Time Finance PLC Corporate Update (2772W)

22 Abril 2021 - 1:00AM

UK Regulatory

TIDMTIME

RNS Number : 2772W

Time Finance PLC

22 April 2021

22 April 2021

Time Finance plc

("Time Finance", the "Group" or the "Company")

Corporate Update

Net Tangible Assets and Net Cash continue to grow. Arrears below

pre-pandemic levels and forbearance down 90% from June 2020

peak

Time Finance plc, the AIM listed independent specialist finance

provider, is pleased to announce the continued strengthening of its

balance sheet with increasing Net Tangible Assets ("NTA") and

further increases in its cash reserves. Additionally, the Group

continues to be supported by its key funding partners, having

recently negotiated renewals and funding increases across a number

of facilities within its Asset and Loan divisions.

Robust Balance Sheet

Notwithstanding the wider macroeconomic environment, the Group's

NTA continue to increase month on month. At 31 March 2021,

unaudited NTA amounted to approximately GBP28.5m compared to

GBP26.5m at 31 May 2020. Over the same period, the Group's focus on

cash generation has continued to have a positive impact on

liquidity with cash and cash equivalents of over GBP6m at 31 March

2021 compared to approximately GBP1.5m as at 31 May 2020. These

healthy cash levels are vital for future lending growth.

The Group's lending book remains robust and resilient with

pandemic-related forbearance having reduced from over GBP25m in

June 2020 to under GBP2.5m at 31 March 2021. Most significantly, as

at 31 March 2021, total arrears had fallen below the pre-Covid

Levels of 28 February 2020 for the first time since the start of

the pandemic.

Improved Funding Facilities

The Group has distinct funding lines for each of its three

own-book lending divisions - Asset, Loan and Invoice Finance - and

is pleased to report that it continues to enjoy significant support

from all of its key funding partners. The Group has recently

negotiated renewed and increased Block Discounting facilities for

its Asset and Loan divisions totalling approximately GBP103.5m.

These facilities sit alongside the Group's GBP42m back-to-back

facility for the invoice finance division and the GBP25m

medium-term loan note programme which is used primarily in the

Loans division.

As has always been the case with the Group's asset and loan

funding, these renewed borrowing facilities require the Group to

fund between 10% and 20% of each deal from its own resources, with

the funder providing the balance. The term lengths with funders are

largely "matched" with the Group's own-book lending to UK SMEs. As

such, the funding amortises over the duration of the lease or loan

term, which is typically three years, and is not impacted by

interest rate changes. This matching practice and fixed interest

rate policy are key elements of the Group's risk management and

governance policies.

James Roberts, Chief Financial Officer commented:

"I am pleased to report the further strengthening of the Group's

commercial partnerships with a number of key funders, many of whom

have been long-standing supporters of the Group. I believe this

support is reflective of the regard the Group is held in by many

parties within our industry. We now have sizeable funding

facilities with significant headroom in place across all of our

lending divisions. This affords both confidence and visibility in

our funding capabilities to help achieve steady organic growth over

the foreseeable future as we navigate a return to normality.

"I am also delighted that the value of deals in arrears is now

below the level experienced before the pandemic began back in the

first quarter of 2020. This is testament to both the resilience of

our lending book and also the hard work and dedication of our

credit and collections staff over the past twelve months. "

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

For further information,

please contact:

Time Finance plc

Ed Rimmer, Chief Executive

Officer 01225 474230

James Roberts, Chief Financial

Officer 01225 474230

Cenkos Securities plc (NOMAD)

Max Hartley / Ben Jeynes

(Nomad)

Julian Morse (Sales) 0207 397 8900

Walbrook PR 0207 933 8780

Paul Vann / Nicholas Johnson 07768 807631

paul.vann@walbrookpr.com

About Time Finance:

Time Finance's strategy is to focus on providing or arranging

the finance UK SMEs require to fund their businesses and arranging

vehicle and property-backed finance for consumers. The

multi-product range for SMEs includes asset, vehicle, loan and

invoice finance facilities. The Group operates a "hybrid" lending

and broking model enabling it to optimize business levels through

market and economic cycles

More information is available on the Company website

www.timefinance.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKBBNPBKKOQB

(END) Dow Jones Newswires

April 22, 2021 02:00 ET (06:00 GMT)

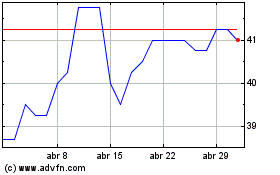

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024