TIDMTMIP TIDMTMI

RNS Number : 3632G

Taylor Maritime Investments Limited

26 July 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR TO THE UNITED STATES, CANADA, AUSTRALIA, THE

REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY MEMBER STATE OF THE EUROPEAN

ECONOMIC AREA ("EEA") (OTHER THAN ANY MEMBER STATE OF THE EEA WHERE

SECURITIES MAY BE LAWFULLY MARKETED) OR ANY OTHER JURISDICTION

WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT. THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE OR FORM PART OF

ANY OFFER TO ISSUE OR SELL, OR ANY SOLICITATION OF ANY OFFER TO

SUBSCRIBE OR PURCHASE, ANY INVESTMENTS IN ANY JURISDICTION.

PLEASE SEE THE SECTION ENTITLED "IMPORTANT LEGAL INFORMATION"

TOWARDS THE OF THIS ANNOUNCEMENT.

26 July 2021

Taylor Maritime Investments Limited (the "Company")

Result of Placing

The Board of Taylor Maritime Investments Limited, the specialist

dry bulk shipping company, is pleased to announce that the Company

has successfully raised its target gross proceeds of US$75 million

through the issue of 65,217,392 new ordinary shares in the capital

of the Company (the "New Ordinary Shares") (the "Placing") to be

rapidly deployed to acquire up to six Handysize vessels.

The Placing was oversubscribed and a scaling back exercise has

been undertaken.

The Issue Price per New Ordinary Share was US$1.15. The Sterling

equivalent issue price has been fixed at 83.63 pence per New

Ordinary Share which is based on the Relevant Sterling Exchange

Rate of 0.72722.

Nicholas Lykiardopulo, Chairman of Taylor Maritime Investments Limited, said:

" The Executive Team has assembled a high quality pipeline of

Japanese-built Handysize vessels which are expected to be acquired

at attractive prices and will deliver strong earnings in the

current rate environment. The level of demand from new and existing

investors during this fundraise reflects their confidence in our

business model and approach and we appreciate and value their

continued support ."

Edward Buttery, CEO of Taylor Maritime Investments Limited,

said:

"We are grateful for the trust placed in us by our investors and

look forward to putting this money to work rapidly to capitalise

upon these attractive market conditions. The fundraise has

continued to broaden our investor base and should enhance secondary

market liquidity in the shares."

Applications for admission

Application has been made for the 65,217,392 New Ordinary Shares

to be admitted to the premium listing segment of the Official List

of the UK Listing Authority and to trading on the Main Market of

the London Stock Exchange . It is expected that Admission will

become effective and dealings in the New Ordinary Shares will

commence on the London Stock Exchange at 8.00 a.m. on 28 July

2021.

Total Voting Rights

Following Admission, the total number of Ordinary Shares in

issue will be 327,895,878, each with equal voting rights. This

total voting rights figure can be used by shareholders as the

denominator for the calculations by which they will determine

whether they are required to notify their interest in the Company

under the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority.

The Placing is being conducted under the Company's existing

Placing Programme in accordance with the Company's Prospectus.

Terms used and not defined in this announcement have the meanings

given in the Prospectus.

Dealing codes

The dealing codes for the Ordinary Shares are

as follows:

ISIN GG00BP2NJT37

SEDOL (in respect of Ordinary Shares traded BP2NJT3

in US Dollars)

SEDOL (in respect of Ordinary Shares traded BP2NJW6

in Sterling)

Ticker symbol of the Ordinary Shares traded TMI

in US Dollars

Ticker symbol of the Ordinary Shares traded TMIP

in Sterling

LEI: 213800FELXGYTYJBBG50

For further information, please contact:

Taylor Maritime Investments Limited +852 2252 3882

Edward Buttery info@tminvestments.com

Alexander Slee

Jefferies International Limited +44 20 7029 8000

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden

Montfort Communications

Nick Bastin TMI@montfort.london

Alison Allfrey

Miles McKechnie

About the Company

Taylor Maritime Investments Limited is a recently established,

internally managed investment company listed on the Premium Segment

of the Official List and traded on the Main Market of the London

Stock Exchange. The Company invests in a diversified portfolio of

vessels which are primarily second-hand and which, historically,

have demonstrated average yields in excess of the Company's target

dividend yield of 7% p.a. and were acquired at valuations that are

expected to be below long-term average prices.

The Company's initial investments comprise Geared Bulk Carriers

(Handysize and Supramax types) employed utilising a variety of

employment/Charter strategies.

The Company intends to pay dividends on a quarterly basis with

dividends declared in January, April, July and October. The Company

expects to declare its first dividend of 1.75 cents per Ordinary

Share for the initial period ended 30 September 2021 in October

2021. Once the Company is fully invested, the Company will target a

Total NAV Return of 10 to 12% p.a. (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to long

term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team previously worked closely

together for the Commercial Manager, Taylor Maritime. Established

in 2014, Taylor Maritime is a privately owned management business

with a seasoned team that includes the founders of dry bulk

shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

The Company specializes in the acquisition and chartering of

vessels in the Handysize and Supramax bulk carrier segments of the

global shipping sector. These "Geared" vessels, which have their

own loading equipment, are mostly acquired second-hand, leveraging

valuations that are below long-term average prices. The Handysize

market segment is particularly attractive, given the flexibility,

versatility and port accessibility of these vessels which carry

necessity goods - principally food and products related to

infrastructure building - ensuring broad diversification of fleet

activity.

Important Legal Information

This announcement is an advertisement for the purposes of the UK

Prospectus Rules and is not a prospectus and not an offer of

securities for sale in any jurisdiction. Neither this announcement

nor anything contained herein shall form the basis of, or be relied

upon in connection with, any offer or commitment whatsoever in any

jurisdiction. Investors should not purchase or subscribe for any

securities referred to in this announcement except on the basis of

information in the Prospectus.

Investors could lose all or part of their investment. The value

of the New Ordinary Shares and the income from them is not

guaranteed and can fall as well as rise due to stock market and

currency movements. When you sell your investment you may get back

less than you originally invested. This announcement does not

constitute a recommendation concerning any securities. Potential

investors should consult a professional advisor as to the

suitability of the New Ordinary Shares for the person

concerned.

The target returns and dividends set out in this announcement

are targets only and are not profit forecasts. There can be no

assurance that these targets can or will be met and they should not

be seen as an indication of the Company's expected or actual

results or returns. The Company's ability to distribute dividends

will be determined by the existence of sufficient distributable

reserves, legislative requirements and available cash reserves.

Accordingly, investors should not place any reliance on these

targets in deciding whether to invest in New Ordinary Shares or

assume that the Company will make any distributions at all.

In the United Kingdom, this announcement is only directed at (i)

persons who have professional experience in matters relating to

investments falling within the definition of "investment

professionals" in article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

" Order "); or (ii) persons falling within article 49(2)(a) to (d)

("high net worth companies, unincorporated associations, etc") of

the Order; or (iii) persons to whom it may otherwise be lawfully

communicated; (all such persons together being referred to as "

relevant persons "). This announcement must not be acted on or

relied on by persons who are not relevant persons. Persons

distributing this announcement must satisfy themselves that it is

lawful to do so. Any investment or investment activity to which

this announcement relates is available only to relevant persons and

will be engaged in only with relevant persons.

This announcement may not be published, distributed or

transmitted by any means or media, directly or indirectly, in whole

or in part, in or into the United States. This announcement does

not constitute an offer to sell, or a solicitation of an offer to

buy, securities in the United States. The securities mentioned

herein have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the "US Securities Act") or

with any securities regulatory authority of any state or other

jurisdiction of the United States and, subject to limited

exceptions, will not be offered, sold, exercised, resold,

transferred or delivered, directly or indirectly, in or into the

United States or to, or for the account or benefit of, any US

person (as defined under Regulation S under the US Securities Act).

The Company has not been, and will not be, registered under the

U.S. Investment Company Act of 1940, as amended. No public offering

of securities is being made in the United States.

Neither this announcement nor any copy of it may be: (i) taken

or transmitted into or distributed in any member state of the

European Economic Area, Canada, Australia, Japan or the Republic of

South Africa or to any resident thereof, or (ii) taken or

transmitted into or distributed in Japan or to any resident

thereof. Any failure to comply with these restrictions may

constitute a violation of the securities laws or the laws of any

such jurisdiction. The distribution of this announcement in other

jurisdictions may be restricted by law and the persons into whose

possession this document comes should inform themselves about, and

observe, any such restrictions.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters

that are not historical facts regarding the Company's investment

strategy, financing strategies, investment performance, results of

operations, financial condition, prospects and the dividend

policies of the Company and the instruments in which it will

invest. By their nature, forward-looking statements involve risks

and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. There are a number of factors that could cause actual

results and developments to differ materially from those expressed

or implied by these forward- looking statements. These factors

include, but are not limited to, changes in general market

conditions, legislative or regulatory changes, changes in taxation

regimes or development planning regimes, the Company's ability to

invest its cash in suitable investments on a timely basis and the

availability and cost of capital for future investments.

The Company expressly disclaims any obligation or undertaking to

update or revise any forward-looking statements contained herein to

reflect actual results or any change in the assumptions, conditions

or circumstances on which any such statements are based unless

required to do so by the UK Market Abuse Regulation, FSMA, the

Listing Rules, the UK Prospectus Rules or the Prospectus Regulation

Rules of the Financial Conduct Authority or other applicable laws,

regulations or rules.

Jefferies International Limited ("Jefferies") is authorised and

regulated by the FCA and is acting exclusively for the Company and

for no one else in connection with the Placing and will not be

responsible to anyone (whether or not a recipient of this document)

other than the Company for providing the protections afforded to

clients of Jefferies or for affording advice in relation to the

Placing, the contents of this announcement or any matters referred

to herein. This does not exclude any responsibility which Jefferies

may have under FSMA or the regulatory regime established

thereunder.

Apart from the liabilities and responsibilities (if any) which

may be imposed on Jefferies by FSMA or the regulatory regime

established thereunder, Jefferies makes no representations, express

or implied, nor accepts any responsibility whatsoever for the

contents of this announcement nor for any other statement made or

purported to be made by Jefferies or on its behalf in connection

with the Company, the New Ordinary Shares, the Placing or

Admission. Jefferies and its affiliates accordingly disclaim all

and any liability (save for any statutory liability) whether

arising in tort or contract or otherwise which it or they might

otherwise have in respect of this announcement or any such

statement.

For the avoidance of doubt, the contents of the Company's

website, including the websites of the Company's business units,

are not incorporated by reference into, and do not form part of,

this announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK MiFIR Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any manufacturer (for

the purposes of the UK MiFIR Product Governance Requirements) may

otherwise have with respect thereto, the New Ordinary Shares have

been subject to a product approval process, which has determined

that such New Ordinary Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as respectively defined in paragraphs 3.5 and 3.6 of the FCA

Handbook Conduct of Business Sourcebook; and (ii) eligible for

distribution through all permitted distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors should note that: the price of the New

Ordinary Shares may decline and investors could lose all or part of

their investment; the New Ordinary Shares offer no guaranteed

income and no capital protection; and an investment in the New

Ordinary Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom; and the Ordinary Shares will be admitted

to the London Stock Exchange which is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in such companies. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Issue.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Jefferies will only procure investors who meet the

criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the New Ordinary

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

UK PRIIPs Regulation

In accordance with the UK version of Regulation (EU) No.

1286/2014 on key information documents for packaged retail and

insurance-based investment products, which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018, as amended (the

"UK PRIIPs Regulation"), a key information document (the "KID") in

respect of an investment in the Shares has been prepared by the

Company and is available to investors at

www.taylormaritimeinvestments.com. If a new class of C Shares is

issued under the Placing Programme, the Company will make available

a key information document in relation to such class of C Shares as

required under the UK PRIIPs Regulation.

If you are distributing New Ordinary Shares, it is your

responsibility to ensure that the KID is provided to any clients

that are "retail clients".

The Company is the only manufacturer of the New Ordinary Shares

for the purposes of the UK PRIIPs Regulation and Jefferies is not a

manufacturer for these purposes. Jefferies does not make any

representations, express or implied, or accept any responsibility

whatsoever for the contents of the KID prepared by the Company nor

accepts any responsibility to update the contents of the KID in

accordance with the UK PRIIPs Regulation, to undertake any review

processes in relation thereto or to provide the KID to future

distributors of Ordinary Shares. Jefferies and its affiliates

accordingly disclaim all and any liability whether arising in tort

or contract or otherwise which it or they might have in respect of

the key information documents prepared by the Company. Investors

should note that the procedure for calculating the risks, costs and

potential returns in the KID are prescribed by laws. The figures in

the KID may not reflect actual returns for the Company and

anticipated performance returns cannot be guaranteed.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDKQBDQBKDPOB

(END) Dow Jones Newswires

July 26, 2021 02:00 ET (06:00 GMT)

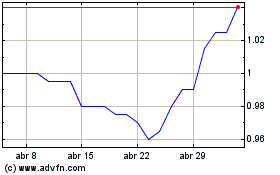

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024