

1. Net asset value total return per ordinary share with income reinvested

2. Euromoney Smaller European Companies (ex UK) Index expressed in Sterling

3. Share price total return including dividends reinvested and using mid-market price

4. Includes the interim dividend paid on 23 April 2021 and final

dividend recommended to shareholders for approval

5. The sector is the AIC European Smaller Companies sector

6. Calculated using the methodology prescribed by the Association of Investment Companies

Sources: Morningstar Direct, Janus Henderson, Refinitiv

Datastream

Chairman's Statement

Performance

Our Company has had a good year. The NAV total return per ordinary

share was 63.5%, an outperformance against the benchmark of 27.0%,

with a share price total return per ordinary share of 79.5%.

Our Fund Manager's long-held approach of finding high quality and

growing businesses in which to invest, but also being valuation aware,

was a key driver of performance over the year. The consistency of

this approach throughout the market volatility that was caused by

the Covid-19 pandemic, laid sound foundations for excellent performance

through the recovery.

The revenue generated by the portfolio rose from GBP9.1m for the year

ended 30 June 2020 to GBP13.5m for the year ended 30 June 2021, despite

the European Central Bank continuing to restrict dividend payments

from financial services companies. This restriction was lifted in

October 2020, but investee companies must continue to seek consent

from their respective central banks prior to making dividend payments.

Dividend

Following this performance, the Board is proposing a final dividend

of 16.80p to shareholders at the annual general meeting later this

year. Together with the interim dividend of 8.20p this brings the

total dividend for the year to 25.00p, being an increase of 13.6%

on the prior year total dividend.

If approved, the dividend will be paid on 3 December 2021, to shareholders

on the register on 22 October 2021.

Strategic review

The Board has devoted considerable time this year to carrying out

a strategic review of the Company's investment objective, operations

and positioning in the market. Without any doubt, the review concluded

that the investment objective and policy continued to meet investors'

demands and the Fund Manager's approach to investing was well suited

to the objective and the long-term nature of the Company.

However, the review did highlight that more could be done to improve

the Company's positioning in relation to the retail investor market.

To that end, the Board has decided to make a number of changes which

we gauge will assist our marketing teams in bringing the Company's

investment proposition to the attention of this growing section of

the market. The first of these changes is to rename the Company The

European Smaller Companies Trust PLC. The purpose of doing so is to

make the Company's investment proposition immediately clear to potential

investors. The second change, is to implement an 8:1 share split which

will improve the liquidity of the Company's shares and enhance the

ability of investors to make more efficient regular monthly investments

on share dealing platforms. The third change, reduces the management

fee from 0.6% of net assets up to GBP500m and 0.5% thereafter, to

0.55% of net assets up to GBP800m and 0.45% thereafter.

With this combination of changes, we aim to increase demand for the

Company's shares which will, in turn, narrow the discount achieving

a better alignment of the share price and NAV, and therefore be of

benefit to all shareholders.

As a matter of operational efficiency, we will also replace the benchmark,

currently the Euromoney Smaller European Companies (ex UK) Index with

the MSCI Europe ex UK Small Cap Index. Our risk assessment of the

two indices has indicated that the change is immaterial and the Fund

Manager has confirmed it will have no impact on his investment approach.

The change will, though, better align the Company with its peers and

improve the quality of the data available to the fund management team

on a day-to-day basis. This change will only become effective from

1 July 2022 and will not be retrospectively applied to any fee calculations.

The Company's Investment Policy will update in line with the change

in benchmark from this date.

Succession planning

When I last provided an update to you on our succession planning,

I explained that the Board had asked Andrew Martin Smith to remain

as a director for a further year as the Covid-19 pandemic continued

to wreak havoc on global economies. We wished to retain his knowledge

and experience of the closed end sector as governments and companies

navigated their way out of the crisis.

We took stock of the prevailing market conditions when we recently

reviewed our succession planning and I can now report that Andrew

will be retiring from the Board at the conclusion of the upcoming

annual general meeting. I would like to thank Andrew sincerely for

his guidance and wisdom. Throughout his time serving our Company,

he has made a very significant contribution to important discussions

on the Company's performance and the options available. His diligence

and thoughtful challenge to the approach taken by the Fund Manager,

and Janus Henderson Investors in their wider delivery of services

to the Company, has been extremely valuable.

Looking further forward, I can also let you know that Alexander Mettenheimer

has indicated his intention to retire from the Board at the annual

general meeting due to be held in 2022. We will, of course, review

these plans next year and report in more detail to you in due course.

Senior Independent Director

We were pleased to announce the appointment of Simona Heidempergher

as the Company's senior independent director with effect from 26 July

2021.

She has a great wealth of asset management experience and is very

familiar with the Company's portfolio. In addition, she brings, as

do all of our European-based directors, insight into the prevailing

sentiment in European markets.

Annual General Meeting

The Company's 31st Annual General Meeting is due to be held on Monday,

29 November 2021 and, Covid-19 restrictions permitting, we look forward

to being able to report to our shareholders in person. The meeting

will be held at the offices of our investment manager, Janus Henderson

Investors, at 201 Bishopsgate, London, EC2M 3AE with proceedings commencing

at 12.30 pm. As is our usual practice, voting will take place on a

show of hands for those physically present at the meeting.

A copy of the Company's Notice of Meeting has been included with this

annual report. We are proposing a number of additional resolutions

for shareholder consideration this year which include the share split

which I have already mentioned, and the adoption of new articles of

association to facilitate the share split, as well as afford us the

opportunity to bring them in line with current best practice.

For any shareholders unable to attend, we will be offering you the

opportunity to join using the video conferencing software, Zoom. Due

to technological restrictions, we are unable to offer voting to those

attending via Zoom and therefore encourage all shareholders, particularly

those who will not be present in person, to submit their votes by

proxy ahead of the deadline to ensure their vote is taken into account.

Outlook

Equity markets and the Company more specifically have had an excellent

year as economies bounced back from the darkest days of the Covid-19

pandemic. Our Fund Manager's investment approach - which emphasises

the importance of valuation discipline in addition to seeking future

growth - has been very beneficial, particularly when the vaccine roll

out seemed to have delivered some semblance of normality. Over the

summer, concern over Covid-19 variants and a belief that inflation

is merely transitory, led to a fall in bond yields. This resulted

in high multiple growth stocks providing market leadership again,

leading to disappointing performance by the Company.

A global backdrop of increasing GDP and a pick-up in corporate earnings

is supportive for European smaller companies. The Fund Manager and

I would caution that, as growth inevitably slows post the Covid-19

recovery and the Central Bank liquidity fuelled re-rating wanes, it

would be reasonable to expect more modest returns in the medium term.

With the backdrop outlined above and, we think, the heightened risk

of inflation in the coming years, we believe the days of stocks trading

on ever-higher valuation multiples, justified by no inflation and

low bond yields, are coming to an end. Therefore, we remain supportive

of our Fund Manager's valuation approach.

The fund management team believes that the growth opportunities offered

in the European smaller company space - in areas such as energy transition,

companies like Nexans and Friedrich Vorwerk - means that the asset

class remains a very attractive investment area with the opportunity

to uncover good investments in the years ahead.

Christopher Casey

Chairman

13 October 2021

FUND MANAGER'S REPORT

Introduction

The financial year ending 30 June 2021 was a period of strong performance

for the Company, which generated a total return of 63.5% compared

to the benchmark of 36.5%. During this time, a number of very effective

vaccines to protect against Covid-19 were produced and, after some

initial missteps, efficiently distributed throughout much of the developed

world. This offered a pathway out of the pandemic and prompted considerable

market optimism. Meanwhile, unprecedented global monetary and fiscal

stimulus in response to the pandemic globally, raised concerns around

inflation and rising interest rates for the first time since the global

financial crisis of 2009. As a result, the market was subjected to

a substantial rotation away from growth and into value stocks. Our

strategy's strong valuation discipline proved to be an important protection

during this period.

Over the period, we noted a change in sentiment towards Europe from

an investment perspective. In the US, the election of President Biden

incited drama as the result was contested by the outgoing Trump administration.

Despite this, the change in regime seems to have ushered in a slightly

calmer style of government and the former President's Twitter account

no longer serves as a source of market volatility in Europe. The development

of mRNA vaccines for Covid-19, highlighted ingenuity in the European

technology sector. Important steps were taken to create a fiscal capacity

for the European Union and a more coherent banking sector and significant

heat was taken out of the soap opera that was the Brexit saga. All

this combined to alter the widespread prejudice that Europe was a

region that could be ignored by investors.

The more constructive attitude to Europe was combined with an enormous

amount of capital market activity. With the huge number of initial

public offerings ('IPOs') taking place over the course of the year,

we were able to add some solid businesses to the portfolio as a result

of the IPO wave. We saw an increase in mergers and acquisitions activity,

with many companies being acquired by private equity. It is interesting

to note that the companies being acquired by private equity are cash

generating and the companies being sold are often high growth and

cash consumptive.

The Portfolio

The strategy is to blend a mix of early stage growth stocks with sensibly

priced high return structural growth stocks, undervalued cash generative

mature names and self-help turnaround stocks. We care intensely about

the price that we pay for the cash generated by a company, and while

we do not manage a 'value fund', we are acutely valuation aware. Valuation

discipline has not been in vogue for most of the last decade, but

proved its worth in the last financial year. Our inclusion of early

stage high growth names helped the Company in the previous year as

many of those stocks found their growth to be turbocharged by Covid-19.

This year, the inclusion of self-help turnaround stories and more

cyclical value names benefited the performance of the portfolio.

Notable turnaround additions to the portfolio over the period include

Swiss-listed specialist manufacturer of highly engineered aerospace

parts, Montana Aerospace. The company listed in May 2021 to repair

its balance sheet and finance acquisitive growth. It has a strong

skillset in creating lightweight parts to improve the environmental

impact of air travel and we believe it will benefit as global travel

begins to re-open. We opened a position in French mail related conglomerate

Quadient. The core of the business is a letter franking machine business

that is in decline, but which offers customer relationships that have

been leveraged into digital communication software and a parcel locker

business. The company has been through a big transformation that the

stock market has not yet fully appreciated and we hope for a substantial

rerating in due course.

Additions to the early stage growth names include German listed electronic

systems and solutions designer, Katek. The company operates with blue

chip customers; one example is designing a mobile charging solution

for the electric Porsche Taycan. Another early stage German business

is Apontis Pharma, whose business is to combine multiple off-patent

pharmaceuticals to create 'single pills' which have far superior compliance

outcomes from patients who require multiple medicines.

In the sensibly priced high return structural growth area, we added

names such as Irish-listed Uniphar, a provider of pharmaceutical and

medtech services. We invested in German energy infrastructure engineer,

Friedrich Vorwerk, a company that is at the forefront of the green

energy transition. We added mature businesses such as German communication

equipment manufacturer Adva Optical Networking, and Swedish-listed

aluminium manufacturer Granges, which has exciting exposures to structural

growth trends such as electric vehicles and heating, ventilation and

air conditioning.

Performance attribution

There were dramatic price moves in some stocks over the course of

the financial year ending June 2021, and the Company benefited from

owning a handful of stocks that exhibited substantial price increases

in that time. German online retailer of furniture and decorative items,

Westwing, increased by 535.7% over the course of the year, contributing

a helpful sum to performance. Similarly, French commerce and marketing

technology company Criteo increased 297.5% over the course of the

year as the extremely cheap valuation unwound with the advent of a

new CEO and the urgent need for businesses to get online during the

pandemic. Dutch bank and wealth manager Van Lanschot increased 66.0%

in the period.

Detractors from performance included German pharmaceutical distributor,

Medios, which struggled to obtain sufficient drug supply due to the

pandemic. We felt that valuation was stretched and decided to exit

the position. Norwegian electricity distributor, Fjordkraft, suffered

as rising spot electricity prices squeezed the profitability of their

semi-fixed price electricity contracts. Finally, Norwegian harvester

and producer of krill oil, Aker Biomarine, delivered lacklustre performance

due to a poor krill harvest and weak sales of oil in South Korea.

Geographical and sector distribution

The investment process is fundamentally one of bottom-up stock picking

rather than allocating capital to specific sectors or geographies,

although we carefully monitor the overall structure of the portfolio

to avoid risky concentrations. We do not use the benchmark as a guide

to structure and are content to run the portfolio with substantial

divergence from the benchmark.

At a geographical level, the Company is substantially overweight to

Germany where we continue to find a good mix of sensibly valued companies

and strong growth prospects. In Germany we have added names such as

online bicycle and accessories retailer, Bike24, and windfarm developer

EnergieKontor. Other overweight countries include France, the Netherlands

and Ireland. We have added global financial advisory specialist, Rothschild

& Co as well as omnichannel electronics retailer FNAC Darty in France.

Meanwhile, the Company is underweight in Switzerland, Austria and

Sweden where we perceive the markets to be populated with relatively

expensive shares.

At a sector level we are overweight in the industrials, financials

and consumer goods sectors, and underweight in the real estate and

health care sectors. In the industrials space, we have added German

supplier of laser-based processing tools LPKF Laser & Electronics,

as we believe the company's technology in thin film solar modules

will increase in uptake. In financials we have added Irish bank, AIB,

where we believe a combination of cost cutting plans and a far more

consolidated market will benefit the company. Finally, we added Danish

housebuilder, HusCompagniet, within the consumer goods sector.

Other purchases

We added Swedish listed Media and Games Invest that publishes video

games and provides marketing services to the wider industry. We see

both legs of the business having strong synergy benefits from consolidating

their respective areas of focus. We added Grenergy Renovables, a Spanish

listed renewable energy developer that operates in Western Europe

and South America. The energy transition is driving a huge demand

for renewable energy, which presents a structural growth tailwind

for this company.

Other disposals

We exited French semiconductor material producer SOITEC having originally

invested as a turnaround idea. The company makes silicon-on-insulator,

a very power-efficient semiconductor material that is included in

a range of 5G applications. The shares had seen a dramatic rerating,

but we had concerns that the company may need to invest substantial

capital expenditure and that the increasing capitalised development

cost was flattening profitability.

We exited our position in Swiss-listed online pharmacy Zur Rose, whose

shares had performed very strongly after the pandemic boosted online

business models, before becoming quite fully valued. We had reservations

that the balance sheet looked stretched given the business is loss-making

and that the history of substantial mergers and acquisitions might

create some digestion issues. We exited our holding in German manufacturer

of patent free pharmaceuticals and medical devices, Dermapharm, which

has been a very profitable investment for the Company. After the company

became involved in manufacturing the BioNtech-Pfizer vaccine the shares

attained an expensive multiple and we decided to take profit.

Currency

The Company is denominated in Sterling, while investing in largely

Euro-denominated assets. We do not hedge this currency exposure.

Outlook

It has become apparent that Covid-19 is unlikely to be entirely eradicated

and that society will need to cope with yet another endemic virus

forevermore. The advent of multiple vaccines with such high levels

of efficacy is a tribute to European science and technology. This

offers a route towards something that will seem a lot like normality.

The advent of the incredibly transmissible Delta variant seems to

suggest that those who don't get vaccinated will acquire immunity

through infection. This may well cause problems in the final few months

of 2021 as health care systems in the US and some European countries

may be stretched. The reappearance of Covid-19 in China may cause

further disruption with new lockdowns.

We believe that the policy environment in the US and Europe remains

constructive. Monetary policy is relatively loose and fiscal policy,

especially in the US, is expansionary. There are notes of caution

to be had from the Chinese clamp down on technology companies and

efforts to suppress inflation given European smaller companies are

largely driven by global growth.

Political leadership in Europe has changed with the retirement of

Angela Merkel. A French Presidential election will no doubt be presented

as the usual drama in certain parts of the media while cultural tensions

between the European Commission and Eastern states such as Poland

and Hungary will likely persist. However, the direction of travel

on many of the structural issues within the European Union and the

Eurozone are moving in the right direction, specifically around fiscal

powers and banking union.

Europe is one of the principal drivers of the environmental agenda

and we are fortunate in our area of investment focus to be naturally

bestowed with companies with strong environmental, social and governance

('ESG') characteristics. However, smaller companies are often less

focused on presenting what they do in these areas, and more focused

on the operations of their business. This leaves our market laden

with hidden ESG. We have considerable exposure to companies that can

easily benefit from the premium attached to ESG companies once they

improve the presentation of their activities. The energy transition

is going to be a big factor in the investment world for some time

to come, with a shift away from fossil fuels and the internal combustion

engine. Significant capital expenditure and research and development

will be required and disruptive smaller companies are well placed

to take advantage of this shift.

Over the summer the consensual view was that the inflation in the

global system was transitory. This led to falling bond yields and

a period of disappointing performance for the Company, as high multiple

growth stocks outperformed. However, we remain of the view that the

prospect of inflation is not adequately reflected in market prices.

The rising oil price and the recent surge in the gas price may be

a harbinger of this. The expansionary policy environment, bottlenecks

in global supply chains and the constraints imposed by Covid-19 are

creating inflationary pressures that may be with us longer than many

assume. Shortages in the shipping market are coupled with uncertainty

as to what the environmental fuel standards mean for investment decisions.

Freight costs are unlikely to reduce much in such an environment.

Near-shoring in Europe and the US appears to be an increasing theme

as a result. All of this abates some of the disinflationary pressure

we have seen in recent decades.

After the strong economic recovery following the nadir of the Covid-19

crisis, it is hard to argue that the markets look cheap. There is

a very noticeable bifurcation of the market into a subset of incredibly

expensive growth stocks and a long tail of more reasonably priced

companies. As managers, we have been trying to recycle capital from

the expensive into the attractively priced, aiming to find the next

stock that will be perceived as a market darling. While the market

in general is skewed by the tail of expensive stocks, we feel that

the multiples paid on the broader portfolio remain attractive. There

continues to be a large number of neglected opportunities for us to

pursue and we believe we can continue to deliver value for our shareholders.

Ollie Beckett, Rory Stokes and Julia Scheufler

13 October 2021

Geographic exposure at 30 June 2021 (% of

portfolio excluding cash)

-----------------------------------------------

2021 2020

% %

----------------------- ---------- ----------

Austria 0.9 0.7

Belgium 4.9 4.3

Denmark 2.5 2.3

Finland 3.7 5.0

France 12.1 13.6

Germany 24.3 22.4

Greece 1.5 0.6

Ireland 4.4 1.5

Italy 8.1 10.6

Malta 1.5 -

Netherlands 7.6 9.1

Norway 3.8 3.5

Portugal 1.5 1.6

Spain 4.2 2.6

Sweden 11.9 12.0

Switzerland 7.1 10.2

---------- ----------

100.0 100.0

Sector exposure at 30 June 2021 (% of portfolio

excluding cash)

-----------------------------------------------------

2021 2020

% %

--------------------------------- -------- --------

Industrial 33.3 32.4

Consumer Discretionary 25.1 18.7

Financials 12.5 13.5

Technology 11.4 13.9

Utilities 4.4 2.6

Consumer Staples 4.0 4.8

Health Care 3.4 7.1

Energy 2.4 2.3

Telecommunications 1.3 0.8

Basic materials 1.1 2.5

Real Estate 1.1 1.4

100.0 100.0

-------- --------

MANAGING risks

Investing, by its nature, carries inherent risk. The Board, with the

assistance of the Manager, carries out a robust assessment of the

principal and emerging risks and uncertainties facing the Company

which could threaten the business model and future performance, solvency

and liquidity of the portfolio. A matrix of these risks, along with

the steps taken to mitigate them, is maintained and is kept under

regular review. The mitigating measures include a schedule of investment

limits and restrictions within which the Manager must operate.

Our assessment includes consideration of the possibility of severe

market disruption, which this year, focused on the ongoing impact

of the Covid-19 pandemic and Europe's ability to continue economic

activity. The principal risks which have been identified and the steps

we have taken to mitigate these are set out in the below. We do not

consider these risks to have changed during the period.

* Investment strategy and objective

The investment objective or policy is not appropriate in the prevailing

market or sought by investors, leading to a wide discount and hostile

shareholders.

Poor investment performance over an extended period of time, driven

by either external (political, financial shock, pandemic) or internal

factors (poor stock selection), leading to shareholders voting to

wind up the Company.

The Manager periodically reviews the Investment Objective and Policy

in line with best practice and taking account of investor appetites.

The Board receives regular updates on professional and retail investor

activity from the Manager, and reports from the corporate broker,

to inform themselves of investor sentiment and how the Company is

perceived in the market.

The Board reviews the Key Performance Indicators ('KPIs') at each

meeting and the Fund Manager maintains a diversified portfolio with

a view to spreading risk.

* Operational

Failure of, disruption to or inadequate service levels provided by

principal third-party service providers leading to a loss of shareholder

value or reputational damage.

The Board engages reputable third-party service providers and formally

evaluates their performance, and terms of appointment, at least annually.

The Audit Committee assesses the effectiveness of internal controls

in place at the Company's key third-party services providers through

review of their ISAE 3402 reports, quarterly internal control reports

from the Manager and monthly reporting on compliance with the investment

limits and restrictions established by the Board.

* Legal and regulatory

Loss of investment trust status, breach of the Companies Act 2006,

Listing Rules, Prospectus and/or Disclosure Guidance and Transparency

Rules or the Alternative Fund Managers Directive and/or legal action

brought against the Company and/or directors and/or the investment

manager leading to decrease in shareholder value and reputational

damage.

The Board engages reputable third-party service providers and formally

evaluates their performance, and terms of appointment, at least annually.

The Audit Committee assesses the effectiveness of internal controls

in place at the Company's key third-party service providers through

review of their ISAE 3402 reports and, in respect of the Manager's

investment trust operations, reporting from the Manager's internal

audit function. The Manager's Compliance function has reporting obligations

under AIFMD, with any non-compliance being captured in the Manager's

quarterly internal control reporting to the Board.

* Financial

Market, liquidity and/or credit risk, inappropriate valuation of assets

or poor capital management leading to a loss of shareholder value.

The Board determines the investment parameters and monitors compliance

with these at each meeting. The directors review the portfolio liquidity

at each meeting and periodically consider the appropriateness of hedging

the portfolio against currency risk.

The Board reviews the portfolio valuation at each meeting.

Investment transactions are carried out by a large number of approved

brokers whose credit standard is periodically reviewed and limits

are set on the amount that may be due from any one broker, cash is

only held with the depositary/custodian or reputable banks.

The Board monitors the broad structure of the Company's capital including

the need to buy back or allot ordinary shares and the extent to which

revenue in excess of that which is required to be distributed, should

be retained.

Assessing our viability

In keeping with provisions of the Code of Corporate Governance issued

by the Association of Investment Companies (the 'AIC Code'), the Board

has assessed the prospects of the Company over a period longer than

the 12 months required by the going concern provision.

We consider the Company's viability over a three-year period as we

believe this is a reasonable timeframe reflecting the longer-term

investment horizion for the portfolio, but acknowledges the inherent

shorter term uncertainties in equity markets.

As part of the assessment, we have considered the Company's financial

position, as well as its ability to liquidate the portfolio and meet

expenses as they fall due. The following aspects formed part of our

assessment:

* the purpose of the Company continued to be focussed

on long-term returns;

* a robust assessment of the principal risks and

uncertainties facing the Company had been undertaken

and no materially adverse issues had been identified;

* the nature of the portfolio remained diverse and

comprised a wide range of stocks which are traded on

major international exchanges meaning that, in normal

market conditions, three quarters of the portfolio

could be liquidated in ten days;

* the closed end nature of the Company which does not

need to account for redemptions;

* the level of the Company's revenue reserves and

banking facility;

* the expenses incurred by the Company, which are

predictable and modest in comparison with the assets

and the fact that there are no capital commitments

currently foreseen which would alter that position;

and

* the next continuation vote for the Company which will

take place at the annual general meeting in 2022 and

its performance against objectives leading up to

this.

As a matter of routine business, shareholders have the opportunity

to wind up the Company every three years. In the past, this resolution

has readily been passed with the support of the majority of shareholders.

The Board supports the continuation of the Company as it offers investors

a unique exposure to small and medium sized European companies and

has a reasonable expectation that similar resolutions will attract

shareholder support in future. However, if such a resolution was not

passed, the directors would follow the provisions in the Company's

articles relating to the winding up of the assets.

Based on the results of the viability assessment, we have a reasonable

expectation that the Company will be able to continue its operations

and meet its expenses and liabilities as they fall due for our assessment

period of three years. We will revisit this assessment annually and

provide shareholders with an update on our view in the annual report.

Related party transactions

The Company's transactions with related parties in the year were with

the directors and the Manager, Janus Henderson.

There have been no material transactions between the Company and its

directors during the year. The only amounts paid to them were in respect

of expenses and remuneration for which there were no outstanding amounts

payable at the year end.

As a matter of operational efficiency, the Company will replace its

current benchmark, the Euromoney Smaller European Companies (ex UK)

Index with the MSCI Europe ex UK Small Cap Index. The change will

improve the quality of the benchmark data available to the fund management

team on a day-to-day basis and aligns the benchmark with a number

of the Company's peers. The change will become effective from 1 July

2022, the start of the next financial year. This change in the benchmark

index will have an indirect impact on the Company's investment policy,

which is managed by reference to the benchmark, and performance fees

payable by the Company to the Manager, as such fees are determined

based on performance relative to the benchmark.

The Company and the Manager have entered into an agreement to reflect

the change in the benchmark in connection with the calculation of

the performance fee with effect from 1 July 2022. The performance

relative to the benchmark for years prior to 1 July 2022 for the purposes

of the calculation of any performance fees (which is calculated on

a three-year rolling basis), shall remain unchanged and will continue

to be calculated relative to the Euromoney Smaller European (ex UK)

Index.

The agreement is considered a smaller related party transaction for

the purposes of Listing Rule 11.1.10R.

In relation to the provision of services by the Manager, other than

fees payable by the Company in the ordinary course of business and

the provision of marketing activities, there have been no material

transactions affecting the financial position of the Company during

the year under review. More details on transactions with the Manager,

including amounts outstanding at the year end, are given in note 21

on page 70 of the annual report.

Directors' responsibility STATEMENTS

Each of the directors confirms that, to the best of his or her knowledge:

* the financial statements prepared in accordance with

International Accounting Standards in conformity with

the requirements of the Companies Act 2006 give a

true and fair view of the assets, liabilities,

financial position and profit and loss of the issuer

and the undertakings included in the consolidation

taken as a whole; and

* the Strategic Report includes a fair review of the

development and performance of the business and the

position of the Company, together with a description

of the principal risks and uncertainties that it

faces.

For and on behalf of the Board

Daniel Burgess

Director

13 October 2021

Statement of Comprehensive Income

Year ended 30 June 2021 Year ended 30 June 2020

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- ---------- ----------- --------- ---------- -----------

Investment income 13,475 - 13,475 9,123 - 9,123

Other income - - - 1 - 1

Gains on investments held

at fair value through profit

or loss - 326,600 326,600 - 9,464 9,464

--------- ---------- ----------- --------- ---------- -----------

Total income 13,475 326,600 340,075 9,124 9,464 18,588

Expenses

Management and performance

fee (826) (7,853) (8,679) (582) (2,329) (2,911)

Other operating expenses (720) - (720) (716) - (716)

--------- ---------- ---------- --------- ---------- ----------

Profit before finance costs

and taxation 11,929 318,747 330,676 7,826 7,135 14,961

Finance costs (155) (620) (775) (141) (564) (705)

--------- -------- --------- --------- -------- ---------

Profit before taxation 11,774 318,127 329,901 7,685 6,571 14,256

Taxation (1,384) - (1,384) (731) - (731)

--------- --------- ---------- --------- --------- ----------

Profit for the year and

total comprehensive income 10,390 318,127 328,517 6,954 6,571 13,525

====== ======= ======= ====== ======= =======

Return per ordinary share

- basic and diluted 20.73p 634.88p 655.61p 13.88p 13.11p 26.99p

====== ======== ======= ====== ======== =======

The total column of this statement represents the Statement of Comprehensive

Income, prepared in accordance with International Accounting Standards

in conformity with the requirements of the Companies Act 2006.

The revenue return and capital return columns are supplementary to

this and are prepared under guidance published by the Association

of Investment Companies.

All income is attributable to the equity holders of the Company.

Statement of Changes in Equity

Consolidated year ended 30 June 2021

------------------------ ---------------------------------------------------------------------------

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total equity at 1 July

2020 6,264 120,364 13,964 358,759 24,023 523,374

Total comprehensive

income:

Profit for the year - - - 318,127 10,390 328,517

Ordinary dividends

paid - - - - (11,224) (11,224)

--------- ---------- --------- ---------- --------- ----------

Total equity at 30

June 2021 6,264 120,364 13,964 676,886 23,189 840,667

===== ====== ===== ====== ===== ======

Consolidated year ended 30 June 2020

------------------------ ---------------------------------------------------------------------------

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total equity at 1 July

2019 6,264 120,364 13,964 352,188 28,243 521,023

Total comprehensive

income:

Profit for the year - - - 6,571 6,954 13,525

Ordinary dividends

paid - - - - (11,174) (11,174)

--------- ---------- --------- ---------- --------- ----------

Total equity at 30

June 2020 6,264 120,364 13,964 358,759 24,023 523,374

===== ====== ===== ====== ===== ======

Balance Sheet

At 30 June At 30 June

2021 2020

GBP'000 GBP'000

------------------------------------------------- ------------- -------------

Non current assets

Investments held at fair value through

profit or loss 933,499 573,086

----------- -----------

Current assets

Receivables 3,412 4,453

Cash and cash equivalents - 57

---------- ----------

3,412 4,510

----------- -----------

Total assets 936,911 577,596

----------- -----------

Current liabilities

Payables (7,154) (5,941)

Bank overdrafts (89,099) (48,281)

------------ ------------

(96,244) (54,222)

------------ ------------

Net assets 840,667 523,374

======= =======

Equity attributable to equity shareholders

Called up share capital 6,264 6,264

Share premium account 120,364 120,364

Capital redemption reserve 13,964 13,964

Retained earnings:

Other capital reserves 676,886 358,759

Revenue reserve 23,189 24,023

------------ ------------

Total equity 840,667 523,374

======= =======

Net asset value per ordinary share - basic

and diluted 1,677.70p 1,044.48p

======== ========

Cash Flow Statement

Year ended

Year ended 30 June

30 June 2021 2020

GBP'000 GBP'000

-------------------------------------------------- -------------- -----------

Operating activities

Profit before taxation 329,901 14,256

Add back: interest payable 775 705

Less: gains on investments held at fair

value through profit or loss (326,600) (10,433)

Sales of investments held at fair value

through profit or loss 458,813 341,928

Purchases of investments held at fair

value through profit or loss (495,971) (324,358)

Withholding tax on dividends deducted

at source (2,116) (1,354)

Decrease/(increase) in prepayments and

accrued income 295 (35)

Decrease in amounts due from brokers 1,287 559

Increase in accruals and deferred income 5,415 687

Increase in amounts due to brokers (4,211) (1,464)

---------- ----------

Net cash (outflow)/inflow operating activities

before interest and taxation(1) (32,412) 20,491

---------- ----------

Interest paid (775) (705)

Taxation recovered 144 271

---------- ----------

Net cash (outflow)/inflow from operating

activities (33,043) 20,057

---------- ----------

Financing activities

Equity dividends paid (net of refund of

unclaimed dividends - see note 8) (11,224) (11,174)

Net drawdown/(repayment) of bank overdraft 44,210 (8,826)

Net cash raised/(used) in financing 32,986 (20,000)

(Decrease)/increase in cash and cash equivalents (57) 57

Cash and cash equivalents at the start

of the year - -

Cash and cash equivalents at the end of

the year 57 57

Comprising:

Cash at bank - 57

---------- ----------

- 57

====== ======

1. In accordance with IAS7.31 cash inflow from dividends was

GBP11,699,000 (2020: GBP7,280,000) and cash inflow from interest

was GBPnil (2020: GBP1,000).

Notes to the Financial Statements

1. Accounting policies

Basis of preparation

TR European Growth Trust PLC is a company registered in England and

Wales with number 02520734. The Company is listed on the London Stock

Exchange and subject to the provisions of the Companies Act 2006 as

set out in English law. The financial statements of the Company for

the year ended 30 June 2021 have been prepared in accordance with International

Accounting Standards in conformity with the requirements of the Companies

Act 2006 (the 'Act'). These comprise standards and interpretations

approved by International Accounting Standards Board ('ISAB'), together

with interpretations of the International Accounting Standards and

Standing Interpretations Committee approved by the IFRS Interpretations

Committee ('IFRS IC') that remain in effect. The accounting policies

have been consistently applied in the current and previous year.

The financial statements have been prepared on a going concern basis.

They have also been prepared on the historical cost basis, except for

the revaluation of certain financial instruments at fair value through

profit and loss. The principal accounting policies adopted are set

out below. Where presentational guidance set out in the Statement of

Recommended Practice ('SORP') for investment trusts issued by the Association

of Investment Companies ('AIC') in October 2019 is consistent with

the requirements of IFRSs, the directors have sought to prepare the

financial statements on a basis consistent with the recommendations

of the SORP.

Going concern

The Company's shareholders are asked every three years to vote for

the continuation of the Company. An ordinary resolution to this effect

was put to the annual general meeting held on 25 November 2019 and

passed by the substantial majority of the shareholders. The next such

resolution will be put to the shareholders at the annual general meeting

in 2022.

The directors have considered the impact of Covid-19, including cash

flow forecasting, a review of covenant compliance including the headroom

above the most restrictive covenants and an assessment of the liquidity

of the portfolio. They have concluded that they are able to meet their

financial obligations, including the repayment of the bank overdraft,

as they fall due for a period of at least twelve months from the date

of approval of these financial statements. Having assessed these factors,

the principal risks and other matters discussed in connection with

the viability statement, the Board has determined that it is appropriate

for the financial statements to be prepared on a going concern basis.

2. Management and performance fees

2021 2020

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Management fee 826 3,304 4,130 582 2,329 2,911

Performance fee - 4,549 4,549 - - -

----- -------- -------- ----- -------- --------

Total 826 7,853 8,679 582 2,329 2,911

=== ===== ===== === ===== =====

3. Return per ordinary share

The return per ordinary share figure is based on the net gain for the

year of GBP328,517,000 (2020 gain: GBP13,525,000) and on the weighted

average number of ordinary shares in issue during the year of 50,108,397

(2020: 50,108,397).

The return per ordinary share figure detailed above can be further

analysed between revenue and capital, as below. The Company has no

securities in issue that could dilute the return per ordinary share.

Therefore the basic and diluted return per ordinary share are the same.

2021 2020

GBP'000 GBP'000

------------------------------------------------------ ------------------- ------------------

Net revenue profit 10,390 6,954

Net capital profit 318,127 6,571

------------ ------------

Net profit 328,127 13,525

======= =======

Weighted average number of ordinary

shares in issue during the year 50,108,397 50,108,397

2021 2020

Pence Pence

------------------------------------------------------ ------------------- ------------------

Revenue return per ordinary share 20.74 13.88

Capital return per ordinary share 634.88 13.11

----------- -----------

Total return per ordinary share 655.62 26.99

====== ======

4. Net asset value per ordinary share

The NAV per ordinary share is based on the net assets attributable

to the ordinary shares of GBP840,667,000 (2020: GBP523,374,000) and

on the 50,108,397 ordinary shares in issue at 30 June 2021 (2020: 50,108,397).

The Company has no securities in issue that could dilute the NAV per

ordinary share (2020: same). The NAV per ordinary share at 30 June

2021 was 1,677.70p (2020: 1,044.48p).

The movements during the year in assets attributable to the ordinary

shares were as follows:

2021 2020

GBP'000 GBP'000

------------------------------------------------------ ------------------- ------------------

Net assets attributable to ordinary

shares at start of year 523,374 521,023

Profit for the year 328,517 13,525

Dividends paid in the year (11,224) (11,174)

------------ ------------

Net assets at 30 June 840,667 523,374

======= =======

5. Dividends 2021 2020

GBP'000 GBP'000

------------------------------------------------ ---------- ----------

Amounts recognised as distributions to equity

holders in the year:

Final dividend of 14.20p for the year ended

30 June 2020 (2019: 14.50p) 7,115 7,266

Interim dividend of 8.20p per ordinary share

for the year ended 30 June 2021 (2019: 7.80p) 4,109 3,908

--------- ---------

11,224 11,174

===== =====

The final dividend of 14.20p per ordinary share in respect of the year

ended 30 June 2020 was paid on 27 November 2020 to shareholders on

the Register of Members at the close of business on 23 October 2020.

The total dividend paid amounted to GBP7,115,000.

Subject to approval at the annual general meeting in November 2021,

the proposed final dividend of 16.80p per ordinary share will be paid

on 3 December 2021 to shareholders on the Register of Members at the

close of business on 22 October 2021. The shares will be quoted ex-dividend

on 21 October 2021.

The proposed final dividend for the year ended 30 June 2021 has not

been included as a liability in these financial statements. Under IFRS,

these dividends are not recognised until approved by shareholders.

The total dividends payable in respect of the financial year which

form the basis of the test under s.1158 are set out below:

2021 2020

GBP'000 GBP'000

------------------------------------------------ ----------- -----------

Revenue available for distribution by way of

dividends for the year 10,390 6,954

Interim dividend of 8.20p per ordinary share

for the year ended 30 June 2021 (2020: 7.80p) (4,109) (3,908)

Proposed total dividend for the year ended

30 June 2021 - 16.80p (2020: 14.20p) (based

on 50,108,397 shares in issue at 11 October

2021) (8,418) (7,115)

---------- ----------

Transfer from revenue reserve (2,137) (4,069)

====== ======

For s.1158 purposes there is no undistributed revenue (2020: same)

of total income.

6. Called up share capital

2021 2020

---------------------------------

number number

of shares GBP'000 of shares GBP'000

--------------------------------- ------------ --------- ------------ ---------

Allotted, issued and fully paid

Ordinary shares of 12.5p 50,108,397 6,264 50,108,397 6,264

During the year no ordinary shares were issued (2020: same) for proceeds

of GBPnil (2020: same). In the current year to date and prior financial

year, the Company has not repurchased any shares for cancellation.

7. 2021 Financial information

The figures and financial information for the year ended 30 June 2021

are extracted from the Company's annual financial statements for that

period and do not constitute statutory accounts. The Company's annual

financial statements for the year to 30 June 2021 have been audited

but have not yet been delivered to the Registrar of Companies. The

Independent Auditors' Report on the 2021 annual financial statements

was unqualified, did not include a reference to any matter to which

the auditors drew attention without qualifying the report, and did

not contain any statements under Sections 498(2) or 498(3) of the Companies

Act 2006 .

8. 2020 Financial information

The figures and financial information for the year ended 30 June 2020

are compiled from an extract of the published financial statements

for that year and do not constitute statutory accounts. Those financial

statements have been delivered to the Registrar of Companies and included

the report of the auditors which was unqualified, did not include a

reference to any matter to which the auditors drew attention without

qualifying the report, and did not contain any statements under Sections

498(2) or 498(3) of the Companies Act 2006.

9. Annual Report

The annual report will be posted to shareholders in late October 2021

and will be available on the Company's website ( www.treuropeangrowthtrust.com

).

10. Annual General Meeting

The annual general meeting will be held on Monday 29 November 2021

at 12.30 pm at 201 Bishopsgate, London, EC2M 3AE. The Notice of Meeting

will be sent to shareholders with the annual report.

11. General information

Company Status

TR European Growth Trust PLC is registered in England and Wales, No.

2520734, has its registered office at 201 Bishopsgate, London EC2M

3AE and is listed on the London Stock Exchange.

SEDOL/ISIN: 0906692/GB0009066928

London Stock Exchange (TIDM) code: TRG

Global Intermediary Identification Number (GIIN): JX9KYH.99999.SL.826

Legal Entity Identifier (LEI): 213800N1B1HCQG2W4V90

Directors and Secretary

The directors of the Company are Christopher Casey (Chairman), Daniel

(Dan) Burgess (Chairman of the Audit Committee), Ann Grevelius, Simona

Heidempergher, Andrew Martin Smith and Alexander Mettenheimer. The

Corporate Secretary is Henderson Secretarial Services Limited.

Website

Details of the Company's share price and net asset value, together

with general information about the Company, monthly factsheets and

data, copies of announcements, reports and details of general meetings

can be found at www.treuropeangrowthtrust.com

For further information please

contact:

Ollie Beckett

Fund Manager

TR European Growth Trust PLC

Telephone: 020 7818 4331/3997

James de Sausmarez Laura Thomas

Director and Head of Investment Investment Trust PR Manager

Trusts Janus Henderson Investors

Janus Henderson Investors Telephone: 020 7818 2636

Telephone: 020 7818 3349

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOOWRAUURAAA

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

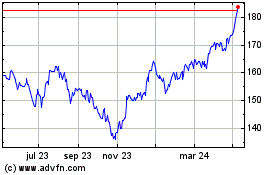

The European Smaller Com... (LSE:ESCT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

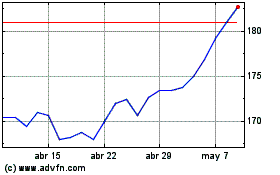

The European Smaller Com... (LSE:ESCT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024