TIDMTATE

RNS Number : 2817R

Tate & Lyle PLC

04 November 2021

Half year results for six months to 30 September 2021

Thursday 4 November 2021

Strategic transformation progressing well; strong growth in Food

& Beverage Solutions

Headlines

-- Group delivered strong H1 performance

-- Double-digit revenue growth in Food & Beverage Solutions

-- New Products revenue growth acceleration

-- Effective management of cost inflation through productivity, cost discipline and pricing

-- Delivered environmental commitment to eliminate use of coal

in all operations four years ahead of target

-- Transaction to create two focused businesses on track for

completion in Q1 of 2022 calendar year

-- Strong platform for growth as a focused Food & Beverage Solutions business

Financial highlights(1)

Continuing operations (new Tate & Lyle)

-- Revenue +19%; profit before tax +20%

- Food & Beverage Solutions revenue +19%

- New Products revenue +48%

- Sucralose revenue +17%

-- Adjusted diluted EPS + 25%

Discontinued operations (2) (NewCo)

-- Adjusted profit after tax ( 12)% lower

Total operations (Tate & Lyle Group)

-- Statutory profit after tax (23)% low er at GBP 102m with

exceptional costs of GBP67m partially offset by benefit of GBP25m

held for sale accounting adjustments

-- Adjusted diluted EPS +3% higher at 29.8p

-- Free cash flow GBP67m lower at GBP127m, net debt GBP8m lower at GBP409m

-- Interim dividend increased by 2.3% to 9.0p

Nick Hampton, Chief Executive said

"In a year of significant change as we re-position Tate &

Lyle as a growth-focused speciality food and beverage solutions

business, the Group delivered strong first half performance despite

inflationary headwinds. Food & Beverage Solutions had an

excellent half and we made good progress on the priorities we set

out at the start of the year.

Consumer demand for healthier food and drink continues to

strengthen across our markets and this was reflected in the

performance of Food & Beverage Solutions which delivered strong

volume and double-digit revenue growth across all regions. Our

investment in innovation and focus on working more closely with

customers continues to generate excellent results with revenue from

New Products 48% higher.

The strategic transformation we announced in July is progressing

well and we remain on course to complete the sale of a controlling

stake in our Primary Products business in the Americas in the first

quarter of 2022.

The strong performance of Food & Beverage Solutions

underpins Tate & Lyle's future potential as a growth-focused

speciality food and beverage solutions business. The new Tate &

Lyle is very well-positioned to deliver on its five-year ambition

for mid single-digit organic revenue growth and annual operating

margin expansion of at least 50 to 100 basis points per year,

supported by increased investment in innovation and a strong

balance sheet to fund both organic growth and M&A.

We are entering a new, ambitious and exciting chapter for Tate

& Lyle and I look forward to the future with great

optimism."

---------------------------------------------------------------------------------------------------------------------------

1 Adjusted metrics percentage changes are in constant

currency

2 Defined as the "Disposed Primary Products business" in this

statement. Adjusted to exclude impact of exceptional items and IFRS

5 held for sale accounting.

Financial Summary

Proposed sale of a controlling stake in Primary Products and

associated reporting changes

On 12 July 2021, we announced we had entered into an agreement

to sell a controlling stake in a new company and its subsidiaries

which will hold the Primary Products business in North America and

Latin America and its interests in the Almidones Mexicanos S.A de

C.V and DuPont Tate & Lyle Bio-Products Company, LLC joint

ventures (together, 'NewCo') to KPS Capital Partners, LP (the

'Transaction'). From July, NewCo has been classified as held for

sale and met the definition of a discontinued operation in

accordance with IFRS 5. As a result, NewCo is required to be

treated as a discontinued operation for all of the year ending 31

March 2022. This classification has been adopted in this half-year

results statement. The continuing operations comprise: Food &

Beverage Solutions (into which the European Primary Products

business, which is not part of the Transaction, and some stranded

costs have been combined); Sucralose; and Central costs. The

results for comparative periods have been restated on a consistent

basis.

Summary of results for six months ended 30 September 2021

Adjusted results(1) Statutory results

2021 2020 vs 2020 2021 2020 vs 2020

Continuing operations

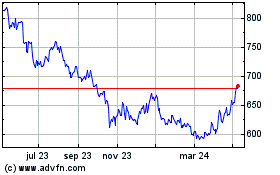

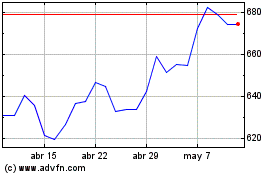

Revenue GBP656m GBP592m +19% +11%

Profit before tax GBP85m GBP78m +20% GBP21m GBP58m (64%)

Diluted earnings per

share 14.4p 12.9p +25% 2.5p 9.6p (74%)

Discontinued operations

Profit after tax GBP72m GBP90m (12%) GBP90m GBP88m +3%

Total operations

Diluted earnings per

share 29.8p 32.1p +3% 21.7p 28.4p (24%)

Free cash flow GBP127m GBP194m GBP(67)m

Net debt (vs. at 31 GBP409m GBP417m

March 2021)

Dividend per share 9.0p 8.8p +2.3%

-------- -------- --------- ------- ------- --------

1 The adjusted results for the six months to 30 September 2021

exclude exceptional items, amortisation of acquired intangible

assets, the tax on those adjustments and tax items that are

themselves exceptional. The adjusted results of discontinued

operations have also been adjusted to exclude the impact of IFRS 5

held for sale accounting. A reconciliation of statutory and

adjusted information is included in Note 2 and Note 6 to the

Financial Information. Growth percentages are calculated on

unrounded numbers. Changes in adjusted performance metrics are in

constant currency throughout this statement.

2 Adjusted operating profit

Continuing operations (new Tate & Lyle)

-- Food & Beverage Solutions:

- Volume +9% with a particularly strong performance from Asia,

Middle East, Africa and Latin America

- Revenue +19% with double-digit organic growth across all regions; 3ppts from acquisitions

- New Products revenue +48% reflecting strong customer demand for sugar reduction solutions

- Profit(2) +9% higher with benefit of positive mix and some reinvestment in future growth

o Profit(2) +2% higher at GBP83m when including lower

performance from Primary Products Europe

-- Sucralose:

- Volume +23% led by strong demand in beverages and phasing of

customer orders into the first half

- Revenue +17% with higher volume partially offset by customer mix and modest pricing pressure

- Profit(2) +34% at GBP31m

-- Adjusted profit before tax +20%; Adjusted diluted EPS +25%

Discontinued operations (NewCo)

-- Volume up +3% as out-of-home consumption continued to recover; strong industrial starch growth

-- Profit(2) (10)% lower at GBP74m

- Sweeteners & Starches profit(2) down (13)% due to cost

inflation and operational and supply chain disruption

- Commodities profit(2) 4% higher reflecting good market conditions at the start of the period

Total operations (Tate & Lyle Group)

-- Adjusted diluted EPS +3%

-- GBP26m cost inflation mitigated to GBP2m net of GBP10m of

pricing and GBP14m of productivity benefits

-- Adjusted free cash flow GBP(67)m lower due to GBP54m higher

working capital from higher revenue and corn price

-- Net debt GBP 8m lower at GBP409m; Net Debt to EBITDA ratio 0.8x

-- Interim dividend increased by 2.3% to 9.0p

Outlook for Year Ending 31 March 2022

We continue to work on completing the sale of a controlling

interest in the Primary Products business in the Americas and

certain joint venture interests to KPS Capital Partners, LP in the

first quarter of the 2022 calendar year. For the purposes of

providing an outlook, we are assuming completion of the transaction

on 31 March 2022.

On that basis , for the year ending 31 March 2022 we expect:

Continuing operations (new Tate & Lyle)

-- Food & Beverage Solutions to deliver another year of progress

-- Sucralose profit to be ahead of the prior year

-- Growth in adjusted profit before tax in constant currency to

be in the high single-digit percent range

Discontinued operations (NewCo)

-- Sweeteners and Starches adjusted operating profit to be below

the prior year and Commodities profit to be significantly lower

Total operations (Tate & Lyle Group)

-- Change in adjusted diluted earnings per share in constant

currency to be mid-single digits percent lower due to the

performance of discontinued operations and expected cost

inflation.

Overview of the Half-Year

Business environment and trading

The Group benefitted from an improved trading environment while

having to navigate changing demand patterns, disruption to

international supply chains, evolving Covid-19 restrictions and

cost inflation. Performance was in line with our expectations at

the start of the 2022 financial year although the divisional mix

was different than anticipated with stronger profit growth in Food

& Beverage Solutions and Sucralose offsetting lower profits

from Primary Products.

Food & Beverage Solutions saw strong demand as in-home

consumption remained robust and out-of-home consumption continued

to recover. Each region delivered strong volume and double-digit

revenue growth. The business continues to benefit from increasing

consumer awareness of the importance of a healthier diet. With its

broad portfolio and technical capabilities in sweetening, mouthfeel

and fortification, Food & Beverage Solutions provides customers

with solutions to reduce sugar, calories and fat, and add fibre to

their products. These capabilities, together with good commercial

execution, supported strong top-line delivery in the half.

In Sucralose, recovering out-of-home consumption led to strong

volume growth in beverages. The business benefitted from phasing of

customer orders into the half which we expect will mostly unwind in

the second half.

In discontinued operations, lower sweetener volume caused by

short-term operational disruption from the installation of new gas

turbines at our facility in Lafayette, Indiana to increase

long-term efficiency and environmental performance, together with

cost inflation, resulted in lower profits in Primary Products.

Industrial starches performed very well with higher volume from

continued growth in the sustainable plant-based packaging

market.

Across the business we saw cost inflation totaling GBP26 million

in the first half in areas such as energy, labour, consumables and

transportation. This was mitigated by productivity benefits of

GBP14 million, pricing of GBP10 million and cost discipline. We

expect cost inflation to increase in the second half and to be

partially mitigated through a combination of the same actions, with

pricing playing a greater role, particularly in the fourth quarter

reflecting the annual contracting cycle.

Delivering strategic progress in Food & Beverage

Solutions

Food & Beverage Solutions made good progress delivering its

strategy and working closely with customers on reformulating

existing products and launching new products. During the half:

-- Food & Beverage Solutions delivered double-digit revenue growth in each region

-- New Product revenue increased by 48% in constant currency

-- New Products represented 14% of Food & Beverage Solutions revenue

-- The value of the new business pipeline increased by 4%

-- The risk adjusted value of the innovation pipeline grew by 2%

-- Integration of the acquisitions of stevia and tapioca

businesses in H2 of fiscal 2021 progressed well.

Growth within Food & Beverage Solutions is being driven by

delivery of its strategic growth framework which is centered on

four pillars - market focus; portfolio expansion; accelerating

innovation; and integrated solutions for customers. Progress in

each pillar in the half is summarised below.

Market focus

Our aim is to maximise opportunities in developed markets and

accelerate growth in the faster growing markets of Asia, Middle

East, Africa and Latin America. We focus on three global categories

- dairy, beverage, and soups, sauces and dressings - as well as two

or three regional categories where we have local expertise such as

bakery and snacks. This category focus, combined with expertise in

sweetening, mouthfeel and fortification, provides a unique and

attractive offering for customers. In North America, revenue from

bakery and snacks grew by 32% and from beverages by 17% supported

by strong demand for fibre and stevia solutions, respectively. In

Asia, revenue from soups, sauces and dressings grew by 16%, while

in Latin America we saw double-digit revenue growth in all three

global categories.

We continue to invest in both infrastructure and capabilities to

support our customers particularly in higher growth markets. In

October, we opened a new Application Technical Centre in Dubai to

serve customers in the Middle East, Turkey and Africa region, where

consumer demand for healthier food and drink is increasing. The

Centre's state-of-the-art technology will speed up the innovation

process for customers and increase their speed to market. It will

also support a new initiative we have launched - The Middle East

Sugar and Calorie Reduction Knowledge Building Programme - together

with the UAE Food & Beverage Manufacturers Group.

Portfolio expansion

The integration of the two acquisitions we made at the end of

the 2021 financial year (Sweet Green Fields, a leading global

stevia solutions business, and Chaodee Modified Starch Co., Ltd. a

speciality tapioca food starch business in Thailand) is progressing

well. Our expanded stevia business is performing very well with

revenue more than doubling. To meet growing customer demand for

stevia solutions, we are investing in our stevia facility in Anji,

China to increase extraction capacity and to install new

environmental equipment. We are also increasing the capacity of our

stevia production line in the US. The capital investment programme

to significantly increase capacity over the next three years for

higher functionality tapioca starches at our facility in Thailand

is progressing as planned.

We strengthened our sweetener platform with two New Product

launches including PUREFRUIT(TM) Monkfruit Juice Concentrate. We

also strengthened our health and wellness platform through a new

distribution agreement for chickpea protein and flour with

Nutriati, a US-based company.

Accelerate Innovation

We continue to increase our investment in R&D, both by

building on our strong in-house scientific expertise and with

external partners through open innovation. New Product revenue grew

by 48% with the sweetener platform delivering exceptionally strong

performance with revenue nearly three times higher driven mainly by

demand for stevia solutions. Revenue in the health & wellness

platform grew by 23% with good demand in the sports nutrition

category while revenue from texturants grew by 9%.

Our increased focus on open innovation is unlocking exciting new

ideas and opportunities. We are seeing good progress in our

partnership with Zymtronix (US), an early-stage company developing

enzyme immobilization technologies used to enhance the efficiency

of production processes. We formed a new partnership with TNO in

the Netherlands to explore the use of 3D food digital technology to

deliver personalised food and nutrition choices for consumers. We

also extended our existing work with APC Microbiome Ireland to

undertake scientific research on the potential metabolic health

benefits of combining dietary fibre with certain bacterial

strains.

Integrated Solutions

We continue to focus on creating integrated solutions for

customers to strengthen our position as their partner for growth.

Our deep understanding of how ingredients interact across the food

matrix in our core categories, together with our leading product

portfolio and technical expertise, mean we can provide customers

with a unique solutions' offering. To further strengthen our

offering, we are increasing our investment in category and consumer

insights, for example through the establishment of a new position

of Global Head of Marketing and Insights, as well as strengthening

our customer-facing applications teams across our regions.

In April, to support our solutions offering, we launched the

Stabiliser University(TM), an online modular course designed to

help formulators and food scientists solve even the toughest

stabiliser formulation challenges. This follows the success of

three other curriculums - Texture University(TM), Sweetener

University(TM) and Fibre University(TM) - which have attracted

thousands of attendees worldwide.

Delivering on our near-term priorities

We are successfully delivering on the four near-term priorities

we set out as we entered the year.

Looking after our colleagues and communities

-- Established new Employee Resource Group focused on providing

support and information on mental health.

-- Partnered with the China Foundation for Poverty Alleviation

to provide children in nine schools with a nutritious daily meal,

nutrition education and to install modern kitchen equipment in the

school canteens.

-- Created a new role of Chief Equity, Diversity & Inclusion Officer.

-- Covid-19 safety protocols in place at all our sites to ensure

the workplace is as safe as possible for our people.

Strengthen our relationships with customers

-- Continued to stay very close to our customers by using

technology and increasingly by meeting in person.

-- All our manufacturing facilities remained operational and our

customers served during the pandemic.

-- Partnered with Nutrição em Pauta, a leading nutrition

education platform in Brazil, the Brazilian Society for Food and

Nutrition and Coca-Cola, to offer health and food industry

professionals a free-to-access digital course to explain the

origins, safety and efficacy of low and no calorie sweeteners.

-- Partnered with the Kellogg's Nutrition and Health Institute

to launch an online course to share the latest science on dietary

fibres with health clinicians, nutritionists, and industry

professionals in Latin America.

Continue to progress our strategy

-- Announced transaction to re-position Tate & Lyle as a

growth-focused global food and beverage solutions business through

the sale of a controlling stake in Primary Products in the Americas

and certain joint ventures. This transaction is explained in more

detail later in this statement.

-- Further information on how we are progressing our strategy is

set out in the "Delivering strategic progress in Food &

Beverage Solutions" section in this statement.

Maintaining our financial strength

-- Robust financial position and strong balance sheet. No

employees furloughed or government aid sought.

-- Continued to execute against productivity programme to

deliver US$150 million benefits over a six-year period ending 31

March 2024 with US$20 million of benefits delivered in the half. Of

this US$14 million was realised from projects in our operations and

US$6 million from SG&A savings.

-- Total benefits since start of programme are US$144 million,

coming from areas including capital investments to reduce costs,

supply chain efficiencies and SG&A savings.

Caring for our Planet - eliminating the use of coal from our

operations

In May 2020 we announced a set of ambitious environmental

targets for 2030 to significantly reduce our absolute greenhouse

gas emissions, beneficially use all the waste we generate, reduce

water consumption and to continue to support sustainable

agriculture. We also committed to eliminate the use of coal in our

operations by 2025.

During the half, we completed projects to replace coal boilers

with natural gas fired heat and power systems at our plants in

Lafayette, Indiana and Decatur, Illinois. Both projects were part

of a multi-year US$150 million capital investment programme to

reduce greenhouse gas emissions and increase operational efficiency

in our plants. With the completion of these projects, we delivered

on our commitment, four years ahead of schedule, to eliminate the

use of coal in all our operations.

We also launched a new sustainability programme for stevia

farmers in Eastern China, developed with the environmental charity

Earthwatch and Nanjing Agricultural University, to help growers

lower their environmental impact and improve their economic

returns.

Changes to Executive Management

William 'Bill' Magee was appointed as President, North America,

Food & Beverage Solutions, and as a member of Tate & Lyle's

Executive Committee, with effect from 1 October 2021. Bill joined

Tate & Lyle in 2018 and had previously served as Senior Vice

President and General Manager, North America, Food & Beverage

Solutions.

Re-positioning Tate & Lyle as a growth-focused business

On 12 July 2021, we announced we had entered into an agreement

to sell a controlling stake in the Primary Products business in

North America and Latin America and certain joint ventures

interests ("NewCo" or the "NewCo Business") to KPS Capital

Partners, LP (the "Transaction"). Full details of the Transaction

are set out in the circular to shareholders posted on 13 September

2021 (the "Circular"), a copy of which is available on the

company's website.

Growth-focused speciality food and beverage solutions

business

The Transaction re-positions Tate & Lyle as a leading global

food and beverage solutions business focused on faster growing

speciality markets with the opportunity to, firstly, benefit from

growing global consumer demand for healthier food and drink a trend

which the global pandemic is accelerating; secondly, to accelerate

growth through a step-up in R&D investment and innovation; and

thirdly to increase the focus on solutions development to support

and strengthen customer relationships. Tate & Lyle's ambition

over the five years following completion of the Transaction is to

increase R&D spend to more than 4% of Food & Beverage

Solutions revenue per annum, and to grow revenue from New Products

to around 20% of Food & Beverage Solutions revenue by the 2026

financial year.

With increased focus, positive top-line momentum, and our plans

to increase investment in innovation, we are confident we have a

strong platform in place from which to sustainably accelerate

organic growth. Our ambition for the five years following

completion is to deliver:

-- Organic revenue growth of mid single-digit percent per annum

-- Operating margin expansion of at least 50 to 100 basis points per annum

-- Organic return on capital employed improvement of 50 basis points per annum on average.

The performance of Food & Beverage Solutions over the three

years ended 31 March 2021 (compound annual revenue growth of 4%)

and in the first half of the 2022 financial year (19% revenue

growth), supports this ambition and demonstrates the potential of

Food & Beverage Solutions as a growth-focused business.

Progress towards completion

Completion of the Transaction is subject to various conditions.

Progress on key areas include:

i) Approval of shareholders was received at a General Meeting

held on 30 September 2021. The ordinary resolution was passed with

99.9% of the votes cast in favour.

ii) Anti-trust clearance from five out of the six the relevant

jurisdictions has been received to-date.

iii) The legal restructuring required to separate the NewCo

Business from Tate & Lyle is proceeding as planned.

iv) The information technology separation to enable both Tate

& Lyle and NewCo to report financially on a standalone basis

from completion is also on track.

We remain on track to complete the Transaction in the first

quarter of the 2022 calendar year.

Dividend

The Board has approved an increase in the interim dividend for

the six months to 30 September 2021 of 0.2p to 9.0p. This will be

paid on 5 January 2022 to all shareholders on the Register of

Members on 26 November 2021. As well as the cash dividend option,

shareholders will be offered a Dividend Reinvestment Plan

alternative.

As set out in the Circular, consistent with the sale of a

controlling stake in NewCo, it is intended to reduce the dividend

to reflect the earnings base of the re-focused Tate & Lyle. The

pay-out ratio (excluding any NewCo earnings) is expected to be

maintained and the dividend per share reduced by around 50%, before

the impact of the share consolidation. Following payment of the

intended special dividend of around GBP500 million and the

associated share consolidation, it is intended that a progressive

dividend policy will be maintained.

With completion of the Transaction expected on or before 31

March 2022, it is expected that the final dividend for the 2022

financial year will be re-based.

Operating Performance - Continuing Operations (New Tate &

Lyle)

Six months to 30 September Volume Revenue Revenue Adjusted Adjusted

2021 change growth operating operating

profit profit

change

-------- -------- -------- ----------- -----------

North America +4% GBP260m +19% - -

Asia, Middle East, Africa

and

Latin America +19% GBP151m +20% - -

Europe(1) +9% GBP167m +18% - -

-------- -------- -------- ----------- -----------

Food & Beverage Solutions +9% GBP578m +19% GBP83m +2%

-------- ----------- -----------

Memo: Food & Beverage

Solutions (before reporting

changes) +10% GBP528m +19% GBP98m +9%

-------- ----------- -----------

Sucralose +23% GBP78m +17% GBP31m +34%

Central costs GBP(17)m +25%

-------- -------- ----------- -----------

Total - Continuing operations GBP656m +19% GBP97m +18%

------------------------------- -------- -------- -------- ----------- -----------

The adjusted results for the six months to 30 September 2021

have been adjusted to exclude exceptional items, amortisation of

acquired intangible assets, the tax on those adjustments and tax

items that are themselves exceptional. A reconciliation of

statutory and adjusted information is included in Note 2 to the

Financial Information. Growth percentages are calculated on

unrounded numbers. Changes in revenue and adjusted operating profit

are in constant currency.

1 Includes loss from the retained Primary Products Europe

business for the six months to 30 September 2021 GBP(11) million

loss (2020 - loss of GBP(4) million) and cost re-allocations

(stranded costs) of GBP(4) million (2020 - GBP(4) million).

FOOD & BEVERAGE SOLUTIONS

Excellent top-line growth

Volume increased by 9% with revenue 19% higher in constant

currency at GBP578 million. Customer demand for ingredients used

for in-home consumption, such as packaged and shelf-stable foods,

remained strong, supplemented by increasing demand for ingredients

used in food and drink consumed out-of-home. Consumer demand for

healthier food and beverages that are lower in sugar and calories,

with cleaner labels and added fibre, also continued to grow. Strong

mix management, together with the pass through of higher corn costs

contributed 7ppts of price/mix leverage. Acquisitions contributed

3ppts to revenue growth.

Looking through the impact of the Covid-19 pandemic and before

the impact of reporting changes, compared to the six months to 30

September 2019, volume was 11% higher and revenue 21% higher.

Adjusted operating profit was 2% higher in constant currency at

GBP83 million with the benefit of strong mix management, strong

cost discipline and productivity benefits mitigated by selected

investments in future growth. As a result of the transaction to

sell a controlling stake in the Primary Products business in the

Americas, Primary Products Europe is now included in the Food &

Beverage Solutions division. Operating losses in the European

Primary Products business increased by GBP7 million to GBP11

million reflecting the impact of higher corn costs and low sugar

pricing. Excluding this, adjusted operating profit for the division

was 9% higher in constant currency. The effect of currency

translation decreased revenue by GBP39 million and adjusted

operating profit by GBP8 million.

North America

Top-line momentum continued with volume 4% higher as strong

demand for in-home consumption continued supported by improving

out-of-home demand, especially for customers in the food service

channel. Demand for solutions which make food and beverage

healthier remained strong in our focus categories in the North

American market, driving volume growth well ahead of the overall

food and beverage market which remained in line with the

comparative period. Growth was driven by strong performance across

categories such as beverage, confectionery and nutrition and

bakery, especially for solutions using our fibre portfolio.

Revenue was 19% higher in constant currency at GBP260 million.

Significant volume growth to revenue growth leverage reflects good

mix with particularly strong growth from the fibre portfolio and

New Products, the impact of acquisitions and the pass through of

higher corn costs. Revenue for New Products increased by more than

50% in North America in the half, with high customer demand for

stevia and allulose sweeteners.

Asia, Middle East, Africa and Latin America

Volume was 19% higher reflecting double-digit growth in each

sub-region, the impact of acquisitions and a comparative period

impacted by the pandemic. Revenue increased by 20% in constant

currency to GBP151 million. Revenue growth was strong in each

sub-region with especially strong growth in Latin America.

In Asia, revenue growth was strong in South East and North Asia.

In China, we saw strong revenue growth in stevia while overall

revenue was lower reflecting a strong comparative. In Latin

America, sugar reduction solutions for customers addressing new

front-of-pack labelling rules accelerated growth in the Mexico and

Central American region, while growth was also strong in Southern

Latin America driven by strong stevia performance. In Brazil,

revenue was slightly lower. In Middle East and Africa, revenue grew

strongly reflecting good performance in Turkey and North West

Africa and strong demand for texturants.

Europe

Volume was 9% higher. Revenue for the region was GBP167 million

including GBP50 million from the retained European Primary Products

business. Revenue was 18% higher in constant currency both before

and after the inclusion of the European Primary Products business.

Revenue growth benefited from strong performance in the beverage,

bakery and confectionary categories and a comparative period

impacted by pandemic lockdowns.

New Products

Revenue from New Products (products launched in the last seven

years) increased by 48% in constant currency to GBP80 million,

representing 14% of Food & Beverage Solutions revenue (after

inclusion of Primary Products Europe), with revenue growth across

the three platforms of sweeteners, texturants and health &

wellness. Acquisitions, particularly the Sweet Green Fields stevia

business, helped to accelerate New Product revenue growth.

The sweeteners platform delivered exceptionally strong

performance with revenue nearly three times higher in the half

driven mainly by demand for stevia solutions. Stevia is an

important natural sweetening ingredient for customers and consumers

and our stevia solutions are used to reduce sugar and calories in

products across a range of categories such as beverage, dairy,

confectionery and bakery. Excluding acquisitions, revenue from the

sweetener platform doubled. Revenue in the health & wellness

platform also grew strongly reflecting strong demand in the sports

nutrition category.

SUCRALOSE

Robust demand

Sucralose volume increased by 23% with strong customer demand in

the beverage category as out-of-home consumption recovered and

customers phased orders into the first half.

Revenue increased by 17% in constant currency to GBP78 million

reflecting strong volume growth partially offset by the impact of

customer mix and modest pricing pressure. In the second half of the

2022 financial year, we expect the impact of customer order phasing

to mostly unwind and further modest pricing pressure to

continue.

Looking through the impact of the Covid-19 pandemic, compared to

a comparative period for the six months to 30 September 2019,

volume was 21% higher and revenue 14% higher.

Adjusted operating profit at GBP31 million was 34% higher in

constant currency reflecting both operational leverage of higher

revenue and one-off production costs incurred in the comparative

period. Currency translation decreased revenue by GBP7 million and

adjusted operating profit by GBP3 million.

Operating Performance - Discontinued Operations (NewCo)

Six months to 30 September Volume Revenue Revenue Adjusted Adjusted

2021 change growth operating operating

profit(1) profit

change

-------- -------- -------- ----------- -----------

Sweeteners and Starches(2) - - - GBP60m (13% )

Commodities - - - GBP14m +4%

-------- -------- -------- ----------- -----------

Primary Products +3% GBP891m +22% GBP74m (10%)

Memo: Primary Products

(before reporting changes) +3% GBP941m +22% GBP59m (19%)

----------------------------- -------- -------- -------- ----------- -----------

The adjusted results for the six months to 30 September 2021

have been adjusted to exclude exceptional items, amortisation of

acquired intangible assets, the tax on those adjustments and tax

items that are themselves exceptional. A reconciliation of

statutory and adjusted information is included in Note 6 to the

Financial Information. Growth percentages are calculated on

unrounded numbers. Changes in revenue and adjusted operating profit

are in constant currency.

1 Adjusted results for discontinued operations have also been

adjusted to exclude the impact of IFRS 5 'held for sale'

accounting.

2 Excludes Primary Products Europe, which has been retained.

Reflects cost re-allocations (stranded costs) transferred to Food

& Beverage Solutions reflecting separation of the businesses

see Note 3.

Resilient performance

Volume was 3% higher with sweetener volume 1% lower and

industrial starch volume 22% higher. Sweetener volume benefited

from improved out-of-home demand for beverages but was impacted by

operational and supply chain disruption. Industrial starch volume

benefited from its strategy to focus on packaging markets as well

as a weak comparative period impacted by Covid-19. Revenue at

GBP891 million increased by 22% in constant currency reflecting

higher volume, the pass through of higher corn costs and

significantly higher revenue from Commodities due to higher

co-product prices.

Looking through the impact of the Covid-19 pandemic and before

reporting changes, compared to the six months to 30 September 2019,

volume was 5% lower and revenue 15% higher.

Adjusted operating profit was 10% lower in constant currency at

GBP74 million. Adjusted operating profit in Sweeteners and Starches

was 13% lower in constant currency reflecting costs associated with

productivity related operational disruption at our Lafayette,

Indiana facility of GBP6 million and input cost inflation. Benefits

from the productivity programme also supported financial

performance. Profit for the period was also lower as the

comparative period benefited from transactional foreign exchange in

Latin America of GBP3 million. Commodities adjusted operating

profit at GBP14 million was 4% higher in constant currency.

Currency translation decreased revenue by GBP84 million and

adjusted operating profit by GBP8 million.

Sweeteners

Volume was 1% lower with out-of-home consumption continuing to

recover after declining during Covid-19 lockdowns mitigated by the

impact of operational disruption. While out-of-home consumption

continues to recover, demand in that channel remains below

pre-pandemic levels.

Industrial Starches

Volume was 22% higher as demand for paper and packaging

recovered compared to weak demand in the comparative period. Our

strategy to partner with customers focused on more sustainable,

plant-based packaging delivered growth ahead of the market.

Commodities

Commodities delivered adjusted operating profit of GBP14

million, 4% higher in constant currency. As we entered the period,

market conditions remained good and co-product recoveries high,

with market conditions and co-product recoveries weakening as the

half progressed.

Additional Commentary in Financial Statements

Constant

Restated* currency

Six months to 30 September (1) 2021 2020 Change change

Continuing operations GBPm GBPm % %

------------------------------------------- ------ ---------- ------- ----------

Revenue 656 592 11% 19%

Adjusted operating profit(2)

- Food & Beverage Solutions 83 90 (7% ) 2%

- Sucralose 31 25 22% 34%

- Central (17) (24) 27% 25%

------- ----------

Adjusted operating profit 97 91 6% 18%

Net finance expense (12) (13) 5% (3% )

Adjusted profit before tax 85 78 8% 20%

Exceptional items (59) (15) (>99%) (>99%)

Amortisation of acquired intangible

assets (5) (5) (5% ) (11% )

Profit before tax 21 58 (64%) (41%)

Income tax expense(3) (9) (13) 26% 23%

------------------------------------------- ------ ----------

Profit for the period - continuing

operations 12 45 (74%) (46%)

Profit for the period - discontinued

operations 90 88 3% 12%

Profit for the period - total operations 102 133 (23%) (8%)

Earnings per share (pence) - continuing

operations

Adjusted diluted 14.4p 12.9p 11% 25%

Diluted 2.5p 9.6p (74% ) (46% )

------------------------------------------- ------ ---------- ------- ----------

Earnings per share (pence) - total

operations

Adjusted diluted 29.8p 32.1p (7%) 3%

Diluted 21.7p 28.4p (24%) (8%)

------------------------------------------- ------ ---------- ------- ----------

Cash flow and net debt - total operations

Adjusted free cash flow 127 194

Net debt - At 30 September (comparative

31 March 2021) 409 417

------------------------------------------- ------ ---------- ------- ----------

* Prior period restated to reflect discontinued operations (see

Notes 1 and 6)

1. Adjusted results and certain other terms and performance

measures used in this document are not directly defined within

IFRS. We have provided descriptions of such metrics and their

reconciliations to the most directly comparable measures reported

in accordance with IFRS and the calculation (where relevant) of any

ratios in Note 2.

2. For a reconciliation to the IFRS 8 segmental results refer to

Note 3.

3. Statutory income tax expense on continuing operations of GBP9

million comprises adjusted income tax charge of GBP17 million

(Difference of GBP8 million comprises

exceptional tax charge of GBP6 million and tax credit on

adjusting items of GBP14 million). Refer to Note 5.

Continuing operations - adjusted operating profit

Constant

currency

Six months to 30 September 2021 2021 2020 change

Adjusted operating profit GBPm GBPm %

-------------------------------------------------- ------ ------ ----------

Food & Beverage Solutions

As previously reported 98 98 9%

Cost re-allocations(1) (4) (4) (4%)

Retained European Primary Products business(2) (11) (4 ) (>99%)

-------------------------------------------------- ------ ------ ----------

Food & Beverage Solutions 83 90 2%

Sucralose 31 25 34%

Central costs (17) (24) 25%

-------------------------------------------------- ------ ------ ----------

Adjusted operating profit - continuing

operations 97 91 18%

-------------------------------------------------- ------ ------ ----------

1. Inclusion of certain operating costs which are reallocated

from Primary Products to Food & Beverage Solutions because they

will remain with the Group post disposal.

2. Adjustment to include the European Primary Products business

in Food & Beverage Solutions, which is not subject to the NewCo

disposal transaction.

Central costs

Central costs, which include head office costs and certain

treasury and legal activities, were 27% lower (25% lower in

constant currency) at GBP17 million benefitting from strong

discipline on overhead costs. Higher costs in the comparative

period also reflected higher self-insurance costs.

Net finance expense and liquidity

Net finance expense from continuing operations at GBP12 million

was 5% lower (3% higher in constant currency), mainly reflecting

lower finance costs in the comparative period due to the US$200

million Private Placement issued in August 2020.

Exceptional items

The Group recorded a net exceptional charge of GBP65 million in

continuing operations, comprising GBP59 million of exceptional

items included in profit before tax and a GBP6 million charge

included as an exceptional item within tax. Such items principally

included the following:

-- GBP41 million of cash costs associated with the transaction

to dispose of the Americas Primary Products business ("NewCo" or

the "NewCo Business");

-- GBP13 million non-cash impairment charge related to the

write-off of dedicated assets in the European Primary Products

business and certain other assets, which are obsolete as a result

of the NewCo Business disposal;

-- GBP2 million of cash costs relating to productivity and

simplification projects in our operations; and

-- GBP3 million net charge related to historical legal matters in the US.

The exceptional cash outflows for the period totalled GBP15

million (for total operations), comprising GBP8 million of cash

outflows related to charges recorded in the current period and GBP7

million of cash outflows resulting from exceptional costs recorded

in prior year.

The Group is in the fourth year of its programme to generate

productivity benefits of US$150 million by 31 March 2024 and has

delivered US$144 million of total benefits to date. During the six

months to 30 September 2021, exceptional cash costs in respect of

this programme of US$3 million (GBP2 million, total operations)

were recognised (either paid or provided), bringing the total to

date to US$51 million.

In the comparative period, the Group recorded a net exceptional

charge of GBP15 million in continuing operations.

Taxation

The adjusted effective tax rate on continuing operations was

20.2% (30 September 2020 (restated) - 22.5%). The rate reflects the

prevailing rates of corporation tax in the US and UK, the

jurisdictions most applicable to the Group's activities, as well as

the benefit from the recognition of additional deferred tax assets

following the announced future increase in the UK corporation tax

rate. We expect the adjusted effective tax rate for the year ending

31 March 2022 to be at a similar level to this rate .

The reported effective tax rate (on statutory earnings) for

continuing operations was 44.7% (30 September 2020 - 21.9%). The

higher effective tax rate on statutory earnings reflects the GBP6

million exceptional tax charge recorded in the period.

Earnings per share

For continuing operations, adjusted earnings per share increased

by 11% (25% in constant currency) to 14.5p and adjusted diluted

earnings per share at 14.4p were also 11% higher (25% in constant

currency). This increase reflects both stronger business

performance as well as a slightly lower tax rate. Statutory diluted

earnings per share decreased by 7.1p to 2.5p, principally

reflecting the higher exceptional costs in the period.

Discontinued operations

Discontinued operations comprises the NewCo Business which

represents a disposal group.

Constant

currency

2021 2020 Change change

Six months to 30 September 2021 GBPm GBPm % %

----------------------------------------- ------ ------ ------- ----------

Revenue 891 797 12% 22%

Primary Products as previously reported

- adjusted operating profit 59 83 (28%) (19%)

Costs re-allocations to continuing

operations(1) 4 4 5% 4%

Transfer of European Primary Products

to continuing operations(2) 11 4 >99% >99%

----------------------------------------- ------ ------ ------- ----------

Adjusted operating profit 74 91 (19%) (10%)

Net finance expense (2) (2) 21% 13%

Adjusted share of profit after tax

from joint ventures 15 13 13% 12%

Adjusted profit before tax 87 102 (14%) (7%)

Exceptional items (2) (3) 30% 24%

IFRS 5 held for sale adjustments 25 - - % - %

Profit before tax 110 99 11% 20%

Income tax expense (20) (11) (74% ) (88%)

----------------------------------------- ------ ------ ------- ----------

Profit for the period - discontinued

operations 90 88 3% 12%

----------------------------------------- ------ ------ ------- ----------

1. Inclusion of certain operating costs which are reallocated

from Primary Products to Food & Beverage Solutions because they

will remain with the Group post disposal.

2. Adjustment to include the European Primary Products business

in Food & Beverage Solutions, which is not subject to the NewCo

disposal transaction.

Adjusted profit after tax for discontinued operations (which

excludes the impact of exceptional items and IFRS 5 held for sale

adjustments) of GBP72 million was 12% lower than the comparative

period, mainly reflecting weaker operating performance.

IFRS 5 Held for Sale adjustments of GBP25 million

IFRS 5 requires certain adjustments to assets held for sale, for

which the relevant items to the Group from the Transaction were as

follows:

-- Cessation of depreciation of assets of the NewCo Business,

this reduced operating costs by GBP23 million; and

-- Cessation of equity accounting of the share of profits from

the Group's existing joint venture interests in Almex and Bio-PDO.

The impact of this resulted in a reduction in joint venture income

of GBP7 million, however dividends received in the period were

recorded as income within discontinued operations, an income of

GBP9 million.

Such adjustments applied prospectively from 1 July 2021 (being

the date at which the Transaction became highly probable) and

comparatives are not restated. The impact of these adjustments is

reflected in discontinued operations only.

Adjusted share of profit after tax of joint ventures

The Group's adjusted share of profit after tax of joint ventures

of GBP15 million was 13% higher (12% higher in constant currency)

principally due to higher profits in DuPont Tate & Lyle

Bio-Products (Bio-PDO), as demand recovered from the pandemic

period. Almex saw stronger sweetener demand in the half as

consumption recovered compared to a Covid-19 pandemic impacted

comparative period. Almex profit was in line with the comparative

period, as the impact of higher volume was offset by the benefit in

the comparative period of transactional foreign exchange of GBP4

million. The statutory share of profit after tax of joint ventures

of GBP8 million reflects the impact of stopping equity accounting

on 1 July 2021 (reduction in joint venture income of GBP7

million).

Net finance expense

Relates to the interest charge on certain leases, principally

railcars.

Exceptional items

Relates to the exceptional charge recognised within the NewCo

Business. This cash charge of GBP2 million relates principally to

productivity and simplification projects in our operations.

Cash flow, net debt and liquidity - total operations

Adjusted free cash flow for the total Group was GBP127 million

(2020 - GBP194 million). The decrease of GBP67 million reflects the

weaker performance in Primary Products, as well as an increase in

working capital of GBP54 million. The increase in working capital

was due to higher receivables as a result of increased revenue and

an increase in inventory as a result of higher corn prices.

We continue to expect capital expenditure for the 2022 financial

year to be between GBP160 million and GBP180 million Such forecast

capital expenditure assumes completion of the Transaction to sell

the NewCo Business on 31 March 2022.

Net debt at 30 September 2021 of GBP409 million was GBP8 million

lower than at 31 March 2021. Net cash flow generated from operating

activities was largely offset by dividend payments of GBP102

million and capital expenditure of GBP67 million leading to this

modest reduction in the period.

At 30 September 2021 the Group held cash and cash equivalents of

GBP396 million (including GBP11 million classified as held for

sale) and had access to a committed, undrawn revolving credit

facility of US$800 million until 2025. Net debt to EBITDA ratio was

0.8 times (31 March 2021 - 0.8 times). On a covenant-testing basis,

net debt to EBITDA ratio was 0.6 times, which was materially lower

than the required covenant ratio of not greater than 3.5 times,

demonstrating significant headroom above this covenant

requirement.

Retirement benefits

The Group maintains pension plans for certain of its current and

former employees in a number of countries. Certain of these

arrangements are defined benefit pension schemes. All funded

schemes in the UK and US are closed for further accrual. In the US,

the Group also continues to provide an unfunded post-retirement

medical benefit scheme.

On disposal of the NewCo Business, the Group will retain all US

defined benefit pension schemes. However, certain funded

non-qualified deferred compensation arrangements as well as the

unfunded post-retirement medical plans relating to employees

transitioning as part of the Transaction (together representing a

net deficit of GBP28 million) will be disposed of and are therefore

classified as held for sale.

At 30 September 2021, the Group's retirement benefit obligations

were in a net deficit of GBP114 million (31 March 2021 - net

deficit of GBP140 million). The largest component of the net

deficit relates to schemes in the US that are by their nature

unfunded schemes (e.g. US post-retirement medical benefit

scheme).

During the period to 30 September 2021, the asset performance

closely matched and offset the actuarial losses in the funded

plans. As a result, the net deficit position increased marginally

to GBP142 million before the impact of reclassification to held for

sale.

The main UK plan was subject to a 'buy-in' in the 2020 financial

year whereby any increases in pension obligations are offset by

equal and opposite movements in the 'buy-in' insurance policy. As a

result, the balance sheet for the UK plans has remained consistent

with the 31 March 2021 position.

In the six months to 30 September 2021, pension contributions of

GBP5 million were in line with the comparative period.

Basis of preparation

Notwithstanding the application of IFRS 5 'Non-current assets

Held for Sale and Discontinued Operations' to the NewCo Business,

the Group's principal accounting policies are unchanged compared

with the year ended 31 March 2021 with one exception. During the

six months to 30 September 2021, the Group has revised its

accounting policy in relation to upfront configuration and

customisation costs incurred in implementing Software-as-a-Service

arrangements in response to an IFRS Interpretations Committee

decision (Configuration or Customisation Costs in a Cloud Computing

Arrangement (IAS 38 Intangible Assets)-Agenda Paper 2).

Details of the basis of preparation, including information in

respect of the Group's alternative performance measures, can be

found in Note 1 to the attached financial information.

Going Concern

The Directors are satisfied that the Group has adequate

resources to continue to operate as a going concern for the

foreseeable future and that no material uncertainties exist with

respect to this assessment. In making the assessment, the Directors

have considered the Group's balance sheet position and forecast

earnings and cash flows for the period from the date of approval of

this condensed set of consolidated financial information to 31

March 2023. The Directors have also considered the impact of the

Transaction on this assessment. The business plan used to support

the going concern assessment (the "Base case") is derived from

Board-approved forecasts together with certain downside

sensitivities.

Further details of the Directors' assessment are set out

below:

At 30 September 2021, the Group has significant available

liquidity, including GBP396 million of cash and US$800 million of

committed and undrawn revolving credit facility, of which US$100

million matures in 2025 and US$700 million matures in 2026. In

addition, none of the Group's existing financing matures during the

going concern assessment period and the Transaction does not

require any of it to be repaid or refinanced. The earliest maturity

date is October 2023, when US$120 million of private placement debt

will mature. During the prior year, the Group demonstrated its

ability to raise new finance despite the uncertainties of the

Covid-19 pandemic, raising US$200 million of new private placement

debt in August 2020, with ten-year and twelve-year tenors at 2.91%

and 3.01%, respectively.

The Group has only one debt covenant requirement which is to

maintain a net debt to EBITDA ratio of not more than 3.5 times. On

the covenant-testing basis this was 0.6 times at 30 September 2021

(Refer to Note 2). For a covenant breach to occur it would require

a profound reduction in Group profit. Such reduction is considered

to be extremely unlikely.

As set out in our 31 March 2021 Annual Report, during May 2021,

the Directors modelled the impact of a 'worst case scenario' to the

Base case by including the same three plausible but severe downside

risks also used for the Group's viability statement, being: a major

shutdown of our largest manufacturing facility; the loss of two of

our largest Food & Beverage Solutions customers; and a slower

recovery from the impact of the Covid-19 pandemic. In aggregate,

such 'worst case scenario' did not result in any material

uncertainty to the Group's going concern assessment and did not

erode the significant headroom above the Group's debt covenant

requirement. The Directors also calculated a 'reverse stress test',

which represents the changes that would be required to the Base

case in order to breach the Group's debt covenant. Such 'reverse

stress test' showed that the forecast Group profit would have to be

reduced to almost zero in order to cause a breach.

Since the assessment in May, the Directors updated the model

such that it considered similar downside cases (being a major plant

shutdown, loss of our two largest Food & Beverage Solutions

customers and a slower recovery from the Covid-19 pandemic). This

assessment also considered a scenario where the Transaction did not

complete. Based on this assessment, the Directors concluded that in

both the Base Case and worst case scenario, the Group has

significant liquidity and covenant headroom throughout the period

to 31 March 2023. Accordingly, the Directors have concluded that

there are no material uncertainties with respect to going concern

and have adopted the going concern basis in preparing the condensed

consolidated financial information of the Group as at 30 September

2021.

Risks and uncertainties

The principal risks and uncertainties affecting the business

activities of the Group are detailed on pages 71 to 76 of the Tate

& Lyle Annual Report 2021, a copy of which is available on the

Company's website at www.tateandlyle.com . Given the work currently

being undertaken to complete the transaction announced on 12 July

2021 to sell a controlling stake in the Primary Products business

in the Americas ("NewCo") to KPS Capital Partners, LP, the Board

has decided to add a further principal risk to those outlined in

the Annual Report 2021 which is 'Failure to successfully manage the

transition to two standalone businesses following the sale of the

controlling stake in Primary Products'. The Board considers that

actions are also being taken to substantially mitigate the impact

of this risk. Except as described above, the Board considers that

the principal risks set out in the Annual Report 2021 remain

unchanged and that actions continue to be taken to substantially

mitigate the impact of such risks, should they materialise.

CAUTIONARY STATEMENT AND CONFERENCE CALL DETAILS

Cautionary statement

This statement of Half Year Results contains certain

forward-looking statements with respect to the financial condition,

results, operations and businesses of Tate & Lyle PLC. These

statements and forecasts involve risk and uncertainty because they

relate to events and depend upon circumstances that will occur in

the future. There are a number of factors that could cause actual

results or developments to differ materially from those expressed

or implied by these forward-looking statements and forecasts.

A copy of this statement of Half Year Results for the six months

to 30 September 2021 can be found on our website at

www.tateandlyle.com. A hard copy of this statement is also

available from the Company Secretary, Tate & Lyle PLC, 1

Kingsway, London WC2B 6AT.

Webcast and Q&A Details

An audio presentation of the results by Chief Executive, Nick

Hampton, and Chief Financial Officer, Vivid Sehgal, will be

available to view on our website from 07.00 (GMT) on Thursday 4

November 2021. To access the presentation, visit

https://www.investis-live.com/tate-and-lyle/61718bc1835ae21200bc2f0b/dfgh

.

This presentation will be live streamed at 10.00 (GMT), and will

then be followed by a live Q&A session. To view and listen to

this audio webcast and Q&A, visit

https://www.investis-live.com/tate-and-lyle/61718e74b3a1780c00c8bf58/hunb

Please note that only sell-side analysts and any pre-registered

buy-side investors will be able to ask questions during the Q&A

session. Sell-side analysts will be automatically pre-registered.

To pre-register, please contact Lucy Huang at

lucy.huang@tateandlyle.com.

The archive version of the audio webcast with Q&A will be

available on the same link at

https://www.investis-live.com/tate-and-lyle/61718e74b3a1780c00c8bf58/hunb

within two hours of the end of the live broadcast.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383

CONDENSED (INTERIM) CONSOLIDATED INCOME STATEMENT

(UNAUDITED)

Restated* Restated*

Six months Six months Year to

to to 31 March

30 September 30 September 2021

2021 2020 GBPm

Continuing operations Notes GBPm GBPm

-------------------------------------- ---- ------- --------------- ------ -------------- -------- ------------

Revenue 2 656 592 1 211

-------------------------------------------- ------- --------------- ------ -------------- -------- ------------

Operating profit 2 33 71 116

Finance income - 1 1

Finance expense (12) (14) (27)

Profit before tax 21 58 90

Income tax expense 5 (9) (13) (1)

-------------------------------------------- ------- --------------- ------ -------------- -------- ------------

Profit for the period - continuing

operations 12 45 89

Profit for the period - discontinued

operations 6 90 88 164

-------------------------------------------- ------- --------------- ------ -------------- -------- ------------

Profit for the period - total

operations 102 133 253

-------------------------------------------- ------- --------------- ------ -------------- -------- ------------

Profit for the period attributable

to:

--------------------------------------- --- ------- --------------- ------------------ ----------------

- Owners of the Company 102 133 253

- Non-controlling interests - - -

--------------------------------------- --- ------- --------------- ------------------ ----------------

Profit for the period - total

operations 102 133 253

--------------------------------------- --- ------- --------------- ------------------ ----------------

Earnings per share Pence Pence Pence

--------------------------------------- --- ------- --------------- ------------------ ----------------

Continuing operations

- basic 7 2.5p 9.7p 19.3p

- diluted 7 2.5p 9.6p 19.1p

--------------------------------------- --- ------- --------------- ------------------ ----------------

Total operations

- basic 7 21.9p 28.6p 54.4p

- diluted 7 21.7p 28.4p 53.8p

--------------------------------------- --- ------- --------------- ------------------ ----------------

Analysis of adjusted profit GBPm GBPm GBPm

for the period - continuing

operations

--- ------- --------------- ------------------

Profit before tax - continuing

operations 21 58 90

Adjusted for:

Net charge for exceptional

items 4 59 15 34

Amortisation of acquired intangible

assets 5 5 10

Adjusted profit before tax

- continuing operations 2 85 78 134

Adjusted income tax expense

- continuing operations 2 (17) (17) (16)

--------------------------------------- --- ------- --------------- ------------------ ----------------

Adjusted profit for the period

- continuing operations 2 68 61 118

--------------------------------------- --- ------- --------------- ------------------ ----------------

* Prior periods restated to reflect discontinued operations (see

Notes 1 and 6)

CONDENSED (INTERIM) CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME (UNAUDITED)

Six months Six months

to to

30 30 Year to

September September 31 March

2021 2020 2021

Notes GBPm GBPm GBPm

------------------------------------------------------------ ------ ------------ ------------- -----------

Profit for the period - total

operations 102 133 253

Other comprehensive income/(expense):

Items that have been/may be reclassified

to profit or loss:

Gain/(loss) on currency translation

of foreign operations 41 (35) (141)

Fair value (loss)/gain on net

investment hedges (28) 13 39

Net gain on cash flow hedges 40 1 1

Net change in cost of hedging (2) - -

Share of other comprehensive income/(expense)

of joint ventures 5 (3) (6)

Tax effect of the above items (10) - -

------------------------------------------------------------ ------ ------------ ------------- -----------

46 (24) (107)

------------------------------------------------------------ ------ ------------ ------------- -----------

Items that will not be reclassified

to profit or loss:

Re-measurement of retirement benefit

plans:

* return on plan assets 11 35 186 129

* net actuarial loss on retirement benefit obligations 11 (35) (177) (80)

Change in the fair value of FVOCI

investments 10 (1) (1) 3

Tax effect of the above items - (3) (13)

------------------------------------------------------------ ------ ------------ ------------- -----------

(1) 5 39

Total other comprehensive income/(expense) 45 (19) (68)

------------------------------------------------------------ ------ ------------ ------------- -----------

Total comprehensive income 147 114 185

------------------------------------------------------------ ------ ------------ ------------- -----------

Analysed by:

- Continuing operations 2 58 129

- Discontinued operations 145 56 56

------------------------------------- ---- ---- ----

Total comprehensive income - total

operations 147 114 185

------------------------------------- ---- ---- ----

Attributable to:

- Owners of the Company 147 114 185

- Non-controlling interests - - -

------------------------------------ ---- ---- ----

Total comprehensive income - total

operations 147 114 185

------------------------------------- ---- ---- ----

CONDENSED (INTERIM) CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

At Restated(*) Restated(*)

30 September At 30 September At 31 March

2021 2020 2021

Notes GBPm GBPm GBPm

------------------------------------- -------- -------------- ----------------- -------------

ASSETS

Non-current assets

Goodwill and other intangible

assets 290 319 345

Property, plant and equipment

(including right-of-use assets

of GBP46 million (30 September

2020 -

GBP133 million, 31 March 2021

- GBP121 million)) 426 1 152 1 105

Investments in joint ventures - 98 104

Investments in equities 10 50 65 59

Retirement benefit surplus 11 22 9 18

Deferred tax assets 44 30 32

Trade and other receivables 1 1 1

Derivative financial instruments 10 - 3 1

833 1 677 1 665

------------------------------------- -------- -------------- ----------------- -------------

Current assets

Inventories 263 391 532

Trade and other receivables 251 314 333

Current tax assets 11 5 11

Derivative financial instruments 10 3 9 23

Other current financial assets 10 - 38 32

Cash and cash equivalents 9 385 484 371

-------------------------------------- -------- -------------- ----------------- -------------

913 1 241 1 302

------------------------------------- -------- -------------- ----------------- -------------

Assets classified as held for

sale 6 1 372 - -

-------------------------------------- -------- -------------- ----------------- -------------

2 285 1 241 1 302

------------------------------------- -------- --------------

TOTAL ASSETS 3 118 2 918 2 967

-------------------------------------- -------- -------------- ----------------- -------------

EQUITY

Capital and reserves

Share capital 117 117 117

Share premium 407 407 407

Capital redemption reserve 8 8 8

Other reserves 196 223 144

Retained earnings 779 668 777

-------------------------------------- -------- -------------- ----------------- -------------

Equity attributable to owners

of the Company 1 507 1 423 1 453

Non-controlling interests 1 - 1

-------------------------------------- -------- -------------- ----------------- -------------

TOTAL EQUITY 1 508 1 423 1 454

LIABILITIES

Non-current liabilities

Borrowing (including lease

liabilities of GBP52 million

(30 September 2020 - GBP116

million,

31 March 2021 - GBP116 million)) 9 699 800 746

Retirement benefit deficit 11 136 200 158

Deferred tax liabilities 8 26 41

Provisions 13 12 11

856 1 038 956

------------------------------------- -------- -------------- ----------------- -------------

Current liabilities

Borrowings (including lease

liabilities of GBP9 million

(30 September 2020 - GBP27

million,

31 March 2021 - GBP27 million)) 9 25 42 42

Trade and other payables 211 333 431

Provisions 16 20 24

Current tax liabilities 15 51 25

Derivative financial instruments 10 17 1 9

Other current financial liabilities 10 - 10 26

-------------------------------------- -------- -------------- ----------------- -------------

284 457 557

------------------------------------- -------- -------------- ----------------- -------------

Liabilities directly associated

with the assets held for sale 6 470 - -

754 457 557

------------------------------------- -------- -------------- ----------------- -------------

Total liabilities 1 610 1 495 1 513

-------------------------------------- -------- -------------- ----------------- -------------

TOTAL EQUITY AND LIABILITIES 3 118 2 918 2 967

-------------------------------------- -------- -------------- ----------------- -------------

* Prior periods restated for change in accounting policy

(Configuration or Customisation Costs in a Cloud

Computing Arrangement (IAS 38 Intangible Assets) - Agenda Paper 2, see Notes 1 and 15)

CONDENSED (INTERIM) CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

Six months Six months Year to

to 30 September to 30 September 31 March

2021 2020 2021

Notes GBPm GBPm GBPm

Cash flows from operating activities

- total operations

Profit before tax from total operations 131 157 283

Adjustments for:

Depreciation of property, plant

and equipment (excluding exceptional

items) 47 72 142

Amortisation of intangible assets 14 16 33

Share-based payments 6 7 8

Net impact of exceptional income

statement items 4 46 1 10

Net finance expense 14 15 30

Share of profit after tax of joint

ventures (8) (13) (26)

Net retirement benefit obligations (2) (2) (8)

Changes in working capital and other

non-cash movements (28) 26 (24)

Cash generated from total operations 220 279 448

Net income tax paid (31) (24) (57)

Interest paid (10) (10) (22)

Net cash generated from operating

activities 179 245 369

------------------------------------------- -------- ----------------- ----------------- ----------

Cash flows from investing activities

Purchase of property, plant and

equipment (62) (62) (134)

Disposal of property, plant and

equipment - 5 5

Acquisition of businesses, net of

cash acquired 1 - (62)

Investments in intangible assets (5) (7) (18)

Purchase of equity investments 10 (2) (3) (4)

Disposal of equity investments 10 2 2 3

Interest received - 1 1

Dividends received from joint ventures 25 4 4

Net cash used in investing activities (41) (60) (205)

------------------------------------------- -------- ----------------- ----------------- ----------

Cash flows from financing activities

Purchase of own shares including

net settlement (4) (4) (5)

Cash inflow from additional borrowings 1 153 154

Cash outflow from repayment of borrowings - - (5)

Repayment of leases (16) (18) (36)

Dividends paid to the owners of

the Company 8 (102) (97) (137)

Net cash (used in)/ generated from

financing activities (121) 34 (29)

------------------------------------------- -------- ----------------- ----------------- ----------

Net increase in cash and cash equivalents 9 17 219 135

------------------------------------------- -------- ----------------- ----------------- ----------

Cash and cash equivalents

Balance at beginning of period 371 271 271

Net increase in cash and cash equivalents 17 219 135

Currency translation differences 8 (6) (35)

------------------------------------------- -------- ----------------- ----------

Balance at end of period 9 396 484 371

------------------------------------------- -------- ----------------- ----------------- ----------

A reconciliation of the movement in cash and cash equivalents to

the movement in net debt is presented in Note 9. Included in the

total cash and cash equivalents of GBP396 million held at 30

September 2021, is GBP11 million classified as held for sale.

CONDENSED (INTERIM) CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED)

Share

capital Attributable

and Capital to owners Non-controlling

share redemption Other Retained of the interests Total

premium reserve reserves earnings Company equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

At 1 April 2021

(restated)* 524 8 144 777 1 453 1 1 454

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

Profit for the period - - - 102 102 - 102

Other comprehensive

income - - 45 - 45 - 45

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

Total comprehensive

income - - 45 102 147 - 147

Hedging losses

transferred

to inventory - - 9 - 9 - 9

Tax effect of the

above

item - - (2) - (2) - (2)

Transactions with

owners:

Share-based

payments,

net of tax - - - 6 6 - 6

Purchase of own

shares

including net

settlement - - - (4) (4) - (4)

Dividends paid (Note

8) - - - (102) (102) - (102)

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

At 30 September 2021 524 8 196 779 1 507 1 1 508

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

At 1 April 2020 523 8 239 629 1 399 - 1 399

Software-as-a-Service

restatement - - - (6) (6) - (6)

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

At 1 April 2020 -

restated* 523 8 239 623 1 393 - 1 393

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

Profit for the period - - - 133 133 - 133

Other comprehensive

(expense)/ income - - (25) 6 (19) - (19)

----------------------- --------- ------------ ---------- ---------- -------------- ----------------- ---------

Total comprehensive

(expense)/ income - - (25) 139 114 - 114

Hedging losses

transferred

to inventory - - 13 - 13 - 13