TIDMVSL

RNS Number : 4554N

VPC Specialty Lending Invest. PLC

30 September 2021

30 September 2021

VPC SPECIALTY LING INVESTMENTS PLC

(the "Company" or "Parent Company" with its subsidiaries

(together) the "Group" )

Half-Year Report and Unaudited Financial Statements

For the Six-Month Period Ended 30 June 2021

The Board of Directors (the "Board") of VPC Specialty Lending

Investments PLC (ticker: VSL) present the Company's Half-Year

Report and Unaudited Financial Statements for the period ended 30

June 2021.

Enquiries

For further information, please contact:

Victory Park Capital via Jefferies or Winterflood

Brendan Carroll (Senior Partner (below) info@vpcspecialtylending.com

and Co-Founder)

Gordon Watson (Partner)

Jefferies International Limited Tel: +44 20 7029 8000

Stuart Klein

Neil Winward

Gaudi le Roux

Winterflood Securities Limited Tel: +44 20 3100 0000

Neil Morgan

Chris Mills

Link Company Matters Limited (Company Tel: +44 20 7954 9567

Secretary) Email: VPC@linkgroup.co.uk

A copy of the Company's Half Year Report will shortly be

available to view and download from the Company's website,

https://vpcspecialtylending.com . Neither the contents of the

Company's website nor the contents of any website accessible from

hyperlinks on the Company's website (or any other website) is

incorporated into or forms part of this announcement.

All page numbers below refer to the Half-Year Report on the

Company's website.

Further information on VPC Specialty Lending Investments PLC is

available at https://vpcspecialtylending.com .

LEI: 549300UPEXC5DQB81P34

FINANCIAL HIGHLIGHTS

RETURN SUMMARY AS AT 30 JUNE 2021

Net Asset Value per Ordinary Share

106.19p

(30 June 2020: 89.78p)

(31 December 2020: 95.72p)

NAV (Cum Income) Return

+ 15.12%

(30 June 2020: + 0.48%)

(31 December 2020: + 11.12%)

Total Shareholder Return at 30 June 2021(1)

(based on share price)

+ 11.82%

(30 June 2020: - 10.49%)

(31 December 2020: + 10.87%)

Dividends per Ordinary Share(2)

4.00p

(30 June 2020: 4.00p)

(31 December 2020: 8.00p)

AS AT AS AT AS AT

30 JUNE 2021 30 JUNE 2020 31 DECEMBER

2020

----------------------------------------- ---------------- --------------- ----------------

Total Net Assets attributable to equity GBP295,507,964 GBP260,396,391 GBP270,537,108

shareholders of the Parent Company

(on a consolidated basis)

========================================= ================ =============== ================

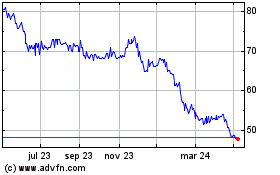

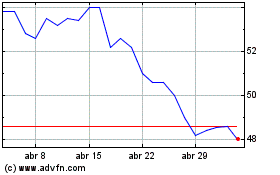

Ordinary Share price 84.00p 66.00p 78.70p

========================================= ================ =============== ================

Discount to Net Asset Value 20.90% 26.49% 17.77%

========================================= ================ =============== ================

Net return on ordinary activities after GBP39,946,428 GBP(3,457,994) GBP22,954,679

taxation

========================================= ================ =============== ================

Revenue Return on ordinary activities GBP9,598,498 GBP15,148,516 GBP23,898,852

after taxation

========================================= ================ =============== ================

Ordinary Shares repurchased (in the

period) (4,370,972) (22,266,293) (29,654,941)

========================================= ================ =============== ================

Shares in issue (at the end of the

period) 278,276,392 290,036,012 282,647,364

========================================= ================ =============== ================

(1) Net of issue costs.

(2) Dividends declared and paid which relate to the period.

INTRODUCTION TO THE COMPANY

VPC Specialty Lending Investments PLC (the "Company" or "VSL")

provides asset-backed lending solutions to emerging and established

businesses ("Portfolio Companies") with the goal of building

long-term, sustainable income generation. VSL focuses on providing

capital to vital segments of the economy, which for regulatory and

structural reasons are underserved by the traditional banking

industry. Among others, these segments include small business

lending, working capital products, consumer finance and real

estate. VSL offers shareholders access to a diversified portfolio

of opportunistic credit investments originated by non-bank lenders

with a focus on the rapidly developing technology-enabled lending

sector.

The Company's investing activities are undertaken by Victory

Park Capital Advisors, LLC (the "Investment Manager" or "VPC"). VPC

is an established private capital manager headquartered in the

United States with a global presence. VPC identifies and finances

emerging and established businesses globally and seeks to provide

the Company with attractive yields on its portfolio of credit

investments. VPC offers a differentiated private lending approach

by financing Portfolio Companies through asset-backed delayed draw

term loans, which is referred to as "Balance Sheet Lending,"

designed to limit downside risk while providing shareholders with

strong income returns. Through rigorous due diligence and credit

monitoring by the Investment Manager, the Company generates stable

income with significant downside protection.

This half year report for the period to 30 June 2021 includes

the results of the Company (also referred to as the "Parent

Company") and its consolidated subsidiaries (together the "Group").

The Company (No. 9385218) was admitted to the premium listing

segment of the Official List of the Financial Conduct Authority

("FCA") (the "Official List") and to trading on the London Stock

Exchange's main market for listed securities (the "Main Market") on

17 March 2015, raising GBP200 million by completing a placing and

offer for subscription (the "Issue"). The Company raised a further

GBP183 million via a C Share issue on 2 October 2015. The C Shares

were converted into Ordinary Shares and were admitted to the

Official List and to trading on the Main Market on 4 March

2016.

The Company's investment objectives are to:

v generate an attractive total return for shareholders of

consistent distributable income and capital growth through

asset-backed lending;

v achieve portfolio diversification to emerging and established

businesses across different industries and geographies with the

goal of building long-term, sustainable value; and

v enable shareholders to benefit from equity upside through

equity-linked securities issued in conjunction with asset-backed

lending.

CHAIRMAN'S STATEMENT

I am pleased to present to you the half year results for the

Company for the period to 30th June 2021. I took over as Chairman

following the Annual General Meeting of the Company on 24 June

2021, succeeding Kevin Ingram, and I must begin by recording my

appreciation and the renewed thanks of the whole Board to Kevin for

his leadership of and service to the Company since its launch in

2015. First as Chairman of the Audit Committee and then as

Chairman. I am also happy to report that against the challenging

and continued effect of COVID-19, the Company delivered a total

return of 15.12% and declared quarterly dividends that totalled

4.00 pence per share. While the macro backdrop for non-traditional

credit has continued to be volatile through the first half of 2021,

VPC's risk mitigation procedures, the resilience and performance of

the investment portfolio and the new investments made in 2021 have

driven the strong returns for the period. Recent performance and

returns continue to differentiate the Company from many of its

peers in the investment trust lending sector.

INVESTMENTS

BALANCE SHEET LOAN INVESTMENTS

The Company's balance sheet loan investments continue to

represent the bulk of its portfolio and deliver a stable and

predictable level of income return as all contractual cash payments

have been received through the date of this report. As at 30 June

2021, the balance sheet portfolio comprised 26 portfolio companies

with a weighted average coupon rate (excluding gearing) of 10.82%

and a weighted average remaining life of 32 months. During the

period, seven new balance sheet investments were made by the

Company and three fully exited. Most of these investments are

delayed draw, floating rate senior secured loans that have equity

subordination. The balance sheet investments are backed by

underlying collateral consisting of consumer loans, small business

loans and other types of collateral.

On 1 March 2021, the Company signed a USD$130 million gearing

facility with Massachusetts Mutual Life Insurance Company

("MassMutual"). The MassMutual facility was negotiated at

attractive terms including a three-year revolving period, an

interest rate lower than that of the previous facility, an option

to upsize the facility from $130 million to $200 million and a

six-year maturity. This facility will continue to provide flexible

and cost-effective borrowing for the Company to continue to grow

the balance sheet investment portfolio while maintaining a modest

look-through gearing ratio.

EQUITY INVESTMENTS

The Company's equity investments have delivered strong returns

during the first half of the year. Many of these investments were

acquired in conjunction with making the Company's balance sheet

loan investments. The equity investments are made up of common

stock, preferred stock, warrants and convertible debt. As at 30

June 2021, the Company had exposure to 37 portfolio companies

through the equity investments which comprise approximately 18% of

NAV (14% at 31 December 2020; 11% at 30 June 2020). At the same

date, NAV comprised approximately 11% of cost and 7% unrealised

gains on the equity investments, including the SPAC investments,

and during the first six months of the year, the equity investments

generated a gross capital return of 14.23%.

SPAC Investments

Over the last twelve months, the Company has had the opportunity

to enter the special purpose acquisition company ("SPAC") space as

the Investment Manager has launched four SPACs. VPC has used its

industry expertise and network to identify opportunities within the

sector. As at the date of this report, the Investment Manager has

been able to find attractive financial technology deals for three

of the SPACs and continues to work on identifying a target for the

fourth. The Company has invested just over 1% of NAV in SPACs, and

at 30 June 2021, the SPACs represented approximately 7% of NAV of

which 6% of the total is unrealised gain. The Board is encouraged

by the strong performance of the portfolio, including equities,

which has resulted in outperformance against its UK listed peer

group. Given the overall strength of the equity markets to 30 June

2021, the Board is cautious about the prospects for similar

performance for the remainder of the year.

SHARE PRICE DISCOUNT MANAGEMENT

Through 30 June 2021, the share price discount to NAV ranged

from 6.60% to 18.81%. The discount narrowed during the first half

of the year and was less volatile than the volatility in 2020, it

remains a major area of focus for both the Board and the Investment

Manager. While we consider that having strong and consistent

investment performance is a precondition for reducing the discount

at which the Company's shares trade, we also continue to work with

the Investment Manager on the initiatives described in our Annual

Report. During the year, the Company bought back a total of

4,370,972 shares at an average price of 85.61p, representing 1.55%

of the Company's issued shares as at 31 December 2020 and at an

average discount to NAV of 13.80%.

OUTLOOK

During the period, the Board has been directing our focus not

only on strategy but towards the Company's positioning, improving

the way in which our investment proposition is articulated, to the

way that environmental, social and governance factors are

incorporated into our investment process and the environmental

impact of the Company. The Investment Manager has built the

Company's investment portfolio using its expertise in managing

credit and performance through multiple credit cycles along with

the processes and systems that have been put in place to monitor

risk. The Board and Investment Manager continuously monitor

business continuity plans and operational resilience strategies to

take all reasonable steps to continue meeting the Company's

regulatory obligations and to assess operational risks, the ability

to continue operating and the steps it needs to take to serve and

support the Company's shareholders.

As of the date of this report, we are pleased to note that our

balance sheet lending investments have remained resilient to the

macroeconomic stress resulting from the COVID-19 pandemic and have

continued to perform in line with expectations. At the same time,

our equity holdings have performed strongly, adding materially to

our returns. We believe that the Company's investments are well

positioned to weather continued volatility or deterioration, due to

the pandemic, in the credit environment as the effects of the

immediate fiscal stimulus in the U.S. start to be reduced and the

longer-term impacts of the crisis unfold. More detail about the

performance of the Company's investments can be found in the

Investment Manager's Report.

Finally, your Board and I would like to thank shareholders for

their continued support.

Graeme Proudfoot

Chairman

30 September 2021

INVESTMENT MANAGER'S REPORT

VPC employees had returned to the office on a limited basis,

however with the recent updates and guidance from the Centers for

Disease Control and Prevention ("CDC") in the United States and

increase in transmission of COVID-19 to those that are vaccinated,

the VPC Senior Leadership team felt it was prudent for the safety

of our employees and their families to work from home until is

deemed safe to return. VPC will continue to evaluate the situation,

monitor the requirements and guidelines from the CDC and address

any additional precautions required before returning to the office.

During this time, employees are welcome to continue to work in the

office, utilise resources and meet with visitors at their comfort

level, provided they continue to follow the procedures outlined in

the corporate Pandemic Response Plan.

As it relates to portfolio management, we remain focused on

proactive risk management and controls across the portfolio. Our

senior management team continues to hold multiple calls each week

and the investment teams are in constant contact with our Portfolio

Companies to proactively ensure that they are taking prudent steps

to mitigate risk on a real time basis.

PERFORMANCE REVIEW

Despite the continued challenging societal, economic and market

activity during the first half of the year, we believe the

portfolio is in a strong position due to the protections structured

into the balance sheet investments. Since the onset of the

pandemic, VPC has been proactive and decisive in its portfolio

management. In addition to relying on the structured portfolio

protections in place, VPC's senior management team has been in

constant communication with each Portfolio Company to ensure that

they are taking prudent steps to mitigate risk on a real time

basis.

During the period, the Company generated a total return of

15.12% for shareholders, declared dividends for the period of 4.00p

and the NAV per share as at 30 June 2021 was 106.19p. The Company

generated gross revenue returns of 6.14% as a percentage of NAV in

the first half of 2021 from the Company's balance sheet

investments, continuing the strong performance trend of the past

few years. Equity capital returns of 14.23% were driven by strong

performance of the Company's equity investments, which includes the

SPAC investments. Finance costs were -0.88% and operating expenses

and management fees were -1.09% for the period.

PORTFOLIO UPDATE

As of the date of this report, the existing balance sheet debt

portfolio has continued to perform in line with expectations. While

the world has not yet returned to "normal", collateral across asset

classes has remained healthy and stable and there has not been any

signs of a resurgence in the volatility witnessed in 2020. In the

U.S. there has been a marked rebound in consumer demand for credit,

while credit metrics remain in line with expectations. The

portfolio has continued to see a significant growth in eCommerce

related assets, as that sector has remained a growth sector in

economies around the world.

After the unprecedented uncertainty in early 2020, in the latter

half of the year the Manager began to assess the investing

landscape and re-engage in underwriting new investments, closing

three new balance sheet debt investments in the second half of

2020. These investments have benefited from the lessons learned

through COVID-19, and from the new perspectives on the economic

environment. During the first half of 2021, the Company has

continued to find new investments and has added seven new balance

sheet investments to the portfolio. We believe that the post-COVID

investments present attractive risk adjusted returns and will

continue to provide growth opportunities over the coming years.

SPAC UPDATES

As the Chairman noted, in the last year, we identified a highly

attractive opportunity to use our expertise and relationships as an

investment manager in the financial technology sector to supplement

our core business model and apply it to the SPAC market. We have

launched four SPACs in the last ten months and to date have

announced potential targets for three of the four SPACs. The

Company has invested at a cost of just over 1% of NAV in the four

SPACs. In the latest NAV dated 31 August 2021, the discounted

market value of the SPAC holdings was a total of GBP27,756,999 or

9% of NAV.

Below is a summary of the three proposed deals and a breakdown

of each of the Company's investments in the SPACs at 30 June 2021.

As at 30 June 2021, the investment in VPC Impact Acquisition

Holdings II was held at cost as the proposed deal had not yet been

announced.

SPAC Investment Summary at 30 June 2021

VPC Impact

Acquisition VPC Impact Acquisition VPC Impact Acquisition L&F Acquisition

Holdings Holdings II Holdings III Corp. Total

--------------- ---------------------- ---------------------- --------------- -----------

Investment Status Deal Announced Post-IPO(1) Deal Announced Post-IPO

------------------ --------------- ---------------------- ---------------------- --------------- -----------

Bakkt Holdings,

Target LLC Dave Inc.

------------------ --------------- ---------------------- ---------------------- --------------- -----------

Total Value

as at

30 June 2021 $21,493,681 $1,254,358 $8,764,219 $168,051 $31,680,309

------------------ --------------- ---------------------- ---------------------- --------------- -----------

Total Cost as

at

30 June 2021 $2,708,301 $1,254,358 $1,247,795 $168,051 $5,378,505

------------------ --------------- ---------------------- ---------------------- --------------- -----------

(1) The Company disclosed in August 2021 that VPC Impact

Acquisition Holdings II announced a merger with Kredivo. As at 30

June 2021 the investment in the SPAC was held at cost.

VPC Impact Acquisition Holdings

VPC Impact Acquisition Holdings (NASDAQ: VIHAU, VIH and VIHAW)

("VIH"), announced on September 17, 2021 that the U.S. Securities

and Exchange Commission ("SEC") has declared effective VIH's

Registration Statement on Form S-4 (the "Registration Statement"),

as amended, which was filed in connection with VIH's previously

announced business combination (the "Business Combination") with

Bakkt. This announcement paves the way for the vote for the

business combination and moves this transaction one step closer to

completion.

VPC Impact Acquisition Holdings II

In August 2021, Kredivo, the leading digital consumer credit

platform in Southeast Asia, announced plans to become a publicly

traded company via merger with VPC Impact Acquisition Holdings II

(VIH II). Through VIH II's sponsor entity, the Fund made a $1.3

million investment in the SPAC and currently owns 823,703 Class B

Shares and 666,691 private placement warrants in VIH II and as of

June 30, 2021, the position was held at cost. Please reference the

FinAccel press release from the Company dated 3 August 2021 for

further information.

VPC Impact Acquisition Holdings III

In June 2021, Dave, a leading banking app with 10 million

customers, announced plans to become publicly traded company via

merger with VPC Impact Acquisition Holdings III, Inc. (VIH III).

Through VIH III's sponsor entity, the Fund made a $1.3 million

investment in the SPAC and currently owns 817,142 Class B Shares

and 663,192 private placement warrants in VIH III and as of June

30, 2021, the position was valued at $8.8 million. Please reference

the Dave press release from the Company dated 7 June 2021 for

further information.

PORTFOLIO COMPOSITION

As at 30 June 2021, consumer exposure accounted for 65% of the

invested portfolio, while small business exposure accounted for

35%. Investments in U.S. portfolio companies accounted for 76% of

the invested portfolio, investments in Latin American portfolio

companies accounted for 13% with the remaining exposure in Europe,

the UK and Asia. Investments in the debt portfolio accounted for

70% of NAV with the fair market value of the equity investments

comprising 25% of NAV.

Gross Asset Allocation (1)

======================================== ====

Debt 73%

======================================== ====

Common Stock 9%

======================================== ====

Preferred Stock 8%

======================================== ====

Warrant 3%

======================================== ====

Convertible Debt 4%

======================================== ====

Cash 3%

======================================== ====

Net (Cum Income) Allocation (1)

======================================== ====

Debt 70%

======================================== ====

Common Stock 10%

======================================== ====

Preferred Stock 7%

======================================== ====

Warrant 3%

======================================== ====

Convertible Debt 5%

======================================== ====

Cash 5%

======================================== ====

Investment Exposure, Borrower Type (2)

======================================== ====

Consumer 65%

======================================== ====

SME 35%

======================================== ====

Investment Exposure, Geography (2)

======================================== ====

United States 76%

======================================== ====

United Kingdom 3%

======================================== ====

Europe 6%

======================================== ====

Latin America 13%

======================================== ====

Asia 2%

======================================== ====

(1) Percentages calculated on a look-through basis to the

Company's investee entities and SPVs.

(2) Calculations using gross asset exposure and not reduced for

gearing. Excludes cash.

SUMMARY HIGHLIGHTS FOR THE FIRST HALF OF 2021

v January 2021: VPC Impact Acquisition Holdings (NASDAQ: "VIH")

announced on 11 January 2021 that it had entered into a definitive

agreement to combine with Bakkt Holdings, LLC.

v February 2021: The Company declared a dividend of 2.00p for

the three-month period to 31 December 2020.

v March 2021: The Company fully exited its equity investment in

Elevate Credit, Inc. (NYSE: ELVT) and the Company funded equity

investments in VPC Impact Acquisition Holdings II (NASDAQ: VPCB)

and VPC Impact Acquisition Holdings III (NYSE: VPCC) for USD$1.3

million each. Additionally, the Company closed on a USD$130 million

gearing facility with Massachusetts Mutual Life Insurance Company,

which was used to repay the Company's previous gearing facility

with Pacific Western Bank and the first-out participation facility

on Avant, held with Axos Bank.

v April 2021: The Company fully exited its balance sheet

investments in ATA KS Holdings, LLC and reinvested in in three new

balance sheet and equity investments in Razor Group GmbH ("Razor"),

Moonshot Holdings LLC ("Moonshot"), and CHEQ Limited ACN

("Beforepay").

v May 2021: The Company declared its 13th consecutive dividend

of 2.00 pence per share for the three-month period to 31 March

2021.

v May 2021: The Company invested in three new balance sheet

investments in Pattern Brands, Inc. ("Pattern"), Factory 14

S.a.r.l. ("Factory 14") and Holland Law Firm ("Holland").

v June 2021: VPC Impact Acquisition Holdings III, Inc. (NYSE:

VPCC) ("VPCC") entered into a definitive agreement to combine with

Dave. The business combination, which remains subject to VPCC

shareholder and customary regulatory approval approvals, is

expected to close in the third or fourth quarter of 2021.

SUBSEQUENT EVENTS

v July 2021: The Company invested in one new balance sheet

investment, TALA Mobile, S.A.P.I. DE C.V. ("Tala").

v August 2021: The Company declared its 14th consecutive

dividend of 2.00 pence per share for the three-month period to 30

June 2021.

v August 2021: VPC Impact Acquisition Holdings II (NASDAQ: VPCB)

("VPCB"), a special purpose acquisition company sponsored by VPC

Impact Acquisition Holdings Sponsor II, LLC, an affiliate of

Victory Park Capital, announced it has entered into a definitive

agreement to combine with FinAccel Pte. Ltd.

RISKS AND UNCERTAINTIES

Although there are several risks and uncertainties, we believe

that the most significant include:

v Changes in interest rates: While the Company's investment

portfolio primarily consists of floating rate credit facilities

with interest rate floors, changes in interest rates could affect

our investments, the profitability of the portfolio companies and

that of the underlying borrowers, potentially leading to lower

returns or changes in repayments or default rates of the underlying

borrowers. Lower interest rates may also lead to increased

refinancing activity.

v Potential risk of refinancing: The Company retains a right of

first refusal ("ROFR") to match the credit facility terms offered

by any third-party on most of the Company's investments. In an

instance where the market pricing and underlying risk for these

deals are not in line with the Company's investment objectives, we

will not exercise the ROFRs. We have a significant pipeline of

undrawn capacity as well as new deal flow that allows us to quickly

reinvest the liquidity generated by a potential refinancing event

in the near term. The increasingly competitive environment might

affect the ability to quickly reinvest capital if this trend

continues over the long-term.

v Potential changes in credit risk: There is inherent risk in

the Company's underlying investments of a borrower default and a

majority of the underlying exposure is in the U.S. Given the short

duration of the collateral in the portfolio, the underly portfolio

companies continue to generate sufficient cash flow. The potential

for credit risk remains heightened during the COVID-19 pandemic and

we remain vigilant in the risk analysis performed for all portfolio

companies.

v Potential operational risk impact from the COVID-19 pandemic:

The Investment Manager continues to review its business continuity

plans and operational resilience strategies on an ongoing basis and

will take all reasonable steps to continue meeting its regulatory

obligations and to assess operational risks, the ability to

continue operating and the steps it needs to take to serve and

support its clients, including the Board.

OUTLOOK

While credit has continued to perform well, the impacts of

COVID-19, particularly the Delta variant, continue to have

significant impacts on economies around the globe. In the U.S., we

are seeing the reinstatement of various regional COVID-19

restrictions, and the prospect for more to come if circumstances do

not improve. Simultaneously we are seeing inflation numbers that

have not been seen for decades which may or may not prove

persistent. While none of these looming issues has manifested in

collateral deterioration or negative performance, the environment

remains highly uncertain, and we continue to monitor credit very

closely across the portfolio.

We believe the investment portfolio offers favourable returns

relative to other areas of the credit markets while simultaneously

carrying lower levels of overall risk, especially in the current

economic environment. While we often discuss the underlying credit

performance of our balance-sheet investments, it is also important

to emphasise that we have additional layers of protection beyond

our direct asset security. Due to the structured nature of our

balance-sheet investments, including (in most cases) corporate

guarantees and significant first-loss protection, our investments

are not affected by changes in credit performance until a platform

defaults and all corporate resources (separate from our borrowing

base of loan collateral) are exhausted. In addition to monitoring

the credit performance, we monitor the overall corporate

performance of our Portfolio Companies, including attending board

meetings as an observer and having weekly update calls with

management.

We continue to look for and identify other trends that can

create opportunities for investments in the future. We will

continue to deploy capital cautiously and we believe the portfolio

is well positioned to withstand any potential challenges to come

this year and next.

Victory Park Capital Advisors, LLC

Investment Manager

30 September 2021

DIRECTORS' RESPONSIBILITY STATEMENT

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

The Directors acknowledge responsibility for the Half-Year

Financial Report and confirm that to the best of their

knowledge:

(a) the unaudited consolidated financial statements have been

prepared in accordance with UK-adopted IAS 34 'Interim Financial

Reporting' and give a true and fair view of the assets,

liabilities, financial position and profit for the period of the

Group as required by the Disclosure Guidance and Transparency Rules

("DTR") 4.2.4 R;

(b) the Interim Management Report (including the Chairman's

Statement and the Investment Manager's Report) includes a fair

review of the information required by DTR 4.2.7 R (indication of

important events that have occurred during the six-month period to

30 June 2021 and their impact on the set of consolidated financial

statements and a description of the principal risks and

uncertainties for the remaining six months of the financial year);

and

(c) the Half-Year Financial Report includes a fair review of the

information concerning related party transactions as required by

DTR 4.2.8 R.

Signed on behalf of the Board by:

Graeme Proudfoot

Chairman

30 September 2021

INTERIM MANAGEMENT REPORT

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

CAUTIONARY STATEMENT

This Interim Management Report has been prepared solely to

provide additional information to shareholders to assess the

strategies of the Company and its subsidiaries (together "the

Group"). The Interim Management Report should not be relied on by

any other party or for any other purpose.

The Interim Management Report contains certain forward-looking

statements. These statements are made by the Directors in good

faith based on the information available to them up to the time of

their approval of the Half-Year Financial Report but such

statements should be treated with caution due to the inherent

uncertainties, including both economic and business risk factors,

underlying any such forward-looking information.

ACTIVITIES

The activities of the Group are described in the Chairman's

Statement and in the Investment Manager's Report. Refer to the

Chairman's Statement on page 5 and the Investment Manager's Report

on pages 7 through 10 of the Half-Year Financial Report. Further

refer to Note 1 to the consolidated financial statements.

STRATEGY AND INVESTMENT OBJECTIVES

The important events that have occurred during the period under

review and the key factors influencing the consolidated financial

statements are described in the Chairman's Statement and in the

Investment Manager's Report.

Refer to the Chairman's Statement on page 5 and the Investment

Manager's Report on pages 7 through 10 of the Half-Year Financial

Report.

GOING CONCERN

As stated in Note 2 to the consolidated financial statements,

the Directors are satisfied that the Group has sufficient resources

to continue in operation for the foreseeable future, a period not

less than 12 months from the date of this Half-Year Report.

Accordingly, they continue to adopt the going concern basis in

preparing the consolidated financial statements.

PRINCIPAL RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties which

could have a material impact on the Group's performance over the

remaining six months of the financial period and could cause actual

results to differ materially from expected and historical results.

Refer to the Investment Manager's Report on pages 7 through 10 of

the Half-Year Financial Report as well as Note 5 to the

consolidated financial statements for the potential risks and

uncertainties. The principal risks and uncertainties are consistent

with those disclosed in the Annual Report for the year ended 31

December 2020 which can be found on the Company's website.

FINANCIAL PERFORMANCE

The financial and operational highlights of the Group can be

found on page 3 of the Half-Year Financial Report.

RELATED PARTY TRANSACTIONS

Related party transactions are disclosed in Note 13 to the

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

(UNAUDITED) (UNAUDITED) (AUDITED)

30 JUNE 2021 30 JUNE 2020 31 DECEMBER

2020

NOTE GBP GBP GBP

------------------------------- ----- -------------- ------------------------ ----------------------------------

Assets

=============================== ===== ============== ======================== ==================================

Cash and cash equivalents 12,827,525 14,835,744 6,416,028

=============================== ===== ============== ======================== ==================================

Cash posted as collateral 2,038,095 1,100,000 1,140,000

=============================== ===== ============== ======================== ==================================

Derivative financial assets - 1,416,582 5,758,880

=============================== ===== ============== ======================== ==================================

Interest receivable 4,174,208 4,182,426 3,613,047

=============================== ===== ============== ======================== ==================================

Dividend and distribution

receivable 3,763 15,138 3,812

=============================== ===== ============== ======================== ==================================

Other assets and prepaid

expenses 2,699,365 1,121,703 889,148

=============================== ===== ============== ======================== ==================================

Loans at amortised cost 3,7 291,351,321 318,953,868 293,123,379

=============================== ===== ============== ======================== ==================================

Investment assets designated

as held

at fair value through profit

or loss 3 107,162,812 39,092,920 51,417,983

------------------------------- ----- -------------- ------------------------ ----------------------------------

Total assets 420,257,089 380,718,381 362,362,277

------------------------------- ----- -------------- ------------------------ ----------------------------------

Liabilities

=============================== ===== ============== ======================== ==================================

Management fee payable 8 168,635 66,156 92,241

=============================== ===== ============== ======================== ==================================

Performance fee payable 8 7,047,774 - 4,040,085

=============================== ===== ============== ======================== ==================================

Derivative financial

liabilities 3,692,219 155,933 -

=============================== ===== ============== ======================== ==================================

Unsettled share buyback

payable 169,147 229,947 -

=============================== ===== ============== ======================== ==================================

Deferred income 192,170 329,321 253,403

=============================== ===== ============== ======================== ==================================

Other liabilities and accrued

expenses 8 1,066,774 1,305,245 1,332,920

=============================== ===== ============== ======================== ==================================

Notes payable 6 112,385,146 118,132,012 86,087,183

------------------------------- ----- -------------- ------------------------ ----------------------------------

Total liabilities 124,721,865 120,218,614 91,805,832

------------------------------- ----- -------------- ------------------------ ----------------------------------

Total assets less total

liabilities 295,535,224 260,499,767 270,556,445

------------------------------- ----- -------------- ------------------------ ----------------------------------

Capital and reserves

=============================== ===== ============== ======================== ==================================

Called-up share capital 20,300,000 20,300,000 20,300,000

=============================== ===== ============== ======================== ==================================

Share premium account 161,040,000 161,040,000 161,040,000

=============================== ===== ============== ======================== ==================================

Other distributable reserve 112,779,136 121,391,830 116,520,960

=============================== ===== ============== ======================== ==================================

Capital reserve (20,053,701) (68,018,577) (50,393,578)

=============================== ===== ============== ======================== ==================================

Revenue reserve 20,221,752 24,472,138 21,847,960

=============================== ===== ============== ======================== ==================================

Currency translation reserve 1,220,777 1,211,000 1,221,766

Total equity attributable to

equity shareholders of the

Parent Company 295,507,964 260,396,391 270,537,108

------------------------------- ----- -------------- ------------------------ ----------------------------------

Non-controlling interests 15 27,260 103,376 19,337

Total equity 295,535,224 260,499,767 270,556,445

------------------------------- ----- -------------- ------------------------ ----------------------------------

Net Asset Value per Ordinary

Share 9 106.19p 89.78p 95.72p

These consolidated financial statements of VPC Specialty Lending

Investments PLC registered number 9385218 were approved and

authorised for issue by the Board and signed on its behalf by :

Graeme Proudfoot

Chair

30 September 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

(UNAUDITED) (UNAUDITED) (UNAUDITED)

REVENUE CAPITAL TOTAL

NOTE GBP GBP GBP

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Revenue

==================== ==================================== ============================ ============================ ============================

Net gain (loss) on

investments 4 - 38,544,646 38,544,646

==================== ==================================== ============================ ============================ ============================

Foreign exchange

gain (loss) - (1,667,217) (1,667,217)

==================== ==================================== ============================ ============================ ============================

Interest income 14,989,688 9,781 14,999,469

Other income 4 2,994,307 - 2,994,307

Total return 17,983,995 36,887,210 54,871,205

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Expenses

==================== ==================================== ============================ ============================ ============================

Management fee 8 1,780,159 - 1,780,159

==================== ==================================== ============================ ============================ ============================

Performance fee 8 1,693,853 5,353,921 7,047,774

==================== ==================================== ============================ ============================ ============================

Credit impairment

losses 7 - 1,102,970 1,102,970

==================== ==================================== ============================ ============================ ============================

Other expenses 2,084,520 82,389 2,166,909

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Total operating

expenses 5,558,532 6,539,280 12,097,812

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Finance costs 2,826,965 - 2,826,965

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Net return on

ordinary

activities

before taxation 9,598,498 30,347,930 39,946,428

Taxation on - - -

ordinary activities

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Net return on

ordinary

activities

after taxation 9,598,498 30,347,930 39,946,428

-------------------- ------------------------------------ ---------------------------- ---------------------------- ----------------------------

Attributable to:

==================== ==================================== ============================ ============================ ============================

Equity shareholders 9,598,498 30,339,877 39,938,375

========================================================== ============================ ============================ ============================

Non-controlling

interests - 8,053 8,053

=================== ===================================== ============================ ============================ ============================

Return per Ordinary Share (basic and diluted) 3.25p 10.27p 13.52p

Other comprehensive income

========================================================== ============================ ============================ ============================

Currency translation differences - (1,119) (1,119)

---------------------------------------------------------- ---------------------------- ---------------------------- ----------------------------

Total comprehensive income 9,598,498 30,346,811 39,945,309

---------------------------------------------------------- ---------------------------- ---------------------------- ----------------------------

Attributable to:

========================================================== ============================ ============================ ============================

Equity shareholders 9,598,498 30,338,888 39,937,386

========================================================== ============================ ============================ ============================

Non-controlling

interests - 7,923 7,923

==================== ==================================== ============================ ============================ ============================

The total column of this statement represents the Group's

statement of comprehensive income, prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and also international

financial reporting standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union. The supplementary

revenue and capital columns are both prepared under guidance

published by the Association of Investment Companies ("AIC"). All

items in the above Statement derive from continuing operations.

Amounts in Other comprehensive income may be reclassified to profit

or loss in future periods.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX-MONTH PERIODED 30 JUNE 2020

(UNAUDITED) (UNAUDITED) (UNAUDITED)

REVENUE CAPITAL TOTAL

NOTE GBP GBP GBP

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Revenue

========================= =========================== ============================ ============================ ============================

Net gain (loss) on

investments 4 - (9,532,461) (9,532,461)

========================= =========================== ============================ ============================ ============================

Foreign exchange gain

(loss) - (1,662,430) (1,662,430)

========================= =========================== ============================ ============================ ============================

Interest income 21,342,243 58,353 21,400,596

Other income 4 1,014,268 - 1,014,268

Total return 22,356,511 (11,136,538) 11,219,973

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Expenses

========================= =========================== ============================ ============================ ============================

Management fee 8 1,798,060 - 1,798,060

========================= =========================== ============================ ============================ ============================

Performance fee 8 - - -

========================= =========================== ============================ ============================ ============================

Credit impairment losses 7 - 7,304,791 7,304,791

========================= =========================== ============================ ============================ ============================

Other expenses 1,123,033 165,181 1,288,214

Total operating expenses 2,921,093 7,469,972 10,391,065

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Finance costs 4,286,902 - 4,286,902

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Net return on ordinary

activities

before taxation 15,148,516 (18,606,510) (3,457,994)

Taxation on ordinary - - -

activities

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Net return on ordinary

activities

after taxation 15,148,516 (18,606,510) (3,457,994)

------------------------- --------------------------- ---------------------------- ---------------------------- ----------------------------

Attributable to:

========================= =========================== ============================ ============================ ============================

Equity shareholders 15,148,516 (18,644,222) 11,149,760

====================================================== ============================ ============================ ============================

Non-controlling

interests - 37,712 37,712

========================= =========================== ============================ ============================ ============================

Return per Ordinary Share (basic and diluted) 4.97p -6.11p -1.15p

Other comprehensive income

====================================================== ============================ ============================ ============================

Currency translation differences - 8,146 8,146

------------------------------------------------------ ---------------------------- ---------------------------- ----------------------------

Total comprehensive income 15,148,516 (18,598,364) (3,449,848)

------------------------------------------------------ ---------------------------- ---------------------------- ----------------------------

Attributable to:

====================================================== ============================ ============================ ==============================

Equity shareholders 15,148,516 (18,640,800) (3,492,284)

====================================================== ============================ ============================ ==============================

Non-controlling

interests - 42,436 42,436

========================= =========================== ============================ ============================ ==============================

The total column of this statement represents the Group's

statement of comprehensive income, prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and also international

financial reporting standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union. The supplementary

revenue and capital columns are both prepared under guidance

published by the Association of Investment Companies ("AIC"). All

items in the above Statement derive from continuing operations.

Amounts in Other comprehensive income may be reclassified to profit

or loss in future periods.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2020

(AUDITED) (AUDITED) (AUDITED)

REVENUE CAPITAL TOTAL

NOTE GBP GBP GBP

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Revenue

=================== ====== ============================ ============================ ============================

Net gain (loss) on

investments 4 - 1,845,962 1,845,962

=================== ====== ============================ ============================ ============================

Foreign exchange

gain (loss) - (2,970,304) (2,970,304)

=================== ====== ============================ ============================ ============================

Interest income 35,454,974 524,984 35,979,958

Other income 4 5,799,767 - 5,799,767

Total return 41,254,741 (599,358) 40,655,383

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Expenses

=================== ====== ============================ ============================ ============================

Management fee 8 3,394,740 - 3,394,740

=================== ====== ============================ ============================ ============================

Performance fee 8 4,040,085 - 4,040,085

=================== ====== ============================ ============================ ============================

Credit impairment

losses 7 - 112,550 112,550

=================== ====== ============================ ============================ ============================

Other expenses 2,313,540 232,265 2,545,805

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Total operating

expenses 9,748,365 344,815 10,093,180

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Finance costs 7,607,524 - 7,607,524

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Net return on

ordinary

activities

before taxation 23,898,852 (944,173) 22,954,679

Taxation on - - -

ordinary

activities

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Net return on

ordinary

activities

after taxation 23,898,852 (944,173) 22,954,679

------------------- ------ ---------------------------- ---------------------------- ----------------------------

Attributable to:

=================== ====== ============================ ============================ ============================

Equity shareholders 23,898,852 (1,019,223) 22,879,629

=========================== ============================ ============================ ============================

Non-controlling

interests - 75,050 75,050

=================== ====== ============================ ============================ ============================

Return per Ordinary Share

(basic and diluted) 8.08p -0.34p 7.74p

Other comprehensive income

=========================== ============================ ============================ ============================

Currency translation

differences - 21,443 21,443

--------------------------- ---------------------------- ---------------------------- ----------------------------

Total comprehensive income 23,898,852 (922,730) 22,976,122

--------------------------- ---------------------------- ---------------------------- ----------------------------

Attributable to:

=========================== ============================ ============================ ============================

Equity shareholders 23,898,852 (1,005,035) 22,893,817

=========================== ============================ ============================ ============================

Non-controlling

interests - 82,305 82,305

=================== ====== ============================ ============================ ============================

The total column of this statement represents the Group's

statement of comprehensive income, prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and also international

financial reporting standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union. The supplementary

revenue and capital columns are both prepared under guidance

published by the Association of Investment Companies ("AIC"). All

items in the above Statement derive from continuing operations.

Amounts in Other comprehensive income may be reclassified to profit

or loss in future periods.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

(UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED)

CALLED-UP SHARE OTHER (UNAUDITED) (UNAUDITED) CURRENCY TOTAL NON- (UNAUDITED)

SHARE PREMIUM DISTRIBUTABLE CAPITAL REVENUE TRANSLATION SHAREHOLDERS' CONTROLLING TOTAL

CAPITAL ACCOUNT RESERVE RESERVE RESERVE RESERVE EQUITY INTERESTS EQUITY

GBP GBP GBP GBP GBP GBP GBP GBP GBP

----------------- ------------------ -------------------- ------------------------- ------------------------ ------------------------- ---------------------- -------------------------- ----------------------- --------------------

Opening balance

at

1 January 2021 20,300,000 161,040,000 116,520,960 (50,393,578) 21,847,960 1,221,766 270,537,108 19,337 270,556,445

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Amounts paid on

buyback

of Ordinary

Shares - - (3,741,824) - - - (3,741,824) - (3,741,824)

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Contributions by

non-controlling

interests - - - - - - - - -

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Distributions to

non-controlling

interests - - - - - - - - -

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Return on

ordinary

activities

after taxation - - - 30,339,877 9,598,498 - 39,938,375 8,053 39,946,428

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Dividends

declared

and paid - - - - (11,224,706) - (11,224,706) - (11,224,706)

----------------- ------------------ -------------------- ------------------------- ------------------------ ------------------------- ---------------------- -------------------------- ----------------------- --------------------

Other

comprehensive

income

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Currency

translation

differences - - - - - (989) (989) (130) (1,119)

================= ================== ==================== ========================= ======================== ========================= ====================== ========================== ======================= ====================

Closing balance

at

30 June 2021 20,300,000 161,040,000 112,779,136 (20,053,701) 20,221,752 1,220,777 295,507,964 27,260 295,535,224

----------------- ------------------ -------------------- ------------------------- ------------------------ ------------------------- ---------------------- -------------------------- ----------------------- --------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX-MONTH PERIODED 30 JUNE 2020

(UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED) (UNAUDITED)

CALLED-UP SHARE OTHER (UNAUDITED) (UNAUDITED) CURRENCY TOTAL NON- (UNAUDITED)

SHARE PREMIUM DISTRIBUTABLE CAPITAL REVENUE TRANSLATION SHAREHOLDERS' CONTROLLING TOTAL

CAPITAL ACCOUNT RESERVE RESERVE RESERVE RESERVE EQUITY INTERESTS EQUITY

GBP GBP GBP GBP GBP GBP GBP GBP GBP

----------------- ---------------------- ------------------------ ------------------------------ --------------------------- ---------------------------- --------------------------- -------------------------------- ---------------------------- ------------------------

Opening balance

at

1 January 2020 20,300,000 161,040,000 136,682,176 (49,374,355) 21,623,852 1,207,578 291,479,251 60,940 291,540,191

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Amounts paid on

buyback

of Ordinary

Shares - - (15,290,346) - - - (15,290,346) - (15,290,346)

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Contributions by

non-controlling

interests - - - - - - - - -

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Distributions to

non-controlling

interests - - - - - - - - -

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Return on

ordinary

activities

after taxation - - - (18,644,222) 15,148,516 - (3,495,706) 37,712 (3,457,994)

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Dividends

declared

and paid - - - - (12,300,230) - (12,300,230) - (12,300,230)

----------------- ---------------------- ------------------------ ------------------------------ --------------------------- ---------------------------- --------------------------- -------------------------------- ---------------------------- ------------------------

Other

comprehensive

income

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Currency

translation

differences - - - - - 3,422 3,422 4,724 8,146

================= ====================== ======================== ============================== =========================== ============================ =========================== ================================ ============================ ========================

Closing balance

at

30 June 2020 20,300,000 161,040,000 121,391,830 (68,018,577) 24,472,138 1,211,000 260,396,391 103,376 260,499,767

----------------- ---------------------- ------------------------ ------------------------------ --------------------------- ---------------------------- --------------------------- -------------------------------- ---------------------------- ------------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

(AUDITED) (AUDITED) (AUDITED) (AUDITED) (AUDITED) (AUDITED)

CALLED-UP SHARE OTHER (AUDITED) (AUDITED) CURRENCY TOTAL NON- (AUDITED)

SHARE PREMIUM DISTRIBUTABLE CAPITAL REVENUE TRANSLATION SHAREHOLDERS' CONTROLLING TOTAL

CAPITAL ACCOUNT RESERVE RESERVE RESERVE RESERVE EQUITY INTERESTS EQUITY

GBP GBP GBP GBP GBP GBP GBP GBP GBP

----------------- ------------------ -------------------- ------------------------- ---------------------- ----------------------- ---------------------- -------------------------- ----------------------- --------------------

Opening balance

at

1 January 2020 20,300,000 161,040,000 136,682,176 (49,374,355) 21,623,852 1,207,578 291,479,251 60,940 291,540,191

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Amounts paid on

buyback

of Ordinary

Shares - - (20,161,216) - - - (20,161,216) - (20,161,216)

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Contributions by

non-controlling

interests - - - - - - - - -

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Distributions to

non-controlling

interests - - - - - - - (123,908) (123,908)

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Return on

ordinary

activities

after taxation - - - (1,019,223) 23,898,852 - 22,879,629 75,050 22,954,679

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Dividends

declared

and paid - - - - (23,674,744) - (23,674,744) - (23,674,744)

----------------- ------------------ -------------------- ------------------------- ---------------------- ----------------------- ---------------------- -------------------------- ----------------------- --------------------

Other

comprehensive

income

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Currency

translation

differences - - - - - 14,188 14,188 7,255 21,443

================= ================== ==================== ========================= ====================== ======================= ====================== ========================== ======================= ====================

Closing balance

at

31 December

2020 20,300,000 161,040,000 116,520,960 (50,393,578) 21,847,960 1,221,766 270,537,108 19,337 270,556,445

----------------- ------------------ -------------------- ------------------------- ---------------------- ----------------------- ---------------------- -------------------------- ----------------------- --------------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

(UNAUDITED) (UNAUDITED) (AUDITED)

30 JUNE 2021 30 JUNE 31 DECEMBER

2020 2020

GBP GBP GBP

------------------------------------------ --------------- ----------------------- -----------------------------

Cash flows from operating activities:

========================================== =============== ======================= =============================

Total comprehensive income 39,945,309 (3,449,848) 22,976,122

=========================================== =============== ======================= =============================

Adjustments for:

========================================== =============== ======================= =============================

- Interest income (14,999,469) (21,400,596) (35,979,958)

=========================================== =============== ======================= =============================

- Dividend and distribution income (2,994,307) (1,014,268) (5,799,767)

=========================================== =============== ======================= =============================

- Finance costs 2,826,965 4,286,902 7,607,524

=========================================== =============== ======================= =============================

- Exchange (gains) losses 1,667,217 1,662,430 2,970,304

-------------------------------------------

Total 26,445,715 (19,915,380) (8,225,775)

------------------------------------------- --------------- ----------------------- -----------------------------

Gain on investment assets (38,544,646) 9,532,461 (1,845,962)

=========================================== =============== ======================= =============================

(Gain) loss on derivative financial

instruments 10,980,503 (20,749,369) (1,402,050)

=========================================== =============== ======================= =============================

Decrease (increase) in other assets and

prepaid expenses (1,810,217) (227,546) 5,009

=========================================== =============== ======================= =============================

Increase (decrease) in management fee

payable 76,394 (77,259) (51,174)

=========================================== =============== ======================= =============================

Increase (decrease) in performance fee

payable 3,007,689 (7,410,614) (3,370,529)

=========================================== =============== ======================= =============================

Decrease in deferred income (61,233) (161,001) (236,919)

=========================================== =============== ======================= =============================

Decrease in accrued expenses and other

liabilities (701,861) (629,895) (458,591)

=========================================== =============== ======================= =============================

Interest received 14,438,308 22,448,520 37,597,261

=========================================== =============== ======================= =============================

Purchase of loans (104,041,783) (64,081,377) (105,292,885)

=========================================== =============== ======================= =============================

Redemption or sale of loans 101,968,924 114,742,276 160,405,704

=========================================== =============== ======================= =============================

Impairment of loans 1,102,970 7,304,791 112,550

-------------------------------------------

Net cash inflow (outflow) from operating

activities 12,860,763 40,775,607 77,236,639

------------------------------------------- --------------- ----------------------- -----------------------------

Cash flows from investing activities:

========================================== =============== ======================= =============================

Investment income received 2,994,356 1,018,502 5,815,327

=========================================== =============== ======================= =============================

Purchase of investment assets (24,402,638) (6,322,262) (16,671,467)

=========================================== =============== ======================= =============================

Sale of investment assets 5,874,872 3,275,979 8,538,783

=========================================== =============== ======================= =============================

Decrease of cash posted as collateral (898,095) (120,000) (160,000)

=========================================== =============== ======================= =============================

Net cash inflow (outflow) from investing

activities (16,431,505) (2,147,781) (2,477,357)

------------------------------------------- --------------- ----------------------- -----------------------------

Cash flows from financing activities:

========================================== ============== ============== ============================

Dividends distributed (11,224,706) (12,300,230) (23,674,744)

=========================================== ============== ============== ============================

Treasury shares repurchased (3,572,677) (15,112,905) (20,213,722)

=========================================== ============== ============== ============================

Distributions to non-controlling

interests - - (123,908)

=========================================== ============== ============== ============================

Increase (decrease) in note payable 27,250,133 (1,641,963) (23,502,528)

=========================================== ============== ============== ============================

Finance costs paid (2,391,251) (3,701,025) (7,165,276)

=========================================== ============== ============== ============================

Net cash inflow (outflow) from financing

activities 10,061,499 (32,756,123) (74,680,178)

------------------------------------------- -------------- -------------- ----------------------------

Net change in cash and cash equivalents 6,490,757 5,871,703 79,104

=========================================== ============== ============== ============================

Exchange gains (losses) on cash

and cash equivalents (79,261) 2,832,919 205,802

=========================================== ============== ============== ============================

Cash and cash equivalents at the

beginning of the period 6,416,028 6,131,122 6,131,122

-------------------------------------------

Cash and cash equivalents at the

end of the period 12,827,524 14,835,744 6,416,028

------------------------------------------- -------------- -------------- ----------------------------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIODED 30 JUNE 2021

1. GENERAL INFORMATION

VPC Specialty Lending Investments PLC (the "Parent Company")

with its subsidiaries (together "the Group") is focused on

asset-backed lending to emerging and established businesses with

the goal of building long-term, sustainable income generation. The

Group focuses on providing capital to vital segments of the economy

that are underserved by the traditional banking industry, including

small businesses, working capital products, consumer finance and

real estate, among others. The Group executes this strategy by

identifying investment opportunities across various industries and

geographies to offer shareholders access to a diversified portfolio

of opportunistic credit investments originated by non-bank lenders

with a focus on the rapidly developing technology-enabled lending

sector. The Parent Company, which is limited by shares, was

incorporated and domiciled in England and Wales on 12 January 2015

with registered number 9385218. The Parent Company commenced its

operations on 17 March 2015 and intends to carry on business as an

investment trust within the meaning of Chapter 4 of Part 24 of the

Corporation Tax Act 2010.

The Group's investment manager is Victory Park Capital Advisors,

LLC (the "Investment Manager"), a US Securities and Exchange

Commission registered investment adviser. The Investment Manager

also acts as the Alternative Investment Fund Manager of the Group

under the Alternative Investment Fund Managers Directive ("AIFMD").