U.S. Dollar Higher As Producer Inflation Accelerates

12 Agosto 2021 - 5:35AM

RTTF2

The U.S. dollar appreciated against its major rivals in the

European session on Thursday, as strong U.S. producer inflation

data for July and falling jobless claims suggested that economic

recovery remained on track.

Data from the Labor Department showed that U.S. producer prices

increased more than expected in the month of July.

The producer price index for final demand surged up by 1.0

percent in July, matching the jump seen in the previous month.

Economists had expected producer prices to climb by 0.6

percent.

Excluding prices for food, energy and trade services, core

producer prices advanced by 0.9 percent in July after rising by 0.5

percent in June. Core prices were expected to show another 0.5

percent increase.

Separate report showed that first-time claims for U.S.

unemployment benefits recorded a modest decrease in the week ended

August 7.

The report said initial jobless claims edged down to 375,000, a

decrease of 12,000 from the previous week's revised level of

387,000.

Economists had expected jobless claims to dip to 375,000 from

the 385,000 originally reported for the previous week.

Positive U.S. economic data and hawkish remarks from Federal

Reserve officials fueled expectations that the Fed is likely to

announce a tapering of bond buying program this year.

Kansas City Federal Reserve President Esther George said on

Wednesday that the conditions for a pull back in stimulus may have

already been met by the economy.

"Today's tight economy … certainly does not call for a tight

monetary policy, but it does signal that the time has come to dial

back the settings," George added.

The greenback rose to 1.1724 against the euro and 0.9236 against

the franc, up from its prior lows of 1.1748 and 0.9207,

respectively. The greenback is likely to challenge resistance

around 1.16 against the euro and 0.94 against the franc.

The greenback rebounded from its previous lows of 110.32 against

the yen and 1.3878 against the pound, gaining to 110.55 and 1.3834,

respectively. The greenback is seen finding resistance around 112

against the yen and 1.36 against the pound.

The greenback firmed to 0.7335 against the aussie and 0.7000

versus the kiwi, following its early lows of 0.7377 and 0.7047,

respectively. On the upside, 0.70 and 0.68 are possibly seen as its

next resistance levels against the aussie and the kiwi,

respectively.

In contrast, the greenback pulled back to 1.2501 against the

loonie, from a high of 1.2526 seen at 9:30 am ET. The greenback is

poised to find support around the 1.21 level.

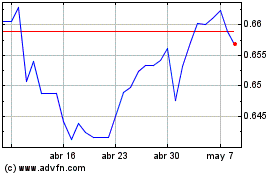

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

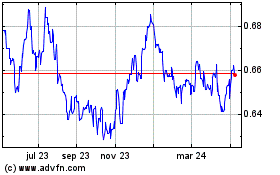

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024