TIDMTMIP TIDMTMI

RNS Number : 0863E

Taylor Maritime Investments Limited

05 July 2021

5 July 2021

Taylor Maritime Investments Limited (the "Company")

Trading Update

Charter rates up 30% since IPO

Portfolio valuation up $33.3 million (10.5%) since IPO

Delivered fleet yielding annualised unlevered return of

>20%

Market rates strengthening faster than ship prices giving rise

to attractive investment opportunities

Taylor Maritime Investments Limited, the recently listed

specialist dry bulk shipping investment company, is today providing

a trading update for the period ended 30 June 2021 including an

update on its portfolio valuation. The Company's first unaudited

NAV, as at 30 June 2021, is expected to be published during the

week beginning 19 July 2021. All figures disclosed in this

announcement are unaudited.

Commenting on the trading update, Edward Buttery, Chief

Executive Officer, said:

"As envisaged at the time of our IPO, we have been able to take

full advantage of the improving market conditions in the Handysize

and Supramax bulk carrier segment. The material upward movement in

our valuation reflects the sustained improvement in charter rates

and is proof of the strong investment rationale for acquiring high

quality second-hand vessels at this point in the valuation cycle.

We continue to be able to buy at our target prices and will seek

further compelling opportunities to both purchase vessels and lock

in future fleet earnings at attractive levels."

Dry bulk shipping market continues to strengthen

The period following the Company's IPO has seen our vessel

values rise significantly, driven by constrained world fleet growth

and strong demand for shipping capacity due to improving global

economic conditions. Industrial activity continues to normalize as

we emerge from the Covid pandemic further fueling demand for our

vessel types.

As expected in this environment, charterers are seeking longer

term employment contracts in anticipation of a sustained upward

trend in time charter rates and the Company has taken full

advantage of this trend with a range of longer and high yielding

employment contracts. We expect our upcoming charter renewals to

capture further upside from the current rate momentum.

New ship orders in the Handysize and Supramax segment are not

being reported in any material numbers, space in existing shipyards

remains very tight and notional newbuild price quotes are still

rising, underpinning the current favourable supply and demand

metrics which are expected to be supportive for the Company's

portfolio over the next 2-3 years.

Significant increase in portfolio valuation since

acquisition

The independent valuation of the Company's delivered fleet of 17

vessels as at 30 June 2021 indicates an increase in value from

$208.7 million to $230.6 million, equivalent to an increase of

10.5% since 7 May 2021 when the Company's IPO prospectus (the

"Prospectus") was published. The undelivered seed fleet of six

vessels has increased in value from $81.3 million to $90.8 million,

equivalent to an increase of 11.7%. The two additional vessels

acquired (although not yet delivered) following the IPO, as

announced on 16 June 2021, have increased in value from $26.5

million to $28.3 million, equivalent to an increase of 7.1%. The

overall increase in the delivered and committed fleet value as at

30 June 2021 has therefore been $33.3 million, equivalent to an

increase of 10.5% over the aggregate vessel purchase price.

The latest independent valuation has been prepared on a basis

consistent with that prepared for the purposes of the Prospectus,

taking the arithmetical mean of two independent valuation reports

from Hartland Shipping Services and Braemar ACM Valuations.

The Company currently expects delivery of the eight committed

vessels (being the remaining six seed vessels described in the

Prospectus and the two further committed vessels announced on 16

June 2021) on the following schedule, which will take the Company's

fleet to 25 vessels:

-- July 2021 - 2 vessels

-- October 2021 - 2 vessels

-- November 2021 - 2 vessels

-- December 2021 - 1 vessel

-- January 2022 - 1 vessel

Strong charter rate environment

Since 7 May 2021, net time charter rates have increased by over

30%. The average net time charter rate for the delivered fleet is

approximately $15,400 per day with an average duration of 10

months, generating average annualized unlevered gross cash yields

in excess of 20%. The strong earnings environment has continued to

improve underlining the Company's significant cash generation

potential. As a consequence, the implied dividend cover from the

delivered fleet alone is approximately 2.7 times (based only on the

earnings of the 17 delivered vessels). This is expected to rise

materially once the remaining eight vessels are delivered.

Since IPO, eight of the delivered fleet have had their initial

charter contracts renewed and been employed on new charters with an

average remaining duration of 11 months. A further two vessels in

the delivered fleet are due for charter renewal within the next two

months. The fleet's earning power is expected to increase further

as a consequence of the staged delivery of the eight committed

vessels, six of which will be fixed on new charters in the run-up

to their delivery and should benefit from the strong rate

environment.

Financing

The Company remains committed to a financially prudent approach,

maintaining an ungeared long term capital structure to support

dividend yield and provide downside protection, and using

borrowings on a temporary basis when acquiring new vessels. Hence,

approximately $30 million of long-term debt associated with the

acquisition of the seed fleet is being repaid: $5 million having

been repaid in June 2021 with the balance of $25 million expected

to be repaid before final delivery of the committed fleet. The

Company expects to draw on its shorter term $60 million Revolving

Credit Facility to partially finance the eight committed vessel

acquisitions.

Pipeline

The Executive Team continues to conduct due diligence on a

pipeline of Handysize and Supramax vessel acquisition opportunities

at attractive prices and looks forward to providing more details in

due course.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation EU 596/2014 as it forms

part of retained EU law (as defined in the European Union

(Withdrawal) Act 2018).

For further information, please contact:

Taylor Maritime Investments Limited

Edward Buttery

Alexander Slee +852 2252 3882

Jefferies International Limited +44 20 7029 8000

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden

Montfort Communications

Nick Bastin TMI@montfort.london

Alison Allfrey

Miles McKechnie

LEI: 213800FELXGYTYJBBG50

NOTES:

About the Company

Taylor Maritime Investments Limited is a newly established,

internally managed investment company listed on the Premium Segment

of the Official List and traded on the Main Market of the London

Stock Exchange. The Company invests in a diversified portfolio of

vessels which are primarily second-hand and which, historically,

have demonstrated average yields in excess of the Company's target

dividend yield of 7% p.a. and can be acquired at valuations that

are expected to be below long-term average prices.

The Company's initial investments comprise Geared Ships

(Handysize and Supramax types) employed utilising a variety of

employment/Charter strategies.

The Company intends to pay dividends on a quarterly basis with

dividends declared in January, April, July and October. The Company

expects to declare its first dividend of 1.75 cents per Ordinary

Share for the initial period ended 30 September 2021 in October

2021. Once the Company is fully invested, the Company will target a

Total NAV Return of 10 to 12% p.a. (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to long

term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team have to date worked closely

together for the Commercial Manager, Taylor Maritime. Established

in 2014, Taylor Maritime is a privately owned ship-owning and

management business with a seasoned team that includes the founders

of dry bulk shipping company Pacific Basin Shipping (listed in Hong

Kong 2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong and

London.

This trading update contains certain forward looking statements

with respect to Taylor Maritime Investments Limited. These

statements and forecasts involve risk and uncertainty because they

relate to events and depend upon circumstances that may or may not

occur in the future. There are a number of factors that could cause

actual results or developments to differ materially from those

expressed or implied by these forward-looking statements and

forecasts. Nothing in this announcement should be construed as a

profit forecast.

For more information, please visit

www.taylormaritimeinvestments.com .

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

TSTEAPXLEEPFEFA

(END) Dow Jones Newswires

July 05, 2021 02:00 ET (06:00 GMT)

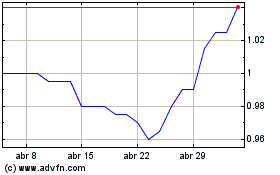

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024