TIDMTAST

RNS Number : 9806M

Tasty PLC

27 September 2021

27 September 2021

Tasty plc

("Tasty", the "Group" or the "Company")

Unaudited Interim Results for the 26 weeks ended 27 June

2021

Key Points:

-- Revenue GBP11.6m (2020: GBP8.7m); increase of 33%

-- Adjusted EBITDA(1) of GBP0.8m (2020: loss GBP0.1m)

-- Impairment charge of GBPnil (2020: GBP7.6m)

-- Loss after tax for the period of GBP2.7m (28 June 2020: loss of GBP11.0m)

-- Bank loan as at 27 June 2021 of GBP1.25m (28 June 2020: GBPnil)

-- Net cash after allowing for bank loan and aged creditors of

GBP4.2m (28 June 2020: net debt of GBP0.4m)

-- All sites closed from 5 January 2021 for indoor dining,

re-opened in April 2021 for outdoor dining and dine-in from May

2021

-- Currently trading from 49 of 54 restaurants - with temporary

closures throughout the half-year due to Covid-19

-- Staff shortages have also forced temporary closures and

prevented the re-opening of some of the Group's sites

-- Trading post period end to date has exceeded management's expectations

(1) Adjusted for depreciation, amortisation and share based

payments.

Chairman's statement

Introduction

The start of 2021 like 2020 has been a very challenging time but

thanks to our dedicated teams, who have worked tirelessly to

sustain the business, Tasty has been able to navigate its way

through the issues caused by the pandemic. This included lockdowns,

re-opening with restrictions and staff shortages. Tasty has managed

to adapt to the changing environment, the different UK Government

guidelines whilst at the same time responding to customer

preferences and feedback.

Our new bank facility and support from our creditors and

landlords, as well as Government support, has seen us through this

difficult period, and we now have a viable platform on which to

build a successful business.

Since re-opening for dine-in in May 2021, sales have been

encouraging. However, we remain cautious in our approach as we are

mindful that performance has been assisted by VAT and rate support,

staycations, pent-up demand and a higher level of disposable

income.

Tasty is now in a good position to take advantage of the

opportunities in the sector due to reduced competition and vacant

restaurant and retail space.

Rent negotiations

The Group has been successful in achieving rent reductions and

lease concessions across most of the estate. Landlords have, in the

main, been extremely understanding and supportive.

The Group will continue to review its existing estate to

consider further sales of underperforming restaurants. It is likely

that certain underperforming sites will not re-open and may be sold

or surrendered back to the landlord in future.

With the support of the majority of our landlords we have

managed to avoid a Creditors Voluntary Arrangement (CVA) within the

Group. However, with the potential of rising infections as we head

into the colder months, we will continue to monitor the situation

closely in the coming months.

People

As we have re-opened for dine-in we have been delighted to be

creating new jobs. However, like many in the hospitality industry,

recruitment and retention has proved to be very difficult, and this

continues to be the case. With the increased sales volume and

recruitment not keeping up with the needs of the business, our

teams have played a huge part in ensuring that we continue to

operate as "normal" as possible. We have been overwhelmed by the

dedication and diligence of our teams.

Sam Kaye stepped down from the Board on 14 May 2021 to allow him

to focus on his other commercial interests. The Board would once

again like to thank Sam for the enormous support and invaluable

experience that he has provided to the Group from inception.

Harald Samúelsson was appointed as a Non-Executive Director in

May 2021. Harald has over 20 years of experience in the UK

restaurant industry, including as joint managing Director of Côte

Restaurants, and we are delighted to have him on our Board .

We currently have plans to strengthen our senior team to

establish a structure that will allow us to expand the

business.

Environmental, social and governance

From the onset of the pandemic the Board acted quickly to secure

the survival of the business and the long-term financial position

of the Group, whilst protecting the health of our employees and

customers. We have also retained our focus on sustainability and

the environmental impact of the business, and we are an equal

opportunities employer.

Re sults

Revenue increased by 33% to GBP11.6m (2020: GBP8.7m); several

factors contributed to this. In H1 2021 even though the lockdown

restrictions unexpectedly lasted longer than H1 2020, we were

better positioned to take greater advantage of the takeaway and

delivery market which has grown significantly throughout the

pandemic and continues to remain strong after the re-opening of

dine-in. The adjusted EBITDA for the period was GBP0.8m (2020: loss

GBP0.1m).

Operating loss before highlighted items (as detailed below) was

GBP1.4m (2020: loss GBP2.7m).

IFRS16 has resulted in depreciation on right-of-use (ROU) assets

and the interest charge on lease liabilities being greater than the

charge for rent that would have been reported pre-IFRS16; the net

impact on reported loss is GBP0.8m. The interest charge on the

lease liabilities is higher in the earlier years of a lease.

We have reviewed the impairment provision across the ROU assets,

fixed assets and goodwill and have not made any provision for the

period under review (2020: GBP7.6m).

After taking into account all non-trade adjustments, the Group

has a stated loss after tax for the period of GBP2.7m (2020: loss

GBP11m).

Cash flows and financing

Cash inflow from operations was GBP2.4m (2020: GBP0.8m). During

the period, the net proceeds from the sale of property were GBPnil

(2020: GBP1.9m). A bank loan of GBP1.25m was drawn down in January

2021 (2020: repayment of GBP1.7m).

Overall, the net cash inflow for the period was GBP1.8m (2020:

outflow GBP1.4m). As at 27 June 2021, the Group had net cash after

bank loan of GBP8.6m (28 June 2020: net cash of GBP3.2m). After

allowing for aged creditors net cash was GBP4.2m (28 June 2020: net

debt of GBP0.4m).

Going concern

Covid-19 and Government restrictions have had a significant

impact on trading. Since the onset of the pandemic the Group has

minimised costs and cash outflows. This included negotiating rent

reductions and lease concessions across most of the estate. The

Government Job Retention Scheme (CJRS) was used to support

furloughed staff. To improve liquidity, a GBP1.25m four year term

loan was fully drawn down in January 2021.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. In reaching this conclusion the Directors have

considered the financial position of the Group, together with its

forecasts for the next 12 months from the date of approval of these

interim accounts and taking into account possible changes in

trading performance. The going concern basis of accounting has,

therefore, been adopted in preparing the interim financial

report.

Outlook

Trading since re-opening for dine-in in May 2021 has been

encouraging and exceeded the Board's expectations. We are hopeful

that this will continue to remain positive as schools go back and

more people return to the office. However, we expect that the

pent-up demand for eating out will naturally diminish in the winter

months and any new Government restrictions on dealing with the

pandemic may negatively impact the Group's performance. Despite

these uncertainties the Board remains optimistic as to the outlook

for the Group and expects to keep under review future opportunities

for growth.

Finally thank you once again to all our people, shareholders,

suppliers, landlords and other stakeholders who have helped our

business in these very difficult times.

K Lassman

Chairman

Tasty plc

27 September 2021

Enquiries:

Tasty plc Tel: 020 7637 1166

Jonny Plant, Chief Executive

Cenkos Securities Tel: 020 7397 8900

Katy Birkin/Mark Connelly

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(596/2014). Upon publication of this announcement via a regulatory

information service, this information is considered to be in the

public domain.

Consolidated statement of comprehensive income

for the 26 weeks ended 27 June 2021 (unaudited)

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Revenue 11,629 8,723 24,228

Cost of sales (14,526) (14,304) (30,330)

------------------------------------- --------- --------- ------------

Gross loss (2,897) (5,581) (6,102)

Other income 2,050 3,612 5,413

Total operating expenses (628) (7,673) (9,328)

Operating loss before highlighted

items (1,410) (2,671) (2,235)

Highlighted items (65) (6,971) (7,782)

------------------------------------- --------- --------- ------------

Operating loss (1,475) (9,642) (10,017)

Finance income - 3 4

Finance expense (1,263) (1,284) (2,548)

Loss before tax (2,738) (10,923) (12,561)

Income tax - (105) (105)

Loss and total comprehensive

income for period and attributable

to owners of the parent (2,738) (11,028) (12,666)

Loss per share attributable

to the ordinary equity owners

of the parent

Basic (1.94p) (7.82p) (8.98p)

Diluted (1.85p) (7.82p) (8.98p)

The table below gives additional information to shareholders on

key performance indicators:

Post IFRS Pre IFRS Post IFRS Pre IFRS

16 16 16 16

26 weeks 26 weeks 26 weeks 26 weeks

to to to to

27 June 27 June 28 June 28 June

2021 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000

EBITDA before highlighted

items 824 (1,207) (131) (2,492)

Depreciation and amortisation (663) (689) (694) (694)

Incremental depreciation

resulting due to IFRS16 (1,571) - (1,846) -

------------------------------- ---------- --------- ---------- ---------

Operating loss before

highlighted items (1,410) (1,896) (2,671) (3,186)

------------------------------- ---------- --------- ---------- ---------

Analysis of highlighted items 26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Profit on disposal of property

plant and equipment - 1,061 1,184

Restructuring costs - (15) (408)

Impairment of right-of-use assets - (10,466) (10,043)

Impairment of goodwill - (326) (326)

Impairment of property, plant

and equipment - 3,195 2,255

Share based payments (65) (20) (44)

Impairment of stock due to Covid-19 - (400) (400)

------------------------------------- --------- --------- ------------

Total highlighted items (65) (6,971) (7,782)

Consolidated statement of changes in equity

for the 26 weeks ended 27 June 2021 (unaudited)

Share Share Merger Retained Total

Capital Premium Reserve Deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 27 December 2020 6,061 24,251 992 (30,708) 596

Issue of ordinary shares - 3 - - 3

Total comprehensive income

for the period - - - (2,738) (2,738)

Share based payments - credit

to equity - - - 65 65

Balance at 27 June 2021 6,061 24,254 992 (33,381) (2,074)

Balance at 29 December 2019 6,061 24,251 992 (18,018) 13,286

Issue of ordinary shares - - - - -

Total comprehensive income

for the period - - - (11,028) (11,028)

Share based payments - credit

to equity - - - 20 20

Balance at 28 June 2020 6,061 24,251 992 (29,026) 2,278

Balance at 29 December 2019 6,061 24,251 992 (18,018) 13,286

Issue of ordinary shares - - - - -

Cost of placing of ordinary

shares - - - (68) (68)

Total comprehensive income

for the period - - - (12,666) (12,666)

Share based payments - credit

to equity - - - 44 44

Balance at 27 December 2020 6,061 24,251 992 (30,708) 596

In January 2021 Daniel Jonathan Plant was awarded 15,676,640 'B'

shares in Tasty plc which can be converted to 'A' shares subject to

achievement of certain hurdle rates. These 'B' shares were issued

at nominal value of 0.00001 pence.

Consolidated balance sheet

At 27 June 2021 (unaudited)

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 30 25 26

Property, plant and equipment 15,098 17,120 15,572

Right-of-use- assets 38,337 41,525 39,811

Other non-current assets 129 147 129

Deferred Tax - - -

Total non-current assets 53,594 58,817 55,538

--------------------------------- --------- --------- ------------

Current assets

Inventories 1,834 2,208 1,822

Trade and other receivables 1,397 2,038 1,363

Cash and cash equivalents 9,884 3,160 8,028

Total current assets 13,115 7,406 11,213

--------------------------------- --------- --------- ------------

Total assets 66,709 66,223 66,751

--------------------------------- --------- --------- ------------

Current liabilities

Trade and other payables (12,210) (7,668) (10,617)

Lease liabilities (3,620) (2,768) (2,904)

Borrowings (104) - -

Total current liabilities (15,934) (10,436) (13,521)

--------------------------------- --------- --------- ------------

Non-current liabilities

Provisions (335) (5) (335)

Lease liabilities (51,288) (53,376) (52,219)

Long-term borrowings (1,146) - -

Other payables (80) (128) (80)

Total non-current liabilities (52,849) (53,509) (52,634)

--------------------------------- --------- --------- ------------

Total liabilities (68,783) (63,945) (66,155)

--------------------------------- --------- --------- ------------

Total net (liabilities)assets (2,074) 2,278 596

--------------------------------- --------- --------- ------------

Equity

Share capital 6,061 6,061 6,061

Share premium 24,254 24,251 24,251

Merger reserve 992 992 992

Retained deficit (33,381) (29,026) (30,708)

Total equity (2,074) 2,278 596

--------------------------------- --------- --------- ------------

Consolidated cash flow statement

for the 26 weeks ended 27 June 2021 (unaudited)

26 26 52

weeks weeks weeks ended

to to

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Operating activities

Cash generated from operations 2,365 913 7,575

Corporation tax paid - (105) (105)

-------- -------- -------------

Net cash inflow from operating

activities 2,365 808 7,470

----------------------------------------- -------- -------- -------------

Investing activities

Proceeds from sale of property,

plant and equipment - 1,862 2,039

Purchase of property, plant

and equipment (192) (28) (120)

Interest received - 3 4

-------- -------- -------------

Net cash flows used in investing

activities (192) 1,837 1,923

----------------------------------------- -------- -------- -------------

Financing activities

Net proceeds from issues 3 - -

of ordinary shares

Bank loan receipts 1,250 - -

Bank loan repayment - (1,652) (1,652)

Interest paid (1,263) (1,284) (2,548)

Principal paid on lease liabilities (307) (1,119) (1,735)

-------- -------- -------------

Net cash flows used in financing

activities (317) (4,055) (5,935)

----------------------------------------- -------- -------- -------------

Net increase in cash and

cash equivalents 1,856 (1,410) 3,458

Cash and cash equivalents at beginning

of the period 8,028 4,570 4,570

-------- -------- -------------

Cash and cash equivalents as at

27 June 2021 9,884 3,160 8,028

----------------------------------------- -------- -------- -------------

Notes to the condensed financial statements

for the 26 weeks ended 28 June 2021 (unaudited)

1 General information

Tasty plc is a public limited company incorporated in the United

Kingdom under the Companies Act (registration number 05826464). The

Company is domiciled in the United Kingdom and its registered

address is 32 Charlotte Street, London, W1T 2NQ. The Company's

ordinary shares are traded on the AIM Market of the London Stock

Exchange ("AIM"). Copies of this Interim Report and the Annual

Report and Financial Statements may be obtained from the above

address or on the investor relations section of the Company's

website at www.dimt.co.uk .

2 Basis of accounting

The condensed set of financial statements included in this

interim financial report has been prepared in accordance with IAS

34 'Interim Financial Reporting', as adopted by the European Union

and accounting policies consistent with International Financial

Reporting Standards (IFRS) and International Financial Reporting

Interpretations Committee (IFRIC) interpretations as endorsed by

the European Union. The same accounting policies, presentation and

methods of computation have been followed in the preparation of

these results as were applied in the Company's latest annual

audited financial statements.

The financial information for the 26 weeks ended 27 June 2021

has not been subject to an audit nor a review in accordance with

International Standard on Review Engagements 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity, issued by the Financial Reporting Council.

The financial information for the period ended 27 December 2020

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for 2020 have been filed

with the Registrar of Companies. The Independent Auditors' Report

on the Annual Report and Financial Statements for 2020 was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

The condensed financial statements are presented in sterling and

all values are rounded to the nearest thousand pounds

(GBP'000).

Except when otherwise indicated, the consolidated accounts

incorporate the financial statements of Tasty plc and its

subsidiary, Took Us A Long Time Limited, made up to the relevant

period end.

Use of judgements and estimates

In preparing these interim financial statements management has

made judgements and estimates that affect the application of

accounting policies and measurement of assets and liabilities,

income and expense provisions. Actual results may differ from these

estimates.

Going concern

Covid-19 and Government restrictions have had a significant

impact on trading. Since the onset of the pandemic the Group has

minimised costs and cash outflows. This includes negotiating rent

reductions and lease concessions across most of the estate. The

Government Job Retention Scheme (CJRS) was used to support

furloughed staff. To improve liquidity a GBP1.25m four-year term

loan was fully drawn down in January 2021. The Group has also

secured a GBP0.25m overdraft facility which has not been

utilised.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. In reaching this conclusion the Directors have

considered the financial position of the Group, together with its

forecasts for the next 12 months from the date of approval of these

interim accounts and taking into account possible changes in

trading performance should Government restrictions be reintroduced.

The Group monitors cash balances closely to ensure there is

sufficient liquidity. Accordingly, t he Directors believe that it

remains appropriate to prepare the financial statements on a going

concern basis.

IFRS 16 'Leases'

The Group adopted IFRS 16 for its period starting 30 December

2019 using the modified retrospective approach on transition,

recognising leases at the carried forward value had they been

treated as such from inception, without restatement of comparative

figures.

The right-of-use assets all relate to property leases. The

right-of-use assets as at 27 June 2021 were GBP38.3m (28 June 2020:

GBP41.5m). During the period ended 27 June 2021 the Group made a

provision for impairment of the right-of-use assets against a

number of sites totalling GBPnil (period ended 28 June 2020:

GBP10.5m).

Lease liabilities are measured at the carried forward present

value of the remaining lease payments discounted using the Group's

incremental borrowing rate of 4.5% plus the Bank of England base

rate of 0.1%. The lease liabilities as at 27 June 2021 were

GBP54.9m (28 June 2020: GBP56.1m).

Included in profit and loss for the period is GBP1.6m

depreciation of right-of-use assets and GBP1.2m financial expenses

on lease liabilities.

Amounts Recognised in the Balance Sheet

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Right-of-use assets

Recognition of adoption of IFRS

16 - 55,119 55,119

Balance at beginning of the period 39,811 - -

Additions 541 - -

Reassessment of leases (444) (1,244) (814)

Reassessment due to disposal - - (859)

Provided for the period (1,571) (1,846) (3,592)

Impairment of right-of-use assets - (10,504) (10,043)

Balance at end of the period 38,337 41,525 39,811

--------- --------- ------------

Lease liabilities

Recognition of adoption of IFRS

16 - (57,408) (57,408)

Balance at beginning of the period (55,123) - -

Additions (535) - -

Reassessment of leases 447 1,264 814

Reassessment due to disposal - - 1,039

Interest (1,237) (1,278) (2,514)

Lease payment 1,540 1,278 2,946

Balance at end of the period (54,908) (56,144) (55,123)

--------- --------- ------------

Current (3,620) (2,768) (2,904)

Non-current (51,288) (53,376) (52,219)

--------- --------- ------------

Total (54,908) (56,144) (55,123)

--------- --------- ------------

Amounts Recognised in the Income Statement

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Depreciation charge of right-of-use

assets 1,571 1,846 3,592

Interest expense (included in finance

cost) 1,237 1,278 2,514

Total 2,808 3,124 6,106

--------------------------------------- --------- --------- ------------

Impairments

All assets (ROU, fixed assets and goodwill) are reviewed for

impairment in accordance with IAS 36 Impairment of Assets, when

there are indications that the carrying value may not be

recoverable.

Assets are subject to impairment tests whenever events or

changes in circumstances indicate that their carrying amount may

not be recoverable. Where the carrying value of an asset or a cash

generating unit (CGU) exceeds its recoverable amount, i.e. the

higher of value in use and fair value less costs to dispose of the

asset, the asset is written down accordingly. The Group views each

restaurant as a separate CGU. Value in use is calculated using cash

flows excluding outflows from financing costs over the remaining

life of the lease for the CGU discounted at 6% (2020: 6%), being

the rate considered to reflect the risks associated with the CGUs.

A growth rate of 0.5% has been applied (2020: 0.5%).

An impairment review was undertaken which resulted in an

impairment charge of GBPnil (2020: GBP7.6m), this is mainly due to

trading outside of lockdown being favourable.

The assumptions will be reviewed at year-end to ensure that the

cashflow expectations are in line with the latest outlook.

Other income

The Group has received Government grants in relation to the

Coronavirus Job Retention Scheme (CJRS) and Covid-19 Business

Grants, provided by the Government in response to Covid-19's impact

on the business.

In accordance with IAS 20 (Accounting for Government Grants and

Disclosure of Government Assistance) guidelines, the Group has

recognised the salary expense as normal and recognised the grant

income in profit and loss as the Group becomes entitled to the

grant.

Other income includes Government Coronavirus Job Retention

Scheme ("CJRS") (GBP1.9m) and sub-let property income (GBP0.1m).

The Group has also received GBP1.8m of Government Grants which at

the present time have not been recognised in other income while

Group assesses when the recognition conditions are met in full.

3 Income tax

The income tax charge has been calculated by reference to the

estimated effective corporation tax and deferred tax rates of 19%

(2020: 19%).

Tax charge GBPnil (2020: GBP0.1m).

4 Loss per share

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

Pence Pence Pence

Loss per ordinary share

(basic) (1.94p) (7.82p) (8.98p)

Loss per ordinary share

(diluted) (1.85p) (7.82p) (8.98p)

The basic and diluted loss per share figures are calculated by

dividing the net loss for the period attributable to shareholders

by the weighted average number of ordinary shares in issue during

the period. The diluted earnings per share figure allows for the

dilutive effect of the conversion into ordinary shares of the

weighted average number of options outstanding during the period.

Options are only taken into account when their effect is to reduce

basic earnings per share.

Loss per share is calculated using the numbers shown below:

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

number number number

'000 '000 '000

Weighted average ordinary shares

(basic) 141,090 141,090 141,090

Weighted average ordinary shares

(diluted) 148,067 141,090 141,090

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Loss for the financial period (2,738) (11,028) (12,666)

------------------------------------- --------- --------- ------------

5 Reconciliation of result before tax to net cash generated from operating activities

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Loss before tax (2,738) (10,923) (12,561)

Finance income - (3) (4)

Finance expense 26 6 34

Finance expense (IFRS 16) 1,237 1,278 2,514

Share based payment charge 65 20 44

Share issue costs - - (68)

Depreciation 2,232 2,540 4,934

Amortisation of intangible assets 2 2 3

Impairment of goodwill - 326 326

Impairment of property, plant

and equipment - (3,195) (2,255)

Impairment of Right-of-use assets - 10,466 10,043

Profit from sale of property

plant and equipment - (1,061) (1,184)

Dilapidations provision - - 335

Other non cash - - 1

(Increase) / decrease in inventories (12) 442 827

(Increase) / decrease in trade

and other receivables (34) 1,159 1,852

Increase / (decrease) in trade

and other payables 1,587 (144) 2,734

Net cash inflow from operating

activities 2,365 913 7,575

-------------------------------------- --------- --------- ------------

6 Property, plant and equipment and right-of-use assets

Leasehold Furniture Total ROU assets Grand

improvements fixtures fixed total

and computer assets

equipment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 29 December

2019 38,661 10,107 48,768 - 48,768

Recognition

on adoption

of IFRS16 - - - 55,119 55,119

At 30 December

2019 38,661 10,107 48,768 55,119 103,887

Additions 2 118 120 - 120

Reassessment

of leases - - - (1,673) (1,673)

Disposal (1,487) (333) (1,820) - (1,820)

At 27 December

2020 37,176 9,892 47,068 53,446 100,514

----------------- -------------- -------------- -------- ----------------- --------

Additions 13 174 187 541 728

Reassessment

of leases - - - (444) (444)

At 27 June 2021 37,189 10,066 47,255 53,543 100,798

----------------- -------------- -------------- -------- ----------------- --------

Depreciation

At 29 December

2019 26,674 7,524 34,198 - 34,198

Provided for

the period 757 585 1,342 3,592 4,934

Impairments (2,133) (122) (2,255) 10,043 7,788

Disposal (1,464) (325) (1,789) - (1,789)

At 27 December

2020 23,834 7,662 31,496 13,635 45,131

----------------- -------------- -------------- -------- ----------------- --------

Provided for

the period 381 280 661 1,571 2,232

At 27 June 2021 24,215 7,942 32,157 15,206 47,363

----------------- -------------- -------------- -------- ----------------- --------

Net book value

At 27 June 2021 12,974 2,124 15,098 38,337 53,435

----------------- -------------- -------------- -------- ----------------- --------

At 27 December

2020 13,342 2,230 15,572 39,811 55,383

----------------- -------------- -------------- -------- ----------------- --------

7 Borrowings

26 weeks 26 weeks 52 weeks

to to ended

27 June 28 June 27 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Current

Secured bank borrowings 104 - 800

------------------------- --------- --------- ------------

Non-current

Secured bank borrowings 1,146 - 852

------------------------- --------- --------- ------------

Total 1,250 - 1,652

------------------------- --------- --------- ------------

The GBP1.25m loan is a four year term loan which has a capital

repayment holiday of 12 months and carries interest at a rate of

4.5% per annum over the Bank of England Base Rate. The facility was

fully drawn down in January 2021.

8 Reconciliation of financing activity

Lease liabilities Lease liabilities Bank Loan Bank Loan Total

Due within Due after Due within Due after

1 year 1 year 1 year 1 year

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net debt as at 29

December 2019 - - 800 852 1,652

IFRS 16 transitional

adjustment 1,647 55,761 - - 57,408

Net debt as at 30

December 2019 1,647 55,761 800 852 59,060

Cashflow (1,735) - (800) (852) (3,387)

Addition / (decrease)

to lease liability 2,992 (3,542) - - (550)

----------------------- ------------------ ------------------ ----------- ---------- --------

Net debt as at 27

December 2020 2,904 52,219 - - 55,123

Cashflow (305) - 104 1,146 945

Addition / (decrease)

to lease liability 1,021 (931) - - 90

Net debt as at 27

June 2021 3,620 51,288 104 1,146 56,158

----------------------- ------------------ ------------------ ----------- ---------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR XQLFLFKLZBBQ

(END) Dow Jones Newswires

September 27, 2021 02:00 ET (06:00 GMT)

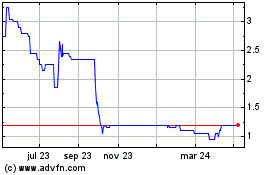

Tasty (LSE:TAST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tasty (LSE:TAST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024