Taylor Maritime Investments Limited Dividend Declaration (3550Q)

27 Octubre 2021 - 1:00AM

UK Regulatory

TIDMTMIP TIDMTMI

RNS Number : 3550Q

Taylor Maritime Investments Limited

27 October 2021

27 October 2021

Taylor Maritime Investments Limited (the "Company")

Dividend Declaration

The Board of Taylor Maritime Investments Limited ("TMI"), the

listed specialist dry bulk shipping company, is pleased to declare

an interim dividend in respect of the period to 30 September 2021

of 1.75 US Cents per ordinary share.

Ex Date: 4 November 2021

Record Date: 5 November 2021

Last day for currency 8 November 2021

elections: 24 November 2021

Payment Date:

The default payment for dividends remains in US Dollar, however,

dividends are capable of being paid in sterling, provided that the

relevant shareholder has registered to receive their dividend in

sterling under the Company's Dividend Currency Election. A copy of

the Dividend Currency Election form will be sent to all

shareholders by post, but will also be available for download from

the Company's website www.taylormaritimeinvestments.com . Completed

Dividend Currency Election forms should be sent to the Company's

registrar, Computershare Investor Services (Guernsey) Limited, c/o

The Pavilions, Bridgwater Road, Bristol, BS99 6ZY.

CREST shareholders must elect via CREST.

LEI: 213800FELXGYTYJBBG50

ENDS

For further information, please contact:

Taylor Maritime Investments +852 2252 3882

Limited info@tminvestments.com

Edward Buttery

Alexander Slee

Jefferies International Limited +44 20 7029 8000

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden

Montfort Communications

Nick Bastin TMI@montfort.london

Alison Allfrey

Miles McKechnie

About the Company

Taylor Maritime Investments Limited is a recently established,

internally managed investment company listed on the Premium Listing

Category of the Official List and traded on the Main Market of the

London Stock Exchange. The Company invests in a diversified

portfolio of vessels which are primarily second-hand and which,

historically, have demonstrated average yields in excess of the

Company's target dividend yield of 7% p.a. and were acquired at

valuations that are expected to be below long-term average

prices.

The Company's initial investments comprise Geared Bulk Carriers

(Handysize and Supramax types) employed utilising a variety of

employment/Charter strategies.

The Company intends to pay dividends on a quarterly basis with

dividends declared in January, April, July and October. Once the

Company is fully invested, the Company will target a Total NAV

Return of 10 to 12% p.a. (net of expenses and fees but excluding

any tax payable by Shareholders) over the medium to long term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team previously worked closely

together for the Commercial Manager, Taylor Maritime. Established

in 2014, Taylor Maritime is a privately owned ship-owning and

management business with a seasoned team that includes the founders

of dry bulk shipping company Pacific Basin Shipping (listed in Hong

Kong 2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

The Company specializes in the acquisition and chartering of

vessels in the Handysize and Supramax bulk carrier segments of the

global shipping sector. These "Geared" vessels, which have their

own loading equipment, are mostly acquired second-hand, leveraging

valuations that are below long-term average prices. The Handysize

market segment is particularly attractive, given the flexibility,

versatility and port accessibility of these vessels which carry

necessity goods - principally food and products related to

infrastructure building - ensuring broad diversification of fleet

activity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVFQLLLFBLFFBD

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

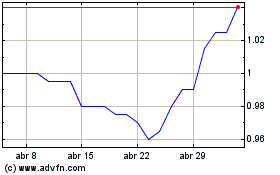

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024