Taseko Mines Limited Taseko Announces US$50 Million Revolving Credit Facility

05 Octubre 2021 - 8:02AM

UK Regulatory

TIDMTKO

Taseko Mines Announces New US$50 Million Revolving Credit Facility and Update

on Florence Copper Permitting

VANCOUVER, BC, Oct. 5, 2021 /CNW/ - Taseko Mines Limited (TSX: TKO) (NYSE MKT:

TGB) (LSE: TKO) ("Taseko" or the "Company") is pleased to announce that it has

signed a US$50 million Revolving Credit Facility (the "Facility"). The

Facility, which is arranged and fully underwritten by National Bank of Canada,

will be available for working capital and general corporate purposes.

Stuart McDonald, President and CEO of Taseko, commented, "At current copper

prices, we expect to fully fund construction of the Florence Copper Project

with cashflow from Gibraltar operations and our existing cash balance. While we

have no intention of drawing any funds from the new Facility on closing, it

will further improve our already strong balance sheet and provide us with

additional flexibility as we advance Florence towards production, making it

America's newest source of low-carbon copper."

Additionally, the U.S. Environmental Protection Agency ("EPA") has advised

Taseko that it intends to send a draft Underground Injection Control ("UIC")

permit to the Company in mid-October and provide the Company with a two-week

review period before the draft permit is formally issued, commencing the public

comment period.

Mr. McDonald continued, "The UIC permit is the final permitting step required

prior to construction of Florence Copper, and the EPA continues to make

progress towards finalizing the permit with no significant issues raised

to-date. Receipt of the draft permit will represent another significant step

towards Florence Copper being fully permitted and ready for construction."

About the Revolving Credit Facility

The Facility has an initial tenor of 42 months and is extendable annually

thereafter. The Facility will be secured by a first lien charge against

Taseko's rights under the Gibraltar Joint Venture as well as its shares of

Gibraltar Mines Ltd., Curis Holdings (Canada) Ltd., and Florence Holdings Inc.

The Facility includes financial and other covenants commensurate with a

corporate revolving credit facility of this nature. The Facility is expected to

close this week upon satisfaction of customary closing conditions. A copy of

the Facility agreement will be available on the SEDAR website ( www.sedar.com).

Stuart McDonald

President and CEO

No regulatory authority has approved or disapproved of the information

contained in this news release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This document contains "forward-looking statements" that were based on Taseko's

expectations, estimates and projections as of the dates as of which those

statements were made. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as "outlook",

"anticipate", "project", "target", "believe", "estimate", "expect", "intend",

"should" and similar expressions.

Forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the Company's actual results,

level of activity, performance or achievements to be materially different from

those expressed or implied by such forward-looking statements. These included

but are not limited to:

* uncertainties about the effect of COVID-19 and the response of local,

provincial, federal and international governments to the threat of COVID-19

on our operations (including our suppliers, customers, supply chain,

employees and contractors) and economic conditions generally and in

particular with respect to the demand for copper and other metals we

produce;

* uncertainties and costs related to the Company's exploration and

development activities, such as those associated with continuity of

mineralization or determining whether mineral resources or reserves exist

on a property;

* uncertainties related to the accuracy of our estimates of mineral reserves,

mineral resources, production rates and timing of production, future

production and future cash and total costs of production and milling;

* uncertainties related to feasibility studies that provide estimates of

expected or anticipated costs, expenditures and economic returns from a

mining project;

* uncertainties related to the ability to obtain necessary licenses permits

for development projects and project delays due to third party opposition;

* uncertainties related to unexpected judicial or regulatory proceedings;

* changes in, and the effects of, the laws, regulations and government

policies affecting our exploration and development activities and mining

operations, particularly laws, regulations and policies;

* changes in general economic conditions, the financial markets and in the

demand and market price for copper, gold and other minerals and

commodities, such as diesel fuel, steel, concrete, electricity and other

forms of energy, mining equipment, and fluctuations in exchange rates,

particularly with respect to the value of the U.S. dollar and Canadian

dollar, and the continued availability of capital and financing;

* the effects of forward selling instruments to protect against fluctuations

in copper prices and exchange rate movements and the risks of counterparty

defaults, and mark to market risk;

* the risk of inadequate insurance or inability to obtain insurance to cover

mining risks;

* the risk of loss of key employees; the risk of changes in accounting

policies and methods we use to report our financial condition, including

uncertainties associated with critical accounting assumptions and

estimates;

* environmental issues and liabilities associated with mining including

processing and stock piling ore; and

* labour strikes, work stoppages, or other interruptions to, or difficulties

in, the employment of labour in markets in which we operate mines, or

environmental hazards, industrial accidents or other events or occurrences,

including third party interference that interrupt the production of

minerals in our mines.

For further information on Taseko, investors should review the Company's annual

Form 40-F filing with the United States Securities and Exchange Commission

www.sec.gov and home jurisdiction filings that are available at www.sedar.com,

including the "Risk Factors" included in our Annual Information Form.

on Taseko, please visit the Taseko website at www.tasekomines.com or contact:

Brian Bergot, Vice President, Investor Relations - 778-373-4533 or toll free

1-877-441-4533

END

(END) Dow Jones Newswires

October 05, 2021 09:02 ET (13:02 GMT)

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

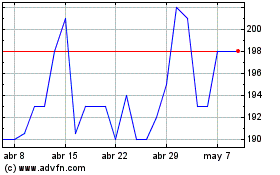

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024