U.S. Dollar Appreciates On Early Fed Tapering Expectations

10 Agosto 2021 - 3:30AM

RTTF2

The U.S. dollar moved up against its most major rivals in the

European session on Tuesday, as hawkish comments from Fed officials

intensified hopes that the Fed will begin to scale back the bond

purchase program in the coming months.

Atlanta Fed President Raphael Bostic said on Monday that the

central bank could commence tapering between October and December,

or even earlier provided there is another month or two of strong

employment gains.

There is substantial progress towards the Fed's goal, Bostic

said, adding that July's job numbers were "definitely quite

encouraging in that regard."

Bostic and Richmond Fed President Tom Barkin said inflation has

already reached the Fed's 2 percent threshold, one of two

conditions needed before a rate hike move.

Investors await U.S. inflation data due on Wednesday for more

clues on the Fed's policy outlook.

The U.S. Senate is expected to pass $1 trillion bipartisan

infrastructure bill later in the day and send it to the House of

Representatives for a vote.

Senate Majority Leader Chuck Schumer said that after the vote on

the infrastructure bill, the Senate will begin a fresh debate on

$3.5 trillion plan aimed at expansion of social programs.

The greenback firmed to near a 3-week high of 0.9226 against the

franc, more than 4-month high of 1.1716 against the euro and a

fresh 2-week high of 110.55 against the yen, off its previous lows

of 0.9190, 1.1743 and 110.22, respectively. Next key resistance for

the currency is likely seen around 0.94 against the franc, 1.15

against the euro and 112 against the yen.

In contrast, the greenback weakened to 0.7348 against the

aussie, 0.7000 against the kiwi and 1.2555 against the loonie,

after rising to near a 3-week high of 0.7316, 1-week high of 0.6969

and near a 2-week high of 1.2589, respectively in early trading.

The greenback is poised to challenge support around 0.75 against

the aussie, 0.72 against the kiwi and 1.24 against the loonie.

The greenback pulled back from an early 2-week high of 1.3836

against the pound and was worth 1.40. The greenback may locate

support around the 1.40 level.

Data from the British Retail Consortium showed that UK retail

sales continued to grow in July but the pace of growth slowed.

Total retail sales grew 6.4 percent on a yearly basis in July.

At the same time, like-for-like sales were up 4.7 percent.

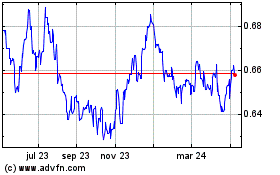

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

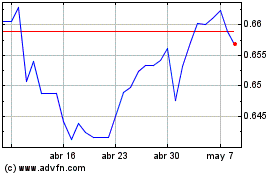

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024