TIDMYCA

RNS Number : 5956F

Yellow Cake PLC

19 July 2021

1 9 July 2021

Yellow Cake plc ("Yellow Cake" or the "Company")

Annual Results for the year ended 31 March 2021

Highlights

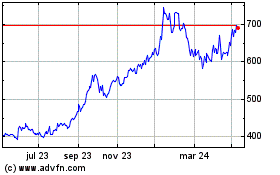

- Continued improvement in the market for U(3) O(8) , with the spot price increasing 12% from

USD27.40/lb on 31 March 2020 to USD30.65/lb (1) on 31 March 2021

- The value of the Company's U(3) O(8) holding of 9.86 million lb has increased 39% to USD302.1

(2) million as at 31 March 2021 relative to the average acquisition cost of USD217.3 million

(USD22.05/lb)

- Profit after tax of USD29.9 million for the year ended 31 March 2021 (2020: USD12.5 million)

- Raised GBP99.3 million (USD138.5 million) through a placing of shares in March 2021 and applied

the proceeds to acquire 0.5 million lb of U(3) O(8) during the financial year and an additional

net 3.4 million lb of U(3) O(8) post year end (3)

- Buyback of 4,156,385 ordinary shares in the Company (now held in treasury) between January

2020 and October 2020 for a total consideration of USD11.5 million (GBP8.9 million) at a volume

weighted average price of GBP2.13 per share (USD2.75 per share) in a share buyback scheme.

The shares were acquired at a volume weighted average discount to net asset value of 21%,

effectively acquiring exposure to uranium at a discount to the commodity spot price

- Net asset value of USD421.4 million (GBP2.38 per share (4) ) as at 31 March 2021 (2020: USD267.1

million (GBP2.45 per share))

- After year end, the U(3) O(8) spot price continued to rise, increasing to USD32.35/lb on 12

July 2021, and the value of the Company's U(3) O(8) holding increased a further 42% to USD430.4

million (5)

- Raised GBP62.5 million (USD86.9 million) post year end through a placing of shares in June

2021, the proceeds of which are partly being applied to acquire a further 550,000 lb of U(3)

O(8) in the spot market at an average price of USD 32.35/lb for delivery later in 2021. The

Company also expects to conclude an agreement with Kazatomprom to purchase a further 2.0 million

lb of U(3) O(8) at a price of USD32.23/lb

- Holding of 13.3 million lb of U(3) O(8) (including post year-end purchases) acquired at an

average cost of USD24.05/lb

Andre Liebenberg, CEO of Yellow Cake, said:

"This has been a year of considerable progress for Yellow Cake,

during which we have acted quickly to capitalise on improved market

sentiment around uranium for the benefit of our shareholders. We

took decisive action to address the discount to NAV through a

targeted buyback programme, and I am pleased to report we now trade

at a premium to NAV.

We've also considerably increased our overall uranium holdings

during the last 12 months. We undertook two separate oversubscribed

capital raises, enabling us first to fully exercise our Kazatomprom

2021 option and acquire an additional USD100million of uranium,

while securing additional funds to acquire further volume on an

opportunistic basis, where we saw value in doing so. Since March

this year, our total holdings have increased from 9.6 million lb to

13.3 million lb, and by the end of 2021 we expect to hold almost 16

million lb.

Above all, we remain confident in the outlook for the uranium

price and our investment thesis. This confidence is founded on

continued unique supply-demand fundamentals, whereby demand is now

clearly outstripping supply, which combined with on-going mine

closures and the steady drawdown of stockpiles, supports our view

on the price outlook. We also saw in the period a true shift in

sentiment towards nuclear energy, which is now increasingly

recognised as the only existing source of clean baseload power in a

world with rapidly growing electricity demand, and a critical

element of the future energy mix."

E nquiries:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

+44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

Henry Fitzgerald-O'Connor James Asensio

Georgina McCooke

+ 44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Wyllie

Varun Talwar Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Media/Investor Relations: Powerscourt

Peter Ogden

+44 (0) 779 3 85 8211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company founded and established

by Bacchus Capital and headquartered in Jersey, which offers

exposure to the uranium spot price. This is achieved through its

strategy of buying and holding physical triuranium octoxide ("U(3)

O(8) "). It may also seek to add value through the acquisition of

uranium royalties and streams or other uranium related activities.

Yellow Cake seeks to generate returns for shareholders through the

appreciation of the value of its holding of U(3) O(8) and its other

uranium related activities in a rising uranium price environment.

The business is differentiated from its peers by its ten-year

Framework Agreement for the supply of U(3) O(8) with Kazatomprom,

the world's largest uranium producer. Yellow Cake currently holds

13.3 million lb of U(3) O(8) , all of which is held in storage in

Canada and France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

Chairman's statement

Yellow Cake was established to provide investors with long-term

exposure to the uranium spot price through a liquid and

publicly-quoted vehicle. Our long-term partnership with Kazatomprom

is a key strategic advantage that provides access to material

volumes of uranium at the prevailing market price. The Company's

strict governance structures, practices and policies provide

assurance to investors and the low-cost outsourced business model

minimises cost leakage and risk exposure as we do not participate

in the uranium production chain.

COVID-19 had a significant impact across the full uranium

production cycle, highlighting the concentrated nature of uranium

supply, while global demand remained relatively unaffected due to

nuclear's role as a reliable and consistent baseload energy source.

This resulted in a steady increase in the price of uranium during

the year, in line with our investment thesis.

The resilience of Yellow Cake's business model was evident in

the year under review with minimal direct impact of the COVID-19

pandemic on the Company. Yellow Cake's two employees (the CEO and

CFO) perform their duties remotely and the Company has no operating

assets and a balance sheet with no leverage. Working capital is

maintained at a level that provides sufficient liquidity and

resources to cover an extended period of operation.

However, the pandemic had a significant impact across the full

uranium production cycle, from exploration to development, mining

and processing, highlighting the concentrated nature of uranium

supply. Production was significantly curtailed as a result of the

initial lockdowns as well as the second closure at a key producer

later in the year due to resurgences in COVID-19 infection

rates.

The equity market has warmed to the uranium story during the

second half of our financial year and uranium equities are up

significantly. A number of junior/developer companies have been

able to raise equity from a very supportive equity market.

Nuclear energy has an important role in a low carbon future

With the increasing focus on the urgent need to address climate

change, nuclear energy's role in a low-carbon future is becoming

more widely accepted by governments around the world. The recently

released report from the European Commission's Joint Research

Centre(6) concluded that the environmental and social impacts of

nuclear energy over its full lifecycle are comparable with

hydropower and other forms of renewable energy. Nuclear energy has

proven to be an excellent complement to renewables and currently

provides around 55% of the US's carbon-free electricity and 53% of

the European Union's carbon-free electricity(7) . In the world's

most populous and fastest growing nations, China and India, which

rely heavily on coal-fired electricity plants, nuclear energy

currently comprises less than 15% of carbon- free electricity(8)

.

While Yellow Cake's direct social and environmental impact is

not significant, the Board recognises that long-term value can only

be created by taking an approach that looks beyond financial

performance to consider the Company's broader environmental, social

and governance (ESG) performance. The Company conducts the

necessary due diligence on suppliers and business partners to

ensure that they share our commitment to responsible business

practices and Yellow Cake has a zero-tolerance approach to bribery,

corruption and unethical practices.

Supply is constrained while demand looks set to grow

While the COVID-19 pandemic affected activity and energy use in

all countries, nuclear energy proved to be a resilient electricity

source. Nuclear's role as a low-cost and non- carbon energy source

is likely to grow as energy intensity increases. Additions to the

current global reactor fleet forecast strong growth in nuclear

electricity generation from facilities currently under construction

(+15%), planned (+27%) and proposed (+90%)(9) . Net of old plants

retired, total reactors are forecast to grow by 30% to 2040.

Significant investments are being made in advanced reactor

technologies including small modular reactors that can reduce

capital costs, shorten construction times, increase safety and

broaden acceptance.

Beyond the short-term disruption caused by the pandemic, the

sustained underinvestment in future uranium supply and

concentration of production suggests continued supply constraints

in the medium to long term.

This asymmetry in uranium supply and demand was the fundamental

principle upon which Yellow Cake was established. Although the

uranium spot price improved over the last twelve months, it remains

well below the price required to support profitable investment in

developing new resources. The recent strong run in uranium stocks

suggests that these trends are becoming evident to a broader

audience. With the policy uncertainty that affected long- term

contracting for uranium supply largely resolved over the last

twelve months, the return of nuclear utilities to the long-term

contracting market could be the catalyst to the necessary recovery

in the uranium price.

Increasing holdings of U(3) O(8)

In early March 2021, the Company placed 44.5 million new

ordinary shares, the proceeds of which were used to purchase a net

4.0 million lb of U(3) O(8) , during the financial year and after

year end, at an average cost of USD28.83/lb during a pullback in

the uranium price. We were pleased with the strong reception that

the share placement received from both institutional and retail

investors, which resulted in the placement increasing to circa

USD140 million from the USD110 million originally proposed. This

enabled the Company to not only acquire the full USD100 million

U(3) O(8) allotment in terms of the Kazatomprom Framework Agreement

but also to acquire a further net 534,985 lb in the spot

market.

We are pleased to report that at 31 March 2021 Yellow Cake's

share price closed at a 15% premium to net asset value and the

share price ended 45% up for the financial year. The share buyback

programme implemented in January 2020 and extended in June was

instrumental in this regard and proved to be an effective way to

increase shareholders' exposure to U(3) O(8) at a discount to the

commodity spot price. The programme was financed by the disposal of

300,000 lb of U(3) O(8) in June 2020 and, at its conclusion in

October 2020, a total of USD11.5 million in value had been returned

to shareholders through the programme.

The Company held a General Meeting on 10 June 2021 at which

shareholders approved the renewal of the Board's authorities to

allot up to 25 million new ordinary shares prior to the Annual

General Meeting in September 2021. This was necessary to ensure

that Yellow Cake remained in a position to act opportunistically

should new uranium purchase opportunities present themselves prior

to the meeting, as the shares issued during the year had almost

fully utilised the authorities obtained at the 2020 Annual General

Meeting.

On 21 June 2021, the Company fully utilised this authority and

placed 25 million new ordinary shares. In July 2021, the Company

concluded agreements to purchase a further 550,000 lb of U(3) O(8)

in the spot market at an average price of USD32.35/lb for a total

consideration of USD17.8 million. The Company expects to conclude

an agreement with Kazatomprom to purchase a further 2.0 million lb

of U(3) O(8) at a price of USD32.23/lb for a total consideration of

USD64.5 million, pursuant to Kazatomprom's offer of 12 June 2021.

The purchase transactions and the proposed purchase transactions

are expected to complete later in 2021. The completion of these

uranium purchases will take the Company's total holding to almost

16 million lb of U(3) O(8) , which represents over 10% of current

annual global uranium mine production.

Governance

Yellow Cake's Board of Directors is committed to maintaining

high ethical standards as reflected in our governance framework and

Code of Conduct. The Code of Conduct sets the operational and

performance requirements for Yellow Cake's employees, directors,

business partners, contractors and advisers, and promotes the

Company's key values of dignity, diversity, business integrity,

compliance and accountability.

Yellow Cake has applied the principles and provisions of the UK

Corporate Governance Code 2018 (the "Code") to the degree

appropriate to the size and nature of its business. The small scale

and simplicity of the organisation reduces the number of points of

interface, improves communication and enhances governance and

oversight. Compliance policies are regularly reviewed and updated

to ensure continued alignment with the latest developments in

corporate governance requirements and guidelines. Effective

policies and measures are in place to prevent the opportunity for

bribery or inducements, and a whistleblowing policy is in

place.

The Board plays an active role in overseeing the Company's

activities and met 14 times during the year to 31 March 2021.

Meetings were also held by the Audit, Remuneration and Nomination

Committees during the period to discharge their duties as set out

in their terms of reference.

Alexandra Nethercott-Parkes, who acted as a Client Director of

Langham Hall Fund Management (Jersey) Limited, resigned as an

Independent Non-executive Director with effect from 31 March 2021

and was replaced by Emily Manning, who is also a client director of

Langham Hall Fund Management (Jersey) Limited. On behalf of the

Board, I would like to express our sincere gratitude to Alexandra

for her significant contribution to Yellow Cake.

The Board values its dialogue with stakeholders and the Company

proactively facilitates opportunities for engagement with its

stakeholders. Day-to-day queries raised by stakeholders are

addressed by the Executive Directors, the chairs of the Board

Committees will seek engagement with shareholders on significant

matters related to their areas of responsibility and the Chairman

is available to the Company's major shareholders to discuss

governance, strategy and performance as required. The outcomes of

these engagements are regularly communicated to the Board and

inform its deliberations. As the 2020 Annual General Meeting was a

virtual event, stakeholders were invited to submit questions in

written form.

Dividend policy

One of Yellow Cake's primary objectives is to realise a return

on investment from the appreciation in the value of its U(3) O(8)

holdings and the Company does not currently expect to issue

dividends on a regular or fixed basis. The Board reserves the right

to declare a dividend, as and when deemed appropriate.

Acknowledgements and thanks

I would like to thank my fellow Board members for their

diligence and contribution during the year. The Framework Agreement

with Kazatomprom, our strategic supplier, is an important asset of

the Company that enables value creation for shareholders and we

thank them for their support. We are grateful to our shareholders

and investors for their strong interest in the share issue during

the year and welcome our new shareholders to the Company.

The Lord St John of Bletso

Chairman

CEO statement

2020 was a transition year for the uranium market in that a

number of factors and uncertainties that were affecting the uranium

price were resolved or reached a point where their implications for

higher prices became undeniable.

Recent market trends continue to highlight the long-term

supply/demand disconnect in the uranium market, while the

regulatory uncertainty that was more prevalent in 2019 is now

largely resolved and there is a growing recognition of nuclear

power's importance in meeting carbon emission reduction

targets.

The impact of COVID-19 emphasised the supply-side risk in the

uranium market with 76% of global production concentrated in four

countries. Disruptions due to the pandemic led to the loss of

approximately 20 million lb of production that will not be

recovered and production in calendar 2020 fell 12% to 125 million

lb of U(3) O(8) (10) . This follows three years of production

declines from the peak in 2016 at 160 million lb of U(3) O(8) ,

while reactor demand has stayed relatively steady around 175

million lb of U(3) O(8) a year, implying consistent inventory

drawdowns. In February and March of this year we also saw the

permanent closure of the Ranger mine in Australia and the Cominak

mine in Niger. Historically these mines in aggregate produced

around nine million lb per annum(11) .

Demand for uranium looks set to grow as the current global fleet

of 443 operating reactors is expanding with a further 155 reactors

under construction or planned(9) , mainly in China, Russia, India

and the Middle East. The remarkable improvement in air quality as

activity decreased at the height of the pandemic demonstrated the

significant negative impact of fossil fuels in countries that rely

heavily on energy from these sources, including China and

India.

The perception of nuclear energy is becoming more positive as

more countries commit to carbon neutrality and support for a

"renewables plus nuclear" solution increases. For the first time in

many years, the nuclear industry in the US is receiving bipartisan

support, and President Biden's pre-election policy statements

explicitly included nuclear in the energy policy. The UK's Ten

Point Plan for Green Industrial Revolution includes a commitment to

nuclear energy and small modular reactors continue to gain traction

globally as cost-effective and small footprint alternatives to

traditional reactors.

Although nuclear energy currently accounts for nearly half of

the low-carbon electricity in Europe, its inclusion in the EU

taxonomy for sustainable finance has not yet been confirmed and it

would be a negative for the industry if it was excluded. Recently

the EU's Joint research Centre (JRC) concluded that nuclear energy

does not cause any more harm than the energy sources currently

included in the taxonomy(6) . The JRC report is still subject to

review prior to implementation. However, most of the growth in

reactors is forecast to take place outside the EU, so exclusion is

not expected to have a significant impact on the industry's future

growth.

The ability of producers to respond to the forecast increase in

demand is, in our view, limited. For several years, the majority of

current uranium supply is thought to have been loss making at

prevailing uranium spot prices, disincentivizing investment in new

resources even as current mines deplete. Despite the increased

current and planned activity around nuclear builds, we have seen

little progress in the uranium mining projects in the market at the

time of Yellow Cake's IPO in 2018. We believe that the lack of

bankable long-term off-take contracts are a key constraint to

projects being able to secure the necessary finance for

construction. At the same time, the main US policy issues that

created uncertainty for utility contracting over the last two years

have been clarified. These include the release of the

recommendations of the US Nuclear Fuels Working Group and the

finalisation of the Russian Suspension Agreement.

Developments in the uranium market(12)

The uranium spot market price started 2020 at USD25.00/ lb and

ran up nearly 20% in April on record volumes as COVID-19 forced the

closure of mining production around the world. The price peaked at

USD34.00/lb in May 2020 before trending down to around USD30/lb

where it ended the calendar year, closing 20% up on 2019 and nearly

70% up since the 2016 low. In 2021, after initially declining the

price reached USD30.65/lb by the end of March.

Spot market volumes reached record levels in the 2020 calendar

year at 92.3 million lb of U (3) O(8) (CY2019: 64.3 million lb)

compared to the previous record of 88.7 million lb of U (3) O(8) in

2018. We believe that this activity was driven by enhanced

purchasing activity by primary uranium producers that had reduced

production or suspended their operations due to the COVID-19

pandemic, as well as by market intermediaries.

Aggregate term contracting in CY2020 amounted to only around 56

million lb of U (3) O(8) (equivalent) which includes

delivery/purchase commitments within the so-called carry

trade/mid-term market (1-3 years forward), as well as the more

traditional long-term contracting market (3-5 years or more). Term

contracting levels in CY2020 were at unprecedented lows (96.2

million lb of U (3) O(8) (equivalent) in CY2019 and 90.5 million lb

of U (3) O(8) (equivalent) in CY2018).

Uranium spot market activity decreased markedly in the first two

months of the 2021 calendar year, totaling slightly more than 10

million lb of U (3) O(8) . We believe this decline may be

attributable to reduced purchasing by utilities as well as limited

market activity by uranium producers in the new year. Spot market

transactions rose significantly in March with the acquisition of

physical uranium by financial entities (including Yellow Cake's

acquisitions discussed below) and by several junior uranium

companies. Aggregate transaction volumes for March rose to 10.9

million lb of U (3) O(8) under 68 separate transactions(13) .

Increase in Yellow Cake's U(3) O(8) holdings

In the final quarter of 2020, we witnessed significant investor

interest in uranium equities on the back of the improving uranium

fundamentals highlighted above and this trend continued into 2021.

These market dynamics allowed Yellow Cake to take advantage of the

strong investor interest in uranium and we were able to raise

USD138.5 million at net asset value in an oversubscribed equity

offering.

The equity raise allowed us to fully exercise the Kazatomprom

2021 option to acquire USD100 million of U(3) O(8) this year and to

apply the surplus cash raised to make additional uranium purchases

for value. In June 2021, the Company raised gross proceeds of

USD86.9 million and committed to further purchases of U(3) O(8) ,

which are expected to bring the Company's holding of U(3) O(8) to

more than 15 million lb in the 2021 calendar year.

A number of other uranium companies have also taken the

opportunity provided by the improved sentiment towards the

commodity and since February 2021 around USD930 million has been

raised, including Yellow Cake's equity offerings. We are also

seeing a new strategy by uranium project companies that are using

the funds raised to purchase uranium in the spot market to enhance

financing options as they pursue the restart/development of their

projects. In 2021 to date, about 12.7 million lb of U(3) O(8) has

been purchased (including Yellow Cake's 3.5 million lb from

Kazatomprom), which represents approximately 10% of forecast 2021

primary production.

The share buyback programme Yellow Cake initiated last year and

extended during the current year took advantage of the persistent

discount between the Yellow Cake share price and net asset value to

effectively increase shareholders' exposure to uranium at a

discount to the spot price. The Company's shares ended the 2021

financial year 45% up on the prior year and trading at a premium to

net asset value.

The fair value of the Company's holding of U(3) O(8) increased

by USD33.4 million in the year to 31 March 2021. At year-end Yellow

Cake's net asset value increased 58%, although after accounting for

the increased shares in issue, net asset value per share declined

marginally to GBP2.38 per share. The Company delivered a net profit

after tax for the year of USD29.9 million and ended the year with

cash and cash equivalents of USD126.2 million on the balance sheet.

The CFO's Review provides more information regarding the Company's

financial results for the period.

Stakeholder relationships

While COVID-19 prevented face to face engagements, we held a

large number of virtual engagements with shareholders, investors,

analysts and the media through investor conferences, conference

calls, investor briefings with industry experts, media briefings

and interviews to improve the understanding of the Company and the

industry. Our focus on broadening our retail shareholder base

continued and, very pleasingly, both the March and June share

placements included a retail component that was very well

supported. The Company's retail shareholding currently accounts for

25% of the share register, up from zero at the time of the IPO in

July 2018.

Outlook

Demand for uranium is likely to continue with nuclear energy

playing a key role in the long-term global energy mix as a low

carbon, low operating cost, reliable and sustainable source of

energy that complements renewable sources of energy. New supply of

uranium is uneconomic without a significant increase in prices from

current levels and the ongoing disruptions to supply from COVID-19

are resulting in producers being increasingly active in the spot

market to meet contracted volumes.

The return of long-term contracting by utilities will be the key

trigger for a rebound in the market. Market sources, including

UxC(14) , indicate that nuclear utilities are beginning to focus on

the long-term uranium market and expectations remain for long-term

uranium contracting to increase during 2021 as utility fuel

managers pursue forward uranium coverage.

The long-term fundamentals supporting our view that uranium is

currently underpriced remain intact and Yellow Cake is well placed

to realise further value for shareholders as a result.

Andre Liebenberg

Chief Executive Officer

CFO's review

In March 2021, the Company completed an upsized share placing,

raising gross proceeds of USD138.5 million at an issuance price

equal to net asset value at the time of the placing. The proceeds

were applied to fully exercise the Company's 2021 option to

purchase USD100 million of U(3) O(8) from Kazatomprom under the

Framework Agreement, to purchase additional uranium for value and

to fund related expenses and working capital.

During the first nine months of the financial year, the

Company's shares continued to trade at a significant discount to

net asset value. The Yellow Cake Board therefore took the decision

to continue with a share buyback programme while this discount

persisted as a means of effectively acquiring exposure to uranium

at a discount to the commodity spot price and delivering value to

shareholders. The buyback programme was largely financed through

the sale of 300,000 lb of U(3) O(8) in June 2020 that generated

cash proceeds of USD9.9 million after costs and commission. Between

January 2020 and October 2020, the Company applied USD11.5 million

(GBP8.9 million) to purchasing its shares at a volume-weighted

average discount to net asset value of 21%.

The buyback programme completed in October 2020 and by the end

of 2020, the discount to net asset value had closed. By March 2021,

Yellow Cake's shares were trading at a premium to net asset value,

putting the Company in a position to successfully complete an

upsized share placing and apply the proceeds to the purchase of an

additional 4 million lb of U(3) O(8) .

It is my pleasure to report a number of highlights for the

year:

- An increase in the Company's uranium holding of USD38.6

million from USD263.5 million to USD302.1 million

- Proceeds of USD138.5 million from the share placing in March

2021 of which USD115.0 million was applied or committed

to net purchases of 4.0 million lb of U(3) O(8) at an average

price of USD28.83/lb

- Returned USD11.5 million in value to shareholders through

a share buyback programme, with shares purchased at a 21%

discount to net asset value

- Profit after tax of USD29.9 million (2020: USD12.5 million)

Uranium transactions

Yellow Cake started the financial year with a holding of 9.62

million lb of U(3) O(8) and sold 300,000 lb of U(3) O(8) in June

2020 to finance the share buyback programme. In March 2021, the

Company acquired an additional 540,000 lb of U(3) O(8) to end the

financial year with a total holding of 9.86 million lb of U(3) O(8)

.

On 3 March 2021 Yellow Cake exercised the Kazatomprom option to

acquire a further 3.45 million lb of U(3) O(8) for an aggregate

cash consideration of USD100.0 million. The Kazatomprom purchase

completed after financial year end and the Company took delivery of

the uranium on 21 June 2021.

As part of the subscription agreement entered into at the time

of the Company's IPO in July 2018, the Company granted Uranium

Royalty Corp. an option to acquire between USD2.5 million and

USD10.0 million worth of U(3) O(8) per year in each of the nine

calendar years commencing on 1 January 2019, up to a maximum

aggregate amount over such nine-year period of USD31.25 million

worth of U(3) O(8) . On 30 March 2021, Yellow Cake accepted Uranium

Royalty Corp's option exercise notice to purchase 348,068 lb of

U(3) O(8) from Yellow Cake at USD28.73/lb for an aggregate

consideration of USD10.0 million. The sale to Uranium Royalty Corp.

completed after financial year end on 28 April 2021.

On 20 May 2021, Yellow Cake completed the purchase of 343,053 lb

of U(3) O(8) in the market at a price of USD29.15/lb for total

consideration of USD10.0 million.

In July 2021, the Company concluded agreements to purchase a

further 550,000 lb of U(3) O(8) in the spot market at an average

price of USD32.35/lb for a total consideration of USD17.8 million.

The Company will take delivery of this uranium between July and

August 2021.

T he Company expects to conclude an agreement with Kazatomprom

to purchase a further 2.0 million lb of U(3) O(8) for delivery

between October and December 2021 at a price of USD32.23/lb for a

total consideration of USD64.5 million, pursuant to Kazatomprom's

offer of 12 June 2021.

Uranium-related profit

Yellow Cake made a total uranium related profit of USD33.9

million in the year to 31 March 2021 (2020: USD15.9 million). This

comprised an increase in the fair value of the Company's uranium

investment of USD33.4 million (2020: USD15.7 million), a premium to

the prevailing spot price on the disposal of 300,000 lb of U(3)

O(8) of USD0.2 million and USD1.1 million in location swap fees.

These gains were partially offset by an increase in the fair value

of a uranium derivative liability related to the Kazatomprom

repurchase option of USD0.8 million (detailed in note 7 of this

report).

Of the 9.62 million lb of U(3) O(8) held at the beginning of the

financial year, 300,000 lb of U(3) O(8) was sold at the end of June

2020 at a price of USD33.20/lb and at a premium of USD0.60/lb above

the carrying value of USD32.60/lb(15) on the date of disposal,

being the prevailing market price at the time.

The increase in the fair value of the Company's uranium

investment of USD33.4 million during the year was attributable

to:

- an increase of USD5.20/lb in the carrying value of the 300,000

lb of U(3) O(8) sold at the end of June 2020;

- an increase of USD3.25/lb in the carrying value of the 9.32

million lb of U(3) O(8) uranium investment held by the Company

since the beginning of the financial year (as the underlying

price of U(3) O(8) increased from USD27.40/lb to USD30.65/lb

over the financial year); and

- an increase of USD2.83/lb in the carrying value of the additional

0.54 million lb of U(3) O(8) acquired by the Company in

March 2021 for an average price of USD27.82/lb.

At the end of the financial year, the Company's uranium

investment comprised 9.86 million lb of U(3) O(8) .

Operating performance

Yellow Cake delivered profit after tax for the year of USD29.9

million (2020: USD12.5 million).

Expenses for the year of USD4.0 million (2020: USD3.5 million)

recognised in the Statement of Comprehensive Income included the

following costs:

- USD0.7 million in costs related to Yellow Cake's share placing

(2020: USD0.5 million); and

- USD0.3 million in commissions payable to 308 Services Limited

in relation to the purchase by Yellow Cake of U(3) O(8)

(2020: USD0.2 million).

- Operating costs of a recurring nature of USD2.9 million

(2020: USD2.8 million), comprising: - Procurement and market consultancy fees (holding fees and

storage incentive fees) paid to 308 Services Limited of

USD1.1 million (2020: USD1.0 million) (detailed in note

12); and

- Other operating costs of USD1.7 million (2020: USD1.8 million).

Operating expenses of a recurring nature of USD2.9 million

represent approximately 0.7% of the Company's net asset value at 31

March 2021.

Share buyback programme

The share buyback programme (the "Programme") approved by the

Board early in 2020 to purchase up to USD2.0 million of the

Company's ordinary shares continued during the year under review.

On 30 June 2020, the Company announced its intention to enlarge the

Programme, with a view to purchase up to an additional USD10.0

million of the Company's outstanding ordinary shares.

During the financial year, the Company purchased 3,846,597

shares under the Programme for a total consideration of GBP8.3

million (USD10.7 million). The Programme was completed in October

2020 with the acquisition of a total of 4,156,385 of the Company's

shares for a total consideration of GBP8.9 million (USD11.5

million) at a volume weighted average price of GBP2.13 per share

and volume weighted average discount to the Company's estimated net

asset value of 21%.

The shares repurchased are held in treasury.

The Company does not propose to declare a dividend for the

year.

Share placings

On 2 March 2021, the Company issued a total of 43,001,944 new

ordinary shares to existing and new institutional investors and

1,523,070 new ordinary shares to retail investors, at a price of

GBP2.23 per share, equal to the Company's estimated net asset value

per share at the date of the offering. The Company raised net

proceeds of GBP96.3 million (USD equivalent: 134.4 million net of

costs of USD4.1 million).

On 21 June 2021, after year end, the Company issued 23,947,009

new ordinary shares to existing and new institutional investors and

1,052,991 new ordinary shares to retail investors, at a price of

GBP2.50 per share, equal to a 1% premium to the Company's estimated

net asset value at the date of the offering. The Company raised net

proceeds of GBP60.6 million (USD equivalent: 84.0 million net of

costs of USD2.9 million).

Additional transactions to realise value from the company's U(3)

O(8) holdings

On 24 July 2020, the Company concluded a location swap agreement

that realised gross proceeds of USD1.1 million. The location swap

was reversed in May 2021 and realised a small profit

contribution.

Under the location swap agreement, the Company exchanged 500,000

lb of U(3) O(8) located at Cameco's storage facility in Canada for

an equal volume of U(3) O(8) located at Orano's storage facility in

France. In consideration, Yellow Cake received gross proceeds of

USD1.1 million on 11 August 2020. The location swap was reversed in

May 2021, at which time Yellow Cake received the same volume of

uranium in Canada in exchange for uranium held in France and

received a swap fee of USD100,000.

The Company will continue to pursue attractive uranium related

transaction opportunities as they arise, including location

swaps.

Balance sheet and cash flow

The share placing and retail offer which completed on 2 March

2021 raised net proceeds of USD134.4 million. USD15.0 million was

applied to purchasing uranium during the financial year, while the

Company committed to purchasing USD100.0 million of U(3) O(8) from

Kazatomprom under the Framework Agreement after financial year-end.

The Kazatomprom purchase transaction completed in June 2021.

Yellow Cake's U(3) O(8) investment increased by 15% to USD302.1

million at year-end compared to USD263.5 million at the end of the

2020 financial year, as a result of the appreciation in the uranium

price and a net increase in the volume of uranium held. As at 31

March 2021, Yellow Cake had cash of USD126.2 million (2020: USD6.5

million).

Yellow Cake's net asset value at 31 March 2021 was GBP2.38 per

share(16) or USD421.4 million, consisting of 9,856,385 lb of U(3)

O(8) valued at a spot price of USD30.65/lb, a uranium derivative

liability of USD3.4 million, cash and cash equivalents of USD126.2

million and other net current assets and liabilities of USD3.5

million.

Yellow Cake's estimated net asset value on 12 July 2021 was

USD533.8 million, consisting of 13,305,601 lb(17) of U(3) O(8)

valued at the weekly price of USD32.35/lb published by UxC LLC on

12 July 2021, a uranium derivative liability of USD3.4 million,

cash and cash equivalents of USD126.2 million and other net current

assets and liabilities of USD3.5 million as at 31 March 2021, less

net consideration paid for net purchases of USD100.0 million

completed after the end of the financial year, plus net proceeds of

the share placing on 21 June 2021 of USD84.0 million.

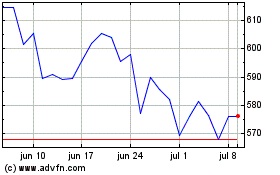

Yellow Cake's estimated net asset value per share as at 12 July

2021 was GBP2.50 per share. At market close on 12 July 2021, the

Company's share price was GBP2.68 per share, which represents a 7%

premium to the estimated net asset value.

Carole Whittall

Chief Financial Officer

Financial statements

Statement of Financial Position

As at As at

31 March 2021 31 March 2020

Notes USD'000 USD'000

========================================== ======== ============== ==============

ASSETS

Non-current assets

Investment in uranium 4 302,098 263,489

------------------------------------------ -------- -------------- --------------

Total non-current assets 302,098 263,489

------------------------------------------ -------- -------------- --------------

Current assets

Trade and other receivables 5 119 89

Cash and cash equivalents 6 126,159 6,481

------------------------------------------ -------- -------------- --------------

Total current assets 126,278 6,570

------------------------------------------ -------- -------------- --------------

Total assets 428,376 270,059

------------------------------------------ -------- -------------- --------------

LIABILITIES

Non-current liabilities

Uranium derivative liability 7 - (2,587)

------------------------------------------ -------- -------------- --------------

Total non-current liabilities - (2,587)

------------------------------------------ -------- -------------- --------------

Current liabilities

Trade and other payables 8 (3,621) (392)

Uranium derivative liability 7 (3,361) -

------------------------------------------ -------- -------------- --------------

Total current liabilities (6,982) (392)

------------------------------------------ -------- -------------- --------------

Total liabilities (6,982) (2,979)

------------------------------------------ -------- -------------- --------------

NET ASSETS 421,394 267,080

------------------------------------------ -------- -------------- --------------

EQUITY

Attributable to the equity owners of the company

Share capital 9 1,785 1,164

Share premium 9 358,812 224,437

Share-based payment reserve 10 141 2

Treasury shares 11 (11,458) (,726)

Retained earnings 72,114 42,203

------------------------------------------ -------- -------------- --------------

TOTAL EQUITY 421,394 267,080

========================================== ======== ============== ==============

Statement of Comprehensive Income

1 April 1 April

2020 2019

to to

31 March 31 March

2021 2020

Notes USD'000 USD'000

=============================================== ====== ========= =========

Uranium related profit

Fair value movement of investment in uranium 4 33,365 15,714

Uranium swap income 4 1,145 -

Premium to spot price on disposal of uranium 4 180 -

Fair value movement of uranium derivative

liability 7 (774) 212

----------------------------------------------- ------ --------- ---------

Total uranium related profit 33,916 15,926

----------------------------------------------- ------ --------- ---------

Expenses

Share-based payments 10 (139) (2)

Equity offering expenses 9 (681) (547)

Commission on uranium transactions 12 (282) (152)

Procurement and market consultancy fees 12 (1,124) (1,017)

Other operating expenses 13 (1,739) (1,756)

----------------------------------------------- ------ --------- ---------

Total expenses (3,965) (3,474)

----------------------------------------------- ------ --------- ---------

Bank interest income 3 104

Loss on foreign exchange (43) (47)

----------------------------------------------- ------ --------- ---------

Profit before tax attributable to the equity owners

of the Company 29,911 12,509

------------------------------------------------------- --------- ---------

Tax expense 14 - -

----------------------------------------------- ------ --------- ---------

Profit and total comprehensive income for the year

after tax attributable to the equity owners of

the Company 29,911 12,509

Basic earnings per share attributable to the

equity owners of the company (USD) 16 0.34 0.14

Diluted earnings per share attributable to

the equity owners of the company (USD) 16 0.33 0.14

=============================================== ====== ========= =========

Statement of Changes in Equity

Attributable to the equity owners of the company

Share based Retained

Share capital Share premium payment reserve Treasury shares earnings Total equity

Notes USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

===================== ============= ============= ================ =============== ================ ============

As at 31 March

2019 1,007 192,248 - - 29,694 222,949

----------------- ------------- ------------- ---------------- --------------- ---------------- ------------

Total

comprehensive

income after tax

for the year - - - - 12,509 12,509

Transactions with

owners:

Shares issued 9 157 33,608 - - - 33,765

Share issue costs 9 - (1,419) - - - (1,419)

Share incentive

options 10 - - 2 - - 2

Purchase of own

shares 11 - - - (726) - (726)

----------------- ------------- ------------- ---------------- --------------- ---------------- ------------

As at 31 March

2020 1,164 224,437 2 (726) 42,203 267,080

----------------- ------------- ------------- ---------------- --------------- ---------------- ------------

Total

comprehensive

income after tax

for the year - - - - 29,911 29,911

Transactions with

owners:

Shares issued 9 621 137,879 - - - 138,500

Share issue costs 9 - (3,504) - - - (3,504)

Share incentive

options 10 - - 139 - - 139

Purchase of own

shares 11 - - - (10,732) - (10,732)

----------------- ------------- ------------- ---------------- --------------- ---------------- ------------

As at 31 March 2021 1,785 358,812 141 (11,458) 72,114 421,394

===================== ============= ============= ================ =============== ================ ============

Statement of Cash Flows

1 April 2020 1 April 2019

to to 31 March 2020

31 March 2021 USD'000

USD'000

Notes

======================================================= ============================ ===============================

Cash flows from operating activities

Profit after tax 29,911 12,509

Adjustments for:

Change in fair value of investment in uranium 4 (33,365) (15,714)

Change in fair value of uranium derivative

liability 7 774 (212)

Premium to spot price on disposal of uranium 4 (180) -

Share based payments 10 139 2

Loss/(gain) on foreign exchange 43 47

Interest income (3) (104)

--------------------------------------------------- ---------------------------- -------------------------------

Operating profit before changes in capital (2,681) (3,472)

--------------------------------------------------- ---------------------------- -------------------------------

Changes in working capital:

Increase in trade and other receivables (29) (73)

Increase in trade and other payables 3,216 14

--------------------------------------------------- ---------------------------- -------------------------------

Cash generated from/(used in) operating activities 506 (3,531)

--------------------------------------------------- ---------------------------- -------------------------------

Interest received 3 104

--------------------------------------------------- ---------------------------- -------------------------------

Cash generated from/(used in) operating activities 509 (3,427)

--------------------------------------------------- ---------------------------- -------------------------------

Cash flows from investing activities

Purchase of uranium 4 (15,025) (30,409)

Proceeds of sale of uranium 4 9,960 -

--------------------------------------------------- ---------------------------- -------------------------------

Net cash used in investing activities (5,065) (30,409)

--------------------------------------------------- ---------------------------- -------------------------------

Cash flows from financing activities

Proceeds from issue of shares 9 138,500 33,765

Issue costs paid 9 (3,504) (1,419)

Share buyback programme 11 (10,732) (726)

--------------------------------------------------- ---------------------------- -------------------------------

Net cash generated from financing activities 124,264 31,620

--------------------------------------------------- ---------------------------- -------------------------------

Net increase/(decrease) in cash and cash

equivalents during the year 119,708 (2,216)

Cash and cash equivalents at the beginning of the

year 6,481 8,750

Effect of exchange rate changes (30) (53)

--------------------------------------------------- ---------------------------- -------------------------------

Cash and cash equivalents at the end of the year 126,159 6,481

=================================================== ============================ ===============================

Notes to the Financial Statements

For the year ended 31 March 2021

1. General information

Yellow Cake plc (the "Company") was incorporated in Jersey,

Channel Islands on 18 January 2018. The address of the registered

office is Liberation House, Castle Street, St Helier, Jersey, JE1

2LH.

The Company operates in the uranium sector and was created to

purchase and hold U(3) O(8) . The strategy of the Company is to

invest in long-term holdings of U(3) O(8) and not to actively

speculate with regards to short-term changes in the price of U(3)

O(8) .

The Company was admitted to list on the London Stock Exchange

AIM market ("AIM") on 5 July 2018.

2. Summary of significant accounting policies

Basis of preparation

The financial information has been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006.

In accordance with Section 105 of The Companies (Jersey) Law

1991, the Company confirms that the financial information for the

period ended 31 March 2021 is derived from the Company's audited

financial statements and that these are not statutory accounts and,

as such, do not contain all information required to be disclosed in

the financial statements prepared in accordance with International

Financial Reporting Standards ("IFRS").

The statutory accounts for the period ended 31 March 2021 have

been audited and approved, but have not yet been filed.

The Company's audited financial statements for the period ended

31 March 2021 received an unqualified audit opinion and the

auditor's report contained no statement under section 113B (3) and

(6) of The Companies (Jersey) Law 1991.

The financial information contained within this preliminary

statement was approved and authorised for issue by the Board on 18

July 2021.

The principal accounting policies adopted are set out below.

New and revised standards

At the date of approval of these financial statements there are

no new or revised standards that are in issue but not yet effective

and are relevant to the financial statements of the Company.

The principal accounting policies adopted are set out below.

Going concern

The Directors, having considered the Company's objectives and

available resources along with its projected income and expenditure

for at least twelve months from the date of approval of the audited

financial statements, are satisfied that the Company has adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, the directors have adopted the going concern

basis in preparing these audited financial statements.

The COVID-19 pandemic has had a material impact on the general

economy and a number of the Company's counterparties. The Company's

operations however continue to remain unaffected by COVID-19, given

that it has no physical operations and the executive team is

already home-based. The Company's key service providers have put in

place effective business continuity plans that have enabled them to

continue with the provision of all key support services that were

provided to the Company prior to the pandemic outbreak.

After taking into account the Company's post year end

commitments to purchase USD109,999,982 of U(3) O(8) and to sell

USD10,000,000 of U(3) O(8) , the Company considered that as at 31

March 2021 it had sufficient cash balances to meet approximately

4.5 years of working capital requirements before it would need to

raise additional funds. The Company has no debt or hedge

liabilities on its balance sheet.

On 21 June 2021, after year end, the Company issued 25 million

new ordinary shares raising net proceeds of GBP60.6 million (USD

equivalent: 84.0 million net of costs of USD2.9 million. The

Company will apply the net proceeds to the purchase of additional

uranium and towards working capital and general corporate

purposes.

The Company aims to retain three years' of working capital

requirements following an equity issuance and may therefore apply

some of its cash balances which are in excess of three years'

working capital requirements to the purchase of additional uranium,

subject to value.

Sale of uranium and uranium swaps

The income in respect of disposals of uranium is recognised at

the point when the significant risks and rewards of ownership and

legal title have been transferred to the buyer. At the point of

disposal the carrying value of the uranium, being the spot price,

is derecognised from the balance sheet.

The gain or loss on disposal of uranium is calculated as the

difference between the sale price and the carrying value, being the

spot price, at the point of sale. This gain or loss is reflected as

a premium or discount to the spot price on a separate line in the

statement of comprehensive income during the period in which the

disposal occurs.

The Company has entered into certain uranium location swap

agreements under which it has agreed to exchange, by way of book

transfer, an equal quantity of uranium between specified storage

facilities. In certain instances, the location swap is temporary

and the uranium will be swapped back to the original location at

the end of an agreed term. Where the swap is temporary and for a

fixed term, the income which the Company is entitled to receive in

consideration for the swap is recognised over the term of the swap,

in line with the substance of the transaction and delivery of the

related performance obligations.

Investments in uranium

Acquisitions of U(3) O(8) are initially recorded at cost net of

transaction costs incurred and are recognised in the Company's

statement of financial position on the date the risks and rewards

of ownership pass to the Company, which is the date that the legal

title to the uranium passes.

After initial recognition, investments in U(3) O(8) are measured

at fair value based on the most recent month-end spot price for

U(3) O(8) published by UxC LLC.

IFRS lacks specific guidance in respect of accounting for

investments in uranium. As such the Directors of the Company have

considered the requirements of International Accounting Standard 1

"Presentation of Financial Statements" and International Accounting

Standard 8 "Accounting Policies, Changes in Accounting Estimates

and Errors" to develop and apply an accounting policy. The

Directors of the Company consider that measuring the investment in

U(3) O(8) at fair value provides information that is most relevant

to the economic decision-making of users. This is consistent with

International Accounting Standard 40 Investment Property, which

allows for assets held for long-term capital appreciation to be

presented at fair value.

Foreign currency translation Functional and presentation

currency

The financial statements are presented in United States Dollars

("USD") which is also the functional currency of the Company.

These financial statements are presented to the nearest round

thousand, unless otherwise stated.

Foreign currency translation

Transactions denominated in foreign currencies are translated

into USD at the rate of exchange ruling at the date of the

transaction.

Monetary assets and liabilities denominated in foreign

currencies at the reporting date are translated into USD at the

rate of exchange ruling at the reporting date. Foreign exchange

gains or losses arising on translation are recognised through

profit or loss in the statement of comprehensive income.

Financial instruments

Financial assets and financial liabilities are recognised when

the Company becomes a party to the contractual provisions of the

instrument. The Company shall offset financial assets and financial

liabilities if the Company has a legally enforceable right to set

off the recognised amounts and intends to settle on a net

basis.

The carrying amount of the Company's financial assets and

financial liabilities are a reasonable approximation of their fair

values due to the short-term nature of these instruments.

Financial assets

The Company's financial assets comprise trade and other

receivables. These assets are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. They are initially recognised at fair value and

subsequently carried at amortised cost using the effective interest

method, less any provision for impairment.

Cash and cash equivalents comprise cash in hand and short-term

deposits in banks with an original maturity of three months or

less.

Financial liabilities

The Company's financial liabilities comprise trade and other

payables. They are initially recognised at fair value and

subsequently carried at amortised cost using the effective interest

method.

The Company also recognised a derivative financial liability in

the scope of IFRS 9. This financial instrument is recognised at

fair value and value changes are recognised in profit and loss.

Fair value has been determined based on the expected option payoff

using a Monte Carlo simulation produced by an independent financial

valuation company.

Share capital

The Company's ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of shares are

recognised in equity as a deduction from proceeds of the share

issue.

Treasury shares

The Company's treasury shares are classified as equity. Treasury

shares are accounted for at cost and shown as a deduction from

equity in a separate reserve.

Share-based payments

Where the Company issues equity instruments to external parties

or employees as consideration for services received, the statement

of comprehensive income is charged with the fair value of the goods

and services received, except where services are directly

attributable to the issue of shares, in which case the fair value

of such amounts is recognised in equity as a deduction from share

premium.

Equity-settled transactions are awards of shares, or options

over shares that are provided to employees in exchange for the

rendering of services.

Equity-settled transactions are measured at fair value on grant

date. Fair value is independently determined using a Black-Scholes

option pricing model that takes into account the exercise price,

the term of the option, the impact of dilution, the share price at

grant date and expected price volatility of the underlying share,

the expected dividend yield and the risk free interest rate for the

term of the option, together with non-vesting conditions that do

not determine whether the consolidated entity receives the services

that entitle the employees to receive payment. No account is taken

of any other vesting conditions.

The cost of equity-settled transactions is recognised as an

expense with a corresponding increase in equity over the vesting

period. The cumulative charge to profit or loss is calculated based

on the grant date fair value of the award, the best estimate of the

number of awards that are likely to vest and the expired portion of

the vesting period. The amount recognised in profit or loss for the

period is the cumulative amount calculated at each reporting date

less amounts already recognised in previous periods.

Market conditions are taken into consideration in determining

fair value. Therefore any awards subject to market conditions are

considered to vest irrespective of whether or not that market

condition has been met, provided all other conditions are

satisfied.

If equity-settled awards are modified, as a minimum an expense

is recognised as if the modification has not been made. An

additional expense is recognised, over the remaining vesting

period, for any modification that increases the total fair value of

the share-based compensation benefit as at the date of

modification.

If the non-vesting condition is within the control of the

Company or employee, the failure to satisfy the condition is

treated as a cancellation. If the condition is not within the

control of the Company or employee and is not satisfied during the

vesting period, any remaining expense for the award is recognised

over the remaining vesting period, unless the award is

forfeited.

If an equity-settled award is cancelled, it is treated as if it

has vested on the date of cancellation, and any remaining expense

is recognised immediately. If a new replacement award is

substituted for the cancelled award, the cancelled and new awards

are treated as if they were a modification.

Taxation

As the Company is managed and controlled in Jersey it is liable

to be charged to tax at a rate of 0% under schedule D of the Income

Tax (Jersey) Law 1961 as amended.

Expenses

Expenses are accounted for on an accruals basis.

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker is responsible for allocating

resources and assessing performance of the operating segments and

has been identified as the Board of Directors of the Company.

The Company is organised into a single operating segment being

the holding of U(3) O(8) for long-term capital appreciation.

Critical accounting judgments and estimation uncertainty

The preparation of financial statements requires management to

make judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances. Revisions to accounting estimates are recognised in

the year in which the estimate is revised and in any future years

affected.

The resulting accounting estimates will, by definition, seldom

equate to the related actual results.

Accounting estimates

The accounting estimates in the year are the assumptions made in

valuing the derivative financial liability. These assumptions are

set out in note 7 and the carrying value of the derivative

financial liability is USD3,361,000 as at 31 March 2021 (31 March

2020: USD2,587,000).

Judgements

The directors have considered the tax implications of the

Company's operations and have reached judgement that no tax

liability has arisen during the year (period ended 31 March 2020:

USD nil).

3. MANAGEMENT OF FINANCIAL RISKS

Financial risk factors

The Company's financial assets and liabilities comprise of cash,

derivatives, receivables and payables that arise directly from its

operations. The accounting policies in note 2 include criteria for

the recognition and the basis of measurement applied for financial

assets and liabilities. Note 2 also includes the basis on which

income and expenses arising from financial assets and liabilities

are recognised and measured.

The Company's assets and liabilities have been primarily

categorised as assets and liabilities at amortised cost, with the

exception of the investment in uranium and derivative financial

liability being held at fair value. The carrying amounts of all

such instruments are as stated in their respective notes.

Market risk

The fair value or future cash flows of a financial instrument

may fluctuate because of changes in market prices. This market risk

comprises two elements - interest rate risk and other price risk

and arises mainly from the changes in values of the investment of

uranium and derivatives.

Interest rate risk

Any cash balances are held on variable rate bank accounts or in

money market funds yielding rates of interest dependent on the base

rate of the applicable institution or fund return.

Price risk and sensitivity

If the value of the investment in uranium fell by 5% at the year

end, the profit after tax would decrease by USD15,104,910.

Likewise, if the value rose by 5% the profit after tax would have

increased by USD15,104,910.

Economic Risk

The COVID-19 pandemic is an ongoing situation and will continue

to have a significant impact on the global economy and many

businesses across the world. The Company's operations however

continue to remain unaffected by COVID-19, given that it has no

physical operations and the executive team is already home-based.

The Company's key service providers have put in place effective

business continuity plans that have enabled them to continue with

the provision of all key support services that were provided to the

Company prior to the pandemic outbreak.

Liquidity risk

This is the risk that the Company will encounter in realising

assets or otherwise raising funds to meet financial commitments.

Prudent liquidity risk management involves maintaining sufficient

liquidity and short-term investment securities, being able to raise

funds based on suitably adapted lines of credit and a capacity to

unwind market positions.

At year end, the liquidity of the Company is composed of either

bank account or bank deposits, for a total amount of USD126,159,065

(31 March 2020: USD6,480,946).

Carrying amount < 1 year 1 to 2 years 2 to 10 years

As at 31 March 2021 USD'000 USD'000 USD'000 USD'000

============================= =============== ================= ============ =============

Cash and cash equivalents 126,159 126,159 - -

Other creditors and accruals (3,621) (3,621) - -

As at 31 March 2020 USD'000 USD'000 USD'000 USD'000

============================= =============== ================= ============ =============

Cash and cash equivalents 6,481 6,481 - -

Other creditors and accruals (392) (392) - -

============================= =============== ================= ============ =============

Fair value estimation

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date, regardless of whether

that price is directly observable or estimated using another

valuation technique. In estimating the fair value of an asset or

liability, the Company takes into account the

characteristics of the asset or liability at the measurement

date. IFRS 13 requires the Company to classify fair value

measurements using fair value hierarchy that reflects the

significance of the inputs used in making the measurements. The

fair value hierarchy has the following levels:

1 Quoted prices (unadjusted) in active markets for identical

- assets or liabilities (level 1);

2 Inputs other than quoted prices included within level

- 1 that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is,

derived from prices) (level 2); and

3 Inputs for the asset or liability that are not based on

- observable market data (that is, unobservable inputs)

(level 3).

The level to the fair value hierarchy within which the fair

value measurement is categorised in its entirety is determined on

the basis of the lowest level input that is significant of an input

is assessed against the fair value measurement in its entirety. If

a fair value measurement uses observable inputs that require

significant adjustment based on unobservable inputs, that

measurement is a level 3 measurement. Assessing the significance of

a particular input to the fair value measurement in its entirety

requires judgement, considering factors specific to the asset or

liability. The following table analyses within the fair value

hierarchy the Company's financial assets and liabilities (by class)

measured at fair value.

Assets and liabilities Level 1 Level 2 Level 3 Total

As at 31 March 2021 USD'000 USD'000 USD'000 USD'000

============================= ======= ================= ======= =======

Investment in uranium 302,098 - - 302,098

Uranium derivative liability - (3,361) - (3,361)

As at 31 March 2020

============================= ======= ================= ======= =======

Investment in uranium 263,489 - - 263,489

Uranium derivative liability - (2,587) - (2,587)

============================= ======= ================= ======= =======

4. Investment in uranium

Fair Value

USD'000

As at 31 March 2019 217,366

======================= ===========

Purchase of U(3) O(8) 30,409

Change in fair value 15,714

----------------------- -----------

As at 31 March 2020 263,489

----------------------- -----------

Purchase of U(3) O(8) 15,024

Change in fair value 33,365

Sale of U(3) O(8) (9,780)

----------------------- -----------

As at 31 March 2021 302,098

======================= ===========

The value of the Company's investment in U(3) O(8) is based on

the month end spot price for U(3) O(8) of USD30.65/lb as published

by UxC LLC on 29 March 2021 (2020: USD27.40/lb as published by UxC

LLC on 30 March 2020).

Purchase of uranium

The Company has purchased a total of 10,156,385 lb of U(3) O(8)

at an average price of USD22.01/lb. The total cash consideration

for the purchases was USD223,588,600 made up as follows:

- Purchase of 8,091,385 lb of U (3) O(8) from Kazatomprom

at IPO on 5 July 2018 for a cash consideration of USD170,000,000

under a 10-year Framework Agreement (the "Initial Purchase").

- A second purchase of 350,000 lb from Kazatomprom for a cash

consideration of USD8,155,000.

- A third purchase of 1,175,000 lb from Kazatomprom on 31

May 2019 under the Framework Agreement for a cash consideration

of USD30,409,000.

- On 23 March 2021, the Company purchased 440,000 lb of U(3)

O(8) for a cash consideration of USD12,029,600.

- On 30 March 2021, the Company purchased a further 100,000

lb of U(3) O(8) for a cash consideration of USD2,995,000.

Post year-end purchases of uranium

On 3 March 2021, the Company committed to purchase a further

3,454,231 lb of U(3) O(8) from Kazatomprom under the Framework

Agreement for a cash consideration of USD99,999,987. The Company

took delivery of the uranium on 21 June 2021, at which point legal

title passed to the Company.

On 20 May 2021, the Company completed the purchase of and took

title to 343,053 lb of U(3) O(8) in the market at a price of

USD29.15/lb for total consideration of USD9,999,995.

In July 2021, the Company concluded agreements to purchase a

further 550,000 lb of U(3) O(8) in the spot market at an average

price of USD32.35/lb for a total consideration of USD17.8 million.

The Company will take delivery of this uranium between July and

August 2021.

The Company expects to conclude an agreement with Kazatomprom to

purchase a further 2.0 million lb of U(3) O(8) at a price of

USD32.23/lb for a total consideration of USD64.5 million for

delivery between October and December 2021, pursuant to

Kazatomprom's offer of 12 June 2021.

Location swaps

Since May 2018, Yellow Cake has held an account with Cameco

Corporation ("Cameco") for the storage of uranium owned by the

Company at Cameco's facilities at Blind River and Port Hope,

Ontario in Canada.

On 15 November 2019, the Company entered into an agreement with

Orano Cycle ("Orano") to open a holding account for the storage of

uranium owned by the Company at Orano's conversion facility at the

Malvési and Tricastin sites in France.

During the year, the Company entered into the following location

swap transactions:

1) On 3 April 2020, a location swap agreement was entered into

to exchange 100,000 lb of U(3) O(8) , earning an exchange

fee of USD20,000. On 20 April 2020, the Company transferred

100,000 lb of U(3) O(8) from the Cameco facility to the

Orano facility in satisfaction of its obligations under

this location swap agreement.