TIDMTRR

RNS Number : 4299O

Trident Royalties PLC.

08 October 2021

8 October 2021

Trident Royalties Plc

("Trident" or the "Company")

Royalty Portfolio Update: Thacker Pass Lithium Resource

Upgrade

Trident Royalties Plc (AIM:TRR, FSX:5KV), the growth-focused

mining royalty and streaming company, is pleased to note the recent

announcement(1) by Lithium Americas Corp. ("Lithium Americas" or

"LAC") regarding positive progress at the Thacker Pass Lithium

Project ("Thacker Pass" or the "Project"), in Nevada, USA. Trident

holds a 60% interest in a gross revenue royalty ("GRR")(2) over the

entirety of the Project, further details of which are set out below

(the " Thacker Pass Royalty " or the "Royalty").

Lithium Americas has released a significant update to the

Thacker Pass Mineral Resource Estimate ("MRE") - more than doubling

the size of the MRE - and set out technical inputs to the ongoing

Feasibility Study and Project timelines.

The Thacker Pass MRE has increased to 13.7Mt of lithium

carbonate equivalent ("LCE") grading 2,231 parts per million

lithium ("ppm Li") of Measured and Indicated ("M&I") Resources

and 4.4Mt of LCE grading 2,112ppm Li of Inferred Resources. The

Feasibility Study is now considering an optimised mine plan

targeting Phase 1 capacity of 40,000 tonnes per annum ("tpa")

lithium carbonate (+30% increase over the 30,000tpa LCE targeted

for Phase 1 in the original Pre-Feasibility Study ("PFS")) and a

Phase 2 total capacity of 80,000tpa LCE (+30% increase over the

60,000tpa LCE targeted for Phase 2 in the original PFS).

Adam Davidson, Chief Executive Officer of Trident commented:

"This latest update from Lithium Americas more than doubles to

the lithium Resource estimate for Thacker Pass which has a very

positive read through for Trident's potential future earnings from

this project, which is the largest lithium reserve in the United

States. The ongoing Feasibility Study is now considering an

optimised mine plan targeting an initial Phase 1 of 40,000tpa

lithium carbonate with a potential Phase 2 expansion to target

total capacity of 80,000tpa lithium carbonate - a significant

increase over the Pre-Feasibility targets of 30,000tpa and

60,000tpa for Phases 1 and 2 respectively. This comes at a time

when LCE prices have more than doubled over the course of 2021. In

addition, Lithium Americas reports the permitting process to be on

track, with a final decision expected in Q1/2022 and with the

planned pilot plant expected to become operational during

H1/2022.

"Under the revised production profile targets announced by LAC

(but retaining the PFS LCE price of US$12,000/tonne), Phase 1

royalty revenue attributable to Trident would increase from

approximately US$3.8 million per annum to +US$5 million, with Phase

2 royalty revenue increasing from approximately US$7.6 million per

annum to +US$10 million; noting that the current LCE price is now

>US$25,000 per tonne."

THACKER PASS UPDATE SUMMARY

The ongoing Thacker Pass Feasibility study considers an

optimised mine plan and the following key variables. Lithium

Americas expects to provide an update on timing of the Feasibility

Study by early 2022.

-- Updated Mineral Resource Estimate : Expanded M&I Resource

estimate to 13.7Mt LCE at 2,231ppm Li (see Table 1 and

comparison(3) Table 2). The updated MRE incorporates the Southwest

Basin, a change in cut-off grade, and additional drilling since the

2018 M&I Resource of 6.0Mt LCE at 2,917ppm Li(3) .

Figure 1: Thacker Pass Location and Mineral Resource Model

Compared to the Boundary of 2018 Resource Model: to view the image,

please click on the following link

http://www.rns-pdf.londonstockexchange.com/rns/4299O_1-2021-10-7.pdf

Table 1: Mineral Resource Estimate for the Thacker Pass Project,

announced 7 October 2021 (CIM NI43-101 compliant)

Resource Classification Tonnage Ave. Li Grade Lithium Carbonate

(million tonnes) (ppm) Equivalent

Mt (million tonnes)

Mt

------------------------- ------------------ -------------- ------------------

Measured 654.2 2,356 8.2

Indicated 499.4 2,067 5.5

Measured and

Indicated 1,153.6 2,231 13.7

Inferred 391.6 2,112 4.4

See Resource Mineral Estimate notes (2)

-- Phase 1 capacity increased to target 40,000tpa lithium

carbonate : Initial Phase 1 targeted capacity increased to reflect

the optimized mine plan and leaching efficiencies. Optimisation

work is focused on maximising lithium carbonate production in Phase

1 without increasing the size of the proposed 3,000 tonnes per day

("tpd") sulphuric acid plant or water usage. Improvements include a

mine plan focused on the illite clay and processing technologies to

increase yield.

-- Phase 2 to target additional 40,000tpa capacity for total

capacity of 80,000tpa lithium carbonate: Plans to include an

expansion scenario to target total capacity of 80,000tpa of lithium

carbonate. The addition of a 40,000tpa expansion ("Phase 2"), is

designed to demonstrate Thacker Pass' ability to scale production

and align with potential customer and partner longer-term demands.

The Phase 2 expansion scenario would entail additional time

required to amend and meet permitting requirements beyond Phase 1.

To meet potential customer and partner needs, LAC continues to also

advance engineering to consider an option for a 20,000tpa lithium

hydroxide chemical conversion plant.

-- Permitting process on track with final decision expected in

Q1 2022 : All key State permits(2) are expected to be released for

public comment in Q4/2021. At the Federal level, a court hearing on

the appeal of the Record of Decision(3) is expected to take place

in February 2022, with the ruling to follow shortly thereafter.

-- Developing integrated pilot plant to support increased scale:

Working on an integrated pilot plant, expected to be operational in

H1/2022, to support ongoing optimisation work, confirm certain

assumptions in the design and operational parameters and provide

product samples for potential customers. The existing process

testing facility will be relocated to a new facility in Reno and

expanded to run the full Thacker Pass flowsheet to produce lithium

carbonate samples.

-- Early-works construction expected to commence in H1/2022:

Early-works includes roads, site preparation, water line and

additional infrastructure to condense and de-risk the overall

construction schedule.

-- Discussions continue with potential strategic partners and

customers: LAC has retained Greenhill & Co. to act as financial

advisor for the Thacker Pass strategic partnership process.

-- Designed to minimise environmental footprint: Thacker Pass is

being designed to incorporate carbon-free power as its primary

energy source, state-of-the-art air emissions control technologies,

a zero-water discharge process, water recycling technologies to

reduce water consumption and adopt active reclamation to maintain

low footprint. Environmental impact analysis is underway by Golder

Associates to align with the proposed Feasibility Study design.

The technical details summarised in this announcement are based

on technical information compiled by the Qualified Persons in

compliance with Canadian National Instrument 43-101 as set out in

the referenced Lithium Americas announcements and reports.

Thacker Pass Royalty Information

Trident holds a 60% interest in the Thacker Pass GRR. The key

terms of the GRR are as follows:

-- A gross revenue royalty on all mineral products generated at

the mine of 8% (4.8% attributable to Trident) reducing to 4% (2.4%

attributable to Trident) after US$22 million is paid.

-- The right to reduce the GRR to 1.75% (1.05% attributable to

Trident) by the operator making a Buyback payment of US$22 million

at any time (US$13.2 million attributable to Trident).

-- Trident notes that the Prefeasibility Study ("PFS")(6)

assumes the Buyback is completed within the first year of operation

and, as such, Trident has assumed that it would benefit from a

1.75% GRR (1.05% attributable to Trident) through the life cycle of

the project.

-- Based on the PFS parameters and assuming the Buyback is

exercised before the commencement of production, the anticipated

Phase 1 steady-state royalty revenue attributable to Trident is

expected to be approximately US$3.8 million per annum, increasing

to approximately US$7.6 million per annum at Phase 2

steady-state(7) . Under the revised production profile targets

announced by LAC (but retaining the PFS LCE price of

US$12,000/tonne), Phase 1 royalty revenue attributable to Trident

would increase to +US$5 million per annum, with Phase 2 royalty

revenue increasing to +US$10 million per annum; noting that the

current LCE price is now >US$25,000 per tonne.

Notes & References

All of the technical information in this release has been

extracted from the publicly available source documents identified

below, the reader is advised that the appropriate CIM tables and

Qualified Persons Statements may be found in those documents.

1 Source: Lithium Americas Corp. (TSX: LAC, NYSE: LAC)

announcement. Lithium Americas Expands Resource at Thacker Pass and

Increases Phase 1 Capacity to Target 40,000 tpa Lithium Carbonate,

7 October 2021

(

https://www.lithiumamericas.com/news/lithium-americas-expands-resource-at-thacker-pass-and-increases-phase-1-capacity-to-target-40000-tpa-lithium-carbonate

)

2 Mineral Resource Estimate Notes for the 7 October 2021 update

produced in accordance with CIM Definition Standards along with

Mineral Resource and Mineral Reserve Estimation Best Practice

Guidelines (2019):

-- The Qualified Person who supervised the preparation of and

approved disclosure for the estimate is Randal Burns, B.Sc.Geology

and SME, VP Exploration at Lithium Nevada Corp., a wholly owned

subsidiary of Lithium Americas.

-- Mineral Resources are reported using an economic break-even

calculation formula: "Operating Cost per Resource Tonne"/"Price per

Recovered Tonne Lithium" * 10^6 = ppm Li Cut-off. "Operating Cost

per Resource Tonne" = US$58.58, "Price per Recovered Tonne Lithium"

is calculated: ("LCE Price" * 5.32 * (1 - "Royalties") *

"Recovery". Variables are "LCE Price" = US$12,000/tonne Li2CO3,

"Royalties" = 1.75% and "Recovery" = 70%.

-- A resource economical pit shell has been derived from

performing a pit optimization calculation using Vulcan

software.

-- The conversion factor for lithium metal (100%) to LCE is 5.323.

-- Applied density is 1.79 tonnes/m3.

-- Measured Mineral Resources are in blocks estimated using at

least six drill holes and eighteen samples within a 262 m × 262 m

search radius in the horizontal plane and 5 m in the vertical

direction; Indicated Mineral Resources are in blocks estimated

using at least two drill holes and six to eighteen samples within a

483 m × 483 m search radius in the horizontal plane and 5 m in the

vertical direction; and Inferred Mineral Resources are blocks

estimated with at least one drill hole and three to six samples

within a search radius of 722 m × 722 m in the horizontal plane and

5 m in the vertical plane.

-- Rounding errors may exist.

3 Mineral Resource Estimate comparison between 7 October 2021

MRE update and previous 5 April 2018 MRE. See referenced PFS for 5

April 2018 MRE assumptions.

Table 2: Comparison between 7 October 2021 MRE and 5 April 2018

MRE.

Category EFFECTIVE DATE OF 7 OCTOBER 2021 EFFECTIVE DATE OF 5 APRIL 2018

1,334 PPM LI CUT-OFF GRADE 2,000 PPM LI CUT-OFF GRADE

Measured 654.2 Mt 242.2 Mt

2,356 Average Li (ppm) 2,948 Average Li (ppm)

8.2 Mt LCE 3.8 Mt LCE

----------------------------------- ---------------------------------

Indicated 499.4 Mt 143.1 Mt

2,067 Average Li (ppm) 2,864 Average Li (ppm)

5.5 Mt LCE 2.2 Mt LCE

----------------------------------- ---------------------------------

Total Measured and Indicated 1,153.6 Mt 385.3 Mt

2,231 Average Li (ppm) 2,917 Average Li (ppm)

13.7 Mt LCE 6.0 Mt LCE

----------------------------------- ---------------------------------

Inferred 391.6 Mt 147.4 Mt

2,112 Average Li (ppm) 2,932 Average Li (ppm)

4.4 Mt LCE 2.3 Mt LCE

----------------------------------- ---------------------------------

4 State Permits: Three key state-level permits are expected to

be published in draft form by the Nevada Department of

Environmental Protection ("NDEP") for public comment in Q4 2021:

(1) Water Pollution Control Permit, (2) Mine Reclamation Permit and

(3) Class II Air Permit. LAC expects to have final versions of

these permits in December 2021. LAC expects that early-works on the

water line could begin as early as February 2022, once permits are

received. Other early-works are expected to begin in H1 2022,

including roads, site preparation and additional infrastructure, to

condense and de-risk overall construction schedule. A decision on

the water rights transfer application is anticipated by Q1

2022.

5 The Record of Decision ("ROD") was received in January 2021

from the Bureau of Land Management ("BLM"). In February 2021,

claims were filed against the BLM to appeal the issuance of the

ROD. Injunction requests over the Company's plan to begin

pre-construction work were denied in Q3 2021. A court hearing on

the appeal is expected to take place in February 2022, with the

ruling to follow shortly thereafter.

6 Technical Report on the Pre-Feasibility Study for the Thacker

Pass Project, Humboldt County, Nevada, USA, Effective Date 1 August

2018 , results announced 21 June 2018 Study link :

https://www.lithiumamericas.com/staging/lithiumamericas.com/_resources/pdf/investors/technical-reports/thacker-pass/Technical-Report-Thacker-Pass.pdf?v=0.228

7 Assuming that the Buyback of US$13.2 million attributable to

Trident is exercised to reduce the GRR rate. Note that the

steady-state cash flows exclude the Buyback payment.

Competent Person's Statement

The technical information contained in this disclosure has been

read and approved by Mr Nick O'Reilly (MSc, DIC, MAusIMM, MIMMM,

FGS), who is a qualified geologist and acts as the Competent Person

under the AIM Rules - Note for Mining and Oil & Gas Companies.

Mr O'Reilly is a Principal Consultant working for Mining Analyst

Consulting Ltd which has been retained by Trident to provide

technical support.

** Ends **

Contact details:

Trident Royalties Plc www.tridentroyalties.com

Adam Davidson +1 (757) 208-5171

Grant Thornton (Nominated Adviser) www.grantthornton.co.uk

Colin Aaronson / Samantha Harrison +44 020 7383 5100

/ Lukas Girzadas

---------------------------

Tamesis Partners LLP (Joint Broker) www.tamesispartners.com

Richard Greenfield +44 20 3882 2868

---------------------------

Shard Capital Partners LLP (Joint www.shardcapital.com

Broker) +44 20 7186 9927

Erik Woolgar / Isabella Pierre

---------------------------

St Brides Partners Ltd (Financial www.stbridespartners.co.uk

PR & IR) +44 20 7236 1177

Susie Geliher / Catherine Leftley

---------------------------

About Trident

Trident is a growth-focused diversified mining royalty and

streaming company, providing investors with exposure to a mix of

base and precious metals, bulk materials (excluding thermal coal)

and battery metals.

Key highlights of Trident's strategy include:

-- Expanding on a royalty and streaming portfolio which broadly

mirrors the commodity exposure of the global mining sector

(excluding thermal coal) with a bias towards production or

near-production assets, differentiating Trident from the majority

of peers which are exclusively, or heavily weighted, to precious

metals;

-- Acquiring royalties and streams in resource-friendly

jurisdictions worldwide, while most competitors have portfolios

focused on North and South America;

-- Targeting attractive small-to-mid size transactions which are

often ignored in a sector dominated by large players;

-- Active deal-sourcing which, in addition to writing new

royalties and streams, will focus on the acquisition of assets held

by natural sellers such as: closed-end funds, prospect generators,

junior and mid-tier miners holding royalties as non-core assets,

and counterparties seeking to monetise packages of royalties and

streams which are otherwise undervalued by the market;

-- Maintaining a low-overhead model which is capable of

supporting a larger scale business without a commensurate increase

in operating costs; and

-- Leveraging the experience of management, the board of

directors, and Trident's adviser team, all of whom have deep

industry connections and strong transactional experience across

multiple commodities and jurisdictions.

The acquisition and aggregation of individual royalties and

streams is expected to deliver strong returns for shareholders as

assets are acquired on terms reflective of single asset risk

compared with the lower risk profile of a diversified, larger scale

portfolio. Further value is expected to be delivered by the

introduction of conservative levels of leverage through debt. Once

scale has been achieved, strong cash generation is expected to

support an attractive dividend policy, providing investors with a

desirable mix of inflation protection, growth and income.

Forward-looking Statements

This news release contains forward -- looking information. The

statements are based on reasonable assumptions and expectations of

management and Trident provides no assurance that actual events

will meet management's expectations. In certain cases, forward --

looking information may be identified by such terms as

"anticipates", "believes", "could", "estimates", "expects", "may",

"shall", "will", or "would". Although Trident believes the

expectations expressed in such forward -- looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal

prices, general economic and political conditions, environmental

risks, and community and non-governmental actions. Such factors

will also affect whether Trident will ultimately receive the

benefits anticipated pursuant to relevant agreements. This list is

not exhaustive of the factors that may affect any of the forward --

looking statements. These and other factors should be considered

carefully and readers should not place undue reliance on

forward-looking information.

Third Party Information

As a royalty and streaming company, Trident often has limited,

if any, access to non-public scientific and technical information

in respect of the properties underlying its portfolio of royalties

and investments, or such information is subject to confidentiality

provisions. As such, in preparing this announcement, the Company

often largely relies upon information provided by or the public

disclosures of the owners and operators of the properties

underlying its portfolio of royalties, as available at the date of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBDLLBFBLLFBL

(END) Dow Jones Newswires

October 08, 2021 02:00 ET (06:00 GMT)

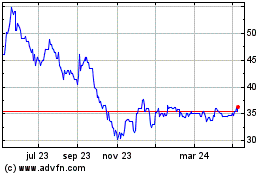

Trident Royalties (LSE:TRR)

Gráfica de Acción Histórica

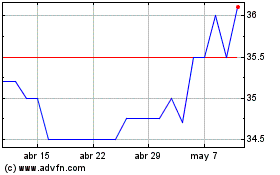

De Mar 2024 a Abr 2024

Trident Royalties (LSE:TRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024