TIDMEBOX TIDMBOXE

RNS Number : 3114S

Tritax EuroBox PLC

15 November 2021

15 November 2021

FUNDING OF PRIME LOGISTICS ASSET IN THE RHINE-RUHR REGION OF

GERMANY FOR EUR118 MILLION

Tritax EuroBox plc ("Tritax EuroBox" or the "Company") (ticker:

EBOX (Sterling) and BOXE (Euro)), which invests in high-quality,

prime logistics real estate strategically located across

continental Europe, announces that it has agreed to acquire land

and fund the development of an EUR117.9 (1) million asset in a

prime location in the Rhine-Ruhr region in Germany, which is

pre-let to the Rhenus Warehousing Solutions SE & Co KG

("Rhenus"), one of the leading global logistics service providers

(the "Bönen Proposal").

The property will comprise a single building with a total gross

internal area of approximately 66,065 sqm comprising six

purpose-built logistics units located in the heart of the prime

logistics location in the Rhine-Ruhr region. The development is

expected to be completed in February 2023.

This transaction is structured as a forward funding development

opportunity, where the Company will buy the land initially and then

fund the construction of the building under a fixed price contract.

The total cost of the land and development expenditure is capped at

EUR117.9 million. From receipt of the building permit expected by

February 2022 and during the 12-months construction phase, the

Company will receive from the developer an income return equivalent

to the agreed net initial yield.

The optimal location of Bönen in the Rhine-Ruhr metropolitan

region allows the asset to access motorway infrastructure and be a

part of the most important logistics hub in Europe, where one

quarter of all logistics centers in Germany are located.

This project meets several of the Company's sustainability

objectives via redevelopment of a brownfield site to a DGNB Gold in

use sustainability standard.

The entire building is pre-let on a 15-year lease to Rhenus,

commencing on practical completion expected in February 2023. The

lease will generate a total annual rent of approximately EUR4.1

million.

The development cost of EUR117.9 million reflects a net initial

yield of 3.5% based on the income from the agreed upon lease.

This acquisition forms part of the deployment strategy for

Tritax EuroBox following the successful equity raise in September

2021.

The Company has entered into a conditional contract with several

entities including Dietz Aktiengesellschaft, all part of the Dietz

group of companies (collectively referred to as "Dietz AG") in

respect of the Bönen Proposal.

Alina Iorgulescu, Assistant Fund Manager of Tritax EuroBox,

commented:

"The Rhine-Ruhr region of Germany is the largest population

centre in the country and is an area which benefits from excellent

transport connectivity and strong supply / demand fundamentals.

This is the tenth German investment in the Tritax EuroBox

portfolio, bringing our total amount invested in the country to

just over EUR700 million, providing significant critical mass in

the most important logistics market in Europe. This off-market

funding, developed by our long term development partner Dietz AG,

is at an attractive yield which also offers the opportunity to

capture the rental growth evident in the prime German logistics

market."

Related Party Transaction and General Meeting

As Dietz AG is considered as a related party to the Company

under the Listing Rules, the Bönen Proposal is subject to

shareholder approval. A circular containing further information

about the Bönen Proposal as well as the Gelsenkirchen Proposal

announced by the Company on 22 October 2021, and a notice convening

a General Meeting of the Company at which shareholders will be

asked to vote in favour of resolutions to approve the proposed

transactions will be posted to shareholders as soon as practicable.

Further details of the Bönen Proposal, including the key commercial

terms, are set out in the appendix to this announcement.

Notes

1 Property price. The Company will acquire the asset by way of a

share deal, purchasing 89.9% of the shares in Dietz 23. Grundbesitz

GmbH.

For further information please contact:

Tritax Group

+44 (0) 20 8051 5070

Nick Preston

Mehdi Bourassi

Jo Blackshaw (Investor Relations)

Maitland/AMO (Media inquiries)

James Benjamin

+44 (0) 7747 113 930

tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

Notes:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are expected to deliver an attractive capital

return and secure income to shareholders. These assets fulfil key

roles in the logistics and distribution supply-chain focused on the

most established logistics markets and on the major population

centres across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain

optimisation.

The Company's Manager, Tritax Management LLP, has assembled a

full-service European logistics asset management capability

including specialist "on the ground" asset and property managers

with strong market standings in the Continental European logistics

sector.

Further information on Tritax EuroBox plc is available at

www.tritaxeurobox.co.uk

APPIX

Background to and reasons for the Bönen Proposal

The Bönen Proposal forms part of the deployment strategy for

Tritax EuroBox following the successful equity raise in September

2021.

The acquisition is structured as a corporate acquisition, with

the Company acquiring 89.9 per cent. of the shares in the entity

holding the Bönen asset (the "Bönen SPV") from Dietz AG. The total

consideration is approximately EUR117.9 million, which includes the

commitment to fund the development of a new, highly-specified

logistics warehouse which has been pre-let to Rhenus. Dietz AG will

retain the remaining 10.1 per cent. interest in the Bönen SPV.

The property will comprise a single building with a total gross

internal area of approximately 66,065 sqm comprising six

purpose-built logistics units located in the heart of the prime

logistics location in the Rhine-Ruhr region. The development is

expected to be completed in February 2023. The building will then

be fully let to Rhenus on a 15-year lease for an annual rental of

approximately EUR4.1 million.

The Company and Tritax Management LLP believe that the Bönen

Proposal represents good value for the Company and will assist in

achieving the Company's near-term investment objectives. In

addition to the investment returns expected to be generated from

the Bönen Proposal, it will also represent the Company's tenth

acquisition in Germany, helping the Company build scale and spread

costs over a wider asset base. As the twentieth asset in the

Company's portfolio(1) , this will also provide wider

diversification to spread risk across the portfolio.

Jones Lang LaSalle Ltd ("JLL") has independently valued the

completed Bönen asset.

Principal terms of the Bönen Proposal

-- On 12 November 2021, the Company entered into a conditional

share purchase agreement with the Dietz AG pursuant to which Dietz

AG agreed to sell and the Company agreed to purchase an 89.9 per

cent. interest in the Bönen SPV (the "Bönen Sale Agreement").

-- The total consideration to be paid by the Company, including

the repayment of existing shareholder loans, construction fees and

other fees and costs, is fixed at approximately EUR117.9 million

and will be made in stage payments, with the first payment to be

paid on completion under the Bönen Sale Agreement, with the

remainder paid in two stages: upon obtaining the building permit in

respect of the Bönen asset and upon practical completion of the

Bönen asset.

-- As part of the proposal, during construction of the Bönen

asset, Dietz AG will pay the Bönen SPV a rental guarantee until

practical completion.

-- Upon completion of the sale and purchase of the 89.9 per

cent. interest in the Bönen SPV, Dietz AG and the Company will

enter into a shareholders agreement in respect of the retained 10.1

per cent. Dietz AG interest and the 89.9 per cent. Company interest

in the Bönen SPV.

-- The gross property assets of the Bönen SPV, which are the

subject of the transaction on acquisition, total approximately

EUR22.7 million as at 31 October 2021. Other assets and

liabilities, which include shareholder loans, amount to a net

liability of approximately EUR24.6million. Post completion of the

development, and assuming no other changes, the Company expects the

total value of the Bönen asset to exceed EUR117.9 million.

-- The Bönen Sale Agreement is conditional on the approval of

shareholders at the General Meeting.

-- It is anticipated that a building contract with a third party

building contractor will be entered into, pursuant to which the

Company will procure the construction of the Bönen asset.

Note:

(1) - this includes the acquisitions relating to the Rosersberg,

Oberhausen, Settimo Torinese and Gelsenkirchen assets, which are

also subject to completion.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPGAAGUPGPGC

(END) Dow Jones Newswires

November 15, 2021 02:00 ET (07:00 GMT)

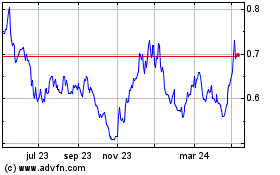

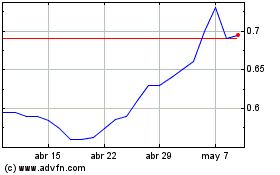

Tritax Eurobox (LSE:BOXE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tritax Eurobox (LSE:BOXE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024