TIDMTGA

RNS Number : 5239I

Thungela Resources Limited

13 August 2021

THUNGELA RESOURCES LIMITED (Incorporated in the Republic of

South Africa)

Registration number: 2021/303811/06

JSE Share Code: TGA

LSE Share Code: TGA

ISIN: ZAE000296554

Tax number: 9111917259

('Thungela' or the 'Group' or the 'Company')

REVIEWED INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

KEY FEATURES

-- Safety - Thungela remains committed to achieving a

fatality-free business. It is with sadness that we report the loss

of Moeketsi Mabatla at our Goedehoop colliery on 23 June 2021

-- Successful transition to a standalone, JSE and LSE listed business from 7 June 2021

-- Comprehensive ongoing response to the COVID-19 pandemic

-- Operating profit of R990 million and Adjusted EBITDA of

R1,888 million for the six months ended 30 June 2021

-- Robust financial position with cash of R3,135 million (Net

cash of R3,043 million) supported by strong cash generation since

the Group achieved economic and operational independence

-- Confirmation of full year production and FOB cost per export tonne outlook

-- Disciplined capital allocation - set to achieve low end of

full year capital expenditure guidance range and Thungela remains

committed to its stated dividend policy

KEY FINANCIAL INFORMATION

Rand million (unless otherwise stated) 30 June 2021 30 June 2020 % change

Revenue 10,046 1,657 506%

------------- ------------- ---------

Operating profit 990 52 1,803%

------------- ------------- ---------

Adjusted EBITDA 1,888 247 664%

------------- ------------- ---------

Profit / (loss) for the reporting

period 351 (122)

------------- ------------- ---------

Earnings / (loss) per share (cents) 313 (193)

------------- ------------- ---------

Headline earnings / (loss) per share

(cents) 305 (193)

------------- ------------- ---------

Refer to comparability of results detailed below for context as

to the significant movements reflected.

MESSAGE FROM THE CHIEF EXECUTIVE OFFICER

July Ndlovu, Chief Executive Officer of Thungela, commented:

" Thungela is pleased to announce a significant increase in

interim earnings as we report for the first time as an independent,

focused coal export business. Our operating profit of R990 million

and Adjusted EBITDA of R1,888 million demonstrate our ability to

operate profitably notwithstanding the ongoing pandemic. Our

listing on the Johannesburg Stock Exchange and London Stock

Exchange on 7 June 2021 was a significant milestone for our new

business and for the shareholders and partners who have embarked on

this journey with us .

We mourn the sad passing of our colleague and friend Moeketsi

Mabatla at Goedehoop Colliery on 23 June 2021. We have lost 12 of

our colleagues to COVID-19, and many of us have also lost family

and friends to this pandemic. The loss of these lives casts a

shadow over the start of our journey and our heartfelt condolences

go out to all who have lost loved ones.

After a month of operating as a standalone business, we are cash

positive and well positioned to deliver on our targets. We are

pleased to note the recent recovery of global thermal coal prices.

These are reflective of the continued demand for high quality coal

amid challenging supply dynamics across many regions. Our business

reported an increase in earnings, with earnings per share of 313

cents. The steps we have taken to upgrade our portfolio and our

continued focus on improving productivity and operating costs, will

no doubt stand us in good stead into the future."

COMPARABILITY OF RESULTS

An internal restructuring process (referred to as the 'Internal

Restructure') was undertaken to prepare the Group for the Demerger.

The impact of the Internal Restructure is significant to the

financial and operating results of the Group, given that the

ownership structure reflected only one out of seven operating mines

until 31 December 2020, which is not reflective of the operations

of the Group on a forward-looking basis. The comparatives included

in the condensed consolidated interim financial statements are

therefore not fully reflective of the operations of the Group over

the comparative period. On this basis, the Group has presented a

Pro Forma condensed consolidated interim statement of profit or

loss for the six months ended 30 June 2021 and 30 June 2020 (the

'Pro Forma Financial Information') to reflect what the financial

results may have been, if the Internal Restructure had happened at

the start of the reporting period.

The Pro Forma Financial Information, which is the responsibility

of the Thungela directors, has been prepared to enhance users'

understanding of the condensed consolidated interim financial

statements, based on the timing of the Internal Restructure and the

impact thereof on the comparability of the financial results. The

Alternative Performance Measures presented, Adjusted EBITDA and

Adjusted operating free cash flow, are the responsibility of the

Thungela directors , and have been assessed consistently in each

period presented. The Alternative Performance Measures used by

Thungela are financial and operating measures which the directors

utilise to assess the performance of the Group on an ongoing basis.

Neither the Pro Forma Financial Information nor the Alternative

Performance Measures haves been reported on by the Group's

independent auditor. Further details of the Alternative Performance

Measures and Pro Forma Financial Information have been set out in

Annexure 1 and Annexure 3 respectively of the condensed

consolidated interim financial statements for the six months ended

30 June 2021.

A detailed commentary on the comparability of results is

available in the reviewed condensed consolidated interim financial

statements for the six months ended 30 June 2021 which can be

downloaded from the Thungela website at

https://www.thungela.com/investors/results and at

https://senspdf.jse.co.za/documents/2021/JSE/ISSE/TGAE/Int2021.pdf

OUTLOOK

Thungela is committed to running a fatality-free business, and

we will continue to make every effort to ensure that everyone

returns home safely every day. We confirm the guidance for export

saleable production of between 15Mt and 16Mt and flat FOB cost per

export tonne of R830 for the full year.

As we begin to review the appropriate level of expenditure with

a Thungela lens, capital expenditure is now expected to be on the

low end of the range (R2,600 million to R3,000 million) previously

provided for the full year.

With continued strong prices as well as improved performance by

TFR through the remainder of the year, the Group is likely to

achieve positive Adjusted operating free cash flow for the

remainder of 2021. Our strong balance sheet coupled with the above

paves the way for Thungela to consider the declaration of a maiden

dividend at the annual results for 2021, in line with Thungela's

stated dividend policy of a minimum pay-out of 30% of Adjusted

operating free cash flow.

FORWARD-LOOKING STATEMENTS

This document includes forward-looking statements. All

statements other than statements of historical facts included in

this document, including, without limitation, those regarding

Thungela's financial position, business, acquisition and divestment

strategy, dividend policy, plans and objectives of management for

future operations (including development plans and objectives

relating to Thungela's products, production forecasts and Reserve

and Resource positions) and environmental, social and corporate

governance goals and aspirations, are forward-looking statements.

By their nature, such forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Thungela or industry

results to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements.

The Group assumes no responsibility to update forward-looking

statements in this announcement except as required by law.

Investors are cautioned not to rely on these forward-looking

statements and are encouraged to read the full reviewed condensed

consolidated interim financial statements for the six months ended

30 June 2021, which are available on

https://www.thungela.com/investors/results

SHORT FORM ANNOUNCEMENT

This short form announcement, including the forward-looking

statements, is the responsibility of the directors of the Group.

Shareholders are advised that this short form announcement

represents a summary of the information contained in the full

results announcement and does not contain full details.

Any investment decisions by investors and/or shareholders should

be based on a consideration of the full results announcement as a

whole and investors and/or shareholders are encouraged to review

the full results announcement, which is available on the Thungela

website: https://www.thungela.com/investors/results and at

https://senspdf.jse.co.za/documents/2021/JSE/ISSE/TGAE/Int2021.pdf

The reviewed condensed consolidated interim financial statements

for the six months ended 30 June 2021 were reviewed by

PricewaterhouseCoopers Incorporated who have issued an unmodified

review opinion. This short form announcement has not been audited

or reviewed by the Group's independent auditor. Any reference to

future financial performance included in this announcement has not

been separately reported on by the Group's independent auditor.

Copies of the full announcement may be requested by contacting

Thungela Investor Relations by email at ryan.africa@thungela.com

and are available for inspection at the Company's registered office

at no charge, by appointment, subject to the prevailing

restrictions.

On behalf of the Board of Directors

Sango Ntsaluba, Chairperson

July Ndlovu, Chief Executive Officer

11 August 2021

Johannesburg (South Africa)

Date of SENS release: 13 August 2021

Sponsor

RAND MERCHANT BANK (A division of FirstRand Bank Limited)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFAEFEEFSESA

(END) Dow Jones Newswires

August 13, 2021 02:00 ET (06:00 GMT)

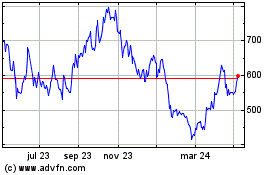

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024