TIDMUVEL

RNS Number : 0654R

UniVision Engineering Ltd

03 March 2021

RNS ANNOUNCEMENT: This announcement contains inside information

as stipulated under the UK version of the Market Abuse Regulation

No 596/2014 which is part of English Law by virtue of the European

(Withdrawal) Act 2018, as amended. On publication of this

announcement via a Regulatory Information Service, this information

is considered to be in the public domain.

3 March 2021

UniVision Engineering Limited

("UniVision", the "Company" or the "Group")

Proposed PDMR Dealing

UniVision (AIM: UVEL), the Hong Kong based group whose principal

activities are the supply, design, installation and maintenance of

closed circuit television (CCTV) and surveillance systems, and the

sale of security related products, announces that it has been

informed by its Chairman, Stephen Koo, that he has entered into a

non-binding Memorandum of Understanding ("MOU") with SinoCloud

Group Limited, an investment holding company listed on the Catalist

Board of the Singapore Stock Exchange ("SinoCloud"), to sell

SinoCloud 200,959,700 of his ordinary shareholding in UniVision

(representing approximately 52.4% of the issued share capital of

the Company) for a total consideration of HK$89,080,000 million

(approximately GBP8.2 million); equivalent to a price of

approximately 4.1 pence per Ordinary Share, payable in a

combination of cash and new SinoCloud ordinary shares ("Proposed

Transaction").

The Proposed Transaction is subject to a number of

pre-conditions, including satisfactory due diligence on UniVision

by SinoCloud, an equity fundraising by SinoCloud and approval by

SinoCloud's shareholders of the Proposed Transaction in general

meeting. The pre-conditions are set out below and, even if these

pre-conditions are satisfied, the Proposed Transaction is not

expected to complete until sometime in April 2021. As envisaged in

the MOU, Stephen Koo would retain 78,744,000 Ordinary Shares in

UniVision, representing 20.52% of the issued share capital and

remain as Executive Chairman.

SinoCloud has made a regulatory announcement to the Singapore

Stock Exchange regarding the signing of this MOU.

Pre-conditions for the Proposed Transaction

The MOU is non-binding and has been executed to demonstrate the

sincerity and the agreement by Stephen Koo and SinoCloud to

progress these negotiations. The MOU is subject to, inter alia, due

diligence, agreement by all parties on terms of the share purchase,

execution of a definitive sale and purchase agreement with terms

and conditions (including, but not limited to pricing, number of

Stephen Koo's UniVision shares to be acquired by SinoCloud, and

terms of payment) to be agreed by Stephen Koo and SinoCloud and

approval by SinoCloud shareholders.

At this time, there is no certainty or assurance that the

Proposed Transaction will complete.

Information on SinoCloud and potential benefits for

UniVision

SinoCloud is listed on the Catalist Board of the Singapore Stock

Exchange. It has been listed on the Singapore Stock Exchange since

2004 and was formerly known as Armarda Group Limited until August

2015. It began as an IT services provider, but in the last 10 years

it has diversified into various IT-related investments. Its major

current investment is a majority holding in a T4 Internet Data

Centre in Guiyang, China. The board of SinoCloud believes that it

can add value to UniVision, to assist the Company to grow by

allowing it access to additional funds, introduced by SinoCloud, to

expand the Group's business as well as providing data storage

facilities (through its Data Centre business) for UniVision to

offer alongside its current services.

As part of the MOU, SinoCloud has undertaken to both Stephen Koo

(as the potential vendor) and the Company that:

(a) SinoCloud will enter into a Relationship Agreement with the

Company to govern its future relationship with UniVision,

conditional upon completion of the Proposed Transaction;

(b) SinoCloud will use its best endeavours to ensure that

UniVision will continue to be able to comply with the QCA Corporate

Governance Code in relation to its admission to trading on AIM;

and

(c) whilst SinoCloud may seek board representation on the

Company's board to be able to monitor its investment, SinoCloud's

current intention is to allow the Company to continue to trade as

an independently operated business, with the current executive

management, admitted to trading on AIM.

SinoCloud has also undertaken to Stephen Koo and the Company

that the definitive sale and purchase agreement will include a term

that, should the Proposed Transaction complete, SinoCloud agrees to

make a minimum funding facility of HK$10.0 million available to

UniVision within three months of completion of the sale and

purchase agreement, by way of a loan facility on normal commercial

terms to be agreed. SinoCloud intends to seek such funding facility

in due course.

Shareholders are reminded that the UK Takeover Code does not

apply to UniVision and, should the Proposed Transaction complete as

envisaged, SinoCloud will own 52.4% of the issued share capital of

UniVision. SinoCloud has indicated that it has no current intention

to make a general offer for all of the share capital in the

Company.

Further announcements will be made by the Company as

appropriate.

For further information visit www.uvel.com or contact :

UniVision Engineering Limited Tel: +852 2389 3256

Stephen Koo, Chairman www.uvel.com

Danny Kwok Fai Yip, Finance Director

Nicholas Lyth, Non-Executive Director Tel: +44 (0)7769 906686

SPARK Advisory Partners Limited Tel: +44 (0)20 3368 3551

(Nominated Adviser)

Mark Brady / Neil Baldwin www. sparkadvisorypartners.com

SI Capital Limited Tel: +44 (0)1483 413500

(Broker) www.sicapital.co.uk

Nick Emerson

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHUPUBPWUPGGWW

(END) Dow Jones Newswires

March 03, 2021 08:32 ET (13:32 GMT)

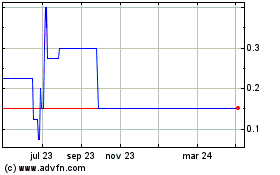

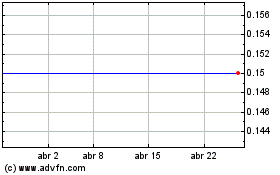

Univision Engineering (LSE:UVEL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Univision Engineering (LSE:UVEL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024