Taylor Maritime Investments Limited Acquisition of two geared Handysize bulk vessels (0020C)

16 Junio 2021 - 1:00AM

UK Regulatory

TIDMTMIP

RNS Number : 0020C

Taylor Maritime Investments Limited

16 June 2021

16 June 2021

Taylor Maritime Investments Limited (the "Company")

Acquisition of two geared Handysize bulk vessels completes

deployment of IPO proceeds

Taylor Maritime Investments Limited, the recently launched

specialist dry bulk shipping investment company, is pleased to

announce that is has successfully completed the deployment of the

proceeds raised at IPO following the purchase of two Japanese built

geared Handysize bulk vessels for an aggregate consideration of

US$26.45 million in cash. Both vessels are being acquired at below

80% of depreciated replacement cost.

These two vessels are in addition to the 23 Seed Assets

comprising the Company's Seed Portfolio. The average age of the two

vessels is in line with the current average fleet age of the Seed

Portfolio of 10.6 years. Delivery of the two ships is expected in

mid-July and early-November 2021.

Since the Company's Prospectus was published on 7 May 2021, five

vessels of the Company's Seed Portfolio have, on renewal of their

initial employment, been fixed on charters of approximately one

year in duration at an average annualised unlevered gross cash

yield of over 20%.

Following completion of the Remaining Seed Asset Acquisition

Agreements, the Company's fleet will comprise 25 vessels. The

Executive Team continues to make positive progress on its pipeline

of primarily Handysize and Supramax vessels. The Company looks

forward to providing more details on these opportunities in due

course.

Edward Buttery, Chief Executive Officer, said: "We are pleased

to have made these two attractively priced acquisitions which fully

deploy our IPO proceeds. We have also successfully placed another

five of the vessels in our existing fleet on new charters that are

delivering a strong yield and have a good duration. We continue to

see significant potential in the Handysize market with its ongoing

robust fundamentals."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018

("UK MAR").

For further information, please contact:

Taylor Maritime Investments Limited

Edward Buttery

Alexander Slee +852 2252 3882

Jefferies International Limited

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden +44 20 7029 8000

LEI: 213800FELXGYTYJBBG50

NOTES:

About the Company

Taylor Maritime Investments Limited is a newly established,

internally managed investment company listed on the Premium Segment

of the Official List and traded on the Main Market of the London

Stock Exchange. The Company will invest in a diversified portfolio

of vessels which will primarily be second-hand and which,

historically, have demonstrated average yields in excess of the

Company's target dividend yield of 7% p.a. and are capable of being

acquired at valuations that are expected to be below long-term

average prices.

The Company's initial investments forming the Seed Portfolio

comprise Geared Ships (Handysize and Supramax types) to be employed

utilising a variety of employment/Charter strategies.

The Company intends to pay dividends on a quarterly basis with

dividends declared in January, April, July and October. The Company

expects to declare its first dividend of 1.75 cents per Ordinary

Share for the initial period ended 30 September 2021 in October

2021. Once the Company is fully invested, the Company will target a

Total NAV Return of 10 to 12% p.a. (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to long

term. [1]

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team have to date worked closely

together for the Commercial Manager, Taylor Maritime. Established

in 2014, Taylor Maritime is a privately owned ship-owning and

management business with a seasoned team that includes the founders

of dry bulk shipping company Pacific Basin Shipping (listed in Hong

Kong 2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

[1] The above references to dividends and returns are

expectations and not profit forecasts and there can be no assurance

that these will be met.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQSFIFIIEFSEIM

(END) Dow Jones Newswires

June 16, 2021 02:00 ET (06:00 GMT)

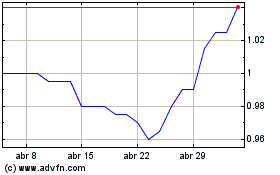

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024