Taseko Mines Limited Taseko Mines Sells Harmony Gold Project

12 Julio 2021 - 7:30AM

UK Regulatory

TIDMTKO

Taseko Mines Sells Harmony Gold Project

Vancouver, BC, July 12, 2021 /CNW/ - Taseko Mines Limited (TSX: TKO) (NYSE MKT:

TGB) (LSE: TKO) ("Taseko" or the "Company") is pleased to announce that it has

entered into an agreement to sell the Harmony Gold Project ("Harmony" or the

"Project") to JDS Gold Inc. ("JDS"), a newly incorporated company controlled by

JDS Energy & Mining Inc. and affiliates. Under the terms of the agreement, JDS

will become the owner and operator of the Harmony Gold Project, a high-grade

development-stage gold project located on Graham Island in Haida Gwaii.

Taseko will retain a 15% carried interest in JDS and a 2% net smelter return

royalty on the Project. Taseko also has the right to terminate the agreement

and revert to 100% ownership of Harmony in the event JDS does not achieve

certain project development milestones and an IPO or other liquidity event

within an agreed timeframe. Closing of the transaction remains subject to

customary terms and conditions.

Stuart McDonald, President and CEO of Taseko, commented, "We are continually

looking for ways to create shareholder value from our extensive pipeline of

high-quality development projects. With Florence Copper expected to commence

construction later this year and our large-scale Yellowhead Copper project

preparing to enter the environmental assessment process, we did not expect to

be in a position to advance Harmony for a number of years. JDS Energy & Mining

Inc. has a proven track record of developing mineral projects, and this

transaction structure allows Taseko to participate in their success and create

value from this asset in the near-term."

Jeff Stibbard, CEO of JDS Energy & Mining Inc., stated, "As a mining

development company, we are always in search of high-quality projects in safe

jurisdictions, particularly in Canada. Harmony, which had been in Taseko's

inventory for two decades, is a mining project which fits very well within the

JDS group. With our engineering, permitting and mine construction expertise, we

believe we can advance this project and create significant value for all

stakeholders."

About Harmony Gold Project

The Harmony Gold Project is located on Graham Island in Haida Gwaii, off the

west coast of British Columbia, Canada. The project comprises of 58 mineral

claims covering 177 square km. Previous owners of the Project have carried out

over 80,000 meters of drilling in 543 holes. Taseko purchased the project in

late 2001 and advanced engineering work until 2008, when the Company focused

efforts on its Gibraltar Mine. The project has a historical resource estimate

containing over 3 million ounces of gold within 22 million tonnes of measured

and 42 million tonnes of indicated resources grading 1.77 and 1.41 g/t gold

respectively at a 0.60 g/t gold cut-off grade. This historical resource was

estimated by M. Nowak, P.Eng. in 1997 using multiple indicator kriging and

classified in 2001 as described by Nowak et al. in a February 2001 Misty

Mountain Gold Ltd. report entitled "Resource Estimate for the Specogna Gold

Deposit". A qualified person has not done sufficient work to classify the

historical estimate as a current mineral resource and the Company is not

treating the historical estimate as a current mineral resource. A qualified

person would be required to review the historical estimate and make

recommendations in order to upgrade or verify it as a current mineral resource.

About JDS Energy & Mining

JDS Energy & Mining Inc. was founded in 2004 by President and CEO, Jeff

Stibbard. The team is comprised of a diverse set of skilled and highly

experienced resource sector professionals with a proven track record delivering

and executing project plans on budget, on time, and most importantly, safely

with no harm to people, environment, assets, or reputation. JDS is focused on

maintaining a social license to operate, globally, and prides itself on

delivering fit-for-purpose project concepts from inception to full operations -

a process it has executed seamlessly for operations throughout Canada and the

world, including the Minto Mine in the Yukon, the Gahcho Kue Mine located in

the Northwest Territories, the Silvertip Mine in northern British Columbia,

Victoria Gold's Eagle Gold Mine in the Yukon, and most recently, the PureGold

Mine in Red Lake Ont.

Stuart McDonald

President and CEO

No regulatory authority has approved or disapproved of the information

contained in this news release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This document contains "forward-looking statements" that were based on Taseko's

expectations, estimates and projections as of the dates as of which those

statements were made. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as "outlook",

"anticipate", "project", "target", "believe", "estimate", "expect", "intend",

"should" and similar expressions.

Forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the Company's actual results,

level of activity, performance or achievements to be materially different from

those expressed or implied by such forward-looking statements. These included

but are not limited to:

* uncertainties about the effect of COVID-19 and the response of local,

provincial, federal and international governments to the threat of COVID-19

on our operations (including our suppliers, customers, supply chain,

employees and contractors) and economic conditions generally and in

particular with respect to the demand for copper and other metals we

produce;

* uncertainties and costs related to the Company's exploration and

development activities, such as those associated with continuity of

mineralization or determining whether mineral resources or reserves exist

on a property;

* uncertainties related to the accuracy of our estimates of mineral reserves,

mineral resources, production rates and timing of production, future

production and future cash and total costs of production and milling;

* uncertainties related to feasibility studies that provide estimates of

expected or anticipated costs, expenditures and economic returns from a

mining project;

* uncertainties related to the ability to obtain necessary licenses permits

for development projects and project delays due to third party opposition;

* uncertainties related to unexpected judicial or regulatory proceedings;

* changes in, and the effects of, the laws, regulations and government

policies affecting our exploration and development activities and mining

operations, particularly laws, regulations and policies;

* changes in general economic conditions, the financial markets and in the

demand and market price for copper, gold and other minerals and

commodities, such as diesel fuel, steel, concrete, electricity and other

forms of energy, mining equipment, and fluctuations in exchange rates,

particularly with respect to the value of the U.S. dollar and Canadian

dollar, and the continued availability of capital and financing;

* the effects of forward selling instruments to protect against fluctuations

in copper prices and exchange rate movements and the risks of counterparty

defaults, and mark to market risk;

* the risk of inadequate insurance or inability to obtain insurance to cover

mining risks;

* the risk of loss of key employees; the risk of changes in accounting

policies and methods we use to report our financial condition, including

uncertainties associated with critical accounting assumptions and

estimates;

* environmental issues and liabilities associated with mining including

processing and stock piling ore; and

* labour strikes, work stoppages, or other interruptions to, or difficulties

in, the employment of labour in markets in which we operate mines, or

environmental hazards, industrial accidents or other events or occurrences,

including third party interference that interrupt the production of

minerals in our mines.

For further information on Taseko, investors should review the Company's annual

Form 40-F filing with the United States Securities and Exchange Commission

www.sec.gov and home jurisdiction filings that are available at www.sedar.com,

including the "Risk Factors" included in our Annual Information Form.

For further information on Taseko, please visit the Taseko website at

www.tasekomines.com or contact: Brian Bergot, Vice President, Investor

Relations - 778-373-4533 or toll free 1-877-441-4533

END

(END) Dow Jones Newswires

July 12, 2021 08:30 ET (12:30 GMT)

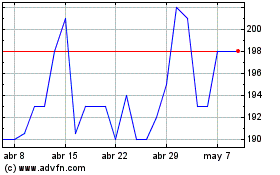

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024