Zegona Communications PLC Notice of GM (9383G)

29 Julio 2021 - 6:00AM

UK Regulatory

TIDMZEG

RNS Number : 9383G

Zegona Communications PLC

29 July 2021

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR TO ANY US PERSON, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA

(OTHER THAN SPAIN) OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona")

LEI: 213800ASI1VZL2ED4S65

29 JULY 2021

NOTICE OF GENERAL MEETING

On 24 May 2021, the Board announced that if the sale of its

investment in Euskaltel to MásMóvil is successful it plans to

return GBP335 million in cash to Shareholders.

On 23 July 2021, Zegona began this return of cash to

shareholders with a GBP5.7 million dividend payment. After payment

of this dividend, Zegona's commitment, assuming the successful sale

of its investment in Euskaltel, is now to return the balance of the

GBP335 million, being at least GBP329,306,778 (the "Return of

Capital").

If the sale is successful, the Board is seeking to complete the

Return of Capital as soon as is reasonably practicable once the

funds have been received. The Board has determined, following

advice from its legal advisers, that the mechanism it should use is

an on-market share buyback by way of a tender offer because the

Directors believe this offers the best combination of timeliness,

cost effectiveness and tax efficiency. The Return of Capital is

therefore expected to follow a similar structure to the one that

the Company used in 2017, subject to any changes required as a

result of changes in law or regulation or market practice.

As Shareholders will be aware, MásMóvil's takeover bid for

Euskaltel has not yet completed and is subject to a number of

conditions. The acceptance period for the takeover is currently

expected to run to 30 July 2021 and, were the takeover to become

wholly unconditional, sale proceeds would be expected to be

received by Zegona before the end of the second week of August

2021.

Whilst there is no guarantee that the MásMóvil Offer will

complete, the Board is sufficiently confident that it will do so

that it is taking steps now to reduce the Company's share premium

account from GBP95,339,759 to GBP100,000 (the "Capital Reduction")

to prepare for the Return of Capital.

In order to obtain the necessary Shareholder approvals for the

proposed Capital Reduction, Zegona announces that the following

documents have today been posted to Shareholders:

-- a Circular containing a Notice of General Meeting (the

"Circular"); and

-- a Form of Proxy for the General Meeting.

The above documents will be submitted to the Financial Conduct

Authority via the National Storage Mechanism and will shortly be

available to the public for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

These documents will also be available on the Company's website

at

https://www.zegona.com//media/files/z/zegona/shareholder-information-disclaimer-docs/210729-shareholder-circular.pdf

, subject to certain access restrictions.

The General Meeting will be held at Travers Smith LLP, 10 Snow

Hill, London EC1A 2AL at 10:30 a.m. on 20 August 2021.

Capitalised terms used but not defined in this announcement

shall have the meanings set out in the Circular.

Enquiries

Tavistock (Public Relations adviser - UK)

Tel: +44 (0)20 7920 3150

Jos Simson / Lulu Bridges

IMPORTANT NOTICES

This announcement has been prepared in accordance with English

law, the Listing Rules and the Disclosure Guidance and Transparency

Rules and information disclosed may not be the same as that which

would have been prepared in accordance with the laws of

jurisdictions outside England.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGKZGZNGLFGMZM

(END) Dow Jones Newswires

July 29, 2021 07:00 ET (11:00 GMT)

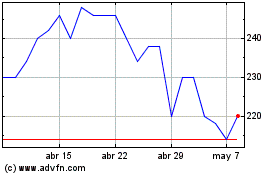

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024