TIDMTRP

RNS Number : 2277I

Tower Resources PLC

11 August 2021

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO

OR FROM THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH

JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any decision in respect of Tower

Resources PLC or other evaluation of any securities of Tower

Resources PLC or any other entity and should not be considered as a

recommendation that any investor should subscribe for or purchase

any such securities.

11 August 2021

Tower Resources plc

Placing to raise GBP1.5 million and appointment of Joint

Broker

Planned repayment of Pegasus Petroleum Limited Loan Facility

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa, is

pleased to announce that it has raised GBP1.5 million via a placing

of 352,941,176 new ordinary shares of 0.001p each (the "Placing

Shares") at a price of 0.425 pence per Placing Share (the

"Placing"), a discount of 14% to the closing share price on 10

August 2021.

Novum Securities Limited ("Novum"), has acted as sole broker on

this Placing and will serve as Joint Broker to the Company going

forward.

The Company will use the net proceeds of the Placing to repay

the US$750,000 loan facility from Pegasus Petroleum Ltd (whose

ultimate beneficial owner is the Company's Chairman and CEO, Jeremy

Asher) together with accrued interest and fees of US$102,500, and

to cover working capital requirements going forward, including:

-- Work programme costs in Namibia (for license PEL 96) and

South Africa (for the Algoa-Gamtoos license operated by 50% partner

New Age Energy Algoa (Pty) Ltd, which adjoins the Total-operated

blocks 11B/12B);

-- Funding maintenance and planning expenditure in Cameroon to

maintain the long-lead items inventory ready for the commencement

of drilling and testing of the NJOM-3 well, pending completion of

the farm-out announced yesterday;

-- General working capital purposes.

The Company has agreed with Pegasus Petroleum Ltd that repayment

of the loan facility will be made within five business days of 15

August 2021, being the extended deadline as announced on 24 June

2021, and that this will not result in the increased share of

production-based payments to Pegasus that would otherwise have

resulted from any further extension of the loan facility. These

production-based payments will therefore effectively be limited to

3.75% of the Contractor share of revenues from the Thali

production-sharing contract, net of the Government share and net of

all Petroleum Taxes. This amount would have increased materially if

the loan facility were not being repaid at this time.

Share Capital following the Placing

The Placing is conditional on, inter alia, the Placing Shares

being admitted to trading on AIM. Application has been made for the

Placing Shares to be admitted to trading on AIM and it is expected

that Admission of the Shares will become effective and that

dealings will commence at 8.00 a.m. on or around 18 August 2021

.

Following admission of the Placing Shares, the Company's

enlarged issued share capital will comprise 2,109,172,592 Ordinary

Shares of 0.001 pence each with voting rights in the Company. This

figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in the

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

Jeremy Asher, Chairman and Chief Executive Officer,

commented:

"We are pleased to welcome Novum Securities aboard and to

complete this placing, which puts the Company onto a much stronger

financial footing to continue planning for drilling in Cameroon

while completing our recently-announced farm-out, and also allows

us to move forward with work programme commitments on our Namibian

and South African licenses. While we felt that this placing was

timely and necessary, we have sought to minimise share issues and

will continue to do so, especially while financing our operations

at the asset level remains more cost-effective. We are looking

forward to providing further updates to shareholders as we move

forward with our drilling programme in Cameroon and with 3D seismic

data acquisition in South Africa together with our partners."

Note regarding forward-looking statements

This announcement contains certain forward-looking statements

relating to the Company's future prospects, developments and

business strategies. Forward-looking statements are identified by

their use of terms and phrases such as "targets" "estimates",

"envisages", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative of those, variations or comparable

expressions, including references to assumptions.

The forward-looking statements in this announcement are based on

current expectations and are subject to risks and uncertainties

which could cause actual results to differ materially from those

expressed or implied by those statements. These forward-looking

statements relate only to the position as at the date of this

announcement. Neither the Directors nor the Company undertake any

obligation to update forward looking statements, other than as

required by the AIM Rules for Companies or by the rules of any

other applicable securities regulatory authority, whether as a

result of the information, future events or otherwise. You are

advised to read this announcement and the information incorporated

by reference herein, in its entirety. The events described in the

forward-looking statements made in this announcement may not

occur.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

Any person receiving this announcement is advised to exercise

caution in relation to the Placing. If in any doubt about any of

the contents of this announcement, independent professional advice

should be obtained.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and

Joint Broker

Stuart Gledhill

Caroline Rowe + 44 20 3470 0470

Novum Securities Limited

Joint Broker

Gavin Burnell + 44 20 7399 9400

ETX Capital

Joint Broker

Thomas Smith + 44 20 7392 1436

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker + 44 20 3657 0050

Panmure Gordon (UK) Limited

Joint Broker

Nick Lovering

Hugh Rich + 44 20 7886 2500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEGZGMRZGDGMZZ

(END) Dow Jones Newswires

August 11, 2021 02:00 ET (06:00 GMT)

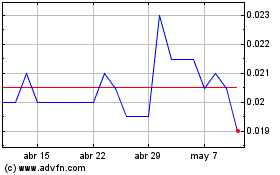

Tower Resources (LSE:TRP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tower Resources (LSE:TRP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024