TIDMTMIP TIDMTMI

RNS Number : 6492V

Taylor Maritime Investments Limited

15 December 2021

TAYLOR MARITIME INVESTMENTS LIMITED

INTERIM RESULTS STATEMENT FOR THE PERIOD 31 MARCH 2021 TO 30

SEPTEMBER 2021

SUCCESSFUL VESSEL ACQUISITIONS AND CHARTERING COMBINED WITH

POSITIVE OUTLOOK

15 December 2021 - Taylor Maritime Investments Limited (TMI /

TMIP), the specialist dry bulk shipping company, announces its

interim results for the initial period ended 30 September 2021.

Key highlights:

-- Taylor Maritime Investments Limited is a compelling

investment opportunity in the shipping sector with an ambition to

deliver strong income and capital returns

-- Successful IPO on 27 May on the London Stock Exchange raising

$254m ($160m in cash and $94m in consideration shares), followed by

a subsequent capital raise of $75m on 28 July

-- Selective strategy to acquire second hand, highest quality

Japanese built Handysize vessels at attractive prices with nine

vessels acquired since IPO taking fleet to 32 vessels (20

delivered, 12 undelivered at 30 September). 29 vessels delivered

post period with 3 vessels remaining to be delivered by end of

January 2022

-- Substantial NAV appreciation with unaudited NAV up from $249m

at IPO to $458m at 30 September. Total NAV Return per Ordinary

Share of 43% for the period from IPO to 30 September. NAV per share

up from $0.9800 to $1.3982 per share. This was driven by attractive

vessel acquisitions that have strongly appreciated in value during

the period

-- At 30 September, TMI's fleet consisted of 32 vessels with a

total market value of US$535 million, of which 20 vessels were

delivered as at 30 September (with a market value of US$325

million) and 12 vessels were yet to deliver (with a market value of

US$210 million). Of the 32 vessels, 30 are Handysize and 2 are

Supramax

-- Successful chartering out of vessels with strategic balance

between pricing and contract longevity, including achieving two 3-5

month charters with cash yields >50% and three 2-3 year charters

with cash yields between 15-25% after period end

-- Fleet average net time charter rate at 30 September

approximately $17,000 per day, with average duration of eight

months and average annualized gross unlevered yield in excess of

20% ($20,000 per day, average duration of nine months and average

annualised gross unlevered yield of 29% as at 25 November investor

update presentation)

-- Committed to integrating environmental, social and governance

factors into the Company's investment process including fleet GHG

gas emission reductions through energy efficiency standards and

approved modifications for vessels owned and acquired

-- Total Group Operating Profit on a look-through basis for the

period of $22m and Fair Value gain of $108m and a Profit for the

period before tax of $127m

-- Delivery on target dividend policy with first quarterly

dividend for end September of 1.75 cents per share and forecast

dividend cover for the full financial period ending 31 March 2022

of 3.9x. Scope to pay an extraordinary dividend if the strong

market persists

-- Buoyant market, leading position in Handysize niche and

continued market strength expected for the next 2 to 3 years

-- Subsequent to the period, TMI agreed to acquire a 22.6% stake

in Grindrod Shipping for $77.9m. The transaction is expected to

close in early 2022 and no later than 28 February 2022 and will

bring the Group's total holding in the Grindrod Shipping to 25.7%

including the 3.1% position acquired by TMI in the open market (of

which 2.2% announced on 13 December 2021 RNS).

Commenting on performance in this first interim period, Nicholas

Lykiardopulo, Independent Chair, said:

"As a specialist owner of Handysize vessels, the workhorses of

the dry bulk shipping trade transporting necessity goods around the

world, TMI has made a strong start as a listed company, delivering

on its investment thesis by growing the fleet at attractive prices.

We are focused on high-quality, fuel-efficient vessels which we can

operate in an increasingly sustainable way as we transition towards

alternate fuels. TMI has built a strong foundation since IPO, with

an excellent fleet and highly cash generative charters which will

allow us to deliver predictable long-term income to

shareholders".

Edward Buttery, CEO , added:

"This has been a formative, dynamic period following our

well-received IPO, a period of milestones and momentum - efficient

deployment of IPO proceeds through new vessel acquisitions,

successful chartering balancing attractive rates and visibility,

and a strong investment position marrying agility with financial

discipline. TMI is on a firm footing, operating in a clearly

defined niche of a market with systemic demand".

Outlook

Given buoyant markets, the highest demand and charter rates seen

in a decade and attractive opportunities for the specialist vessel

buyer, we anticipate continued market strength for the coming two

to three years. The favourable combination of slowing fleet growth,

healthy demand for commodities, likely slower operating speeds for

the global fleet and muted ship ordering arising from evolving

emissions regulations will benefit our earnings, secondhand asset

values and shareholder returns. The Board remains committed to

meeting its stated target dividend commitments, but will consider

the company's financial position at the year end and the potential

for an additional extraordinary dividend.

Click on, or paste the following link into your web browser to

view the Interim Report.

http://www.rns-pdf.londonstockexchange.com/rns/6492V_1-2021-12-14.pdf

The full results are available on the Company's website at

www.taylormaritimeinvestments.com .

Notes to editors

Enquiries:

Taylor Maritime Investments Limited IR@tminvestments.com

Edward Buttery

Alexander Slee

Jefferies International Limited

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden +44 20 7029 8000

Montfort Communications TMI@montfort.london

Nick Bastin

Alison Allfrey

Isabel Garnon

Sanne Fund Services (Guernsey) Limited

(formerly Praxis Fund Services Limited)

Tom Daish

Matt Falla +44 1481 737600

About the Company

Taylor Maritime Investments Limited is a recently established,

internally managed investment company listed on the Premium Segment

of the Official List and traded on the Main Market of the London

Stock Exchange. The Company invests in a diversified portfolio of

Geared vessels which are primarily second-hand.

The Company's initial investments comprise Geared Ships

(Handysize and Supramax types) employed utilising a variety of

employment/Charter strategies.

The Company intends to pay dividends on a quarterly basis with

dividends declared in January, April, July and October. The Company

declared its first dividend of 1.75 cents per Ordinary Share for

the initial period ended 30 September 2021 in October 2021. The

Company targets a Total NAV Return of 10 to 12% p.a. (net of

expenses and fees) over the medium to long term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team previously worked closely

together for the Commercial Manager, Taylor Maritime. Established

in 2014, Taylor Maritime is a privately owned ship-owning and

management business with a seasoned team that includes the founders

of dry bulk shipping company Pacific Basin Shipping (listed in Hong

Kong 2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

The Company specializes in the acquisition and chartering of

vessels in the Handysize and Supramax bulk carrier segments of the

global shipping sector. Geared vessels are characterised by their

own loading equipment. The Handysize market segment is particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally food and products related to infrastructure building -

ensuring broad diversification of fleet activity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR USVBRARUUAAA

(END) Dow Jones Newswires

December 15, 2021 01:59 ET (06:59 GMT)

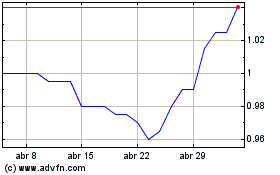

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024