Tritax EuroBox PLC Acquires logistics asset in Rhine-Ruhr in Germany (8835P)

22 Octubre 2021 - 1:00AM

UK Regulatory

TIDMEBOX TIDMBOXE

RNS Number : 8835P

Tritax EuroBox PLC

22 October 2021

22 October 2021

Ninth investment in Germany for Tritax EuroBox

ACQUISITION OF LOGISTICS ASSET IN THE RHINE-RUHR REGION OF

GERMANY FOR EUR32 MILLION

Tritax EuroBox plc ("Tritax EuroBox" or the "Company") (ticker:

EBOX (Sterling) and BOXE (Euro)), which invests in high-quality,

prime logistics real estate strategically located across

continental Europe, announces that it has agreed the acquisition of

a EUR32 (1) million asset in the Rhine-Ruhr region in Germany.

The asset, held freehold, has a total gross internal area of

approximately 16,632 sqm and comprises three purpose-built

logistics facilities located in the heart of the prime logistics

location in the Rhine-Ruhr region. Unit 1 is expected to be

completed in December 2021 whilst units 2 and 3 will be delivered

in January-February 2022.

The optimal location of Gelsenkirchen in the Rhine-Ruhr

metropolitan region allows the asset to access motorway

infrastructure and be a part of the most important logistics hub in

Europe, where one quarter of all logistics centers in Germany are

located.

This project presents a strong opportunity to meet several of

the sustainability objectives via redevelopment of a brownfield

site to a DGNB Gold in use sustainability standard.

Of the building's three units, Units 1 and 2 are let to strong

tenants with robust covenants, whilst Unit 3 is currently vacant

with the benefit of a rental guarantee. Noting the sought-after

logistics location, which benefits from strong occupier demand and

constrained supply, the Manager will be seeking to let the vacant

unit in the near term.

The asset will generate a total annual rent of EUR1.21 million

on leases with a weighted average unexpired lease term of six

years.

The acquisition price of EUR32 million reflects a net initial

yield of 3.7% based on the income from the existing leases and

rental guarantee, with the opportunity to capture upside from the

letting of the vacant unit under rental guarantee.

This acquisition forms part of the deployment strategy for

Tritax EuroBox following a successful equity raise in September

2021and the Green Bond issuance in June 2021.

Completion of the acquisition is subject to practical completion

of the construction of Unit 1, anticipated in December 2021. Given

Dietz AG is the developer and vendor of the asset and considered a

related party to the Company under the Listing Rules, the

Gelsenkirchen Proposal is subject to shareholder approval. A

circular containing further information about the proposed

transaction and a notice convening a General Meeting of the Company

at which shareholders will be asked to vote in favour of a

resolution to approve the Gelsenkirchen Proposal will be posted to

shareholders as soon as practicable.

Alina Iorgulescu, Assistant Fund Manager of Tritax EuroBox,

commented:

"We are delighted to be acquiring this asset, which is the ninth

German investment for Tritax EuroBox, bringing our total amount

invested in the country to just over EUR600 million. This

off-market acquisition of a new, purpose-built asset is at an

attractive yield which also offers opportunities to add value

through capturing the convincing rental growth in the area.

The asset is in a prime logistics location in the Rhine-Ruhr

region of Germany, the largest population centre in the country and

an area which benefits from excellent transport connectivity and

strong supply / demand fundamentals."

Notes

1 The Company will acquire the asset by way of a share deal,

purchasing 89.9% of the shares in Dietz 26. Grundbesitz GmbH.

For further information please contact:

Tritax Group

+44 (0) 20 8051 5070

Nick Preston

Mehdi Bourassi

Jo Blackshaw (Investor Relations)

Maitland/AMO (Media inquiries)

James Benjamin

+44 (0) 7747 113 930

tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

Notes:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are expected to deliver an attractive capital

return and secure income to shareholders. These assets fulfil key

roles in the logistics and distribution supply-chain focused on the

most established logistics markets and on the major population

centres across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain

optimisation.

The Company's Manager, Tritax Management LLP, has assembled a

full-service European logistics asset management capability

including specialist "on the ground" asset and property managers

with strong market standings in the Continental European logistics

sector.

Further information on Tritax EuroBox plc is available at

www.tritaxeurobox.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPPGUCUUPGPGG

(END) Dow Jones Newswires

October 22, 2021 02:00 ET (06:00 GMT)

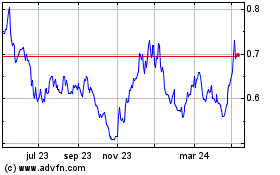

Tritax Eurobox (LSE:BOXE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

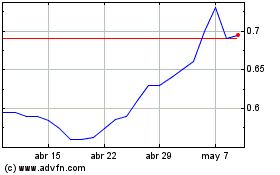

Tritax Eurobox (LSE:BOXE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024