U.S. Dollar Climbs As Weak Retail Sales Data Dampens Sentiment

17 Agosto 2021 - 5:43AM

RTTF2

The U.S. dollar appreciated against its major opponents in the

European session on Tuesday, amid a rise in treasury yields after

the release of weaker than expected U.S. retail sales data for

July.

Data from the Commerce Department showed that retail sales

slumped by 1.1 percent in July after climbing by an upwardly

revised 0.7 percent in June.

Economists had expected retail sales to dip by 0.3 percent

compared to the 0.6 percent increase originally reported for the

previous month.

Excluding the steep drop in sales by motor vehicles and parts

dealers, retail sales fell by 0.4 percent in July after jumping by

1.6 percent in June. Ex-auto sales were expected to inch up by 0.1

percent.

Risk sentiment deteriorated as a spike in COVID-19 cases in Asia

and elsewhere raised fears of a slowdown in global economic

growth.

Traders focus on a speech from Fed Chair Jerome Powell for more

clues on the timing of a withdrawal of monetary stimulus.

The greenback rose in the Asian session amid safe haven appeal,

as investors worry about the spread of the Delta variant of the

coronavirus and its potential impact on global growth.

The greenback advanced to a 4-day high of 1.1732 against the

euro from Monday's close of 1.1777. Should the currency rallies

again, 1.16 is possibly seen as its next resistance level.

Flash estimate from Eurostat showed that the euro area economy

recovered from a technical recession in the second quarter.

Gross domestic product grew 2 percent sequentially, in contrast

to a 0.3 percent drop in the first quarter. The quarter-on-quarter

growth rate matched the flash estimate released on July 30.

The greenback firmed to 1.3753 against the pound, its highest

level since July 26. The pound-greenback pair had ended yesterday's

trading session at 1.3841. The greenback may face resistance around

the 1.34 region, if it gains again.

Data from the Office for National Statistics showed that the UK

unemployment rate declined in the second quarter.

The unemployment rate dropped 0.2 percentage points to 4.7

percent in the second quarter. This was slightly below the expected

rate of 4.8 percent.

The greenback rebounded to 109.56 against the yen, from a low of

109.12 seen at 3:00 am ET. The pair had closed Monday's deals at

109.20. Next key resistance for the greenback is found around the

112.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity rose for the first time in three

months in June.

The tertiary activity index rose 2.3 percent month-on-month in

June, after a 2.9 percent decrease in May.

After falling to nearly a 2-week low of 0.9100 at 8:20 am ET,

the dollar bounced off to 0.9126 against the franc. At yesterday's

trading close, the pair was quoted at 0.9122. Further rally in the

currency may challenge resistance around the 0.93 region.

The greenback moved up to near a 3-week high of 0.6904 against

the kiwi and a 9-month high of 0.7262 against the aussie from

yesterday's closing values of 0.7016 and 0.7335, respectively. The

greenback is likely to locate resistance around 0.68 against the

kiwi and 0.71 against the aussie.

The greenback rose to its highest level since July 21 against

the loonie, at 1.2631. The greenback was trading at 1.2569 against

the loonie at yesterday's close. Immediate resistance for the

dollar is likely seen around the 1.28 level.

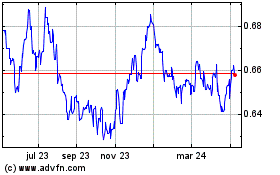

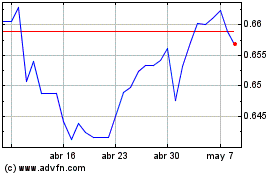

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024