TIDMTEAM

RNS Number : 3602Z

Team PLC

21 May 2021

21 May 2021

TEAM plc

("TEAM" or the "Company")

Interim Results

TEAM plc (AIM: TEAM), the Jersey based active fund management

group, is pleased to announce its interim results for the six

months ended 31 March 2021.

Highlights

-- TEAM plc was created to be a leading private client

investment and asset management business

-- January 2020, completed first acquisition, Theta Enhanced

Asset Management Ltd with AUM of GBP140 million. Since then AUM has

grown to GBP286 million (as at 31 March 2021)

-- March 2021, completed successful listing on AIM raising gross

proceeds of GBP7.5 million and attracted the support of leading

institutional fund managers

-- For the six months to 31 March 2021:

o Revenue was GBP0.6 million

o Loss before tax was GBP0.9 million

o Loss per share was 17 pence, the adjusted loss per share was 7

pence

-- Strengthened investment management team with new senior

hires, and corporate governance with three non-executive

directors

-- Invested in client engagement, systems and controls

-- Pursuing mix of organic and acquisition led growth

Commenting on the results Mark Clubb, Executive Chairman of

TEAM, said:

"We are at the start of developing a new business and I am

pleased to say we have made a good start. Just over a year ago we

identified an opportunity to become a leading private client

investment and asset management business. In January 2020, we

acquired Theta with AUM of GBP140 million, we have grown that

business under the TEAM brand to GBP286 million of AUM, listed on

AIM raising GBP7.5 million, with the support of several well-known

investors, and established a scalable platform which retains

in-house investment management expertise whilst utilising market

leading third parties to provide administrative support. We have a

pipeline of opportunities to support our expansion and we are

looking forward to an active period ahead."

Enquiries

TEAM plc

Mark Clubb / Matthew Moore

Telephone: +44 (0) 1534 877210

Hannam & Partners

(Financial Adviser to TEAM)

Giles Fitzpatrick / Richard Clarke / Ernest Bell

Telephone: +44 20 7907 8500

Canaccord Genuity Limited

(Nominated Adviser and Broker to TEAM)

Bobbie Hilliam / Alex Aylen / Jeremy Grime

Telephone: +44 20 7523 8000

Novella Communications

(Financial Public Relations)

Tim Robertson / Fergus Young

Telephone: +44 20 3151 7008

Information on TEAM

TEAM is a Jersey based specialist, investment-led active

investment and fund manager providing discretionary and advisory

portfolio management services to private clients, companies and

trusts. On 8 March 2021, TEAM's shares were admitted to trading on

AIM in an IPO raising GBP7.5 million. TEAM's strategy is to grow

into an internationally recognised investment and asset management

group. https://www.teamassetmanagement.com/

Executive Chairman's Statement

I am pleased to be making this, my first report as Executive

Chairman of TEAM, since our listing in March 2021. We have

completed a very successful period for the business, and we are now

embarking on a period of expansion which we expect to be driven by

a mix of organic and acquisition-led growth.

TEAM was incorporated to take advantage of the positive

demographic and business trends we see in the international wealth

and asset management markets. We are embarking on the greatest

inter-generational transfer of wealth, following years of asset

price inflation, especially in real estate, which has concentrated

wealth amongst the older generations. This is creating

opportunities for nimble and differentiated organisations, such as

TEAM, as the beneficiaries of this reallocation of wealth typically

look for a service differentiated from the one that their

precedents used. This has driven TEAM's move to a market-leading

digital interface with clients and intermediaries, and an

investment philosophy that reflects global trends, better matching

our clients' outlook. A Jersey base is a further advantage with

Jersey being a highly regarded international financial centre in a

tax-neutral environment with strong connectivity, stable regulatory

authorities and a large and growing finance marketplace for

investment services.

In addition to organic growth opportunities, both in Jersey and

in other international finance centres, we see significant

prospects through the acquisition of overlapping and complementary

businesses. The market for investment related financial services is

a highly fragmented one, reflecting the relatively low barriers to

entry that enabled entrepreneurial individuals and teams to start

their own businesses after developing their skills and clients in

larger institutions. We now see many smaller, high quality

businesses where the founders are looking to realise their life's

work and find a suitable partner to provide an excellent service to

their long-standing clients. There is a plethora of well-funded

private equity backed businesses in competition for these

businesses, especially onshore in the UK, but they don't always

appeal to vendors. TEAM is ideally placed to partner with such

firms, as we are well capitalised, have a client-service culture

and infrastructure that stands up to the vendor's scrutiny, and the

directors are highly experienced in making such a business model

work. We have a pipeline of acquisitions at a range of stages, and

while transactions are never certain to complete, we expect to be

able to announce earnings enhancing transactions over the coming

six months.

The successful listing on AIM has provided us with new capital

and access to significant further equity capital, if required, to

support our ambitions. We are looking at a range of opportunities

and targeting those markets where we see the most scope for

profitable growth. We expect to have an active period ahead of us

and we are looking forward to it.

Mr J M Clubb

Executive Chair

20 May 2021

Operational and Financial Review

The first six months of the year saw significant progress in the

development of the TEAM business, with the successful listing of

its shares on the London AIM market, on 8 March 2021. To achieve

this, the business invested in putting in place a robust set of

corporate and risk governance measures, which are proving to be

effective, suitable and fit for purpose. The results for this

6-month period reflect the listing costs of GBP1.1 million, of

which GBP0.9 million is recognised in this period. The Group

recorded a loss before tax of GBP0.9 million and is not

recommending a dividend for the period. The business is well

capitalised, with over GBP6 million of available cash following the

IPO.

TEAM Jersey

The six-month period from September 2020 to March 2021 saw a

period of consolidation and internal investment in the operating

business, following the rapid expansion since it was acquired in

January 2020.

Client AUM reduced very slightly from GBP291 million to GBP286

million. The funds division accounted for the majority of this

change with AUM down from GBP89m to GBP85m, while performance in

the main Keox ESG fund continued to be excellent - first quartile

over 1,3 & 5 years.

New business opportunities continue to be seen with new clients

adding 1.5% to AUM in the period, despite the challenges of

lockdown in Jersey due to the necessary responses to the COVID

pandemic. The focus of the business was therefore on current

clients and enhancing our service to them, new business prospects

are expected to re-engage following the loosening of

restrictions.

We are now live with our new custody and administration partner,

Pershing, and have, since the period end, completed the client

migration exercise. This will allow for a far improved experience

and digital interface for clients. There will be a short-term cost

to the business as platformed assets reach scale, while the

improved risk management and trading capabilities are already

enhancing client outcomes.

M&A

In March we made an approach to the board of Tavistock plc, a

listed UK wealth manager, regarding a possible offer for the

company. A combination of the Tavistock and TEAM businesses could

have given a scale start point for a UK division, with potential

synergies from the TEAM Jersey business and plc head office

functions. Following a lack of engagement by the Tavistock board,

we announced that TEAM was no longer proceeding with a potential

offer on April 20th.

Looking forward

In the second half of the financial year our focus will move to

re-enforcing client service and investment performance standards,

new client development, and the launch of our International Equity

Fund. This in addition to building a pipeline of individual and

team hires and acquisition opportunities to accelerate asset growth

in the Jersey market and beyond.

We have a growing pipeline of business combination opportunities

in our home Jersey private client market, with complementary

businesses based within the Channel Islands, and with like-minded

businesses in other international finance centres. There remains

much to do to capitalise on these opportunities, while we have made

a positive start to the development of TEAM plc.

Mr M C Moore

CFO and COO

Consolidated Statement of Comprehensive Income

Unaudited for the 6 months ended 31 March 2021

6 months ended 6 months ended

31 March 2021 31 March 2020

(unaudited) (unaudited)

Note GBP'000 GBP'000

Revenue 2 610 181

Cost of sales (41) (23)

Operating expenses (1,036) (199)

Listing costs 3 (468) -

Interest payable and similar

expenses 2 (1)

Loss on ordinary activities

before taxation (933) (42)

---------------------- ------------------------

Taxation 12 (8)

Loss for the period and total

comprehensive income (921) (50)

====================== ========================

Loss per share (basic and diluted) 5 GBP(0.17) GBP(1.12)

Consolidated Statement of Financial Position

Unaudited as at 31 March 2021

As at As at

30 September

31 March 2021 2020

(unaudited) (audited)

Note GBP'000 GBP'000

Non-current assets

Intangible assets 936 989

Property, plant & equipment 522 44

Deferred tax 56 43

Long term deposit 55 50

--------------- --------------

1,569 1,126

--------------- --------------

Current assets

Trade, other receivables and

prepayments 366 307

Cash and cash equivalents 6,404 253

--------------- --------------

6,770 560

--------------- --------------

Payables: amounts falling due

within one year (206) (316)

Net current assets 6,564 244

=============== ==============

Total assets less current liabilities 8,133 1,370

Payables: amounts falling due

after one year (463) -

Net assets 7,670 1,370

=============== ==============

Equity

Share capital 4 9,053 9

Share premium reserves - 1,823

Retained earnings brought forward (462) -

Retained earnings (921) (462)

--------------- --------------

Total equity 7,670 1,370

=============== ==============

The condensed consolidated interim financial statements were

approved and authorised for issue by the board of the directors on

the 20(th) day of May 2021 and were signed on its behalf by:

.........................................

.........................................

Mr J M Clubb Mr M C Moore

Director Director

Consolidated Statement of Changes in Equity

Unaudited for the six months ending 31 March 2021

Share Share Stated Retained Total

capital premium capital earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2019 - - - - -

New share capital 9 1,626 - - 1,635

Loss for the period - - - (50) (50)

At 31 March 2020 9 1,626 - (50) 1,585

========= ========= ========= ========== =========

Share Share Stated Retained Total

capital premium capital earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2020 9 1,823 - (462) 1,370

New share capital - 163 - - 163

Cost of shares issued

through IPO - (443) - - (443)

Conversion of shares (9) (1,543) 1,552 - -

Share premium received

from IPO - - 7,501 - 7,501

Loss for the period - - - (921) (921)

At 31 March 2021 - - 9,053 (1,383) 7,670

========= ========= ========= ========== =========

Consolidated Statement of Cash Flow

Unaudited for 6 months ended 31 March 2021

The only changes in liabilities other than from financing cash

flows are in respect of leases.

6 months ended 6 months ended

31 March 2021 31 March 2020

(unaudited) (unaudited)

GBP'000 GBP'000

Note

Cash flows from operating activities

Loss for the period before tax (933) (42)

Adjustments to cash flows from

non-cash items:

Depreciation and amortisation 85 27

Finance costs (2) 1

(Increase) in trade and other

receivables (63) (184)

(Decrease)/ increase in trade

and other payables (115) 44

Net cash outflow from operating

activities (1,028) (154)

----------------------- ---------------------

Cash flows from investing activities

Acquisition of subsidiary net

of cash acquired - (772)

Acquisition of property, plant

and equipment (8) (1)

Net cash outflow from investing

activities (8) (773)

----------------------- ---------------------

Cash flows from financing activities

Lease liability paid (34) (28)

IPO costs capitalised 3 (443) -

Issue of share capital at par 4 - 9

Issue of share capital at no

par 4 7,501 -

Share premium on issue of shares 4 163 1,228

Net cash flow from financing

activities 7,187 1,209

----------------------- ---------------------

Net increase in cash and cash

equivalents 6,151 282

----------------------- ---------------------

Cash and cash equivalents from

acquired subsidiaries at the

beginning of the period 253 -

Cash and cash equivalents at

end of period 6,404 282

======================= =====================

Notes to the Consolidated Financial Statements for the six

months ended 31 March 2021

IPO costs

On 8 March 2020 the Group was successfully admitted to the

Alternative Investment Market ("AIM"). The Initial Public Offering

("IPO") costs were GBP1.05m of which GBP443,000 has been allocated

to the Share Premium reserve, with the balance of GBP608,000

expensed in both this reporting period (GBP468,000) and in the

reporting period ended 30 September 2020 (GBP140,000) Accounting

policies

Basis of preparation and accounting policies

The accounting policies and estimates adopted are consistent

with those of the previous financial period as disclosed in the

2020 Period Report and Audited Consolidated Financial

Statements

The financial information in this interim report has been

prepared in accordance with the disclosure requirements of the AIM

Rules for Companies and the recognition and measurements of

International Financial Reporting Standards ("IFRS"), as adopted by

the European Union ("EU"). They have been prepared on a going

concern basis with reference to the accounting policies and methods

of computation and presentation set out in the Group's Consolidated

financial statements for the year ended 30 September 2020.

The Interim Condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's audited financial statements for the year ended 30

September 2020, which have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board ("IASB"), the

interpretations issued by the International Financial Reporting

Interpretations Committee ("IFRIC") and the requirements of

Companies (Jersey) Law 1991.

The information relating to the six months ended 31 March 2021

is unaudited and does not constitute statutory financial

statements. The Group's Consolidated financial statements for the

year ended 30 September 2020 have been reported on by the Group's

auditor. The report of the auditor was unqualified and did not draw

attention to any matters by way of emphasis.

Consolidated financial statements

The consolidated financial statements incorporate the financial

statements of the Company and subsidiary entities controlled by the

Company made up to 31 March 2021. Control is achieved where the

Company is exposed, or has rights, to variable returns from its

involvement with an investee company and has the ability to affect

those returns through its power over the other entity; power

generally arises from holding a majority of voting rights.

New standards and interpretations not yet adopted

There are no newly issued standards expected to potentially have

a material impact on the condensed consolidated interim financial

statements and the consolidated financial statements to the

Group.

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements will be

consistent with those to be followed in the preparation of the

Group's annual financial statements for the year ending 30

September 2021. Accounting policies (continued)

Going concern

After making enquiries, the Directors have formed a judgement,

at the time of approving the financial information, that there is a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason the Directors continue to adopt the going concern basis

in preparing the financial information.

The COVID-19 coronavirus pandemic was firstly discovered and

defined in March 2020 and while significant scientific developments

have been achieved in controlling its economic and social

implications in the form of vaccinations, COVID-19 coronavirus

pandemic continues to have a financial impact on the global

economy. The Company continues to closely communicate with

customers during the ongoing global crisis. The Directors have

considered the impact of COVID-19 on the Group and are of the view

that it remains a going concern after revising forecasts for 202 1

and reviewing the impact of COVID-19 on the working capital of the

Group .

Critical accounting estimates and judgements

The Group makes certain estimates and assumptions in the

preparation of financial statements. Estimates and judgements are

continually evaluated based on historical experience and other

factors, including expectations of future events that are believed

to be reasonable that best reflects the conditions and

circumstances that exist at the reporting date.

The principal estimates and judgements that could have an effect

upon the Group's financial results are the useful economic lives of

property, plant and equipment, the impairment of trade receivables

and intangible assets and the provision for income and deferred

taxes. Further details of these estimates and judgements are set

out in the related accounting policies for these items.

1. Segment reporting

Operating segments are identified based on internal reports that

are regularly reviewed by the Board to allocate resources and to

assess performance.

The Group continues to identify a single reportable segment and

within this single reportable segment, total revenue from

continuing operations is as follows:

6 months ending 6 months ending

31 March 2021 31 March 2020

(unaudited) (unaudited)

GBP'000 GBP'000

Fees 541 121

Commissions 69 60

---------------- ----------------

610 181

================ ================

2. Exceptional items

6 months ending 31 March 2021 6 months ending 31 March 2020

(unaudited) (unaudited)

GBP'000 GBP'000

Costs relating to the admission of the shares 468 -

============================== ==============================

On 8 March 2020 the Group was successfully admitted to AIM. The

IPO costs were GBP1.05m of which GBP443,000 has been allocated to

the Share Premium reserve, with the balance of GBP608,000 expensed

in both period ended 30 September 2020 (GBP140,000) and this period

(GBP468,000).

3. Share capital and share premium

On 13 January 2021, the company's shareholders passed a special

resolution, whereby the below decisions were passed:

-- That all of the 10,000 unissued Class B Shares to be cancelled

-- That each of the Class A Shares in the company is converted into a no par value share

-- That each of the issued and unissued Class A Shares in the

Company is subdivided into 82 shares in the Company

-- That the company be authorised to issue up to 15,580,000

Class A Shares of no par value in addition to the 8,036,000 Class A

Shares in issue.

4. Loss per share

The weighted-average number of outstanding ordinary shares for

the period is as follows:

Weighted

Number of average number

shares outstanding Time weighting of shares

1 October 2020 - Balance

brought forward 93,000 6/6 93,000

19 October 2020 - Shares

issued 3,600 5/6 3,000

6 January 2021 - Shares

issued 900 3/6 450

6 January 2021 - Bonus issue

of 82 for 1 7,897,500 3/6 3,948,750

6 January 2021 - Shares

issued 41,000 3/6 20,500

8 March 2021 - Initial Public

Offering 8,523,334 1/6 1,420,556

-------------------------------- -------------------- --------------- ----------------

Weighted average for the

period 6 months 5,486,256

================================ ==================== =============== ================

Loss per share (continued)

6 months ending 6 months ending

31 March 2021 31 March 2020

(unaudited) (unaudited)

Loss for the financial period GBP920,862 GBP49,694

Weighted average number of shares 5,486,256 44,433

----------------------------------- ---------------- ----------------

(Loss) per share (GBP) (0.17) (1.12)

=================================== ================ ================

To provide the investors with a view on a more relevant loss per

share for the period, we have also calculated the adjusted loss per

share:

6 months ending 6 months ending

31 March 2021 31 March 2020

(unaudited) (unaudited)

Loss for the financial period and

total comprehensive loss GBP(920,862) GBP(49,694)

Adjusting for non-cash and one-off

items:

Depreciation GBP31,885 GBP10,533

Amortisation GBP52,954 GBP17,651

Interest paid GBP(2,061) GBP786

Listing costs GBP468,000 -

Adjusted loss for the financial

period and total comprehensive loss GBP(370,084) GBP(20,724)

====================================== ================ ================

Weighted average number of shares 5,486,256 44,433

-------------------------------------- ---------------- ----------------

Adjusted (loss) per share (GBP) (0.07) (0.47)

====================================== ================ ================

5. Events after the statement of financial position date

No events occurred after the statement of financial position

date which are required to be disclosed.

6. Dividends

No interim dividend has been paid or proposed in respect of the

current financial period (2020: nil).

Company number

129405

Brokers and nominated adviser

Cannacord Genuity Limited

88 Wood Street

London

EC2V 7QR

United Kingdom

Financial adviser

Hannam & Partners

2 Park Street

London

W1K 2HX

Bankers

Butterfield Bank (Jersey) Ltd

St Paul's Gate

New Street

St Helier

Jersey

JE4 5PU

Registered office

1st and 3rd Floors

6 Caledonia Place

St Helier

Jersey

JE2 3NG

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDEEIIFIL

(END) Dow Jones Newswires

May 21, 2021 02:00 ET (06:00 GMT)

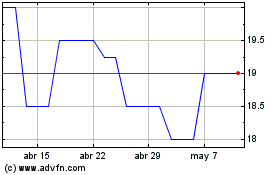

Team (LSE:TEAM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Team (LSE:TEAM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024