TIDMZEG

RNS Number : 5315I

Zegona Communications PLC

13 August 2021

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR TO ANY US PERSON, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF

SOUTH AFRICA OR ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA

(OTHER THAN SPAIN) OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona" or the "Company")

LEI: 213800ASI1VZL2ED4S65

13 august 2021

ZEGONA ANNOUNCES TER OFFER AT GBP1.535 PER SHARE

London, England, 13 August 2021 - Zegona announces the

publication of a circular (the "Circular") for a return of up to

GBP329.3 million to shareholders by way of a tender offer at a

price of GBP1.535 per share (the "Tender Offer")

Tender Offer delivers on Zegona's commitment to return capital

to shareholders after selling its investment in Euskaltel

-- On 24 May 2021, Zegona announced that on the successful

sale of its investment in Euskaltel to MásMóvil,

it would return GBP335 million in cash to Shareholders.

-- On 23 July 2021, Zegona began this return of cash to shareholders

with a GBP5.7 million dividend payment.

-- Following this dividend and the successful sale of its

investment in Euskaltel, Zegona's commitment is now to

return the balance of the GBP335 million, being at least

GBP329.3 [1] million and will do so through a Tender Offer,

-- The Tender Offer is a straightforward mechanism to return

this capital quickly and tax efficiently.

-- Today Zegona has published a Circular detailing the Tender

Offer and the required General Meeting.

-- Under the Tender Offer, each qualifying holder of Zegona's

ordinary shares (the "Shares") will be entitled to sell

approximately 98.0% of their Shares (their "Tender Offer

Entitlement") at a price of GBP1.535 per Share.

-- Shareholders may tender more than their Tender Offer Entitlement

and will be allocated a pro rata portion of any Tender

Offer Entitlement not used by other shareholders.

-- The Tender Offer will close on 5 October 2021 with cash

payments expected shortly thereafter.

Eamonn O'Hare, Zegona's Chairman and CEO commented: "Today,

Zegona is delivering on its commitment to return GBP335 million to

shareholders quickly and tax efficiently. We believe that combined

with the dividend we paid in July, this tender offer represents an

attractive return on investment for our shareholders.

We continue to see good potential to deliver attractive

shareholder returns. We intend to continue executing Zegona's

original strategy and we are actively developing a number of new

investment opportunities in the European TMT industry where we

believe we can again successfully apply our innovative 'Buy Fix

Sell' strategy"

Enquiries

Tavistock (Public Relations adviser - UK)

Tel: +44 (0)20 7920 3150

Jos Simson / Lulu Bridges - jos.simson@tavistock.co.uk /

lulu.bridges@tavistock.co.uk

FURTHER INFORMATION

On 24 May 2021, the Board announced that if the sale of its

investment in Euskaltel to MásMóvil is successful it plans to

return GBP335 million in cash to shareholders.

On 23 July 2021, Zegona began this return of cash to

shareholders with a GBP5.7 million dividend payment. After payment

of this dividend, Zegona's commitment is now to return the balance

of the GBP335 million, being at least GBP329.3 [2] million (the

"Return of Capital"). As announced on 29 July 2021, Zegona has

initiated steps to reduce the Company's share premium account to

prepare for the Return of Capital.

As shareholders will be aware, MásMóvil's takeover bid for

Euskaltel has become wholly unconditional and the sale proceeds

have now been received.

Launch of Tender Offer

The Board confirms today the launch of the Tender Offer (further

details of which are set out below), at a price of GBP1.535 per

Share (the "Tender Price"), in order to effect the Return of

Capital. Under the Tender Offer, each Qualifying Shareholder will

be entitled to sell approximately 98.0% of their Shares at the

Tender Price (their "Basic Tender Offer Entitlement"). Qualifying

Shareholders may tender more than their Tender Offer Entitlement,

up to 100% of their Shares, and will be allocated a pro rata

portion of any Tender Offer Entitlement not used by other

shareholders for these additional Shares tendered.

Publication of Circular and Notice of General Meeting

In order to explain the details of the Tender Offer and obtain

the necessary shareholder approvals for the proposed Return of

Capital by way of the Tender Offer, and in order to enable

Qualifying Shareholders to confirm their intentions in respect of

the Tender Offer, Zegona announces that the following documents

have today been posted to shareholders:

-- a circular setting out details of the Tender Offer and

containing a Notice of General Meeting at which shareholder

approval for the Tender Offer will be sought (the "General

Meeting");

-- Tender Forms in respect of the US Tender Offer and the

Non-US Tender Offer; and

-- a Form of Proxy for the General Meeting.

The above documents will be submitted to the Financial Conduct

Authority via the National Storage Mechanism and will shortly be

available to the public for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

These documents will also be available on the Company's website

at

https://www.zegona.com//media/files/z/zegona/shareholder-information-disclaimer-docs/210812-shareholder-circular.pdf

, subject to certain access restrictions.

The General Meeting will be held at Travers Smith LLP, 10 Snow

Hill, London EC1A 2AL at 11:00 a.m. on 6 September 2021.

Capitalised terms used but not defined in this announcement

shall have the meanings set out in the Circular.

Details of the Tender Offer as a whole

The Tender Offer is comprised of the Non-US Tender Offer (which

is being conducted by Canaccord Genuity Limited ("Canaccord")) and

the US Tender Offer (which is being conducted by Zegona). Although

the Non-US and US Tender Offers are being conducted on

substantially the same terms, certain specific details relating to

each are set out below, together with a timetable of key events in

respect of the Tender Offer.

Each Qualifying Shareholder will be entitled to sell all, or

part, of their Basic Tender Offer Entitlement under the Tender

Offer at the Tender Price. Each Qualifying Shareholder may also

tender more than their Basic Tender Offer Entitlement under the

Tender Offer and that may be acquired depending on the actions of

other Qualifying Shareholders.

The Tender Offer will close at 1.00 p.m. on 5 October 2021 and

tenders received after that time will not be accepted unless

otherwise approved by both Canaccord and Zegona. It is expected

that Qualifying Shareholders who successfully tender their Shares

will receive payment for such Shares on or before 14 October

2021.

The Tender Offer is subject to, amongst other things, the

passing of the special resolution at the General Meeting to approve

and authorise the Tender Offer (the "Resolution").

Details of the Non-US Tender Offer

Subject to certain conditions (including the Resolution being

passed at the General Meeting), the Non-US Tender Offer will be

implemented on the basis of Canaccord, acting as principal and not

as agent, nominee or trustee, acquiring the successfully tendered

Shares under the Non-US Tender Offer and a subsequent repurchase of

the tendered Shares from Canaccord by the Company by way of an

on-market transaction on the London Stock Exchange, in both cases

at the Tender Price (the "Repurchase"). To give effect to these

arrangements, Canaccord has entered into a Put and Call Option

Agreement with the Company. Shares Repurchased in connection with

the Non-US Tender Offer will be cancelled.

Details of the US Tender Offer

Subject to certain conditions (including the Resolution being

passed at the General Meeting), the US Tender Offer will be

implemented directly by the Company (or an agent of the Company),

by way of an on-market transaction on the London Stock Exchange at

the Tender Price. Shares successfully tendered to it in connection

with the US Tender Offer will be cancelled. The US Tender Offer

will be open solely to those US Shareholders on the Register on the

Record Date who are both "qualified institutional buyers" as

defined in Rule 144A under the US Securities Act of 1933, as

amended, and "qualified purchasers" as defined in Section 2(a)(51)

of the US Investment Company Act of 1940, as amended.

EXPECTED TIMETABLE

All dates 2021

Publication of the Circular 13 August

Tender Offer opens 13 August

Latest time and date for receipt of Forms 11.00 a.m. on 2 September

of Proxy

Time and date of General Meeting 11.00 a.m. on 6 September

Outcome of General Meeting announced by 6 September

Publication of interim results on or before 30 September

Latest time and date for receipt of Tender 1.00 p.m. on 5 October

Forms and TTE Instructions from CREST Shareholders

(i.e. close of Tender Offer)

Record date for the Tender Offer 6.00 p.m. on 5 October

Outcome of Tender Offer announced by 6 October

Purchase of Shares under the Tender Offer 7 October

Cheques despatched for certificated Shares By 14 October

purchased pursuant to the Tender Offer, payment

through CREST for uncertificated Shares purchased

pursuant to the Tender Offer, despatch of

balance share certificates for unsold certificated

Shares and CREST accounts credited with uncertificated

Shares being returned to Shareholders

Notes

The times and dates set out in the timetable above and

throughout the Circular that fall after the date of this

Announcement are based on the Zegona's current expectations and are

subject to change. Any changes to the timetable will be notified to

Shareholders by an announcement made by Zegona through a Regulatory

Information Service.

The timetable assumes that there is no adjournment of the

General Meeting. If the scheduled date for the General Meeting

changes, the revised date and/or time will be notified to

Shareholders by an announcement made by Zegona through a Regulatory

Information Service.

References to times in this document are to London time.

Update on other matters

As noted in the Company's announcement on 24 May 2021, as part

of its acquisition of Telecable in 2017, Euskaltel agreed to pay

Zegona a contingent consideration equal to 35% of the value of

Telecable's tax assets once these were confirmed as being available

for use by Euskaltel. Zegona had expected Euskaltel to pay this

contingent consideration no later than 15 days after the settlement

of the offer for Euskaltel at the value of EUR8.654 million, which

is the liability to Zegona recorded in Euskaltel's published

audited financial statements for the year ended 31 December 2020.

However, it became apparent that Euskaltel would seek to either

reduce and delay the payment to Zegona substantially or require

Zegona to deliver a financial or insurance instrument to transfer

any risk in the tax assets at Zegona's cost. Each of these

alternatives was not acceptable to Zegona, so it has sold the right

to the contingent payment for EUR6.4 million in cash.

As also noted in the Company's announcement on 24 May 2021, it

committed to return cash using the mechanism which the directors

believe offers the best combination of timeliness, cost

effectiveness and tax efficiency, which the directors have

concluded is a tender offer. This has resulted in forecast

additional costs of approximately GBP2 million, principally 0.5%

stamp duty payable on the acquisition of the shares, which will

reduce the net assets of the business following the completion of

the Tender Offer.

The impact of these two changes reduces the expected Net Asset

Value [3] of the Company immediately following the Tender Offer

(assuming it completes and is accepted in full) to approximately

GBP6.8 million, which is equivalent to approximately 3.1 pence per

share based on the number of shares currently outstanding [4] .

Zegona's management team has also committed to re-invest up to

GBP4 million of the incentive payment it will receive on completion

of the Tender Offer [5] , however the aggregate amount of this

investment will be scaled back pro rata if the shares to be issued

would otherwise exceed 28.1% of the issued share capital of the

Company at the time.

Current estimates for the expected Net Asset Value of the

Company following the completion of the Tender Offer would result

in the number of Shares subscribed for by Management being scaled

back. As a result, it is currently expected that the aggregate

subscription consideration for the shares to be subscribed by

Management will be approximately GBP2.7 million, and following such

subscription the Company would have free cash of approximately

GBP9.5 million.

IMPORTANT NOTICES

This announcement has been issued by, and is the sole

responsibility of, the Company.

This announcement has been prepared in accordance with English

law, the Listing Rules and the Disclosure Guidance and Transparency

Rules and information disclosed may not be the same as that which

would have been prepared in accordance with the laws of

jurisdictions outside England.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

Canaccord, which is authorised and regulated by the Financial

Conduct Authority, is acting exclusively for Zegona and for no one

else in connection with the Non-US Tender Offer and Canaccord, its

affiliates and its and their respective directors, officers,

employees and agents are not, and will not, be responsible to

anyone other than the Company for providing the protections

afforded to customers of Canaccord nor for providing advice in

relation to the Non-US Tender Offer. For the avoidance of doubt,

none of Canaccord, its affiliates and it and their respective

directors, officers, employees and agents will be responsible for,

or liable in relation to the US Tender Offer, any other

transaction, arrangement or other matter referred to in this

announcement, or the Circular, other than the Non-US Tender

Offer.

Apart from the responsibility and liabilities, if any, which may

be imposed on Canaccord by the Financial Services and Markets Act

2000 (as amended), the Financial Services Act 2012, or the

regulatory regimes established thereunder, Canaccord does not

accept any responsibility or liability whatsoever nor make any

representation or warranty, express or implied, concerning the

contents of this announcement or the Circular, including its

accuracy, completeness or verification, or for any other statement

made or purported to be made by it, or on its behalf, in connection

with the Company, the Non-US Tender Offer, the Circular or this

announcement. Each of Canaccord, its affiliates and their

respective directors, officers, employees and agents accordingly

disclaims all and any responsibility or liability whether arising

in tort, contract or otherwise (save as referred to above) which it

might otherwise have in respect of this announcement, the Circular

or any such statement.

The US Tender Offer is made solely by the Company. While the US

Tender Offer is being made available to US Shareholders, the right

to tender Shares is not being made available in any jurisdiction in

the United States in which the making of the US Tender Offer or the

right to tender Shares would not be in compliance with the laws of

such jurisdictions.

The US Tender Offer is being made for the securities of a UK

company and is subject to UK disclosure requirements, which are

different from those of the United States. The settlement procedure

with respect to the US Tender Offer will be consistent with UK

practice, which differs from US domestic tender offer procedures in

certain material respects, particularly with regard to date of

payment. US Shareholders should note that the Shares are not listed

on a US securities exchange and the Company is not subject to the

periodic reporting requirements of the US Securities Exchange Act

of 1934, as amended, (the "Exchange Act") and is not required to,

and does not, file any reports with the US Securities and Exchange

Commission thereunder. The US Tender Offer is not subject to the

disclosure and other procedural requirements of Regulation 14D

under the Exchange Act. The US Tender Offer will be made in

accordance with the requirements of Regulation 14E under the

Exchange Act to the extent applicable. Accordingly, the US Tender

Offer will be subject to disclosure and other procedural

requirements, including with respect to withdrawal rights, offer

timetable, settlement procedures and timing of payments that are

different from those applicable under US domestic tender offer

procedures and law.

Certain information in this announcement is based on management

estimates. By their nature, estimates may not be correct or

complete. Accordingly, no representation or warranty (express or

implied) is given that such estimates are correct or complete or

founded on reasonable grounds. No representation or warranty

(express or implied) is given that such estimates are founded on

reasonable grounds. Zegona does not undertake any obligation to

correct or complete any estimate whether as a result of being aware

of information (new or otherwise), future events or otherwise.

Cautionary Note Regarding Forward-Looking Information

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"envisages", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking

statements include matters that are not facts. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. A number of factors

could cause actual results and developments to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation changing business or other market

conditions and general economic conditions. These and other factors

could adversely affect the outcome and financial effects of the

plans and events described in this announcement. Forward-looking

statements contained in this announcement based on past trends or

activities should not be taken as a representation that such trends

or activities will continue in the future. Subject to any

requirement under the Listing Rules, Prospectus Regulation Rules,

the Disclosure Guidance and Transparency Rules or other applicable

legislation or regulation, Zegona does not undertake any obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Investors

should not place undue reliance on forward-looking statements,

which speak only as of the date of this announcement.

[1] GBP329,306,778

[2] GBP329,306,778

[3] Adjusted to remove the non-current tax receivable of GBP4.4

million which is dependent on a successful appeal by Zegona in

respect of the tax paid by Zegona to HMRC on 4 March 2021 relating

to the UK's Controlled Foreign Company legislation and the European

Commission's decision in 2019 that the associated Group Financing

Exemption was an aid scheme and amounted to illegal state aid (as

disclosed in Zegona's accounts for the year ended 31 December

2020).

[4] 218,970,076 shares

[5] The subscription price for Zegona management's agreed

re-investment into the business post the Tender Offer will be the

adjusted Net Asset Value per Share immediately prior to completion

of the subscription. The adjusted Net Asset Value will be

calculated post the Tender Offer of GBP329.3 million, with no

provisions being made for any potential value being received from

the non-current tax receivable and no provisions for the

termination costs of any contracts or other future potential

liabilities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENFFFEFTIIFLIL

(END) Dow Jones Newswires

August 13, 2021 02:00 ET (06:00 GMT)

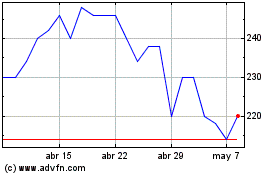

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024