TIDMVLE

RNS Number : 3286S

Volvere PLC

16 March 2021

16 March 2021

Volvere plc

(the "Group" or "Volvere")

Trading Update and Notice of Final Results

Volvere plc (AIM: VLE), the growth and turnaround investment

company, is pleased to provide the following trading update for the

financial year ended 31 December 2020. All data in this

announcement is unaudited, although the comparative information for

the year ending 31 December 2019 has been extracted from audited

data for that year.

In February 2020, the Group acquired the business and assets of

Indulgence Patisserie Limited ("Indulgence"), a frozen desserts

manufacturer. This, along with Shire Foods Limited ("Shire"), the

Group's frozen pastry products manufacturer, comprise the Group's

trading operations.

In October 2020, the Group raised approximately GBP9.7 million

through a share placing (net of associated expenses of GBP0.3

million).

Financial Performance

The Group expects to report revenue from continuing operations

of approximately GBP30.81 million (2019: GBP23.04 million) and an

overall loss before tax of GBP0.53 million (2019: profit before tax

of GBP3.18 million, stated after a profit arising from discontinued

operations of GBP3.1 million). The costs of the share placing have

been charged directly to reserves.

Operating Businesses

Shire Foods

Shire, in which Volvere has an 80 per cent. holding, grew

revenues by approximately 18% to GBP27.2 million (2019: GBP23.04

million) and achieved a profit before tax, intra-group interest and

management charges* of approximately GBP1.81 million (2019: GBP1.38

million). Profit before tax was GBP1.61 million (2019: GBP1.18

million) - with the difference being intra-group interest and

management charges.

The performance of Shire was outstanding, achieving record

revenues and profits during our period of ownership. Especially

pleasing was the progress made with the Naughty Vegan brand (for

which we have some sweet products launching in 2021 made by

Indulgence).

COVID-19 restrictions impacted negatively on foodservice sales

but this was more than offset by growth in the retail channel. The

proportion of foodservice sales (net of rebates) to total sales

fell from 12.2% in 2019 to 9.7% in 2020. Foodservice will recover

as the education and hospitality sectors in the UK reopen, however

this may reduce retail sales as fewer people eat at home.

We continue to invest in site capacity and in early 2021

commissioned another manufacturing line to supply future

anticipated revenue growth.

Indulgence Patisserie Limited

The Group acquired Indulgence on 7 February 2020, purchasing the

business and assets following the seller's administration for

approximately GBP1.25 million plus costs of approximately GBP0.10

million. Indulgence manufacturers premium frozen cakes, cheesecakes

and other desserts from its site in Colchester, UK.

For the period 7 February - 31 December 2020 Indulgence

generated revenues of GBP3.62 million and incurred a loss before

tax of GBP1.00 million. The Group has funded the initial purchase,

working capital and trading losses by way of intra-Group loans.

Indulgence had traditionally focussed on supplying the

foodservice sector (mainly outside of the UK), along with some UK

retail business. The pandemic, coupled with uncertainty due to the

administration of the former owner, not surprisingly has impacted

revenues. We have, however, been working hard to increase our

retail offering and to build new relationships with customers in

the UK foodservice sector, through increased innovation and

improved customer engagement. We are also investing in new plant to

increase productivity and the breadth of products we can offer.

The outlook for Indulgence in the short term is dependent

principally on the reopening of foodservice channels in the UK and

Europe. We believe the quality of the company's products and the

work we are doing behind the scenes to improve the customer

experience, will continue to present new opportunities for the

company over time.

Group Net Assets per Share and Net Assets

The Group expects to report year-end consolidated net assets per

share (excluding non-controlling interests) of approximately

GBP13.29 (31 December 2019: GBP13.85; 30 June 2020: GBP13.29) and

Group net assets of approximately GBP36.10 million (31 December

2019: GBP26.99 million; 30 June 2020: GBP26.02 million).

Of the Group net assets, cash represented approximately GBP23.71

million (31 December 2019: GBP19.32 million; 30 June 2020: GBP16.11

million).

The increase in the Group's net assets and corresponding cash

movements reflect the placing in October 2020, the positive trading

in Shire, offset by central costs, capital expenditure in new

plant, the purchase of Indulgence and the associated working

capital movements.

Current Trading and COVID-19

The lockdown in the UK and Europe has continued to impact

materially on foodservice sales in Indulgence. Whilst both Shire

and Indulgence have experienced staff absences due to COVID-19, we

have been able to minimise any impact on customer deliveries by

managing inventory levels proactively.

Revenues in the early part of 2021 for Shire are ahead of the

same period in 2020 and we are hopeful that this will continue. As

noted above, Indulgence stands to benefit from the re-opening of

the hospitality sector and from an expected greater penetration of

the retail market later in 2021.

More generally the number of companies in financial distress has

not been as high as we might have expected. However, we believe

this is due to the continuance of government support schemes -

which may soon be withdrawn. At that point, we expect there will be

a greater focus on balance sheet quality. The strength of the

Group's balance sheet puts it in a position to be able to exploit

the opportunities that we think will arise in the coming months. In

the interim, we seek to continue to deliver growth and increased

profitability in our food businesses.

Our staff have had to adapt to changing working practices in

response to the pandemic and shown much resilience in continuing

working whilst other sectors were closed. We are grateful to them

for their hard work and commitment.

* profit before intra-group interest and management charges is

considered to be a relevant, useful interpretation of the trading

results of the business such that its performance can be understood

on a basis which is independent of its ownership by the Group.

Notice of Final Results

Volvere expects to announce its full year results for the year

ended 31 December 2020 on or around 28 May 2021.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information:

Volvere plc

Jonathan Lander, CEO Tel: +44 (0) 1926 335700

www.volvere.co.uk

Cairn Financial Advisers LLP (Nominated Adviser)

Sandy Jamieson/James Lewis Tel: + 44 (0) 207 213 0880

Canaccord Genuity Limited (Joint Broker) Tel: + 44 (0) 207 523 8000

Bobbie Hilliam/Alex Aylen/Georgina McCooke

Hobart Capital Markets LLP (Joint Broker)

Lee Richardson Tel: + 44 (0) 207 070 5691

Notes to editors:

Volvere plc (AIM: VLE), is a growth and turnaround investment

company. The Group's current trading businesses are involved in

food manufacturing. The Group currently employs approximately 270

people.

For further information, please visit www.volvere.co.uk .

Forward-looking statements:

This announcement may contain certain statements about the

future outlook for Volvere plc. Although the directors believe

their expectations are based on reasonable assumptions, any

statements about future outlook may be influenced by factors that

could cause actual outcomes and results to be materially

different.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIAVRIELIL

(END) Dow Jones Newswires

March 16, 2021 03:00 ET (07:00 GMT)

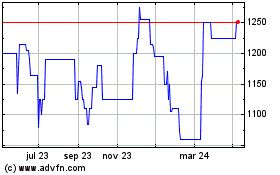

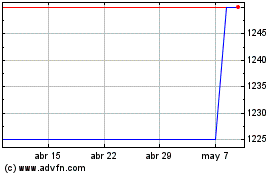

Volvere (LSE:VLE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Volvere (LSE:VLE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024