URU Metals Limited Prospecting Right Application Update (2263M)

20 Septiembre 2021 - 12:59AM

UK Regulatory

TIDMURU

RNS Number : 2263M

URU Metals Limited

20 September 2021

20 September 2021

URU Metals Limited

("URU" or "the Company")

Commencement of Public Participation Process and Environmental

Impact Assessment in support of the application for a new

Prospecting Right adjacent to the Zebediela Project

URU is pleased to announce that, further to the announcement of

13 September 2021, the Company's appointed environmental

consultants, Tshifcor Investment and Resources (Pty) Ltd

("Tshifcor"), an independent environmental practitioner, have

commenced with an Environmental Impact Assessment ("EIA") and a

public participation process in support of the application for a

Prospecting Right over ten portions of the farm Piet Potgietersrust

Town and Townlands 44 KS totalling 246 hectares ("Prospecting

Right").

The following activities will take place during the week of the

20(th) to 25(th) September 2021:

1. Advertisements in the local community newspaper have been

booked, notifying Interested and Affected Parties ("I&AP's") of

the Prospecting Right application;

2. Site Notices will be erected;

3. Site visits will be conducted by Tshifcor;

4. A Background Information Document ("BAR") will be distributed

identified IAPs and relevant South African government

departments;

5. A draft BAR will be placed on Tshifcor's website,

https://www.tshifcor.co.za , for stakeholder review and

comment.

These activities are required in order for the Company to

complete the EIA for the Prospecting Right application, which will

allow the South African Department of Mineral Resources to grant

the Prospecting Right.

In addition URU is pleased it has agreed Boothbay Absolute

Return Strategies LP to extend/ amend the notice period relating to

the Convertible Loan Note (the "Loan Note") as announced on 26 May

2020 until 31 March 2022. All other terms related to the Loan Note

remain the same. The key terms of the Loan Note are as follows:

All other terms related to the Loan Note remain the same. The

key terms of the Loan Note are as follows:

(i) conversion price is a 35 per cent. discount to the Volume

Weighted Average Price ("VWAP") per share in the 5 trading days

prior to the noteholder serving a conversion notice);

(ii) a voluntary conversion price triggered on the noteholder

serving a conversion notice (being GBP0.85 per share for a period

of 90 days from the date of the Loan Note and now from 305 days

following from Amended Loan Note Instrument of 31 May 2021; and

following expiry of the 305 day period, a 35 per cent. discount to

the Volume Weighted Average Price ("VWAP") per share in the 5

trading days prior to the noteholder serving a conversion

notice);

(ii) on a fund raising, a 35 per cent. discount to the price per

share paid by investors on the fund raising;

(iii) on a share sale (meaning a sale of Ordinary Shares giving

control of the Company, whether for cash and/or by way of exchange

for shares in another company and/or for other consideration, and

whether or not control of the Company changes as a result of such

transaction), a 35 per cent. discount to the price per share paid

on the share sale; or

(iii) if there is no conversion notice served, fund raising or

share sale prior to the maturity date, at a 35 percent. discount to

the VWAP per share in the 5 trading days prior to the maturity

date.

CEO of URU Metals, Mr John Zorbas, commented: " We are excited

to be moving forward with the Prospecting Right approval process.

Being the adjoining property to the Zebediela Nickel Property,

owned by Zeb Nickel Corp (TSXV: ZBNI) increases the exposure of URU

to the massive nickel sulphide and PGE exploration potential on the

Northern Limb of the Bushveld Complex. Subject to the approval of

the Prospecting Right Application by the South African Department

of Mineral Resources we look forward to fast tracking the

exploration of this project in order to quickly understand any

economic potential the ground may hold .

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer) +1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat + 44 (0) 203 470 0470

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFVAAVIALIL

(END) Dow Jones Newswires

September 20, 2021 01:59 ET (05:59 GMT)

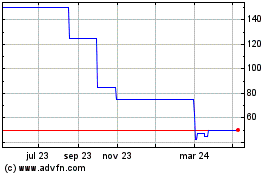

Uru Metals (LSE:URU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Uru Metals (LSE:URU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024