Tufton Oceanic Assets Ltd. New commitments to decarbonise shipping (4934M)

22 Septiembre 2021 - 12:59AM

UK Regulatory

TIDMSHIP

RNS Number : 4934M

Tufton Oceanic Assets Ltd.

22 September 2021

22 September 2021

Tufton Oceanic Assets Limited (The "Company")

New commitments to decarbonise shipping

The Company's Investment Manager, Tufton Investment Management

Ltd, announced as part of the UN General Assembly and Climate Week

NYC its commitments to align its funds to the Paris Agreement by

fully transitioning them to zero carbon energy sources by 2050 and

investing in zero carbon capable vessels before 2030. These new

commitments are significantly ahead of current industry targets and

aligned with those of other industry leaders who have also been

members of the Getting to Zero Coalition alongside the Investment

Manager since September 2019.

The Company announced in July that it plans to invest

approximately $1m per vessel in Energy Saving Devices ("ESD") over

the next few years. These ESD will increase efficiency and reduce

emissions by approximately 10% and have expected returns above the

Company's targets. The Investment Manager believes that further

retrofits enabling secondhand vessels to become capable of

consuming zero carbon fuels are technically feasible and will

increasingly become economically attractive over the next few

years. The Investment Manager will continue to assess the

suitability of the Company's vessels for such further retrofits in

collaboration with leading charterers with strong decarbonisation

targets.

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Paulo Almeida +44 (0) 20 7518 6700

Singer Capital Markets

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $277.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange, on 20 December 2017, a subsequent

placing and offer in October 2018, a placing in March 2019, a

placing in September 2019 and tap issues in March and August 2021

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAANFASLFEFA

(END) Dow Jones Newswires

September 22, 2021 01:59 ET (05:59 GMT)

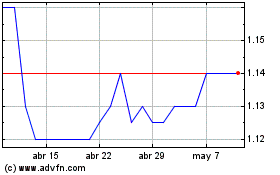

Tufton Oceanic Assets (LSE:SHIP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tufton Oceanic Assets (LSE:SHIP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024