TIDMVELA

RNS Number : 8515P

Vela Technologies PLC

21 October 2021

21 October 2021

Vela Technologies plc

("Vela")

Update re. WeShop Limited

The Board of Vela (AIM: VELA) notes the announcement made on 20

October 2021 by Boanerges Limited ("Boanerges"), a special purpose

acquisition company currently listed on the AQSE Growth Market,

regarding, inter alia, the proposed acquisition by Boanerges of the

business, assets and name of WeShop Limited ("WeShop"). This

proposal is to be considered by Boanerges' shareholders at a

general meeting to be held on 17 November 2021. As noted in the

announcement released by Boanerges, the passing of the resolutions

by Boanerges is conditional upon WeShop shareholders passing a

resolution to approve the acquisition.

Vela holds 71,429 shares in WeShop, representing 1.47% of

WeShop's share capital, which it acquired in 2014 by investing

GBP100,000 as part of a GBP1 million seed-funding round. WeShop is

a digital social network platform with plans to become a leader in

the social e-commerce sector.

The Board of Vela is considering Boanerges' announcement and

circular as well as WeShop's shareholder resolution and further

announcements will be made by Vela at the appropriate time.

Extracts from the announcement issued by Boanerges yesterday are

set out below. The full announcement can be found here:

https://www.londonstockexchange.com/news-article/market-news/gm-weshop-deal-jp-jenkins-admission-and-withdrawal/15181137

For further information, please contact:

Vela Technologies plc Tel: +44 (0) 7421

Brent Fitzpatrick, Non-Executive Chairman 728875

James Normand, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20 3328

and Joint Broker) 5656

Nick Athanas/Piers Shimwell

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0) 20 7469

0930

Lucy Williams / Duncan Vasey / Eran Zucker

About Vela Technologies

Vela Technologies plc (AIM: VELA) is an investing company

focused on early stage and pre-IPO long term disruptive technology

investments. Vela's investee companies have either developed ways

of utilising technology or are developing technology with a view to

disrupting the businesses or sector in which they operate. Vela

Technologies will also invest in already-listed companies where

valuations offer additional opportunities.

Extract No. 1

Boanerges Limited

("Boanerges" or the "Company")

Notice of General Meeting

AND

Withdrawal from AQSE Growth Market

Acquisition of business, assets and name of WeShop Limited

Admission to JP Jenkins Direct

Boanerges, a special purpose acquisition company, established

for the purpose of identifying investment opportunities and

acquisitions in small and medium sized enterprises ("SMEs") within

the technology sector, in the UK or Europe, is pleased to announce

that it is posting a General Meeting circular to Shareholders today

("Circular").

The General Meeting will be held at Garfield-Bennett Trust

Company Limited, First Floor, Durell House, 28 New Street, St.

Helier, Jersey, JE2 3RA on 17 November 2021 at 10.30 a.m., and

Resolutions will be proposed to approve the acquisition of the

business, assets and name of WeShop Limited and to approve the

withdrawal from the AQSE Growth Market on 18 November 2021.

WeShop Limited has developed a social/commerce platform that

allows users to share information and recommend products, via

affiliate networks.

JP Jenkins Direct

The Company is proposing to list its Ordinary Shares on JP

Jenkins Direct, a Matched Bargain Facility. Under the Matched

Bargain Facility, Shareholders or persons wishing to acquire or

dispose of Ordinary Shares will be able to leave an indication on

the JP Jenkins Direct trading platform electronically, of the

number of Ordinary Shares that they are prepared to buy or sell at

an agreed price.

The passing of the Company's Resolutions, are conditional upon

WeShop Limited shareholders passing their resolution to approve the

acquisition by the Company.

Extract No. 2

Notice of General Meeting

AND

Withdrawal from AQSE Growth Market

Acquisition of business, assets and name of WeShop Limited

Admission to JP Jenkins Direct

1. Introduction and Background to the General Meeting

The Company was admitted to trading on the AQSE Growth Market on

17 May 2021, having raised GBP500,000 through the issue of

2,500,000 Ordinary Shares via a subscription of Ordinary Shares.

Since than the Company has continued to search for a target company

in its stated investment strategy within the technology sector,

honing on opportunities in Big Data, Machine Learning, Internet of

Things and Telematics. On 2 August 2021, the Company announced that

it entered into an option to invest GBP2 million at a pre-money

valuation of GBP12 million, into Fintech Digital Platforms ("FDP").

The amount paid for the option was GBP25,000. During the 6-month

option period, the Company is monitoring the performance and

progress of FDP.

Since the Company was quoted on AQSE, and recently, the Company

entered into discussions with WeShop Limited. On 18 October 2021,

the Company made a formal offer to the board of WeShop Limited to

acquire all the assets and business, that include, inter alia, the

goodwill, customer contracts, IT systems and technology/platform,

records, intellectual property rights and the WeShop Limited

name.

WeShop Limited has developed a social/commerce platform that

allows users to share information and recommend and purchase

products, via affiliate networks.

The passing of the Company's Resolutions, are conditional upon

WeShop Limited shareholders passing their resolution to approve the

acquisition by the Company.

The consideration payable is 33,333,333 Ordinary Shares of the

Company, and at 75 pence per share, valuing the assets, business

and the WeShop Limited name at approximately GBP25,000,000.

The Asset Purchase Agreement requires the Company to lay a

Resolution before Shareholders to approve the acquisition.

Resolution 1 proposes to approve the acquisition.

Extract No. 3

3. Withdrawal from AQSE Growth Market

Conditional on passing the Resolutions, at the General Meeting

and the WeShop Limited Shareholders approving the acquisition by

the Company, the Company intends to withdraw from the AQSE Growth

Market. The Company is required to obtain a majority of not less

than 75 per cent. of the votes attaching to the securities voted on

the resolutions, and where an issuer has a controlling shareholder,

a majority of the votes attaching to the securities of independent

shareholders voted on the resolution. The Company today announced

its intention to withdraw from the AQSE Growth Market and if the

Resolutions are passed, withdrawal will take effect on 18 November

2021, being at least 20 business days' notice of the intended

withdrawal. It is intended that Shareholders holding Ordinary

Shares electronically in CREST will continue to able to do so

following Withdrawal.

The proposed WeShop Limited transaction will allow the Company

to develop the asset and business. The Board may review the

benefits of moving to a regulated stock exchange in the medium

term, but for now want to focus management attention on developing

the business and assets into an attractive and valuable

social/commerce platform. The Company is of the belief that after

acquiring WeShop Limited, it will have the necessary financial

resources for the required working capital to develop the WeShop

Limited business, assets and name.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKDBKNBDDPKB

(END) Dow Jones Newswires

October 21, 2021 09:08 ET (13:08 GMT)

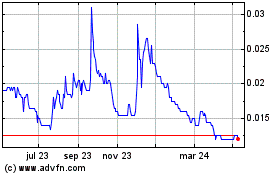

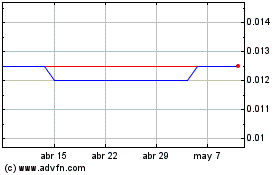

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024