TIDMTATE

RNS Number : 9575Z

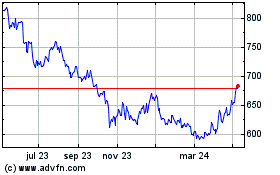

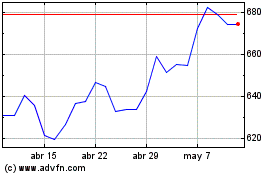

Tate & Lyle PLC

27 May 2021

TATE & LYLE PLC

FULL YEAR RESULTS

For the year ended 31 March 2021

Adjusted results(1) Statutory results

2021 2020 vs 2020 2021 2020 vs 2020

---------- ---------- -------- -------- --------

Revenue GBP2 807m GBP2 882m +1% (3%)

Profit before tax (PBT) GBP335m GBP331m +6% GBP283m GBP296m (4%)

Diluted earnings per

share (EPS) 61.2p 57.8p +12% 53.8p 52.1p +3%

Free cash flow GBP250m GBP247m +GBP3m

Net debt GBP417m GBP451m

Dividend per share 30.8p 29.6p +4.1%

---------- ---------- -------- -------- -------- --------

Movements in adjusted results are shown in constant currency

throughout this statement.

Robust performance with strong growth in Food & Beverage

Solutions

Strategic highlights

-- Food & Beverage Solutions delivers strong top-line growth and double-digit profit(2) growth

-- Primary Products profit(2) higher, benefiting from record year of Commodities profits(2)

-- Strong demand for New Products with revenue up 21% at GBP133m

-- Acquisition of stevia and tapioca businesses expands customer offering and presence in Asia

-- Productivity programme continues to support operational efficiency and investment in growth

-- 2030 sustainability targets on track with Scope 1 and 2 greenhouse gas emissions reduced by 7%

-- Three years of consistent strategic and financial delivery,

creating strong platform for future growth

-- Exploring separation of two businesses by selling controlling stake in Primary Products

Financial highlights

-- Food & Beverage Solutions profit(2) +12% to GBP177m; +3% volume and +6% revenue

-- Sucralose profit(2) -9% to GBP55m reflecting pricing pressure and higher production costs

-- Primary Products profit(2) +5% to GBP158m with Sweeteners and Starches -13%, Commodities +98%

-- Group adjusted profit before tax +6%

-- Adjusted diluted EPS +12%, benefitting from lower effective tax rate of 14.3% (2020: 17.9%)

-- Group statutory diluted EPS +3% after exceptional costs to

explore separating businesses and for productivity

-- Adjusted free cash flow +GBP3m higher at GBP250m

-- Net debt GBP34m lower at GBP417m; Net Debt to EBITDA ratio 0.8x

-- Strong return on capital employed of 17.2%, a 30bps decrease

due to the short-term impact of acquisitions

-- Final dividend increased by 5.8% to 22.0p, making a full year dividend of 30.8p, up 4.1%

Emerging stronger from the pandemic

-- Purpose-led response to pandemic ensuring colleagues and

communities supported and customers served

-- Broadening product portfolio, investing in innovation and strengthening technical capabilities

-- Pandemic accelerating trends for healthier food and drink;

supporting growth in new business and innovation

1 The adjusted results for the year ended 31 March 2021 have

been adjusted to exclude exceptional items, amortisation of

acquired intangible assets, the tax on those adjustments and tax

items that are themselves exceptional. A reconciliation of

statutory and adjusted information is included in Note 3 to the

Financial Information. Growth percentages are calculated on

unrounded numbers. Changes in adjusted performance metrics are in

constant currency.

2 Adjusted operating profit.

NICK HAMPTON, CHIEF EXECUTIVE, SAID:

"Despite all the challenges thrown at us by the pandemic, we

progressed our strategy, grew our profits, strengthened our

financial position and increased our dividend.

In response to the pandemic, we focused on making the right

decisions for our colleagues, communities, customers and the

environment. Inspired by our purpose of Improving Lives for

Generations, this included protecting and supporting colleagues at

our sites and at home, providing over one and a half million meals

to food banks in our local communities, operating with agility to

meet customers' rapidly changing needs, and delivering significant

progress on our sustainability targets. I would like to express my

personal thanks to all our colleagues for their dedication during

an extremely demanding year.

Both businesses performed well, with the impact of the pandemic

starting to ease through the second half. Food & Beverage

Solutions delivered another year of strong top-line growth and

double-digit profit growth. The pandemic is accelerating consumer

demand for healthier food and drink and with its leading

capabilities in sweetening, mouthfeel and fortification, Food &

Beverage Solutions is well-placed to capitalise on this trend.

Primary Products delivered resilient performance with profit higher

despite a significant reduction in out-of-home consumption in North

America. This reflects a record year of profits from Commodities as

well as a focus on customer service, operational performance and

rigorous cost discipline.

We continue to make good progress on our strategy. We acquired

two businesses in Asia to strengthen our sweetener and texturant

portfolios in Food & Beverage Solutions. New Products delivered

double-digit revenue growth, our new business and innovation

pipelines both grew and our productivity programme continued to

generate significant benefits.

Since we announced our strategic priorities in 2018, we have

delivered three years of consistent progress and built a strong

platform for future growth. We are exploring the potential to

separate our Food & Beverage Solutions and Primary Products

businesses through the sale of a controlling stake in Primary

Products to a long-term financial partner. This transaction would

create two businesses, each able to focus on its own strategic and

capital allocation priorities - Tate & Lyle focused on Food

& Beverage Solutions, and Primary Products in partnership with

a new investor with a long-term commitment to growing the

business.

The past year has tested us like no other, and our performance

has demonstrated the resilience, quality and agility of Tate &

Lyle. We are emerging stronger from the pandemic and I am more

confident than ever in the long-term growth potential of our

business."

OUTLOOK FOR YEARING 31 MARCH 2022

For the year ending 31 March 2022, despite the continuing impact

of the Covid-19 pandemic, we expect:

-- Food & Beverage Solutions to deliver another year of progress

-- Sucralose to see further modest pricing pressure

-- In Primary Products, Sweeteners and Starches to return to

growth as out-of-home consumption recovers and Commodities profits

to be significantly lower

-- Further productivity benefits.

With overall positive momentum, we expect growth in Group

adjusted operating profit before Commodities to be in the

mid-single digit range in constant currency.

Reflecting significantly lower Commodities profits and an

increase in the adjusted effective tax rate, Group adjusted diluted

earnings per share are expected to be lower than the prior year in

constant currency.

OVERVIEW OF THE YEAR

Business environment and trading

Demand was closely correlated to the imposition and easing of

lockdowns in our largest markets of North America and Europe. At

the start of the year, in April and May, with lockdowns in place in

both regions, we saw a significant reduction in demand for products

used in out-of-home consumption, partially offset by stronger

in-home consumption. From June onwards, demand improved as

lockdowns eased, although as we finished the year out-of-home

demand remained below pre-pandemic levels. In Asia and Latin

America, demand improved in China from the second quarter as it

emerged from lockdown, while in Latin America demand slowed as

lockdowns were imposed.

All our manufacturing facilities remained operational during the

year. Our operations and customer-facing teams adapted quickly to

the new working environment, adjusting to our customers' changing

needs. Excellent operational execution, productivity and cost

reduction were reflected in the Group's financial performance.

The pandemic has heightened consumer awareness of the importance

of a healthier diet and lifestyle. Our high-quality portfolio and

technical capabilities in sweetening, mouthfeel and fortification

which help reduce sugar, calories and fat, and add fibre to food

and drink, mean we are well-positioned to provide the solutions

needed to meet this growing trend.

Delivering our priorities for the year

In May 2020, as the global pandemic took hold, we set out four

priorities for the year - to look after our colleagues and

communities, strengthen our relationships with customers, continue

to progress our strategy and maintain our financial strength. We

made good progress on each of these priorities during the year and,

with the pandemic continuing, they remain our near-term focus. Our

three longer-term priorities established in May 2018 - Sharpen our

Focus on the Customer, Accelerate Portfolio Development and

Simplify the Business - continue to underpin business performance

and drive a culture of agility and accountability across the

organisation.

Look after our colleagues and communities

Our purpose of Improving Lives for Generations has been central

to our response to Covid-19 with our two purpose pillars of

Supporting Healthy Living and Building Thriving Communities

particularly relevant. During the year, we intensified our

programmes to support the mental wellbeing of colleagues and to

promote health education more widely. Working with Nestlé in Latin

America we launched a free online education programme on the health

benefits of dietary fibre and, in the UK, we became a founder

member of FastFutures, a programme to help young people from

disadvantaged backgrounds learn new skills and increase their

employability. We also took steps to build a more inclusive and

diverse culture within Tate & Lyle, including the creation in

April 2021 of the new role of Chief Equity, Diversity &

Inclusion Officer.

Strengthen our relationships with customers

The pandemic is making us a more agile organisation and we

continue to stay very close to our customers. Through technology we

are connecting and collaborating with them in new ways and building

stronger relationships. This includes bespoke customer webinars on

topics such as sugar reduction and plant-based ingredients, virtual

prototype tastings and video links in our applications labs. These

initiatives led to a 44% increase in our technical team's

interactions with customers during the year.

We accelerated the launch of customer-focused online programmes.

For example, in July, a year earlier than originally planned, we

launched Sweetener Vantage(TM) Expert Systems, a set of innovative

sweetener solution design tools to provide technical support to our

customers to create sugar-reduced food and drinks using low-calorie

sweeteners. Then, in February, we launched our Fibre University, an

online modular course designed to help formulators and food

scientists at our customers solve difficult fibre formulation

challenges. Also in February, we launched the Tate & Lyle

Nutrition Centre, a new digital hub providing customers, scientists

and health professionals with easy access to expert insights,

research and educational tools to increase the awareness of

evidence-based science for ingredients including low- and

no-calorie sweeteners and dietary fibres, and their role in a

healthy, balanced diet.

These actions helped increase the value of our new business

pipeline for Food & Beverage Solutions by 12%. Our work with

customers on reformulation and new product launches increased the

risk adjusted revenue value of our innovation pipeline by 18%.

Continue to progress our strategy

In November, we acquired the outstanding majority shareholding

in Sweet Green Fields, a leading global stevia solutions business.

This acquisition brings us a broad portfolio of stevia products and

a fully integrated stevia supply chain including leaf sourcing,

leaf varietal development and established agricultural programmes.

Sweet Greet Fields has dedicated stevia production and research and

development facilities located in Anji, China. This acquisition

strengthens our sweetener platform and our position as a leading

provider of innovative sweetener solutions with the capabilities to

create foods and beverages that are lower in sugar and calories and

with cleaner labels for customers across the world.

In February, we completed the acquisition of an 85% shareholding

in Chaodee Modified Starch Co., Ltd. a speciality tapioca food

starch business in Thailand. This investment strengthens our

texturant platform and brings new tapioca capabilities and raw

material sourcing expertise. It also establishes a dedicated

tapioca facility in Asia and expands our customer offering in

categories including dairy, bakery, snacks, noodles, and soups,

sauces and dressings.

New Products revenue was once again strong, up 21% in constant

currency, with double-digit growth in both our texturants and

sweeteners platforms benefitting from strong performance from our

CLARIA(R) clean-label starches and stevia sweetener solutions,

respectively. New Products represent 14% of Food & Beverage

Solutions revenue, up from 12% in the prior year.

In Primary Products we continue to execute our strategy to

diversify our product mix by moving into new and growing

end-markets. In sweeteners, we continue to see good demand for

craft beers and other alcohols, while in industrial starches, we

continue to work with formulators on our TEXTURLUX(R) Personal Care

Additives, a range of bio-based specialty polymers for skin, hair

and sun care applications available in North America. Our long-term

strategy to move from the printing and writing paper market into

packaging proved beneficial as online shopping accelerated

significantly during the pandemic. The volume of industrial

starches used in packaging increased by 19%.

Maintain our financial strength

We finished the year in a more robust financial position than we

started with positive cash delivery and a stronger balance sheet.

No employees were furloughed and we did not seek any government

aid.

In May 2020, we extended the maturity of our committed but

undrawn US$800 million revolving credit facility by one year to

2025 . Then, in March 2021, we extended US$700 million of this

facility by a further year to 2026. The pricing of this facility is

linked to the delivery of our 2030 environmental targets for Scope

1 and 2 greenhouse gas emissions, water use and beneficial use of

waste. I n August, w e also issued US$200 million in US private

placement debt at an average coupon of 2.96%. As a result, we have

strong liquidity headroom with access to US$1.3 billion through

cash on hand and a committed and undrawn revolving credit facility.

Leverage remains low with a Net Debt to EBITDA ratio at 31 March

2021 of 0.8x (0.6x on a covenant basis). Following the issuance of

US private placement debt in August, the Group has US$800 million

of private placement debt.

During the year we took steps to reduce costs and preserve cash

to mitigate the financial impact of lower demand. Actions taken

included freezing salary increases and non-essential recruitment,

significantly reducing discretionary costs and re-prioritising

capital commitments. We continued to execute against our

productivity programme to deliver US$150 million benefits over a

six-year period ending 31 March 2024. This programme is ahead of

schedule. In the 2021 fiscal year, the programme delivered US$37

million of benefits taking the total benefits from the first three

years of the programme to US$124 million. These benefits come from

many areas including capital investments to reduce energy costs,

supply chain efficiency improvements and SG&A savings.

Exploring opportunities to separate two businesses

On 25 April 2021, following speculation in the media, we issued

a statement confirming that we are in the process of exploring the

potential to separate our Food & Beverage Solutions and Primary

Products businesses through the sale of a controlling stake in

Primary Products to a long-term financial partner. This

transaction, if concluded, would create two businesses - Tate &

Lyle, focused on Food & Beverage Solutions and a global leader

in sweetening, mouthfeel and fortification, and Primary Products, a

leader in plant-based products for the food and industrial markets,

alongside a new investor with a strong appetite to develop and grow

the business.

We continue to successfully execute our strategy and remain

confident in the future growth prospects of the company. However,

the Board believes that if a transaction of this nature were to be

completed, it would enable Tate & Lyle and the new business to

focus their respective strategies and capital allocation priorities

and create the opportunity for enhanced shareholder value.

Discussions with potential new partners for Primary Products are

ongoing. During the year, we incurred GBP19 million of exceptional

costs, principally for external advisors, for work performed in

relation to this potential transaction. There can be no certainty

that a transaction will be concluded, and we will make further

announcements when appropriate. Any transaction, if concluded,

would be subject to shareholder approval.

Good progress on 2030 environmental targets

Caring for our Planet and helping to protect its natural

resources for the benefit of future generations is one of the three

pillars of our purpose. In May 2020 we announced a set of new,

ambitious environmental targets for 2030 to reduce our greenhouse

gas emissions, beneficially use all the waste we generate, reduce

water consumption and to continue to support sustainable

agriculture. We also committed to eliminate the use of coal in our

operations by 2025, and to make our Scope 1 and 2 and Scope 3

greenhouse gas emissions reduction targets science-based to ensure

we play our part in limiting global warming in line with the goals

of the Paris Agreement. Our emissions targets were validated as

science-based by the Science Based Targets initiative in

September.

We made good progress on our targets during the year:

-- Scope 1 and 2 absolute greenhouse gas emissions reduced by 7% (2030 target: 30%)

-- Water usage reduced by 1% (2030 target: 15%)

-- 69% of our waste was beneficially used (2030 target: 100%) to

generate energy or as nutrients for farms

-- We continued to support 1.5 million acres of sustainably

farmed corn through our partnership with Truterra.

Three major projects are underway at our plants in Lafayette and

Decatur (both US) and Santa Rosa (Brazil) to further reduce our

Scope 1 and 2 greenhouse gas emissions and increase operational

efficiency at each site. When completed, these projects will reduce

our Scope 1 and 2 greenhouse gas emissions by up to 20% (from our

2019 baseline) and deliver on our commitment to eliminate coal from

our operations by 2025.

We also exceeded the two environmental targets set with a 2008

baseline to be delivered by 2020. The first was to reduce

greenhouse gas emissions by 19% per tonne of production, and we

delivered 25% reduction. The second was to reduce waste to landfill

by 30%, and we delivered 37% reduction.

Dividend

The Board recognises the importance of dividends to shareholders

and operates a progressive dividend policy. Due to the uncertainty

caused by the Covid-19 pandemic, the Board decided not to increase

either the final dividend for the 2020 financial year or the

interim dividend for the 2021 financial year. Given this year's

robust performance, the Board is recommending a 1.2p or 5.8%

increase in the final dividend to 22.0p (2020 - 20.8p) per share,

bringing the full year dividend to 30.8p per share (2020 - 29.6p),

an increase of 4.1%. This increase brings dividends back to a level

consistent with the Board's progressive dividend policy,

notwithstanding the pandemic.

The final dividend is subject to approval by shareholders at the

AGM on 29 July 2021. Subject to shareholder approval, the final

dividend will be due and payable on 6 August 2021 to all

shareholders on the Register of Members on 25 June 2021. In

addition to the cash dividend option, shareholders will continue to

be offered a Dividend Reinvestment Plan alternative.

Changes to the Board of Directors

-- John Cheung joined the Board as a non-executive director on 1 January 2021.

-- Imran Nawaz, Chief Financial Officer stepped down from the Board on 31 March 2021.

-- Vivid Sehgal joined the Board on 1 March 2021 as Chief

Financial Officer Designate and became Chief Financial Officer on 1

April 2021.

-- Dr Ajai Puri, a non-executive director, retired from the Board on 31 March 2021.

-- Patrícia Corsi joined the Board as a non-executive director on 1 May 2021.

-- Anne Minto, a non-executive director, will retire from the

Board at the Company's AGM on 29 July 2021.

Changes to Executive Management

-- Andrew Taylor, previously President, Innovation and

Commercial Development, was appointed as President, Asia, Middle

East, Africa and Latin America from 1 October 2020.

-- Victoria Spadaro Grant joined the Company in November 2020 as

President, Innovation and Commercial Development. She also became a

member of the Executive Committee. She joined from Barilla, the

Italian multinational food company, where she had been Chief Global

Research Development and Quality Officer since 2014.

-- Harry Boot, President, Asia Pacific, Food & Beverage

Solutions left the Company on 31 March 2021.

-- As stated above, Vivid Sehgal joined as Chief Financial

Officer Designate on 1 March 2021, when he also joined the

Executive Committee.

SEGMENTAL OPERATING PERFORMANCE

Year ended 31 March 2021 Volume Revenue Revenue Adjusted Adjusted

change growth operating operating

profit profit

change

--------------------------- -------- ---------- -------- ----------- -----------

North America +4% GBP485m +6% - -

Asia, Middle East, Africa

and Latin America +2% GBP269m +7% - -

Europe +4% GBP216m +2% - -

-------- ---------- -------- ----------- -----------

Food & Beverage Solutions +3% GBP970m +6% GBP177m +12%

-------- ----------- -----------

Sucralose - % GBP151m (2%) GBP55m (9% )

Sweeteners and Starches - - - GBP109m (13% )

Commodities - - - GBP49m +98%

-------- ---------- -------- ----------- -----------

Primary Products (5%) GBP1 686m (2%) GBP158m +5%

-------- ----------- -----------

Central costs GBP(51)m - %

---------- -------- ----------- -----------

Total Group GBP2 807m +1% GBP339m +7%

--------------------------- -------- ---------- -------- ----------- -----------

The adjusted results for the year ended 31 March 2021 have been

adjusted to exclude exceptional items, amortisation of acquired

intangible assets, the tax on those adjustments and tax items that

are themselves exceptional. A reconciliation of statutory and

adjusted information is included in Note 3 to the Financial

Information. Growth percentages are calculated on unrounded

numbers. Changes in revenue and adjusted operating profit are in

constant currency.

FOOD & BEVERAGE SOLUTIONS

Strong top-line growth

Volume increased by 3% with revenue 6% higher in constant

currency at GBP970 million. Stronger customer demand for

ingredients used in packaged and shelf-stable foods for consumption

in-home more than offset reduced demand for ingredients used in

food and drink consumed out-of-home. Momentum built as the year

progressed, benefitting from growing demand for healthier food and

beverages that are lower in sugar and calories, with cleaner labels

and added fibre and a gradual recovery in out-of-home consumption.

Good mix management further contributed to revenue growth.

Adjusted operating profit was 12% higher in constant currency at

GBP177 million with good operational performance and strong cost

discipline. The effect of currency translation decreased revenue by

GBP26 million and adjusted operating profit by GBP4 million.

As explained earlier in the statement, we completed two

acquisitions during the year. In November 2020, we acquired the

outstanding 85% interest in the global stevia sweetener solutions

business of Sweet Green Fields. In February 2021, we acquired an

85% holding in Chaodee Modified Starch Co., Ltd, a tapioca business

based in Thailand. These acquisitions broaden our customer

offering, strengthen our sweetener and texturant platforms and

expand our presence in the higher growth Asian markets.

During the year, to increase our focus on building our business

and presence in higher growth markets, we created a new single

Asia, Middle East, Africa and Latin America region. This comprises

the regions previously reported as Asia Pacific, Latin America and

Middle East and Africa (formerly part of Europe, Middle East and

Africa). Additional information on page 33 of this statement

provides the divisional results for the year ended 31 March 2021 in

the format used in the previous financial years.

North America

Top-line momentum continued with volume 4% higher. The Covid-19

pandemic caused significant changes in demand patterns earlier in

the year with strong demand for in-home consumption offset by

weaker out-of-home demand. The North American market for food and

beverages saw low single-digit growth in the year benefiting from

stronger in-home consumption. A focus on customer service and good

performance across categories such as beverage and confectionery,

and nutrition and bakery helped us grow ahead of the market.

Revenue in constant currency was 6% higher at GBP485 million,

benefiting from good mix management with strong growth from clean

label starches, stevia sweeteners and our fibre portfolio.

Strengthening out-of-home consumption and good commercial

performance saw revenue growth accelerate as the year

progressed.

Asia, Middle East, Africa and Latin America

Volume was 2% higher with a weaker first half due to the

pandemic and strong growth in the second half. Revenue increased by

7% in constant currency to GBP269 million helped by good price and

mix management. Asia saw high single-digit revenue growth, while in

Latin America constant currency revenue growth benefitted from US

dollar-based pricing with the region delivering double-digit

revenue growth.

In Asia, revenue growth was strong in China, where the pandemic

recovery started earlier, and in Australia and New Zealand, while

revenue was slightly lower in South East Asia. In Latin America,

revenue grew strongly in Brazil where pandemic restrictions were

less stringent, with Mexico slightly lower due to lockdowns. Across

Latin America, new front-of-pack labelling rules are leading to

increased reformulation opportunities with customers, particularly

to reduce sugar. In Middle East and Africa revenue was in line with

the prior year, reflecting the impact of the pandemic mainly in the

first half, and increased focus on credit risk management.

Europe

Volume was 4% higher with revenue 2% higher in constant currency

at GBP216 million. Volume growth reflected solid demand for in-home

consumption offset by weaker out-of-home demand. Revenue grew more

slowly than volume as strong texturant demand impacted mix with

customers looking for bulking and cost reduction in foods. This was

mitigated by higher stevia and clean label texturants revenue as

well as the benefit of increased revenue from higher-grade

maltodextrin, used in categories such as baby food, following the

opening of additional capacity at our facility in Slovakia.

New Products

Revenue from New Products (products launched in the last seven

years) increased by 21% in constant currency to GBP133 million,

representing 14% of Food & Beverage Solutions revenue, up from

12% in the prior year. Acquisitions, particularly the Sweet Green

Fields stevia business, helped to accelerate New Product revenue

growth.

Our texturants platform delivered strong double-digit revenue

growth driven by high demand for our Non-GMO and CLARIA(R) line of

functional clean label starches. Revenue from the sweeteners

platform also delivered strong double-digit growth, particularly in

stevia and allulose, as sugar and calorie reduction across

categories such as beverage, dairy, confectionery and bakery

remained an important focus for customers and consumers. Revenue

was lower in the health and wellness platform reflecting reduced

consumption in the sports nutrition category due to Covid-19

lockdowns.

SUCRALOSE

Robust demand

Sucralose volume was in line with the prior year with customer

orders slightly higher in the second half despite continued

softness in beverages consumed out-of-home. Revenue in constant

currency decreased by 2% to GBP151 million reflecting customer mix

and pricing pressure. We expect further modest pricing pressure to

continue in the 2022 financial year.

Adjusted operating profit at GBP55 million was 9% lower in

constant currency reflecting de-leverage from lower revenue and

one-off production costs. Currency translation decreased revenue by

GBP6 million and adjusted operating profit by GBP2 million.

PRIMARY PRODUCTS

Resilient performance

Volume was 5% lower with sweetener volume 7% lower and

industrial starch volume 6% lower, both reflecting the impact of

the Covid-19 pandemic. Revenue at GBP1,686 million decreased by 2%

in constant currency, reflecting lower volume mitigated by improved

mix and higher Commodities revenue where co-product prices were

higher. Adjusted operating profit was 5% higher in constant

currency at GBP158 million. Currency translation decreased revenue

by GBP59 million and adjusted operating profit by GBP9 million.

Adjusted operating profit in Sweeteners and Starches was 13%

lower in constant currency. Actions to reduce costs across the

business, especially in operations, and further productivity

benefits were successful in mitigating some of the impact of lower

volume. Adverse US winter weather increased costs by GBP6 million

in the last months of the year. Profit for the year also benefited

from transactional foreign exchange in Latin America of GBP3

million. In the prior year, adjusted operating profit included

profit of GBP7 million from a non-core, savoury ingredients

business closed during that year.

Commodities adjusted operating profit at GBP49 million was GBP26

million higher in constant currency.

Sweeteners

Volume was 7% lower reflecting reduced out-of-home consumption

(representing around 30% of sweetener consumption) as lockdowns in

North America impacted consumer consumption patterns in the early

part of the year. The pandemic also impacted consumption in Mexico,

with export volume lower. As the year progressed, out-of-home

consumption began to recover but demand remains below pre-pandemic

levels.

The 2021 calendar year bulk sweetener pricing round was more

competitive than in previous years delivering slight unit margin

compression which we expect to mitigate with our continuing

productivity programme.

Industrial Starches

Volume was 6% lower reflecting lower demand for paper, partially

mitigated by stronger demand for packaging.

The pandemic resulted in lower demand from the printing and

writing paper industry following the closure of many schools and

offices. Demand for printing and writing paper improved later in

the year but remains below pre-pandemic levels. In packaging,

demand was higher, benefitting from increased online shopping. Our

strategy over recent years to diversify away from the printing and

writing paper market towards other markets such as packaging helped

to mitigate the impact of these changes.

Commodities

Commodities delivered a record year with adjusted operating

profit of GBP49 million, GBP26 million higher in constant currency.

Co-product recoveries were significantly higher, benefiting from

good market conditions including increased market demand and strong

prices across our co-products, and in particular for corn oil

prices.

ADDITIONAL COMMENTARY ON FINANCIAL STATEMENTS

Constant

currency

Year ended 31 March (1) 2021 2020 Change change

Continuing and total operations GBPm GBPm % %

--------------------------------------------- ------ ------ ------- ----------

Revenue 2 807 2 882 (3% ) 1%

Adjusted operating profit

- Food & Beverage Solutions 177 162 10% 12%

- Sucralose 55 63 (12% ) (9%)

- Primary Products 158 158 (1% ) 5%

- Central (51) (52) 1% -%

Adjusted operating profit 339 331 2% 7%

Net finance expense (30) (28) (7%) (9%)

Share of profit after tax of joint ventures 26 28 (6%) 7%

--------------------------------------------- ------ ------ ------- ----------

Adjusted profit before tax 335 331 1% 6%

Exceptional items (42) (24) (69%) (73%)

Amortisation of acquired intangible assets (10) (11) 5% 4%

Profit before tax 283 296 (4%) 1%

Income tax expense (30) (51) 39% 40%

--------------------------------------------- ------ ------ ------- ----------

Profit for the year 253 245 3% 10%

Earnings per share (pence)

Adjusted diluted 61.2p 57.8p 6% 12%

Diluted 53.8p 52.1p 3% 10%

--------------------------------------------- ------ ------ ------- ----------

Cash flow and net debt

Adjusted free cash flow 250 247

Net debt 417 451

--------------------------------------------- ------ ------ ------- ----------

1 Adjusted results and a number of other terms and performance

measures used in this document are not directly defined within

IFRS. We have provided descriptions of the various metrics and

their reconciliation to the most directly comparable measures

reported in accordance with IFRS and the calculation (where

relevant) of any ratios in Note 3.

Central costs

Central costs, which include head office costs and certain

treasury and legal activities, were 1% lower (in line with the

prior year in constant currency). This reflected continued strong

discipline on overhead costs but was largely offset by higher

self-insurance costs and additional costs incurred as we adapted to

new ways of working during the pandemic and positioned the Group to

exit the pandemic a stronger business.

Net finance expense and liquidity

Net finance expense at GBP30 million was 7% higher. This

reflected lower interest income on cash balances, the loss of

non-cash finance income following the 'buy-in' of the main UK

defined benefit pension scheme during the prior year and the issue

of US$200 million of US private placement debt in August 2020,

which was issued to increase the Group's access to liquidity.

In May 2020, we extended the maturity of our committed but

undrawn US$800 million revolving credit facility by one year to

2025. Then, in March 2021, we extended US$700 million of this

facility by a further year to 2026. The pricing of this facility is

linked to the delivery of our 2030 environmental targets for Scope

1 and 2 greenhouse gas emissions, water use and beneficial use of

waste. As set out above, in August 2020, we issued US$200 million

in US private placement debt comprising US$100 million 2.91% notes

maturing in 2030 and US$100 million 3.01% notes maturing in

2032.

As a result, we have strong liquidity headroom with access to

US$1.3 billion through cash on hand and a committed and undrawn

revolving credit facility. Leverage remains low with a net debt to

EBITDA ratio at 31 March 2021 of 0.8x (0.6x on a covenant

basis).

Share of profit after tax of joint ventures

The Group's share of profit after tax of joint ventures of GBP26

million was 6% lower (7% higher in constant currency), reflecting a

weakening of the Mexican Peso. In Almex, the Group's joint venture

in Mexico, weaker sweetener demand was offset by transactional

foreign exchange benefit of GBP4 million. In DuPont Tate & Lyle

Bio Products (Bio-PDO(TM) ) weaker demand for high-performance

textiles and cosmetics, both impacted by the pandemic, saw volume

and profits lower than the prior year.

Exceptional items

The Group recorded a net exceptional charge of GBP35 million,

comprising GBP42 million of exceptional items included in profit

before tax and a GBP7 million credit included as an exceptional

item within tax. Such items principally included the following:

-- GBP20 million of restructuring charges (GBP12 million cash

costs and GBP8 million non-cash costs) for the previously-announced

simplification and productivity programme.

-- GBP19 million of costs (all cash costs), principally for

external advisors, for work performed in exploring the potential to

separate the Food & Beverage Solutions and Primary Products

businesses.

-- A GBP3 million net charge related to historical legal matters

in the US, including income recorded for the favourable settlement

of an insurance claim.

-- The exceptional credit of GBP7 million within tax related to

the release of an uncertain tax provision in the US, which had been

recorded at the time of the Group's exit of Sucralose manufacturing

in Singapore. At that time, the costs arising from the closure of

Singapore and the associated tax were recorded as exceptional

items.

The exceptional cash outflows for the period were GBP32 million,

comprising GBP19 million of cash outflows related to charges

recorded in the current period and GBP13 million of cash outflows

resulting from exceptional costs recorded in the prior years.

In the prior year, the Group recorded a net exceptional charge

of GBP24 million which comprised GBP19 million of restructuring

costs related to the productivity programme and a GBP5 million

charge related to the decision to exit a small non-core savoury

business.

The Group is in the third year of a six-year programme to

generate productivity benefits of US$150 million by 31 March 2024.

For the first half of the year the Group reported spend of US$22

million. US$12 million of this has now been classified as spend

relating to the potential separation of the two businesses and as

such the total spend for the year on productivity projects other

than this was US$15 million (GBP12 million). This brings the total

to date to US$48 million. We now expect to spend less than the

previously announced estimate of around US$75 million in delivering

the targeted benefits of US$150 million.

Taxation

The adjusted effective tax rate was 14.3% (2020 - 17.9%). The

rate was lower than the prior year reflecting the release of

certain tax provisions following expiry of statute of limitations

as well as recognition of certain tax credits in the US.

Given the release of certain tax provisions noted above we now

expect the adjusted effective tax rate for the year ending 31 March

2022 to be higher than the year ended 31 March 2021.

The reported effective tax rate (on statutory earnings) was

10.9% (2020 - 17.1%), this was lower than the adjusted effective

tax rate due to the impact of the factors highlighted above and the

impact of the GBP7 million tax credit recorded as an exceptional

item.

Earnings per share

Adjusted basic earnings per share increased by 6% (12% in

constant currency) to 61.9p and adjusted diluted earnings per share

at 61.2p were 6% higher (12% in constant currency). Statutory

diluted earnings per share increased by 1.7p to 53.8p reflecting

the items above and higher exceptional charges in the year.

Cash flow, net debt and liquidity

Adjusted free cash flow was GBP250 million (2020 - GBP247

million). The increase of GBP3 million reflects higher adjusted

earnings, lower capital expenditure and lower retirement benefit

contributions following the buy-in of the main UK pension scheme in

the prior year , partially offset by the impact of higher corn

prices on working capital. Capital expenditure of GBP152 million

(2020 - GBP166 million) included investment in our Lafayette and

Decatur plants in the US to further reduce our greenhouse gas

emissions and increase operational efficiency at each site.

We expect capital expenditure for the 2022 financial year to be

between GBP180 million and GBP200 million reflecting both a step up

in Food & Beverage Solutions growth capacity and investment

related to acquisitions.

Net debt at 31 March 2021 of GBP417 million was GBP34 million

lower than at 31 March 2020. This movement mainly reflects the

strong net cash flow generated from operating activities and the

favourable translation impact of the weaker US dollar on US

dollar-denominated debt, partially offset by exceptional cash flows

of GBP32 million, investments to acquire businesses totalling GBP62

million and dividend payments of GBP137 million.

At 31 March 2021, the Group held cash and cash equivalents of

GBP371 million and had a committed, undrawn revolving credit

facility of US$800 million until 2025 (of which US$700 million has

been extended to 2026). Net Debt to EBITDA ratio was 0.8 times (31

March 2020 - 0.9 times). On a covenant-testing basis, Net Debt to

EBITDA ratio was 0.6 times, which was significantly lower than the

covenant ratio of not greater than 3.5 times, demonstrating

continued significant headroom above this covenant requirement.

Retirement benefits

The Group maintains pension plans for its current employees and

former employees in a number of countries. Certain of these

arrangements are defined benefit pension schemes. All funded

schemes in the UK and US are closed for further accrual. In the US,

the Group also continues to provide an unfunded post-retirement

medical benefit scheme.

At 31 March 2021, the Group's retirement benefit obligations are

in a net deficit of GBP140 million (31 March 2020 - net deficit of

GBP203 million). The largest component of the net deficit relates

to schemes in the US that are by their nature unfunded schemes

(e.g. US post-retirement medical benefit scheme).

The net deficit decreased by GBP63 million, due to higher

returns of GBP30 million on plan assets in the US funded plans and

reductions in retirement benefit obligations in the US of GBP21

million, due to changes in actuarial assumptions. Additionally, US

dollar denominated plans showed a foreign exchange translation

benefit of GBP20 million.

The main UK plan was subject to a 'buy-in' in the prior year and

therefore the significant increase in obligations due to a lower

discount rate and the impact of higher inflation was largely

off-set by an increase in the value of the 'buy-in' insurance

policy. As a result, the balance sheet for the UK plans remained

broadly consistent with the prior year.

In the year ended 31 March 2021, pension contributions were

GBP14 million lower than the prior year as a result of cessation of

contributions to the main UK scheme following the 'buy-in'.

CAUTIONARY STATEMENT AND CONFERENCE CALL DETAILS

This statement of Full Year Results contains certain

forward-looking statements with respect to the financial condition,

results, operations and businesses of Tate & Lyle PLC. These

statements and forecasts involve risk and uncertainty because they

relate to events and depend upon circumstances that will occur in

the future. There are a number of factors that could cause actual

results or developments to differ materially from those expressed

or implied by these forward-looking statements and forecasts.

A copy of this statement of Full Year Results for the year ended

31 March 2021 can be found on our website at www.tateandlyle.com. A

hard copy of this statement is also available from the Company

Secretary, Tate & Lyle PLC, 1 Kingsway, London WC2B 6AT.

Webcast and Q&A Details

An audio presentation of the results by Chief Executive, Nick

Hampton, and Chief Financial Officer, Vivid Sehgal, will be

available to view on our website from 07.00 (BST) on Thursday 27

May 2021. To access the presentation, visit

https://www.investis-live.com/tate-and-lyle/609d4b818b32171000610eec/njkl

.

This presentation will be live streamed at 10.00 (BST), and will

then be followed by a live Q&A session. To view and listen to

this video webcast and Q&A, visit

https://www.investis-live.com/tate-and-lyle/609ce9ab8afe380a00646c9d/bsdf

. Please note that only sell-side analysts and any pre-registered

buy-side investors will be able to ask questions during the Q&A

session. Sell-side analysts will be automatically pre-registered.

To pre-register, please contact Lucy Huang at

lucy.huang@tateandlyle.com .

The archive version of the audio webcast with Q&A will be

available on the same link at

https://www.investis-live.com/tate-and-lyle/609ce9ab8afe380a00646c9d/bsdf

within two hours of the end of the live broadcast.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383

CONSOLIDATED INCOME STATEMENT

Year ended 31 March

----------------------

2021 2020

Notes GBPm GBPm

---------------------------------------- -------- ---------- ----------

Continuing operations

Revenue 4 2 807 2 882

----------------------------------------- -------- ---------- ----------

Operating profit 287 296

Finance income 6 1 5

Finance expense 6 (31) (33)

Share of profit after tax of joint

ventures 26 28

----------------------------------------- -------- ---------- ----------

Profit before tax 283 296

Income tax expense 7 (30) (51)

----------------------------------------- -------- ---------- ----------

Profit for the year - continuing

operations 253 245

Profit for the year - total operations 253 245

----------------------------------------- -------- ---------- ----------

Attributable to:

---------------------------------------- -------- ---------- ----------

- owners of the Company 253 245

- non-controlling interests - -

---------------------------------------- -------- ---------- ----------

Profit for the year 253 245

----------------------------------------- -------- ---------- ----------

Earnings per share Pence Pence

---------------------------------------- -------- ---------- ----------

Continuing operations:

- basic 8 54.4p 52.8p

- diluted 8 53.8p 52.1p

----------------------------------------- -------- ---------- ----------

Total operations:

- basic 8 54.4p 52.8p

- diluted 8 53.8p 52.1p

----------------------------------------- -------- ---------- ----------

Analysis of adjusted profit for the year -

continuing operations GBPm GBPm

-------

Profit before tax 283 296

Adjusted for:

Net charge for exceptional items 5 42 24

Amortisation of acquired intangible

assets 10 11

Adjusted profit before tax 3 335 331

Adjusted income tax expense 3, 7 (48) (59)

---------------------------------------- ----- ------- -------

Adjusted profit for the year 3 287 272

---------------------------------------- ----- ------- -------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended 31 March

----------------------

2021 2020

Note GBPm GBPm

------------------------------------------------- ------- ---------- ----------

Profit for the year 253 245

------------------------------------------------- ------- ---------- ----------

Other comprehensive (expense)/income

Items that have been/may be reclassified

to profit or loss:

(Loss)/gain on currency translation of foreign

operations (141) 46

Fair value gain/(loss) on net investment

hedges 39 (18)

Net gain/(loss) on cash flow hedges 1 (1)

Share of other comprehensive expense of joint

ventures (6) (3)

(107) 24

Items that will not be reclassified to profit

or loss:

Re-measurement of retirement benefit plans

- actual return higher/(lower) on plan assets 11 129 (58)

- impact of 'buy-in' on main UK pension scheme 11 - (195)

- net actuarial (loss)/gain on retirement

benefit obligations 11 (80) 12

Changes in the fair value of equity investments

at fair value through OCI 3 2

Tax effect of the above items (13) 41

------------------------------------------------- ------- ----------

39 (198)

Total other comprehensive expense (68) (174)

------------------------------------------------- ------- ---------- ----------

Total comprehensive income 185 71

------------------------------------------------- ------- ---------- ----------

Attributable to:

----------------------------- ---- ---

- owners of the Company 185 71

- non-controlling interests - -

----------------------------- ---- ---

Total comprehensive income 185 71

------------------------------- ---- ---

Total comprehensive income relates entirely to continuing

operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 March

------------------------

2021 2020

Notes GBPm GBPm

---------------------------------------------- -------- ------ ------

ASSETS

Non-current assets

Goodwill and other intangible assets 354 340

Property, plant and equipment (including

right-of-use assets of GBP121 million

(2020 - GBP150 million)) 1 105 1 190

Investments in joint ventures 104 91

Investments in equities 59 63

Retirement benefit surplus 11 18 4

Deferred tax assets 32 30

Trade and other receivables 1 -

Derivative financial instruments 1 1

---------------------------------------------- -------- ------ ------

1 674 1 719

---------------------------------------------- -------- ------ ------

Current assets

Inventories 532 456

Trade and other receivables 333 323

Current tax assets 11 10

Derivative financial instruments 23 5

Other current financial assets 32 67

Cash and cash equivalents 10 371 271

1 302 1 132

---------------------------------------------- -------- ------ ------

TOTAL ASSETS 2 976 2 851

---------------------------------------------- -------- ------ ------

EQUITY

Capital and reserves

Share capital 117 117

Share premium 407 406

Capital redemption reserve 8 8

Other reserves 144 239

Retained earnings 783 629

---------------------------------------------- -------- ------ ------

Equity attributable to owners of the Company 1 459 1 399

Non-controlling interests 1 -

---------------------------------------------- -------- ------ ------

TOTAL EQUITY 1 460 1 399

---------------------------------------------- -------- ------ ------

LIABILITIES

Non-current liabilities

Borrowings (including lease liabilities

of GBP116 million (2020 - GBP141 million)) 10 746 682

Retirement benefit deficit 11 158 207

Deferred tax liabilities 44 42

Provisions 11 11

Derivative financial instruments - 2

959 944

---------------------------------------------- -------- ------ ------

Current liabilities

Borrowings (including lease liabilities

of GBP27 million (2020 - GBP30 million)) 10 42 40

Trade and other payables 431 370

Provisions 24 21

Current tax liabilities 25 38

Derivative financial instruments 9 20

Other current financial liabilities 26 19

557 508

---------------------------------------------- -------- ------ ------

Total liabilities 1 516 1 452

---------------------------------------------- -------- ------ ------

TOTAL EQUITY AND LIABILITIES 2 976 2 851

---------------------------------------------- -------- ------ ------

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended 31 March

----------------------

2021 2020

Notes GBPm GBPm

Cash flows from operating activities

Profit before tax from continuing

operations 283 296

Adjustments for:

Depreciation of property, plant

and equipment (excluding exceptional

items) 142 137

Amortisation of intangible assets 33 35

Share-based payments 8 14

Net impact of exceptional income

statement items 5 10 1

Net finance expense 6 30 28

Share of profit after tax of joint

ventures (26 ) (28)

Net retirement benefit obligations (8) (21)

Changes in working capital and other

non-cash movements (24) 2

-------------------------------------------- -------- ----------- ---------

Cash generated from continuing operations 448 464

Net income tax paid (57) (49)

Interest paid (22) (30)

Net cash generated from operating

activities 369 385

-------------------------------------------- -------- ----------- ---------

Cash flows from investing activities

Purchase of property, plant and

equipment (134) (141)

Disposal of property, plant and

equipment (exceptional) 5 - (1)

Disposal of property, plant and 5 -

equipment

Acquisition of businesses, net of (62) -

cash acquired

Investments in intangible assets (18) (25)

Purchase of equity investments (4) (6)

Disposal of equity investments 3 4

Interest received 1 5

Dividends received from joint ventures 4 35

Net cash used in investing activities (205) (129)

-------------------------------------------- -------- ----------- ---------

Cash flows from financing activities

Purchase of own shares including

net settlement (5) (22)

Cash inflow from additional borrowings 154 157

Cash outflow from repayment of borrowings (5) (234)

Repayment of leases (36) (37)

Dividends paid to the owners of

the Company 9 (137) (137)

Net cash used in financing activities (29) (273)

-------------------------------------------- -------- ----------- ---------

Net increase/(decrease) in cash

and cash equivalents 10 135 (17)

-------------------------------------------- -------- ----------- ---------

Cash and cash equivalents:

Balance at beginning of year 271 285

Net increase/(decrease) in cash

and cash equivalents 135 (17)

Currency translation differences (35) 3

-------------------------------------------- -------- ----------- ---------

Balance at end of year 10 371 271

-------------------------------------------- -------- ----------- ---------

A reconciliation of the movement in cash and cash equivalents to

the movement in net debt is presented in Note 10.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Attributable

capital to the Non-

and Capital owners controlling

share redemption Other Retained of the interests Total

premium reserve reserves earnings Company (NCI) equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

At 1 April 2019 523 8 217 733 1 481 - 1 481

Profit for the year -

total operations - - - 245 245 - 245

Other comprehensive

income/(expense) - - 26 (200) (174) - (174)

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

Total comprehensive

income - - 26 45 71 - 71

Hedging gains

transferred

to inventory - - (6) - (6) - (6)

Tax effect of the above

item - - 2 - 2 - 2

Transactions with

owners:

Share-based payments,

net of tax - - - 14 14 - 14

Purchase of own

shares

including net

settlement - - - (22) (22) - (22)

Dividends paid (Note

9) - - - (137) (137) - (137)

Other movements - - - (4) (4) - (4)

------------------------- ----------- ------------- ------------- ---------

At 31 March 2020 523 8 239 629 1 399 - 1 399

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

Profit for the year -

total operations - - - 253 253 - 253

Other comprehensive

(expense)/income - - (104) 36 (68) - (68)

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

Total comprehensive

(expense)/income - - (104) 289 185 - 185

Hedging losses

transferred

to inventory - - 12 - 12 - 12

Tax effect of the above

item - - (3) - (3) - (3)

Transactions with

owners:

Share-based payments,

net of tax - - - 10 10 - 10

Issue of share

capital 1 - - - 1 - 1

Purchase of own

shares

including net

settlement - - - (5) (5) - (5)

Dividends paid (Note

9) - - - (137) (137) - (137)

NCI in subsidiaries

acquired - - - - - 1 1

Other movements - - - (3) (3) - (3)

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

At 31 March 2021 524 8 144 783 1 459 1 1 460

------------------------- --------- ------------- ----------- ----------- ------------- ------------- ---------

TATE & LYLE PLC

NOTES TO THE FINANCIAL INFORMATION

FOR THE YEARED 31 MARCH 2021

1. Background

The financial information on pages 14 to 31 is extracted from

the Group's consolidated financial statements for the year ended 31

March 2021, which were approved by the Board of Directors on 26 May

2021.

The financial information does not constitute statutory accounts

within the meaning of sections 434(3) and 435(3) of the Companies

Act 2006 or contain sufficient information to comply with the

disclosure requirements of International Financial Reporting

Standards (IFRS) adopted pursuant to Regulation (EC) No 1606/2002

as it applies in the European Union.

The Company's auditor, Ernst & Young LLP, has given an

unqualified report on the consolidated financial statements for the

year ended 31 March 2021. The auditor's report did not include

reference to any matters to which the auditor drew attention

without qualifying its report and did not contain any statement

under section 498 of the Companies Act 2006. The consolidated

financial statements will be filed with the Registrar of Companies,

subject to their approval by the Company's shareholders on 29 July

2021 at the Company's Annual General Meeting.

2. Basis of preparation

Basis of accounting

The Group's consolidated financial statements for the year ended

31 March 2021 have been prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006 and international financial reporting standards

adopted pursuant to Regulation (EC) No 1606/2002 as it applies in

the European Union.

The Directors are satisfied that the Group has adequate

resources to continue to operate as a going concern for the

foreseeable future and that no material uncertainties exist with

respect to this assessment. In making the assessment, the Directors

have considered the Group's balance sheet position and forecast

earnings and cash flows for the period from the date of approval of

these financial statements to 31 March 2023. The business plan used

to support the going concern assessment (the "Base case") is

derived from Board-approved forecasts together with certain

downside sensitivities.

Further details of the Directors' assessment are set out

below:

At 31 March 2021, the Group has significant available liquidity,

including GBP371 million of cash and US$800 million (GBP579

million) of committed and undrawn revolving credit facility, none

of which matures before March 2025. In addition, none of the

Group's existing financing matures during the going concern

assessment period, with the earliest maturity being in the year

ending 31 March 2024. During the year, the Group demonstrated its

ability to raise new finance despite the uncertainties of the

Covid-19 pandemic, raising US$200 million of new private placement

debt in August 2020, with ten-year and twelve-year tenors at 2.91%

and 3.01%, respectively.

The Group has only one debt covenant requirement which is to

maintain a net debt to EBITDA ratio of not more than 3.5 times. On

the covenant-testing basis this was 0.6 times at 31 March 2021. As

set out below, for a covenant breach to occur it would require a

profound reduction in Group profit. Such reduction is considered to

be extremely unlikely.

As described elsewhere in the annual report and accounts, the

Group's performance has demonstrated resilience to the challenges

of Covid-19, with revenue, profit and cash-flow growth being

delivered during the year ended 31 March 2021. None of the

scenarios modelled in the Directors' 'worst case scenario' in the

Group's two most recent going concern assessments (30 September

2020 and 31 March 2020) have come to fruition to any degree.

In concluding that the going concern basis is appropriate, the

Directors have modelled the impact of a 'worst case scenario' to

the Base case by including the same three plausible but severe

downside risks also used for the Group's viability statement,

being: a major operational failure causing an extended shutdown of

our largest manufacturing facility; the loss of two of our largest

Food & Beverage Solutions customers; and a slower recovery from

the impact of the Covid-19 pandemic. In aggregate, such 'worst case

scenario' does not result in any material uncertainty to the

Group's going concern assessment and the resultant position still

has significant headroom above the Group's debt covenant

requirement.

In addition, the Directors have calculated a 'reverse stress

test', which represents the changes that would be required to the

Base case in order to breach the Group's debt covenant. Such

'reverse stress test' shows that the forecast Group profit would

have to be reduced to almost zero in order to cause a breach.

Finally, the Group has and continues to demonstrate its ability to

operate all of its manufacturing facilities safely in the current

environment.

Having reviewed the 'worst case scenario' and 'reverse stress

test', the Directors consider that there is no reasonable scenario

in which available liquidity could be exhausted or the Group's debt

covenant could be breached. Accordingly, there is no reasonable

basis under which the Group would not be a going concern.

The Group's principal accounting policies have been consistently

applied throughout the year and will be set out in the notes to the

Group's 2021 Annual Report.

Accounting standards adopted during the year

In the current year, the Group has adopted, with effect from 1

April 2020, the following new accounting standards:

- Amendments to IFRS 3 Definition of a Business

- Amendments to IAS 1 Presentation of Financial Statements and IAS 8 Definition of Material

The adoption of these amendments from 1 April 2020 has had no

material effect on the Group's financial statements.

Accounting standards issued but not yet adopted

No other new standards, new interpretations or amendments to

standards or interpretations have been published which are expected

to have a significant impact on the Group's financial

statements.

Changes in constant currency

Where year-on-year changes in constant currency are presented in

this statement, they are calculated by retranslating current year

results at prior year exchange rates. Reconciliations of the

movement in constant currency have been included in 'Additional

information' within this document.

Alternative performance measures

The Group also presents alternative performance measures,

including adjusted operating profit, adjusted profit before tax,

adjusted earnings per share and adjusted free cash flow, which are

used for internal performance analysis and incentive compensation

arrangements for employees. They are presented because they provide

investors with additional information about the performance of the

business which the Directors consider to be valuable. For the years

presented, alternative performance measures exclude, where

relevant:

- Exceptional items (excluded as they are material in amount;

and are outside the normal course of business or relate to events

which do not frequently recur, and therefore merit separate

disclosure in order to provide a better understanding of the

Group's underlying financial performance);

- Amortisation of acquired intangible assets (costs associated

with amounts recognised through acquisition accounting that impact

earnings compared to organic investments); and

- Tax on the above items and tax items that themselves meet

these definitions. For tax items to be treated as exceptional,

amounts must be material and their treatment as exceptional enable

a better understanding of the Group's underlying financial

performance.

Alternative performance measures reported by the Group are not

defined terms under IFRS and may therefore not be comparable with

similarly-titled measures reported by other companies.

Reconciliations of the alternative performance measures to the most

directly comparable IFRS measures are presented in Note 3.

Exceptional items

Exceptional items comprise items of income, expense and cash

flow, including tax items that: are material in amount; and are

outside the normal course of business or relate to events which do

not frequently recur, and therefore merit separate disclosure in

order to provide a better understanding of the Group's underlying

financial performance. Examples of events that give rise to the

disclosure of material items of income, expense and cash flow as

exceptional items include, but are not limited to:

-- significant impairment events;

-- significant business transformation activities;

-- disposals of operations or significant individual assets;

-- litigation claims by or against the Group; and

-- restructuring of components of the Group's operations.

For tax items to be treated as exceptional, amounts must be

material and their treatment as exceptional enable a better

understanding of the Group's underlying financial performance.

Exceptional items in the Group's financial statements are

classified on a consistent basis across accounting periods.

3. Reconciliation of alternative performance measures

Income statement measures

For the reasons set out in Note 2, the Group presents

alternative performance measures including adjusted operating

profit, adjusted profit before tax and adjusted earnings per

share.

The following table shows the reconciliation of the key income

statement alternative performance measures to the most directly

comparable measures reported in accordance with IFRS:

Year ended 31 March Year ended 31 March 2020

2021

---------------------------------- ----------------------------------

GBPm unless otherwise

stated IFRS Adjusting Adjusted IFRS Adjusting Adjusted

Continuing operations reported items reported reported items reported

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Revenue 2 807 - 2 807 2 882 - 2 882

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Operating profit 287 52 339 296 35 331

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Profit before tax 283 52 335 296 35 331

Income tax expense (30) (18) (48) (51) (8) (59)

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Profit for the year 253 34 287 245 27 272

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

Basic earnings per share

(pence) 54.4p 7.5p 61.9p 52.8p 5.8p 58.6p

Diluted earnings per

share (pence) 53.8p 7.4p 61.2p 52.1p 5.7p 57.8p

Effective tax rate % 10.9% 3.4% 14.3% 17.1% 0.8% 17.9%

-------------------------- ---------- ---------- ---------- ---------- ---------- ----------

The following table shows the reconciliation of the adjusting

items impacting adjusted profit for the year:

Year ended 31 March

----------------------

2021 2020

Continuing operations Notes GBPm GBPm

--------------------------------------------- -------- ---------- ----------

Exceptional costs in operating profit 5 42 24

Amortisation of acquired intangible assets 10 11

--------------------------------------------- -------- ---------- ----------

Total excluded from adjusted profit before

tax 52 35

Tax effect of adjusting items 7 (11) (8)

Exceptional US tax credit 5, 7 (7) -

Total excluded from adjusted profit for the

year 34 27

--------------------------------------------- -------- ---------- ----------

Cash flow measure

The Group also presents an alternative cash flow measure, 'A

djusted free cash flow' which is defined as cash generated from

continuing operations after net interest and tax paid, after

capital expenditure, and excluding the impact of exceptional

items.

The following table shows the reconciliation of adjusted free

cash flow:

Year ended 31

March

----------------

2021 2020

GBPm GBPm

---------------------------------------------------------- ------- -------

Adjusted operating profit from continuing operations 339 331

Adjusted for:

Adjusted depreciation and adjusted amortisation (1) 165 161

Share-based payments 8 14

Changes in working capital and other non-cash movements (24) 2

Net retirement benefit obligations (8) (21)

Capital expenditure (152) (166)

Net interest and tax paid (78) (74)

---------------------------------------------------------- ------- -------

Adjusted free cash flow 250 247

---------------------------------------------------------- ------- -------

1 Total depreciation of GBP148 million (2020 - GBP145 million)

and amortisation of GBP33 million (2020 - GBP35 million) less GBP6

million (2020 - GBP8 million) of accelerated depreciation

recognised in exceptional items and GBP10 million (2020 - GBP11

million) of amortisation of acquired intangible assets.

Financial strength measures

The Group uses two financial metrics as key performance measures

to assess its financial strength. These are the net debt to EBITDA

ratio and the return on capital employed ratio. For the purposes of

KPI reporting, the Group uses a simplified calculation of these

KPIs to make them more directly related to information in the

Group's financial statements.

All ratios are calculated based on unrounded figures in GBP

million.

The net debt to EBITDA ratio is as follows:

31 March

------------

2021 2020

GBPm GBPm

Calculation of net debt to EBITDA ratio

Net debt (Note 10) 417 451

---------------------------------------------------------- ----- -----

Adjusted operating profit 339 331

Add back adjusted depreciation and adjusted amortisation 165 161

EBITDA(1) 504 492

---------------------------------------------------------- ----- -----

Net debt to EBITDA ratio (times) 0.8 0.9

---------------------------------------------------------- ----- -----

1 EBITDA is calculated as adjusted operating profit GBP339

million (2020 - GBP331 million) adding back adjusted depreciation

of GBP142 million (2020 - GBP137 million) (total depreciation of

GBP148 million (2020 - GBP145 million) less GBP6 million (2020 -

GBP8 million) of accelerated depreciation recognised in exceptional

items) and adding back adjusted amortisation of GBP23 million (2020

- GBP24 million) (total amortisation of GBP33 million (2020 - GBP35

million) less GBP10 million (2020 - GBP11 million) of amortisation

of acquired intangible assets).

The return on capital employed calculation is as follows:

31 March

---------

2021 2020 2019

GBPm GBPm GBPm

----------------------------------------------------- ------ ------ ---------

Calculation of return on capital employed (ROCE)

Adjusted operating profit 339 331

Deduct: amortisation of acquired intangible assets (10) (11)

----------------------------------------------------- ------ ------

Profit before interest, tax and exceptional items

from continuing operations for ROCE 329 320

----------------------------------------------------- ------ ------

Goodwill and other intangible assets 354 340 342

Property, plant and equipment 1 105 1 190 982

Working capital, provisions and non-debt-related

derivatives(1) 421 409 401

Invested operating capital of continuing operations 1 880 1 939 1 725

----------------------------------------------------- ------ ------ ---------

Average invested operating capital(2) 1 910 1 832

----------------------------------------------------- ------ ------

Return on capital employed (ROCE) % 17.2% 17.5%

----------------------------------------------------- ------ ------

1 All derivatives held at 31 March 2021 and 2020 were

non-debt-related derivatives. For the purpose of this calculation

other current financial assets and liabilities are also

included.

2 Average invested operating capital represents the average at

the beginning and end of the year of goodwill and other intangible

assets, property, plant and equipment, working capital, provisions

and non-debt-related derivatives.

4. Segment information

Segment information is presented on a basis consistent with the

information presented to the Board (the designated Chief Operating

Decision Maker). All revenue is from external customers.

(a) Segment results

Year ended 31 March 2021

-------------------------- ------------ -----------------------------

Food & Beverage Solutions

GBPm Primary

Sucralose Products Central Total

Continuing operations GBPm GBPm GBPm GBPm