TIDMYCA

RNS Number : 3677G

Yellow Cake PLC

26 July 2021

26 July 2021

Yellow Cake plc ("Yellow Cake" or the "Company")

Grant and Exercise of Share Options

Yellow Cake plc (the "Company") , a nnounces the grant of share

options over the Company's ordinary shares on 26 July 2021 under

the Rules of the Yellow Cake plc Share Option Plan 2019 to the

Chief Executive Officer and the Chief Financial Officer, as part of

the annual bonus award in respect of the year to 31 March 2020

("Options"). The Company also announces the exercise of all of the

Options on the same date.

The annual bonus award, described in the Company's 2020 Annual

Report, was divided into two tranches, both with a vesting date of

8 July 2021. The grant of the first tranche was made on 8 July 2020

and the second tranche was granted today. Further detail on the

award and grant can be seen in the Company's 2020 Annual Report,

which also includes the performance criteria for the 2020 annual

bonus calculation, as well as in the Company's 2021 Annual Report

published this morning(1) . The Options have an exercise price of 1

pence per share and expire 6 months after the vesting date.

Details of the Options and the resultant shareholdings are set

out below:

PDMR Position Options Granted on 26 Exercise of Options Resultant total number

July 2021 granted on 8 July 2020 of Ordinary Shares

and granted on 26 July owned*

2021

Andre Liebenberg Chief Executive Officer 20,879 48,271 121,478

----------------------- ----------------------- -----------------------

Carole Whittall Chief Financial Officer 16,703 38,616 49,918

----------------------- ----------------------- -----------------------

(*) Includes previous direct share purchases.

This notification is made under Article 19 of the UK Market

Abuse Regulation.

1. Details of the person discharging managerial responsibilities / person closely associated

a. Name Andre Liebenberg

--------------------------------------------------------- -------------------------------------------

2. Reason for the notification

------------------------------------------------------------------------------------------------------

a. Position/status Chief Executive Officer

--------------------------------------------------------- -------------------------------------------

b. Initial notification /Amendment Initial notification

--------------------------------------------------------- -------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

------------------------------------------------------------------------------------------------------

a. Name Yellow Cake plc

--------------------------------------------------------- -------------------------------------------

b. LEI 213800CVMYUGOA9EZY95

--------------------------------------------------------- -------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

------------------------------------------------------------------------------------------------------

a. Description of the financial instrument, type of Ordinary Shares

instrument, identification code ISIN Code JE00BF50RG45

--------------------------------------------------------- -------------------------------------------

b. Nature of the transaction Grant of Options

--------------------------------------------------------- -------------------------------------------

c. Price(s) and volume(s) Exercise price: 1.0 p per share 20,879

options

--------------------------------------------------------- -------------------------------- ---------

d. Aggregated information

* Aggregated volume As for c above

* Price

--------------------------------------------------------- -------------------------------------------

e. Date of the transaction 26 July 2021

--------------------------------------------------------- -------------------------------------------

f. Place of the transaction Off market

--------------------------------------------------------- -------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

g. Description of the financial Ordinary Shares

instrument, type of instrument, ISIN Code JE00BF50RG45

identification code

--------------------------------- -------------------------------------------------------------------------

h. Nature of the transaction Exercise of Options granted on 8 July 2020 and granted on 26 July 2021

--------------------------------- -------------------------------------------------------------------------

i. Price(s) and volume(s) Exercise price: 1.0 p per share 48,271

options

--------------------------------- -------------------------------------------------------- ---------------

j. Aggregated information

* Aggregated volume As for c above

* Price

--------------------------------- -------------------------------------------------------------------------

k. Date of the transaction 26 July 2021

--------------------------------- -------------------------------------------------------------------------

l. Place of the transaction Off market

--------------------------------- -------------------------------------------------------------------------

1. Details of the person discharging managerial responsibilities / person closely associated

a. Name Carole Whittall

--------------------------------------------------------- -------------------------------------------

2. Reason for the notification

------------------------------------------------------------------------------------------------------

a. Position/status Chief Financial Officer

--------------------------------------------------------- -------------------------------------------

b. Initial notification /Amendment Initial notification

--------------------------------------------------------- -------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

------------------------------------------------------------------------------------------------------

a. Name Yellow Cake plc

--------------------------------------------------------- -------------------------------------------

b. LEI 213800CVMYUGOA9EZY95

--------------------------------------------------------- -------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

------------------------------------------------------------------------------------------------------

a. Description of the financial instrument, type of Ordinary Shares

instrument, identification code ISIN Code JE00BF50RG45

--------------------------------------------------------- -------------------------------------------

b. Nature of the transaction Grant of Options

--------------------------------------------------------- -------------------------------------------

c. Price(s) and volume(s) Exercise price: 1.0 p per share 16,703

options

--------------------------------------------------------- -------------------------------- ---------

d. Aggregated information

* Aggregated volume As for c above

* Price

--------------------------------------------------------- -------------------------------------------

e. Date of the transaction 26 July 2021

--------------------------------------------------------- -------------------------------------------

f. Place of the transaction Off market

--------------------------------------------------------- -------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

g. Description of the financial Ordinary Shares

instrument, type of instrument, ISIN Code JE00BF50RG45

identification code

--------------------------------- -------------------------------------------------------------------

h. Nature of the transaction Exercise of Options granted on 8 July 2020 and granted on 26 July

2021

--------------------------------- -------------------------------------------------------------------

i. Price(s) and volume(s) Exercise price: 1.0 p per share 38,616

options

--------------------------------- -------------------------------------------------- ---------------

j. Aggregated information

* Aggregated volume As for c above

* Price

--------------------------------- -------------------------------------------------------------------

k. Date of the transaction 26 July 2021

--------------------------------- -------------------------------------------------------------------

l. Place of the transaction Off market

--------------------------------- -------------------------------------------------------------------

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

+44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

Henry Fitzgerald-O'Connor James Asensio

Georgina McCooke

+ 44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Wyllie

Varun Talwar Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Media/Investor Relations: Powerscourt

Peter Ogden

+44 (0) 779 3 85 8211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide ("U(3) O(8) "). It may also seek to add value through the

acquisition of uranium royalties and streams or other uranium

related activities. Yellow Cake seeks to generate returns for

shareholders through the appreciation of the value of its holding

of U(3) O(8) and its other uranium related activities in a rising

uranium price environment. The business is differentiated from its

peers by its ten-year Framework Agreement for the supply of U(3)

O(8) with Kazatomprom, the world's largest uranium producer. Yellow

Cake currently holds 13.31 million lb of U(3) O(8) , all of which

is held in storage in Canada and France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

[1] The Company's Annual Results Announcement on 19 July

included an incorrect reference in Note 10 to the Options grant

being deferred to after the Company's Annual General Meeting on 8

September 2021. For the avoidance of doubt the Option grant was

agreed by the Company's Remuneration Committee to occur today, 26

July 2021 as also stated in Note 10 of the Annual Report published

today.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHRAMLTMTTTBRB

(END) Dow Jones Newswires

July 26, 2021 02:01 ET (06:01 GMT)

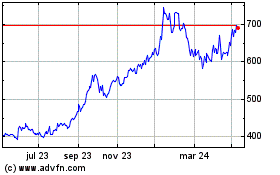

Yellow Cake (LSE:YCA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

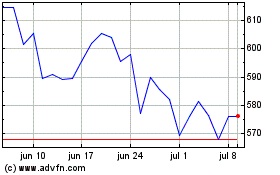

Yellow Cake (LSE:YCA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024