TIDMTRAK

RNS Number : 4551S

Trakm8 Holdings PLC

16 November 2021

16 November 2021

TRAKM8 HOLDINGS PLC

("Trakm8" or the "Group")

Half Year Results and Director Change

Trakm8 Holdings plc (AIM: TRAK), the global telematics and data

insight provider, announces its unaudited results for the six

months ended 30 September 2021:

Financial Highlights

6 months 6 months Year to Change

to to 31

30 Sept 30 Sept March 2021

2021 2020

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

---------- ---------- ----------- -------

Revenue 9,021 7,321 15,961 +23%

---------- ---------- ----------- -------

of which, recurring revenue(1) 4,806 4,635 9,379 +4%

---------- ---------- ----------- -------

Profit/(Loss) before

tax 47 (845) (1,867) +106%

---------- ---------- ----------- -------

Adjusted Profit/(Loss)

before tax(2) 444 (314) (342) +241%

---------- ---------- ----------- -------

Profit/(Loss) after tax 273 (732) (1,237) +137%

---------- ---------- ----------- -------

Cash generated from operations 868 2,055 4,737 -58%

---------- ---------- ----------- -------

Net Debt(3) 6,157 5,574 4,887 +10%

---------- ---------- ----------- -------

Basic earnings per share 0.13p (1.46p) (2.47p) +108%

---------- ---------- ----------- -------

Adjusted basic earnings

per share 0.81p (0.56p) 0.07p +244%

---------- ---------- ----------- -------

1 Recurring revenues are generated from ongoing service and

maintenance fees

2 Before exceptional costs and share based payments

3. Total borrowings less cash excluding IFRS 16 adjustment for

leased property and motor vehicles

Operational Overview

-- H1 2021 results:

o 23% growth in revenues

o Return to profitability

o Gross margins improved due to higher proportion of software

revenues

o Underlying overheads benefitting from previous years'

actions

o Reduced cash generation from operations despite significant

reduction in losses, as PAYE & VAT time to pay arrangements

were met

-- Continuation of new contract wins:

o New telematics contract awards with a wide range of smaller

Fleet and Insurance customers

o Approximately 255,000 connections (March 2021: 254,000

connections), an increase of 1,000 connections, (0.4%) in the six

month period since last year end.

-- Continuation of contract renewals:

o Strong period of contract renewals in the Fleet business.

-- H2 and FY2023 outlook:

o Insurance telematics policy sales plateau due to high backlog

of driving tests and cost of second hand cars only modestly

improving due to new insurance clients' launches

o Several new Insurance customers launching during H2 but mainly

impact FY2023 and beyond

o Backlog of driving tests expected to diminish in FY2023,

improving demand

o Strong level of orders, post period, from existing and new

Fleet customers

Outlook

Despite additional costs associated with mitigating supply chain

challenges and expected significant component price increases, the

Board remains confident that for the full year ending 31(st) March

2022, the Group will be slightly ahead of current market

expectations on all profit measures. It is expected that this will

be achieved on lower than previously expected revenues of circa

GBP18m due to softening of the telematics insurance market.

- Ends -

For further information:

Trakm8 Holdings plc

John Watkins, Executive Chairman Tel: +44 (0) 167 543 4200

Jon Edwards, CFO www.trakm8.com

Arden Partners plc (Nominated Adviser Tel: +44 (0) 20 7614 5900

& Broker)

Paul Shackleton, Head of Corporate www.arden-partners.com

Finance

Simon Johnson, Head of Sales

About Trakm8

Trakm8 is a UK based technology leader in fleet management,

insurance telematics, connected car, and optimisation. Through IP

owned technology, the Group uses AI data analytics collected from

its installed base of telematics units to fine tune the algorithms

that are used to produce its' solutions; these monitor driver

behaviour, identify crash events and monitor vehicle health to

provide actionable insights to continuously improve the security

and operational efficiency of both company fleets and private

drivers.

The Group's product portfolio includes the latest data analytics

and reporting portal (Trakm8 Insight), integrated

telematics/cameras/optimisation, self-installed telematics units

and one of the widest ranges of installed telematics devices.

Trakm8 has over 255,000 connections.

Headquartered in Coleshill near Birmingham alongside its

manufacturing facility, the Group supplies to the Fleet,

Optimisation, Insurance and Automotive sectors to many well-known

customers in the UK and internationally including the AA, Saint

Gobain, EON, Iceland Foods, Parts Alliance, Direct Line Group,

ByMiles and Ingenie.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005. Trakm8 is also recognised with the LSE Green

Economy Mark.

www.trakm8.com / @Trakm8

Executive Chairman's Statement

Results

I am pleased to report Trakm8's results for the six months ended

30 September 2021.

The first half of the financial year was a significant

improvement on the previous year and ahead of recent Company

guidance. Revenues for the six months ending 30 September 2021

increased by 23% over the corresponding period of the previous year

to GBP9.02m.

There was an increase of GBP1.29m (29%) in Fleet and

Optimisation revenues to GBP5.7m and an increase in Insurance and

Automotive revenues of GBP0.41m (14%) to GBP3.31m.

The Group is reporting a significant improvement in trading with

a return to profitability with Group adjusted profit of GBP0.44m

(2020: loss GBP0.31m), Profit before Tax of GBP0.05m (2020: Loss

GBP0.85) and Profit after Tax of GBP0.27m (2020: loss

GBP0.73m).

During the period, connections increased by 0.5% to 255,000

(31.3.2021: 254,000). Fleet connections were static at 70,000

(31.3.21: 70,000), Insurance & Automotive connections increased

0.7% to 185,000 (31.3.21: 184,000).

In the last few months of the period we saw a recovery in the

fleet numbers but there has been little recovery in the insurance

market as difficulties with new drivers taking tests and the

increased cost of second hand cars.

The Recurring Revenues in the period increased over the previous

year by 4% to GBP4.81m and represent 53% of Group revenues. In

addition, the Group generated GBP0.98m of software revenues (H1

2020: GBP0.30m), which represent 11% of Group revenues.

The Group has incurred GBP0.13m in additional costs to mitigate

the impact of Covid-19 on the electronic component supply chain but

has maintained supplies to customers without significant

interruptions. In the last few months we have seen significant

price increases in certain components and we expect this to

continue for the balance of the year. We have worked hard to avoid

disruption of our supply chain but there remains an ever present

risk.

Gross profit margin has improved to 65% (2020: 62%). This is

despite the higher hardware revenues as a percentage of sales and

the impact of Covid-19. The improvement in margin is due to higher

software sales during the period.

Total overhead costs, excluding exceptional costs, increased by

GBP0.47m to GBP5.27m (H1 2020: GBP4.80m). This is the result of

GBP0.16m increase in depreciation & amortisation, a GBP0.15m

increase in marketing spend and reduced furlough support of

GBP0.38m. Underlying payroll costs further reduced overall by

GBP0.16m. Exceptional costs reduced significantly during the period

to GBP0.30m, and included furloughed employees costs of GBP0.20m

net of GBP0.18m Government payments and GBP0.11m of other costs.

Share based payments remained consistent compared to the previous

year at GBP0.91m (H1 2020: GBP0.89m)

Financial position

Cash generation from operations has been GBP0.87m (H1 FY-2020:

GBP2.06m) and at 30 September 2021 the Group net debt excluding the

impact of the IFRS16 lease liability was GBP6.16m (GBP7.88m

including IFRS 16 liability) which is GBP1.27m higher than as at 31

March 2021. The HMRC time to pay liability reduced by GBP0.94m. H1

FY21 benefitted from agreeing with the Revenue authorities to delay

payments of GBP0.7m into FY22 and FY23. At the 30 September 2021

the Group had GBP0.89m of cash on hand and a further GBP0.50m of

available funds under an overdraft facility.

The overall cash outflow for the period was GBP1.48m (H1 2020:

outflow of GBP0.12m).

Strategy

The Group has been following the strategy outlined in the 2021

Annual Report. Our focus is to provide ever more meaningful

insights to our customers using the data generated by our installed

devices and other connections so that they can run their operations

more efficiently and safely.

Our primary strategy going forward is the growth of our business

through more connections, increased device sales and higher service

fees. Due to the high level of new contract wins across the

business and reduced rates of attrition in Fleet, the number of

connections have increased overall by 0.8% in the past 12 months

and by 0.4% in past 6 months. The number of devices sold has

increased by 30% to 64,000 (H1 2020: 49,000).

Trakm8 has focused on delivering market leading technology and

ensuring that the solutions are generating the best possible ROI's

for our customers. We have maintained the levels of expenditure in

R&D. We will continue to own the majority of IP in our value

chain. We have focused on building out greater functionality of

existing solutions rather than a wider range. We have focused on

using AI to maximise value in our algorithms in risk, crash and

video analysis. We have obtained very exciting results from this

and are receiving positive interest from customers as a result.

Our third strategy has been to improve the efficiencies of our

business in every possible way. We have been successful in

maintaining similar operating overheads level like for like before

the impact of the furlough support, despite salary inflation and

higher marketing costs. We will continue to seek efficiencies as we

go forward.

Director Resignation

Peter Mansfield, Trakm8 Group Sales and Marketing Director, has

resigned from the Board of Directors with immediate effect. Paul

Wilson who had previously been Group Sales and Marketing Director

will be assuming responsibilities for Fleet Sales and

Marketing.

JOHN WATKINS

Executive Chairman

Unaudited Consolidated Statement of Comprehensive Income for the six months

to 30 September 2021

---------------------------------------------------------------------------------------------------------------------------------

Six months Six months Year

to 30 September to 30 September to

31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Revenue 3 9,021 7,321 15,961

Cost of sales (3,177) (2,804) (6,643)

Gross profit 5,844 4,517 9,318

Other income 4 13 103 194

Administrative expenses excluding exceptional

costs (5,262) (4,800) (9,585)

Exceptional administrative costs 7 (306) (442) (1,342)

Total administrative costs (5,568) (5,242) (10,927)

Operating profit/(loss) 289 (622) (1,415)

Finance income 32 39 78

Finance costs 8 (274) (262) (530)

Profit/(Loss) before taxation 47 (845) (1,867)

Income tax 226 113 630

Profit/(Loss) for the period 273 (732) (1,237)

Other Comprehensive Income

Items that may be subsequently reclassified

to profit or loss:

Exchange differences on translation of foreign

operations 4 5 (3)

Total other comprehensive income 4 5 (3)

---------------------- -------------------- --------------

Total Comprehensive Profit/(Loss) for the

period attributable to owners of the parent 5 277 (727) (1,240)

---------------------- -------------------- --------------

Profit/(Loss) before taxation 6 47 (845) (1,867)

Exceptional administrative costs 306 442 1,342

IFRS2 Share based payments charge 91 89 183

---------------------- -------------------- --------------

Adjusted profit/(loss) before tax 444 (314) (342)

Earnings per ordinary share (pence) attributable to owners

of the Parent

Basic 9 0.55 (1.46) (2.47)

Diluted 9 0.55 (1.46) (2.47)

The results relate to continuing operations.

Unaudited Consolidated Statement of Changes in Equity for the six months

to 30 September 2021

---------------------------------------------------------------------------------------------------------------------------------------------

Share Share Merger Translation Treasury Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 April

2020 500 14,691 1,138 196 (4) 4,658 21,179

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Comprehensive

income

Loss for the

period - - - - - (732) (732)

Other

comprehensive

income

Exchange

differences

on

translation

of overseas

operations - - - 5 - - 5

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Total

comprehensive

income - - - 5 - (732) (727)

Transactions

with owners

IFRS 2

Share-based

payments - - - - - 89 89

Transactions

with owners - - - - - 89 89

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Balance as at

30 Sept

2020 500 14,691 1,138 201 (4) 4,015 20,541

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Comprehensive

income

Loss for the

period - - - - - (505) (505)

Other

comprehensive

income

Exchange

differences

on

translation

of overseas

operations - - - (8) - - (8)

Total

comprehensive

income - - - (8) - (505) (513)

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Transactions

with owners

IFRS2

Share-based

payments - - - - - 94 94

Transactions

with owners - - - - - 94 94

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Balance as at

31 March

2021 500 14,691 1,138 193 (4) 3,604 20,122

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Comprehensive

income

Profit for the

period - - - - - 273 273

Other

comprehensive

income

Exchange

differences

on

translation

of overseas

operations - - - 4 - - 4

Total

comprehensive

income - - - 4 - 273 277

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Transactions

with owners

IFRS2 Share

based

payments - - - - - 91 91

Transactions

with owners - - - - - 91 91

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Balance as at

30 Sept

2021 500 14,691 1,138 197 (4) 3,968 20,490

-------------- --------------- --------------- --------------- --------------------- ------------------ --------------

Unaudited Consolidated Statement of Financial Position as at 30 September

2021

-------------------------------------------------------------------------------------------------------------

As at 30 As at 30 As at 31

September September March

2021 2020 2021

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 10 22,568 22,230 22,187

Plant, property and equipment 911 831 891

Right of use assets 11 2,187 2,838 2,512

Deferred income tax asset - - -

Amounts receivable under finance

leases 39 65 50

25,705 25,964 25,640

------------------- ------------------ ---------------

Current assets

Inventories 1,368 1,701 1,409

Trade and other receivables 7,301 7,171 6,679

Corporation tax receivable 1 317 690

Cash and cash equivalents 888 1,541 2,370

9,558 10,730 11,148

------------------- ------------------ ---------------

Current liabilities

Trade and other payables (5,339) (5,574) (5,417)

Borrowings 12 (1,140) (5,417) (855)

Right of use liability 12 (708) (679) (680)

Provisions - (26) (27)

(7,187) (11,696) (6,979)

------------------- ------------------ ---------------

Current assets less current liabilities 2,371 (966) 4,169

------------------- ------------------ ---------------

Total assets less current liabilities 28,076 24,998 29,809

------------------- ------------------ ---------------

Non-current liabilities

Trade and other payables (474) (593) (1,546)

Borrowings 12 (5,386) (1,231) (5,815)

Right of use liability 12 (1,459) (1,941) (1,767)

Provisions (151) (179) (190)

Deferred income tax liability (116) (513) (369)

(7,586) (4,457) (9,687)

------------------- ------------------ ---------------

Net assets 20,490 20,541 20,122

------------------- ------------------ ---------------

Equity

Share capital 13 500 500 500

Share premium 14,691 14,691 14,691

Merger reserve 1,138 1,138 1,138

Translation reserve 197 201 193

Treasury reserve (4) (4) (4)

Retained earnings 3,968 4,015 3,604

Total equity attributable to owners

of the parent 20,490 20,541 20,122

------------------- ------------------ ---------------

Unaudited Consolidated Cash Flow Statement for the six months to 30 September

2021

----------------------------------------------------------------------------------------------------------------

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Net cash generated from operating

activities 14 868 2,055 4,737

---------------------- ---------------------- -------------

Cash flows from investing activities

Purchases of property, plant and

equipment (230) (183) (330)

Purchases of software (2) (24) (47)

Capitalised Development costs (1,396) (1,220) (2,290)

Net cash used in investing activities (1,628) (1,427) (2,667)

---------------------- ---------------------- -------------

Cash flows from financing activities

New bank loan - - 5,300

Loan arrangement fees - - (86)

Repayment of bank loans (168) (171) (5,379)

Repayment of obligations under lease

agreements (280) (344) (670)

Interest paid (274) (237) (530)

Net cash generated from financing

activities (722) (752) (1,365)

---------------------- ---------------------- -------------

Net (decrease)/increase in cash and

cash equivalents (1,482) (124) 705

Cash and cash equivalents at beginning

of period 2,370 1,665 1,665

Cash and cash equivalents at end

of period 888 1,541 2,370

---------------------- ---------------------- -------------

Notes To The Unaudited Consolidated Financial Statements

-------------------------------------------------------------------------------------------------------------------------------

1. Basis of

preparation

The Group's interim results for the 6 months to 30 September 2021 (prior year

30 September 2020) were approved by the Board of Directors on 15 November

2021.

As permitted this Interim Report has been prepared in accordance with UK AIM

Rules for Companies and not in accordance with IAS 34 "Interim Financial Reporting"

and therefore is not fully in compliance with IFRS.

Trakm8 Holdings PLC ("Trakm8") is a public limited company incorporated in

the United Kingdom under the Companies Act 2006. Trakm8 is domiciled in the

United Kingdom and its ordinary shares are traded on AIM, the market operated

by the London Stock Exchange plc.

The accounting policies adopted in the preparation of the interim financial

statement are the same as those set out in the Group's annual financial statements

for the year ended 31 March 2021. The financial statements have been prepared

on the historical cost basis except for certain liabilities and share based

payment liabilities which are measured at fair value.

The interim financial statements have not been audited or reviewed by Group's

auditors pursuant to the Auditing Practice Board guidance on 'Review of Interim

Financial Information' and do not include all of the information required

for full annual financial statements.

The financial information contained in this report is condensed and does not

constitute statutory accounts of the Group within the meaning of Section 434(3)

of the Companies Act 2006. Statutory accounts for the year ended 31 March

2021 have been delivered to the Registrar of Companies. The audit report of

those accounts was unqualified, did not draw attention to any matters by way

of emphasis and did not contain a statement under Section 498(2) or (3) of

the Companies Act 2006.

Going concern

The consolidated interim financial statements are prepared on a going concern

basis. The directors report that, having reviewed current performance and

projections of its working capital and long term funding requirements, including

assessments against the covenants agreed with our bank and downward sensitivity

analysis, they are satisfied that the Group has sufficient resources to continue

in operation for the foreseeable future, a period of not less than 12 months

from the date of this report. Accordingly, they continue to adopt the going

concern basis in preparing the condensed financial statements.

2. Risks and

uncertainties

The Board has considered the principal risks and uncertainties for the remaining

half of the financial year and determined that the risk presented in the 31

March 2021 Annual Report, described as follows, also remain relevant to the

rest of the financial year: Significant operational system failure; Cyber-attack

and data security; Operating in a fast-moving technology industry where we

will always be at risk from new products being launched; Adverse mobile network

changes; Attracting and maintaining high-quality employees; Access to long

term and working capital; Electronic supply chain materially impacted by Covid-19

and Rate of economic recovery post Covid-19. These are detailed on pages 18

to 20 of the 2021 Annual Report, a copy of which is available on the Group's

website at www.trakm8.com .

3. Segmental

Analysis

The chief operating decision maker ("CODM") is identified as the Board. It

continues to define all the Group's trading under the single Integrated Telematics

Technology segment and therefore review the results of the group as a whole.

Consequently all of the Group's revenue, expenses, assets and liabilities

are in respect of one Integrated Telematics Technology segment.

The Board as the CODM review the revenue streams of Integrated Fleet, Optimisation,

Insurance and Automotive Solutions (Solutions) as part of their internal reporting.

Solutions represents the sale of the Group's full vehicle telematics and optimisation

services, engineering services, professional services and mapping solutions

to customers.

A breakdown of revenue within these streams Six months Six months

are as follows: to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Solutions: 9,021 7,321 15,961

Fleet and optimisation 5,712 4,419 9,520

Insurance and automotive 3,309 2,902 6,441

---------------- ----------------------- -----------------------

Notes To The Unaudited Consolidated Financial Statements

-------------------------------------------------------------------------------------------------------------------------------

4. Other income

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Grant income 13 103 194

13 103 194

------------------------ ---------------------- ----------------

5. Profit/(Loss) per ordinary share attributable to the

owners of the parent

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(Loss) attributable to the

owners of the parent 277 (727) (1,240)

------------------------ ---------------------- ----------------

6. Adjusted profit/(loss)

before tax

Adjusted Profit/(Loss) Before Tax is monitored by the Board

and measured as follows:

Profit/(Loss) Before

Tax 47 (845) (1,867)

Exceptional administrative

costs 306 442 1,342

Share based payments 91 89 183

Adjusted profit/(loss)

before tax 444 (314) (342)

------------------------ ---------------------- ----------------

7. Exceptional

costs

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Integration and restructuring costs 45 97 168

Covid-19 costs 446 891 2,109

Furlough grant income (185) (546) (935)

306 442 1,342

------------------------ ---------------------- ----------------

The integration and restructuring costs in the current year relate to an ongoing

project to streamline and rationalise the operations of the business.

The Group has also incurred exceptional costs relating to the Covid-19 pandemic.

These costs mainly relate to the cost of employees whilst on furlough GBP385,000

(Mar-21: GBP1,607,000, Sep-20: GBP767,000).

Furlough grant income relates to other income received from the Coronavirus

Job Retention Scheme for employees furloughed as a result of Covid-19.

Detailed explanation of prior year exceptional costs are detailed on page

60 of the 2021 Annual Report, a copy of which is available on the Group's

website at www.trakm8.com .

Notes To The Unaudited Consolidated Financial Statements

-------------------------------------------------------------------------------------------------------------------------------

8. Finance costs

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on bank loans 198 191 373

Amortisation of debts

issue costs 24 21 37

Interest on Hire Purchase and similar

agreements 52 50 120

274 262 530

------------------------ ---------------------- ----------------

9. Earnings Per Ordinary Share

The earnings per Ordinary share have been calculated in accordance with IAS

33 using the profit for the period and the weighted average number of Ordinary

shares in issue during the period as follow:

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Profit/(Loss) the year

after taxation 273 (732) (1,237)

Exceptional

administrative

costs 306 442 1,342

Share based payments 91 89 183

Tax effect of

adjustments (58) (84) (255)

Adjusted profit/(loss) after

taxation 612 (285) 33

------------------------ ---------------------- ----------------

No. No. No.

'000 '000 '000

Number of Ordinary shares

of 1p each 50,004 50,004 50,004

Basic weighted average number of Ordinary

shares of 1p each 50,004 50,004 50,004

Diluted weighted average number of Ordinary

shares of 1p each 50,079 50,004 50,004

------------------------ ---------------------- ----------------

Basic earnings/(loss)

per share 0.55p (1.46p) (2.47p)

Diluted earnings/(loss)

per share 0.55p (1.46p) (2.47p)

Adjust for effects of:

Exceptional costs 0.50p 0.72p 2.17p

Share based payments 0.18p 0.18p 0.37p

Adjusted basic earnings/(loss)

per share 1.22p (0.56p) 0.07p

Adjusted diluted earnings/(loss) per share 1.22p (0.56p) 0.07p

Notes To The Unaudited Consolidated Financial Statements

--------------------------------------------------------------------------------------------------------

10. Intangible Assets

Goodwill Intellectual Customer Development Software Total

property Relationships costs

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 31 March 2020 10,417 1,920 100 17,190 1,903 31,530

Additions - Internal

development - - - 1,200 - 1,200

Additions - External

purchases - - - 20 24 44

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2020 10,417 1,920 100 18,410 1,927 32,774

Additions - Internal

development - - - 919 - 919

Additions - External

purchases - - - 151 23 174

Impairments - - - - (155) (155)

Disposals - - - (238) (36) (274)

--------- ------------- --------------- ------------ --------- --------

As at 31 March 2021 10,417 1,920 100 19,242 1,759 33,438

Additions - Internal

development - - - 1,214 - 1,214

Additions - External

purchases - - - 182 2 184

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2021 10,417 1,920 100 20,638 1,761 34,836

--------- ------------- --------------- ------------ --------- --------

Amortisation

As at 31 March 2020 - 1,910 100 6,479 1,044 9,533

Charge for period - 10 - 867 134 1,011

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2020 - 1,920 100 7,346 1,178 10,544

Charge for period - - - 866 115 981

Disposals - - - (238) (36) (274)

--------- ------------- --------------- ------------ --------- --------

As at 31 March 2021 - 1,920 100 7,974 1,257 11,251

Charge for period - - - 924 93 1,017

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2021 - 1,920 100 8,898 1,350 12,268

--------- ------------- --------------- ------------ --------- --------

Net book amount

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2021 10,417 - - 11,740 411 22,568

--------- ------------- --------------- ------------ --------- --------

As at 31 March 2021 10,417 - - 11,268 502 22,187

--------- ------------- --------------- ------------ --------- --------

As at 30 September 2020 10,417 - - 11,064 749 22,230

--------- ------------- --------------- ------------ --------- --------

As at 31 March 2020 10,417 10 - 10,711 859 21,997

--------- ------------- --------------- ------------ --------- --------

Notes To The Unaudited Consolidated Financial Statements

-----------------------------------------------------------------------------------------------------------

11. Right of use assets

Furniture,

Leased fixtures Computer

buildings and equipment equipment Motor vehicles Software Total

COST GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2020 2,098 509 175 619 153 3,554

Additions - - 76 79 - 155

Disposals - - - (10) - (10)

----------- --------------- ----------- --------------- --------- --------

As at 30 September

2020 2,098 509 251 688 153 3,699

Additions - 42 99 - - 141

Impairments - - - - (153) (153)

Disposals - - - (73) - (73)

----------- --------------- ----------- --------------- --------- --------

As at 31 March 2021 2,098 551 350 615 - 3,614

Additions - - - - - -

Disposals - - - (25) - (25)

----------- --------------- ----------- --------------- --------- --------

As at 30 September

2021 2,098 551 350 590 - 3,589

----------- --------------- ----------- --------------- --------- --------

AMORTISATION

As at 1 April 2020 264 49 62 175 - 550

Charge for period 132 46 16 117 - 311

Disposals - - - - - -

----------- --------------- ----------- --------------- --------- --------

As at 30 September

2020 396 95 78 292 - 861

Charge for period 133 29 42 110 - 314

Disposals - - - (73) - (73)

----------- --------------- ----------- --------------- --------- --------

As at 31 March 2021 529 124 120 329 - 1,102

Charge for period 133 35 57 100 - 325

Disposals - - - (25) - (25)

----------- --------------- ----------- --------------- ---------

As at 30 September

2021 662 159 177 404 - 1,402

----------- --------------- ----------- --------------- --------- --------

Net book amount

As at 30 September

2021 1,436 392 173 186 - 2,187

----------- --------------- ----------- --------------- --------- --------

As at 31 March 2021 1,569 427 230 286 - 2,512

----------- --------------- ----------- --------------- --------- --------

As at 30 September

2020 1,702 414 173 396 153 2,838

----------- --------------- ----------- --------------- --------- --------

As at 31 March 2020 1,834 460 113 444 153 3,004

----------- --------------- ----------- --------------- --------- --------

Notes To The Unaudited Consolidated Financial Statements

----------------------------------------------------------------------------------------------------------------------

12. Borrowings

As at 30 September As at 30 September As at 31 March

2021 2020 2021

------------------------- -------------------------- -------------------------

Current Non-Current Current Non-Current Current Non-Current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Borrowings 1,140 5,386 5,417 1,231 855 5,815

Right of use liability 708 1,459 679 1,941 680 1,767

Totals 1,848 6,845 6,096 3,172 1,535 7,582

-------- --------------- -------- ---------------- -------- ---------------

All borrowings are held in sterling and the Directors consider their

carrying amount approximates to their fair values.

Borrowings comprise of the

following loans:

A GBP5.3m term loan with HSBC. The loan is secured by a fixed and floating

charge on all the assets of the Group. It is repayable by 22 monthly instalments

from 30 September 2021 of GBP86,000 and a final repayment of the outstanding

balance on 31 October 2023 and bears interest at a floating rate of 5.1%

over base rate. As at 30 September 2021 the Group owed GBP5.2m (March-21:

GBP5.3m).

A GBP0.5m overdraft facility with HSBC. The overdraft facility bears an

interest rate of 5.3% over LIBOR on the drawn amount. As at 30 September

2021 the Group had not used this overdraft facility.

A GBP1.5m growth capital loan with MEIF WM Debt LP. The loan bears a fixed

interest rate of 8% per annum and is repayable in 15 quarterly instalments

commencing 30 September 2021. The loan is secured by a secondary fixed

and floating charge on all the assets of the Group. As at 30 September

2021 the Group owed GBP1.4m (March-21: GBP1.5m).

The Group's obligations under right of use assets are secured by the

lessors' title to the leased assets.

Obligations under right of use assets by category at 30 September

2021 were as follows:

Furniture,

fixtures

Freehold and Computer Motor

property equipment equipment vehicles Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Current 296 90 109 147 66 708

Non-current 1,235 70 85 42 27 1,459

Total 1,531 160 194 189 93 2,167

--------- ------------- ---------- ------------- --------------------- ---------------

The maturity of obligations under right of use assets as at

30 September 2021 were as follows:

Furniture,

fixtures

Freehold and Computer Motor

property equipment equipment vehicles Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Within 1 year 296 90 109 147 66 708

1 to 2 years 280 66 63 42 27 478

2 to 5 years 750 4 22 0 - 776

More than 5 years 205 - - - - 205

Total 1,531 160 194 189 93 2,167

--------- ------------- ---------- ------------- --------------------- ---------------

Notes To The Unaudited Consolidated Financial Statements

--------------------------------------------------------------------------------------------------------------------

13. Share Capital

As at 30 September As at 30 September As at 31 March

2021 2020 2021

------------------------- ------------------------------------- ----------------------

No's No's No's

000's GBP'000 000's GBP'000 000's GBP'000

Authorised:

Ordinary shares of

1p each 200,000 200,000 200,000 200,000 200,000 200,000

Allotted, issued

and

fully paid:

Ordinary shares of

1p each 50,004 500 50,004 500 50,004 500

Movement in share

capital: GBP'000

As at 1 April 2020 500

---------

As at 30 September

2020 500

---------

As at 31 March 2021 500

As at 30 September

2021 500

---------

The Company currently holds 29,000 Ordinary shares in treasury representing

0.06% (Mar-21: 0.06%) of the Company's issued share capital. The number

of 1 pence Ordinary shares that the Company has in issue less the total

number of Treasury shares is 49,975,002.

14. Cash Generated from Operations

Six months Six months

to to Year to

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Net profit/(loss) before taxation 47 (845) (1,867)

Depreciation 535 380 781

Loss on disposal of fixed

assets - - 318

Amortisation of intangible

assets 1,017 1,011 1,992

Exchange movements 4 - (3)

Interest received (32) (39) (78)

Bank and other interest charges 298 262 565

Share based payments 91 89 183

---------------------- --------------- -----------

Operating cash flows before movement in

working capital 1,960 858 1,891

Movement in inventories 41 342 634

Movement in trade and other

receivables (611) 659 1,166

Movement in trade and other

payables (1,150) (726) 70

Movement in provisions (66) 21 33

Cash generated from operations 174 1,154 3,794

Interest received 32 39 78

Income taxes received 662 862 865

Net cash-inflow from operating

activities 868 2,055 4,737

---------------------- --------------- -----------

15. Further Copies

This statement, full text of the Stock Exchange announcement and the

results presentation can be found on the Group's website www.trakm8.com

and also from the registered office of Trakm8 Holdings PLC. The address

of the registered office is: 4 Roman Park, Roman Way, Coleshill, North

Warwickshire, B46 1HG.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DGBDBRDBDGBU

(END) Dow Jones Newswires

November 16, 2021 02:00 ET (07:00 GMT)

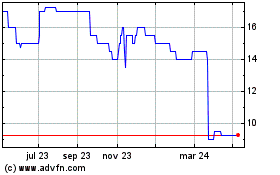

Trakm8 (LSE:TRAK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

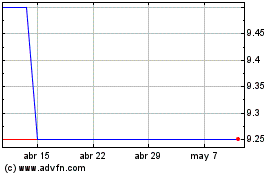

Trakm8 (LSE:TRAK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024