U.S. Dollar Drops Amid Risk Appetite

13 Agosto 2021 - 4:38AM

RTTF2

The U.S. dollar slipped against its major counterparts in the

European session on Friday amid risk appetite, as European shares

rose on the back of strong corporate earnings results and optimism

over economic reopening from the pandemic.

U.S. treasury yields fell in the wake of mixed data on U.S.

consumer and producer inflation in July.

The yield on the benchmark 10-year treasury note dropped 0.015

basis points to 1.352 percent.

Investors await more hints on the Fed's plan to withdraw

stimulus after a surge in producer inflation and a drop in jobless

claims for the third consecutive week.

Several Fed officials have favored a tapering of the QE program

in the coming months given improvement in the labor market and

price pressures.

Data from the Labor Department showed that U.S. import prices

increased less than expected in the month of July.

The report said import prices rose by 0.3 percent in July after

surging up by a revised 1.1 percent in June. Economists had

expected import prices to climb by 0.6 percent compared to the 1.0

percent jump originally reported for the previous month.

Meanwhile, export prices shot up by 1.3 percent in July

following a 1.2 percent leap in the previous month. Export prices

were expected to increase by 0.8 percent.

The greenback weakened to a 3-day low of 0.9197 against the

franc, 4-day lows of 1.1769 against the euro and 110.18 against the

yen, following its prior highs of 0.9239, 1.1729 and 110.46,

respectively. The greenback is seen finding support around 0.90

against the franc, 1.20 against the euro and 108.00 against the

yen.

The greenback touched 1.3834 against the pound, falling from

more than a 2-week high of 1.3791 seen at 4:30 am ET. If the

greenback slides further, 1.40 is possibly seen as its next support

level.

Retreating from its early 2-day highs of 0.7330 against the

aussie and 0.6995 against the kiwi, the greenback edged down to

0.7354 and 0.7018, respectively. The currency may test support

around 0.75 against the aussie and 0.72 against the kiwi.

The greenback pared gains to 1.2513 against the loonie, from a

high of 1.2532 set at 7:25 am ET. The greenback is poised to test

support near the 1.21 level.

The University of Michigan's preliminary consumer sentiment

index for August is set for release at 10 am ET.

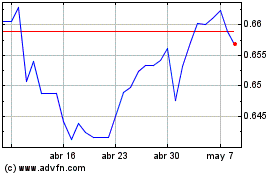

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

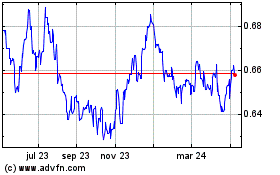

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024